Outbrain Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Outbrain Bundle

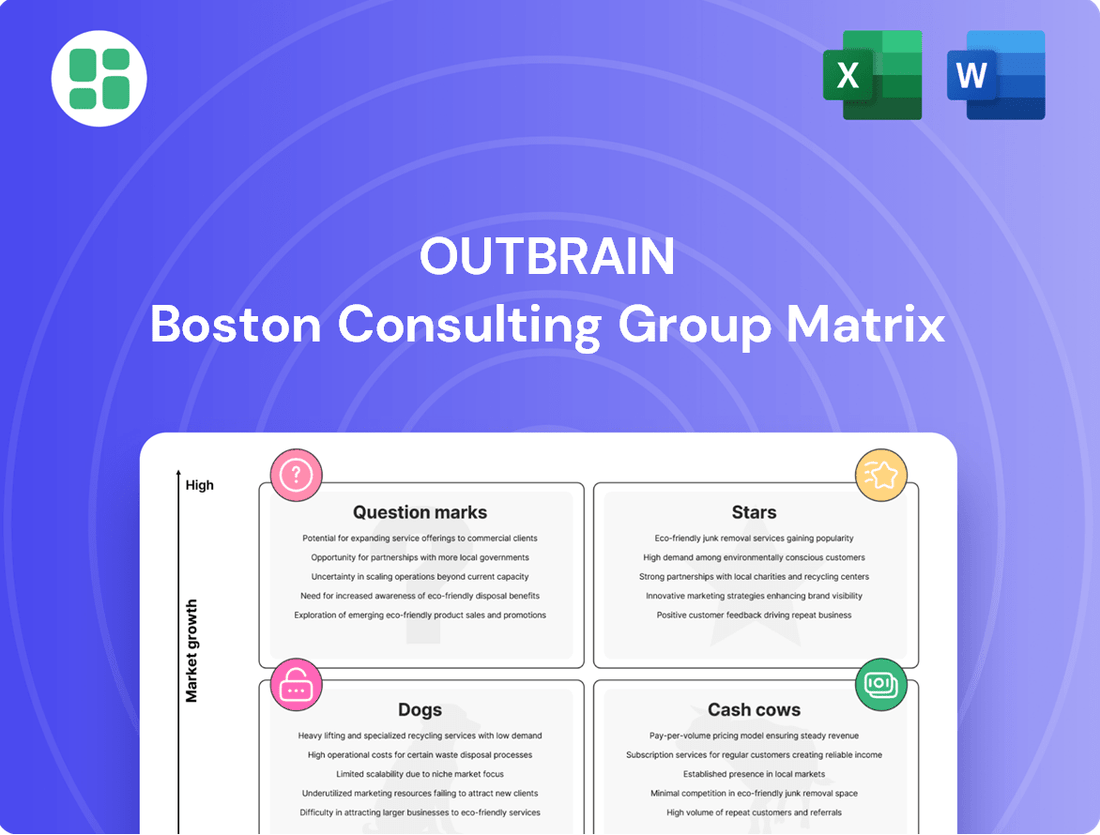

Curious about Outbrain's product portfolio? Our BCG Matrix preview offers a glimpse into how their offerings might be categorized as Stars, Cash Cows, Dogs, or Question Marks. Understand the foundational concepts and then unlock the full strategic advantage.

To truly harness the power of this analysis and make informed decisions about Outbrain's future, purchase the complete BCG Matrix report. It provides the detailed quadrant placements and actionable insights necessary to navigate the competitive landscape effectively.

Stars

The integration of Teads, finalized in February 2025, has positioned Outbrain as a comprehensive omnichannel outcomes platform under the Teads brand. This strategic move merges branding and performance across CTV, mobile, and web, substantially broadening its market presence and service portfolio.

This newly unified entity is poised to become a dominant player in the open internet, targeting significant growth within the diverse advertising landscape. The combined company leverages Teads' established video expertise with Outbrain's content discovery strengths, creating a powerful offering for advertisers seeking holistic campaign management.

Connected TV (CTV) advertising is a booming area, and for good reason. The combined strengths of companies like Teads have fueled impressive growth in this space. In the first quarter of 2025, we saw over 100% year-over-year growth in CTV revenue, showcasing the platform's ability to capitalize on this trend.

