Outbrain SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Outbrain Bundle

Outbrain leverages its extensive publisher network and data insights as key strengths, but faces intense competition and evolving ad regulations as significant threats. Understanding these dynamics is crucial for anyone navigating the digital advertising landscape.

Want the full story behind Outbrain’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

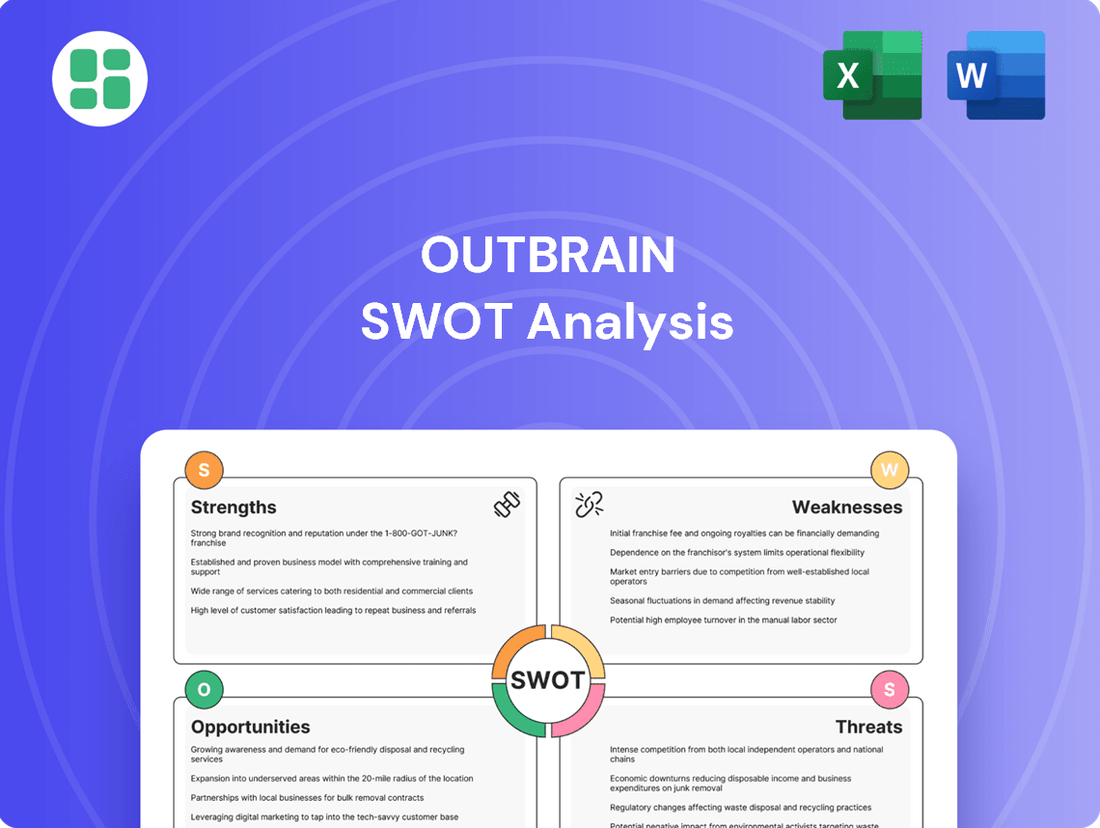

Strengths

Outbrain holds a commanding position in native advertising, recognized for its strong brand and the trust it has cultivated with both publishers and advertisers. This reputation is a significant asset in a competitive digital landscape.

The company's strength lies in its vast network of over 10,000 premium publisher partners worldwide. This includes prominent news and media entities, offering advertisers unparalleled reach and providing publishers with substantial revenue streams.

This expansive publisher network is a critical differentiator, giving Outbrain a substantial edge within the open internet advertising ecosystem. It ensures a continuous flow of high-quality inventory and audience engagement.

The acquisition of Teads, completed in early 2025, has dramatically broadened Outbrain's (now Teads) market presence and service offerings, solidifying its standing as a leading entity in the open web advertising sector. This integration has forged a complete advertising solution, merging Outbrain's expertise in performance marketing with Teads' established strength in premium brand advertising.

