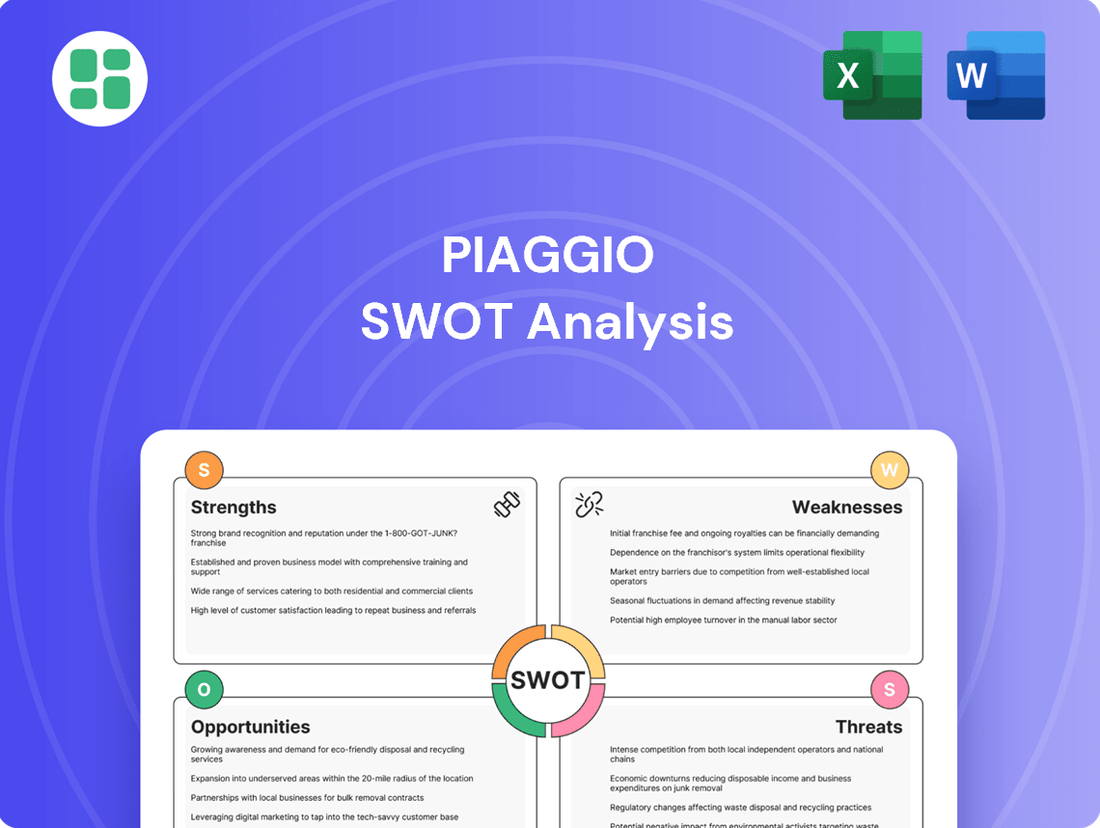

Piaggio SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Piaggio Bundle

Piaggio's iconic brand strength and innovative product lines are key advantages, but the company faces challenges in adapting to evolving mobility trends and intense competition. Understanding these dynamics is crucial for any stakeholder looking to navigate the future of personal transportation.

Want the full story behind Piaggio's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Piaggio commands a powerful lineup of iconic brands, including the beloved Vespa, performance-focused Aprilia, and classic Moto Guzzi. This strong brand portfolio isn't just about recognition; it translates directly into market advantage. For instance, Vespa's enduring appeal as a lifestyle symbol, rather than just a scooter, allows Piaggio to command premium pricing and cultivate a fiercely loyal customer base, a testament to its deep heritage.

Piaggio's strength lies in its remarkably diversified product range, encompassing scooters, motorcycles, and even light commercial vehicles. This broad portfolio allows them to serve a wide array of customer needs and tap into various market segments, reducing reliance on any single product line.

This strategic diversification acts as a powerful buffer against market volatility. For instance, by not solely depending on the two-wheeler market, Piaggio can better weather downturns in specific segments, ensuring a more stable revenue stream. Their 2023 financial reports, showing consistent performance across different vehicle categories, underscore this resilience.

Furthermore, Piaggio's venture into light commercial vehicles, particularly their electric three-wheelers, adds another layer of market resilience. This expansion into new mobility solutions positions them favorably to capture growth in evolving urban logistics and sustainable transport sectors.

Piaggio demonstrates robust market leadership in vital areas. As of the first quarter of 2025, the company commands a 15.3% share of the European scooter market and a significant 29.9% share in North America. This strong positioning highlights successful competitive tactics and well-established distribution channels in key, developed markets, underpinning its profitability and growth potential.