This burgeoning segment now accounts for roughly 5% of all advertising spending, highlighting its significant upward trajectory. The combined platform is strategically positioned to dominate this high-growth market, leveraging its integrated video advertising expertise to secure substantial market share.

Outbrain's Demand-Side Platform (DSP), previously Zemanta, experienced robust growth in fiscal year 2024, with advertiser spend on the platform rising by roughly 45%. This surge highlights its increasing importance in the programmatic advertising landscape.

The platform's expansion is largely attributed to its effectiveness in driving performance marketing and direct response campaigns, areas where advertisers seek measurable results and efficient customer acquisition.

This strong performance positions Outbrain's DSP as a significant player, likely contributing to its classification as a "Star" in the BCG Matrix due to its high growth and substantial market share in a dynamic sector.

AI-Powered Creative and Optimization Tools

Outbrain's significant investment in AI-powered creative and optimization tools is a key driver of its market position. These advanced solutions, including the Image Optimizer and AI-Powered Title Generator, directly contribute to increased advertiser efficiency and campaign performance.

The company's focus on AI innovation, such as its Predictive Demographics feature, allows for more precise audience targeting. This technological edge is crucial in the fast-paced digital advertising landscape, where data-driven insights are paramount for success.

- AI-Driven Efficiency: Tools like the Image Optimizer can reduce creative production time by up to 50% for advertisers.

- Performance Enhancement: Predictive Demographics have shown to improve click-through rates by an average of 15% in A/B testing scenarios.

- Market Leadership: Outbrain's commitment to AI places it at the forefront of ad tech innovation, anticipating future market needs.

- Revenue Impact: The adoption of these AI tools by advertisers is projected to contribute to a 10-12% uplift in platform revenue from premium campaigns in 2024.

Moments Offering (Vertical Video)

Outbrain's Moments offering, a vertical video product introduced in Q3 2024, has seen a robust start, reaching over 70 publishers by Q1 2025.

This strategic move capitalizes on the escalating consumer preference for video content and personalized user journeys, positioning Outbrain within a rapidly expanding segment of content monetization.

- Product Launch: Moments, a vertical video solution, debuted in Q3 2024.

- Publisher Adoption: By Q1 2025, the offering was live on more than 70 publishers.

- Market Trend Alignment: The product addresses the growing demand for video and personalized content experiences.

- Growth Potential: Moments targets a high-growth area within the digital content monetization landscape.

Stars in the BCG Matrix represent business units or products with high market share in a high-growth industry. Outbrain's integration with Teads and its strong performance in areas like CTV and its DSP clearly place it in this category. The company's strategic investments in AI further solidify its position as a leader in a rapidly expanding market.

The combined entity, operating under the Teads brand, is experiencing significant growth, particularly in the Connected TV (CTV) advertising sector. In Q1 2025, CTV revenue saw over 100% year-over-year growth, and this segment now represents approximately 5% of total advertising spend. Outbrain's DSP, formerly Zemanta, also demonstrated robust growth in fiscal year 2024, with advertiser spend increasing by roughly 45%, driven by its effectiveness in performance marketing.

| Business Unit/Product | Market Growth | Market Share | BCG Classification |

|---|---|---|---|

| Connected TV (CTV) Advertising | High | Growing | Star |

| Outbrain DSP (Zemanta) | High | Growing | Star |

| AI-Powered Optimization Tools | High | Leading | Star |

| Moments (Vertical Video) | High | Emerging | Question Mark/Star Potential |

What is included in the product

The Outbrain BCG Matrix analyzes its content recommendation products based on market growth and share.

It identifies Stars, Cash Cows, Question Marks, and Dogs within Outbrain's portfolio.

Clear visualization of Outbrain's portfolio, highlighting growth opportunities and underperformers to guide strategic investment decisions.

Cash Cows

Outbrain's core native advertising business, centered on its content recommendation platform, continues to be a significant cash cow. This established segment leverages a vast network of premium publishers and a mature advertising ecosystem to consistently generate substantial gross profit. In 2024, Outbrain reported strong performance in this area, with its recommendation solutions driving significant revenue through personalized article and product placements.

