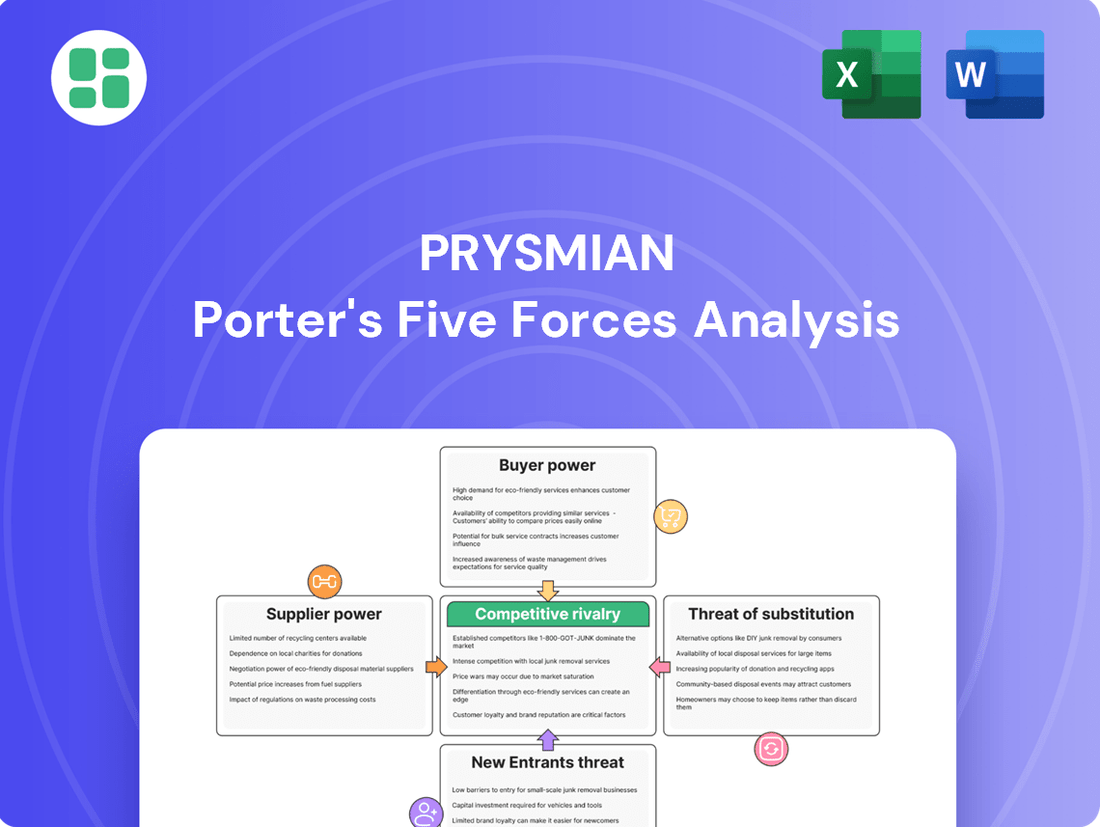

Prysmian Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Prysmian Bundle

Prysmian navigates a competitive landscape shaped by powerful buyer bargaining, intense rivalry, and the looming threat of substitutes. Understanding these forces is crucial for any strategic decision-maker in the cable and wire industry.

The complete report reveals the real forces shaping Prysmian’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Prysmian Group, a major player in the cable industry, depends on essential materials such as copper, aluminum, and polymers. While Prysmian's copper demand accounts for a notable 2-3% of global production, the broader copper market's fragmentation actually dilutes the power of individual suppliers to dictate terms to Prysmian.

The cable industry, including Prysmian, faces significant challenges due to the volatile nature of key raw material prices. Copper, a critical component in electrical cables, experienced a surge, reaching record highs in early July 2025, fueled by robust demand from the burgeoning renewable energy and electric vehicle markets. This price instability directly affects Prysmian's manufacturing expenses and overall profitability, highlighting a key aspect of supplier bargaining power.

Copper and aluminum are absolutely vital for Prysmian's energy and telecom cables, making up a huge chunk of their manufacturing expenses. For instance, in low-voltage cables, raw materials can account for as much as 80% of the total cost. This reliance means suppliers of these essential metals hold significant sway.

