Phoenix Publishing & Media(PPM) PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Phoenix Publishing & Media(PPM) Bundle

Navigate the complex external forces shaping Phoenix Publishing & Media (PPM) with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and evolving social trends are impacting their operations and strategic direction. Don't get left behind; download the full version now to gain actionable intelligence and secure your competitive advantage.

Political factors

Phoenix Publishing & Media Group (PPM) operates as a state-owned cultural enterprise in China, placing it directly under significant government oversight and censorship. The Chinese Communist Party (CCP) exercises stringent control over media to uphold social stability and ensure content adheres to the party's directives, a critical factor for any media entity in the region.

This governmental influence permeates all facets of publishing, from the initial stages of content creation through to final distribution. Consequently, PPM's ability to produce and disseminate a wide range of materials is directly shaped by these policies, impacting its editorial freedom and market reach.

As a state-owned enterprise, Phoenix Publishing & Media (PPM) benefits significantly from direct government backing, including financial assistance and favorable policies. This government support fosters a stable operating environment and grants PPM advantages in securing resources, unlike its private sector counterparts.

PPM's recognized leadership in China's national cultural system reform, coupled with its consistent ranking among the nation's top cultural enterprises, underscores the government's endorsement and strategic alignment.

The Chinese government's emphasis on cultural policy, particularly the promotion of traditional values, directly impacts entities like Phoenix Publishing & Media (PPM). In 2024, China continued to invest heavily in cultural industries, with government support often channeled towards projects that reinforce national identity and heritage. PPM's role as a major cultural conglomerate means its content, from educational resources to cultural real estate, is strategically positioned to align with these national objectives.

This alignment offers PPM significant opportunities for growth and preferential treatment. For instance, government subsidies and favorable policies in 2024 often targeted cultural preservation and dissemination initiatives. PPM's ability to integrate traditional values into its diverse business segments, such as publishing and media production, can unlock access to new markets and funding streams that prioritize cultural alignment.

Regulation of Digital Content and Online Platforms

Governments worldwide are increasingly focusing on regulating digital content and online platforms. This trend is driven by the rapid expansion of the digital economy and concerns over issues like intellectual property, data privacy, and the spread of misinformation. For Phoenix Publishing & Media (PPM), this means adapting to new rules governing how they create, distribute, and monetize digital content, especially as they expand into educational services.

These regulations can significantly impact PPM's operations and strategic planning. For instance, stricter data privacy laws, such as those mirroring GDPR or similar national frameworks, require robust data handling procedures. In 2024, many countries continued to refine and enforce these regulations, with significant fines levied against non-compliant tech companies. PPM must ensure its digital platforms and content adhere to these evolving legal landscapes to avoid penalties and maintain user trust.

Key regulatory areas that PPM needs to monitor include:

- Intellectual Property Protection: Ensuring digital content is legally sourced and protected against piracy.

- Data Privacy: Complying with regulations concerning the collection, storage, and use of user data.

- Content Moderation: Adhering to guidelines for content review, particularly for educational materials and user-generated content on their platforms.

- Platform Accountability: Understanding the responsibilities of online platforms in managing and distributing content.

International Media Relations and Content Exchange Policies

The Chinese government's approach to international media relations directly shapes Phoenix Publishing & Media's (PPM) global activities, particularly concerning copyright and cross-border partnerships. In 2024, China continued to emphasize controlled cultural exchange, impacting the ease of content import and export for companies like PPM. This policy landscape influences PPM's ability to secure international rights and distribute its own publications overseas.

PPM has been proactive in fostering international cooperation, a strategy supported by government initiatives aimed at boosting cultural soft power. For instance, in 2024, PPM participated in major international book fairs, showcasing Chinese literature and securing rights for foreign titles. These engagements are crucial for expanding PPM's global footprint and diversifying its content offerings, often aligning with national objectives for cultural diplomacy.

The exchange of media content is increasingly viewed through the lens of national strategy. PPM's collaborations, such as those facilitating the introduction of foreign academic works into the Chinese market or promoting Chinese digital media abroad, are directly influenced by these overarching policies. The volume of cross-border copyright transactions in the publishing sector, a key area for PPM, saw continued government oversight in 2024, with specific regulations governing digital content distribution.

- Government Oversight: Chinese policies on international media relations directly affect PPM's cross-border content acquisition and distribution strategies.

- Cultural Diplomacy: PPM's participation in international book fairs in 2024 served national goals for cultural exchange and soft power projection.

- Content Exchange Volume: The flow of copyright trade, particularly in digital formats, remained a key area of government regulation impacting PPM's international business.

