Phoenix Publishing & Media(PPM) Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Phoenix Publishing & Media(PPM) Bundle

Phoenix Publishing & Media (PPM) faces moderate bargaining power from buyers, as digital alternatives and self-publishing options are increasingly accessible. The threat of new entrants is also a significant concern, with low barriers to entry in many digital publishing segments.

The complete report reveals the real forces shaping Phoenix Publishing & Media(PPM)’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Phoenix Publishing & Media (PPM) benefits from a diverse supplier base for its essential inputs, including paper, printing equipment, software, and content. This broad network of providers generally dilutes the bargaining power of any single supplier, especially for commodity items like paper where numerous vendors exist.

PPM's substantial purchasing volume for paper further strengthens its position, allowing for negotiation of favorable terms. However, the company must remain attuned to global supply chain dynamics, as shifts in pricing and availability can still impact costs and operational continuity, as seen with paper price increases in early 2024 due to increased demand and logistical challenges.

The bargaining power of niche content creators for Phoenix Publishing & Media (PPM) is significant, especially for those with highly acclaimed or specialized intellectual property. These creators can dictate terms due to their unique value, potentially leading to higher upfront payments or more favorable royalty splits. For instance, a best-selling author in a specific educational niche could command a contract that significantly impacts PPM's cost of goods sold.

Suppliers of advanced digital publishing software and AI tools are increasingly influential, directly impacting Phoenix Publishing & Media's (PPM) operational efficiency and content innovation. These specialized technology providers, offering proprietary solutions for content creation, analysis, and e-learning platforms, possess significant bargaining power.

The leverage these tech suppliers hold stems from the high switching costs associated with integrating their complex systems. For instance, a shift from one AI-driven content analytics platform to another can involve substantial retraining, data migration, and potential disruption to ongoing digital transformation projects, giving vendors considerable leverage over PPM's strategic technology decisions.

Skilled Talent in Digital and Creative Sectors

The demand for specialized skills in digital and creative fields, crucial for Phoenix Publishing & Media's (PPM) growth in areas like AI development and multimedia content, is intensifying. This scarcity directly impacts the bargaining power of suppliers, particularly highly skilled talent.

The EdTech and digital content sectors are experiencing rapid expansion, driving a significant need for professionals adept in AI, data analytics, digital marketing, and advanced content creation. This specialized demand creates a competitive environment for acquiring and retaining top talent.

- High Demand for Niche Skills: Sectors like AI and digital media require very specific expertise, making these professionals scarce.

- Increased Salary Expectations: Scarcity of skilled talent leads to higher salary and benefit demands from these individuals.

- Talent Acquisition Costs: Companies like PPM face rising costs in attracting and retaining these in-demand employees.

- Impact on Profitability: Higher labor costs can directly affect the company's profit margins if not managed effectively.

Varying Power in Real Estate Development

For Phoenix Publishing & Media (PPM) in its cultural real estate projects, suppliers like construction material vendors, architectural design firms, and specialized trade contractors hold varying degrees of influence. This power is not static; it shifts with project scope and the localized availability of construction resources and expertise.

The bargaining power of these suppliers can be significant when specialized skills or unique materials are required, especially in niche cultural developments. For instance, sourcing bespoke stone for heritage building restoration or engaging renowned architects with specific aesthetic visions can grant these suppliers leverage. In 2024, the construction industry, particularly in specialized sectors, experienced continued demand, which can bolster supplier pricing power.

- Material Costs: Fluctuations in global commodity prices for steel, lumber, and concrete directly impact construction material suppliers' ability to negotiate terms. For example, the Producer Price Index for construction materials saw a notable increase in early 2024.

- Skilled Labor Shortages: A persistent shortage of skilled tradespeople in many regions amplifies the bargaining power of specialized contractors, allowing them to command higher wages and dictate project timelines.

- Project Specificity: The uniqueness of cultural real estate projects often necessitates custom-designed components or specialized construction techniques, reducing the number of viable suppliers and increasing their leverage.

