Peas industries AB PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Peas industries AB Bundle

Navigate the complex external environment impacting Peas industries AB with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that will shape its future. Gain a strategic advantage by identifying opportunities and mitigating risks. Download the full report now for actionable intelligence.

Political factors

Government policies, such as subsidies and tax credits, are pivotal in driving the growth of renewable energy. For instance, the Inflation Reduction Act in the United States, enacted in 2022, provides significant tax credits for solar and wind energy projects, extending through 2032. This policy directly impacts the financial attractiveness of these investments.

These incentives are designed to boost the economic viability of renewable energy development, making it more competitive against traditional energy sources. PEAS Industries AB, operating within this sector, benefits from a more favorable investment climate due to such government support, influencing its strategic decisions and market positioning.

Global commitments like the Paris Agreement, aiming for net-zero emissions by 2050, and the EU Green Deal, which targets a 55% reduction in emissions by 2030 compared to 1990 levels, are fundamentally reshaping energy markets. This international push directly fuels demand for renewable energy sources, a core area for PEAS Industries AB.

National targets, such as Sweden's ambition to be carbon-neutral by 2045, create a predictable and supportive policy landscape. This stability is crucial for PEAS Industries AB, allowing for strategic long-term investments in sustainable energy solutions, knowing that policy frameworks will continue to favor such developments.

PEAS Industries AB's long-term investments in the energy sector hinge on predictable and clear regulatory frameworks. This includes established guidelines for grid access, power purchase agreements (PPAs), and licensing procedures. For instance, in 2024, the European Union continued to refine its energy market regulations, aiming for greater stability to encourage renewable energy deployment, a key area for PEAS.

Instability or frequent shifts in these energy market rules can introduce considerable risks and uncertainty for PEAS Industries AB's project development and ongoing operations. A notable example from 2024 saw some nations adjust renewable energy support schemes, impacting the financial viability of previously planned projects and highlighting the sector's sensitivity to regulatory changes.

Geopolitical stability and energy security

Geopolitical instability, particularly in major energy-producing regions, is increasingly driving nations to prioritize energy independence. This trend directly benefits companies like PEAS Industries AB by accelerating the adoption of domestic renewable energy solutions. For instance, the ongoing geopolitical tensions in Eastern Europe have spurred significant investment in renewables across the EU, with Germany alone aiming to source 80% of its electricity from renewables by 2030, a target that has seen increased policy support in 2024.

This political imperative for energy security presents a clear opportunity for PEAS Industries AB to expand its offerings and bolster national energy resilience. As countries seek to reduce reliance on volatile fossil fuel markets, demand for sustainable energy infrastructure, including solar and wind power projects, is projected to surge. The International Energy Agency (IEA) reported in early 2025 that global investment in clean energy technologies reached a record $2 trillion in 2024, highlighting the robust market growth driven by these political factors.

- Accelerated Renewable Adoption: Geopolitical events are a catalyst for national policies promoting domestic renewable energy sources.

- Energy Security Imperative: Nations are actively pursuing energy independence, creating a favorable market for sustainable energy solutions.

- Market Expansion Opportunities: PEAS Industries AB can capitalize on this trend by expanding its portfolio to meet the growing demand for energy resilience.

- Record Investment in Clean Energy: Global investment in clean energy technologies hit $2 trillion in 2024, underscoring the market's response to these political drivers.

Permitting and planning processes

The speed and complexity of obtaining permits and navigating planning processes for new renewable energy projects are critical. Delays or stringent requirements can directly affect how quickly PEAS Industries AB can build new facilities and how much those projects ultimately cost. For instance, in 2024, the average time to secure permits for large-scale solar farms in some European countries extended to 18-24 months, a significant increase from previous years.

Bureaucratic obstacles and potential public objections concerning land use can present considerable challenges for PEAS Industries AB as it aims to grow its portfolio of renewable energy assets. In Sweden, where PEAS Industries AB operates, local planning regulations can vary significantly, sometimes leading to protracted consultation periods that impact development schedules.

- Permitting Timelines: In 2024, average permitting times for new renewable energy infrastructure in key European markets ranged from 12 to over 24 months, impacting project deployment speed.

- Land Use Opposition: Public concerns regarding visual impact and land allocation for wind and solar farms can lead to delays, with some projects facing multi-year review processes.

- Regulatory Complexity: PEAS Industries AB must navigate a patchwork of national and regional planning laws, adding layers of complexity and potential cost to asset expansion efforts.

Government policies, including subsidies and tax incentives, are crucial drivers for renewable energy expansion. For example, the EU's Renewable Energy Directive, with updated targets for 2030, continues to shape investment decisions. PEAS Industries AB benefits from this supportive policy environment, which influences its strategic planning and market entry.