Because these materials are so fundamental, Prysmian needs a consistent and dependable supply. If there aren't many alternative suppliers or if it's really expensive to switch to a different metal, the existing suppliers gain more bargaining power. This can put pressure on Prysmian’s profitability.

Supplier Integration and Sustainability Initiatives

Prysmian's approach to managing supplier power is notably evident in its engagement with key raw material providers, such as those for copper and aluminum. The company's commitment to sustainability is a driving force in these relationships, aiming for long-term viability and shared responsibility.

In 2024, Prysmian refined its supplier evaluation criteria to explicitly incorporate Environmental, Social, and Governance (ESG) performance. This strategic shift signifies a deeper integration and collaboration, moving beyond transactional exchanges to build more resilient supply chains.

- Supplier Engagement: Prysmian prioritizes collaboration with its largest suppliers, especially for critical materials like copper and aluminum.

- Sustainability Focus: The company integrates sustainability as a core tenet in its supplier relationships, fostering environmentally and socially responsible practices.

- Enhanced Assessment: In 2024, Prysmian upgraded its supplier assessment framework to include ESG metrics, reflecting a commitment to sustainable sourcing.

- Mitigating Power: By cultivating long-term, sustainable partnerships, Prysmian aims to reduce the bargaining power of suppliers through mutual reliance and shared objectives.

Diversification of Supply Chain

Diversifying its supply chain is a crucial strategy for Prysmian to mitigate the bargaining power of its suppliers, particularly those providing essential metals like copper and aluminum. Despite the inherent reliance on these key commodities, Prysmian actively works to optimize its sourcing networks. This diversification allows the company to spread risk and avoid over-dependence on any single supplier or region.

Prysmian's substantial global footprint and considerable purchasing volume enable it to engage with numerous major players across the raw material sectors. This scale is instrumental in negotiating favorable terms and maintaining flexibility. For instance, in 2023, Prysmian's revenue reached €15.2 billion, underscoring its significant market influence. By cultivating relationships with multiple large-scale suppliers, Prysmian can effectively counter the leverage individual suppliers might otherwise exert.

- Global Reach: Prysmian's operations span numerous countries, facilitating access to a wider pool of raw material suppliers.

- Supplier Relationships: The company maintains relationships with multiple key players in metal markets, reducing reliance on any single entity.

- Market Influence: Prysmian's significant revenue, exceeding €15 billion in 2023, grants it considerable negotiating power with suppliers.

- Risk Mitigation: Diversification helps buffer against regional supply disruptions or price volatility from individual suppliers.

Suppliers of critical raw materials like copper and aluminum hold significant bargaining power over Prysmian due to the essential nature of these components in cable manufacturing, often representing up to 80% of low-voltage cable costs. Although Prysmian's copper demand is a notable 2-3% of global production, the fragmented nature of the broader copper market limits the power of individual suppliers against Prysmian's scale. The company actively manages this power by diversifying its supply chain and fostering long-term, sustainable relationships, as demonstrated by its 2024 refinement of supplier evaluation criteria to include ESG performance.

| Raw Material | Importance to Prysmian | Supplier Bargaining Power Factor | Prysmian's Mitigation Strategy |

|---|---|---|---|

| Copper | Critical for energy & telecom cables; 2-3% of global production | High due to essential nature, but diluted by market fragmentation | Supply chain diversification, long-term sustainable partnerships |

| Aluminum | Vital for energy & telecom cables | High due to essential nature and cost contribution | Supplier relationship management, global sourcing networks |

| Polymers | Essential for cable insulation and sheathing | Moderate to High, depending on specific polymer type and availability | Strategic sourcing, exploring alternative materials where feasible |

What is included in the product

This analysis dissects the competitive landscape for Prysmian by examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the cable and wire industry.

Instantly identify and mitigate competitive threats with a visual breakdown of industry rivalry and buyer power.

Customers Bargaining Power

Prysmian's customer base is characterized by significant concentration, with major clients including large utilities, national infrastructure projects, and global telecommunications giants. These entities often engage in procuring substantial volumes of cables for extensive, long-term initiatives, such as the development of offshore wind farms or the modernization of national power grids.

