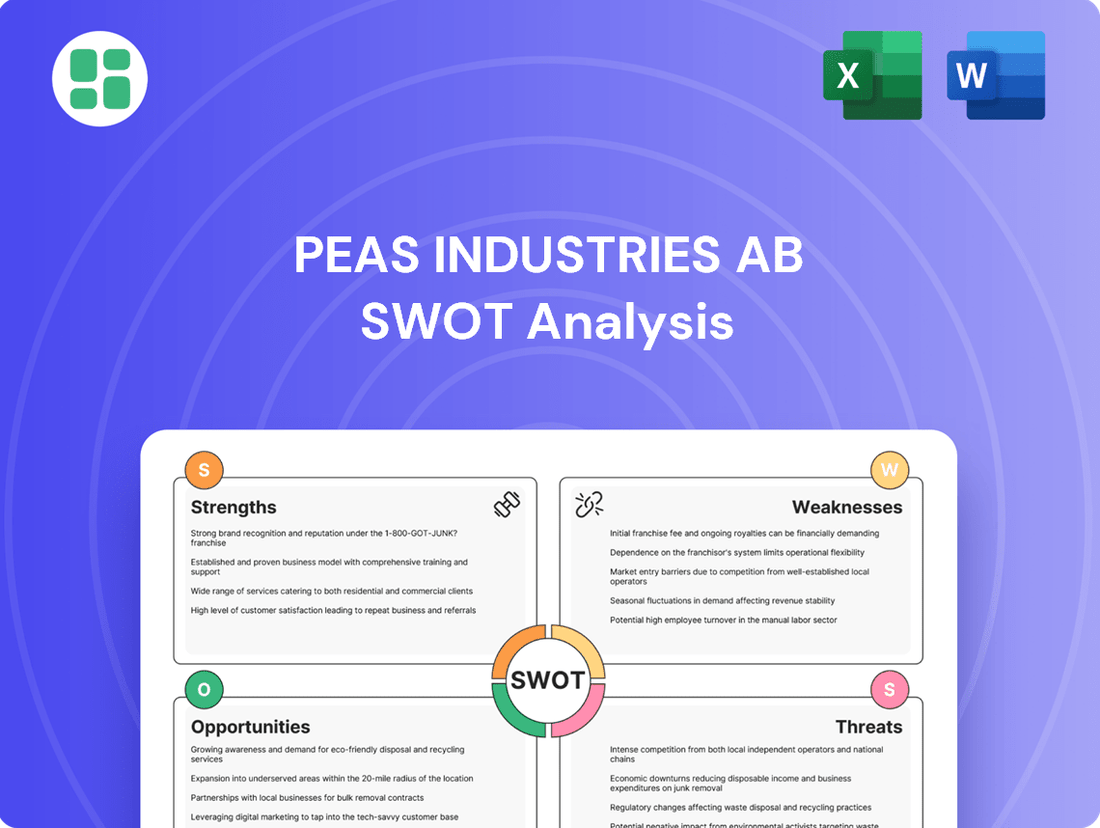

Peas industries AB SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Peas industries AB Bundle

Peas Industries AB demonstrates significant strengths in its innovative product development and strong brand reputation within the agricultural sector. However, it faces potential threats from fluctuating raw material prices and increasing competition. Understanding these dynamics is crucial for strategic planning.

Want the full story behind Peas Industries AB's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

PEAS Industries AB showcased a strong financial standing in 2023, with a consolidated turnover reaching €11,171 thousand. This robust performance was further underscored by earnings before taxes of €5,125 thousand, highlighting the company's profitability and operational efficiency.

The company's balance sheet reflects significant financial stability, boasting total assets of €977,355 thousand. Coupled with an impressive solvency ratio of 99.3%, PEAS Industries AB demonstrates a remarkably secure financial foundation, well-positioned for sustained growth and investment opportunities.

