Orsted PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Orsted Bundle

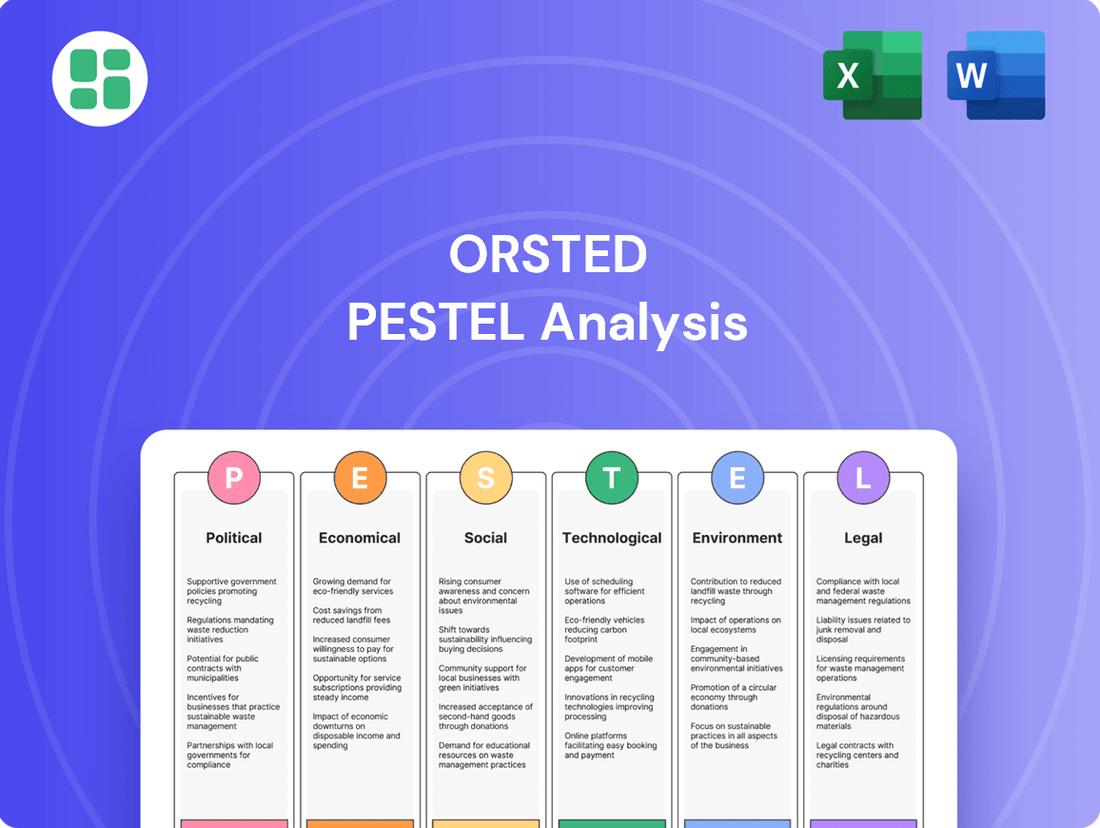

Navigate the complex world of renewable energy with our comprehensive PESTLE analysis of Orsted. Understand how political shifts, economic fluctuations, technological advancements, and environmental regulations are shaping the company's trajectory. This expert-crafted report provides the crucial context you need to make informed decisions. Download the full analysis now and gain a strategic advantage.

Political factors

Government policies and incentives, like tax credits and renewable energy mandates, are vital for Ørsted's project success. The US Inflation Reduction Act, for instance, offers substantial tax credits for renewable energy projects, significantly boosting investment potential. These supportive frameworks reduce project risks, especially for offshore wind developments, making them more attractive to investors.

Ørsted's global operations are significantly shaped by international collaboration and trade policies. In 2024, the European Union's continued focus on renewable energy targets, such as the REPowerEU plan aiming for 42.5% renewable energy by 2030, directly impacts Ørsted's market opportunities and regulatory environment.