The sheer scale of these procurement needs, coupled with the strategic criticality of Prysmian's products for these large-scale projects, grants these customers considerable bargaining power. For instance, a single utility company might represent a substantial portion of Prysmian's annual revenue, making it difficult to walk away from a deal without significant financial repercussions.

For specialized cable systems like high-voltage power transmission and submarine cables, switching suppliers is a complex and costly undertaking. These projects demand intricate technical specifications, rigorous testing, and often involve long-term commitments, making a change disruptive and risky.

Customers face significant expenses related to requalification, integration, and potential project delays if they decide to switch from a supplier like Prysmian. This complexity inherently limits their ability to easily shift to competitors, thereby reducing their bargaining power once a relationship is established.

For instance, the energy sector, a key market for Prysmian's high-voltage cables, often engages in multi-year projects where supplier reliability and technical compatibility are paramount. The cost of re-certifying new equipment and retraining personnel can easily run into millions of dollars, reinforcing customer loyalty and limiting their leverage.

Prysmian’s strategic pivot towards becoming a solutions provider, offering tailored innovations for intricate projects, significantly strengthens its market position. This evolution moves beyond mere cable manufacturing, fostering deeper customer integration and loyalty.

By providing customized solutions, Prysmian embeds itself more profoundly within client operations, making it harder for customers to switch to competitors offering standardized products. This integration effectively diminishes the bargaining power of customers who might otherwise seek lower prices for generic offerings.

Quality and Reliability Requirements

Customers in sectors like energy transmission and telecommunications place a premium on quality and reliability. The potential costs associated with product failure or service disruption in these critical infrastructure areas are substantial, making technical compliance and dependable performance paramount. Prysmian, as a recognized global leader in advanced cable technology, benefits from this customer preference. This strong reputation allows Prysmian to maintain its pricing power, as clients are often unwilling to sacrifice essential quality for marginal cost savings.

This emphasis on quality translates into significant bargaining power for customers when Prysmian's offerings are perceived as commoditized or when competitors can demonstrate equivalent reliability. However, Prysmian's historical investment in research and development, evidenced by its significant R&D expenditure, often creates a differentiation that mitigates this power. For instance, Prysmian's continued innovation in areas like advanced insulation materials for high-voltage direct current (HVDC) cables, crucial for offshore wind farm connections, solidifies its position as a preferred supplier where failure is not an option.

- High Cost of Failure: In energy and telecom, a cable failure can lead to millions in lost revenue and extensive repair costs.

- Technical Compliance: Meeting stringent industry standards and certifications is non-negotiable for critical infrastructure projects.

- Reputation as a Differentiator: Prysmian's established track record in delivering high-performance cables reduces customer willingness to switch based on price alone.

- R&D Investment: Continuous innovation in materials and manufacturing processes reinforces Prysmian's quality advantage, limiting customer leverage.

Demand from Macro-Trends

The strong global demand for energy transition, digitalization, and infrastructure development significantly influences the bargaining power of customers for companies like Prysmian. While these macro-trends create a robust market, they also mean customers are in critical need of specialized products. This sustained demand, especially for high-voltage and fiber optic cables, provides Prysmian with a degree of leverage, as customers require these essential components for their own growth and operational needs.

For instance, the global renewable energy sector, a key driver of demand for high-voltage cables, saw significant investment in 2024. Prysmian's ability to supply these critical components for offshore wind farms and grid modernization projects means that while customers have choices, they also rely on Prysmian's expertise and capacity. This interdependence helps to moderate the absolute bargaining power of customers.

- Sustained demand for energy transition solutions: Prysmian's high-voltage cables are crucial for connecting renewable energy sources to the grid.

- Digitalization driving fiber optic cable needs: The ongoing expansion of 5G networks and data centers fuels demand for Prysmian's fiber optic solutions.

- Infrastructure development as a constant market: Government investments in upgrading electrical grids and telecommunications infrastructure ensure a consistent customer base.

Prysmian's customers, particularly large utilities and infrastructure developers, wield significant bargaining power due to the substantial volume of their orders and the critical nature of Prysmian's products for their projects. However, the high costs associated with switching suppliers, including requalification and integration expenses, limit this power once a relationship is established.