Peas Industries AB's strength lies in its unwavering commitment to sustainable energy solutions and infrastructure. As a holding company, it strategically invests in, develops, and operates renewable energy projects, directly contributing to the global green transition. This focused approach resonates strongly with increasing investor demand for environmentally, social, and governance (ESG) compliant businesses.

Peas Industries AB, through its subsidiary OX2, is a dominant force in Europe's renewable energy landscape, particularly in large-scale onshore wind power development. This leadership is underscored by OX2's consistent expansion of its project pipeline, which now encompasses offshore wind, solar power, and emerging green hydrogen ventures, showcasing robust operational expertise and a clear strategic vision for future growth in the sector.

Diversified Portfolio in Impactful Sectors

PEAS Industries AB’s strength lies in its diversified portfolio, extending beyond renewable energy into crucial areas like circular waste management and sustainable food production. This strategic breadth mitigates risks associated with over-reliance on any single market, fostering robust long-term value creation. For instance, their investment in circular economy initiatives aligns with the growing global demand for resource efficiency, a market projected to reach $1.5 trillion by 2025 according to some industry forecasts.

This diversification across impactful sectors offers PEAS Industries AB significant advantages:

- Reduced Market Dependence: Spreading investments across renewable energy, waste management, and food production cushions the company against downturns in any one sector.

- Enhanced Growth Opportunities: Tapping into multiple high-growth, sustainability-focused markets broadens the company's revenue streams and potential for expansion.

- Synergistic Potential: Interconnectedness between these sectors, such as waste-to-energy solutions, can create operational efficiencies and new business models.

- Alignment with Global Trends: The company's focus areas directly address pressing environmental and social challenges, positioning it favorably with investors and consumers prioritizing ESG (Environmental, Social, and Governance) factors.

Strategic Acumen and Growth Initiatives

Peas Industries AB demonstrates strong strategic acumen, highlighted by the 2020 sale of a 30% stake in OX2 AB. This transaction significantly enhanced the company's profit and equity position, providing a solid foundation for future endeavors.

The company's growth strategy is firmly rooted in capitalizing on the burgeoning sustainable industries sector. With market indicators pointing towards a favorable environment for their core businesses throughout 2024, Peas Industries is well-positioned to leverage these trends.

- Strategic Foresight: The 2020 sale of a 30% share in OX2 AB generated substantial profit and equity growth for Peas Industries.

- Growth Focus: The company is actively pursuing opportunities within the sustainable industries sector.

- Market Outlook: Positive market indicators for 2024 suggest favorable conditions for Peas Industries' core business segments.

PEAS Industries AB boasts a strong financial foundation, evident in its 2023 consolidated turnover of €11,171 thousand and earnings before taxes of €5,125 thousand. This profitability is supported by total assets of €977,355 thousand and an exceptional solvency ratio of 99.3%, demonstrating remarkable financial stability and a secure position for future growth.

The company's leadership in large-scale renewable energy development, particularly onshore wind through its subsidiary OX2, is a significant strength. OX2's expanding pipeline, which now includes offshore wind, solar, and green hydrogen, highlights operational expertise and a clear vision for continued expansion in the burgeoning green energy sector.

PEAS Industries AB's diversified portfolio across renewable energy, circular waste management, and sustainable food production offers a key advantage. This breadth reduces market dependence and taps into multiple high-growth areas, aligning with increasing investor demand for ESG-compliant businesses and addressing global sustainability challenges.

The strategic sale of a 30% stake in OX2 AB in 2020 significantly bolstered PEAS Industries AB's profit and equity, providing capital for further development. The company's growth strategy is well-aligned with favorable market trends in sustainable industries, with positive indicators for 2024 reinforcing its potential.

What is included in the product

Delivers a strategic overview of Peas industries AB’s internal and external business factors, highlighting key strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework for identifying and addressing Peas Industries AB's strategic challenges.

