Piaggio Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Piaggio Bundle

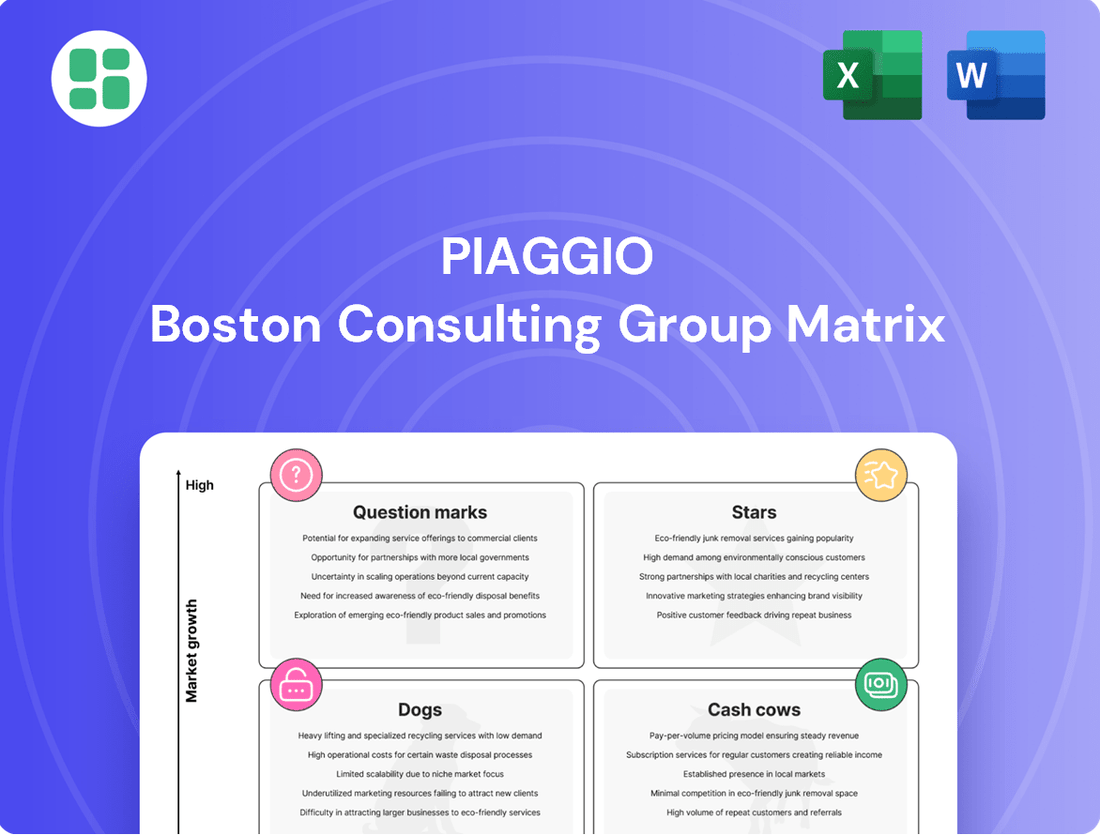

Curious about how a company's product portfolio stacks up? Our BCG Matrix analysis breaks down products into Stars, Cash Cows, Dogs, and Question Marks, offering a vital snapshot of market performance and potential. Don't just get a glimpse; unlock the full strategic advantage by purchasing the complete BCG Matrix, which provides detailed quadrant placements and actionable insights for optimizing your investments and product strategy.

Stars

The Vespa Elettrica 2.0 is strategically placed as a Star in Piaggio's BCG Matrix. This classification stems from its operation within the burgeoning electric two-wheeler market, a sector experiencing significant expansion and technological advancement. Piaggio's dedication to broadening its electric offerings, with the Elettrica 2.0 as a key model, underscores its potential for high growth and market leadership.

The global electric two-wheeler market is on a strong upward trajectory, with projections indicating it will reach USD 114.3 billion by 2033. This growth is fueled by a compound annual growth rate of 11.0% between 2025 and 2033. Vespa's established brand equity, combined with strategic product introductions like the Elettrica 2.0, positions it favorably to capitalize on this expanding market segment.

The Aprilia RS 457 and Tuono 457, with their new 457cc engines, are poised to be significant players in the motorcycle market, particularly in emerging regions like India where they have seen a positive reception and boosted sales. These models are strategically targeting the expanding premium sport and adventure motorcycle segments.