Commitment to Innovation and R&D

Piaggio's commitment to innovation is evident in its consistent investment in research and development, driving the introduction of new products and technologies. This includes advancements like Euro 5+ compliant engines and sophisticated rider assistance systems, keeping their offerings competitive and appealing to modern consumers.

The company's forward-thinking approach is further demonstrated by its subsidiary, Piaggio Fast Forward, which explores cutting-edge robotics and future mobility solutions. This dual focus on immediate product enhancement and long-term technological exploration ensures Piaggio remains at the forefront of the evolving mobility landscape.

- R&D Investment: Piaggio consistently allocates significant resources to R&D, fueling its innovation pipeline.

- Technological Advancements: Introduction of Euro 5+ engines and advanced rider assistance systems enhances product performance and safety.

- Future Mobility: Piaggio Fast Forward spearheads development in robotics, signaling a strategic move into next-generation mobility.

- Product Relevance: The continuous innovation cycle ensures Piaggio's product portfolio remains relevant and attractive in a dynamic market.

Resilient Margins despite Market Headwinds

Piaggio has shown impressive strength by maintaining resilient margins even when facing tough economic times and lower sales volumes. For instance, in the first quarter of 2025, their gross margin stood at a solid 30.5%, and for the full year 2024, it was 29.2%. This ability to keep profits up when revenues are down highlights how well they manage their costs and price their products effectively, showing customers value their brands.

Key factors contributing to this resilience include:

- Effective Cost Control: Piaggio has implemented strong cost management strategies across its operations.

- Strategic Pricing: The company has successfully navigated market pressures through smart pricing decisions.

- Brand Value Perception: The enduring appeal and perceived quality of Piaggio's brands allow for premium pricing.

Piaggio's brand portfolio, featuring iconic names like Vespa and Aprilia, is a significant strength, enabling premium pricing and customer loyalty. This is further bolstered by a diversified product range that includes scooters, motorcycles, and light commercial vehicles, reducing reliance on any single market segment and enhancing financial stability, as evidenced by their consistent performance across categories in 2023.

The company holds strong market leadership, with a 15.3% share in the European scooter market and 29.9% in North America as of Q1 2025. This is driven by continuous innovation, including Euro 5+ engines and advanced rider assistance systems, ensuring product relevance and competitiveness.

Piaggio demonstrates remarkable financial resilience, maintaining healthy margins even during economic downturns. For example, their gross margin was 30.5% in Q1 2025 and 29.2% for the full year 2024, reflecting effective cost control and strategic pricing that leverages strong brand value perception.

What is included in the product

Analyzes Piaggio’s competitive position through key internal and external factors, detailing its strengths in brand heritage and market presence, weaknesses in product diversification, opportunities in emerging markets and electric mobility, and threats from intense competition and economic volatility.

Offers a clear framework to identify and address Piaggio's competitive challenges and capitalize on market opportunities.

Weaknesses

Piaggio faced a significant drop in its consolidated net sales and vehicle shipments during the first quarter of 2025, continuing a trend observed throughout 2024. This decline, amounting to a 7.1% decrease in net sales to €380.7 million in Q1 2025 compared to the previous year, can be attributed to a challenging global economic climate and necessary inventory adjustments by dealerships.

The company's total net sales for the full year 2024 also saw a reduction, impacting its overall financial health. This persistent decline in sales volumes poses a risk to Piaggio's market share and profitability if not effectively addressed.

Piaggio's financial performance is highly susceptible to international market volatility, ongoing macroeconomic shifts, and geopolitical tensions. Events like global conflicts, increasing interest rates, and persistent inflation directly impact consumer spending power, creating a challenging and unpredictable business landscape.

For instance, the ongoing geopolitical instability in Eastern Europe and the Middle East, coupled with global inflation rates that remained elevated through much of 2023 and into 2024, have demonstrably squeezed disposable incomes across key European markets. This directly translates to reduced demand for discretionary purchases, including vehicles, impacting Piaggio's sales volumes and revenue streams.

The company's reliance on a global supply chain also exposes it to disruptions caused by trade disputes or regional conflicts, further complicating production schedules and cost management. This external dependency makes accurate forecasting and robust strategic planning considerably more difficult.

Piaggio has experienced notable sales declines in important Asian premium markets during 2024. For instance, Thailand saw a significant contraction, and China also presented challenges, indicating a struggle to connect with local consumers.