This strategic union is projected to generate significant annual cost synergies, estimated to reach $75 million by the end of 2026, thereby bolstering the company's financial performance and profitability.

Outbrain's advanced AI and machine learning capabilities are a significant strength. The company processes over a billion engagement signals every minute, utilizing sophisticated algorithms to personalize content recommendations and optimize advertising campaigns. This data-driven approach directly translates to a better user experience and more effective targeting for advertisers.

The integration of AI is crucial for driving higher engagement rates and improving campaign yields. In 2023, Outbrain reported a 12% year-over-year growth in its Media business, partly attributed to these technological advancements that enhance platform performance and advertiser ROI.

Diversified Ad Formats and Offerings

Outbrain's advertising capabilities extend well beyond its traditional content recommendation feeds, showcasing a strategic diversification of its offerings. New formats like Moments, a vertical video solution, and expansion into Connected TV (CTV) advertising are actively capturing a broader range of advertiser interest.

The company's Demand-Side Platform (DSP), formerly Zemanta, has experienced robust growth, with advertiser spending increasing significantly. This expansion into diverse ad formats and platforms allows Outbrain to tap into a larger share of digital advertising budgets across multiple channels, enhancing its market position.

- Diversified Ad Formats: Outbrain now offers vertical video (Moments) and CTV advertising, moving beyond its core feed.

- DSP Growth: Advertiser spending on Outbrain's DSP platform (Zemanta) has seen substantial increases.

- Expanded Reach: This diversification enables Outbrain to capture a wider array of advertiser budgets across various digital touchpoints.

Positive Financial Outlook and Growth Initiatives

Outbrain, now integrated with Teads, is positioned for strong financial performance through 2024 and 2025. The company forecasts significant year-over-year growth in Ex-TAC gross profit, bolstered by strategic investments and the realization of cost synergies following the Teads acquisition.

Management anticipates achieving substantial EBITDA margins by 2025, a key indicator of operational efficiency and profitability. This financial outlook is supported by ongoing strategic initiatives and the successful integration of Teads' operations.

Key growth drivers include the recent launch of Onyx, a new branding platform, which has already demonstrated positive contributions to revenue.

- Projected Growth: Anticipating meaningful year-over-year growth in Ex-TAC gross profit for 2024 and 2025.

- Profitability Targets: Aiming for significant EBITDA margins by 2025, driven by acquisition synergies and strategic investments.

- Revenue Boosters: The launch of the Onyx branding platform has positively impacted revenue streams.

- Strategic Integration: Cost synergies from the Teads acquisition are expected to enhance overall financial health.

Outbrain's strengths are anchored in its robust publisher network, advanced AI, and strategic diversification. The acquisition of Teads in early 2025 significantly expanded its market reach and service capabilities, creating a comprehensive advertising solution. This integration is projected to yield substantial cost synergies, estimated at $75 million annually by the end of 2026, enhancing financial performance.

The company's sophisticated AI and machine learning process over a billion engagement signals per minute, optimizing ad campaigns and personalizing content. This data-driven approach fuels higher engagement and improved advertiser ROI, evidenced by a 12% year-over-year growth in its Media business in 2023. Outbrain is also broadening its offerings with new formats like vertical video (Moments) and expansion into Connected TV (CTV) advertising, alongside strong growth in its DSP platform.

| Metric | 2023 Performance | 2024/2025 Outlook |

|---|---|---|

| Publisher Network | 10,000+ premium partners | Continued expansion and integration |

| AI Engagement Signals | 1 billion+ per minute | Ongoing optimization for campaign performance |

| Media Business Growth | 12% YoY (2023) | Continued growth driven by AI and new formats |

| Teads Synergies | N/A (Acquisition completed early 2025) | Projected $75M annual cost synergies by end of 2026 |

| EBITDA Margins | Targeting significant margins by 2025 | Focus on operational efficiency post-integration |

What is included in the product

Maps out Outbrain’s market strengths, operational gaps, and risks.

