Prysmian Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Prysmian Bundle

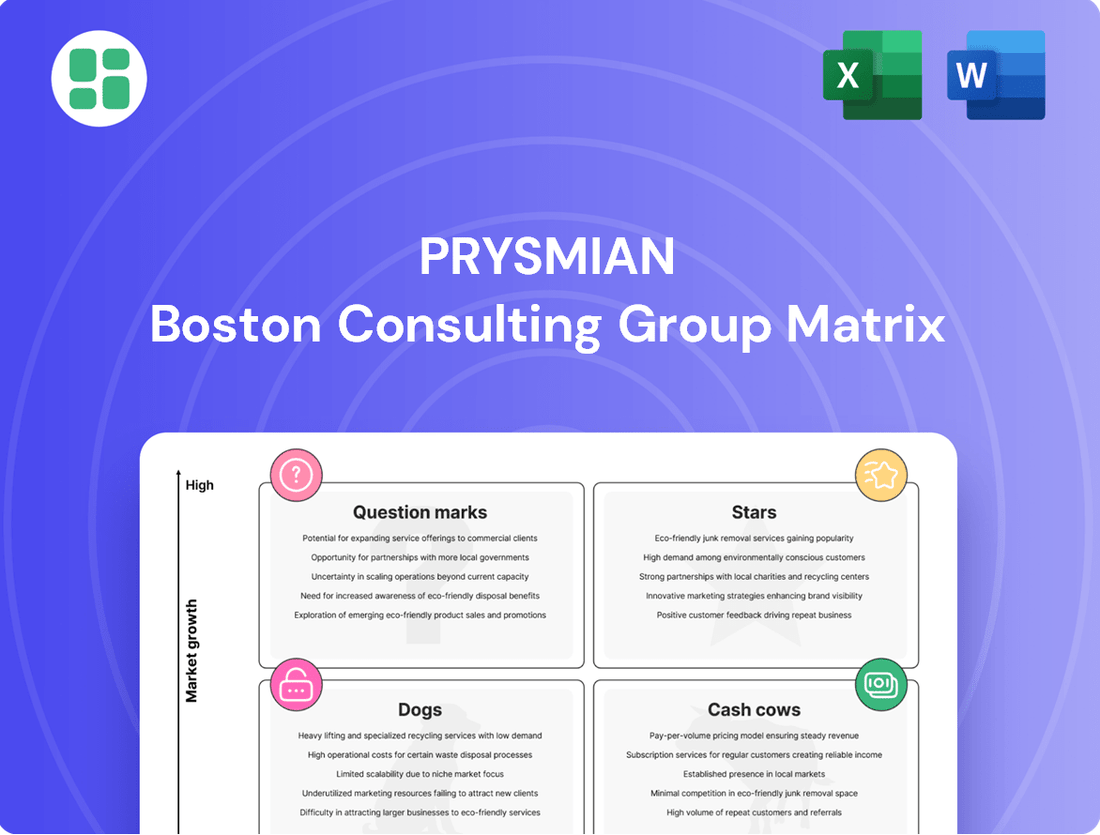

Uncover the strategic positioning of Prysmian's product portfolio with our comprehensive BCG Matrix analysis. Understand which segments are driving growth (Stars), generating consistent revenue (Cash Cows), requiring careful consideration (Question Marks), or potentially hindering progress (Dogs).

This preview offers a glimpse into Prysmian's market dynamics, but the full BCG Matrix unlocks a treasure trove of actionable intelligence. Gain detailed quadrant placements, data-driven insights, and strategic recommendations to optimize your investment decisions and product development roadmap.

Don't miss out on the opportunity to gain a competitive edge. Purchase the complete Prysmian BCG Matrix today and equip yourself with the clarity needed to navigate the evolving landscape and drive sustainable success.

Stars

Prysmian's high-voltage submarine and underground cables are a clear Star in the BCG Matrix. The company commands an impressive 35-40% market share in this sector, which is poised for significant expansion. By 2025, the market for awarded projects is expected to exceed €8 billion annually.

This segment is crucial for the global energy transition, fueled by the growing need for grid interconnections and offshore wind farm development. Prysmian's Transmission business demonstrated remarkable performance, with a 33.7% growth in Q4 2024, underscoring the strength of this Star.