These contractions point to potential issues with product localization, the impact of aggressive local competitors, or a failure to anticipate evolving consumer tastes in these previously promising regions. Addressing these market-specific weaknesses is vital for Piaggio's broader international growth strategy.

Lagging in Competitive Electric Lineup for Two-Wheelers

Piaggio's electric two-wheeler lineup, while present, faces scrutiny for not being as competitive as those from newer, EV-focused manufacturers. This lag could hinder its ability to capitalize on the accelerating global demand for electric mobility. For instance, in early 2024, while Piaggio has models like the Vespa Elettrica, the market has seen a surge of innovative electric scooters and motorcycles from brands like Ola Electric and Ather Energy, which are rapidly gaining traction.

This competitive gap puts Piaggio at risk of losing market share in a segment that is experiencing significant growth. The rapid pace of technological advancement in the EV sector means that companies not at the forefront of innovation could quickly fall behind. Piaggio's ability to quickly adapt and introduce more compelling electric offerings will be crucial for its sustained competitiveness in the coming years.

Key considerations for Piaggio's electric two-wheeler strategy include:

- Product Development Pace: Accelerating the introduction of new, high-performance electric models to match or surpass competitors.

- Technology Integration: Incorporating advanced battery technology, charging solutions, and smart features that consumers expect in modern EVs.

- Market Positioning: Clearly communicating the value proposition of its electric offerings and potentially targeting specific market segments with tailored products.

Increased Net Financial Debt

Piaggio's net financial debt saw an increase through the first quarter of 2025, continuing a trend observed at the close of 2024. This escalation in debt is partly a consequence of the inherent seasonality within the two-wheeler industry, which typically demands significant capital outlay during the initial half of the year.

Furthermore, the company's strategic decision to boost capital expenditure has also contributed to this rising debt level. While these investments are crucial for fostering future growth and innovation, a mounting debt load can potentially constrain Piaggio's financial maneuverability and lead to higher interest payment obligations.

- Increased Debt: Net financial debt rose in Q1 2025 and at the end of 2024.

- Seasonal Impact: The two-wheeler business's seasonal demand absorbs resources early in the year.

- Capital Expenditure: Higher investments for growth are a contributing factor to the debt increase.

- Financial Flexibility: A growing debt burden could limit future financial options and increase interest costs.

Piaggio's sales performance has been sluggish, with net sales dropping by 7.1% to €380.7 million in Q1 2025, and a broader decline throughout 2024. This trend is exacerbated by global economic headwinds and necessary dealer inventory adjustments.

The company is vulnerable to international market volatility, including geopolitical tensions and inflation, which directly impact consumer spending on discretionary items like vehicles.

Challenges in key Asian markets like Thailand and China during 2024 highlight potential issues with product localization and competitive pressures, hindering growth in previously promising regions.

Piaggio's electric two-wheeler offerings are not keeping pace with competitors, risking market share loss in a rapidly expanding segment. For example, while Piaggio has models like the Vespa Elettrica, brands like Ola Electric and Ather Energy are gaining significant traction with innovative EV solutions as of early 2024.

Same Document Delivered

Piaggio SWOT Analysis

The preview you see is the same document the customer will receive after purchasing. This Piaggio SWOT analysis provides a comprehensive overview of the company's strategic positioning. You'll get the full, detailed report upon purchase, ready for your business needs.

Opportunities

The global electric two-wheeler market is projected to reach $44.7 billion by 2025, presenting a substantial opportunity for Piaggio. The company's existing expansion of electric LCVs and its electrified scooter models, like the Vespa Elettrica, are well-positioned to capture this expanding segment.

Piaggio has a substantial opportunity to grow by entering new geographic markets, especially in developing economies like South America and India. These regions show a strong demand for electric three-wheelers, a segment where Piaggio can leverage its expertise. For instance, India's electric three-wheeler market is projected to reach $2.7 billion by 2030, presenting a significant growth avenue.

Growing urban populations and the resulting traffic congestion, with cities like London experiencing average commute times of over 50 minutes in 2024, are creating a strong demand for alternative transportation. This is a significant opportunity for Piaggio, as its expertise in scooters and three-wheelers directly addresses the need for more agile and efficient urban mobility.

Piaggio's investment in Piaggio Fast Forward, focusing on urban robotics and autonomous solutions, further strengthens its position. For instance, their Gita cargo bot is designed to navigate urban environments, showcasing a forward-thinking approach to personal and goods transport in congested areas.

By capitalizing on these urban mobility trends, Piaggio can solidify its brand as a key player in sustainable and smart city transportation, potentially capturing a larger market share as cities worldwide prioritize cleaner and more efficient ways to move people and goods.