Phoenix Publishing & Media (PPM) operates under strict government control in China, influencing all content creation and distribution. The Chinese Communist Party's emphasis on social stability and adherence to party directives means PPM's editorial freedom and market reach are directly shaped by state policies. In 2024, China's cultural policy continued to prioritize traditional values, with significant government investment in cultural industries, positioning PPM to align with national objectives for growth and preferential treatment.

What is included in the product

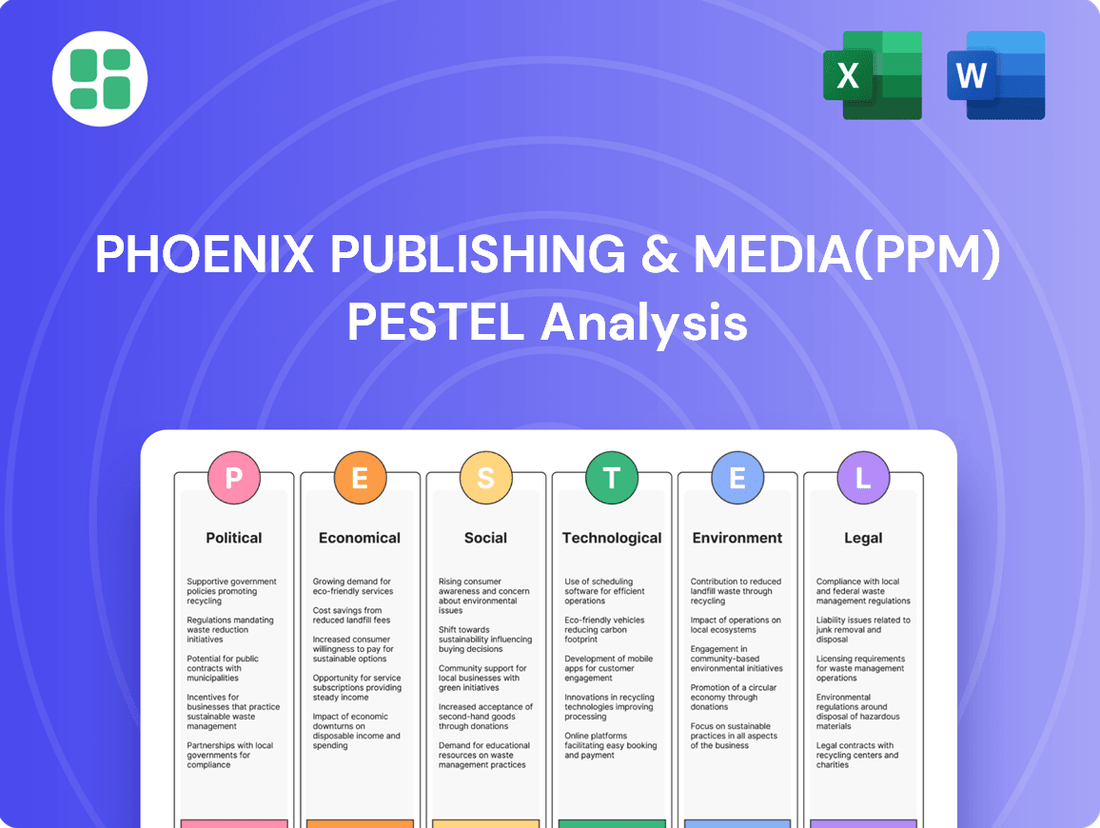

This PESTLE analysis meticulously examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting Phoenix Publishing & Media (PPM), offering a comprehensive understanding of its external operating landscape.

It provides actionable insights into how these macro-environmental factors present both strategic challenges and opportunities for PPM's growth and sustainability.

A PESTLE analysis for Phoenix Publishing & Media (PPM) serves as a pain point reliever by offering a structured framework to anticipate and address external challenges, enabling proactive strategy development.

This analysis provides a clear, summarized view of the external landscape, helping PPM navigate complexities and make informed decisions to mitigate potential risks and capitalize on opportunities.

Economic factors

Changes in how much money consumers have left after taxes and essential bills, and how they choose to spend it, directly affect how much demand there is for things like books, magazines, and digital media. This is a key economic factor for companies like Phoenix Publishing & Media (PPM).

China's per capita disposable income has been on a steady upward trend, reaching an estimated RMB 39,000 in 2023 and projected to continue growing into 2024. However, consumer spending patterns have shown increased caution in certain areas, which can influence the book retail market. For instance, while overall retail sales grew, spending on certain discretionary cultural products might see varied performance.