While Piaggio's overall sales volume might be moderate, the introduction of these 457cc Aprilia models signals a focused effort to strengthen the brand's position in key growth markets, especially in North America, by offering competitive options in high-demand categories.

The 2025 Piaggio Liberty and Medley models are key players in Piaggio's portfolio, demonstrating robust sales in the competitive high-wheel scooter market. These scooters are particularly strong performers in European markets, where Piaggio has a substantial presence, and are also gaining traction in North America. Their success reflects the ongoing consumer preference for efficient and practical urban transportation.

Aprilia's MotoGP Racing Program

Aprilia's MotoGP racing program is a significant asset, positioning the brand as a contender in the elite racing world. Their 2024 season saw a Grand Prix victory, demonstrating tangible on-track success that directly fuels brand prestige.

The recruitment of top-tier talent for 2025, including Jorge Martín and Marco Bezzecchi, underscores Aprilia's commitment and ambition. This racing prowess acts as a powerful marketing engine, boosting demand for their high-performance street motorcycles by attracting enthusiasts who value racing pedigree.

- Brand Equity Enhancement: MotoGP success directly translates to increased brand recognition and desirability.

- Marketing Platform: The racing program serves as a high-visibility platform to showcase technological advancements and performance capabilities.

- Target Audience Appeal: Attracts performance-focused consumers, driving sales of premium Aprilia models.

- Competitive Edge: Demonstrates Aprilia's engineering prowess and commitment to innovation in a highly competitive market.

Piaggio's Electric Three-Wheelers in India

Piaggio's electric three-wheel vehicle segment in India is performing exceptionally well, categorizing it as a Star in the BCG matrix. This strong showing is driven by robust market growth, fueled by government incentives like subsidies and the broader national push towards electric mobility.

India represents a critical market for Piaggio's commercial vehicle operations. The company's strategic focus on electric three-wheelers aligns perfectly with the country's evolving commercial transport landscape, positioning Piaggio to capitalize on the rapid electrification trend in this sector.

- Market Growth: India's electric three-wheeler market is experiencing significant expansion, with projections indicating continued strong growth in the coming years.

- Government Support: Favorable government policies and subsidies are a major catalyst for adoption, making electric three-wheelers an attractive proposition for commercial operators.

- Piaggio's Position: Piaggio has established a solid presence in this segment, leveraging its expertise in three-wheeler manufacturing and adapting to the electric vehicle revolution.

- Future Potential: The ongoing electrification of commercial fleets in India presents a substantial opportunity for Piaggio's electric three-wheeler business to maintain its Star status and further increase market share.

The Vespa Elettrica 2.0, along with Piaggio's electric three-wheelers in India, are classified as Stars within the BCG Matrix. These products operate in high-growth markets with strong potential for market leadership. Their success is driven by expanding global electric mobility trends and specific market dynamics, such as government support in India. Piaggio's investment in these areas indicates a strategy to capture significant market share in rapidly evolving sectors.

| Product/Segment | Market Growth | Market Share | BCG Classification |

|---|---|---|---|

| Vespa Elettrica 2.0 | High (Global Electric Two-Wheeler Market) | Growing | Star |

| Piaggio Electric 3-Wheelers (India) | High (India EV 3-Wheeler Market) | Strong | Star |

What is included in the product

The Piaggio BCG Matrix analyzes product portfolio performance based on market share and growth, guiding strategic decisions for each category.

The Piaggio BCG Matrix offers a clear, visual framework to identify underperforming business units, alleviating the pain of resource misallocation.

Cash Cows

Vespa scooters, excluding their electric variants, represent a significant cash cow for Piaggio. These iconic scooters boast a strong global brand presence and a loyal customer base, consistently contributing substantial revenue and profits to the company.

Despite occasional regional sales variations, Vespa's premium positioning and established market penetration in mature territories ensure robust financial performance. Piaggio's approach focuses on preserving brand equity and maintaining healthy profit margins by avoiding aggressive price cuts.

In 2023, Piaggio reported that its Vespa brand continued to be a cornerstone of its business, with sales in key European markets demonstrating resilience. The brand's enduring appeal allows Piaggio to command premium pricing, supporting its cash cow status.

Piaggio's established internal combustion engine (ICE) light commercial vehicles, notably the Ape series, are solid cash cows. These vehicles dominate short-range urban and suburban transport in key markets like Europe and India, generating consistent sales volumes and revenue.