- Supplier Concentration: In markets where only a few firms offer particular services or materials, supplier power is inherently higher.

Phoenix Publishing & Media (PPM) faces moderate supplier bargaining power, largely influenced by the diversity of its input providers. While commodity suppliers like paper vendors have limited leverage due to a broad market, specialized content creators and technology providers wield significant influence due to unique intellectual property or essential proprietary software. This is further amplified by high switching costs for critical digital platforms, as seen with the ongoing integration of AI tools in 2024, which grants these tech suppliers considerable sway over PPM's strategic decisions and operational costs.

| Supplier Category | Bargaining Power Level | Key Factors Influencing Power | Example Impact on PPM (2024) |

|---|---|---|---|

| Paper Suppliers | Low to Moderate | Numerous vendors, PPM's large volume purchases | Favorable pricing negotiated, but subject to global price fluctuations (e.g., early 2024 price increases) |

| Niche Content Creators | High | Unique intellectual property, acclaimed work | Higher upfront payments, favorable royalty splits impacting cost of goods sold |

| Digital Publishing Software/AI Tools | High | Proprietary solutions, high switching costs | Leverage over strategic tech decisions, potential for increased licensing fees |

| Skilled Talent (Digital/Creative) | High | Scarcity of specialized skills (AI, data analytics) | Increased salary and benefit demands, higher talent acquisition costs impacting profit margins |

| Construction Materials/Firms (Cultural Real Estate) | Moderate to High | Project specificity, skilled labor shortages, material cost volatility | Potential for higher project costs due to demand for specialized trades and fluctuating material prices (e.g., PPI for construction materials in early 2024) |

