Outbrain Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Outbrain Bundle

Outbrain operates in a dynamic digital advertising landscape where the threat of new entrants is moderate, balanced by high capital requirements and established brand recognition. Understanding the bargaining power of buyers, primarily publishers and advertisers, is crucial for navigating pricing and contract terms. Our full Porter's Five Forces Analysis delves into these forces, revealing the intricate competitive pressures shaping Outbrain's market position and offering actionable insights for strategic advantage.

Suppliers Bargaining Power

Outbrain's reliance on publishers for ad inventory means these content providers hold considerable sway. Premium publishers, boasting substantial traffic and strong brand recall, can command better terms or even explore alternative recommendation engines, directly impacting Outbrain's market access and revenue streams.

Outbrain's reliance on technology and data providers presents a nuanced bargaining power dynamic. While many infrastructure services like cloud hosting are largely commoditized, offering Outbrain significant choice and thus limiting supplier leverage, specialized data sets or proprietary AI tools can shift power. For instance, a provider offering unique, high-quality audience segmentation data critical for Outbrain's recommendation engine could command higher prices.

The integration costs associated with switching specialized technology providers also contribute to their bargaining power. If Outbrain has deeply embedded a particular data analytics platform or AI component, the effort and expense of replacing it can make continued reliance more economically feasible, even if pricing increases. This is particularly true as companies like Amazon Web Services (AWS) and Google Cloud Platform, major infrastructure providers, continue to innovate and offer specialized services that become integral to a company's operations.

Content creators and agencies, while not traditional suppliers, hold significant sway over Outbrain's success. The quality and volume of content they produce directly shape Outbrain's platform appeal to consumers and, consequently, its value to advertisers.

If these crucial partners begin demanding more favorable terms, such as lower commission rates or enhanced platform features, Outbrain faces pressure. A substantial shift in their advertising spend towards competing platforms would directly impact Outbrain's revenue streams and market position.

Talent Pool

In the highly competitive native advertising sector, the availability of specialized talent significantly influences supplier bargaining power. Companies like Outbrain rely heavily on skilled engineers, data scientists, and ad technology experts to drive innovation and maintain a competitive edge. The scarcity of these professionals can lead to increased recruitment costs and salary demands, effectively amplifying their influence.

The demand for top-tier tech talent remains exceptionally high. For instance, in 2024, the average salary for a senior data scientist in the US tech industry could range from $150,000 to $200,000 annually, reflecting the intense competition for these skills. This puts considerable leverage in the hands of these professionals, who are essential contributors to product development and operational efficiency.

- High Demand for Specialized Skills: The native advertising industry requires niche expertise in areas like machine learning, AI, and programmatic advertising.

- Rising Labor Costs: Increased competition for talent drives up wages and benefits, impacting operational expenses for companies.

- Impact on Innovation: A limited pool of skilled professionals can hinder a company's ability to develop new features or improve existing ones, giving talent greater bargaining power.

Ad Verification and Measurement Services

Outbrain, like many digital advertising platforms, relies on specialized third-party ad verification and measurement services. These services are crucial for ensuring brand safety, combating ad fraud, and delivering transparent performance data to advertisers. The necessity of these tools for maintaining advertiser trust and compliance can grant these providers significant leverage.

The specialized nature and often industry-mandated requirements for ad verification and measurement mean that platforms like Outbrain have limited alternatives. This lack of substitutability, coupled with the critical functions these services perform, strengthens the bargaining power of suppliers in this segment. For instance, in 2024, the digital ad verification market was projected to reach over $10 billion, highlighting the substantial investment and reliance on these specialized providers.

- Specialized Expertise: Ad verification and measurement services possess niche technical skills and data analytics capabilities that are difficult for ad platforms to replicate internally.

- Industry Standards: Many advertisers and agencies mandate the use of specific, accredited verification partners, limiting a platform's ability to switch providers easily.

- Fraud Prevention: The constant evolution of ad fraud schemes necessitates continuous innovation and updates from verification providers, making their ongoing services indispensable.

- Brand Safety Assurance: Guaranteeing that ads appear alongside appropriate content is paramount for brand reputation, a function directly managed by these specialized services.