The company has set an ambitious target for this business, aiming for a 25-28% compound annual growth rate in adjusted EBITDA from 2024 through 2028, further solidifying its position as a high-growth, high-market-share leader.

The global push for renewable energy, especially offshore wind, is creating a massive need for specialized submarine and land cables. This sector is experiencing significant growth, with projections indicating continued expansion in the coming years.

Prysmian is actively responding to this demand by investing heavily, including a new submarine cable factory in the United States. This strategic move is designed to bolster their capacity and directly support the rapidly expanding offshore wind power industry.

These offshore wind projects represent high-growth opportunities for Prysmian, a recognized market leader in this specialized field. This focus aligns perfectly with their broader strategy centered on driving the energy transition and capitalizing on sustainable energy solutions.

Prysmian is a leader in advanced HVDC transmission solutions, particularly with its development of 525 kV extruded cable systems. These systems are essential for efficiently transmitting large amounts of power over long distances, especially from renewable energy sources like offshore wind farms. This technology is key to building robust, interconnected power grids across Europe.

The industrialization of 525 kV HVDC cables by Prysmian is a significant step towards more efficient power infrastructure. By increasing voltage capacity, fewer cables are needed for the same power transfer, leading to reduced material usage, lower installation costs, and a smaller environmental footprint. This advancement directly supports the expansion of renewable energy by enabling better integration of remote generation sites.

Solutions for Large-Scale Renewable Energy Integration

Prysmian, a major player in the energy sector, is instrumental in connecting millions of homes to renewable power. Their strategic focus, 'Connect, to lead,' emphasizes innovation and investment in grid integration solutions. This commitment extends beyond just cables to encompass holistic approaches for complex energy systems.

Prysmian's investments are geared towards enabling the large-scale integration of renewable energy sources. This includes developing advanced cable technologies and broader infrastructure solutions critical for a stable, modernized grid. Their efforts directly support the global shift towards sustainable energy, a key driver in the current market.

- Prysmian's 'Connect, to lead' strategy prioritizes innovation for renewable energy integration.

- The company invests in comprehensive solutions beyond cables for enhanced power grids.

- Prysmian aims to connect millions of households to sustainable energy sources.

- Their focus is on addressing the complexities of modern energy infrastructure for the energy transition.

Strategic Investments in Production Capacity

Strategic investments in production capacity are a cornerstone of Prysmian's growth strategy, particularly as it aligns with the global energy transition. The company is channeling significant capital to bolster its manufacturing capabilities, ensuring it can meet escalating demand.

By 2024, Prysmian committed approximately €1 billion to expand its production capacity. This investment is strategically focused on areas supporting the energy transition, with a notable emphasis on submarine power transmission cables, a critical component for offshore wind farms and interconnector projects. This proactive expansion positions Prysmian to capitalize on the surging demand in these high-growth sectors.

Further strengthening its capacity expansion efforts, Prysmian secured financing from the European Investment Bank (EIB). This financial backing will be instrumental in doubling the production capacity for extruded cables at several key Prysmian factories. This move is designed to enhance efficiency and output, directly addressing the growing market needs and reinforcing Prysmian's market leadership.

These strategic capacity expansions are vital for Prysmian to maintain its competitive edge and meet the rapidly increasing demand in key markets. The company's commitment to investing in its production infrastructure underscores its dedication to serving the evolving needs of the energy sector and solidifying its position as a global leader.

- Investment Commitment: Prysmian is investing approximately €1 billion by 2024.

- Focus Areas: Expansion targets include submarine power transmission cables, crucial for the energy transition.

- EIB Financing: Recent funding from the European Investment Bank will help double extruded cable production capacity.

- Strategic Goal: These expansions aim to meet growing demand and solidify Prysmian's market leadership.

Prysmian's high-voltage cable segment is a prime example of a Star in the BCG Matrix, driven by strong market share and substantial growth opportunities. The company's dominance in high-voltage submarine and underground cables, holding a 35-40% market share, positions it exceptionally well. This sector is experiencing robust expansion, with awarded projects anticipated to surpass €8 billion annually by 2025, reflecting the critical role these cables play in global energy infrastructure development.

| Business Segment | Market Share | Growth Rate (2024) | Projected Annual Market Value (2025) |

|---|---|---|---|

| High-Voltage Submarine & Underground Cables | 35-40% | 33.7% (Q4 2024 Transmission Business) | > €8 billion |

What is included in the product

The Prysmian BCG Matrix analyzes its business units based on market growth and share, guiding strategic decisions.