Offers a clear, actionable SWOT framework to identify and address Outbrain's core challenges and opportunities.

Weaknesses

Outbrain faced financial headwinds in early 2025, reporting a net loss in Q1 2025 that was notably larger than the previous year. The company also fell short of analyst expectations for both earnings per share and revenue during this period.

While the Teads acquisition did boost overall revenue year-over-year, the reported net loss was heavily influenced by significant costs associated with the acquisition itself, along with impairment charges and restructuring expenses. This suggests potential challenges in achieving immediate profitability and highlights the financial strain from the merger.

Outbrain's reliance on publisher partnerships, while a core strength, also presents a significant weakness. The company's business model is intrinsically tied to the health and continuation of these relationships, making them vulnerable to shifts in publisher strategy or the emergence of more attractive alternatives. This dependence is amplified by a crowded market; for instance, by the end of 2023, the digital advertising space saw continued dominance by major players, with Google AdSense remaining a formidable competitor, alongside other significant recommendation platforms like Taboola, which itself has been actively pursuing strategic acquisitions to expand its reach.

The substantial acquisition of Teads presents significant integration hurdles. Merging disparate operational systems, technological platforms, and distinct corporate cultures can prove complex and time-consuming, potentially delaying synergy realization.

The immediate aftermath of the Teads deal has brought elevated transaction and restructuring expenses, consequently affecting Outbrain's near-term financial performance. For instance, in Q1 2024, Outbrain reported a net loss of $12.4 million, partly influenced by these integration costs.

Achieving the anticipated synergies from the Teads integration is paramount for Outbrain's long-term financial health and strategic success. Failure to effectively meld the two entities could undermine the strategic rationale behind the acquisition.

Exposure to Evolving Privacy Regulations

Outbrain's business model relies on understanding user behavior, making it particularly vulnerable to the increasing wave of privacy regulations. Laws like the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA), along with new U.S. state privacy laws slated for 2025, are reshaping how digital advertising platforms can collect and utilize data. This necessitates significant and continuous adaptation of Outbrain's data handling practices to maintain compliance, potentially impacting the effectiveness of its targeting capabilities.

The company must invest heavily in privacy-preserving technologies and robust consent management systems to navigate this complex regulatory landscape. For instance, the ongoing shift towards a cookieless future, driven by privacy concerns and browser changes, directly challenges data-driven advertising models like Outbrain's. Failure to adapt swiftly could lead to reduced data availability for personalization and audience segmentation, impacting campaign performance and advertiser demand.

- Regulatory Uncertainty: Evolving privacy laws globally create ongoing uncertainty for data-driven businesses.

- Compliance Costs: Adapting to new regulations requires substantial investment in technology and legal expertise.

- Data Access Limitations: Stricter privacy rules can restrict the amount and type of data available for targeting.

- Competitive Disadvantage: Companies that fail to adapt may lose ground to those with more privacy-centric solutions.

Competitive Pressure from Closed Ecosystems

Outbrain faces intense competition from dominant closed advertising ecosystems like Meta and Google. These giants command a substantial share of digital ad spend due to their integrated solutions and vast user data. For instance, in 2024, Meta and Google collectively captured over 50% of the global digital advertising market, making it challenging for open web players like Outbrain to match their reach and targeting capabilities.

The sheer scale and data advantage of these closed platforms create a significant hurdle for Outbrain. Advertisers often gravitate towards these ecosystems for their perceived ability to deliver precise targeting and demonstrable return on investment (ROI). This necessitates Outbrain continuously innovating to showcase its unique value proposition and effectiveness in the increasingly fragmented open internet landscape.

- Dominant Market Share: Meta and Google's combined digital ad revenue is projected to exceed $300 billion in 2024, dwarfing many open web competitors.

- Data Integration: Closed ecosystems benefit from first-party data across multiple user touchpoints, offering a more unified view for advertisers.

- Targeting Precision: The extensive user data within closed platforms allows for highly granular audience segmentation, a key draw for advertisers.