Prysmian's focus on providing tailored solutions and its strong reputation for quality and reliability further mitigate customer leverage. For example, in 2024, the energy sector's substantial investments in renewable energy infrastructure underscored the demand for Prysmian's specialized high-voltage cables, reinforcing its position.

| Customer Type | Project Scale | Switching Costs | Bargaining Power Factor |

|---|---|---|---|

| Major Utilities | Large-scale grid modernization | High (technical integration, certification) | Moderate (due to high switching costs and Prysmian's specialization) |

| Telecom Giants | Fiber optic network expansion | Moderate (equipment compatibility, installation expertise) | Moderate (influenced by technology evolution and Prysmian's R&D) |

| Infrastructure Projects | Offshore wind farm connections | Very High (complex specifications, long-term reliability) | Low to Moderate (dependent on Prysmian's unique capabilities) |

Same Document Delivered

Prysmian Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis for Prysmian, detailing the competitive landscape and strategic positioning within the cable and wire industry. The document you see here is the exact, professionally formatted report you will receive immediately after purchase, offering actionable insights without any alterations or placeholders.

Rivalry Among Competitors

The energy and telecom cable systems sector, especially for high-voltage and submarine applications, is quite concentrated. A handful of global players dominate, with Prysmian, Nexans, Sumitomo Electric, and NKT A/S being prominent. This consolidation means that rivalry among these top firms is intense, influencing pricing and innovation strategies.

Prysmian stands out as a leader in this consolidated market. Its position was significantly bolstered by the acquisition of Encore Wire in North America, a deal valued at approximately $1.1 billion that closed in 2024. This strategic move not only expands Prysmian's geographic reach but also deepens its penetration in a key market, intensifying competition with rivals.

The global wire and cable market is poised for robust expansion, with projections indicating a compound annual growth rate (CAGR) between 6.28% and 7.3% from 2025 through 2034. This upward trajectory is largely driven by powerful macro-trends that are reshaping economies worldwide.

Key growth drivers include the accelerating energy transition, which necessitates vast investments in renewable energy infrastructure and grid modernization, alongside the relentless march of digitalization and the development of smart cities. Furthermore, the burgeoning electric vehicle (EV) sector is creating substantial demand for specialized charging cables and power distribution systems, presenting significant opportunities for established and emerging companies within the wire and cable industry.

While the high-voltage cable market is relatively stable with fewer players due to significant capital requirements and technological expertise, the medium- and low-voltage segments are a different story. These areas see a much more crowded field, with many regional and even smaller, low-cost manufacturers, especially those emerging from Asian economies, actively competing.

This intense rivalry in the lower-voltage segments can translate into significant price pressure. For instance, in 2024, reports indicated that the global low-voltage cable market experienced intensified competition, with some analysts noting an average price erosion of up to 5% in certain product categories due to oversupply and aggressive pricing strategies from new entrants.

Product Differentiation and Innovation

Prysmian actively differentiates its offerings through relentless innovation, focusing on high-performance, sustainable, and specialized cable solutions. This commitment to technological advancement, evident in areas like fiber optics and high-voltage direct current (HVDC) systems, effectively mitigates direct price competition by providing superior or unique product attributes.

Their emphasis on R&D, which saw Prysmian invest €277 million in 2023, allows them to develop cutting-edge products that meet evolving market demands for energy efficiency and connectivity. This innovation strategy creates a competitive moat, making it harder for rivals to directly match their product capabilities solely on price.

- Technological Leadership: Prysmian's advancements in fiber optic technology and HVDC cables provide distinct product advantages.

- Sustainability Focus: Development of eco-friendly cable solutions appeals to a growing segment of environmentally conscious customers.

- Specialized Applications: Tailored cable designs for specific industries, like renewable energy or telecommunications, reduce direct comparisons with generic offerings.

- Investment in R&D: Continued investment, such as the €277 million in 2023, fuels the pipeline of innovative and differentiated products.

High Fixed Costs and Economies of Scale

The cable manufacturing sector, where Prysmian operates, is characterized by substantial fixed costs. These include significant investments in advanced production machinery, research and development for new materials and technologies, and the establishment of extensive global supply chains and distribution networks. For instance, setting up a state-of-the-art cable production facility can easily run into hundreds of millions of dollars.