National energy security concerns, amplified by geopolitical events in 2024, are accelerating the shift towards domestic renewable sources. Countries are actively seeking energy independence, creating a more favorable market for sustainable solutions like those offered by PEAS Industries AB. This trend is reflected in the International Energy Agency's early 2025 report, which noted a record $2 trillion in global clean energy investment in 2024.

| Policy Driver | Impact on PEAS Industries AB | Relevant Data/Example |

|---|---|---|

| Renewable Energy Directives (e.g., EU 2030 targets) | Provides a clear policy framework and financial incentives for renewable projects. | EU aims for at least 42.5% renewable energy by 2030. |

| Energy Security Initiatives | Drives demand for domestic, stable energy sources, reducing reliance on volatile fossil fuels. | Germany's goal to source 80% of electricity from renewables by 2030, with increased policy support in 2024. |

| Permitting and Planning Regulations | Can cause project delays and cost increases if complex or lengthy. | Average permitting times for large solar farms in some European nations reached 18-24 months in 2024. |

What is included in the product

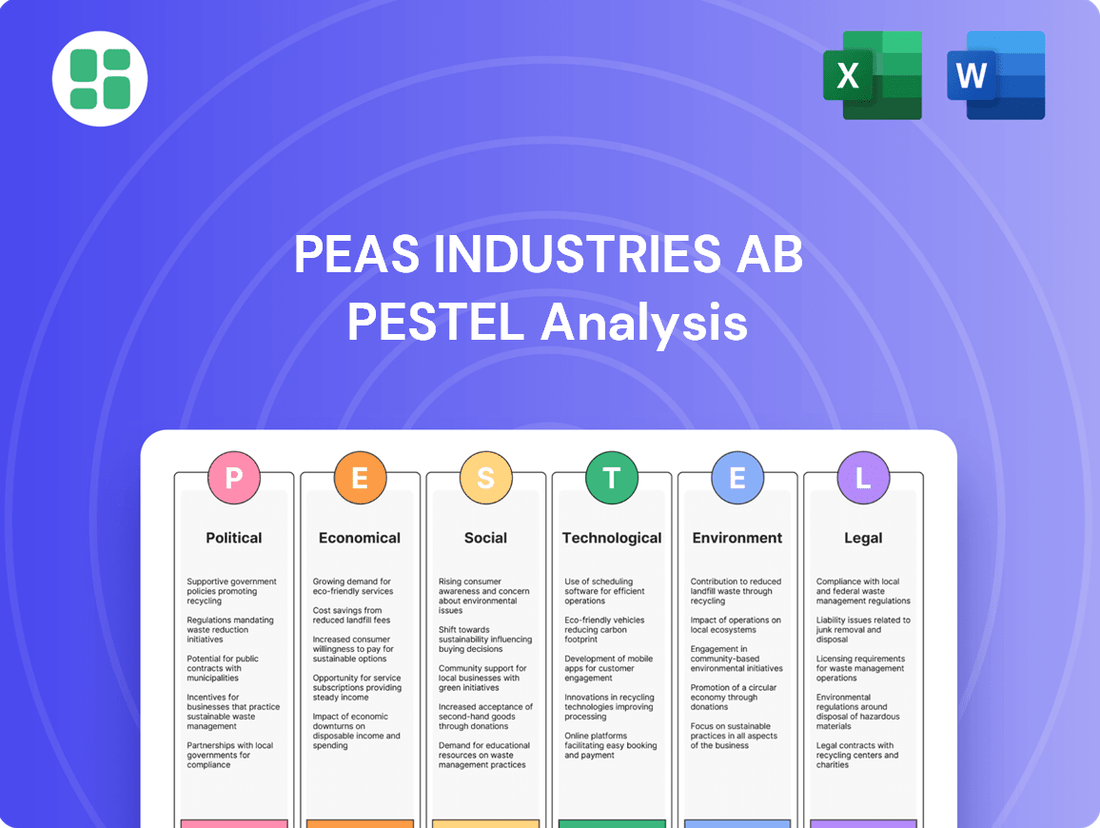

This PESTLE analysis of Peas Industries AB examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting its operations, offering a comprehensive view of the external landscape.

It provides actionable insights for strategic decision-making, identifying potential risks and opportunities within the macro-environment relevant to Peas Industries AB.

A clear, actionable PESTLE analysis for Peas Industries AB, offering a concise overview of external factors to proactively address potential challenges and capitalize on opportunities.

Economic factors

The cost of capital, heavily influenced by prevailing interest rates, is a critical factor for PEAS Industries AB, particularly for its large-scale renewable energy ventures. Higher interest rates directly translate to increased financing costs, potentially slowing down investment in new projects.

For instance, if benchmark interest rates, such as the European Central Bank's main refinancing operations rate, were to rise from their current levels in mid-2024, PEAS Industries AB would face higher borrowing costs for its capital-intensive projects. This could impact the financial viability and timeline of expansion plans.