- ROI Demonstration: The integrated nature of closed systems often makes it easier for advertisers to track and attribute campaign success, impacting Outbrain's competitive positioning.

Outbrain's financial performance in early 2025 showed a net loss, exceeding prior year figures and missing analyst expectations for both earnings and revenue. While the Teads acquisition boosted top-line revenue, significant integration costs, impairment charges, and restructuring expenses contributed to this net loss, indicating potential profitability challenges stemming from the merger.

The company's reliance on publisher partnerships, a core aspect of its business, also represents a vulnerability. This dependence makes Outbrain susceptible to changes in publisher strategies or the adoption of competing platforms, especially in a crowded digital advertising market where giants like Google AdSense and Taboola continue to exert strong influence.

Navigating evolving privacy regulations like GDPR and emerging U.S. state laws in 2025 poses a significant challenge. These regulations necessitate continuous adaptation of data handling practices, potentially impacting Outbrain's targeting capabilities and requiring substantial investment in privacy-preserving technologies and consent management systems.

Outbrain contends with intense competition from closed advertising ecosystems like Meta and Google, which dominate the market due to their integrated solutions and vast user data. In 2024, these platforms collectively held over 50% of the global digital advertising market, creating a significant hurdle for open web players like Outbrain to match their reach and targeting precision.

Preview Before You Purchase

Outbrain SWOT Analysis

You're viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

This is the same SWOT analysis document included in your download. The full content is unlocked after payment.

The content below is pulled directly from the final SWOT analysis. Unlock the full report when you purchase.

Opportunities

Expansion into Connected TV (CTV) advertising presents a substantial opportunity for the merged Outbrain-Teads entity. CTV ad spend saw over 100% year-over-year growth in Q1 2025, demonstrating its rapid ascent in the digital advertising landscape. This growth trajectory allows the combined platform to leverage its enhanced capabilities to capture a significant share of this expanding market, diversifying revenue streams beyond traditional native formats.

Outbrain can significantly boost its offerings by deepening its investment in AI and machine learning. This will sharpen its ability to predict user behavior, refine content recommendations, and optimize ad targeting. For instance, by analyzing vast datasets, AI can identify emerging trends in content consumption, allowing Outbrain to proactively suggest relevant articles and ads to users, thereby increasing engagement.

AI-driven automation can streamline complex advertising processes. This includes automating campaign setup, bid adjustments, and performance monitoring, freeing up advertisers to focus on strategic decisions. In 2024, the digital advertising market saw continued growth, with AI playing a crucial role in campaign efficiency. Outbrain's ability to offer automated, data-backed insights can directly translate to higher return on investment for its clients.

The acquisition of Teads by PubMatic (Outbrain's parent company) in late 2023 presents a prime opportunity to cross-sell. Teads' premium, brand-safe inventory, often favored by large consumer packaged goods and automotive advertisers, can now be offered to Outbrain's existing performance-oriented clients. This integration allows Outbrain to leverage Teads' strong relationships with top-tier brands, potentially increasing average revenue per user (ARPU) by offering a more comprehensive ad solution.

This synergy is expected to boost client retention by providing a wider array of ad formats and enhanced targeting capabilities. For instance, Outbrain can now offer Teads' in-read video and native ad formats to its performance marketers, enabling them to reach audiences in more engaging ways. Conversely, Teads' brand advertisers can benefit from Outbrain's sophisticated performance marketing tools, driving measurable results and expanding their reach across a broader digital landscape.

Growing Demand for Brand Safety and Quality Inventory

The digital advertising landscape is seeing a significant shift towards brand safety and higher quality inventory, a trend that plays directly into Outbrain's strengths. As advertisers become more discerning, particularly in light of concerns surrounding Made-for-Advertising (MFA) content, Outbrain's strategy of forging direct relationships with premium publishers becomes a key differentiator. This focus ensures that the inventory available through Outbrain's platform is inherently more trustworthy and engaging for consumers.