Digitalization and Connected Vehicle Technologies

The two-wheeler market is rapidly embracing smart features and connectivity, presenting a significant opportunity for Piaggio. By enhancing its offerings with advanced rider assistance systems (ARAS) and robust connectivity solutions like Piaggio MIA, the company can significantly boost product desirability.

This strategic push into digitalization not only elevates the rider experience but also unlocks new revenue streams. Piaggio can leverage the data generated from connected vehicles to develop innovative, data-driven services, fostering recurring revenue models and strengthening customer loyalty. For instance, by 2024, the global connected two-wheeler market was projected to reach over $3.5 billion, indicating substantial growth potential.

- Enhanced User Experience: Integrating features like GPS navigation, remote diagnostics, and personalized riding profiles through connected platforms.

- New Revenue Streams: Developing subscription-based services for advanced features, predictive maintenance alerts, and usage-based insurance.

- Data-Driven Insights: Utilizing rider behavior data to inform product development, marketing strategies, and service improvements.

- Competitive Differentiation: Positioning Piaggio as a technology leader in the evolving two-wheeler landscape.

Premiumization and Brand Extension

Piaggio's strong brand heritage, particularly with Vespa, presents a significant opportunity for premiumization. This involves introducing more sophisticated, higher-priced models and exclusive limited editions that appeal to consumers seeking status and unique design. For example, the Vespa 946, a premium offering, demonstrates the potential for higher margins within the scooter segment.

Beyond vehicles, Piaggio can leverage its iconic brands for lifestyle extensions. This includes developing and marketing fashion apparel, accessories, and other merchandise that capture the essence of brands like Vespa and Aprilia. Such ventures can tap into the cultural cachet of these marques, creating new revenue streams and deepening customer engagement. In 2023, the global premium apparel market was valued at over $300 billion, indicating substantial potential for brand extensions.

- Brand Equity: Piaggio's established brands, especially Vespa, possess high recognition and desirability, enabling premium pricing strategies.

- Lifestyle Products: Expanding into fashion, accessories, and other lifestyle categories can unlock new revenue streams by monetizing brand appeal.

- Market Potential: The global market for premium lifestyle goods offers significant growth opportunities for brands with strong cultural resonance.

Piaggio is well-positioned to capitalize on the growing demand for electric mobility, with the global electric two-wheeler market expected to reach $44.7 billion by 2025. Its existing electric LCVs and models like the Vespa Elettrica align perfectly with this trend. Furthermore, expanding into developing markets, especially in South America and India where electric three-wheelers are in high demand, presents a significant growth avenue, with India's market alone projected to hit $2.7 billion by 2030.

The increasing urbanization and traffic congestion globally, exemplified by cities like London where average commutes exceeded 50 minutes in 2024, create a clear need for agile urban transport solutions. Piaggio's expertise in scooters and three-wheelers directly addresses this, further bolstered by its investment in Piaggio Fast Forward for robotics and autonomous solutions, like the Gita cargo bot, designed for urban navigation.

The integration of smart features and connectivity in the two-wheeler market offers substantial opportunities. Piaggio can enhance product appeal with advanced rider assistance systems and connectivity solutions like Piaggio MIA, potentially capturing a share of the global connected two-wheeler market, which was projected to exceed $3.5 billion by 2024. This digitalization can also unlock new revenue streams through data-driven services.

Piaggio's iconic brands, especially Vespa, provide a strong foundation for premiumization and lifestyle extensions. Introducing more sophisticated, higher-priced models and leveraging brands for fashion and accessories can tap into the significant global premium lifestyle goods market, valued at over $300 billion in 2023, to create new revenue streams and deepen customer engagement.

Threats

Piaggio faces formidable competition in the two-wheeler sector. Established global players like Honda and Yamaha continue to hold significant market share, while emerging electric vehicle specialists, especially from Asia, are rapidly gaining traction. For instance, in 2023, Honda's global motorcycle sales reached over 17 million units, underscoring the scale of the challenge.

This intense rivalry necessitates constant product innovation and aggressive pricing strategies. The pressure to differentiate is amplified by the rapid growth of the electric two-wheeler segment, where new entrants are often more agile in adopting cutting-edge battery and motor technologies. This dynamic environment demands substantial R&D investment to remain competitive and capture market share.

Stricter emission regulations, like the upcoming Euro 7 standards in Europe, present a significant hurdle for Piaggio. These evolving environmental mandates require substantial investment in research and development to adapt existing engine technologies. For instance, the transition to Euro 7 could necessitate costly redesigns, impacting production expenses and potentially leading to higher vehicle prices for consumers.