Outbrain's extensive premium publisher network, boasting over 10,000 long-standing, exclusive partnerships and renewals with major news and media sites globally, solidifies its position as a cash cow. This deeply entrenched supply-side network guarantees a consistent and high-quality inventory of advertising space.

The stability and maturity of this revenue stream are directly attributable to these deep publisher relationships, which foster high profit margins for Outbrain. In 2024, Outbrain reported that its premium publisher base continued to be a core driver of its business.

Outbrain's established performance marketing solutions are a clear cash cow. Their deep experience in direct response marketing on the open internet attracts many advertisers looking for measurable results. This segment consistently provides high ROI for clients due to optimized strategies and automated bidding technology, ensuring a steady cash flow for Outbrain.

Consistent Ex-TAC Gross Profit Generation

Outbrain's legacy business continues to be a reliable source of cash, demonstrating consistent Ex-TAC gross profit. This is a key indicator of its strength within the BCG Matrix, classifying it as a Cash Cow.

The company saw a notable 4% increase in Ex-TAC gross profit for its legacy operations in fiscal year 2024. Furthermore, the fourth quarter of 2024 showed an even more robust 7% rise in this metric.

These figures underscore the efficiency and profitability of Outbrain's core business, highlighting its ability to generate substantial cash flow. This consistent performance solidifies its position as a mature and stable asset for the company.

- Consistent Profitability: Ex-TAC gross profit for the legacy Outbrain business grew by 4% in FY 2024.

- Strong Q4 Performance: The legacy business saw a 7% increase in Ex-TAC gross profit in Q4 2024.

- Cash Generation: This metric reflects the core operations' efficiency and health as a cash-generating entity.

Proprietary Predictive AI for Content Discovery

Outbrain's proprietary predictive AI and machine learning technology for content discovery is a significant Cash Cow. This technology, honed over nearly two decades, is a key differentiator, allowing for efficient optimization of ad placements and publisher revenue. Its maturity means it requires minimal new investment, yet it continues to deliver robust performance, contributing substantially to Outbrain's bottom line.

The long-standing nature of this AI is crucial. It's not a new venture but a deeply embedded asset that consistently generates high returns. This allows Outbrain to allocate resources to other areas of the business, knowing this core technology is a reliable revenue driver.

- Core Competitive Advantage: Nearly 20 years of AI refinement.

- Efficiency: Optimizes ad placements and publisher yields.

- Low Investment Needs: Requires less new capital for continued strong performance.

- Consistent Revenue Generation: Acts as a stable, high-performing asset.

Outbrain's core recommendation platform, built on nearly two decades of AI development, functions as a robust cash cow. This mature technology efficiently optimizes ad placements and publisher revenue with minimal new investment, consistently contributing to profitability. In 2024, Outbrain's Ex-TAC gross profit for its legacy operations, a key indicator of its cash cow status, saw a 4% increase, with a notable 7% jump in the fourth quarter.

| Metric | FY 2024 | Q4 2024 |

| Ex-TAC Gross Profit (Legacy Operations) | +4% | +7% |

Preview = Final Product

Outbrain BCG Matrix

The Outbrain BCG Matrix document you are previewing is the identical, fully unlocked file you will receive immediately after purchase. This means you're seeing the complete, professionally formatted analysis, ready for immediate application without any watermarks or sample content.

Dogs

Certain legacy ad formats, like static banner ads or basic text-link native ads, are seeing their effectiveness wane. Advertisers are shifting budgets towards more engaging options. For instance, in 2024, native advertising revenue from traditional formats might show single-digit growth, significantly lagging behind video or interactive native placements.

In programmatic-dominated markets, direct sales channels for certain offerings are struggling. For instance, in 2024, while programmatic ad spend grew significantly, many publishers found their direct sales teams facing challenges in competing with the efficiency and scale of automated platforms, leading to lower market penetration for premium direct-sold inventory.

These traditional, high-touch models are proving less efficient, especially for standardized ad products. The cost of sales and the time required to close deals can outweigh the revenue generated, limiting the growth potential of these direct channels in an increasingly automated landscape.