Advertisers are actively seeking environments that not only protect their brand image but also foster genuine user engagement, moving away from low-quality, ad-heavy placements. Outbrain's commitment to curated partnerships positions it to capitalize on this demand. For instance, in 2024, a significant portion of ad spend is expected to be redirected from less reputable sources to premium publishers, creating a substantial opportunity for platforms like Outbrain that prioritize quality.

This growing demand for brand safety and quality inventory presents several key opportunities for Outbrain:

- Enhanced Advertiser Trust: Outbrain can leverage its direct publisher relationships to build greater advertiser confidence, attracting budgets previously allocated to less transparent platforms.

- Premium Pricing Potential: High-quality, brand-safe inventory typically commands higher CPMs, potentially boosting Outbrain's revenue per impression.

- Competitive Advantage: By focusing on direct partnerships, Outbrain can stand out in a crowded market where many competitors rely on less controlled programmatic channels.

- Industry Leadership: Outbrain can solidify its position as a leader in responsible digital advertising by championing quality and transparency.

Diversification of Revenue Streams Beyond Core Feed

Outbrain is actively diversifying its revenue beyond its core content recommendation feeds. In the first quarter of 2024, the company reported that approximately 25% of its total revenue was generated from advertising placements outside of its traditional recommendation widgets, a notable increase from previous periods.

This strategic expansion into new verticals and ad formats is crucial for mitigating risks associated with over-reliance on a single product. By developing innovative solutions like Moments, which offers a vertical video ad experience, and exploring native header bidding, Outbrain aims to tap into new market segments and capture a larger share of digital advertising spend.

- Revenue Diversification: In Q1 2024, non-feed revenue constituted roughly 25% of Outbrain's total revenue, demonstrating progress in expanding beyond core recommendation products.

- New Verticals and Formats: The company is actively developing and integrating new ad formats like Moments and exploring native header bidding to unlock new revenue opportunities.

- Reduced Reliance: Successful diversification efforts will lessen Outbrain's dependence on its legacy recommendation feed technology, creating a more resilient business model.

- Market Expansion: Exploring new ad formats and verticals allows Outbrain to reach different advertiser categories and consumer engagement patterns, broadening its addressable market.

The integration of Teads' premium inventory with Outbrain's platform offers significant cross-selling opportunities. This allows Outbrain to tap into Teads' strong relationships with major advertisers, particularly those in the CPG and automotive sectors, who prioritize brand safety and premium placements. In 2024, a notable shift in ad spend is occurring, with brands actively seeking higher-quality inventory.

Expanding into Connected TV (CTV) advertising is a key opportunity, with CTV ad spend experiencing over 100% year-over-year growth in Q1 2025. This burgeoning market aligns with Outbrain's strategy to diversify its revenue streams and capture a larger share of digital advertising budgets beyond traditional native formats.

Outbrain's focus on direct publisher relationships strengthens its position in an industry increasingly concerned with brand safety and the prevalence of Made-for-Advertising (MFA) content. This commitment ensures a more trustworthy and engaging ad environment for consumers, attracting advertisers who are reallocating budgets away from less reputable sources, a trend observed throughout 2024.

Threats

The ad tech space is a crowded arena, with giants like Google and Meta dominating, alongside formidable competitors like Taboola. This intense rivalry puts pressure on pricing and demands constant innovation to stay relevant. For Outbrain, this means a continuous need to differentiate and offer superior value to both publishers and advertisers.

Emerging ad tech companies are also adding to the competitive heat, often with agile approaches and specialized solutions. This can make it harder for established players like Outbrain to secure and maintain crucial partnerships, especially as market saturation in content recommendation becomes more pronounced.

Global data privacy laws like GDPR and CCPA are tightening, directly impacting how Outbrain can use user data. This means Outbrain's ability to provide personalized content and targeted ads, a key part of its business, faces significant hurdles.

New state-level privacy laws in the U.S. are also adding complexity. These evolving restrictions could limit the data Outbrain collects and how it's used, potentially affecting its core recommendation engine and advertising capabilities.

Failure to comply with these stringent regulations carries substantial risks, including hefty fines and damage to Outbrain's reputation. For instance, GDPR fines can reach up to 4% of annual global turnover, a significant financial threat.