Clear visualization of Prysmian's portfolio, simplifying strategic decisions and resource allocation.

Cash Cows

Prysmian's established power grid distribution cables are firmly positioned as Cash Cows within the BCG Matrix. This segment consistently generates strong organic growth and impressive margins, reflecting its stable and profitable standing in a mature market.

These essential cables are the backbone of reliable electricity distribution, powering both urban centers and rural communities. While the transmission sector might see faster growth, distribution cables provide a dependable and significant source of cash flow for Prysmian.

For instance, in 2023, Prysmian's Power Grid segment demonstrated robust performance, contributing substantially to the company's overall profitability. This stability underscores the enduring demand for these critical infrastructure components, ensuring consistent revenue generation.

Prysmian is a major player in the industrial cable sector, supplying a wide array of products to various industries. Many of these applications, like routine industrial wiring or cables for predictable manufacturing operations, are well-established markets with stable demand.

This consistent demand translates into reliable cash flow for Prysmian. For instance, in 2023, Prysmian reported a significant portion of its revenue stemming from its Energy and Industrial Solutions segments, which encompass many of these core industrial cable applications, demonstrating their role as consistent cash generators.

Prysmian's traditional telecommunication network infrastructure, particularly its optical fibers and copper cables, remains a significant cash cow. Despite rapid market evolution, these foundational products for existing fixed-line networks and data centers continue to command a high market share, ensuring consistent revenue streams.

In 2024, the demand for high-capacity fiber optic cables, a core Prysmian offering, is projected to remain robust, driven by ongoing upgrades to 5G networks and the expansion of broadband access globally. This sustained demand underpins the predictable and substantial cash flow generated by these established product lines.

General Building Wire and Low-Voltage Cables

The General Building Wire and Low-Voltage Cables segment, bolstered by the 2024 acquisition of Encore Wire, represents a significant Cash Cow for Prysmian. This strategic move dramatically enhanced Prysmian's footprint in the crucial U.S. market, particularly within this sector. Encore Wire's established position and consistent cash generation capabilities were central to this acquisition's value, reinforcing Prysmian's revenue streams.

Despite the often commoditized nature of building wire and low-voltage cables, the segment benefits from enduring demand across construction and infrastructure projects. This consistent need translates into substantial and stable contributions to Prysmian's overall revenue and cash flow generation. The integration of Encore Wire's robust U.S. market presence further solidifies this segment's role as a reliable cash generator.

- Stable Demand: Essential for construction and infrastructure, ensuring consistent sales.

- Revenue Contribution: Significant portion of Prysmian's total revenue.

- Cash Flow Generation: Reliable source of cash due to widespread application.

- 2024 Acquisition Impact: Encore Wire acquisition strengthened U.S. market position and cash flow.

Mature European and North American Power Transmission & Distribution

Prysmian's mature European and North American power transmission and distribution (T&D) segments function as its cash cows. These established markets, characterized by aging infrastructure, necessitate continuous investment in maintenance, upgrades, and the replacement of existing cables. Prysmian benefits from its deep-rooted presence and significant market share in these regions, translating into a dependable revenue stream.

While these developed markets may not exhibit rapid growth, they consistently demand Prysmian's high-quality, reliable products and comprehensive solutions. This steady demand underpins the segment's reliable profitability.

- Stable Revenue Base: Prysmian's strong position in mature European and North American T&D markets provides a predictable and substantial revenue foundation.

- Consistent Demand: Ongoing infrastructure needs, including upgrades and replacements, ensure a continuous demand for Prysmian's cable systems.

- Proven Track Record: The company's long history and established reputation in these regions foster customer loyalty and repeat business.

- Profitability Driver: These segments contribute significantly to Prysmian's overall profitability due to their stable demand and the company's market leadership.

Prysmian's established power grid distribution cables are firmly positioned as Cash Cows within the BCG Matrix. This segment consistently generates strong organic growth and impressive margins, reflecting its stable and profitable standing in a mature market.

These essential cables are the backbone of reliable electricity distribution, powering both urban centers and rural communities. While the transmission sector might see faster growth, distribution cables provide a dependable and significant source of cash flow for Prysmian. For instance, in 2023, Prysmian's Power Grid segment demonstrated robust performance, contributing substantially to the company's overall profitability.