The bargaining power of suppliers for Outbrain is influenced by several factors, including the availability of substitutes, the uniqueness of their offerings, and the overall cost of switching. For instance, while cloud hosting services are largely commoditized, specialized data providers or AI tool developers can wield more influence due to the critical nature of their contributions to Outbrain's recommendation engine.

The talent market also plays a significant role. In 2024, the demand for skilled data scientists and AI engineers remained exceptionally high, with average salaries for senior roles in the US tech sector ranging from $150,000 to $200,000. This scarcity of specialized talent grants these professionals considerable bargaining power, impacting recruitment costs and operational efficiency for companies like Outbrain.

Furthermore, third-party ad verification and measurement services, essential for brand safety and fraud prevention, represent another area where supplier power is notable. The specialized nature of these services and industry mandates limit Outbrain's ability to switch providers easily, especially as the digital ad verification market was projected to exceed $10 billion in 2024.

| Supplier Category | Key Factors Influencing Bargaining Power | Illustrative Impact on Outbrain |

|---|---|---|

| Technology & Data Providers | Uniqueness of data/AI tools, integration costs | Higher costs for specialized data, potential lock-in with integrated platforms |

| Skilled Talent (Data Scientists, Engineers) | High demand, scarcity of specialized skills | Increased recruitment costs, salary inflation impacting operational expenses |

| Ad Verification & Measurement Services | Specialized expertise, industry mandates, fraud prevention needs | Limited alternatives, necessity for advertiser trust, potential for price increases |

What is included in the product

This analysis dissects the competitive forces impacting Outbrain, evaluating supplier and buyer power, the threat of new entrants and substitutes, and the intensity of rivalry within the content discovery market.

Instantly identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces on a dynamic radar chart.

Customers Bargaining Power

Advertisers, a key customer group for Outbrain, wield considerable bargaining power. This strength stems from the sheer volume of alternative advertising channels available. Think about it: beyond direct rivals like Taboola, platforms like Meta's Facebook and Instagram, Google Search, and TikTok all compete for ad spend.

Advertisers frequently engage in multi-homing, meaning they utilize several of these platforms simultaneously. This strategy allows them to spread their risk and fine-tune their marketing efforts across diverse audiences. In 2024, the digital advertising market is projected to reach over $600 billion globally, illustrating the vast array of choices advertisers have and their subsequent leverage.

Publishers, as a crucial customer segment for Outbrain, wield significant bargaining power. Their primary goal is to optimize content monetization, and they have a range of options available to achieve this. This includes partnering with multiple native advertising platforms, engaging in direct ad sales to advertisers, or even building their proprietary content recommendation engines. This diversification of monetization strategies grants publishers considerable leverage when negotiating terms with Outbrain, allowing them to demand favorable commission rates and service agreements.

Customers, meaning both advertisers and publishers, are making it clear they want to see exactly how their campaigns are performing and understand where their ads are showing up and how their data is being used. This push for clarity means Outbrain needs to show a solid return on investment (ROI) and be upfront about its data handling. For instance, in 2024, many advertisers are scrutinizing ad tech platforms more closely, demanding verifiable metrics beyond simple impressions.

Outbrain’s success hinges on its capacity to demonstrate tangible results and maintain trust through ethical data management and adherence to privacy rules like GDPR and CCPA. Failing to provide this transparency can significantly increase customer bargaining power, leading them to seek alternatives that offer greater accountability. The company's ability to adapt to these evolving customer expectations directly impacts its competitive standing.

Consolidation of Agency Holding Companies

The consolidation of agency holding companies significantly amplifies their bargaining power with media suppliers. By aggregating the advertising spend of numerous clients, these large entities can negotiate more favorable pricing and service terms. For instance, major holding groups like WPP, Omnicom, and Publicis collectively manage billions in ad spend, giving them considerable leverage.

This concentrated buying power allows these holding companies to demand better rates and more favorable contract conditions, directly impacting the profitability of media platforms and publishers. In 2024, the trend of mergers and acquisitions within the agency sector continued, further centralizing control over ad budgets.

- Increased Negotiating Leverage: Large agency groups can command lower prices due to the sheer volume of media they purchase.

- Standardized Service Agreements: Consolidation allows for the imposition of stricter service level agreements on suppliers.