What is included in the product

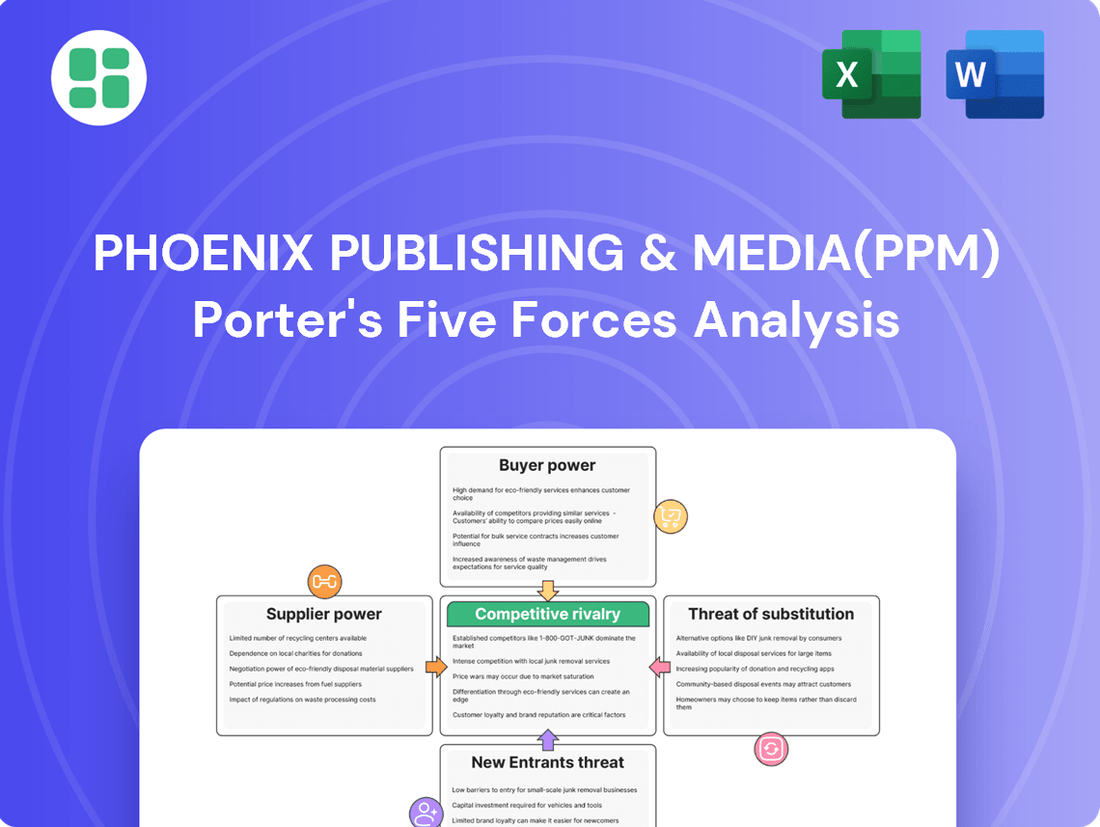

This Porter's Five Forces analysis provides a comprehensive evaluation of the competitive landscape for Phoenix Publishing & Media (PPM), examining the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes.

Instantly pinpoint and address competitive threats with a clear, actionable Porter's Five Forces analysis for Phoenix Publishing & Media, designed for rapid strategic adjustments.

Customers Bargaining Power

Individual readers and consumers of digital content wield significant bargaining power. This stems from the sheer volume of choices available, not just from competing publishers but also from a wide spectrum of digital platforms offering news, entertainment, and often free content. This abundance naturally fosters price sensitivity among consumers.

The low switching costs associated with digital content further amplify customer power. For instance, in 2024, the average consumer subscribed to 3.5 streaming services, a figure that highlights the ease with which they can move between providers. This ease of transition means publishers must constantly compete on value and price to retain their audience.

Large institutional buyers, including schools, universities, and government education departments, hold considerable sway over Phoenix Publishing & Media (PPM) due to their substantial purchasing volumes. This collective bargaining power allows them to negotiate favorable pricing and influence product development to meet specific curriculum needs.

The government's direct involvement in setting educational standards and managing procurement processes further amplifies the bargaining power of these institutional customers. For instance, in 2024, government education tenders often dictate the terms for textbook adoption across entire states or districts, impacting PPM's sales strategies.

Advertisers, a crucial revenue stream for Phoenix Publishing & Media (PPM), are wielding more influence. This growing power stems directly from the explosion of digital advertising avenues. Platforms like Meta, TikTok, and Amazon provide advertisers with sophisticated tools to pinpoint specific demographics, often at a lower cost than traditional media.

For example, in 2024, digital ad spending globally was projected to reach over $600 billion, a significant portion of which flows through these highly targeted channels. This shift means advertisers can more easily bypass traditional media companies like PPM if they don't see compelling value or reach. The ability to measure return on investment with greater precision on digital platforms further amplifies advertiser leverage over media providers.

Impact of Digital Consumption Habits

The increasing shift towards digital consumption, especially through mobile devices and the popularity of short-form video, significantly amplifies customer bargaining power. This trend grants consumers greater control over how and where they access content, forcing Phoenix Publishing & Media (PPM) to be more responsive to their preferences and distribution demands. Customers can readily switch between platforms or opt for readily available free content, putting pressure on PPM's monetization strategies.

This digital empowerment means PPM must continually innovate its content delivery and engagement models to retain its audience. For instance, as of early 2024, mobile devices accounted for over 60% of global internet traffic, highlighting the critical importance of a mobile-first strategy for media companies like PPM. The ease with which consumers can find alternatives or free versions of content directly impacts PPM's ability to command premium pricing or subscription fees.

- Digital Dominance: Over 60% of global internet traffic originates from mobile devices (early 2024 data), underscoring the need for PPM to cater to mobile-first consumption.

- Content Accessibility: Consumers can easily access content across various digital platforms, increasing their ability to compare and switch, thereby enhancing their bargaining power.

- Preference Control: The rise of personalized content feeds and on-demand viewing gives consumers more control over what they consume and when, pressuring PPM to align its offerings with evolving user tastes.

