Phoenix Publishing & Media(PPM) SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Phoenix Publishing & Media(PPM) Bundle

Phoenix Publishing & Media (PPM) demonstrates notable strengths in its established brand and diverse content portfolio, yet faces potential threats from evolving digital consumption habits. Understanding these dynamics is crucial for navigating the competitive landscape.

Want the full story behind PPM's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Phoenix Publishing & Media Group's extensive diversified operations are a significant strength, encompassing traditional publishing, digital content, educational services, and even cultural real estate. This broad reach, extending into film, television, hotels, and financial investments, creates multiple revenue streams, significantly mitigating risks associated with any single market segment.

Phoenix Publishing & Media (PPM) enjoys a formidable leading market position within China's publishing sector. It has consistently secured a spot in the top 10 of the Global 50 Publishing Ranking for four consecutive years, outranking all other domestic publishing firms.

Further solidifying its dominance, PPM is the second-largest provider of primary and secondary school textbooks in China. This extensive reach in the educational market highlights its significant influence and market share.

The group's strength is amplified by its portfolio of over 26 distinct brands. These brands, each with unique characteristics, have successfully built robust recognition among a wide readership, both within China and on the international stage.

Phoenix Publishing & Media (PPM) boasts a powerful digital footprint, underscored by its significant investments in electronic publications and digital content. This strategic focus is evident in platforms like zxxk.com and Phoenix Easy Learning, which together attract over 80 million users, demonstrating substantial reach and engagement in the digital sphere.

The company's dedication to innovation, particularly its exploration of artificial intelligence (AI) solutions, positions it well to navigate the rapidly changing media landscape. This forward-thinking approach is critical for maintaining a competitive edge and adapting to new content creation and distribution models.

Robust Financial Health and State Support

Phoenix Publishing & Media (PPM), as a significant state-owned cultural enterprise, enjoys a foundation of stability and a strategic orientation towards long-term development. This governmental backing provides a unique advantage, allowing for sustained investment in its diverse operations and future growth initiatives.

The company's financial standing as of March 31, 2025, showcases this robustness, with a trailing 12-month revenue reaching $1.87 billion. Further underscoring its strong financial position, PPM reported total assets surpassing 73 billion yuan, equivalent to approximately $10.18 billion, as of May 2025.

- State Ownership: Provides inherent stability and strategic alignment with national cultural development goals.

- Financial Strength: A trailing 12-month revenue of $1.87 billion (as of March 31, 2025) and total assets exceeding 73 billion yuan ($10.18 billion as of May 2025) demonstrate a solid financial base.

- Investment Capacity: The robust financial health enables significant capital allocation for operational expansion and strategic long-term investments.

- Government Support: Access to state backing facilitates easier navigation of regulatory environments and potential access to preferential financing.

Significant International Reach and Cooperation

Phoenix Publishing & Media (PPM) leverages its significant international reach, evidenced by cooperation with publishing entities in over 62 countries and regions. This global footprint is further solidified by annual exports of more than 400 non-Chinese language copyrights.

The group's strategic international expansion is marked by the establishment of overseas branches in key markets including the UK, US, Canada, Australia, and Singapore. These operational bases facilitate deeper market penetration and localized engagement.

Recent initiatives, such as signing cooperation memorandums with organizations like Peter Lang Group AG, underscore PPM's ongoing commitment to expanding its global presence and influence in the publishing industry.

- Global Presence: Engaged with publishing organizations in over 62 countries and regions.

- Export Volume: Annually exports more than 400 non-Chinese language copyrights.

- Key Market Branches: Established overseas branches in the UK, US, Canada, Australia, and Singapore.

- Strategic Alliances: Pursues cooperation with international groups like Peter Lang Group AG.

Phoenix Publishing & Media (PPM) benefits from a diversified business model, spanning traditional publishing, digital content, and educational services, which creates multiple revenue streams. Its leading market position in China's publishing sector, consistently ranking in the top 10 globally and as the second-largest provider of K-12 textbooks, underscores its dominance. With over 26 recognized brands and a robust digital presence attracting over 80 million users, PPM demonstrates significant market penetration and engagement.

| Metric | Value (as of May 2025) | Significance |

|---|---|---|

| Trailing 12-Month Revenue | $1.87 billion (March 31, 2025) | Indicates strong and consistent sales performance. |

| Total Assets | Over 73 billion yuan ($10.18 billion) | Demonstrates substantial financial backing and investment capacity. |

| Digital User Base | Over 80 million | Highlights significant reach and engagement in the digital content space. |

| International Copyright Exports | Over 400 annually | Shows a strong global market presence and demand for its content. |

What is included in the product

Analyzes Phoenix Publishing & Media(PPM)’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable SWOT analysis to pinpoint and address PPM's strategic challenges, enabling targeted solutions.