- Reduced Supplier Options: As holding companies grow, they may consolidate their media buying with fewer, preferred partners, limiting options for smaller suppliers.

- Impact on Pricing: The collective bargaining power can drive down media costs for advertisers, but potentially squeeze margins for media vendors.

Shift to In-House Ad Operations

Large advertisers and publishers are increasingly taking their ad operations in-house. This move allows them greater command over their data, ad budgets, and audience targeting strategies. For instance, in 2024, a significant number of major brands reported increased internal capabilities for digital advertising management, aiming to optimize campaign performance and reduce external dependencies.

This shift directly impacts platforms like Outbrain by diminishing the need for their services. When advertisers manage their own ad operations, their leverage increases, potentially leading to reduced spending on third-party platforms or even a complete bypass of them. This trend highlights a growing desire for direct control and efficiency in the digital advertising ecosystem.

- Increased Advertiser Control: Advertisers gain direct oversight of data, spend, and targeting.

- Reduced Reliance on Third Parties: In-house operations lessen dependency on platforms like Outbrain.

- Enhanced Bargaining Power: Greater control translates to stronger negotiation positions for advertisers.

- Potential for Platform Disintermediation: Some advertisers may eliminate the need for ad tech platforms altogether.

Advertisers and publishers, Outbrain's key customer groups, possess substantial bargaining power. This is driven by the abundance of alternative advertising and monetization channels available, coupled with a growing demand for transparency and demonstrable ROI. In 2024, the digital ad market's vastness, estimated to exceed $600 billion globally, underscores the numerous options advertisers have, enhancing their leverage.

The trend of large agency holding companies consolidating ad spend and advertisers bringing operations in-house further amplifies this customer power. These shifts allow for more favorable negotiations on pricing and service terms, potentially reducing reliance on platforms like Outbrain and demanding greater accountability in data usage and campaign performance.

| Customer Segment | Source of Bargaining Power | 2024 Market Context/Trend |

|---|---|---|

| Advertisers | Abundance of alternative ad platforms (Meta, Google, TikTok) | Global digital ad market projected over $600 billion, offering vast choices. |

| Publishers | Multiple monetization options (other native platforms, direct sales, proprietary engines) | Focus on optimizing content monetization and demanding favorable terms. |

| Agency Holding Companies | Aggregated ad spend from multiple clients | Major groups manage billions, enabling negotiation of better rates and contract conditions. |

| Large Advertisers/Publishers | Bringing ad operations in-house | Increased internal capabilities reduce dependency on third-party platforms. |