Weaknesses

As a holding company, PEAS Industries AB's financial health is closely linked to the performance of its subsidiaries. While OX2 is a significant contributor, any struggles within its operational entities could directly affect the parent company's overall financial results, making it susceptible to the fortunes of its individual businesses.

Peas Industries AB's lack of publicly detailed revenue projections for 2024-2025 presents a notable weakness. This makes it difficult for external parties to accurately gauge short-term growth potential.

While the overall market sentiment for the agricultural technology sector, where Peas operates, is generally positive, the absence of specific financial forecasts can impede thorough financial modeling and potentially dampen investor confidence.

PEAS Industries AB operates in sectors like renewable energy, which saw global investment reach an estimated $1.7 trillion in 2024, a testament to its growth but also its intense competition. This crowded landscape demands continuous innovation and strong strategic planning to defend its market position and maintain a competitive edge.

The pressure from numerous players in these niche markets can directly impact PEAS Industries AB's profitability, potentially squeezing margins and slowing down the pace of growth. For instance, in the solar energy sector, increased competition has led to price reductions, making it crucial for companies to focus on efficiency and technological differentiation.

Vulnerability to Regulatory Changes

PEAS Industries AB's focus on renewable energy and sustainability means its operations are inherently tied to a dynamic regulatory landscape. Shifts in government subsidies, carbon pricing mechanisms, or environmental standards, which are common in this sector, can directly affect project economics. For instance, a reduction in feed-in tariffs for solar power, a key area for PEAS, could alter the profitability of existing and future installations. The company must remain agile, continuously assessing policy shifts, such as potential changes to renewable energy mandates in key European markets by 2025, to mitigate risks to its business model and ensure continued viability.

The company's vulnerability extends to potential changes in international climate agreements or national energy policies that could impact demand for its sustainable solutions. For example, if a major market significantly alters its renewable energy targets or introduces new import tariffs on green technologies by 2024, PEAS might face unexpected operational challenges. This necessitates robust scenario planning and a proactive approach to regulatory engagement to anticipate and adapt to these evolving frameworks.

- Evolving Regulatory Frameworks: Operations in renewable energy and sustainability are subject to constant changes in government policies, incentives, and environmental regulations.

- Impact on Project Viability: Changes in subsidies, carbon pricing, or energy standards can significantly affect the profitability and feasibility of PEAS's projects.

- Need for Strategic Flexibility: Adapting to or mitigating the effects of regulatory shifts requires continuous monitoring and strategic agility to maintain business model integrity.

- Anticipating Policy Shifts: Proactive engagement and scenario planning are crucial to navigate potential changes in renewable energy mandates or climate agreements by 2025.

Potential Capital Intensity of Projects

Developing and operating large-scale renewable energy and infrastructure projects, like those PEAS Industries AB might undertake, typically demands significant upfront capital. This inherent capital intensity is a key consideration for growth.

While PEAS Industries AB benefits from a solid financial footing, its ambitious expansion plans and the continuous pursuit of new projects will likely require sustained access to substantial funding. This could involve leveraging debt markets or seeking equity investments to fuel its development pipeline.

- Capital Requirements: Renewable energy projects often have high initial capital expenditures, with costs for solar farms or wind installations running into millions or even billions of dollars. For instance, the average utility-scale solar project in the US cost around $1.1 million per megawatt in 2023.

- Financing Needs: Continued expansion means PEAS Industries AB may need to raise capital equivalent to a significant percentage of its existing asset base, potentially impacting its debt-to-equity ratios if not managed carefully.

- Market Volatility: Access to capital can be influenced by broader economic conditions and investor sentiment, which can fluctuate, potentially making financing more challenging or expensive during certain periods.

PEAS Industries AB's reliance on a few key subsidiaries, particularly OX2, creates a significant vulnerability. If OX2 experiences operational setbacks or market downturns, the parent company's financial performance will be directly and negatively impacted, limiting its overall resilience.