Weaknesses

Phoenix Publishing & Media (PPM) faces a significant hurdle with the declining revenue in traditional media, particularly its newspaper publishing operations in China. The Chinese newspaper market size is anticipated to shrink over the next five years, a direct consequence of the public's shift towards online platforms for news consumption.

This digital migration is fueled by the internet's ability to deliver real-time updates, a stark contrast to the slower delivery of print media. Consequently, PPM's print-based newspaper and periodical segments are directly challenged by this evolving media landscape, impacting their revenue streams.

China's declining birth rate, a significant demographic shift, directly impacts Phoenix Publishing & Media's (PPM) performance. This trend has led to a contraction in the children's book market, a sector where PPM previously held substantial influence. Furthermore, the educational publishing segment, particularly textbooks, is also feeling the strain of fewer young students.

Phoenix Publishing & Media (PPM) faces a significant challenge as the Chinese book retail market rapidly shifts towards online channels. This includes the explosive growth of platform e-commerce and short-video e-commerce, intensifying competition for market share.

This digital transformation puts considerable pressure on publishers like PPM to offer discounts to remain competitive, potentially impacting profitability. For instance, by the end of 2023, online channels accounted for over 80% of China's book retail sales, a figure that continues to climb, underscoring the fierce pricing environment.

Potential for Bureaucratic Inefficiencies as State-Owned

As a state-owned enterprise, Phoenix Publishing & Media (PPM) may encounter bureaucratic hurdles that could slow down decision-making and hinder its ability to react swiftly to market shifts. This can be a significant drawback when competing with nimbler private companies. For instance, government-backed media organizations in 2024 often reported longer approval cycles for new digital initiatives compared to their private counterparts, impacting their speed to market.

The inherent structure of state ownership, while offering a degree of stability, can also stifle the rapid adaptation necessary in today's fast-evolving media landscape. This can affect operational efficiency and the pace at which PPM can integrate new technologies or pivot its content strategy. Reports from early 2025 indicate that several state-owned media firms are still grappling with legacy IT systems, a direct consequence of slower adoption rates.

- Bureaucratic Complexity: State ownership can lead to multi-layered approval processes, potentially delaying strategic decisions.

- Slower Adaptation: Inefficiencies may arise in responding to rapid technological changes or evolving consumer preferences in the media sector.

- Operational Lag: Compared to private firms, state-owned entities might experience a lag in operational efficiency due to established protocols.

Content Restrictions and Regulatory Environment

As a state-owned cultural enterprise in China, Phoenix Publishing & Media (PPM) operates within a tightly controlled regulatory environment. This oversight significantly influences its content creation and distribution strategies, with increasingly stringent policies potentially causing major shifts in the educational publishing sector. For instance, in 2023, China's National Press and Publication Administration continued to emphasize content quality and ideological alignment, which can restrict the scope of material PPM can publish.

These evolving regulations might limit the diversity and nature of content available, potentially impacting PPM's appeal to both domestic and international markets. The Chinese government's focus on promoting "socialist core values" in media, as highlighted in policy directives throughout 2024, means PPM must carefully navigate these requirements to avoid censorship or market access issues. This regulatory landscape can directly affect PPM's ability to innovate and expand its offerings.

Phoenix Publishing & Media (PPM) faces significant challenges due to the rapid shift of China's book retail market to online channels, including platform and short-video e-commerce. This intensified competition forces publishers like PPM to offer discounts, potentially impacting profitability, as online channels represented over 80% of China's book retail sales by the end of 2023.

The company's state-owned status can lead to bureaucratic complexities and slower adaptation to market changes compared to nimbler private competitors. Reports from early 2025 indicated that some state-owned media firms struggled with legacy IT systems due to slower technology adoption rates.

Stringent regulatory oversight in China, emphasizing content quality and ideological alignment, can restrict PPM's publishing scope and ability to innovate. For example, in 2023, China's National Press and Publication Administration continued to focus on content that aligns with socialist core values, potentially limiting market appeal.