Preview Before You Purchase

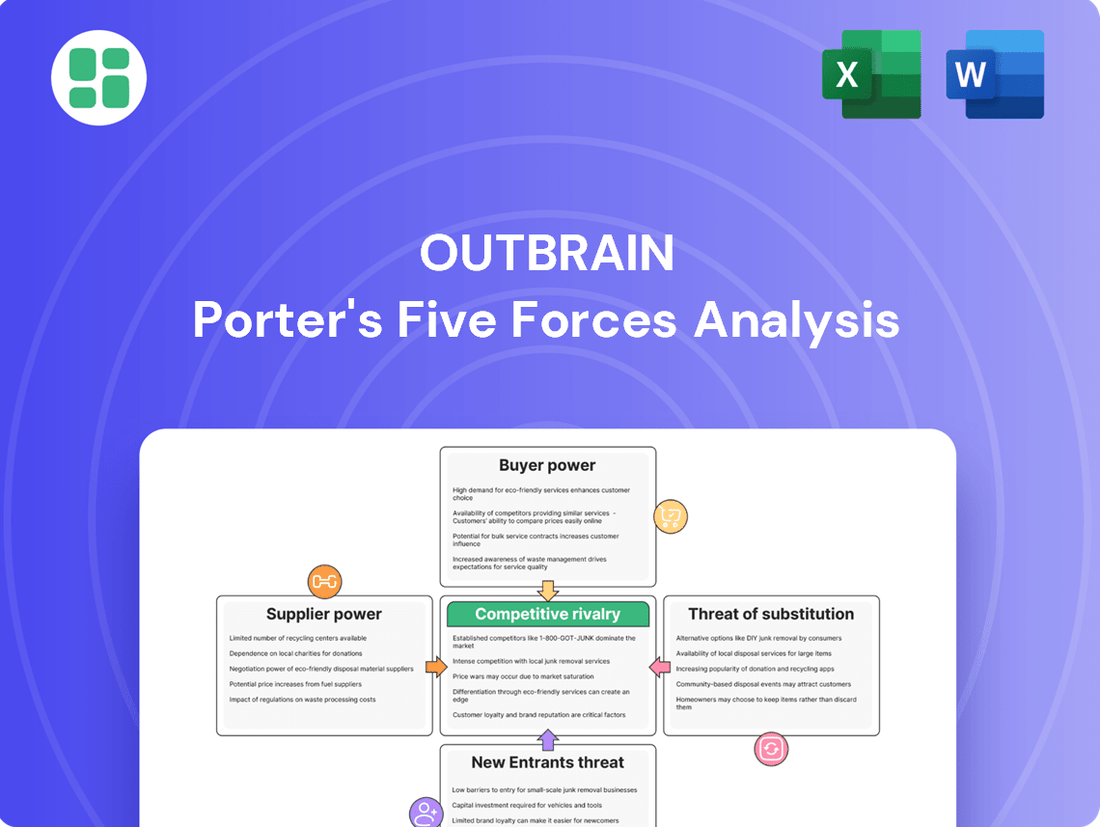

Outbrain Porter's Five Forces Analysis

This preview showcases the complete Outbrain Porter's Five Forces Analysis, offering a detailed examination of competitive rivalry, the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, and the threat of substitute products. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy. This comprehensive analysis provides actionable insights into Outbrain's market position and strategic landscape, allowing you to make informed business decisions.

Rivalry Among Competitors

The native advertising landscape is fiercely competitive, with Outbrain's most significant direct competitor being Taboola. Both companies are locked in a constant battle for dominance in the content recommendation sector, actively seeking publisher partnerships and advertiser budgets.

This direct rivalry fuels aggressive competition, influencing pricing strategies, the development of new features, and the expansion of their respective network reach. For instance, in 2024, the global native advertising market was valued at approximately $50 billion, a figure expected to grow, underscoring the high stakes involved.

Outbrain contends with formidable competition from major 'walled gardens' like Google and Meta. These giants, controlling extensive user data and advertising spend, offer integrated advertising solutions, including native-like formats within their own digital ecosystems.

This concentration of advertising budgets within these platforms diverts significant revenue away from the open internet, the primary operational space for Outbrain. For instance, in 2024, Meta's advertising revenue alone was projected to exceed $130 billion, highlighting the immense scale of these competitors.

The digital advertising technology, or ad tech, industry is incredibly fragmented. Think of it as a vast ecosystem with many different companies, each focusing on a specific niche like display ads, video ads, or the automated buying and selling of ad space known as programmatic advertising. This means Outbrain isn't just up against other native advertising platforms; it faces competition from a wide array of businesses providing various digital advertising solutions.

This broad competition is a significant factor. For instance, in 2024, the programmatic advertising market alone was projected to reach hundreds of billions of dollars globally, showcasing the sheer scale and diversity of players vying for advertiser budgets. Outbrain must constantly innovate to stand out amidst this crowded field, where even companies specializing in search engine marketing or social media advertising represent alternative channels for advertisers.

Pressure on Pricing and Margins

The competitive landscape in the content discovery and native advertising space is fierce, leading to significant pressure on pricing and profit margins for companies like Outbrain. This intense rivalry means that Outbrain must constantly innovate and optimize its offerings to remain competitive.

In 2024, Outbrain's financial performance illustrated this challenge. While the company reported a decrease in revenue, its gross profit saw an increase. This divergence suggests a strategic emphasis on operational efficiency and cost management to counteract the downward pressure on pricing driven by strong competition.

- Intense competition directly impacts Outbrain's ability to command premium pricing for its services.

- 2024 financial results indicated a revenue decline, highlighting the market's price sensitivity.

- Gross profit increase in 2024 points to Outbrain's efforts in improving operational efficiency and managing costs.

- Need for differentiation is crucial for Outbrain to maintain and grow its market share and profitability amidst rivals.