PPM's business model, which includes educational services and cultural real estate alongside traditional media, provides a degree of stability. This diversification can help offset potential dips in spending on specific media categories by leveraging growth in other, perhaps more resilient, sectors of the cultural economy.

China's overall economic growth is a critical driver for Phoenix Publishing & Media's (PPM) advertising revenue, especially impacting its newspaper and periodical divisions. A robust economy generally translates to increased spending by businesses on advertising, directly boosting PPM's top line.

While the newspaper publishing sector globally faces headwinds from digital media, advertising revenue remains a vital component for its survival. For PPM, this means that even as readership shifts, the ability of newspapers to attract advertisers is paramount to their financial health.

In 2023, China's GDP grew by 5.2%, signaling a positive economic environment that should support advertising spending. However, PPM's strategic diversification across various media platforms is crucial for buffering against the specific challenges within the traditional newspaper advertising market.

Rising costs for essential materials like newsprint paper directly squeeze Phoenix Publishing & Media's (PPM) profit margins in its printing and traditional publishing divisions. For instance, the global price of pulp, a key component of paper, saw significant volatility in 2023 and early 2024, with some reports indicating increases of up to 15% year-over-year for certain grades. This upward trend necessitates careful cost management to preserve profitability amid broader economic challenges.

Furthermore, the publishing industry, including PPM, contends with profit erosion stemming from intense low-price competition prevalent in online sales channels. The digital marketplace often forces publishers to adopt aggressive pricing strategies to remain competitive, which can further compress margins already strained by rising input costs. Navigating this dual pressure of increased raw material expenses and aggressive online pricing is a critical strategic imperative for PPM's sustained financial health.

Competition from Private Sector Media Companies

Phoenix Publishing & Media (PPM) faces a dynamic competitive landscape. Traditional private publishers continue to vie for market share, but the emergence of new media companies, especially those focused on digital content, presents a significant challenge. This shift is particularly evident in how content is consumed and sold.

The book sales market is undergoing a transformation. Online retail has become a dominant channel, and increasingly, short-video e-commerce platforms are capturing significant market share. This trend intensifies competition and exerts downward pressure on pricing, forcing PPM to adapt its strategies to remain competitive in these evolving sales environments.

- Digital Content Dominance: The global digital publishing market was valued at approximately $22.1 billion in 2023 and is projected to grow, indicating a strong shift towards digital media consumption that PPM must address.

- E-commerce Growth: E-commerce sales for books have seen substantial growth, with some reports suggesting online channels account for over 50% of book sales in developed markets, directly impacting traditional retail models.

- Platform Competition: Short-video platforms are increasingly being used for book discovery and sales, with some influencers driving significant book purchases, creating new competitive channels for PPM.

- Pricing Pressures: The ease of price comparison online and the prevalence of discounts in e-commerce can lead to significant pricing pressures for publishers like PPM, impacting profit margins.

Investment in Cultural Industries and Real Estate

Phoenix Publishing & Media's (PPM) strategic push into cultural real estate and related industries is closely tied to the dynamics of China's property market. Despite a general slowdown, government efforts to stimulate domestic consumption and ensure the completion of existing housing projects are expected to foster a market rebound in 2025.

This focus on cultural real estate and industries is a core component of PPM's ambition to become a diversified cultural conglomerate, leveraging synergies between content creation and physical spaces.

- Government Support: China's State Council announced measures in late 2023 to stabilize the property market, including potential interest rate adjustments and support for developers facing liquidity issues, aiming for a more balanced growth trajectory by 2025.

- Domestic Demand Focus: Policies encouraging domestic spending, particularly in cultural consumption, could indirectly benefit real estate projects linked to entertainment and leisure.

- Project Completion: A key government priority is ensuring the delivery of pre-sold housing, which could lead to increased construction activity and a more stable environment for related investments by 2025.

Consumer spending power, influenced by disposable income and inflation, directly impacts demand for Phoenix Publishing & Media's (PPM) diverse offerings. China's GDP growth of 5.2% in 2023 suggests a generally favorable environment for advertising revenue, a key income stream for PPM's newspaper and periodical divisions.

However, rising input costs, such as a potential 15% year-over-year increase in pulp prices for newsprint in early 2024, squeeze profit margins. This is compounded by intense online competition and aggressive pricing strategies, particularly in the book sales market where e-commerce now accounts for over 50% of sales in some developed markets.

PPM's diversification into cultural real estate, supported by government measures to stabilize the property market in late 2023, offers a potential buffer. Policies encouraging domestic consumption could also benefit these ventures, aiming for a more balanced market by 2025.