- Free Content Availability: The prevalence of free, ad-supported content models online provides a constant benchmark and alternative for consumers, limiting PPM's pricing flexibility.

Market Dynamics in Cultural Real Estate

The bargaining power of customers in Phoenix Publishing & Media's (PPM) cultural real estate segment is significantly shaped by prevailing property market conditions. Factors like the overall supply of comparable cultural spaces, the intensity of buyer demand, and the general economic stability of the region directly influence how much leverage customers have. For instance, in 2024, markets experiencing a surplus of available cultural properties tend to see buyers exercising greater negotiation power on pricing and amenity packages.

Buyers in this niche often find themselves with a variety of choices, whether it's different types of cultural venues or alternative investment properties. This abundance of options naturally leads to more robust price and feature negotiations, as customers can readily compare offerings and seek the best value. In 2024, the demand for unique, adaptable cultural spaces, while growing, still faces competition from more traditional commercial real estate, allowing discerning buyers to negotiate favorable terms.

- Market Conditions Impact: In 2024, the customer bargaining power in cultural real estate is directly tied to the property market's supply-demand balance and economic stability.

- Buyer Options: The availability of multiple comparable cultural properties or alternative investments empowers buyers to negotiate on price and features.

- Negotiation Leverage: A buyer's ability to secure better terms is enhanced when there is a strong supply of cultural real estate options.

- 2024 Trends: While demand for specialized cultural spaces is rising, competition from other real estate sectors in 2024 still allows buyers to negotiate effectively.

Individual consumers and large institutional buyers for Phoenix Publishing & Media (PPM) possess significant bargaining power due to the vast array of digital content choices and low switching costs. This is further amplified by advertisers who benefit from highly targeted digital platforms, allowing them to demand more value from media providers.

The prevalence of free content and the increasing preference for mobile-first, on-demand consumption models empower consumers to dictate terms and pressure PPM's pricing strategies. Additionally, in the cultural real estate segment, market conditions like property supply and buyer demand directly influence customer negotiation leverage, with more options leading to better terms for buyers.

| Customer Segment | Source of Bargaining Power | 2024 Impact/Data |

|---|---|---|

| Individual Digital Content Consumers | Abundance of choices, low switching costs, free content availability | Subscribed to 3.5 streaming services on average; mobile traffic >60% global internet traffic (early 2024) |

| Institutional Buyers (Education) | Large purchase volumes, government procurement influence | Government tenders dictating textbook adoption across states/districts |

| Advertisers | Sophisticated digital targeting tools, measurable ROI, shift to digital ad spend | Global digital ad spend projected over $600 billion |

| Cultural Real Estate Buyers | Market supply/demand, availability of alternatives | Buyers gain leverage in markets with surplus cultural properties |

Same Document Delivered

Phoenix Publishing & Media(PPM) Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces Analysis for Phoenix Publishing & Media (PPM), detailing the competitive landscape, including the threat of new entrants, the bargaining power of buyers and suppliers, the intensity of rivalry among existing competitors, and the threat of substitute products or services. The document you see here is precisely what you'll receive instantly after purchase, offering a professionally formatted and ready-to-use strategic assessment.

Rivalry Among Competitors

Phoenix Publishing & Media (PPM) navigates a fiercely competitive landscape within China's publishing sector. Established state-owned entities and dynamic private publishing houses actively compete for prime content, aiming to capture significant market share and control distribution networks across books, newspapers, and periodicals. For instance, in 2023, the Chinese book market alone was valued at over 100 billion yuan, highlighting the immense prize for market leaders.

The competitive landscape for Phoenix Publishing & Media (PPM) is intensely shaped by digital media giants. Companies like Google, Meta, and Netflix command vast audiences and advertising budgets, directly siphoning revenue and attention away from traditional print. For instance, in 2024, digital advertising spending continued its upward trajectory, projected to reach over $300 billion in the US alone, a significant portion of which bypasses legacy publishers.