Innovation and Differentiation

Outbrain's competitive rivalry is intensified by the constant need for innovation. To remain relevant, the company must push forward with advanced targeting capabilities, sophisticated AI for personalized content delivery, and the adoption of emerging ad formats such as video and connected TV (CTV). This drive for differentiation is crucial in a crowded digital advertising landscape.

A significant strategic move to bolster its competitive edge is Outbrain's acquisition of Teads in February 2025, followed by a rebranding under the Teads name. This integration aims to create a unified omnichannel 'brandformance' platform, blending brand building with performance marketing objectives. This strategic pivot is designed to offer clients a more comprehensive and effective advertising solution, setting Teads apart from competitors.

- Innovation imperative: Outbrain needs to consistently enhance its platform with AI personalization and new ad formats like video and CTV.

- Teads acquisition: The February 2025 acquisition and rebranding to Teads signifies a major step in differentiation.

- Omnichannel strategy: The focus on an 'brandformance' platform aims to capture both brand awareness and direct response advertising.

- Market positioning: These moves are designed to strengthen Outbrain's (now Teads') position against rivals in the digital advertising space.

Outbrain faces intense rivalry from direct competitors like Taboola and major tech players such as Google and Meta, who command significant advertising spend. The fragmented ad tech market further complicates this, with numerous companies vying for advertiser budgets across various digital channels.

This competitive pressure directly impacts pricing and necessitates constant innovation. For instance, while Outbrain's revenue saw a dip in 2024, its gross profit increased, suggesting a focus on operational efficiency to counter market pressures.

The acquisition of Teads in February 2025 and subsequent rebranding to Teads represents a strategic move to create a unified omnichannel platform, aiming to differentiate and strengthen its market position against a backdrop of fierce competition.

| Competitor Type | Key Players | Impact on Outbrain |

|---|---|---|

| Direct Competitors | Taboola | Price wars, feature development race |

| Walled Gardens | Google, Meta | Diversion of ad spend, ecosystem dominance |

| Ad Tech Fragmented Market | Various niche players | Broad competition for advertiser budgets |

SSubstitutes Threaten

Publishers increasingly have the power to bypass native advertising platforms like Outbrain by forging direct relationships with advertisers. This trend is particularly pronounced among larger publishers who possess robust sales teams and established connections with brands, allowing them to negotiate ad placements directly and retain a larger share of the revenue.

In 2024, the digital advertising market continued to see a shift towards direct deals, with many premium publishers actively seeking to control their inventory and advertiser relationships. This direct engagement model offers publishers greater flexibility in ad formats, pricing, and audience targeting, thereby reducing their reliance on third-party intermediaries.

Advertisers often find social media platforms like TikTok, Instagram, and Facebook, along with search engines like Google, to be powerful substitutes for native advertising on the open internet. These platforms provide immense reach and highly granular targeting options, allowing businesses to connect with specific demographics and interests. For instance, in Q3 2024, Meta's advertising revenue reached $34.1 billion, showcasing the scale of these alternative channels.

Traditional digital display and video advertising, like banner ads and pre-roll videos, represent a significant threat of substitutes for native advertising platforms like Outbrain. Despite challenges such as banner blindness and ad blockers, these formats continue to be widely used by advertisers seeking to reach audiences across the digital landscape.

In 2024, digital advertising spending is projected to reach over $600 billion globally, with a substantial portion still allocated to traditional display and video formats. While native advertising offers a more integrated user experience, the sheer volume and established reach of display and video ads ensure they remain a competitive alternative for advertisers looking for broad audience engagement.

Content Marketing and Organic Reach

Brands can bypass paid native advertising, like Outbrain, by focusing on content marketing and organic reach. This involves investing in SEO, social media, and owned channels to attract audiences organically. High-quality content can drive traffic and conversions without direct ad spend, effectively substituting paid placements.

For instance, in 2024, businesses are increasingly prioritizing inbound marketing strategies. HubSpot reported that in 2023, 70% of marketers were actively investing in SEO, a trend that has only intensified. This shift highlights the growing recognition of organic channels as powerful alternatives to traditional advertising.

- Content Marketing as a Substitute: Brands can build their own audience through valuable blog posts, videos, and social media content, reducing reliance on third-party platforms.