Conversely, lower interest rates, like those seen in previous periods, make accessing capital more affordable. This scenario would empower PEAS Industries AB to accelerate its investment in renewable energy infrastructure, potentially boosting its market position and revenue growth in the 2024-2025 period.

Wholesale electricity prices in Europe have seen significant volatility. For instance, the average day-ahead electricity price in Germany in 2023 was around €99 per megawatt-hour (MWh), a notable decrease from the record highs of 2022 but still higher than pre-energy crisis levels.

The terms of Power Purchase Agreements (PPAs) are crucial for PEAS Industries AB. A stable PPA at a favorable price, perhaps in the range of €50-€70 per MWh for new projects, provides a predictable revenue stream, mitigating the impact of fluctuating spot market prices and ensuring a solid return on investment for renewable energy assets.

Inflationary pressures in 2024 and early 2025 are significantly impacting the renewable energy sector, driving up the costs of essential components like polysilicon for solar panels and critical minerals for batteries. For PEAS Industries AB, this translates directly to higher capital expenditures for new projects. For instance, the average cost of solar PV modules saw an increase of approximately 5-10% in late 2024 compared to the previous year due to these factors.

Supply chain disruptions, exacerbated by geopolitical events and lingering pandemic effects, continue to pose a considerable risk for PEAS Industries AB. Delays in the delivery of specialized equipment and raw materials can push back project timelines, leading to increased financing costs and potential revenue loss. Managing these logistical challenges and the associated cost escalations is paramount for PEAS Industries AB to ensure the profitability and timely execution of its renewable energy developments.

Availability of green financing and investment trends

The market for green financing is expanding rapidly, with global green bond issuance reaching an estimated $600 billion in 2024, a notable increase from previous years. This growth, projected to continue through 2025, signifies a strong investor appetite for environmentally conscious projects. PEAS Industries AB can tap into this burgeoning capital pool to finance its renewable energy initiatives and attract investors prioritizing sustainability.

Sustainable finance instruments, including ESG-focused investment funds, are increasingly popular. By 2025, assets under management in global ESG funds are expected to surpass $40 trillion. This trend offers PEAS Industries AB a strategic advantage, enabling it to secure funding from a growing segment of the investment community that actively seeks out companies with strong environmental, social, and governance credentials.

- Green Bond Market Growth: Global green bond issuance is projected to reach $600 billion in 2024, with continued expansion expected into 2025, providing ample capital for renewable energy projects.

- ESG Investment Surge: Assets managed by global ESG funds are anticipated to exceed $40 trillion by 2025, indicating a significant and growing source of sustainability-focused investment capital.

- Funding Opportunities: PEAS Industries AB can leverage the increasing availability of green financing and the strong investor demand for ESG-compliant investments to secure capital for its portfolio expansion.

- Investor Attraction: By aligning with these financial trends, PEAS Industries AB can attract sustainability-minded investors, enhancing its financial flexibility and strategic partnerships.

Economic growth and energy demand

Global economic growth is a significant driver for energy demand. As economies expand, industrial activity, transportation, and household consumption all increase, leading to a greater need for power. For instance, the International Energy Agency (IEA) projected in their 2024 outlook that global energy demand would rise by 1.3% in 2024, building on a 1.1% increase in 2023, reflecting ongoing economic recovery and development.

This correlation directly benefits companies like PEAS Industries AB, which specialize in sustainable energy solutions. A strong economic environment typically translates into higher disposable incomes and increased business investment, both of which support the adoption of new energy technologies and infrastructure. The prospect of continued economic expansion in key markets, such as the Asia-Pacific region which is expected to account for over half of the global energy demand growth through 2026 according to the IEA, presents a substantial market opportunity for PEAS Industries AB's offerings.

Key economic indicators to monitor for PEAS Industries AB include:

- Global GDP Growth: Higher GDP growth generally correlates with increased energy consumption and investment in energy infrastructure. Projections for 2024 and 2025 suggest continued, albeit varied, global economic expansion, supporting demand for energy solutions.

- Industrial Production Indices: These indices directly reflect manufacturing activity, a major energy consumer. Rising industrial output signals greater demand for electricity and other energy sources.

- Consumer Spending and Confidence: Strong consumer spending often leads to increased residential energy use and demand for goods and services that require energy in their production and transportation.

- Foreign Direct Investment (FDI) in Energy Sector: Increased FDI, particularly in renewable energy projects, signals confidence in the sector's long-term prospects and can drive demand for the technologies and services PEAS Industries AB provides.

