Piaggio Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Piaggio Bundle

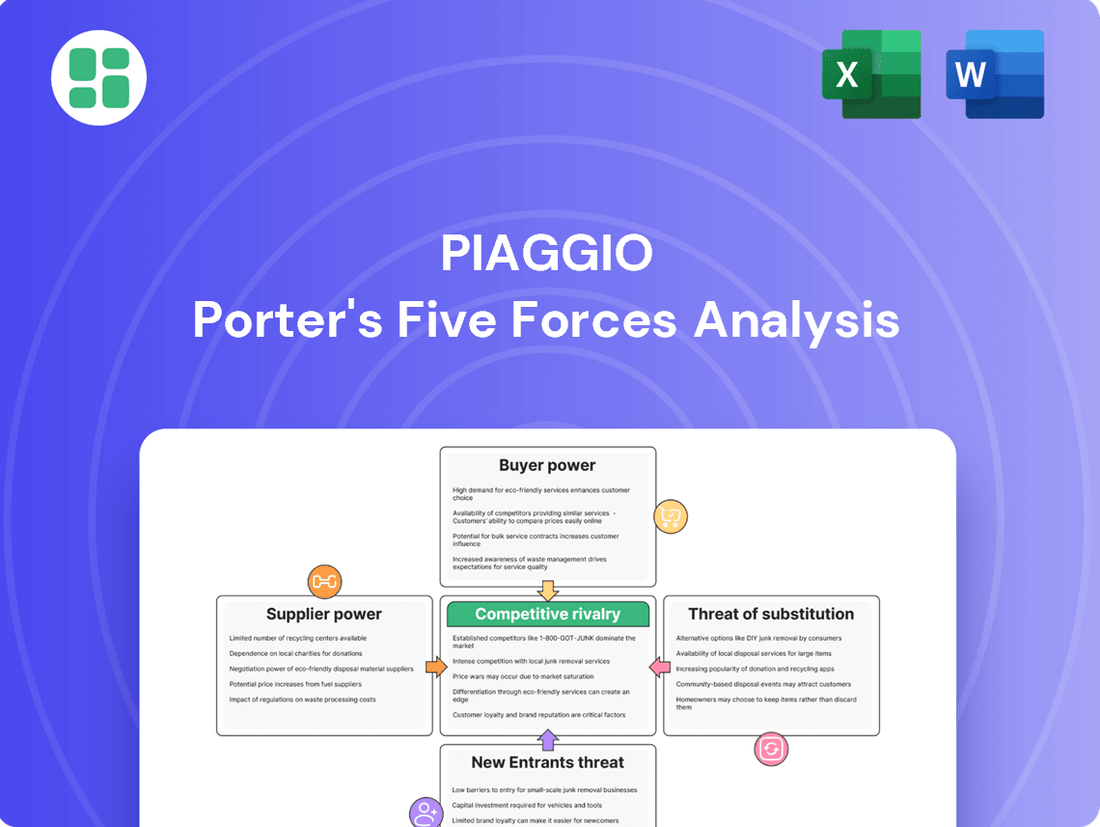

The Piaggio Porter's Five Forces Analysis reveals a landscape shaped by intense competition and evolving buyer expectations. Understanding the bargaining power of both suppliers and buyers is crucial for Piaggio's strategic positioning. The threat of new entrants and the availability of substitutes also present significant challenges.

The complete report reveals the real forces shaping Piaggio’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The concentration of suppliers for critical components significantly impacts the bargaining power of those suppliers over Piaggio. For instance, if the global market for advanced diesel engines, a key component for vehicles like the Piaggio Porter, is dominated by a handful of manufacturers, these suppliers can dictate terms more effectively. In 2024, the automotive supply chain, particularly for specialized electronics and advanced powertrain components, continues to see consolidation. A report from IHS Markit indicated that by the end of 2023, the top five global automotive electronics suppliers held over 60% of the market share, demonstrating a high degree of concentration.

Piaggio faces significant switching costs when considering a change in suppliers for its Porter vehicles. These costs can encompass retooling manufacturing lines, the expense and time involved in re-certifying new components to meet stringent quality and safety standards, and the potential need to redesign existing parts to be compatible with a new supplier's offerings. For instance, a shift in engine supplier could necessitate extensive modifications to the vehicle's chassis and electrical systems.