- SEO Investment: Optimizing content for search engines ensures visibility and organic traffic, directly competing with the reach offered by paid native ads.

- Social Media Engagement: Building a strong community on social platforms allows for direct communication and promotion, bypassing the need for paid amplification.

- Owned Media Channels: Developing email lists and proprietary websites provides direct access to customers, a cost-effective alternative to paid advertising.

In-house Content Recommendation Systems

Large publishers are increasingly exploring the development of their own in-house content recommendation systems. This move directly threatens Outbrain's business by offering a substitute service. By utilizing their extensive user data and vast content libraries, publishers can build proprietary engines that replicate the functionality of third-party providers.

This internal development allows publishers to retain 100% of the ad revenue generated from recommendations, a significant incentive compared to sharing revenue with platforms like Outbrain. Furthermore, it grants them complete control over the user experience, enabling them to tailor recommendations precisely to their audience and brand.

- Publisher Investment: Many major publishers are allocating significant resources to R&D for recommendation technology, aiming to reduce reliance on external platforms.

- Data Advantage: Publishers possess unique first-party data that, when leveraged effectively, can create highly personalized and engaging recommendation experiences.

- Revenue Control: By bringing recommendation systems in-house, publishers can capture the full value chain, potentially increasing their profit margins.

- User Experience Customization: Tailoring the recommendation interface and algorithms allows publishers to optimize user engagement and time on site, a key metric for their advertising partners.

Advertisers have a wide array of substitutes for native advertising, including social media platforms and search engines, which offer extensive reach and precise targeting. In 2024, Meta's advertising revenue alone reached $34.1 billion, demonstrating the significant scale of these alternative channels.

Traditional digital display and video advertising formats, despite facing issues like banner blindness, remain a strong substitute due to their widespread use and established presence. Global digital ad spending in 2024 is expected to exceed $600 billion, with a considerable portion still dedicated to these traditional methods.

Brands can also bypass paid native advertising by focusing on content marketing and organic growth strategies, such as SEO and social media engagement. This approach, exemplified by the 70% of marketers investing in SEO in 2023, allows for direct audience connection without direct ad spend.

| Substitute Channel | Key Advantages | 2024 Relevance/Data |

|---|---|---|

| Social Media Platforms (Meta, TikTok) | Massive reach, granular targeting, high engagement | Meta's Q3 2024 ad revenue: $34.1 billion |

| Search Engines (Google) | Intent-based targeting, high user intent | Google's advertising revenue continues to be a dominant force. |

| Content Marketing & SEO | Organic growth, audience building, cost-effectiveness | 70% of marketers invested in SEO in 2023, a trend continuing in 2024. |

| Direct Publisher Deals | Greater control, higher revenue share for publishers | Growing trend among premium publishers in 2024. |

Entrants Threaten

New entrants into the native advertising space, like Outbrain, encounter substantial hurdles due to the immense capital required to achieve meaningful scale. Building a competitive platform necessitates significant investment in advanced AI and machine learning capabilities for content recommendation and optimization. For instance, developing and maintaining the sophisticated algorithms that power personalized user experiences demands ongoing research and development expenditure.

Furthermore, establishing the necessary technical infrastructure, including cloud computing resources, data storage, and robust content delivery networks, represents a considerable upfront cost. Companies must also invest heavily in sales and marketing to onboard both publishers and advertisers, creating a global network that is crucial for platform effectiveness. The sheer scale of these investments acts as a significant deterrent for potential new players seeking to challenge established entities.

Outbrain's formidable network effects create a significant barrier for new entrants. The more publishers that join Outbrain's platform, the more attractive it becomes to advertisers, and conversely, a larger advertiser base draws in more publishers. This virtuous cycle is difficult for newcomers to replicate.

New entrants face a steep challenge in achieving the critical mass necessary to compete. Outbrain has cultivated deep, established relationships with over 10,000 publishers and a vast network of 20,000 advertisers worldwide, a testament to its years of operation and market penetration.

The need for deep data and AI expertise presents a significant barrier for new entrants in the native advertising space. Companies that can effectively leverage machine learning for audience segmentation and campaign optimization gain a distinct competitive advantage.