Inflationary pressures are a significant concern for PEAS Industries AB, directly impacting the cost of raw materials and components essential for renewable energy projects. For instance, the price of lithium, a key component in battery storage, saw fluctuations in late 2024, with some reports indicating a 15% increase in certain markets compared to early 2024, directly affecting project budgets.

Interest rates remain a critical factor influencing PEAS Industries AB's cost of capital. As of mid-2024, central banks in major economies like the Eurozone maintained a cautious approach to rate cuts, meaning borrowing costs for large infrastructure projects could remain elevated through 2025, potentially impacting investment decisions.

The global economic outlook for 2024-2025 suggests continued, albeit uneven, growth, which directly correlates with energy demand. The International Energy Agency (IEA) projected a 1.3% rise in global energy demand for 2024, a positive signal for companies like PEAS Industries AB that provide energy solutions.

| Economic Factor | Impact on PEAS Industries AB | Data/Projection (2024-2025) |

|---|---|---|

| Inflation | Increased capital expenditure for projects due to higher material costs. | Lithium prices increased by ~15% in select markets late 2024. |

| Interest Rates | Higher financing costs for capital-intensive renewable projects. | Central bank rates in major economies remained steady mid-2024, suggesting sustained borrowing costs. |

| Global Economic Growth | Increased energy demand, creating market opportunities. | IEA projected 1.3% global energy demand growth for 2024. |

Full Version Awaits

Peas industries AB PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Peas Industries AB delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic positioning.

What you’re previewing here is the actual file—fully formatted and professionally structured. It provides actionable insights into the external forces shaping Peas Industries AB, enabling informed decision-making and risk mitigation.

Sociological factors

Public acceptance is a significant hurdle for renewable energy. For instance, in 2024, a proposed wind farm in Scotland faced considerable local opposition, leading to a two-year delay and increased project costs due to visual impact concerns. PEAS Industries AB must prioritize transparent communication and community benefit sharing to mitigate such risks.

Effective community engagement can foster goodwill and support. In 2025, a solar project in Germany successfully integrated local residents by offering them investment opportunities, resulting in strong community backing and faster permitting. PEAS Industries AB should explore similar models to build trust and secure social license to operate.

Societal demand for investments that consider environmental, social, and governance (ESG) factors is rapidly increasing. This heightened awareness, particularly around climate change, means companies like PEAS Industries AB that demonstrate strong sustainability practices are more attractive to a growing pool of investors.

In 2024, sustainable investment funds globally saw continued inflows, with ESG-focused equity funds alone attracting over $100 billion in net new assets by mid-year, according to industry reports. This trend directly benefits PEAS Industries AB by aligning its operations with investor preferences for long-term, responsible value creation.

The booming green energy sector, projected to grow significantly through 2025, is creating a substantial demand for specialized labor. This includes expertise in areas like solar panel installation, wind turbine maintenance, and battery storage technology. For PEAS Industries AB, securing a pipeline of qualified professionals is crucial for scaling its operations and meeting project timelines.

According to a 2024 report, the renewable energy industry in Europe alone is expected to create over 1.5 million new jobs by 2030, highlighting the competitive landscape for talent. PEAS Industries AB must focus on attracting and retaining individuals with skills in project management, electrical engineering, and environmental compliance to support its asset development and ongoing management.

Consumer preferences for green energy

Societal trends increasingly favor energy derived from renewable sources, fueled by a growing environmental awareness. This shift significantly impacts both corporate procurement strategies and individual consumer choices, creating a more receptive market for companies like PEAS Industries AB that contribute to the green energy transition.

This heightened consumer preference translates into tangible market opportunities. For instance, in 2024, the global renewable energy market was valued at approximately $1.3 trillion, with projections indicating robust growth. PEAS Industries AB's focus on sustainable energy solutions positions it to capitalize on this expanding demand, aligning with the broader societal push for decarbonization.

- Growing Demand: Consumer surveys consistently show a willingness to pay more for products and services from environmentally responsible companies.

- Policy Alignment: Government incentives and regulations promoting renewable energy adoption further bolster this consumer preference.

- Market Growth: The renewable energy sector saw significant investment in 2024, with solar and wind power leading the charge, indicating strong market confidence and consumer backing.

Social equity and energy access

Discussions surrounding social equity within the energy transition are intensifying, focusing on the fair distribution of benefits and the mitigation of negative impacts. PEAS Industries AB must actively consider how its initiatives promote equitable energy access, ensuring that underserved communities are not left behind. For instance, the International Energy Agency (IEA) reported in 2024 that while renewable energy deployment is accelerating, significant disparities in access persist, particularly in developing nations, highlighting the need for inclusive project design.

PEAS Industries AB's commitment to social equity translates into tangible actions that enhance community well-being. This includes prioritizing local employment, investing in community development programs, and ensuring that energy projects are implemented with minimal disruption to existing social structures. By fostering these principles, the company can build stronger stakeholder relationships and ensure the long-term sustainability of its operations, aligning with global efforts to achieve Universal Energy Access by 2030.