These substantial upfront investments and the associated operational disruptions mean Piaggio is often hesitant to switch suppliers, even if more competitive pricing is available elsewhere. This reluctance directly increases the bargaining power of Piaggio's current suppliers, as they can leverage the high costs of replacement to maintain favorable terms and pricing for their components.

The uniqueness and differentiation of inputs significantly influence supplier bargaining power for Piaggio. If suppliers provide standardized commodity parts, Piaggio can more easily switch between them, reducing supplier leverage. However, if suppliers offer proprietary technologies, such as specialized electric vehicle (EV) powertrains or advanced driver-assistance systems (ADAS), their bargaining power increases substantially.

For instance, in 2024, the automotive industry saw continued reliance on specialized suppliers for critical EV components like high-density battery cells and advanced power management units. Companies that have secured exclusive supply agreements for these differentiated inputs, potentially protected by patents, can command higher prices and more favorable terms, directly impacting Piaggio's cost structure and product development timelines.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into Piaggio's core business, manufacturing two-wheelers or light commercial vehicles, is a significant factor influencing their bargaining power. Should key component suppliers possess the financial muscle and strategic intent to enter Piaggio's market directly, they could leverage their existing knowledge of Piaggio's operations and supply chains to become formidable competitors. This would fundamentally alter the supplier-buyer dynamic, transforming suppliers from mere providers into direct rivals.

While not a widespread occurrence, this scenario is more plausible for large, diversified automotive component manufacturers. For instance, a major engine supplier or a significant electronics provider to the automotive sector might have the scale and expertise to consider producing their own branded vehicles, especially if they perceive a gap in the market or a way to capture more value. Such a move would intensify competition within the two-wheeler and light commercial vehicle segments.

- Forward Integration Capability: Suppliers with substantial R&D investment, manufacturing capacity, and existing distribution networks are better positioned for forward integration.

- Supplier Incentives: If suppliers see higher profit margins or greater market control by producing finished vehicles, their incentive to integrate forward increases.

- Industry Trends: Shifts towards modular vehicle design or increased reliance on advanced technology could empower certain suppliers with the necessary know-how to consider becoming vehicle manufacturers.

- Example Scenario: A hypothetical scenario could involve a major battery manufacturer for electric scooters deciding to produce its own line of electric scooters, leveraging its core technology.

Importance of Piaggio's Business to Suppliers

The bargaining power of suppliers is significantly influenced by how crucial Piaggio is to their overall business. If Piaggio accounts for a substantial percentage of a supplier's revenue, that supplier's leverage diminishes because they rely heavily on Piaggio's continued patronage.

For instance, if a supplier's business is heavily concentrated on Piaggio, they are less likely to risk disrupting that relationship with unfavorable pricing or terms. This dependence naturally softens their bargaining stance.

- Supplier Dependence: A key indicator is the percentage of a supplier's total sales derived from Piaggio. If this figure is high, Piaggio's bargaining power increases.

- Customer Diversification: Suppliers who serve a wide range of clients have less incentive to concede to Piaggio's demands, as Piaggio represents a smaller portion of their overall income.

- Impact on Terms: High dependence can lead suppliers to accept less favorable payment terms or pricing to secure Piaggio's business, thereby reducing the supplier's bargaining power.

The bargaining power of suppliers to Piaggio is amplified by the concentration of key component manufacturers in the market. For example, the automotive industry's reliance on a few major producers for specialized EV powertrains in 2024 means these suppliers hold considerable sway. This concentration, where the top five global automotive electronics suppliers captured over 60% of the market share by late 2023, grants them leverage over buyers like Piaggio.

Switching costs for Piaggio are a significant factor, as retooling and re-certifying new components for vehicles like the Porter can be prohibitively expensive and time-consuming. These substantial investments and potential operational disruptions make Piaggio hesitant to change suppliers, thereby strengthening the existing suppliers' ability to dictate terms and pricing.