These high upfront investments create a strong barrier to entry. Companies that can achieve greater production volumes, like Prysmian, benefit from economies of scale. This means they can spread their fixed costs over a larger number of units, leading to a lower cost per unit. In 2023, Prysmian reported revenues of €15.2 billion, demonstrating its significant scale within the industry.

- Capital Intensity: The cable industry demands massive capital outlays for plant, property, and equipment.

- Economies of Scale: Larger players like Prysmian leverage scale to reduce per-unit production costs.

- R&D Investment: Continuous innovation requires substantial and ongoing investment in research and development.

- Distribution Networks: Building and maintaining a global reach necessitates significant investment in logistics and sales infrastructure.

Competitive rivalry within Prysmian's sector is intense, particularly in high-voltage and submarine cable segments, dominated by a few global giants like Nexans and Sumitomo Electric. Prysmian's 2024 acquisition of Encore Wire for $1.1 billion highlights aggressive market consolidation and competition. While high-voltage markets are more concentrated, lower-voltage segments face pressure from numerous regional and Asian manufacturers, leading to price erosion, with some reports noting up to a 5% drop in certain categories in 2024.

Prysmian counters this rivalry through technological leadership and innovation, investing €277 million in R&D in 2023 to develop specialized, sustainable solutions like HVDC and fiber optics. This differentiation strategy, focusing on product performance rather than just price, is crucial for maintaining market share against competitors.

| Key Competitor | 2023 Revenue (approx.) | Key Market Focus | Competitive Strategy |

|---|---|---|---|

| Nexans | €11.5 billion | Energy, Telecom, Data Centers | Innovation, Sustainability, Project Execution |

| Sumitomo Electric | ¥3.4 trillion (approx. $22 billion) | Automotive, IT, Energy, Infrastructure | Advanced Materials, Diversified Solutions |

| NKT A/S | €3.4 billion | Power Cables, Turnkey Solutions | High-Voltage Expertise, Green Transition |

SSubstitutes Threaten

The rapid evolution of wireless technologies like 5G, Wi-Fi 6/7, and fixed wireless access poses a significant threat of substitution to traditional telecom cables. These advancements offer increasingly competitive alternatives for last-mile connectivity and mobile broadband services.

For instance, the global 5G services market was valued at approximately $35.8 billion in 2023 and is projected to grow substantially, demonstrating the increasing adoption of wireless solutions. This growth is fueled by the promise of higher speeds and lower latency, making wireless a more attractive option in many scenarios.

In particular, fixed wireless access (FWA) is becoming a viable substitute for wired broadband, especially in rural or difficult-to-deploy areas where laying fiber optic cables is cost-prohibitive. By mid-2024, FWA connections were estimated to be over 100 million globally, showcasing its growing penetration.

Emerging technologies like 'Digital Electricity,' which transmits both DC power and data over low-power cabling, present a potential substitute for certain traditional electrical wiring applications. While still in early development stages, this innovation could affect specific segments of the cable market over the long haul.

The global market for electrical cables is substantial, projected to reach approximately $230 billion by 2024, highlighting the scale of potential disruption. As of early 2024, investments in advanced power transmission technologies are increasing, indicating a growing interest in alternatives that could challenge established cable markets.

Despite the rise of wireless technologies, core cable applications remain largely without direct substitutes. For instance, fiber optic cables are indispensable for the high-capacity, high-speed data transmission required by backbone telecommunication networks and modern data centers. Similarly, high-voltage power transmission cables, especially those for long-distance submarine and underground links, are critical infrastructure with no readily available alternatives.

Energy Efficiency and Reduced Demand

While advancements in energy efficiency might suggest a slowdown in power cable demand, the reality is more nuanced. For instance, improved insulation and smarter grid management can reduce overall energy loss, but the massive global push for electrification, particularly in transportation and industrial processes, is creating substantial new demand for cables. Consider the automotive sector; the transition to electric vehicles alone is projected to significantly increase the need for specialized charging infrastructure cables.