These tech behemoths excel at leveraging user data to personalize content and advertising, creating a sticky ecosystem that PPM struggles to replicate. Their platforms, from YouTube's billions of active users to TikTok's rapid growth, offer diverse content formats that cater to evolving consumer preferences, often at a lower cost to advertisers than print media.

The sheer scale and technological prowess of these digital rivals allow them to innovate rapidly, constantly introducing new features and revenue streams. This rapid evolution puts immense pressure on traditional publishers like PPM to adapt their business models and digital strategies to remain relevant and competitive in a rapidly changing media environment.

The Chinese education technology market is a whirlwind of activity, buzzing with specialized online learning platforms and solution providers vying for attention. Phoenix Publishing & Media (PPM) finds its educational services arm in direct contention with these nimble competitors, especially within the booming K-12 and e-learning segments, as they all chase after students and crucial institutional partnerships.

In 2023, China's online education market was estimated to be worth over $100 billion, highlighting the intense competition PPM faces. Companies like TAL Education Group and Gaotu Techedu, despite regulatory shifts, continue to invest heavily in product development and user acquisition, forcing PPM to constantly innovate to maintain its market share.

Cross-Industry Competition Due to Diversification

Phoenix Publishing & Media's (PPM) diverse portfolio, which spans cultural real estate and other cultural industries, means it faces a wide array of competitors. This broad reach means PPM isn't just up against traditional publishing houses; it's also contending with players in entirely different sectors.

For instance, in its cultural real estate ventures, PPM directly competes with established real estate developers who may have deeper pockets and longer-standing relationships within the property market. These developers are often focused solely on maximizing property value and may have different strategic priorities than PPM.

Furthermore, PPM's involvement in various cultural industries, such as entertainment and media production, pits it against specialized entertainment companies. These companies often possess unique expertise in content creation, distribution, and audience engagement, creating a distinct competitive dynamic.

- Cross-Industry Rivalry: PPM's diversification strategy exposes it to competition from diverse sectors, including real estate developers and entertainment conglomerates.

- Real Estate Competition: In cultural real estate, PPM contends with property developers who may have a primary focus on real estate value.

- Entertainment Sector Challenges: PPM faces competition from specialized entertainment companies with established expertise in content creation and audience engagement.

- Diversified Competitive Landscape: This broad portfolio means PPM must navigate distinct sets of rivals across its various business segments.

Impact of AI and Technology Adoption

The publishing and media sector is experiencing a significant shift due to the rapid integration of AI and advanced technologies. Companies that effectively adopt these tools for content creation, personalization, and operational streamlining are gaining a distinct advantage, compelling competitors to accelerate their own innovation efforts.

This technological wave intensifies competitive rivalry as firms strive to leverage AI for enhanced efficiency and customer engagement. For instance, AI-powered content recommendation engines can significantly boost user retention, a crucial metric in a fragmented digital landscape. By early 2024, many media companies were investing heavily in AI, with some reporting double-digit percentage increases in content engagement following personalized delivery.

- AI-driven content personalization is becoming a key differentiator, leading to higher user engagement and loyalty.

- Operational efficiencies gained through AI, such as automated content tagging and distribution, reduce costs and improve speed to market.

- Companies failing to adopt these technologies risk falling behind in terms of **content quality, reach, and profitability**.

- The ongoing investment in AI by major players like Google and Meta, for example, sets a high bar for innovation across the entire industry.