The General Building Wire and Low-Voltage Cables segment, bolstered by the 2024 acquisition of Encore Wire, represents a significant Cash Cow for Prysmian. This strategic move dramatically enhanced Prysmian's footprint in the crucial U.S. market, particularly within this sector. Encore Wire's established position and consistent cash generation capabilities were central to this acquisition's value, reinforcing Prysmian's revenue streams.

Prysmian's mature European and North American power transmission and distribution (T&D) segments function as its cash cows. These established markets, characterized by aging infrastructure, necessitate continuous investment in maintenance, upgrades, and the replacement of existing cables. Prysmian benefits from its deep-rooted presence and significant market share in these regions, translating into a dependable revenue stream.

| Segment | BCG Category | Key Characteristics | 2023/2024 Data Point |

| Power Grid Distribution Cables | Cash Cow | Stable demand, mature market, consistent cash flow | Substantial contribution to Prysmian's 2023 profitability |

| General Building Wire & Low-Voltage Cables | Cash Cow | Enduring demand, strong U.S. market presence (post-Encore Wire acquisition) | Encore Wire acquisition significantly enhanced U.S. market footprint and cash flow |

| Mature T&D Markets (Europe/North America) | Cash Cow | Aging infrastructure, continuous replacement needs, strong market share | Dependable revenue stream from established regions |

Preview = Final Product

Prysmian BCG Matrix

The Prysmian BCG Matrix preview you are viewing is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks or placeholder content, just a comprehensive strategic analysis ready for your business planning. You can confidently use this preview as an accurate representation of the professional-grade report you will download, enabling you to make informed decisions about Prysmian's product portfolio.

Dogs

In the competitive landscape of standard cables, Prysmian's undifferentiated offerings, such as low-voltage and building wires, are likely positioned as Dogs in the BCG Matrix. This means they operate in mature, slow-growth markets where products are largely interchangeable, putting pressure on margins and market share. For instance, the global low-voltage cable market, while substantial, is characterized by intense competition and price sensitivity, making it challenging to achieve significant profitability without distinct cost advantages or a strong brand presence in specific niches.

Within Prysmian's extensive portfolio, certain legacy product lines may exhibit stagnant demand, fitting the 'dogs' category in the BCG matrix. These are often older technologies or niche offerings that have lost market traction due to evolving industry standards or declining consumer interest.

While Prysmian does not publicly disclose specific product line performance that would definitively label them as dogs, a company of its scale and history is likely to have segments where investment returns are minimal. These areas might consume resources without generating significant growth or profit.

For instance, if Prysmian had older copper-based cable solutions facing strong competition from fiber optics, those specific product lines could be considered dogs. The company's focus in 2024 and beyond is on high-growth areas like renewable energy and smart grids, suggesting a strategic de-emphasis on less dynamic segments.

In geographic markets where Prysmian's penetration is low and competition is fierce, specific product lines might be classified as dogs. These could be areas where significant investment is needed to achieve even modest growth, diminishing their strategic appeal.

For instance, if Prysmian is facing intense competition in the low-voltage cable segment in a developing Asian market where its market share is under 5%, this segment could be a dog. Such markets often demand heavy marketing and distribution expenditures without a clear path to leadership, making them unattractive for further resource allocation.

The company's strategy prioritizes strengthening its leadership in existing strong markets rather than spreading resources thinly across challenging, low-penetration territories. This focus ensures that capital is deployed where it can yield the most significant returns and competitive advantage.

Outdated Manufacturing Processes

Outdated manufacturing processes at Prysmian can significantly impact profitability. Facilities not integrated with the 'Design-to-Cost' program or sustainability goals face higher operational expenses and reduced output efficiency. For instance, if a significant portion of Prysmian's cable production lines, say 15% in 2024, still rely on older machinery, it could translate to a 5-10% increase in energy consumption per unit compared to modernized lines.

These inefficiencies directly affect competitiveness. Products from these older lines may carry higher production costs, making them less attractive in price-sensitive markets. This could lead to lower sales volumes and a diminished contribution to Prysmian's overall financial performance, potentially pushing these product categories into a 'Dog' quadrant within the BCG Matrix. In 2023, Prysmian reported a total revenue of €16.0 billion, and even a small percentage of underperforming products due to outdated processes could represent millions in lost potential earnings.