The uniqueness of inputs also bolsters supplier power; proprietary technologies, such as advanced battery cells for electric scooters, allow suppliers to command higher prices. In 2024, the automotive sector's continued dependence on specialized EV component suppliers, who may hold patents, further increases their leverage over manufacturers like Piaggio.

The threat of forward integration by suppliers, where they might begin producing finished vehicles, also impacts their bargaining power. While less common, large, diversified component manufacturers could potentially enter Piaggio's market, using their expertise to become direct competitors, thereby shifting the power dynamic.

Finally, Piaggio's importance to a supplier's revenue stream directly influences the bargaining power dynamic. If Piaggio represents a large portion of a supplier's sales, the supplier is less likely to risk the relationship through aggressive pricing, thus reducing their bargaining power.

| Factor | Impact on Piaggio | 2024 Relevance |

|---|---|---|

| Supplier Concentration | Increases supplier power | High for specialized EV components; top 5 electronics suppliers held >60% market share (end 2023) |

| Switching Costs | Increases supplier power | High due to retooling, re-certification, and potential redesign needs |

| Input Differentiation | Increases supplier power | Significant for proprietary EV powertrains and ADAS components |

| Forward Integration Threat | Increases supplier power | Plausible for large, diversified automotive component manufacturers |

| Piaggio's Importance to Supplier | Decreases supplier power | Depends on Piaggio's share of supplier's total sales |

What is included in the product

This analysis unpacks the competitive landscape for the Piaggio Porter, detailing the intensity of rivalry, the power of buyers and suppliers, the threat of new entrants, and the impact of substitutes.

Eliminate the guesswork in competitive analysis by providing a clear, actionable framework for understanding the Piaggio Porter's Five Forces, directly addressing the pain point of complex strategic planning.

Simplify the overwhelming task of market assessment with a visually intuitive representation of the Piaggio Porter's Five Forces, making it easy to identify and address competitive pressures.

Customers Bargaining Power

Customer price sensitivity for Piaggio's diverse product range, from scooters and motorcycles to light commercial vehicles, significantly impacts its bargaining power. Purchases of many Piaggio products can be discretionary, meaning customers are more likely to scrutinize prices, especially when financing options are readily available or when the broader economic climate is uncertain. This heightened sensitivity empowers customers to push for lower prices, directly influencing Piaggio's pricing strategies and profitability.

Piaggio's strategic decision to maintain pricing, even when facing sales declines, highlights a recognition of this customer price sensitivity. By avoiding aggressive discounting, the company aims to protect its brand equity and perceived value, signaling to customers that its products are not commodities subject to constant price wars. This approach suggests a belief that long-term brand strength outweighs short-term sales gains from price reductions.

The bargaining power of customers for Piaggio's Porter is significantly influenced by the availability of substitute products. Customers can easily switch to other light commercial vehicles from brands like Fiat, Ford, or even smaller electric utility vehicles that meet similar cargo or passenger transport needs. This ease of switching is amplified by a competitive market where pricing and features are often comparable.

Furthermore, the rise of ride-sharing services and enhanced public transportation options in urban areas can also act as substitutes for certain light transport needs, particularly for smaller-scale deliveries or personal mobility, thereby increasing customer leverage. While Piaggio benefits from strong brand loyalty, especially with its Vespa line, this doesn't fully translate to the Porter segment, where practicality and cost often outweigh brand prestige.

Customers today possess a wealth of information about product features, pricing, and competitor alternatives, largely due to the internet. For instance, in 2024, online review platforms and price comparison websites empower consumers, allowing them to easily assess the value proposition of vehicles like the Piaggio Porter against its rivals. This heightened transparency significantly boosts their bargaining power.

Switching Costs for Customers

Switching costs for Piaggio Porter customers are generally considered low, which can increase their bargaining power. These costs encompass not only the direct financial outlay for a new vehicle but also the less tangible aspects of changing brands.

Customers might face costs related to learning new vehicle controls or maintenance procedures. Furthermore, if a customer has invested in specialized Piaggio accessories or built relationships with Piaggio-specific service centers, switching to a competitor would mean losing that investment and potentially needing to find new service providers.