The threat of substitutes for power cables is relatively low, especially when considering the fundamental need for electricity transmission. However, one area to monitor is the ongoing development of alternative energy transmission methods. While still largely in experimental phases, technologies like wireless power transfer could, in the very long term, offer a substitute for certain short-range applications. For the foreseeable future, though, the extensive infrastructure required for reliable power delivery means traditional cabling remains dominant.

The global energy sector is undergoing a significant transformation, which impacts the demand for power cables. Key trends include:

- Electrification of Transport: The rapid growth in electric vehicle adoption necessitates extensive charging infrastructure, requiring vast quantities of specialized power cables. By 2023, global EV sales surpassed 10 million units, a figure expected to rise substantially.

- Renewable Energy Expansion: The integration of solar, wind, and other renewable sources into the grid requires new and often more complex cabling systems to connect distributed generation points to the main grid. Global renewable energy capacity additions reached record levels in 2023.

- Grid Modernization: Investments in smart grids and upgrading aging infrastructure worldwide are driving demand for advanced, high-performance power cables capable of handling increased data transmission and bidirectional power flow.

Complementary Nature of Technologies

The threat of substitutes for cable infrastructure is mitigated by the complementary nature of emerging technologies. For instance, the rollout of 5G networks, while wireless, significantly increases the demand for robust fiber optic backhaul. This means that 5G doesn't replace cables but rather necessitates more of them to handle the amplified data traffic.

This symbiotic relationship is crucial for understanding the market. While advancements in wireless communication might seem like a substitute, they often create new avenues of demand for traditional cable products. For example, the expansion of data centers, driven by cloud computing and AI, directly fuels the need for high-speed data cables.

The ongoing digital transformation across industries further solidifies this. Businesses are investing heavily in upgrading their internal networks to support higher bandwidth requirements, which translates into continued demand for various types of cables. This trend is expected to persist as digital integration deepens.

- 5G Expansion: The global 5G infrastructure market is projected to reach hundreds of billions of dollars by 2028, with a significant portion dedicated to fiber optic deployment for backhaul.

- Data Center Growth: The number of data centers worldwide is steadily increasing, with a corresponding rise in the demand for high-density cabling solutions.

- Cloud Services: The continued growth of cloud computing services necessitates more robust and faster network connections, directly benefiting cable manufacturers.

While wireless technologies like 5G and Wi-Fi 6/7 offer alternatives for last-mile connectivity, they also drive demand for fiber optic backhaul, creating a symbiotic relationship. The global 5G services market was valued at $35.8 billion in 2023, underscoring this trend.

Emerging technologies like Digital Electricity could potentially substitute for some low-power cabling, but widespread adoption is still distant. The global electrical cable market, projected at $230 billion by 2024, highlights the scale of existing infrastructure that remains largely irreplaceable for core functions.

For critical infrastructure like high-voltage power transmission and backbone telecommunication networks, direct substitutes are virtually non-existent. The ongoing electrification of transport, with over 10 million global EV sales in 2023, and the expansion of renewable energy sources are creating substantial new demand for specialized cables, further mitigating substitution threats.

The growth in data centers and cloud services, driven by digital transformation, directly translates into increased demand for high-speed data cables. For example, the 5G infrastructure market is expected to reach hundreds of billions of dollars by 2028, with a significant portion dedicated to fiber optic deployment.

Entrants Threaten

The cable manufacturing industry, especially for high-voltage and submarine applications, presents a formidable barrier to entry due to immense capital requirements. Establishing state-of-the-art production facilities and acquiring specialized installation vessels can easily run into hundreds of millions, if not billions, of dollars. For instance, the development and deployment of a single advanced cable-laying vessel can cost upwards of $300 million.

This significant financial hurdle makes it incredibly challenging for nascent companies to even begin operations, let alone compete effectively with established players like Prysmian. Such high upfront costs deter potential new entrants, thereby protecting the market share and profitability of existing firms.

The cable industry, particularly for high-performance energy and telecommunications, demands substantial upfront investment in research and development. Companies must continuously innovate with new materials, advanced designs, and sophisticated solutions to meet evolving market needs, like higher voltage capacities for renewable energy integration and faster data transmission speeds. For instance, Prysmian, a leading player, consistently invests heavily in R&D to maintain its competitive edge in areas such as subsea cables and advanced fiber optics.