The digital advertising market, a core area for Outbrain, is highly susceptible to broader economic shifts. During periods of economic uncertainty or recession, businesses often tighten their belts, which frequently translates to reduced spending on advertising. This directly impacts Outbrain's revenue streams, as clients scale back their campaigns.

For instance, during the economic slowdown in 2023, many digital advertising platforms experienced a cooling of growth as marketers became more cautious with their budgets. While specific 2024 ad spend forecasts for Outbrain are still unfolding, general industry trends suggest that continued economic headwinds could pressure its top line. Historically, periods of economic contraction have led to noticeable dips in ad spend across the industry, a pattern Outbrain is not immune to.

Publisher Dependency and Potential for Platform Shifts

Outbrain's business model hinges on its relationships with publishers who provide the advertising inventory. A significant threat arises if publishers decide to develop their own direct advertising solutions, bypassing platforms like Outbrain entirely.

Publishers are increasingly looking to maximize their own revenue streams. This could lead them to reduce their reliance on third-party recommendation platforms or shift their focus to alternative monetization strategies, potentially impacting Outbrain's access to valuable ad space.

Consider the competitive landscape: as of early 2024, platforms like Taboola continue to compete for publisher partnerships. Should publishers find more attractive terms or better integrated solutions from competitors, they might reallocate their inventory away from Outbrain. For instance, in the broader digital advertising space, publishers have been exploring direct deals with brands, a trend that could trickle down to content recommendation services.

This dependency creates vulnerability. A substantial shift in publisher sentiment or strategy could directly affect Outbrain's inventory availability and, consequently, its revenue generation capabilities.

Technological Disruption and Rapid Innovation

The ad tech landscape is in constant flux, driven by rapid technological evolution. Key advancements include the increasing integration of artificial intelligence (AI) into ad targeting and creative optimization, alongside the emergence of novel ad formats like interactive video and shoppable ads. Outbrain must remain at the forefront of these changes to maintain its competitive standing.

Failure to adapt quickly or to effectively implement new technologies poses a significant threat. This could result in a diminished competitive edge, as rivals leveraging AI or newer formats gain traction. For instance, companies that master AI-driven personalization can offer more effective campaigns, potentially drawing advertisers away from less sophisticated platforms.

Keeping pace with these burgeoning trends necessitates substantial and ongoing investment in research and development (R&D). This financial commitment is crucial for developing proprietary technologies and enhancing existing offerings. In 2024, the global ad tech market is expected to see continued growth, with AI-powered solutions becoming increasingly central, highlighting the need for sustained R&D expenditure to remain relevant.

- AI Integration: The widespread adoption of AI in ad tech is reshaping targeting precision and campaign efficiency.

- New Ad Formats: Emerging formats demand platform adaptability and new creative strategies.

- Competitive Pressure: Competitors investing heavily in innovation can quickly outpace slower adopters.

- R&D Investment: Sustained, significant investment in R&D is essential but represents a considerable cost.

Intense competition from established players like Google and Meta, along with agile emerging ad tech firms, pressures Outbrain's pricing and necessitates continuous innovation. Evolving global and state-level data privacy regulations, such as GDPR and CCPA, pose significant hurdles to Outbrain's data utilization for personalized content and targeted advertising, with non-compliance risking substantial fines. Economic downturns can lead to reduced advertiser spending, directly impacting Outbrain's revenue, as seen with general ad market cooling in 2023.

Publishers seeking to maximize their own revenue may develop direct advertising solutions or shift focus, potentially reducing Outbrain's access to ad inventory. The rapid pace of technological advancement, particularly AI integration and new ad formats, requires significant and ongoing R&D investment to maintain a competitive edge, with AI-powered solutions becoming increasingly central in the ad tech market as of 2024.

SWOT Analysis Data Sources

This Outbrain SWOT analysis is built upon a foundation of robust data, including publicly available financial reports, comprehensive market research, and expert industry analysis to provide a well-rounded strategic overview.