- Increased Production Costs: Older machinery can lead to higher energy consumption and maintenance expenses.

- Reduced Efficiency: Outdated processes often result in slower production cycles and higher defect rates.

- Competitiveness Issues: Products may struggle to compete on price or quality against rivals with more modern manufacturing capabilities.

- Lower Profitability: Inefficiently produced goods contribute less to overall company earnings, potentially becoming a financial drain.

Products with High Production Costs and Low Profitability

Within Prysmian's portfolio, certain product lines might be characterized by substantial production expenses that outpace their market value, resulting in diminished profitability. These are often items requiring costly raw materials or intricate manufacturing methods, yet they fail to secure premium pricing in the market. For instance, specialized industrial cables with unique insulation requirements might fall into this category. In 2024, the global average cost of copper, a key component in many cables, saw fluctuations, impacting production budgets significantly. While Prysmian's overall revenue for 2023 reached €16 billion, specific product segments could be under pressure.

These products, burdened by high input costs and unable to command higher selling prices, can become prime candidates for strategic divestment or a thorough reassessment of their market position and operational efficiency. If these segments cannot achieve sustainable, competitive profit margins, Prysmian may need to consider alternatives to maintain overall financial health. For example, a product with a gross profit margin below 15% in a competitive market might warrant such scrutiny.

Consider these points regarding high-cost, low-profitability products:

- High Material Costs: Products relying on expensive raw materials like specialized polymers or rare earth metals can inflate production expenses.

- Complex Manufacturing: Intricate production processes, requiring specialized machinery or extensive labor, contribute to higher operational costs.

- Limited Pricing Power: Despite high production costs, these products may face intense competition or market saturation, preventing premium pricing.

- Strategic Review: Such products may be evaluated for potential divestiture or require significant investment in process innovation to improve profitability.

Prysmian's older, less innovative cable technologies, particularly those in mature markets with intense price competition, are likely positioned as Dogs. These segments, such as basic building wires or certain legacy industrial cables, operate in environments with limited growth potential and high substitutability. For example, the global market for standard copper cables, while still significant, faces pressure from fiber optics and declining demand in some traditional applications, making it difficult to command premium pricing.

These 'dog' products may face challenges due to outdated manufacturing processes, leading to higher production costs and reduced efficiency compared to competitors. If a significant portion of Prysmian's production lines, say 10-15% in 2024, are not integrated with advanced technologies or cost-optimization programs, these product lines could become financially burdensome. This inefficiency can result in a 5-10% higher energy consumption per unit, impacting overall profitability.

Furthermore, products with high material costs, such as specialized insulation or conductors, that cannot achieve premium market pricing also fall into the Dog category. These items might have gross profit margins below 15% in competitive sectors, prompting strategic reviews for divestment or significant process innovation. In 2023, Prysmian reported €16.0 billion in revenue, highlighting the potential financial impact of even a small percentage of underperforming product lines.

For instance, a specific line of industrial cables requiring specialized, costly materials might only achieve a 12% gross margin in a market dominated by price-sensitive buyers. This contrasts with Prysmian's strategic focus on high-growth sectors like renewable energy and smart grids, where higher margins and innovation are key drivers.

Question Marks

Prysmian's strategic investment in Relativity Networks, finalized in July 2025 after an initial agreement in March 2025, highlights its commitment to scaling hollow-core optical fiber (HCF) production. This move positions HCF as a key growth driver, targeting burgeoning markets like high-frequency trading and AI acceleration.

Prysmian is investing heavily in research and development for smart cable systems and advanced sensing solutions. These technologies are crucial for real-time fault location, grid monitoring, and overall power network management. This focus positions Prysmian to capitalize on the growing demand for more resilient and efficient electricity infrastructure.

The market for smart grid solutions is experiencing significant expansion, driven by the global push for modernized and reliable energy delivery. While Prysmian's engagement in this emerging segment is strategic, their current market share in these highly specialized monitoring technologies is likely still in its early phases of development, indicating potential for future growth.

Prysmian is heavily investing in R&D for e-mobility cable solutions, recognizing the sector's significant growth potential. This strategic focus aims to capitalize on the surging demand for electric vehicles and charging infrastructure. For instance, the global electric vehicle market is projected to reach over $1.5 trillion by 2030, indicating a massive opportunity.