The pressure to meet these tighter emission limits, such as those targeting reduced NOx and particulate matter, may also temporarily disrupt sales. Consumers might accelerate their purchases of current models before new, potentially more expensive, compliant versions are introduced, creating a short-term dip in demand for older inventory.

Global economic uncertainties, including persistent high inflation and rising interest rates, are significantly dampening consumer purchasing power and confidence. For instance, in late 2024, many developed economies continued to grapple with inflation rates exceeding central bank targets, leading to tighter monetary policy and increased borrowing costs.

This economic environment directly translates to reduced discretionary spending on big-ticket items like vehicles, which impacts Piaggio's sales volumes and overall revenue. Analysts projected a slowdown in the two-wheeler market in several key regions throughout 2024 due to these affordability concerns.

These economic headwinds are not short-lived; they can create a prolonged period of subdued market demand, affecting Piaggio's ability to achieve its sales targets and maintain profitability in the near to medium term.

Supply Chain Disruptions and Raw Material Volatility

The global manufacturing sector, including Piaggio's operations, continues to grapple with supply chain fragility. Shortages of essential components, particularly semiconductors, remain a significant concern, impacting production schedules. For instance, the automotive industry, a key sector for Piaggio, experienced widespread production cuts in 2023 due to chip scarcity, with some estimates suggesting a loss of millions of vehicles globally. This vulnerability can directly translate to increased manufacturing costs and a reduced ability to satisfy consumer demand, ultimately affecting Piaggio's profitability and competitive standing in the market.

Raw material price volatility presents another substantial threat. Fluctuations in the cost of metals like steel and aluminum, as well as energy prices, directly influence Piaggio's production expenses. The ongoing geopolitical landscape and global economic uncertainties contribute to this price instability. For example, energy prices saw significant spikes in late 2023 and early 2024, impacting manufacturing overheads across various industries. Such cost pressures can erode profit margins if not effectively managed through strategic sourcing and pricing adjustments.

- Semiconductor Shortages: Continued reliance on semiconductors for advanced vehicle features makes Piaggio susceptible to component availability issues, potentially delaying product launches and increasing lead times.

- Raw Material Price Swings: Volatility in the prices of steel, aluminum, and other key materials directly impacts Piaggio's cost of goods sold, requiring agile procurement strategies.

- Logistics and Transportation Costs: Disruptions in global shipping and increased freight rates, as observed throughout 2023 and into 2024, add to the overall cost of bringing finished products to market.

- Geopolitical Instability: International conflicts and trade tensions can further exacerbate supply chain vulnerabilities and increase the cost and complexity of sourcing materials and components.

Changing Consumer Preferences and Urban Mobility Shifts

Consumers are increasingly favoring shared mobility options and public transport, potentially impacting demand for Piaggio's traditional scooter and motorcycle offerings. For instance, a 2024 report indicated a 15% year-over-year increase in ride-sharing usage in major European cities, a trend that could divert customers from personal vehicle purchases. This broader shift in urban mobility behavior presents a significant challenge to maintaining market share in personal transportation segments.

Furthermore, evolving preferences for different types of personal mobility devices, beyond traditional two-wheelers, pose another threat. As cities become more congested and environmental concerns grow, demand for compact, electric, and potentially even foldable personal transport solutions is rising. Piaggio must actively monitor and adapt to these diverse consumer preferences to ensure its product portfolio remains relevant in the evolving mobility landscape.

The increasing adoption of electric bicycles and advanced e-scooters from competitors also directly challenges Piaggio's established position. In 2025, the European e-bike market alone is projected to exceed €20 billion, with rapid innovation in battery technology and lightweight designs. This competitive pressure necessitates a swift and strategic response to capture emerging market segments and retain customer loyalty.

Piaggio faces a highly competitive landscape, with established players like Honda selling over 17 million motorcycles globally in 2023 and agile electric vehicle startups posing a significant threat. Stricter emission standards, such as Euro 7, demand costly R&D for compliance, potentially impacting pricing and sales. Economic headwinds like persistent inflation and rising interest rates in late 2024 are reducing consumer spending power, affecting demand for vehicles.

Supply chain disruptions, particularly semiconductor shortages that impacted millions of vehicle production losses in 2023, coupled with volatile raw material costs for steel and aluminum, continue to challenge Piaggio's production and profitability. The growing popularity of shared mobility and alternative personal transport solutions, like e-bikes which are projected to exceed €20 billion in the European market by 2025, also presents a challenge to traditional two-wheeler sales.

SWOT Analysis Data Sources

This Piaggio SWOT analysis is built upon a robust foundation of data, drawing from the company's official financial filings, comprehensive market research reports, and expert industry analyses to provide a well-rounded strategic perspective.