Trade agreements and potential disputes, like those concerning critical raw materials for wind turbines, can influence supply chain costs. For instance, tariffs or restrictions on components sourced from specific regions could increase capital expenditure for new projects, impacting profitability and project timelines for offshore wind farms, a key area for Ørsted.

Navigating these diverse geopolitical landscapes is crucial. Ørsted's success in securing offshore wind leases in the US, for example, relies on understanding and adapting to varying national energy policies and international investment frameworks, reinforcing the need for strong global partnerships.

The global shift towards decarbonization is a significant tailwind for Ørsted, as its business is fundamentally built on green energy. Governments worldwide are increasingly setting aggressive renewable energy targets and enacting policies to move away from fossil fuels, which directly expands the market for Ørsted's offerings.

Ørsted's strategy is strongly aligned with major energy transition initiatives. For instance, the European Union's Green Deal aims for climate neutrality by 2050, and the United States has set ambitious clean energy goals. These national and regional commitments provide a robust framework for Ørsted's continued expansion and long-term growth.

Political Stability and Permitting Processes

Political stability in key markets directly impacts investor confidence and the predictability of project timelines for companies like Ørsted. Uncertainty or shifts in government policies can deter investment in large-scale renewable energy projects.

Delays or changes within federal permitting processes, particularly for complex offshore wind developments, pose significant risks. These can result in substantial cost escalations and even the cancellation of projects, as Ørsted has experienced. For instance, the Bureau of Ocean Energy Management (BOEM) permitting process for offshore wind in the US has seen evolving timelines and requirements, affecting project economics.

- Regulatory Uncertainty: Evolving permitting requirements can lead to project delays and increased costs.

- Investor Confidence: Stable political environments attract and retain investment in renewable energy infrastructure.

- Project Viability: Efficient and predictable regulatory frameworks are crucial for the financial success of large-scale projects.

Geopolitical Tensions and Energy Security

Heightened geopolitical tensions, particularly concerning global energy supply chains, underscore the strategic imperative for energy security. This environment directly benefits companies like Ørsted that champion domestic renewable energy production, as nations increasingly seek to reduce reliance on volatile international fossil fuel markets. For instance, the ongoing global focus on diversifying energy sources, driven by events in Eastern Europe, has amplified political support for offshore wind projects, a core area for Ørsted. The company's contribution to national energy independence positions it favorably to receive continued government backing and investment, although the inherent volatility of geopolitical situations can also introduce supply chain disruptions and project delays.

The drive for energy security is a significant political factor influencing Ørsted's operating landscape. As of early 2024, many European nations have accelerated their renewable energy targets. For example, Germany aims for 80% renewable electricity by 2030, a goal that necessitates substantial investment in offshore wind. Similarly, the UK has committed to ambitious offshore wind capacity goals, aiming for 50 GW by 2030, with a significant portion expected to come from floating wind technology where Ørsted is actively involved. This political will translates into tangible support mechanisms such as:

- Enhanced subsidies and tax incentives for renewable energy projects.

- Streamlined permitting processes for critical green infrastructure.

- Government-backed financing and loan guarantees for large-scale developments.

- Increased public procurement of green energy solutions.

Government policies and incentives are paramount for Ørsted, with initiatives like the US Inflation Reduction Act providing substantial tax credits for renewable energy, significantly boosting investment in projects. The European Union's REPowerEU plan, targeting 42.5% renewable energy by 2030, also creates a favorable market. These supportive frameworks reduce project risks, especially for offshore wind, making them more attractive to investors.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Ørsted, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers strategic insights into how these global trends present both challenges and opportunities for Ørsted's continued growth and market leadership.

A concise, PESTLE-driven overview of Orsted's external landscape, offering a readily digestible framework to identify and address potential market disruptions and opportunities during strategic planning.

Economic factors

Global economic growth is a key driver for energy demand, and Ørsted is positioned to capitalize on this by providing green energy solutions. A healthy global economy spurs industrial activity and increases electricity consumption, expanding the market for Ørsted's offerings. For instance, the International Monetary Fund (IMF) projected global growth to be 3.2% in 2024, a slight acceleration from 2023, indicating a generally supportive environment for energy demand.