Key considerations for PEAS Industries AB regarding social equity and energy access include:

- Equitable Benefit Sharing: Ensuring that profits and job opportunities generated by energy projects are distributed fairly among local communities and stakeholders.

- Affordability and Access: Designing energy solutions that are affordable and accessible to low-income households and marginalized populations.

- Community Engagement: Actively involving communities in the planning and decision-making processes for energy projects to address their needs and concerns.

- Impact Mitigation: Implementing measures to minimize any negative social or environmental impacts of energy infrastructure development on local communities.

Societal shifts towards sustainability and ethical consumption are profoundly influencing the energy sector. Consumers and investors alike are increasingly prioritizing companies that demonstrate strong environmental, social, and governance (ESG) performance. This trend is driving demand for renewable energy solutions, as seen in the global renewable energy market's valuation of approximately $1.3 trillion in 2024, with strong projected growth through 2025.

The focus on social equity within the energy transition is also gaining momentum, emphasizing fair benefit distribution and inclusive access. PEAS Industries AB must integrate principles of equitable energy access into its project development to foster community well-being and ensure long-term operational sustainability. For instance, the International Energy Agency (IEA) highlighted in 2024 that despite accelerating renewable deployment, significant disparities in energy access persist globally, underscoring the need for inclusive strategies.

The renewable energy industry is experiencing a significant boom, creating a substantial demand for specialized talent. PEAS Industries AB needs to secure a pipeline of qualified professionals, as the European renewable energy sector alone is projected to create over 1.5 million new jobs by 2030, indicating a competitive talent landscape.

Public acceptance remains a critical factor for renewable energy projects. In 2024, a Scottish wind farm faced a two-year delay due to local opposition concerning visual impact, increasing project costs. PEAS Industries AB should prioritize transparent communication and community benefit sharing to mitigate such risks, as demonstrated by a 2025 German solar project that successfully integrated local residents through investment opportunities, securing strong community backing.

Technological factors

Continuous innovation in solar panel efficiency, with commercial modules now exceeding 23% efficiency, and advancements in wind turbine design, allowing for larger rotor diameters and higher capacity factors, directly impact project output and cost-effectiveness. PEAS Industries AB benefits from these advancements, enabling more competitive and higher-performing renewable energy assets.

Progress in battery storage, particularly lithium-ion technology, continues to drive down costs. For instance, BloombergNEF reported that the average global price for lithium-ion battery packs fell by 14% in 2023, reaching $156/kWh. This cost reduction makes integrating battery storage with renewable assets like those of PEAS Industries AB increasingly economically viable, directly addressing the intermittency of solar and wind power.

Advancements in hydrogen storage, including green hydrogen production powered by renewables, offer another avenue for grid stability. The International Energy Agency noted in its 2024 outlook that global renewable energy capacity additions are set to grow by over 10% in 2024 compared to 2023. This expansion necessitates robust storage solutions, and hydrogen's potential for long-duration storage can complement battery systems, enhancing the overall dispatchability and value of PEAS Industries AB's renewable energy portfolio.

The ongoing evolution of smart grid technologies, coupled with advancements in artificial intelligence and broader digitalization of energy systems, is fundamentally reshaping how energy is managed, forecasted, and integrated, particularly for renewable sources. This digital transformation allows for more precise energy management and improved forecasting accuracy, crucial for grid stability.

PEAS Industries AB can significantly benefit from these technological shifts by leveraging them to optimize asset performance and enhance overall operational efficiency. For instance, AI-driven predictive maintenance can reduce downtime for PEAS's energy infrastructure, while digital twins can simulate and improve operational scenarios, leading to cost savings.

In 2024, the global smart grid market was valued at approximately $30 billion and is projected to grow, indicating significant investment and adoption of these digital solutions. This trend underscores the opportunity for PEAS to integrate these technologies to gain a competitive edge in energy management and operational excellence.

Innovation in project development and construction

Innovation in how projects are sited, designed, built, and maintained is a significant technological factor for PEAS Industries AB. New methods can drastically cut costs, speed up the rollout of renewable energy infrastructure, and even make that infrastructure last longer. For instance, advancements in modular construction and prefabrication, which saw significant investment in 2024, can reduce on-site labor needs and construction timelines. This adoption directly translates into a competitive advantage for PEAS Industries AB, improving the overall financial viability of their projects.

The drive for efficiency is pushing the adoption of advanced digital tools. Building Information Modeling (BIM) and AI-powered design software are becoming standard, allowing for more precise planning and fewer errors during construction. In 2024, the global construction technology market was valued at over $15 billion, with a significant portion dedicated to these digital solutions. PEAS Industries AB can leverage these technologies to optimize material usage and reduce waste, further enhancing project economics.