While the e-mobility market is expanding rapidly, Prysmian's specific market share in these specialized cable applications is likely still in its nascent stages. This positions e-mobility cable solutions as a "Question Mark" in the BCG matrix – a high-growth, potentially low-share segment that requires careful strategic consideration and continued investment to gain traction.

Specialized Digital Infrastructure Solutions (post-Channell acquisition)

Prysmian's acquisition of Channell Commercial Corp in early 2025 significantly broadens its portfolio into specialized digital infrastructure solutions, targeting the booming data center and 5G markets in the U.S. This strategic move places Prysmian in a sector experiencing robust growth, with the global data center market projected to reach over $1 trillion by 2030. The integration of Channell's expertise and product lines, particularly in advanced connectivity and cable management systems, is key to capturing this expansion.

The integration and scaling of these specialized connectivity solutions will demand substantial capital and focused strategic planning. Prysmian aims to leverage Channell's established presence to accelerate market share gains in these high-demand areas. For instance, the demand for high-speed data transmission is driving significant investment in fiber optic infrastructure, a core component of digital connectivity solutions.

- Market Entry: Prysmian's acquisition of Channell Commercial Corp in March 2025 signifies a strategic push into specialized digital infrastructure, especially for data centers and 5G in the U.S.

- Growth Sector: This positions Prysmian in a high-growth area, with the U.S. data center market alone expected to see substantial expansion in the coming years.

- Investment Needs: Successfully integrating and expanding market share in these new, specialized connectivity solutions will necessitate significant investment and strategic execution from Prysmian.

- Synergies: The acquisition allows Prysmian to combine its existing strengths in cable manufacturing with Channell's expertise in advanced connectivity solutions, creating a more comprehensive offering for digital infrastructure clients.

New Fiber Optic Sensing Technologies

Prysmian's new fiber optic sensing technologies represent a significant advancement, offering enhanced monitoring and maintenance for critical infrastructure. This innovation targets a specialized segment within the expansive fiber optics market, fueled by the growing need for real-time data acquisition and proactive maintenance strategies. The global fiber optic sensors market, projected to reach approximately $10 billion by 2028, shows the strong potential for these advanced solutions.

- Market Position: Prysmian's entry into advanced fiber optic sensing is likely in the early stages of its growth curve.

- Demand Drivers: The increasing demand for real-time data and predictive maintenance across industries like oil and gas, utilities, and transportation is a key factor.

- Technological Edge: These innovations provide superior performance in harsh environments and offer distributed sensing capabilities, a distinct advantage.

- Future Outlook: As adoption increases, Prysmian is well-positioned to capture a significant share of this high-growth niche.

Prysmian's venture into e-mobility cable solutions and advanced fiber optic sensing technologies are prime examples of "Question Marks" in their portfolio. These areas exhibit high growth potential, driven by market trends like the EV revolution and the need for sophisticated infrastructure monitoring.

While Prysmian is making strategic investments and R&D efforts in these segments, their current market share is likely nascent, requiring significant capital and focused execution to establish a strong foothold. The global electric vehicle market is projected to exceed $1.5 trillion by 2030, and the fiber optic sensors market is expected to reach around $10 billion by 2028, underscoring the growth opportunities.

Success in these "Question Mark" areas hinges on Prysmian's ability to scale production, build brand recognition, and effectively compete against established players. Continued investment and strategic partnerships will be crucial for converting these promising ventures into future "Stars" or strong "Cash Cows."

The company's acquisition of Channell Commercial Corp in early 2025, targeting the U.S. data center and 5G markets, also fits this "Question Mark" profile. This move places Prysmian in a rapidly expanding sector, with the U.S. data center market alone poised for substantial growth.

| Business Area | Market Growth | Prysmian's Share | Strategic Focus |

|---|---|---|---|

| E-Mobility Cables | Very High | Low (Emerging) | R&D, Capacity Expansion |

| Fiber Optic Sensing | High | Low (Niche) | Innovation, Market Penetration |

| Digital Infrastructure (via Channell) | High | Low (New Entry) | Integration, Market Share Gain |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including Prysmian's financial disclosures, industry growth forecasts, and competitor performance analysis to inform strategic positioning.