Conversely, economic downturns can dampen demand for energy and reduce investment in new renewable energy projects. A slowdown in major economies, such as a projected 1.6% growth for the Euro Area in 2024 according to the IMF, could present challenges for Ørsted by potentially tempering the pace of new offshore wind and other renewable developments.

Rising interest rates directly increase Orsted's cost of capital, making it more expensive to finance its large-scale, capital-intensive renewable energy projects. For instance, in 2023, Orsted reported significant impairments, partly attributed to higher interest rates impacting the valuation of its US offshore wind projects, leading to a DKK 28.4 billion impairment charge.

These increased borrowing costs can squeeze project profitability, potentially delaying or even canceling new investments. This financial pressure necessitates careful re-evaluation of investment pipelines and a greater focus on projects with stronger, more resilient financial profiles.

Inflationary pressures are significantly impacting Ørsted's operations, with rising costs for key materials like steel and essential turbine components directly increasing construction and operational expenses. For instance, global steel prices saw substantial volatility throughout 2024, impacting offshore wind project budgets.

Supply chain disruptions, a persistent issue in recent years, continue to cause project delays and inflate expenses for Ørsted. These disruptions affect everything from manufacturing lead times to shipping logistics, directly impacting project timelines and overall financial performance.

Effectively managing these escalating costs is paramount for Ørsted to ensure the viability of its renewable energy projects and maintain healthy financial results. The ability to navigate these economic headwinds will be a key determinant of future profitability.

Wholesale Power Prices and Market Volatility

Fluctuations in wholesale power prices directly impact Ørsted's revenue from energy generation. For instance, in the first half of 2024, while Ørsted reported strong earnings, the volatility in power markets remained a key factor influencing profitability, particularly for unhedged generation volumes.

While long-term power purchase agreements (PPAs) and inflation-indexed Contracts for Difference (CfDs) offer a degree of revenue stability, significant swings in spot market prices can still affect the company's overall financial performance. The European energy market, for example, experienced considerable price volatility in 2023 and early 2024 due to geopolitical events and supply-demand imbalances, directly influencing Ørsted's uncontracted generation.

- Revenue Impact: Wholesale price volatility directly affects Ørsted's earnings from its renewable energy assets.

- Hedging Strategies: The company utilizes PPAs and CfDs to mitigate some of this price risk.

- Market Dynamics: Geopolitical factors and supply-demand shifts in energy markets contribute to price volatility.

- Financial Outlook: Navigating these market dynamics is crucial for maintaining a stable financial outlook and profitability.

Investment Trends in Renewable Energy

Global investment in renewable energy is surging, fueled by ambitious climate targets and a growing emphasis on energy security. This trend offers a significant advantage for companies like Ørsted, which are at the forefront of the green transition.

In 2023, global investment in the energy transition reached a new high, exceeding $1 trillion for the first time, according to BloombergNEF. This substantial capital inflow underscores a robust demand for sustainable energy solutions from both public and private sectors.

This increasing financial commitment directly benefits the offshore wind sector, a key area for Ørsted. The influx of capital is enabling significant project development and technological advancements, paving the way for broader adoption of renewable energy sources.

- Record Investment: Global clean energy investment surpassed $1 trillion in 2023, highlighting a strong market for renewables.

- Government Support: Policies and incentives worldwide are encouraging greater private sector participation in green projects.

- Offshore Wind Growth: The offshore wind market, a core focus for Ørsted, is a major beneficiary of this investment surge.

- Energy Security Driver: Nations are increasingly turning to renewables to enhance their energy independence and resilience.

Economic factors present a mixed but generally positive outlook for Ørsted, with global growth supporting energy demand while rising interest rates and inflation pose cost challenges. The company's financial health is directly tied to its ability to manage these economic variables effectively.

Preview the Actual Deliverable

Orsted PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Orsted PESTLE analysis delves into the Political, Economic, Social, Technological, Regulatory, and Environmental factors impacting the company's operations and strategic decisions.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You will gain valuable insights into how external forces shape Orsted's business landscape, from government energy policies to advancements in renewable technology and global economic trends.