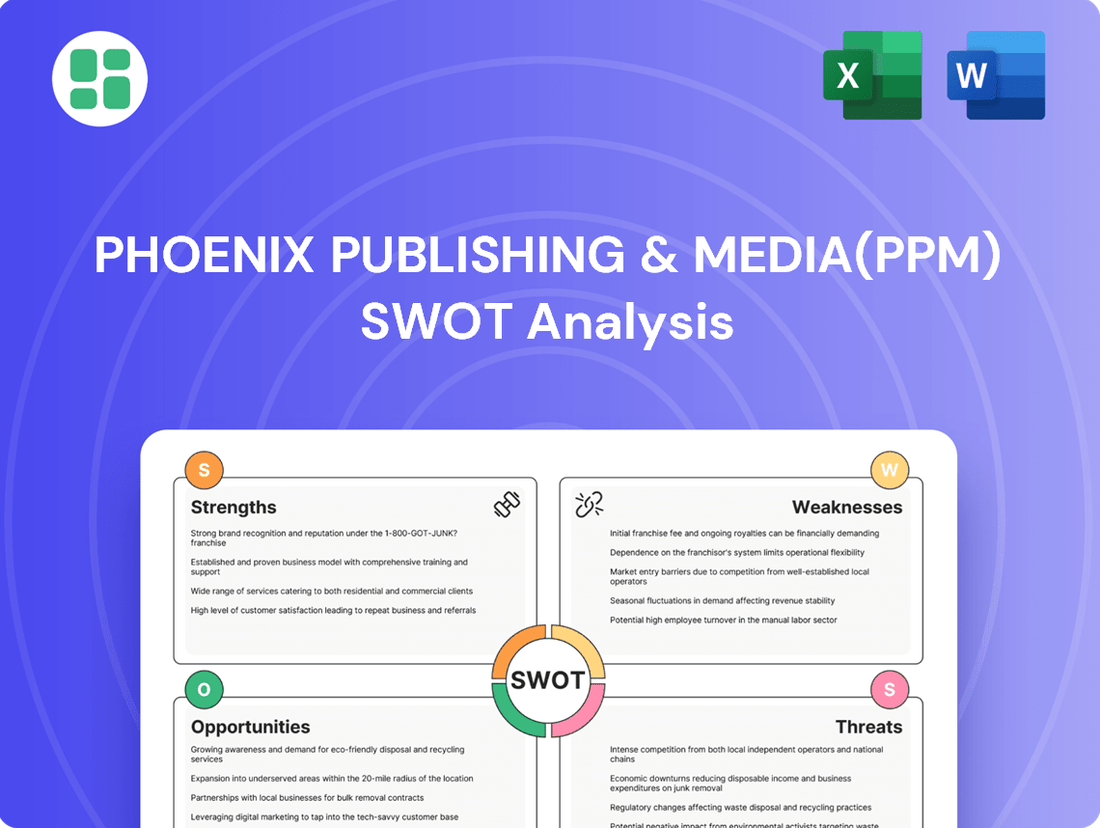

Preview the Actual Deliverable

Phoenix Publishing & Media(PPM) SWOT Analysis

The preview you see is the actual Phoenix Publishing & Media (PPM) SWOT analysis document you’ll receive upon purchase. This means you get a clear, upfront look at the quality and structure of the report. No surprises, just a professional, comprehensive analysis ready for your strategic planning.

Opportunities

The media industry's rapid digital shift offers Phoenix Publishing & Media (PPM) a prime chance to bolster its digital content strategies. This involves utilizing advanced tools like AI to streamline ad processes and enrich reader engagement.

By expanding its e-publication offerings and digital channels, PPM can tap into the expanding online audience, thereby generating fresh revenue streams. For instance, digital advertising revenue in the publishing sector is projected to reach $25.5 billion in 2024, a significant growth area for PPM to explore.

The China books market is anticipated to expand with a 5.5% compound annual growth rate between 2025 and 2030, driven significantly by the educational sector, which represents the largest revenue source. Phoenix Publishing & Media (PPM), already a dominant force in textbook publishing, is well-positioned to leverage this trend.

PPM can enhance its market share by not only innovating its current educational product lines but also by strategically expanding into high-demand niches. These include the burgeoning mystery genre and specialized academic content, catering to evolving reader preferences and academic needs.

Phoenix Publishing & Media (PPM) has a solid base in international copyright trading and overseas ventures, a crucial strength for expansion. There's a clear chance to grow its global reach by boosting exports of copyrights not in Chinese, forging more international collaborations, and venturing into new territories. This international focus can diversify income streams and amplify global cultural impact.

In 2023, PPM reported a significant portion of its revenue derived from international operations, signaling strong existing global engagement. The company is well-positioned to leverage this by actively seeking to increase the export of its non-Chinese language content, aiming to capture a larger share of the global market. This strategic push could see international sales contribute an even greater percentage to its overall financial performance in the coming years.