The Ape range benefits from strong brand recognition and operational efficiency, leading to healthy profit margins. With demand remaining stable and requiring minimal promotional spending, these ICE light commercial vehicles represent a reliable source of income for Piaggio, underpinning its financial stability.

The Moto Guzzi V85 Enduro has found a solid footing in the motorcycle market, demonstrating robust sales performance and contributing significantly to Piaggio's overall volume. This model, with its blend of retro aesthetics and contemporary features, has resonated well with riders seeking a distinctive experience.

Moto Guzzi’s consistent revenue and unit sales highlight a stable, albeit niche, market for its classic-inspired motorcycles. The V85 TT specifically, with its appealing design and technological integration, caters effectively to a dedicated and appreciative customer segment.

Piaggio Liberty and Piaggio Medley (Existing Models)

The Piaggio Liberty and Medley scooters, representing existing models, continue to be significant cash cows for Piaggio. These established models maintain a strong presence in key markets like Europe and North America, where Piaggio holds considerable market share. Their consistent demand and well-recognized brand reduce the need for extensive marketing spend, allowing them to generate reliable cash flow.

- Market Dominance: Piaggio Liberty and Medley hold substantial market share in European and North American scooter segments.

- Established Demand: These models benefit from consistent consumer interest and brand loyalty.

- Reduced Marketing Costs: Lower promotional investment compared to new launches contributes to higher profit margins.

- Steady Cash Generation: Their reliable sales performance ensures a continuous and predictable stream of cash flow for Piaggio.

Piaggio MP3

The Piaggio MP3, especially with recent iterations like the MP3 310, represents a mature product within Piaggio's portfolio. Its established position in markets like Europe, particularly its unique advantage of being drivable with a standard car license, ensures a consistent demand.

This distinct market advantage allows the MP3 to maintain steady sales figures, acting as a reliable revenue generator for Piaggio. The product's maturity means it doesn't necessitate heavy investment in new development or aggressive marketing to achieve its sales targets.

- Consistent European Market Presence: The Piaggio MP3 has a well-established foothold in European urban centers.

- Car License Eligibility: A key differentiator is its operability with a standard car license in many regions, broadening its accessibility.

- Steady Revenue Stream: This unique selling proposition translates into predictable sales, contributing reliably to Piaggio's profitability.

- Mature Product Lifecycle: As a mature product, it requires less capital for innovation and marketing compared to newer models.

The Piaggio Liberty and Medley scooters are prime examples of cash cows, consistently generating strong revenue with established market share in Europe and North America. Their enduring brand loyalty and reduced marketing needs translate into healthy profit margins.

In 2023, Piaggio's established ICE light commercial vehicles, particularly the Ape series, continued their role as reliable cash cows, dominating urban transport in Europe and India. These vehicles benefit from strong brand recognition and operational efficiency, ensuring consistent sales volumes and revenue with minimal promotional spending.

The Vespa brand, excluding electric models, remains a significant cash cow, leveraging its global presence and loyal customer base to deliver substantial profits. Piaggio's strategy focuses on preserving brand equity and premium pricing in mature markets, ensuring robust financial performance.

| Product Line | Category | Market Position | Contribution |

| Vespa (ICE) | Scooters | Global Premium | Strong Revenue & Profit |

| Ape Series (ICE) | Light Commercial Vehicles | Urban Transport Dominance | Consistent Sales & Revenue |

| Liberty & Medley | Scooters | Established European/NA Presence | Steady Cash Flow |

| Piaggio MP3 | Scooters | Unique European Niche | Predictable Revenue |

What You See Is What You Get

Piaggio BCG Matrix

The Piaggio BCG Matrix document you are previewing is the identical, fully formatted report you will receive upon purchase. This means no watermarks or demo content, ensuring you get a professional, ready-to-use strategic tool for analyzing Piaggio's product portfolio. You can confidently use this preview as a direct representation of the high-quality, analysis-ready file you'll download immediately after completing your purchase, enabling swift integration into your business planning and decision-making processes.

Dogs

Certain older or niche Gilera models, possibly in segments experiencing reduced growth, might be classified as Dogs within Piaggio's portfolio. These models may hold a small market share, and with scarce recent sales data, their current focus and performance could be stagnant compared to other Piaggio brands.

Traditional 50cc scooter models, particularly those not updated for Euro 5+ emissions standards, are struggling in established European markets. These models are being discontinued as demand wanes.

With limited growth potential and shrinking market share, these outdated scooters represent a drain on resources. Piaggio's investment in compliance or managing existing inventory for these products yields minimal returns for future expansion.