The content and structure shown in the preview is the same document you’ll download after payment. This detailed analysis provides a robust framework for understanding the opportunities and challenges Orsted faces in the dynamic energy sector.

Sociological factors

Public perception of offshore wind farms significantly influences project timelines and costs. For instance, in 2024, several proposed offshore wind projects in the United States faced delays due to local opposition, impacting investor confidence and projected revenue streams.

Effective community engagement is paramount; a 2025 survey indicated that projects with robust stakeholder consultation reported a 20% higher likelihood of securing permits compared to those with limited engagement. Addressing concerns proactively, such as through visual impact studies and noise mitigation plans, builds trust.

Transparency in the planning process, including open consultations and clear communication channels, is key to fostering public acceptance. Orsted's approach in Europe, involving early and continuous dialogue with coastal communities, has often led to smoother project approvals and stronger local support, contributing to their operational efficiency.

Ørsted's significant investments in renewable energy projects, particularly offshore wind farms, directly fuel local economic development. These ventures are major job creators, requiring thousands of workers during construction phases and hundreds of skilled personnel for long-term operation and maintenance. For instance, the Hornsea 2 project in the UK, one of the world's largest offshore wind farms, supported an estimated 2,000 jobs during its peak construction period, with ongoing roles in its operational life.

Beyond direct employment, Ørsted's commitment to local content policies stimulates the development of regional supply chains. This means that a substantial portion of the project's expenditure is directed towards local businesses for manufacturing components, providing services, and supporting infrastructure. Such investments not only boost employment but also foster the growth of specialized manufacturing capabilities within the communities where Ørsted operates, as seen with the development of port facilities and specialized vessel services in areas like Grimsby, UK.

Furthermore, Ørsted's operations contribute significantly to local tax revenues, providing crucial funding for public services and community initiatives. These financial contributions, coupled with the economic stimulus from job creation and supply chain development, create a positive feedback loop that enhances community support for renewable energy projects and builds shared value. The economic uplift generated by these large-scale projects is a key factor in fostering long-term social acceptance and partnership.

Consumer demand for green energy is a significant driver for Ørsted. Globally, there's a noticeable trend of increasing consumer and corporate awareness regarding climate change, directly translating into a preference for sustainable energy sources. For instance, a 2024 survey indicated that over 70% of consumers are willing to pay more for products and services from environmentally responsible companies.

This societal shift fuels the market for renewable electricity products like those offered by Ørsted. Businesses, in particular, are actively seeking to reduce their carbon footprint to meet ESG (Environmental, Social, and Governance) goals and enhance their brand reputation. This creates a strong market pull for Ørsted's renewable energy solutions, as they directly address this growing demand for sustainability.

Stakeholder Expectations for Sustainability

Stakeholders, from investors to customers and employees, are increasingly looking for companies to do more than just meet environmental goals; they want to see genuine commitment to sustainability across the board. This includes social responsibility and good governance, not just green initiatives.

Ørsted's standing as a frontrunner in climate action, coupled with its dedication to social and governance principles, significantly boosts its image and appeal. This positive perception attracts a wide array of stakeholders.

For instance, in 2023, Ørsted reported that 85% of its total revenue was derived from renewable energy sources, a key indicator of its sustainability focus that resonates with environmentally conscious investors and customers. Furthermore, their commitment to diversity and inclusion, with a reported 40% of management positions held by women in 2023, addresses social expectations.

- Investor Demand: Sustainable investment funds saw significant inflows in 2024, with many specifically targeting companies with strong ESG (Environmental, Social, and Governance) ratings, a category Ørsted consistently ranks high in.

- Customer Preference: Consumer surveys in 2023 indicated that over 60% of respondents were more likely to choose brands that demonstrate a clear commitment to environmental protection and social responsibility.

- Employee Attraction: Ørsted's sustainability leadership was cited in a 2024 employee survey as a primary reason for job satisfaction and company loyalty, with 78% of employees expressing pride in the company's green mission.

- Transparent Reporting: Ørsted's 2023 sustainability report detailed a 70% reduction in Scope 1 and 2 emissions compared to 2006, providing tangible data that meets stakeholder demands for accountability.