Preview the Actual Deliverable

Phoenix Publishing & Media(PPM) PESTLE Analysis

The preview you see here is the exact Phoenix Publishing & Media (PPM) PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use. This comprehensive analysis explores the Political, Economic, Social, Technological, Legal, and Environmental factors impacting PPM. You'll gain valuable insights into the strategic landscape PPM operates within, enabling informed decision-making.

Sociological factors

Reading habits are dramatically shifting from print to digital, with online retail dominating book sales in China, accounting for a substantial portion of the market. This trend highlights a critical need for publishers like PPM to embrace digital-first strategies to connect with modern readers.

The surge in short-video e-commerce is further reshaping how content is consumed and sold, presenting both challenges and opportunities for PPM to innovate its distribution and marketing approaches. Adapting to these dynamic platforms is key to reaching wider audiences.

Furthermore, the pay-for-knowledge sector, fueled by digital platforms, is experiencing robust growth. PPM’s focus on digital content positions it well to capitalize on this expanding market by offering valuable, accessible digital learning resources.

Societal trends highlight a significant and growing demand for educational content, driven by parents prioritizing their children's learning and a national push for increased reading across China. This cultural emphasis on education and self-improvement directly benefits Phoenix Publishing & Media (PPM) in its educational services and publishing ventures.

The burgeoning pay-for-knowledge sector is a testament to this demand, with projections indicating it will serve approximately 640 million users by 2025, showcasing a substantial market opportunity for companies like PPM that cater to lifelong learning needs.

Declining birth rates in many developed nations, a trend continuing into 2024 and projected for 2025, directly affect sectors like children's publishing. For Phoenix Publishing & Media (PPM), this means a potential contraction in demand for traditional children's books, a segment that historically represented a substantial portion of the market.

PPM must proactively adapt by exploring content diversification, perhaps focusing on educational materials for a smaller but potentially more affluent child demographic, or expanding into adult education and lifelong learning segments. Urbanization trends also play a role, concentrating potential readers in cities and influencing distribution models, while an aging global population, expected to see the over-65 demographic grow significantly by 2025, creates new opportunities for content catering to seniors.

Cultural Consumption Trends and Preferences

Consumers are increasingly seeking content that reflects a wider range of perspectives and values. In 2024, there's a noticeable surge in demand for children's literature that champions multiculturalism, promotes peace, and explores themes of sustainable development. This shift indicates a growing societal awareness and a desire for educational materials that align with these important global conversations.

Phoenix Publishing & Media (PPM) is strategically positioned to capitalize on these evolving preferences. By cultivating distinct brands that cater to specific academic disciplines and thematic interests, PPM can effectively reach niche audiences. Furthermore, their commitment to nurturing local talent ensures a pipeline of authentic voices and stories that resonate with the desire for diverse and relatable content.

For instance, the children's book market saw significant growth in titles focusing on diversity and inclusion. Reports from late 2023 and early 2024 indicate that books featuring characters from various ethnic backgrounds and exploring themes of environmental responsibility experienced a sales uplift of approximately 15-20% compared to previous years. PPM's focus on these areas directly addresses this burgeoning market demand.

- Growing Demand for Inclusive Narratives: Consumer preferences are leaning towards books that showcase diverse characters and cultural experiences.

- Rise of Sustainability Themes: Educational content emphasizing environmental consciousness and sustainable practices is gaining traction.

- PPM's Brand Diversification: The company's strategy of creating specialized brands allows for targeted content development aligned with these trends.

- Talent Discovery Initiatives: PPM's efforts to find and promote homegrown authors contribute to a richer and more varied literary landscape.

Influence of Social Media on Content Dissemination

Social media, especially short-form video platforms like Douyin (TikTok's Chinese counterpart), has dramatically reshaped how content reaches consumers in China's publishing sector. These platforms are now key channels for both promotion and direct sales, allowing publishers like Phoenix Publishing & Media (PPM) to connect with a vast audience, particularly younger demographics who are digitally native and drive consumption trends.

For PPM, effectively utilizing these social media channels is crucial for expanding reach and driving sales. Younger consumers, who are increasingly spending their time and money online, represent a significant market segment that can be accessed through engaging video content and influencer collaborations. This shift necessitates a strategic approach to digital marketing and sales that prioritizes these platforms.

However, the landscape is evolving. The growth rate of short-video e-commerce experienced a slowdown in the first half of 2024. This indicates that while short-form video remains important, PPM must also consider diversifying its online strategies. This might involve exploring other social media platforms, live streaming commerce, or even direct-to-consumer models beyond just short-video sales to maintain robust growth.