Phoenix Publishing & Media (PPM) faces intense competition from both traditional players and digital disruptors within China's publishing and media sectors. Established state-owned enterprises and agile private firms vie for content and market share, while digital giants like Google and Meta exert significant pressure by capturing audience attention and advertising revenue through personalized experiences. This dynamic is further complicated by PPM's diversification into areas like cultural real estate, where it competes with specialized property developers, and entertainment, where it encounters dedicated production companies.

| Competitor Type | Key Characteristics | Impact on PPM | Example (2023-2024 Data) |

|---|---|---|---|

| Traditional Publishers | Established networks, content libraries | Direct competition for market share and talent | Chinese book market valued at over 100 billion yuan in 2023 |

| Digital Media Giants | Vast audiences, data analytics, personalized content | Siphoning ad revenue and audience attention | Digital ad spending projected to exceed $300 billion in the US alone in 2024 |

| EdTech Platforms | Online learning specialization, rapid innovation | Competition in the lucrative education sector | China's online education market estimated over $100 billion in 2023 |

| Real Estate Developers | Property market expertise, capital resources | Competition in cultural real estate ventures | N/A (specific PPM real estate competitor data not publicly available) |

| Entertainment Companies | Content creation, distribution, audience engagement expertise | Competition in broader cultural industries | N/A (specific PPM entertainment competitor data not publicly available) |

SSubstitutes Threaten

The threat of substitutes for Phoenix Publishing & Media (PPM) is substantial, primarily stemming from digital publications and online content. E-books, online news portals, and web articles are increasingly displacing traditional print formats. This shift is fueled by their inherent convenience, widespread accessibility, and often more affordable pricing compared to physical books and magazines.

In 2024, the digital publishing market continued its robust growth. Global e-book sales are projected to reach over $23 billion by the end of the year, demonstrating a clear preference for digital alternatives among consumers. Furthermore, online news consumption has become the dominant source of information for a significant portion of the population, with major online news outlets reporting billions of page views monthly.

The threat of substitutes for traditional educational materials, like those Phoenix Publishing & Media (PPM) might offer, is significant and growing. Online educational resources and platforms, including Massive Open Online Courses (MOOCs) and freely available internet content, provide accessible and often lower-cost alternatives. These digital options cater to a demand for flexible learning, offering a vast array of subjects and teaching styles that can directly compete with PPM's established offerings.

Short-form video and social media platforms are increasingly acting as substitutes for traditional media, impacting how consumers, including book buyers, get their information. In 2024, platforms like TikTok and Instagram are not just for entertainment but are becoming significant channels for news and product discovery, directly competing with established media outlets for attention and influencing purchasing decisions.

This shift means publishers like Phoenix Publishing & Media (PPM) face a threat as consumers, especially younger demographics, increasingly rely on these dynamic, algorithm-driven environments for book recommendations and reviews, bypassing traditional marketing channels and even literary criticism.

User-Generated Content and Independent Creators

The proliferation of user-generated content (UGC) presents a significant threat of substitutes for Phoenix Publishing & Media (PPM). Platforms like YouTube, TikTok, and Substack allow individuals to create and distribute content, often for free, directly to a global audience. This bypasses traditional publishing gatekeepers and offers consumers a vast, readily available alternative to professionally produced books, articles, and other media.

Independent creators, empowered by digital tools, can now compete directly with established publishers. For instance, in 2024, the creator economy continued its explosive growth, with platforms enabling millions of individuals to monetize their content. This accessibility means that consumers might opt for free or low-cost UGC over purchasing PPM's offerings, especially for niche interests or timely information.

Consider these points regarding the threat of substitutes:

- Vast Content Availability: UGC platforms offer an almost limitless supply of content across all genres, from educational material to entertainment.

- Low or No Cost: Much of this content is accessible to consumers without direct payment, making it a compelling alternative to paid publications.

- Direct Audience Engagement: Independent creators build loyal followings by interacting directly with their audience, fostering a sense of community that traditional publishing may struggle to replicate.

- Agility and Timeliness: UGC creators can often respond to trends and current events much faster than established media companies, providing more immediate content.

Alternative Entertainment and Leisure Activities

The threat of substitutes for Phoenix Publishing & Media (PPM) extends beyond direct competitors to encompass a wide array of entertainment and leisure activities. Consumers have numerous options for how they spend their time and money, from streaming services like Netflix and Disney+ to interactive video games and outdoor recreational pursuits. For instance, global video game revenue was projected to reach over $200 billion in 2024, illustrating a significant draw on consumer entertainment budgets.