The cable industry faces significant regulatory hurdles and safety standards, acting as a substantial barrier to new entrants. Companies must navigate a complex web of global and national regulations covering everything from product safety and environmental impact to installation practices. For instance, obtaining certifications like CE marking in Europe or UL listing in North America requires rigorous testing and adherence to specific performance criteria, which can be a costly and time-consuming process for newcomers.

Established Customer Relationships and Project Experience

Prysmian and its established competitors benefit from deeply entrenched relationships with key clients like major utilities, government bodies, and telecom giants. These relationships are forged over years of successful project delivery, demonstrating reliability and technical expertise. For instance, Prysmian's long-standing contracts with European energy providers are a testament to this. Newcomers struggle to replicate this level of trust and proven performance, which is essential for winning the complex, high-value projects that define the industry.

The threat of new entrants is significantly mitigated by the substantial project experience incumbents possess. Successfully executing large-scale infrastructure projects, such as offshore wind farm cable installations or national fiber optic network rollouts, requires a proven track record and specialized knowledge. Prysmian, for example, has been a key player in numerous high-profile energy transition projects globally. New companies lack this critical history, making it difficult to gain the confidence of major clients who prioritize risk aversion and guaranteed outcomes.

- Established Trust: Decades of reliable service have built strong bonds with key customers.

- Proven Track Record: Incumbents have a history of successfully delivering complex, large-scale projects.

- Network Advantage: Existing relationships provide access to opportunities that new entrants cannot easily penetrate.

- Risk Aversion: Major clients often prefer established suppliers with a demonstrable history of performance.

Economies of Scale and Global Reach

Existing global leaders like Prysmian leverage substantial economies of scale. In 2023, Prysmian operated in over 50 countries, allowing for significant cost advantages in raw material procurement, high-volume manufacturing, and extensive distribution networks. This global footprint enables them to negotiate better terms with suppliers and optimize production processes, creating a formidable barrier for newcomers.

For a new entrant to match Prysmian's cost efficiencies and global reach would require immense capital investment and time. Replicating a supply chain that spans numerous continents and establishing production facilities capable of competing on price is a monumental challenge. This inherent difficulty in achieving comparable operational scale significantly deters potential new competitors from entering the market.

The threat of new entrants is therefore considerably low due to these entrenched advantages:

- Economies of Scale: Prysmian's massive production volumes in 2023, exceeding 1.1 million kilometers of cables for energy transmission and distribution, translate into lower per-unit costs.

- Global Distribution Network: An established network across numerous countries allows for efficient logistics and faster delivery times, a difficult feat for new players to replicate.

- Capital Requirements: The substantial investment needed to build similar manufacturing capacity and global infrastructure acts as a significant deterrent.

The threat of new entrants into the cable manufacturing industry, particularly for specialized segments like high-voltage and submarine cables, is considerably low. Prysmian and its established peers benefit from substantial capital requirements, with the cost of advanced manufacturing facilities and specialized installation vessels easily reaching hundreds of millions of dollars. For example, a single advanced cable-laying vessel can cost over $300 million, a prohibitive expense for most newcomers.

Furthermore, significant R&D investment is crucial for innovation in materials and design, a continuous expense that new entrants may struggle to match. Regulatory compliance and safety certifications, such as CE marking, also add to the cost and complexity of market entry. Prysmian's extensive global operations in over 50 countries in 2023, producing over 1.1 million kilometers of cables, highlight the economies of scale that create a formidable barrier.

| Barrier Type | Description | Example Impact |

|---|---|---|

| Capital Requirements | High cost of setting up advanced manufacturing and specialized equipment. | A single cable-laying vessel can cost upwards of $300 million. |

| R&D Investment | Continuous innovation needed for new materials and designs. | Prysmian's ongoing investment in subsea and fiber optic technology. |

| Regulatory Compliance | Navigating complex global and national safety and environmental standards. | Obtaining certifications like CE or UL listing is costly and time-consuming. |

| Economies of Scale | Large-scale production leads to cost advantages. | Prysmian's 2023 production of over 1.1 million km of cable offers significant cost efficiencies. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Prysmian leverages data from Prysmian's annual reports, investor presentations, and competitor financial statements, supplemented by industry reports from sources like IHS Markit and Wood Mackenzie.