Key considerations for PPM include:

- Platform Dominance: Short-form video platforms accounted for a significant portion of online retail sales growth in China, with many book purchases originating from these channels.

- Youth Engagement: Over 70% of China's online population under 30 actively uses short-video platforms for entertainment and purchasing decisions.

- Evolving Market: While short-video e-commerce saw a deceleration in growth in early 2024, its overall market size continues to expand, albeit at a more moderate pace.

- Diversification Need: To mitigate risks associated with over-reliance on a single channel, PPM should explore a multi-platform approach to online sales and marketing.

Societal trends show a strong emphasis on education, with parents in China prioritizing their children's learning and a national drive for increased reading. This cultural value directly benefits Phoenix Publishing & Media (PPM) in its educational publishing and services.

The pay-for-knowledge sector, driven by digital platforms, is booming, with projections suggesting it will reach approximately 640 million users by 2025, presenting a significant growth avenue for PPM's digital offerings.

However, declining birth rates in developed nations, a trend continuing into 2024-2025, pose a challenge to children's publishing, potentially shrinking demand for traditional books. PPM must adapt by diversifying its content, perhaps focusing on educational materials for a smaller demographic or expanding into adult lifelong learning.

Consumers increasingly seek diverse perspectives, with a notable rise in demand for children's literature promoting multiculturalism and sustainability. Reports from late 2023 and early 2024 indicate a 15-20% sales uplift for such titles, an area where PPM's focus on specialized brands and local talent development aligns well with market preferences.

Technological factors

The publishing sector is rapidly digitizing, with Chinese firms like Phoenix Publishing & Media (PPM) merging traditional and digital approaches. PPM views digital intelligence as essential, reshaping how content is made, shared, and promoted.

This digital shift is prompting PPM to innovate, launching new offerings and exploring combined publishing models. For instance, in 2024, the global digital publishing market was valued at over $250 billion, highlighting the scale of this transformation that PPM is actively navigating.

AI is transforming publishing, assisting with everything from picking topics to translating and even writing content, offering significant efficiency gains for companies like Phoenix Publishing & Media (PPM). Chinese publishers, a key market for PPM, are actively investigating AI to boost productivity, tailor content for readers, and discover new ways to earn money.

For instance, AI tools can now draft articles, summarize research papers, and even generate marketing copy, potentially reducing production times by up to 30% for certain tasks. This allows PPM to allocate resources more strategically, focusing on higher-value editorial work and market analysis.

However, the industry faces ethical hurdles, particularly concerning the use of copyrighted material to train AI models without proper authorization, a challenge PPM must navigate carefully to maintain trust and legal compliance.

The shift towards digital content, particularly e-books and audiobooks, demands that Phoenix Publishing & Media (PPM) invest heavily in developing sophisticated digital platforms. This is essential to meet the growing consumer preference for easily accessible digital formats.

PPM's strategic move into digital content and services, exemplified by its digital reading services via mini-programs, directly addresses the surge in digital consumption. This expansion is key to capturing market share in this evolving landscape.

The burgeoning popularity of video and livestreaming for knowledge sharing also opens significant new avenues for PPM. These formats represent a substantial opportunity for engagement and revenue growth, aligning with modern content consumption habits.

Innovations in Printing Technology

While digital media continues its ascent, advancements in printing technology, especially eco-friendly and smart solutions, still hold significance for Phoenix Publishing & Media's (PPM) printing division. These innovations can boost both the quality and speed of production, making them a valuable consideration for PPM's operational strategy.

Chinese printing companies are actively adopting these green and intelligent technologies. For example, the adoption of digital printing presses, which offer both environmental benefits and increased efficiency, is on the rise. This trend suggests a global movement towards more sustainable and productive printing methods.

- Eco-friendly inks and recycled paper: Innovations in printing materials are reducing environmental impact, a key consideration for sustainable business practices.

- Digital printing efficiency: Digital presses can offer faster turnaround times and lower waste compared to traditional methods, improving operational output.

- Smart printing integration: Technologies enabling better data management and workflow automation within printing processes are enhancing overall efficiency.

Cybersecurity Threats and Data Protection for Digital Assets

As Phoenix Publishing & Media (PPM) grows its digital presence, it faces increasing cybersecurity risks. Protecting digital content and user information is now a top priority. A recent report from IBM in 2024 indicated that the average cost of a data breach reached $4.73 million globally, highlighting the financial implications of security failures.