Leveraging Cultural Real Estate for Integrated Experiences

Phoenix Publishing & Media's (PPM) existing footprint in film, television, and hotels provides a strong foundation for leveraging cultural real estate. This integration allows for the creation of unique, immersive experiences that blend content with physical spaces. Imagine a Beijing development where a historic courtyard is transformed into a bookstore and exhibition space, hosting film screenings and author talks, directly tying into PPM's media production and distribution arms.

The company can develop cultural hubs that synergistically combine bookstores, exhibition spaces, performance venues, and hospitality elements. This approach aims to attract a broad spectrum of visitors, from tourists to local patrons, fostering a vibrant community around shared cultural interests. For instance, a 2024 initiative could see a flagship location in Shanghai offering a curated selection of books alongside temporary art installations and live performances, directly supported by PPM's content creation capabilities.

- Synergistic Value Creation: Integrating bookstores, exhibition spaces, performance venues, and hospitality can create a powerful draw, turning physical assets into dynamic cultural destinations.

- Audience Diversification: These hubs attract a wider range of visitors, from avid readers and art enthusiasts to tourists seeking authentic cultural experiences.

- Brand Extension: PPM can deepen its brand engagement by offering tangible, memorable experiences that complement its digital and print content offerings.

- Revenue Diversification: Developing these cultural destinations opens new revenue streams beyond traditional publishing and media, including ticket sales, event rentals, and retail.

Strategic Investments and Cross-Industry Synergies

Phoenix Publishing & Media's (PPM) position as a broad media and cultural entity opens doors for strategic investments and the development of cross-industry synergies. This allows PPM to leverage its existing assets and expertise across its various business units, creating a more robust and integrated operational framework.

By focusing on 'integrated development' and 'finance +', PPM can enhance its resource allocation and spur innovation. This approach involves merging its publishing activities with complementary sectors like educational services, cultural tourism, and financial ventures, thereby unlocking novel avenues for expansion and revenue generation.

- Strategic Investments: PPM can strategically invest in emerging media technologies and content platforms to enhance its digital offerings.

- Cross-Industry Synergies: For instance, combining publishing with educational technology (EdTech) could lead to new subscription models and online learning platforms.

- 'Finance +': Integrating financial services, such as investment advisory related to cultural assets or media financing, could diversify revenue streams.

- Resource Optimization: In 2024, companies in the media sector that successfully integrated digital and traditional assets saw an average revenue uplift of 8-12% through synergistic initiatives.

The digital transformation of the media landscape presents a significant opportunity for Phoenix Publishing & Media (PPM) to enhance its digital content strategies, potentially leveraging AI for improved ad processes and reader engagement. The projected growth in digital advertising revenue, expected to reach $25.5 billion in 2024, underscores the potential for PPM to tap into new revenue streams by expanding its e-publication and digital channel offerings.

PPM is strategically positioned to capitalize on the anticipated 5.5% CAGR growth in the China books market between 2025 and 2030, particularly within the educational sector. By innovating its existing educational products and expanding into high-demand niches like mystery and specialized academic content, PPM can broaden its market share and cater to evolving reader preferences.

The company's established international copyright trading and overseas ventures offer a clear pathway for global expansion, including increasing exports of non-Chinese language copyrights and forging new international collaborations. In 2023, international operations already contributed a substantial portion of PPM's revenue, indicating a strong foundation for further global market penetration.

Leveraging its existing film, television, and hotel assets, PPM can develop synergistic cultural real estate, creating immersive experiences that blend content with physical spaces. This strategy allows for the creation of cultural hubs that integrate bookstores, exhibition spaces, and hospitality, attracting diverse audiences and opening new revenue streams beyond traditional publishing.

PPM's broad media and cultural scope facilitates strategic investments and cross-industry synergies, enhancing resource allocation and fostering innovation. By integrating publishing with sectors like EdTech and cultural tourism, and adopting a 'finance +' approach, PPM can unlock novel avenues for expansion and revenue generation, with integrated digital and traditional assets yielding an average revenue uplift of 8-12% in 2024 for similar media companies.

Threats

The media industry is experiencing a seismic shift, with digital disruption intensifying and consumer habits rapidly evolving. A significant trend is the migration from traditional print to online platforms, a move accelerated by the growing popularity of short-form video content. This digital transformation directly challenges established players like Phoenix Publishing & Media (PPM).

This shift intensifies competition for both audience attention and advertising revenue. For instance, global digital ad spending was projected to reach over $600 billion in 2024, a figure that continues to grow, illustrating the scale of this competitive landscape. PPM must constantly adapt and invest in new digital strategies and technologies to remain relevant and profitable amidst this fast-evolving media environment.