The absence of detailed, publicly available revenue projections for PEAS Industries AB for 2024 and 2025 is a notable weakness. This lack of forward-looking financial data makes it challenging for investors and analysts to accurately assess the company's short-term growth trajectory and potential returns.

Operating in highly competitive sectors like renewable energy, where global investment reached an estimated $1.7 trillion in 2024, presents a constant challenge. PEAS Industries AB must continuously innovate and strategically plan to maintain its market share against numerous players, as intense competition can compress profit margins.

The company's capital-intensive nature, common in renewable energy development, necessitates substantial and ongoing funding. Fluctuations in capital markets or economic downturns could make securing the necessary financing for expansion more difficult or expensive, potentially hindering growth plans.

Full Version Awaits

Peas industries AB SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing an actual excerpt from the Peas Industries AB SWOT analysis, providing a clear glimpse into its strategic positioning. The full, comprehensive report, including all detailed insights, becomes available immediately after your purchase.

Opportunities

The global push for cleaner energy sources is a major tailwind, with renewable energy capacity expected to more than double by 2028. This surge is fueled by ambitious climate targets and a growing emphasis on energy independence. PEAS Industries AB is well-positioned to capitalize on this trend, as demand for their solar and wind power solutions continues to climb significantly.

The energy, mining, and utilities sector, a key area for PEAS Industries AB, experienced a substantial 77.8% surge in total deal value during the first half of 2024. This robust growth signals a highly encouraging market for sustainable and green investments.

This trend suggests a fertile ground for PEAS Industries AB's growth and project financing, fueled by a growing influx of clean capital and private investment in cleantech solutions.

PEAS Industries AB, via its subsidiary OX2, is actively exploring nascent green technologies like offshore wind, solar power, and green hydrogen. These sectors are poised to be pivotal in decarbonizing various industries, presenting significant growth opportunities for PEAS. For instance, the global offshore wind market alone is projected to reach $90.4 billion by 2027, according to some market analyses, highlighting the immense potential.

By investing in these cutting-edge solutions, PEAS Industries AB is strategically positioning itself for future market leadership. The increasing global demand for renewable energy sources, driven by climate change concerns and government mandates, creates a fertile ground for companies at the forefront of technological innovation in this space.

Leveraging Circular Economy and Sustainable Food Trends

PEAS Industries AB's commitment to circular waste management and sustainable food production directly taps into a rapidly expanding market. Consumer demand for eco-friendly products is surging, with the global sustainable food market projected to reach $333.1 billion by 2027, growing at a CAGR of 10.1% from 2020. This strategic alignment positions PEAS to capture significant market share in these growing segments.

By diversifying beyond traditional energy, PEAS Industries AB is creating new revenue streams and enhancing its overall resilience. The company's efforts in turning waste into valuable resources, such as biomass for energy or soil improvement, directly contribute to the circular economy, a concept gaining significant traction globally. For instance, the European Union's Circular Economy Action Plan aims to boost recycling rates and reduce waste, creating a favorable regulatory environment for companies like PEAS.

- Growing Consumer Demand: Over 70% of consumers surveyed in a 2023 NielsenIQ report stated they actively seek out brands with sustainable practices.

- Market Expansion: The global circular economy market is expected to grow from $2.3 trillion in 2023 to $4.5 trillion by 2030, offering substantial growth opportunities.

- Revenue Diversification: PEAS's ventures into sustainable food and waste-to-value solutions provide a buffer against volatility in the energy sector and open new profit avenues.

Access to Capital Markets and Strategic Partnerships

Peas Industries AB, through its subsidiary OX2, has significantly enhanced its access to capital markets. OX2's listing on the Nasdaq First North Premier Growth Market in 2023 was a strategic move designed to attract investor attention and secure funding for future expansion and project development. This public offering provided a robust platform for capital infusion, enabling the company to pursue its growth objectives more aggressively.