Workforce Development and Skills Gap

The renewable energy sector's rapid expansion, particularly in offshore wind where Ørsted is a leader, is creating a significant demand for specialized technical skills. This surge in demand can lead to a workforce development challenge, as companies like Ørsted must actively cultivate the talent needed for the entire lifecycle of green energy projects. For instance, the International Renewable Energy Agency (IRENA) projected in 2023 that the global renewable energy sector could employ over 43 million people by 2030, a substantial increase from current figures, highlighting the competitive landscape for skilled labor.

To address this, Ørsted is focusing on attracting, training, and retaining a competent workforce capable of managing its expanding portfolio of solar, wind, and storage assets. This involves not only recruiting experienced professionals but also developing new talent through internal programs. By 2024, Ørsted had expanded its apprenticeship and graduate programs across key operational regions, aiming to build a pipeline of future engineers, technicians, and project managers.

Investing in robust apprenticeship programs and technical training is therefore crucial for Ørsted's sustained growth and operational excellence. These initiatives ensure a steady supply of qualified personnel to handle the complexities of developing, constructing, and maintaining advanced renewable energy infrastructure. For example, Ørsted's commitment to vocational training in countries like Denmark and the UK aims to equip individuals with the specific skills required for offshore wind turbine maintenance and installation, thereby mitigating the skills gap.

- Demand for Specialized Skills: The global push for decarbonization is accelerating the need for workers proficient in offshore wind turbine installation, solar farm maintenance, and battery storage system operation.

- Ørsted's Workforce Strategy: The company is actively investing in talent acquisition and development, including apprenticeships and technical training programs, to meet the growing demand for skilled professionals in the green energy sector.

- Importance of Training: Continuous investment in training ensures Ørsted maintains a competitive edge and operational efficiency by having a workforce equipped with the latest technological expertise.

- Industry Growth Projections: With IRENA forecasting millions of new jobs in renewables by 2030, Ørsted's focus on workforce development is critical for securing its future operational capacity and market position.

Public sentiment and community engagement are vital for Ørsted's offshore wind projects. Delays in 2024 due to local opposition in the US highlighted the need for proactive engagement, as a 2025 survey showed projects with strong stakeholder consultation had a 20% higher permit success rate. Ørsted's European model of early dialogue fosters local support and smoother approvals.

Ørsted's projects significantly boost local economies through job creation and supply chain development. The Hornsea 2 project in the UK, for example, supported approximately 2,000 jobs during peak construction. Local content policies stimulate regional businesses, enhancing specialized manufacturing and services, as seen with port facilities in Grimsby, UK.

Growing consumer and corporate demand for green energy, driven by climate change awareness, directly benefits Ørsted. A 2024 survey found over 70% of consumers willing to pay more for sustainable products. Businesses are increasingly prioritizing ESG goals, creating a strong market for Ørsted's renewable solutions.

Stakeholders increasingly expect genuine commitment to sustainability beyond environmental goals, encompassing social and governance aspects. Ørsted's leadership in climate action and its dedication to social principles enhance its appeal. In 2023, 85% of Ørsted's revenue came from renewables, and 40% of its management positions were held by women, reflecting social expectations.

The renewable energy sector's growth, especially in offshore wind, creates a high demand for specialized skills. IRENA projected over 43 million jobs in renewables globally by 2030, indicating a competitive labor market. Ørsted is addressing this by expanding apprenticeship and graduate programs by 2024 to build a pipeline of talent.