Certain niche or discontinued Gilera motorcycles, like the Gilera GP 800 or older models that haven't been updated, likely reside in the Dogs category of the Piaggio BCG Matrix. These models typically exhibit low market share and low growth potential, often due to a lack of recent innovation or shifting consumer preferences.

Gilera's diminished presence compared to Piaggio's other brands, such as Aprilia and Moto Guzzi, suggests a strategic de-emphasis. This could translate to reduced marketing support and potentially declining sales figures for these specific Gilera models, making them prime candidates for divestiture or discontinuation to reallocate resources.

Legacy Piaggio Scooter Models with Limited Appeal

Certain legacy Piaggio scooter models, perhaps those from earlier eras that didn't achieve the widespread recognition of Vespa or the practical appeal of models like the Liberty or Medley, could be categorized as Dogs within the Piaggio BCG Matrix. These models likely face a combination of low market share and minimal growth, indicating a declining or niche demand.

These underperforming models may represent a drain on resources without significant returns. For instance, if a particular Piaggio model, not a Vespa, saw sales decline by over 10% year-over-year in 2024 and holds less than a 2% market share in its segment, it would fit this profile. Such products often require continued investment for maintenance or inventory, acting as cash traps.

- Low Market Share: Models with less than 3% market share in their respective scooter segments.

- Stagnant or Declining Growth: Sales figures showing no growth or a decline of over 5% annually.

- Limited Brand Premium: Lacking the strong brand equity associated with premium lines like Vespa.

- Potential Cash Traps: Requiring ongoing investment for minimal revenue generation.

Non-Electric Light Commercial Vehicles in Markets Shifting to EV

Non-electric light commercial vehicles (LCVs) in urban areas are facing a significant challenge as cities increasingly mandate or incentivize electric vehicle adoption. For Piaggio, this means that while their traditional ICE LCVs might be cash cows in broader markets, specific models catering to these environmentally conscious urban centers could see their demand shrink. This shift is driven by factors like stricter emissions standards and government subsidies for EVs, making non-electric options less attractive and potentially obsolete in these key segments.

- Urban EV Mandates: Many major cities, including London and Paris, have implemented or are planning ultra-low emission zones (ULEZs) that penalize or ban higher-emission vehicles, directly impacting ICE LCVs.

- Subsidy Landscape: Government incentives for electric LCV purchases, such as tax credits and grants, are making EVs more cost-competitive, eroding the price advantage of traditional ICE vehicles. For example, in 2024, various European countries continued to offer substantial grants for commercial EV adoption.

- Market Share Erosion: Without a swift pivot to electric alternatives, Piaggio's ICE LCVs in these specific urban markets risk losing market share to competitors offering electric solutions.

- Potential for Decline: These ICE models, if not updated or replaced with electric variants, could become question marks, facing declining sales and profitability in segments actively moving towards zero-emission transport.

Certain older or niche Gilera models, particularly those not updated for current emissions standards or consumer trends, likely fall into the Dogs category. These models may have a very small market share, perhaps under 2%, and are experiencing declining sales, potentially over 5% year-over-year in 2024. Their limited growth potential means they are not strategic priorities.

Traditional internal combustion engine (ICE) light commercial vehicles (LCVs) in urban areas are increasingly becoming Dogs. As cities like those in the EU implement stricter emissions regulations and offer incentives for electric vehicles, these ICE LCVs face shrinking demand and market share. For example, in 2024, many European urban centers saw a significant push towards EV adoption, making older ICE models less viable.

These underperforming products represent a drain on resources, requiring ongoing investment for minimal returns. They are prime candidates for discontinuation or divestiture to reallocate capital to more promising segments of Piaggio's portfolio.

| Model Type | Market Share (Est.) | Annual Growth (Est. 2024) | Strategic Implication |

|---|---|---|---|

| Legacy Gilera Motorcycles | < 3% | -5% or lower | Low growth, low share; potential discontinuation |

| Urban ICE LCVs | Declining (Segment Specific) | -10% or lower (in key urban markets) | Threatened by EV mandates; requires strategic review |

| Outdated 50cc Scooters (Non-Euro 5+) | < 2% | -5% or lower | Discontinued due to regulatory changes and low demand |

Question Marks

The Piaggio 1, particularly its 2024 advanced iteration, operates within the burgeoning electric scooter market. While this segment is experiencing rapid expansion, the Piaggio 1 faces stiff competition from established leaders, necessitating substantial investment to bolster its market share.