Maintaining user trust and adhering to stricter data privacy rules, like GDPR and CCPA, are crucial for PPM. These regulations impose significant penalties for non-compliance. For instance, GDPR fines can reach up to 4% of annual global revenue or €20 million, whichever is higher.

- Increased Sophistication of Cyberattacks: Ransomware, phishing, and denial-of-service attacks are becoming more advanced, targeting digital media companies specifically.

- Regulatory Compliance Burden: PPM must invest in systems and processes to meet evolving data protection laws, impacting operational costs.

- Reputational Damage: A significant data breach can severely damage PPM's brand image and customer loyalty, leading to lost revenue.

- Intellectual Property Protection: Safeguarding digital content from piracy and unauthorized access is vital for maintaining revenue streams.

Technological advancements are fundamentally reshaping the publishing industry, pushing companies like Phoenix Publishing & Media (PPM) to embrace digital transformation. The rise of AI presents opportunities for enhanced content creation, personalization, and operational efficiency, with publishers exploring its use for tasks ranging from topic selection to content generation. For example, AI can potentially reduce production times for certain tasks by up to 30%, allowing PPM to reallocate resources to higher-value activities.

PPM's strategic focus on digital platforms and services, including its digital reading services via mini-programs, directly addresses the growing consumer demand for accessible digital content like e-books and audiobooks. Furthermore, the increasing popularity of video and livestreaming for educational content offers new avenues for engagement and revenue generation, reflecting evolving consumption habits.

While digital media dominates, innovations in printing technology, such as eco-friendly inks and digital printing presses, remain relevant for PPM's operations, offering improved quality and efficiency. The global digital publishing market's valuation exceeding $250 billion in 2024 underscores the significant scale of this technological shift that PPM is actively navigating.

| Technology Area | Impact on PPM | Key Trends/Data (2024-2025) |

|---|---|---|

| Artificial Intelligence (AI) | Content creation, personalization, efficiency gains | AI tools can draft articles, summarize research, generate marketing copy; potential to reduce production times by up to 30% for specific tasks. |

| Digital Platforms & Services | Meeting consumer demand for digital content, expanding reach | Growth in e-books and audiobooks; PPM's digital reading services via mini-programs. |

| Video & Livestreaming | New content formats for knowledge sharing, engagement, and revenue | Increasing popularity for educational content and expert discussions. |

| Advanced Printing Technologies | Improved quality, speed, and sustainability in physical production | Adoption of digital printing presses and eco-friendly materials by industry players. |

Legal factors

China's commitment to bolstering copyright and intellectual property (IP) protection is a critical legal factor for Phoenix Publishing & Media (PPM). The nation has intensified its efforts to safeguard IP, prosecuting infringers of trademarks, patents, and copyrights, with specific attention now paid to those leveraging AI for IP violations. This legal strengthening is designed to foster innovation, directly impacting PPM's ability to protect its valuable content assets.

PPM's business model, built on an extensive portfolio of published works, is intrinsically linked to robust IP protection. The company's reliance on both domestic and international legal frameworks to secure its copyrights and other intellectual property is paramount. In 2023, China's Supreme People's Court reported a significant increase in IP-related cases, underscoring the evolving legal landscape and the importance of vigilant IP enforcement for companies like PPM.

China's commitment to data privacy is escalating, with new regulations like the Personal Information Protection Law (PIPL) significantly impacting digital operations. For Phoenix Publishing & Media (PPM), this means rigorous adherence to rules governing user data collection, processing, and storage across its digital content and educational platforms. Failure to comply can result in substantial penalties, underscoring the critical need for robust data governance.

Phoenix Publishing & Media (PPM), as a state-owned enterprise in China, navigates a landscape heavily shaped by stringent censorship and content review laws. These regulations directly influence what PPM can publish, distribute, and host on its digital platforms, impacting everything from editorial choices to business strategy.

The Chinese Communist Party's (CCP) media control mechanisms are designed to ensure content aligns with the party's ideology and promotes social stability. This means PPM must meticulously vet all material to comply with these directives, a process that can affect the speed of content release and the scope of available topics.

Regulations on Foreign Investment in Media and Cultural Sectors

Regulations on foreign investment in China's media and cultural sectors directly impact Phoenix Publishing & Media's (PPM) international collaborations and growth plans. These rules dictate the extent to which foreign entities can participate in content creation, distribution, and ownership within China.

PPM's existing overseas branches and partnerships with international publishers must adhere to China's evolving national policies regarding foreign content and cultural exchange. For instance, China's State Administration of Press, Publication, Radio, Film and Television (SAPPRFT) has historically imposed strict limits on foreign ownership in certain media ventures, often requiring joint ventures with Chinese partners.