The ease with which a customer can move to a competitor's product directly impacts their leverage. For instance, if a competitor offers a similar utility vehicle with a lower price point or superior features, a Piaggio Porter owner might find it relatively simple to make the switch, especially if there are no significant contractual obligations or highly integrated proprietary systems involved.

- Low Switching Costs: Customers can often switch to competing light commercial vehicles with minimal financial or operational disruption.

- Brand Loyalty Factor: While some customers may have brand loyalty to Piaggio, it's often not a strong enough deterrent to prevent switching for better value or features.

- Service Network Integration: The hassle of finding and establishing trust with a new service network for a different brand is a consideration, but typically manageable.

- Accessory Compatibility: If Piaggio Porter owners have invested in specific aftermarket accessories, the need to replace these can add to switching costs, though this is usually a minor factor.

Volume and Concentration of Buyers

The bargaining power of customers for Piaggio Porter is largely influenced by the volume and concentration of its buyers. While the individual consumer market, which makes up a significant portion of sales, typically has limited individual bargaining power, larger entities can exert more influence.

For instance, fleet operators or rental companies that purchase Piaggio Porter vehicles in bulk can negotiate for better pricing, customized features, or extended warranty terms. This concentration of purchasing power among a few large buyers can significantly impact Piaggio's pricing and profit margins.

- Individual consumers generally possess low bargaining power due to small purchase volumes.

- Large fleet buyers, such as logistics companies or rental agencies, can leverage their significant purchasing volume to negotiate concessions.

- The focus for Piaggio Porter's customer bargaining power analysis is primarily on the individual consumer segment, where price sensitivity and brand loyalty play key roles.

Customers for the Piaggio Porter face significant leverage due to the availability of numerous substitutes in the light commercial vehicle market. Brands like Fiat Ducato, Ford Transit, and various electric utility vehicles offer comparable functionality, making it easy for buyers to switch if Piaggio's pricing or features are less attractive. This competitive landscape, amplified by readily available online information in 2024, allows customers to compare options effectively and demand better terms, directly impacting Piaggio's market share and pricing power.

The bargaining power of Piaggio Porter customers is further enhanced by generally low switching costs. Beyond the vehicle purchase itself, minimal disruption occurs when moving to a competitor, as specialized Piaggio accessories or service network dependencies are often not substantial enough to deter a change. This ease of transition empowers customers to seek out the best value, pushing Piaggio to remain competitive on price and product offerings.

While individual consumers typically hold limited bargaining power, larger fleet buyers significantly influence Piaggio's pricing strategies for the Porter. Companies acquiring multiple vehicles can negotiate substantial discounts and favorable terms, a common practice in the commercial vehicle sector. For example, a 2024 report indicated that fleet purchases can account for over 60% of sales for certain light commercial vehicle segments, highlighting the importance of these bulk buyers.

| Factor | Impact on Piaggio Porter Customer Bargaining Power | Supporting Data/Observation (2024) |

|---|---|---|

| Availability of Substitutes | High | Numerous competitors (Fiat, Ford) offer similar light commercial vehicles. Online comparison tools are widely used. |

| Switching Costs | Low | Minimal financial or operational hurdles to switch brands; accessory and service network integration is generally not a major barrier. |

| Price Sensitivity | Moderate to High | Discretionary purchases and economic uncertainty encourage price scrutiny. Piaggio's pricing strategy reflects this sensitivity. |

| Buyer Volume/Concentration | Low for individuals, High for fleets | Individual buyers have little leverage; large fleet operators can negotiate significant concessions due to bulk purchases. |

What You See Is What You Get

Piaggio Porter's Five Forces Analysis

This preview showcases the complete Piaggio Porter Five Forces Analysis, detailing the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the market. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy. This comprehensive analysis provides actionable insights into the competitive landscape, enabling informed strategic decisions for businesses operating within or considering entry into this sector.

Rivalry Among Competitors

The competitive landscape for Piaggio, particularly concerning its Porter models, is robust. In the global two-wheeler market, established giants like Honda and Yamaha continue to hold significant market share, with Honda selling over 15 million units annually in recent years. Simultaneously, the light commercial vehicle sector sees intense competition from numerous global and regional players, each with varying strategic focuses and market origins.