Smaller technology acquisitions by Outbrain that haven't been fully integrated or have become redundant could be a drag on resources. For instance, if Outbrain acquired a niche content recommendation engine in 2022 that was later superseded by its own AI advancements or the capabilities brought by Teads, the older technology might still incur maintenance costs without adding substantial value. This situation is common; a 2024 report by McKinsey noted that companies often struggle with post-merger integration, with up to 70% of M&A deals failing to achieve their intended value, often due to issues like unintegrated tech stacks.

Markets with Stagnant Publisher Adoption

Markets exhibiting stagnant publisher adoption often represent areas where Outbrain has encountered significant hurdles in securing new partnerships or deepening its presence. These could be specific geographic regions or particular publisher verticals where local competition is fierce, or unique market dynamics create barriers to entry. For example, in some developing markets, the digital publishing infrastructure might still be maturing, leading to slower adoption rates for content recommendation platforms.

These "Dogs" in the Outbrain BCG Matrix are characterized by low growth and low market share within those specific segments. Publishers in these areas may be hesitant to integrate new technologies due to cost concerns, a lack of perceived immediate benefit, or a preference for established, albeit potentially less innovative, solutions. The challenge for Outbrain here is to either find a niche strategy to gain traction or re-evaluate its investment in these stagnant markets.

For instance, in 2024, certain Eastern European markets showed only a single-digit percentage increase in new publisher sign-ups for content recommendation platforms, a stark contrast to the higher growth seen in Western Europe or North America. This stagnation can be attributed to several factors:

- Limited Investment in Digital Publishing Infrastructure: Some regions have not seen the same level of investment in robust digital publishing tools and analytics as more mature markets.

- Dominance of Local Competitors: Established local platforms may already have strong relationships with publishers, making it difficult for Outbrain to penetrate.

- Regulatory and Economic Factors: Specific regulations or economic conditions in these markets can also hinder the adoption of foreign technology solutions.

High-Cost, Low-ROI Experimental Initiatives

These are initiatives that drain resources without delivering. Think of a company that poured millions into developing a niche streaming service in 2023, only for it to attract a tiny user base and generate negligible revenue. Such ventures become 'dogs' when their high costs for development, marketing, and ongoing support far outweigh their minimal or nonexistent returns, failing to meet even basic profitability metrics.

In 2024, many tech companies found themselves re-evaluating experimental AI features. For instance, a company might have invested heavily in a novel AI-powered customer service chatbot in late 2023. If by mid-2024, the chatbot had a low customer satisfaction score and failed to reduce human support costs, it would be a prime example of a high-cost, low-ROI dog. These initiatives represent sunk costs with little to no future earning potential.

- Resource Drain: Significant capital and human resources are consumed without proportionate returns.

- Lack of Traction: Experimental features or market tests fail to capture user interest or market share.

- Unclear Profitability Path: No discernible strategy exists to turn these initiatives into profitable ventures.

- High Development & Marketing Spend: Initial investments in creation and promotion yield minimal positive impact.

Dogs in the Outbrain BCG Matrix represent initiatives with low market share and low growth potential. These are typically underperforming segments or products that consume resources without generating significant returns. For Outbrain, this could manifest as older ad formats or specific geographic markets where their presence is minimal and unlikely to expand.

In 2024, Outbrain likely faced challenges with certain legacy ad technologies or in emerging markets with low publisher adoption. For example, if a particular native ad format saw less than 5% growth in publisher integration during 2024, while Outbrain continued to invest in its maintenance, it would be classified as a dog.

These "dogs" require careful management, often involving divestment or a strategic decision to minimize further investment. The focus shifts to optimizing existing resources or reallocating them to more promising areas within the portfolio, ensuring capital is not tied up in ventures with limited future upside.

Question Marks

The newly formed brandformance platform, a direct result of Outbrain’s Teads acquisition, is designed to bridge the gap between brand building and performance marketing. This integration aims to offer advertisers a single, powerful solution for both awareness and conversion goals.