These alternative activities directly compete for consumer attention, potentially diverting engagement away from PPM's traditional publishing and media products. When consumers opt for a night of gaming or a weekend hiking trip, they are less likely to be purchasing books, subscribing to magazines, or consuming other forms of media offered by PPM. This broad competitive landscape means PPM must continuously innovate and offer compelling value to retain its audience.

- Broader Competition: Entertainment and leisure activities beyond direct media rivals pose a significant threat.

- Consumer Time & Income: Activities like gaming and recreation vie for discretionary spending and attention.

- Market Data: Global video game revenue was expected to exceed $200 billion in 2024, highlighting a major alternative.

- Impact on PPM: These substitutes can reduce consumer engagement with PPM's core publishing and media offerings.

The threat of substitutes for Phoenix Publishing & Media (PPM) is multifaceted, encompassing digital content, user-generated material, and alternative leisure activities. Digital publications, including e-books and online news, continue to gain traction due to convenience and cost-effectiveness, with global e-book sales projected to surpass $23 billion in 2024. Furthermore, platforms like TikTok and Instagram are increasingly influencing information consumption and product discovery, directly competing for consumer attention.

User-generated content (UGC) platforms, such as YouTube and Substack, provide a vast and often free alternative to professionally produced media, with the creator economy showing significant growth in 2024. These platforms empower independent creators to directly engage audiences, offering timely and niche content that challenges traditional publishing models. This broad availability of low-cost or free content represents a substantial substitute for PPM's offerings.

Beyond direct media competitors, activities like video gaming and streaming services divert consumer time and discretionary spending. With global video game revenue expected to exceed $200 billion in 2024, these leisure pursuits represent a significant draw on consumer attention and budgets, indirectly impacting engagement with PPM's traditional products.

| Substitute Category | Key Characteristics | 2024 Market Data/Trend |

|---|---|---|

| Digital Publications | Convenience, accessibility, lower cost | Global e-book sales projected > $23 billion |

| User-Generated Content (UGC) | Vast availability, low/no cost, direct engagement | Creator economy experiencing explosive growth |

| Alternative Leisure Activities | Competition for time and discretionary spending | Global video game revenue projected > $200 billion |

Entrants Threaten

The traditional publishing and media landscape, particularly for established players like Phoenix Publishing & Media (PPM), presents a formidable barrier to entry due to the immense capital required for physical infrastructure. Setting up printing facilities, establishing robust distribution networks, and maintaining extensive warehousing capabilities demand significant upfront investment. For instance, a modern commercial printing press can cost upwards of $1 million, and building a nationwide distribution system involves substantial logistical and operational expenses.

China's cultural and media sectors operate under a highly regulated framework, posing a significant barrier to entry for new companies seeking to compete with established state-owned enterprises like Phoenix Publishing & Media (PPM). The process of obtaining essential licenses and approvals is often lengthy and complex, creating substantial upfront challenges.

Navigating the intricate censorship and content control policies mandated by the Chinese government further elevates the difficulty for newcomers. These regulatory hurdles are particularly pronounced for private domestic firms and foreign entities attempting to establish a foothold in the market, effectively limiting the threat of new entrants.

Phoenix Publishing & Media (PPM) benefits from a deeply entrenched brand reputation, cultivated over decades of consistent quality and reliability. This long-standing trust makes it difficult for newcomers to gain immediate traction.

Furthermore, PPM possesses extensive content acquisition networks, including strong relationships with established authors and prestigious educational institutions. For instance, in 2024, PPM secured exclusive publishing rights for several highly anticipated academic journals, a feat that would be incredibly costly and time-consuming for a new entrant to replicate.

The challenge for new entrants lies not only in matching PPM's brand recognition but also in building comparable trust and acquiring a diverse portfolio of high-quality content. This barrier is significant, as it requires substantial investment in author relations and content scouting to even approach PPM's current standing.