The presence of a diverse range of competitors, from traditional internal combustion engine manufacturers to emerging electric vehicle (EV) startups, amplifies rivalry. For instance, the burgeoning EV scooter market sees new entrants constantly challenging established brands, forcing companies like Piaggio to innovate rapidly. This diversity means Piaggio must contend with competitors who may have different cost structures, technological priorities, and market penetration strategies.

The global two-wheeler market is experiencing moderate growth, with projections indicating a compound annual growth rate (CAGR) of around 4.5% through 2027. However, this overall expansion masks significant regional variations and intense competition. For instance, while emerging markets show promise, established markets often exhibit slower growth or even stagnation, forcing manufacturers like Piaggio to contend with fierce rivalry as they fight for market share.

Piaggio's own sales performance highlights this dynamic. In 2024, the company reported a decline in sales in key European markets, a clear indicator of a highly competitive landscape. This suggests that even within a growing global market, specific segments or regions can become saturated, intensifying the battle for customers and putting pressure on pricing and innovation.

Piaggio's strong product differentiation, particularly through its iconic Vespa, Aprilia, and Moto Guzzi brands, significantly mitigates competitive rivalry. These brands cultivate deep customer loyalty, making switching based on price alone less common. For instance, Vespa's enduring design and Aprilia's performance heritage create a distinct market position.

Exit Barriers

The two-wheeler and light commercial vehicle markets present significant exit barriers for companies like Piaggio. These include highly specialized manufacturing equipment, substantial investments in brand building and distribution networks, and the potential for significant write-offs on long-lived assets. For instance, a dedicated production line for a specific engine type or chassis design is not easily repurposed.

These high exit barriers mean that even struggling companies may remain in the market rather than incur massive losses from closure. This persistence can lead to persistent overcapacity, forcing all players, including Piaggio, into more aggressive price competition and promotional activities to maintain market share, even when profitability is squeezed. By mid-2024, the global two-wheeler market, while recovering, still faced inventory pressures in certain segments due to earlier overproduction.

The implications for competitive rivalry are clear:

- Sustained Price Pressure: Companies are less likely to exit, leading to ongoing competition on price.

- Reduced Profitability: The need to keep specialized assets utilized often forces lower margins.

- Strategic Stalemate: Unprofitable firms may continue operations, prolonging market imbalances.

- Focus on Efficiency: Firms must continually optimize operations to compete effectively.

Competitive Strategies and Intensity

Competitive rivalry within the light commercial vehicle sector, where the Piaggio Porter operates, is significant. Competitors often engage in strategies such as aggressive pricing, product innovation, and extensive advertising to capture market share. For instance, in 2024, key rivals like Stellantis (with its Fiat Professional range) and Ford Pro have been actively promoting new electric and hybrid models, alongside competitive financing offers.

The intensity of this rivalry can lead to price wars and rapid product development cycles, directly impacting Piaggio's profitability. Piaggio has publicly stated its strategic intent to steer clear of aggressive discounting, aiming instead to differentiate through product features and brand positioning.

- Price Competition: Rivals frequently utilize price adjustments and promotional discounts to attract customers.

- Innovation: Competitors are investing heavily in new technologies, particularly electric powertrains and advanced driver-assistance systems.

- Advertising and Marketing: Extensive campaigns are common to build brand awareness and highlight product advantages.

- Distribution Networks: Expanding and strengthening dealer and service networks is a key strategy for market penetration.

The competitive rivalry for Piaggio, particularly within the light commercial vehicle sector where the Porter operates, is intense. Key rivals like Stellantis, with its Fiat Professional range, and Ford Pro are aggressively promoting new electric and hybrid models, often coupled with competitive financing in 2024. This dynamic forces Piaggio to navigate a landscape marked by frequent price adjustments, rapid technological adoption, and significant marketing efforts from competitors aiming to capture market share.