- Digital Twins: Creating virtual replicas of physical assets to monitor performance and predict maintenance needs, potentially reducing operational costs by up to 30% for renewable energy assets.

- Advanced Materials: Development of more durable and efficient materials for solar panels and wind turbines, increasing energy output and extending service life.

- Robotics and Automation: Increased use of robots for tasks like welding, assembly, and site inspection, improving safety and speed while lowering labor costs.

- AI in Project Management: Utilizing artificial intelligence to optimize project scheduling, resource allocation, and risk assessment, leading to more predictable project outcomes.

Cybersecurity threats to energy infrastructure

As energy infrastructure increasingly relies on digital systems, the threat of cyberattacks looms larger. These threats can disrupt operations and compromise sensitive data, impacting companies like PEAS Industries AB. The interconnected nature of modern energy grids means a single breach can have cascading effects.

PEAS Industries AB needs to prioritize and significantly invest in advanced cybersecurity solutions to safeguard its critical infrastructure. This includes protecting operational technology (OT) systems alongside information technology (IT). For instance, a 2024 report indicated that the average cost of a data breach in the energy sector reached $4.6 million, highlighting the financial imperative for robust defenses.

- Increased digitization of energy assets elevates cyberattack risks.

- Operational continuity and data integrity are at stake.

- PEAS Industries AB must allocate substantial resources to cybersecurity.

- The energy sector experienced an average data breach cost of $4.6 million in 2024.

Technological advancements in solar panel efficiency, now exceeding 23%, and wind turbine design are making renewable assets more cost-effective. Progress in battery storage, with lithium-ion pack prices falling to $156/kWh in 2023, enhances the viability of integrating storage with renewables, addressing intermittency. Smart grid technologies and AI are improving energy management and forecasting accuracy, crucial for grid stability.

PEAS Industries AB can leverage these trends by adopting digital tools like BIM and AI for optimized project planning and construction, potentially reducing waste and improving project economics. The adoption of modular construction in 2024 also offers faster, more cost-effective project rollouts.

The increasing digitization of energy infrastructure, while beneficial, also heightens the risk of cyberattacks. In 2024, the average cost of a data breach in the energy sector was $4.6 million, underscoring the critical need for PEAS Industries AB to invest heavily in cybersecurity to protect operational technology and data integrity.

| Technological Advancement | Impact on PEAS Industries AB | Key Data/Trend (2023-2024) |

| Solar Panel Efficiency | Increased energy output and cost-effectiveness of renewable assets. | Commercial modules exceeding 23% efficiency. |

| Battery Storage Cost Reduction | Improved economic viability of integrating storage, addressing intermittency. | Lithium-ion battery pack prices fell 14% to $156/kWh in 2023. |

| Smart Grid & AI Integration | Enhanced energy management, forecasting accuracy, and grid stability. | Global smart grid market valued at ~$30 billion in 2024. |

| Digital Construction Tools (BIM, AI) | Optimized planning, reduced errors, material efficiency, and cost savings. | Global construction tech market over $15 billion in 2024. |

| Cybersecurity Risks | Threat to operational continuity and data integrity. | Average energy sector data breach cost: $4.6 million (2024). |

Legal factors

Environmental regulations and impact assessments are critical legal hurdles for PEAS Industries AB. The company must adhere to stringent laws governing new energy projects, including comprehensive environmental impact assessments (EIAs). For instance, in 2024, the European Union continued to enforce its Green Deal objectives, which mandate rigorous environmental reviews for all new industrial developments, potentially adding significant time and cost to project timelines.

Failure to comply with these legal frameworks can lead to substantial fines and project delays. PEAS Industries AB needs to proactively integrate EIA processes into its project planning to ensure all environmental considerations are addressed, thereby securing the necessary permits and approvals for its operations. This includes anticipating potential challenges related to emissions, waste management, and biodiversity impact.

Land use and zoning regulations significantly influence where PEAS Industries AB can develop its renewable energy projects. These laws dictate what types of structures can be built and where, directly impacting the selection of sites for solar and wind farms. For instance, in 2024, many regions are tightening restrictions on industrial development in agricultural zones, potentially limiting available land for large-scale installations.

Navigating these legal frameworks is essential for PEAS Industries AB to ensure project viability and avoid costly delays or disputes. Compliance with zoning laws and understanding protected area designations, such as those for natural habitats or historical sites, are critical steps in securing the necessary permits and approvals. Failure to adhere to these rules can halt development, as seen in several European countries where zoning disputes have stalled wind farm construction.

The legal structures underpinning Power Purchase Agreements (PPAs), equipment supply chains, and construction for renewable energy projects are critical for PEAS Industries AB. These frameworks ensure that revenue streams are predictable and that projects are completed as planned, thereby reducing operational risks. For instance, the enforceability of PPA terms, often governed by national energy regulations and international arbitration standards, directly impacts long-term financial projections.