For instance, Outbrain itself has heavily invested in AI, with its recommendation engine processing billions of data points daily to personalize content delivery. New players must demonstrate comparable capabilities in data science and algorithmic development to compete effectively.

Regulatory and Privacy Hurdles

New entrants face substantial challenges due to the escalating complexity of data privacy regulations like GDPR and CCPA. Navigating these evolving compliance requirements from the outset significantly increases operational complexity and costs for any new player.

The impending deprecation of third-party cookies further complicates market entry, forcing new businesses to develop alternative, compliant strategies for data collection and user engagement. This shift demands substantial investment in new technologies and approaches.

- Regulatory Complexity: New entrants must build compliance frameworks from day one, unlike established players who may have legacy systems to adapt.

- Data Privacy Costs: Adhering to strict data privacy laws can add substantial operational expenses, impacting profitability for startups.

- Cookie Deprecation Impact: The phasing out of third-party cookies necessitates new data acquisition and targeting methods, requiring innovation and investment.

Brand Recognition and Trust

The threat of new entrants into Outbrain's market is significantly mitigated by the substantial value of brand recognition and established trust. Outbrain, particularly following its acquisition of Teads, has cultivated a strong reputation with both advertisers seeking reach and publishers looking for monetization solutions. New competitors face a steep uphill battle, needing to pour considerable resources into marketing and demonstrate consistent performance to even begin chipping away at the loyalty built by incumbents like Outbrain.

Consider the landscape: a new platform would need to overcome the inertia of existing relationships. Advertisers are often hesitant to shift budgets without proven results, and publishers are wary of integrating new, unproven ad technologies. For instance, in 2024, the digital advertising market continues to be dominated by a few major players, highlighting the difficulty for newcomers to gain traction. Outbrain's established network and data insights, built over years, represent a significant barrier to entry.

- Brand Equity: Outbrain's long-standing presence and successful campaigns have built significant brand equity.

- Advertiser Trust: Advertisers rely on Outbrain for performance and audience targeting, a trust that takes time and consistent delivery to build.

- Publisher Relationships: Publishers have integrated Outbrain's technology and value propositions, creating sticky relationships.

- Marketing Investment: A new entrant would require substantial marketing spend to even achieve basic brand awareness in a crowded digital advertising space.

The threat of new entrants into the native advertising market, where Outbrain operates, is considerably low due to several formidable barriers. High capital requirements for platform development, infrastructure, and global network building present a significant hurdle. For example, building a competitive AI-driven recommendation engine requires substantial ongoing investment in research and development.

Network effects, cultivated through deep relationships with thousands of publishers and advertisers, create a powerful moat for incumbents like Outbrain. Achieving the critical mass of users and partners that Outbrain has established, with over 10,000 publishers and 20,000 advertisers, is a lengthy and costly endeavor for newcomers.

The need for advanced data and AI expertise, coupled with the increasing complexity of data privacy regulations like GDPR and CCPA, further elevates the barriers. The deprecation of third-party cookies in 2024 also demands significant investment in new data acquisition and targeting strategies, making market entry even more challenging.

Brand recognition and established trust, bolstered by acquisitions like Teads, also deter new entrants. Advertisers and publishers are often hesitant to switch from proven platforms, requiring new players to invest heavily in marketing and demonstrate consistent performance to gain traction in a market dominated by established players.

| Barrier | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | Building advanced AI, infrastructure, and global networks demands significant investment. | High upfront costs deter smaller players. |

| Network Effects | More publishers attract more advertisers, and vice versa, creating a self-reinforcing cycle. | Difficult for new entrants to achieve critical mass. |

| Data & AI Expertise | Sophisticated algorithms and data science capabilities are crucial for personalization and optimization. | Requires specialized talent and continuous R&D investment. |

| Regulatory Compliance | Navigating data privacy laws like GDPR and CCPA adds complexity and cost. | Increases operational overhead and compliance burden. |

| Brand Trust & Relationships | Established relationships and proven performance build loyalty. | New entrants face inertia and must invest heavily in marketing to build trust. |

Porter's Five Forces Analysis Data Sources

Our Outbrain Porter's Five Forces analysis leverages data from investor relations websites, industry-specific market research reports, and competitor financial filings to comprehensively assess the competitive landscape.