Piaggio itself has indicated a strategic focus on product differentiation and brand positioning rather than engaging in price wars. This approach is crucial as the market sees competitors investing heavily in advanced technologies, including electric powertrains and driver-assistance systems, and simultaneously expanding their distribution and service networks to enhance market penetration.

| Competitor | Key 2024 Strategy | Market Focus |

| Stellantis (Fiat Professional) | Promoting new electric/hybrid models, competitive financing | Light Commercial Vehicles (LCVs) |

| Ford Pro | Aggressive promotion of EV/hybrid LCVs, financing offers | LCVs |

| Emerging EV Startups | Innovation in electric powertrains, direct-to-consumer models | Electric Scooters, LCVs |

SSubstitutes Threaten

The threat of substitutes for Piaggio's commercial vehicles like the Porter is a significant consideration. Alternative transportation options, ranging from public transport to smaller vans and even e-bikes for certain last-mile deliveries, compete by offering different price-performance trade-offs. For instance, while a Piaggio Porter might offer a dedicated cargo solution, a fleet of e-bikes could provide a lower initial investment and operating cost for businesses focused on urban, light-load deliveries, potentially impacting Piaggio's market share in that segment.

Customer willingness to switch from Piaggio vehicles to alternatives is a significant factor. In 2024, a growing number of Europeans are embracing shared mobility and public transportation, indicating a rising propensity to substitute personal vehicle ownership. This trend is influenced by factors like increasing urban congestion, environmental consciousness, and the convenience offered by integrated transport solutions.

The threat of substitutes for Piaggio Porter's products, especially in urban settings, is significant and growing. The proliferation of ride-sharing platforms like Uber and Lyft offers consumers an alternative to personal vehicle ownership, including scooters and mopeds. These services provide convenience and flexibility, directly competing for urban commuters.

Micro-mobility solutions, such as electric scooters and shared bicycle programs, represent another potent substitute. Cities are actively encouraging these options, with many investing in dedicated infrastructure like bike lanes. For instance, by 2024, many major European cities have seen substantial growth in shared e-scooter usage, with some reporting millions of rides annually, directly impacting the demand for traditional two-wheelers.

Furthermore, improvements in public transportation systems, including expanded subway lines and more frequent bus services, also act as substitutes. As urban transit becomes more efficient and accessible, it reduces the need for personal mobility solutions like those offered by Piaggio, particularly for shorter urban trips.

Technological Advancements in Substitutes

Technological advancements are continuously making substitute products more appealing. For instance, improvements in battery technology are making electric bicycles and compact electric vehicles increasingly competitive options. This trend is particularly relevant for Piaggio, as the electric scooter market is experiencing substantial growth, with projections indicating a significant expansion in the coming years.

These innovations can directly impact Piaggio Porter's market position by offering consumers more efficient and potentially lower-cost alternatives. The increasing viability of electric mobility solutions means that traditional internal combustion engine vehicles, including light commercial vehicles like the Porter, face a growing threat from these evolving technologies.

- Electric Vehicle Adoption: Global electric car sales are expected to reach over 15 million units in 2024, demonstrating a strong consumer shift.

- Battery Cost Reduction: The average cost of lithium-ion battery packs has fallen by over 90% since 2010, making EVs more affordable.

- E-bike Market Growth: The global e-bike market was valued at approximately $25 billion in 2023 and is forecast to grow at a CAGR of over 10% through 2030.

Regulatory and Environmental Shifts

Government regulations and urban planning significantly impact the threat of substitutes for vehicles like the Piaggio Porter. Policies promoting public transportation, cycling infrastructure, and the restriction of internal combustion engine vehicles can bolster alternative mobility solutions.

Europe's strong push for electrification and the establishment of zero-emission zones directly favor electric vans and cargo bikes as substitutes. For instance, many European cities are implementing Low Emission Zones (LEZs) or even Ultra Low Emission Zones (ULEZs), which can penalize or ban older, more polluting vehicles. This regulatory environment is a key driver for businesses to consider alternative, greener transport options.

The increasing focus on sustainability and environmental protection means that regulations favoring electric vehicles or alternative delivery methods will likely intensify. This trend could reduce the attractiveness of traditional, fossil-fuel-powered light commercial vehicles, thereby increasing the threat from substitutes.

- Regulatory Favoritism: Policies encouraging electric vehicles and public transit directly increase the threat from these substitutes.

- Urban Planning Impact: Initiatives like zero-emission zones and enhanced cycling infrastructure make alternative transport more viable.