Currently, the Piaggio 1 can be categorized as a Cash Cow or a Question Mark, depending on its specific market performance and investment strategy. It demands significant capital for research and development, as well as for expanding its market presence, which are characteristic of a Question Mark.

Should Piaggio successfully execute aggressive marketing campaigns and continuous product innovation, the Piaggio 1 has the potential to transition into a Star. This would involve capturing a larger portion of the high-growth electric scooter market, thereby generating substantial returns.

New electric motorcycle concepts from Aprilia and Moto Guzzi are positioned as potential Stars in the Piaggio BCG Matrix. While the electric motorcycle market is experiencing rapid growth, these specific models are in their nascent stages with currently low market share. Significant investment in research and development, alongside robust marketing strategies, will be crucial for their success.

The success of these electric concepts hinges on their ability to capture a meaningful share of the burgeoning electric two-wheeler market. For instance, the global electric motorcycle market was valued at approximately USD 10 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of over 15% through 2030, according to various industry reports. Aprilia and Moto Guzzi's ability to innovate and appeal to consumers in this dynamic landscape will determine if they can transition from question marks to market leaders.

Piaggio Fast Forward's (PFF) robotics, including Gita and the newer Kilo, are positioned as question marks in the Piaggio BCG matrix. These are in a rapidly expanding market with substantial future promise, but their current contribution to Piaggio's overall revenue and market share is minimal.

The development and scaling of these advanced mobile robots represent significant research and development expenditures for Piaggio. While they hold considerable potential for future growth, they are currently cash consumers rather than cash generators, necessitating continued investment to achieve market penetration and profitability.

Aprilia RS and Tuono with 457cc Engines in Emerging Markets

The Aprilia RS 457 and Tuono 457, while showing promise, could be considered Question Marks within Piaggio's BCG Matrix in emerging markets. These regions present significant growth opportunities for motorcycles, but Aprilia's brand recognition and market penetration are still building.

To elevate these models from Question Marks to Stars, Aprilia must implement aggressive market share acquisition strategies. This includes adapting pricing, enhancing distribution networks, and focusing marketing efforts on the specific needs and preferences of these developing markets. For instance, in India, where the 457cc segment is gaining traction, Aprilia needs to solidify its position against established players.

- Market Potential: Emerging markets, particularly in Asia and Latin America, represent a substantial growth avenue for the premium motorcycle segment.

- Brand Development: Aprilia's brand presence is still nascent in many of these regions, requiring focused efforts to build awareness and desirability for the RS 457 and Tuono 457.

- Competitive Landscape: The premium segment in these markets is often fiercely contested by both local and international manufacturers, demanding a differentiated approach.

- Strategic Investment: Significant investment in marketing, sales infrastructure, and potentially localized production or assembly will be crucial for these models to capture market share and transition to Stars.

Piaggio's Expansion into New Two-Wheeler Markets (Beyond Vespa/Medium Range)

Piaggio's strategic push into new two-wheeler segments, moving beyond its iconic Vespa and established medium-range offerings, positions these ventures as Question Marks in the BCG matrix. These initiatives are designed to tap into burgeoning markets or entirely new vehicle categories where Piaggio currently has minimal penetration. For instance, their exploration into electric mobility solutions for emerging markets or the development of specialized utility vehicles represent significant investments with uncertain returns in the near term.

- New Market Entry: Piaggio's strategy includes targeting high-growth, underdeveloped two-wheeler markets, potentially in Southeast Asia or Africa, where demand for affordable and efficient personal transportation is rising.

- Product Diversification: Expansion beyond traditional scooters and motorcycles involves venturing into electric scooters, e-bikes, or even lightweight commercial vehicles, requiring substantial R&D and marketing capital.

- Investment Requirement: These new ventures demand significant financial backing for product development, manufacturing setup, distribution networks, and brand building in unfamiliar territories.

- Market Share Potential: While these markets offer substantial growth potential, Piaggio's current market share in these nascent segments is negligible, necessitating aggressive strategies to gain traction.

Question Marks represent Piaggio's ventures into new, high-growth markets or product categories where the company currently holds a small market share. These initiatives, such as the Aprilia and Moto Guzzi electric motorcycles or Piaggio Fast Forward's robotics, require substantial investment to develop and gain traction. Their success hinges on Piaggio's ability to innovate, market effectively, and capture a significant portion of these expanding sectors.

BCG Matrix Data Sources

Our Piaggio BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.