The current financial landscape offers substantial opportunities for strategic partnerships, particularly within the burgeoning green lending sector. The increasing demand for sustainable infrastructure projects is driving innovation in financing models. Collaborations among major industry players are becoming more prevalent, facilitating efficient capital mobilization for large-scale renewable energy initiatives.

- Enhanced Capital Access: OX2's IPO on Nasdaq First North Premier Growth Market in 2023 provided a direct channel to public equity markets for fundraising.

- Green Lending Market Growth: The global green bond market reached an estimated $1 trillion in issuance by early 2024, indicating strong investor appetite for sustainable investments.

- Strategic Partnership Potential: Collaborations with financial institutions and industry leaders can unlock significant capital for renewable energy projects, leveraging the growing ESG investment trend.

- Project Development Funding: Access to capital markets and strategic partnerships is crucial for financing Peas Industries AB's pipeline of renewable energy projects, supporting its long-term strategic goals.

PEAS Industries AB is strategically positioned to benefit from the global shift towards renewable energy, with projections indicating a doubling of renewable capacity by 2028. The company's focus on offshore wind, solar power, and green hydrogen, exemplified by its subsidiary OX2, taps into markets with immense growth potential, such as the offshore wind sector which is anticipated to reach $90.4 billion by 2027. Furthermore, PEAS's expansion into circular waste management and sustainable food production aligns with a market expected to reach $333.1 billion by 2027, driven by increasing consumer preference for eco-friendly products.

The company's access to capital has been bolstered by OX2's 2023 IPO on Nasdaq First North Premier Growth Market, facilitating funding for its extensive project pipeline. This enhanced financial footing, coupled with the burgeoning green lending market, which saw global green bond issuance reach an estimated $1 trillion by early 2024, creates significant opportunities for strategic partnerships and project development financing. These factors collectively support PEAS Industries AB's long-term growth objectives in the sustainable energy and resource management sectors.

| Opportunity Area | Market Projection/Growth | PEAS Industries AB Relevance |

|---|---|---|

| Renewable Energy Expansion | Capacity to double by 2028 | Directly benefits solar and wind power solutions |

| Offshore Wind Market | Projected $90.4 billion by 2027 | Key growth sector for subsidiary OX2 |

| Sustainable Food Market | Projected $333.1 billion by 2027 (10.1% CAGR) | Leverages growing consumer demand for eco-friendly products |

| Circular Economy | Expected to grow from $2.3 trillion (2023) to $4.5 trillion by 2030 | Waste-to-value initiatives align with market expansion |

| Green Lending & Capital Access | Green bond market ~$1 trillion (early 2024) | OX2 IPO and partnerships enhance project financing capabilities |

Threats

The renewable energy and sustainable solutions markets are seeing a significant influx of specialized companies, intensifying competition for market share. This crowded landscape means companies like Peas Industries AB must constantly innovate and optimize operations to stay ahead. For instance, the global renewable energy market was valued at approximately $1.3 trillion in 2023 and is projected to grow substantially, attracting more players.

This heightened competition can lead to pricing pressures, making it crucial for Peas Industries AB to maintain strong market positioning and efficient cost structures. Failure to do so could result in a decline in profitability and market share, especially if new, agile competitors emerge or existing ones aggressively expand their offerings.

Changes in government administrations, particularly in key markets like the United States, can introduce significant policy and regulatory instability. For instance, potential shifts in the approach to renewable energy incentives, such as the Inflation Reduction Act, could directly impact the financing landscape for projects. A rollback or alteration of these incentives could reduce the projected returns for new developments, making them less attractive to investors.

Such regulatory uncertainty can create a challenging environment for long-term capital investments. If the economic viability of planned projects is altered due to new compliance requirements or reduced financial support, it could lead to project delays or cancellations. For example, a change in tax credit structures could necessitate a renegotiation of project economics, potentially impacting Peas Industries AB's pipeline and future revenue streams.