Lower Barriers in Digital Content but Scale Challenges

While the cost to produce and distribute digital content has dramatically decreased, allowing many new players to emerge, the real hurdle lies in achieving meaningful scale and audience engagement. Simply creating content isn't enough; building a substantial readership or viewership and then effectively monetizing it presents a formidable challenge for newcomers.

New digital content creators often find themselves competing directly with established media giants and vast content aggregators, making it difficult to carve out a distinct niche and gain visibility. For instance, in 2024, the global digital advertising market reached an estimated $604.7 billion, indicating the immense competition for consumer attention and advertiser spend.

- Low Initial Investment: Creating digital content requires minimal upfront capital compared to traditional publishing.

- Scale and Reach Obstacles: New entrants struggle to achieve the audience size and distribution networks of incumbents.

- Monetization Difficulties: Converting digital audiences into sustainable revenue streams is complex due to ad saturation and evolving payment models.

- Intense Competition: The digital landscape is crowded with established players and a constant influx of new content creators.

State-Owned Enterprise Advantages

Phoenix Publishing & Media (PPM)'s state-owned enterprise (SOE) status significantly impacts the threat of new entrants. This ownership structure grants PPM preferential access to government resources, including potentially subsidized printing materials or distribution networks, and robust policy support that can shape market conditions. For instance, in 2024, SOEs in China, where PPM operates, continued to benefit from government directives favoring domestic entities in key sectors.

These inherent advantages create a substantial barrier to entry for private or international competitors. New entrants often face a more challenging regulatory environment and lack the established relationships and implicit guarantees that come with state backing. This uneven playing field, combined with the capital requirements for establishing a media and publishing enterprise, effectively deters many potential new players from entering the market.

- State-backed Funding: SOEs may have access to lower-cost capital or direct state investment, reducing financial barriers for PPM compared to private firms.

- Policy Advantages: Favorable regulations or government procurement policies can directly benefit PPM, making it harder for newcomers to compete on a level playing field.

- Resource Access: Preferential access to government-controlled resources, such as paper supply or telecommunications infrastructure, can provide cost efficiencies for PPM.

- Market Influence: PPM's SOE status can lend it greater credibility and influence within the domestic market, attracting talent and partnerships that are less accessible to new entrants.

The threat of new entrants for Phoenix Publishing & Media (PPM) is significantly mitigated by high capital requirements for physical infrastructure and stringent Chinese government regulations, including complex licensing and censorship policies. PPM's established brand reputation and extensive content acquisition networks, evidenced by securing exclusive rights for academic journals in 2024, further solidify its market position. While digital content creation has lowered initial barriers, achieving scale and monetization remains a substantial hurdle for newcomers, who face intense competition in a crowded digital landscape, as highlighted by the $604.7 billion global digital advertising market in 2024.

| Barrier Type | Description | Impact on New Entrants | Example Data (2024) |

|---|---|---|---|

| Capital Requirements | Setting up printing, distribution, and warehousing. | High upfront investment deters entry. | Commercial printing press cost: $1M+ |

| Regulatory Hurdles | Licensing, approvals, censorship in China. | Lengthy and complex processes create significant challenges. | N/A (Qualitative barrier) |

| Brand Reputation & Trust | Decades of consistent quality. | Difficult for newcomers to gain immediate traction. | N/A (Qualitative barrier) |

| Content Acquisition | Relationships with authors and institutions. | Costly and time-consuming for new entrants to replicate. | Exclusive rights for academic journals secured by PPM. |

| Digital Scale & Monetization | Achieving audience size and revenue streams. | Crowded market, ad saturation, evolving payment models. | Global digital ad market: $604.7 billion. |

Porter's Five Forces Analysis Data Sources

Our Phoenix Publishing & Media (PPM) Porter's Five Forces analysis is built upon a robust foundation of data from industry-specific market research reports, financial statements of key players, and public company filings. We also incorporate insights from trade publications and competitor news releases to capture the dynamic competitive landscape.