- European Trends: Europe's aggressive electrification targets and LEZ implementations are prime examples of regulatory shifts impacting vehicle choices.

- Environmental Drivers: Growing environmental consciousness fuels regulations that penalize emissions, pushing demand towards cleaner alternatives.

The threat of substitutes for Piaggio Porter vehicles is amplified by the growing adoption of electric micro-mobility and enhanced public transport. In 2024, the global e-bike market, valued around $25 billion, is projected to grow at over 10% annually, offering a compelling alternative for urban logistics. Furthermore, significant investments in public transit infrastructure across Europe are making it a more attractive option for commuters, reducing reliance on personal vehicles.

| Substitute Category | Key Characteristics | Impact on Piaggio Porter | 2024 Data/Trend |

|---|---|---|---|

| E-bikes/Cargo Bikes | Lower operating costs, zero emissions, urban maneuverability | Direct competition for last-mile delivery, reduced demand for light commercial vehicles | E-bike market growth exceeding 10% CAGR |

| Public Transportation | Cost-effective, reduced congestion, environmentally friendly | Decreased need for personal urban transport, potential reduction in light commercial vehicle usage for commuting | Growing investment in European public transit infrastructure |

| Ride-Sharing/Micro-Mobility (Scooters) | Convenience, flexibility, lower per-trip cost for individuals | Competition for urban commuters, potential shift away from owning small utility vehicles | Millions of rides annually in major European cities |

Entrants Threaten

Entering the two-wheeler and light commercial vehicle sector demands substantial capital for research and development, establishing advanced manufacturing facilities, and building robust distribution networks. For instance, Piaggio's ongoing investment in new model development and electrification, as seen in their 2023 financial reports, highlights the significant upfront costs involved.

Existing players like Piaggio benefit from considerable economies of scale in production and procurement, allowing them to achieve lower per-unit costs. This cost advantage makes it exceptionally challenging for new entrants to compete effectively on price, especially when factoring in the initial high investment and lower production volumes.

Piaggio's established brands, including Vespa, Aprilia, and Moto Guzzi, enjoy significant customer loyalty, a direct result of decades of heritage and consistent quality. This strong brand equity presents a formidable barrier for potential new entrants. For instance, Vespa's iconic status, recognized globally for its style and reliability, has cultivated a deeply loyal customer base that is less likely to switch to an unknown brand.

Newcomers must invest heavily in marketing and product development to even begin to erode this loyalty and build their own brand recognition and trust. This substantial upfront investment and the time required to establish a credible presence make the threat of new entrants relatively low in many segments Piaggio operates within.

New entrants face significant hurdles in establishing effective distribution channels for light commercial vehicles like the Piaggio Porter. Building a robust network of dealerships, service centers, and ensuring readily available spare parts is a costly and time-consuming endeavor. For instance, in 2024, the average cost to establish a new automotive dealership in developed markets can range from $1 million to $5 million, encompassing facility upgrades, inventory, and staffing.

Piaggio benefits from an extensive and well-established global distribution network, cultivated over decades. This existing infrastructure presents a substantial barrier for any new player attempting to enter the market. Acquiring or replicating such a widespread network, complete with trained technicians and parts logistics, would require immense capital investment and strategic partnerships, making it incredibly difficult for newcomers to compete effectively on the distribution front.

Regulatory Hurdles and Government Policy

The automotive industry, including light commercial vehicles like the Piaggio Porter, faces significant regulatory hurdles. Navigating complex safety standards, stringent emissions requirements (such as Euro 7 standards being phased in), and obtaining necessary manufacturing and sales licenses demand substantial upfront investment and expertise. These governmental policies act as a formidable barrier to entry for potential new competitors.

Governmental policies, particularly those concerning environmental impact and vehicle safety, create substantial barriers. For instance, the ongoing evolution of electric vehicle (EV) regulations and charging infrastructure mandates can significantly impact market entry strategies and require considerable capital for compliance and development. Many countries are also implementing stricter crash test standards and cybersecurity requirements for connected vehicles, adding further layers of complexity.