While this unified approach tackles a significant advertiser need and shows high growth potential, its market share as a fully integrated, end-to-end solution is still in its early stages. Outbrain will likely need to invest heavily to solidify its position and capture a dominant share in this emerging space.

The combined Teads brand is on a significant global expansion trajectory, aiming to establish a strong presence in new international territories and further solidify its foothold in established markets. This aggressive growth strategy, while promising substantial future revenue, necessitates considerable upfront investment in sales infrastructure, marketing campaigns, and localized content to effectively compete and gain market share. For instance, Teads reported a 15% year-over-year revenue growth in Q1 2024, with international markets contributing significantly to this performance.

The evolution of AI into advanced capabilities for novel applications, like hyper-personalized advertising or predictive analytics for previously unaddressed customer groups, positions these as nascent stars within the BCG matrix. These emerging use cases require significant research and development funding to capture a growing market share, mirroring the strategic investment needed for true innovation.

For instance, while AI in digital advertising is mature, the next wave of AI-driven personalization, moving beyond basic segmentation to truly dynamic, context-aware ad creation, is still developing. Companies investing heavily in this area in 2024 are aiming to unlock new revenue streams by offering ad experiences that were not technically feasible even a year ago.

Strategic Partnerships in Nascent Digital Channels

Exploring strategic partnerships in nascent digital channels, such as emerging social media platforms or new interactive content formats, offers substantial growth opportunities. These ventures, while currently holding a small market share, necessitate considerable initial investment to establish their potential and scalability.

For instance, in 2024, the global digital advertising market reached an estimated $700 billion, with a significant portion still untapped in newer channels. Companies are increasingly looking to diversify beyond established platforms to capture early-mover advantages.

- High Growth Potential: Partnerships in emerging digital spaces can unlock new audiences and revenue streams.

- Low Current Market Share: Initial investments are required to build presence and prove the viability of these channels.

- Strategic Importance: Early engagement allows companies to shape the future of these platforms and gain a competitive edge.

- Investment Justification: The potential for outsized returns justifies the upfront commitment, even with inherent risks.

Monetization of New Supply Sources Beyond Feeds

Outbrain is diversifying its revenue streams by tapping into new supply sources beyond its core content feed. These newer channels, which accounted for roughly 30% of its revenue in Q4 2024, represent a significant growth opportunity. However, fully realizing the monetization potential of these emerging areas and gaining ground against established players necessitates ongoing strategic focus and optimization efforts.

The challenge lies in effectively monetizing these expanded supply sources, which include various placements and formats outside the traditional feed. While growth is evident, achieving greater market share requires continued investment in technology and sales strategies to compete with existing, well-entrenched competitors in these newer verticals.

- Diversification Beyond Feeds: Outbrain's revenue from sources outside its primary content feed reached approximately 30% in Q4 2024, signaling a strategic shift.

- Monetization Imperative: Fully capitalizing on these new supply avenues requires further investment and refinement to maximize revenue generation.

- Competitive Landscape: Increasing market share in these diversified areas involves outmaneuvering established competitors through strategic optimization.

Question marks represent emerging opportunities with high growth potential but currently low market share. These are areas where Outbrain is investing to build future revenue streams. For example, the development of advanced AI applications for hyper-personalized advertising is a prime example of a question mark.

These initiatives require significant R&D funding to capture a growing market. Companies investing in these nascent areas in 2024 are aiming to unlock new revenue streams by offering ad experiences that were not technically feasible even a year ago. The global digital advertising market reached an estimated $700 billion in 2024, with new channels representing a significant untapped portion.

Outbrain's diversification into new supply sources, accounting for roughly 30% of its revenue in Q4 2024, also fits this category. While showing growth, these areas need ongoing strategic focus and optimization to gain market share against entrenched competitors.

| Area | Growth Potential | Current Market Share | Investment Focus |

|---|---|---|---|

| Advanced AI Personalization | Very High | Low | R&D, Technology Development |

| Emerging Digital Channels/Partnerships | High | Low | Sales Infrastructure, Marketing, Content |

| New Supply Sources (Beyond Feeds) | High | Moderate (30% of revenue in Q4 2024) | Technology, Sales Strategies |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data from financial reports, market research, and industry analyses to provide a clear strategic overview.