In 2024, the global renewable energy sector saw continued evolution in PPA legalities, with a growing emphasis on indexation clauses and force majeure provisions to account for market volatility and climate-related events. PEAS Industries AB's reliance on these contracts means that any ambiguity or dispute resolution challenges within these frameworks can significantly affect project economics and investor confidence. For example, a well-defined dispute resolution mechanism in a 2024 PPA could prevent costly delays.

Competition law and market regulation

Competition laws are crucial in the energy sector, aiming to prevent monopolies and foster fair market conditions. PEAS Industries AB must navigate these regulations diligently, particularly as it diversifies its offerings, to steer clear of anti-competitive practices and maintain open market access. For instance, the European Union's robust competition framework, enforced by the European Commission, actively scrutinizes mergers and acquisitions within the energy market to ensure a level playing field. In 2024, the Commission continued its focus on energy market concentration, investigating several proposed consolidations that could impact pricing and consumer choice.

PEAS Industries AB's adherence to these legal frameworks is paramount for sustainable growth and market participation. Failure to comply can result in significant penalties and reputational damage, hindering expansion plans. Key regulatory considerations include:

- Merger Control: Ensuring any acquisitions do not create dominant market positions.

- Abuse of Dominance: Preventing PEAS Industries AB from leveraging any market power unfairly against competitors or consumers.

- State Aid Rules: Complying with regulations on government support to ensure it does not distort competition.

- Market Transparency: Adhering to rules that promote open and fair trading of energy commodities.

Health and safety regulations

PEAS Industries AB operates within a framework of stringent health and safety regulations, particularly crucial for energy infrastructure projects. These regulations govern every stage, from initial construction and ongoing operations to routine maintenance, ensuring the well-being of employees, contractors, and the general public. Adherence is paramount for maintaining operational integrity and mitigating potential liabilities.

For instance, in 2024, the European Agency for Safety and Health at Work (EU-OSHA) reported a continued focus on improving safety in construction, a sector directly relevant to PEAS. Specific directives, such as those concerning occupational safety and health in the workplace, mandate comprehensive risk assessments and the implementation of preventive measures. PEAS Industries AB must therefore invest in robust safety protocols, training, and equipment to comply with these evolving legal requirements.

Key compliance areas include:

- Workplace Safety Standards: Ensuring compliance with national and international standards for safe working environments, including machinery operation and material handling.

- Environmental Health and Safety (EHS) Management Systems: Implementing and maintaining certified EHS systems, such as ISO 45001, to systematically manage health and safety risks.

- Emergency Preparedness and Response: Developing and regularly testing emergency plans to effectively manage incidents like fires, explosions, or chemical spills.

- Worker Training and Competency: Providing continuous training to all personnel on safety procedures, hazard recognition, and the correct use of personal protective equipment (PPE).

PEAS Industries AB faces a complex legal landscape, from environmental impact assessments to land use zoning, all of which dictate where and how projects can be developed. Compliance with these regulations, such as the EU's Green Deal objectives in 2024, is crucial to avoid costly fines and project delays, requiring proactive integration into planning.

Environmental factors

Global climate change mitigation targets are a significant tailwind for PEAS Industries AB. As nations commit to reducing greenhouse gas emissions, the demand for sustainable solutions, a cornerstone of PEAS Industries AB's offerings, is projected to surge. For instance, the International Energy Agency reported in early 2024 that renewable energy capacity additions reached a record high in 2023, a trend expected to accelerate as countries implement stricter climate policies.

These ambitious targets translate into favorable policy environments and increased investment flows into sectors like renewable energy and energy efficiency, directly benefiting PEAS Industries AB. Governments worldwide are incentivizing the transition away from fossil fuels through subsidies, tax credits, and carbon pricing mechanisms. For example, the European Union's Green Deal aims to make the bloc climate-neutral by 2050, fostering substantial opportunities for companies like PEAS Industries AB that provide green technologies and services.

PEAS Industries AB faces increasing scrutiny regarding the environmental impact of its operations, particularly concerning biodiversity and habitat preservation. Renewable energy projects, such as wind and large-scale solar farms, can significantly affect local ecosystems and wildlife populations. For instance, by 2024, it's estimated that over 1.5 million hectares of land in Europe are dedicated to renewable energy infrastructure, with potential implications for biodiversity.

To mitigate these risks, PEAS Industries AB must integrate robust biodiversity protection measures into its project planning and execution. This includes conducting thorough environmental impact assessments (EIAs) to identify and minimize negative ecological footprints. For example, in 2023, a significant number of wind farm projects in the UK were delayed or required modifications due to concerns over bird migration routes and bat populations, highlighting the critical need for proactive environmental stewardship.