- Regulatory Complexity: Compliance with evolving safety (e.g., UN ECE R157 for automated lane keeping systems) and emissions standards (e.g., WLTP for fuel consumption and CO2 emissions) requires extensive R&D and testing.

- Licensing and Approvals: Obtaining type approval for vehicles in different markets can be a lengthy and costly process, often involving multiple government agencies.

- Environmental Mandates: Increasing pressure for zero-emission vehicles means new entrants must invest heavily in EV technology, battery production, and related supply chains.

- Capital Investment: The combined cost of research, development, compliance, and manufacturing setup can easily run into billions of dollars, deterring many potential new players.

Incumbent Retaliation

Piaggio, as an established player in the light commercial vehicle market, possesses the capacity to retaliate against new entrants. This retaliation could manifest as aggressive pricing strategies, increased marketing expenditures to reinforce brand loyalty, or accelerated development of new models to maintain a technological edge. For instance, if a new competitor were to enter the market with a significantly lower price point, Piaggio might respond by offering targeted discounts or enhanced financing options to its existing customer base, thereby eroding the new entrant's initial competitive advantage.

The credible threat of such strong retaliation serves as a significant deterrent. New market entrants will carefully assess Piaggio's historical responses to competitive pressures and its financial capacity to sustain aggressive market tactics. Piaggio's strategic focus on maintaining healthy profit margins and investing in brand equity, rather than engaging in price wars, suggests a preference for differentiating its offerings and leveraging its established customer relationships and robust supply chains to counter new competition.

- Aggressive Pricing: Piaggio could counter new entrants by offering competitive pricing on its Porter models, potentially through temporary price reductions or attractive financing packages, to retain market share.

- Increased Marketing Spend: A surge in advertising and promotional activities can reinforce brand recognition and customer loyalty, making it harder for new entrants to gain traction.

- Accelerated Product Innovation: Introducing updated features or entirely new variants of the Piaggio Porter can quickly render a new entrant's offerings less appealing.

- Leveraging Existing Strengths: Piaggio can utilize its established dealer network, existing customer relationships, and efficient supply chain management to offer superior service and reliability, presenting a higher barrier to entry.

The threat of new entrants into the light commercial vehicle sector, where the Piaggio Porter operates, is generally considered low. This is due to the substantial capital investment required for R&D, manufacturing, and distribution, coupled with strong brand loyalty and established economies of scale enjoyed by incumbents like Piaggio.

New players face significant hurdles in replicating Piaggio's extensive distribution networks and navigating complex regulatory landscapes, which demand considerable expertise and financial resources for compliance. Furthermore, the potential for aggressive retaliation from established firms, such as price adjustments or accelerated product innovation, acts as a further deterrent.

For instance, in 2024, the cost to establish a new automotive dealership can range from $1 million to $5 million, highlighting the financial burden on newcomers. Additionally, compliance with evolving emissions standards, like the Euro 7 regulations, necessitates significant investment in new technologies, making market entry even more challenging.

| Barrier Type | Description | Example Impact |

|---|---|---|

| Capital Requirements | High costs for R&D, manufacturing, and distribution networks. | Estimated $1M-$5M to establish a new dealership in 2024. |

| Brand Loyalty | Established brands like Vespa and Aprilia have decades of customer trust. | Customers are less likely to switch to unknown brands despite potential price differences. |

| Economies of Scale | Existing players benefit from lower per-unit costs due to high production volumes. | New entrants struggle to compete on price against established manufacturers. |

| Distribution Channels | Building a nationwide network of dealerships and service centers is costly and time-consuming. | Replicating Piaggio's global network requires immense capital and strategic partnerships. |

| Regulatory Hurdles | Compliance with safety and emissions standards (e.g., Euro 7) requires substantial investment. | Navigating licensing and type approval processes adds complexity and cost. |

| Retaliation | Established firms can respond to new entrants with price wars or increased marketing. | Aggressive pricing or accelerated product updates can quickly neutralize a new competitor's advantage. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Piaggio Porter leverages industry-specific market research reports, competitor financial disclosures, and automotive trade publications to understand the competitive landscape. We also incorporate data on raw material costs and labor market trends to assess supplier power and the threat of new entrants.