Peas Industries AB, like many in the renewable energy sector, faces significant risks from global supply chain disruptions. The availability and cost of essential components, such as solar panels, wind turbine parts, and battery storage systems, can be highly volatile. For instance, in early 2024, continued shipping delays and increased raw material costs, particularly for polysilicon and rare earth metals, led to an estimated 5-10% increase in the cost of solar and wind projects globally.

Volatility in commodity prices presents another substantial threat. Fluctuations in the cost of steel, copper, and aluminum directly impact the capital expenditure for new projects. Geopolitical tensions, such as those experienced in Eastern Europe and the Middle East throughout 2023 and into 2024, have further exacerbated these price swings and created logistical hurdles, potentially delaying project timelines and eroding expected profit margins for Peas Industries AB.

Technological Obsolescence and Rapid Innovation

The sustainable energy sector is a hotbed of innovation, meaning technologies can quickly become outdated. PEAS Industries AB faces the threat that its current assets might be surpassed by newer, more efficient, or cost-effective solutions. This necessitates continuous, substantial investment in research and development to maintain a competitive edge.

For instance, the cost of solar photovoltaic (PV) modules has seen dramatic decreases, falling by over 90% in the last decade. Similarly, battery storage costs have also declined significantly. If PEAS Industries AB cannot adapt its technology portfolio to keep pace with these rapid advancements, its market position could erode.

- Risk of existing technology becoming obsolete due to faster, cheaper alternatives.

- Need for substantial, ongoing investment in R&D to stay competitive.

- Potential for reduced competitiveness if innovation outpaces PEAS Industries AB's development.

Economic Downturns and Investment Climate Fluctuations

Global economic slowdowns, like the potential for a recession in major markets throughout 2024-2025, can significantly crimp the availability of capital for substantial infrastructure development. This directly impacts companies like PEAS Industries AB, which often rely on external funding for their large-scale projects.

Shifting interest rate environments, a key concern for 2024 as central banks navigate inflation, can dramatically alter the cost of borrowing. Higher rates make financing new ventures more expensive, potentially delaying or even canceling expansion strategies for PEAS Industries AB.

Investor sentiment is also a critical factor. Periods of economic uncertainty, marked by volatile stock markets and reduced risk tolerance, can lead to a general cooling of investment appetite. This makes it harder for companies to attract the necessary funding for growth initiatives.

Specific economic threats include:

- Reduced Capital Availability: A projected global GDP growth slowdown to around 2.7% in 2024, according to IMF estimates, could mean less readily available capital for infrastructure.

- Increased Financing Costs: Persistent inflation and potential further interest rate hikes by major central banks in 2024 could push borrowing costs higher for PEAS Industries AB.

- Tempered Investor Demand: Volatility in global equity markets, with many indices experiencing significant swings in 2023 and early 2024, signals a more cautious investor base for long-term projects.

The renewable energy sector faces intense competition, with new specialized companies constantly entering the market. This crowded landscape, driven by a global renewable energy market valued at approximately $1.3 trillion in 2023, puts pressure on companies like Peas Industries AB to innovate and maintain cost efficiency to avoid declining profitability.

Regulatory uncertainty, particularly concerning shifts in government incentives like the Inflation Reduction Act, poses a significant threat. Changes in these policies could alter project economics and investor attractiveness, potentially delaying or canceling crucial developments for Peas Industries AB.

Supply chain disruptions and volatile commodity prices, exacerbated by geopolitical tensions in 2023-2024, directly impact project costs. For instance, increased raw material costs in early 2024 led to an estimated 5-10% rise in solar and wind project expenses globally.

Rapid technological advancements in renewable energy, such as the dramatic cost reductions in solar PV modules and battery storage, mean Peas Industries AB must invest heavily in R&D to prevent its current assets from becoming obsolete and maintain its competitive edge.

SWOT Analysis Data Sources

This SWOT analysis for Peas Industries AB is built upon a robust foundation of data, drawing from the company's official financial statements, comprehensive market research reports, and expert analyses from seasoned industry professionals.