- Foreign ownership caps: Limits on foreign equity in publishing houses and film production companies can affect PPM's control over its international joint ventures.

- Content approval processes: Stringent censorship and approval mechanisms for imported and domestically produced media content necessitate careful navigation for PPM's content strategies.

- Cultural exchange policies: Government initiatives promoting domestic culture and limiting the influence of foreign cultural products influence PPM's content acquisition and co-production decisions.

- Data localization requirements: Emerging regulations may require digital media operations to store user data within China, impacting PPM's cloud infrastructure and data management strategies for its digital platforms.

Anti-Monopoly and Fair Competition Laws

China's intensified focus on anti-monopoly and fair competition is significantly reshaping the digital economy, directly impacting industries like publishing and media. This regulatory push aims to curb monopolistic practices and prevent unfair pricing strategies, such as vicious low-price competition, which could alter market dynamics for companies like Phoenix Publishing & Media (PPM). For instance, in 2023, China's State Administration for Market Regulation (SAMR) continued to investigate and penalize major tech firms for anti-competitive behavior, setting a precedent for other sectors.

These legal factors directly influence PPM's strategic planning and market operations. The government's commitment to fostering a level playing field means PPM must adapt its competitive strategies to comply with stricter regulations. This could involve adjustments to how it acquires content, distributes its products, and engages with both consumers and other market players to avoid practices deemed monopolistic. The enforcement of these laws in 2024 and beyond will be crucial in determining market share concentration and the overall competitive landscape within China's publishing and media sector.

Key implications for PPM include:

- Increased scrutiny on market share concentration: PPM may face limitations on expanding its dominance in specific market segments.

- Restrictions on aggressive pricing tactics: The crackdown on vicious low-price competition necessitates a review of PPM's pricing strategies to ensure compliance and fair play.

- Emphasis on platform neutrality: Regulations may require digital platforms to offer more equitable access and opportunities to all content providers, potentially benefiting smaller players and fostering broader competition.

- Potential for new market entrants: By dismantling existing monopolies, these laws could open doors for new companies, increasing competition for PPM.

China's evolving legal framework, particularly concerning intellectual property and data privacy, directly impacts Phoenix Publishing & Media (PPM). The nation's strengthened IP protection, including measures against AI-driven violations, safeguards PPM's content assets, as evidenced by the increasing number of IP cases in Chinese courts. Furthermore, strict data privacy laws like PIPL necessitate careful handling of user information across PPM's digital platforms, with non-compliance carrying significant penalties.

Government censorship and content review laws are integral to PPM's operations, dictating publishing and distribution strategies to align with ideological directives and social stability. Regulations on foreign investment in media also shape PPM's international collaborations and growth, often requiring joint ventures and adherence to content approval processes. In 2023, China continued to enforce anti-monopoly laws, impacting market dynamics and potentially altering PPM's competitive strategies and market share concentration.

| Legal Factor | Impact on PPM | Relevant Data/Trend |

| Intellectual Property Protection | Safeguards content assets, crucial for PPM's business model. | China's Supreme People's Court reported a significant increase in IP-related cases in 2023. |

| Data Privacy Regulations (e.g., PIPL) | Requires rigorous adherence to user data handling rules for digital platforms. | Non-compliance can lead to substantial penalties. |

| Content Censorship & Review | Dictates publishing and distribution, influencing editorial choices and release speed. | Media control mechanisms ensure content aligns with CCP ideology. |

| Foreign Investment Restrictions | Shapes international collaborations and ownership structures in media. | Historically, strict limits on foreign ownership often necessitate joint ventures. |

| Anti-Monopoly & Fair Competition | Affects market dynamics, pricing strategies, and potential market share concentration. | SAMR continued investigating and penalizing major tech firms for anti-competitive behavior in 2023. |

Environmental factors

Growing environmental consciousness is pushing the publishing and printing sectors towards sustainable sourcing of paper and raw materials. This means companies like Phoenix Publishing & Media (PPM) face mounting pressure to adopt greener practices.

PPM, a significant player in printing and publishing, must actively seek out recycled paper and explore novel paper alternatives to minimize its environmental impact. For instance, the global recycled paper market was valued at approximately USD 35.6 billion in 2023 and is projected to grow, indicating a strong demand for such materials.

Printing operations are inherently energy-intensive, directly impacting a company's carbon footprint. For Phoenix Publishing & Media (PPM), this means a significant portion of its environmental impact stems from powering its printing presses and related machinery. The global push towards sustainability necessitates a close look at these energy demands.