The availability and sustainable sourcing of critical raw materials are significant environmental factors for PEAS Industries AB. For instance, the renewable energy sector, a key area for potential growth, relies heavily on materials like rare earth elements for wind turbine magnets and silicon for solar panels. Ensuring a stable and ethically sourced supply chain for these components is paramount.

PEAS Industries AB must actively assess its supply chain's sustainability and its own resource efficiency. The global demand for critical minerals is projected to surge; for example, the International Energy Agency (IEA) reported in 2024 that demand for lithium could increase sixfold by 2040, and cobalt demand could more than double, highlighting the increasing pressure on these resources.

Waste management and end-of-life recycling

The growing adoption of renewable energy, like solar panels and wind turbines, presents a significant challenge in managing waste and recycling components once they reach their end-of-life. PEAS Industries AB must proactively address this by integrating circular economy principles into its operations, ensuring sustainable disposal and material recovery for its assets.

By 2050, it's estimated that global solar panel waste could reach 78 million tonnes, highlighting the urgency for effective recycling solutions. Similarly, wind turbine blade waste is projected to reach 4.5 million tonnes by 2050, with current recycling rates for these blades being very low, often below 10%.

- Circular Economy Integration: PEAS Industries AB should explore business models that prioritize product longevity, repairability, and component reuse to minimize waste generation.

- Sustainable Disposal Solutions: Developing partnerships with specialized recycling facilities or investing in in-house recycling capabilities for key components will be crucial.

- Regulatory Compliance: Staying ahead of evolving waste management regulations and extended producer responsibility (EPR) schemes across different markets is essential for operational continuity.

Water usage in energy production

While renewable energy sources like solar and wind are often lauded for their low water consumption compared to traditional fossil fuels, their operations are not entirely water-free. For instance, the manufacturing of solar panels, particularly the silicon purification process, can be water-intensive. Furthermore, ongoing maintenance, such as cleaning solar panels to ensure optimal efficiency, especially in arid regions, necessitates water. PEAS Industries AB must therefore consider these aspects within its environmental strategy.

The energy sector as a whole is a significant water user globally. In 2023, the U.S. Department of Energy reported that thermoelectric power generation, which includes fossil fuels and nuclear, accounted for approximately 40% of all freshwater withdrawals in the United States. While PEAS Industries AB's focus on renewables mitigates this significantly, understanding the full lifecycle water impact is crucial. For example, studies in 2024 indicated that while a typical photovoltaic solar farm might use around 100-200 gallons of water per acre per year for cleaning, a coal-fired power plant can use up to 25,000 gallons per megawatt-hour for cooling.

PEAS Industries AB should proactively assess and implement strategies to minimize water usage throughout its value chain. This includes exploring water-efficient cleaning technologies for its solar installations and engaging with suppliers to understand and encourage water stewardship in manufacturing processes. By doing so, the company can further enhance its sustainability profile and reduce potential operational risks associated with water scarcity.

- Manufacturing Footprint: The production of photovoltaic solar panels can require substantial water for processes like silicon purification and wafer etching.

- Operational Maintenance: Regular cleaning of solar panels is necessary to maintain energy output, a process that consumes water, especially in dusty or polluted environments.

- Lifecycle Assessment: PEAS Industries AB should conduct a comprehensive lifecycle water assessment to identify and mitigate water usage across all operational phases and supply chain activities.

- Water Scarcity Risks: Regions experiencing water stress may pose operational challenges and increased costs for water-intensive maintenance activities, impacting overall profitability.

Global climate targets are a significant advantage for PEAS Industries AB, driving demand for their sustainable solutions. Record renewable energy capacity additions in 2023, as reported by the IEA, signal an accelerating trend driven by stricter climate policies and government incentives like the EU's Green Deal.

However, PEAS Industries AB must address the environmental impact of its operations, including biodiversity concerns from renewable energy infrastructure. By 2024, over 1.5 million hectares in Europe were dedicated to renewables, with potential ecological implications, underscoring the need for robust biodiversity protection measures.

The company also faces challenges related to critical raw material sourcing for renewables, such as rare earth elements and silicon. The IEA projected in 2024 that lithium demand could increase sixfold by 2040, highlighting the growing pressure on these resources and the necessity for supply chain sustainability assessment.

Managing end-of-life waste from renewable technologies, like solar panels and wind turbine blades, is another key environmental factor. Projections show global solar panel waste could reach 78 million tonnes by 2050, with current recycling rates for turbine blades below 10%, emphasizing the need for circular economy integration.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Peas Industries AB is built on a robust foundation of data, drawing from official government publications, reputable market research firms, and international economic databases. This ensures that every aspect, from political stability to technological advancements, is informed by credible and current information.