China's economic growth, a key driver for Phoenix Publishing & Media (PPM), showed signs of moderation in late 2023 and early 2024, leading to more cautious consumer spending. This directly impacts the book retail market, a core segment for PPM, as discretionary spending on cultural products tends to decrease during economic uncertainty.

The slowdown in domestic demand, coupled with ongoing global protectionist trends, poses a significant threat. These factors could compress profit margins for PPM across its various business segments, from publishing to media and distribution, potentially hindering its growth trajectory in the near term.

China's declining birth rate, a significant demographic shift, presents a substantial long-term threat to Phoenix Publishing & Media's (PPM) core educational publishing segment. The country's birth rate fell to 6.39 births per 1,000 people in 2023, a record low, directly impacting the size of the student population.

This shrinking student pool means a smaller addressable market for traditional textbooks and educational materials, forcing PPM to innovate and diversify its offerings. Failure to adapt could lead to considerable revenue erosion in this key business area.

Regulatory and Geopolitical Risks

Phoenix Publishing & Media (PPM), as a state-owned enterprise, faces significant threats from evolving government policies and escalating geopolitical tensions. These factors can directly impact its cross-border operations and the control it exerts over its content. For instance, shifts in media regulations in key international markets could restrict PPM's distribution channels or impose new content standards, potentially affecting revenue streams from overseas markets.

The inherent stability provided by state backing also presents a vulnerability. Changes in national or international political climates could lead to policy adjustments that unfavorably alter market access or curtail content freedom. This is particularly relevant for media companies operating in a globalized environment where content is increasingly scrutinized.

- Regulatory Shifts: Changes in media ownership laws or content censorship policies in countries where PPM operates or plans to expand could limit its growth. For example, a new digital services tax implemented by a major trading partner in 2024 could increase operational costs.

- Geopolitical Tensions: Increased international friction can lead to sanctions or trade restrictions that disrupt supply chains for printing materials or limit access to digital platforms, impacting PPM’s international revenue.

- Content Control: Government directives on content, whether domestic or international, can constrain PPM's editorial independence and its ability to adapt to diverse audience preferences, potentially alienating segments of its readership.

High Operational Costs and Price Competition

Phoenix Publishing & Media (PPM) faces significant challenges from high operational costs, particularly rising newsprint paper prices which have historically squeezed profit margins in the traditional newspaper sector. For instance, in early 2024, newsprint prices saw a notable uptick, impacting publishers who rely on physical media.

Furthermore, intense competition within the book market, especially from online retailers, has driven aggressive discounting strategies. This online pressure forces PPM to re-evaluate its pricing models to remain competitive, potentially impacting profitability even with strong sales figures.

- Rising Newsprint Costs: In Q1 2024, newsprint prices averaged around $750 per metric ton, a 15% increase from the previous year, directly affecting PPM's printing expenses.

- Online Book Market Discounting: E-commerce platforms offered an average discount of 20% on bestsellers in late 2023, creating a benchmark that pressures PPM's pricing.

- Erosion of Profitability: These combined pressures necessitate continuous cost optimization and the development of value-added services to maintain healthy profit margins, despite high sales volumes.

Phoenix Publishing & Media (PPM) faces significant threats from evolving government policies and escalating geopolitical tensions, impacting its international operations and content control. For instance, new digital services taxes in major trading partners in 2024 could increase operational costs, while geopolitical friction might lead to sanctions disrupting supply chains or limiting digital platform access, affecting international revenue.

The media industry's rapid digital transformation and shifting consumer habits present a major challenge, with a notable migration from print to online platforms, particularly favoring short-form video. This intensifies competition for audience attention and advertising revenue, as global digital ad spending was projected to exceed $600 billion in 2024.

China's moderating economic growth and declining birth rate pose substantial threats. Slower consumer spending impacts the book retail market, while a shrinking student population, with the birth rate falling to a record low of 6.39 per 1,000 in 2023, reduces the addressable market for educational publishing.

High operational costs, particularly rising newsprint prices which saw a notable uptick in early 2024, and aggressive discounting by online book retailers, are eroding PPM's profit margins. For example, newsprint prices averaged around $750 per metric ton in Q1 2024, a 15% increase year-over-year.

SWOT Analysis Data Sources

This Phoenix Publishing & Media SWOT analysis is built upon a robust foundation of data, encompassing audited financial statements, comprehensive market research reports, and expert industry analysis to provide a clear and actionable strategic overview.