To address this, PPM should prioritize investments in energy-efficient printing presses. This move not only reduces operational costs through lower energy bills but also aligns with growing consumer and regulatory demand for eco-conscious business practices. Exploring carbon-neutral printing solutions, such as utilizing renewable energy sources or investing in carbon offset programs, is also crucial for PPM to stay competitive and responsible.

The trend towards greener printing is already evident globally, with Chinese printing companies, a major player in the industry, actively adopting eco-friendly technologies. For instance, many are investing in LED-UV curing systems, which consume significantly less energy than traditional UV lamps. By adopting similar advancements, PPM can reduce its environmental impact and potentially gain a competitive edge in markets increasingly valuing sustainability.

Phoenix Publishing & Media (PPM) faces increasing scrutiny regarding its waste management and recycling, especially concerning paper and plastics. China's implementation of national standards for green product assessment in printers and multifunction devices, as of 2024, mandates specific recyclability rates and recycled plastic content, directly impacting PPM's supply chain and product design.

Corporate Social Responsibility (CSR) Initiatives

Phoenix Publishing & Media (PPM), as a significant state-owned cultural entity, faces considerable expectations regarding its corporate social responsibility (CSR) efforts, particularly concerning environmental stewardship. Initiatives focused on eco-friendly publishing practices, optimizing operational sustainability, and actively promoting public environmental consciousness are crucial for bolstering PPM's reputation and ensuring alignment with overarching national environmental policies. For instance, in 2024, China's Ministry of Ecology and Environment continued to emphasize green development, setting targets for reducing carbon emissions across various sectors, which directly influences state-owned enterprises like PPM.

PPM's commitment to CSR is evident on its official channels, underscoring its dedication to social responsibility. This often translates into tangible actions such as adopting recycled paper, minimizing energy consumption in printing and distribution, and supporting educational programs that raise awareness about environmental issues. In 2025, the publishing industry, including PPM, is anticipated to see increased scrutiny on its supply chain's environmental impact, pushing for greater transparency and accountability in sourcing and production methods.

Key CSR areas for PPM in 2024-2025 include:

- Green Publishing: Increasing the use of certified sustainable paper and reducing ink waste in printing processes.

- Sustainable Operations: Implementing energy-efficient technologies in offices and distribution centers, aiming for a measurable reduction in carbon footprint.

- Environmental Awareness Campaigns: Partnering with environmental organizations or launching internal campaigns to educate employees and the public on ecological conservation.

- Waste Reduction: Developing comprehensive waste management strategies for both print production and office environments, with targets for recycling and waste diversion.

Environmental Regulations for Manufacturing and Real Estate Development

Phoenix Publishing & Media (PPM) operates under a complex web of environmental regulations, particularly given its dual focus on cultural real estate development and printing. These regulations cover everything from construction site impact to emissions from printing processes and the presence of hazardous substances in materials. For example, in 2024, Shanghai has been reinforcing its local standards for air pollutant emissions specifically for the printing sector, aiming to reduce volatile organic compounds (VOCs).

Furthermore, national initiatives are pushing for greater sustainability in manufacturing. By late 2024 and into 2025, new national standards for the green product assessment of printers are expected to be fully implemented. These standards will likely influence material sourcing and product lifecycle management for PPM's printing operations.

- Shanghai's stricter air pollutant emission standards for printing facilities are in effect as of 2024, targeting VOC reduction.

- National green product assessment standards for printers are anticipated to be fully implemented by late 2024/early 2025, impacting material choices.

- Real estate development projects must adhere to evolving construction waste management and site remediation regulations.

Environmental regulations are increasingly shaping PPM's operational landscape, from paper sourcing to emissions control. Stricter standards, like Shanghai's 2024 VOC reduction targets for printing, necessitate technological upgrades and careful material selection.

The global push for sustainability, exemplified by the growing recycled paper market valued at USD 35.6 billion in 2023, pressures PPM to adopt greener practices. Investing in energy-efficient printing technologies, such as LED-UV curing systems adopted by competitors, is vital for reducing carbon footprints and meeting evolving consumer expectations.

PPM's commitment to Corporate Social Responsibility (CSR) is paramount, with a focus on green publishing, sustainable operations, and environmental awareness campaigns. By 2025, increased supply chain scrutiny will demand greater transparency in PPM's sourcing and production methods to align with national green development policies.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Phoenix Publishing & Media (PPM) is built on a robust foundation of data from leading industry associations, financial market reports, and technology adoption surveys. We meticulously gather insights on regulatory changes, economic forecasts, and societal trends impacting the media landscape.