Investing in training is crucial for Ørsted's growth and operational excellence. These initiatives ensure a supply of qualified personnel for renewable energy infrastructure. Ørsted's vocational training in Denmark and the UK equips individuals with skills for offshore wind maintenance, mitigating the skills gap.

| Sociological Factor | Impact on Ørsted | Supporting Data/Examples |

|---|---|---|

| Public Perception & Community Engagement | Influences project timelines, costs, and permit success. | 2024 US project delays due to opposition; 2025 survey: 20% higher permit success with strong consultation. |

| Local Economic Development | Job creation, supply chain stimulation, and tax revenue. | Hornsea 2 supported ~2,000 jobs; development of specialized services in Grimsby, UK. |

| Consumer & Corporate Demand for Green Energy | Drives market for renewable products, supports ESG goals. | 2024 survey: 70%+ consumers willing to pay more for sustainable products. |

| Stakeholder Expectations (ESG) | Enhances company image, attracts investors and customers. | 2023: 85% revenue from renewables; 40% management positions held by women. |

| Workforce Skills & Development | Addresses demand for specialized talent in renewables. | IRENA 2023: 43M+ global renewable jobs by 2030; Ørsted expanding training programs by 2024. |

Technological factors

Continuous innovation in wind turbine design is significantly boosting Ørsted's capabilities. We're seeing turbines get larger and more efficient, leading to higher power generation capacity. For instance, Vestas, a key supplier, delivered its first V236-15.0 MW offshore wind turbine in 2024, boasting a rotor diameter of 236 meters and a swept area of 43,742 square meters, capable of powering approximately 20,000 European homes.

These technological leaps are crucial for reducing the cost of producing electricity from wind. The improved efficiency directly translates to a lower cost per megawatt-hour, making wind energy more competitive. This progress spans both established fixed-bottom offshore wind solutions and emerging floating offshore wind technologies, opening up new geographical possibilities for development.

The drive for advanced energy storage, including large-scale batteries and innovative methods, is paramount for seamlessly integrating variable renewables like wind and solar into the power grid. This technological evolution directly impacts grid stability and the reliable delivery of clean energy.

Ørsted is actively investing in energy storage infrastructure and forging strategic alliances to expedite the deployment of these critical technologies. For instance, in 2023, Ørsted announced plans to develop a 100 MW battery storage project in Ireland, aiming to enhance grid flexibility.

The integration of digitalization and AI is transforming how Ørsted operates and maintains its renewable energy assets. These technologies are boosting efficiency and predictive maintenance for wind and solar farms. For instance, AI can analyze vast datasets to forecast potential equipment failures, allowing for proactive repairs and minimizing downtime. This translates directly into cost savings and improved reliability for Ørsted's global portfolio.

Power-to-X and Green Fuels

Innovation in Power-to-X (PtX) technologies, converting renewable electricity into green hydrogen and synthetic fuels, is a significant technological driver. These advancements offer pathways to decarbonize sectors like heavy transport and industry, which are challenging to electrify directly. Ørsted's strategic investments in PtX projects, such as the H2RES project in Denmark, place it at the vanguard of this evolving green energy landscape, extending its reach beyond traditional power generation.

The development of PtX technologies is crucial for unlocking new markets and revenue streams for companies like Ørsted. By producing green hydrogen and e-fuels, Ørsted can cater to industries seeking sustainable alternatives to fossil fuels. This expansion is vital as the global demand for green fuels is projected to grow substantially. For instance, the International Energy Agency (IEA) reported in its 2024 outlook that global green hydrogen production capacity is expected to reach over 100 million tonnes per year by 2030, a significant increase from current levels.

- Technological Advancement: PtX technologies, including electrolysis and synthetic fuel production, are rapidly maturing, making green hydrogen and e-fuels increasingly viable.

- Market Expansion: Ørsted's participation in PtX projects diversifies its portfolio, moving beyond renewable electricity generation into sustainable fuel markets.

- Decarbonization Potential: PtX solutions are key to reducing emissions in hard-to-abate sectors, aligning with global climate goals and creating new business opportunities.

- Investment Growth: Significant global investment is flowing into PtX infrastructure, with the European Union alone earmarking substantial funds for hydrogen development as part of its Green Deal.

Grid Connectivity and Infrastructure Development

The integration of Ørsted's substantial offshore wind farms into national power grids hinges on robust grid connectivity. Significant investment in upgrading and expanding transmission infrastructure is paramount to accommodate the growing capacity of renewable energy sources. For instance, in 2023, Ørsted continued to advance projects like the Revolution Wind offshore wind farm, which will connect to the onshore grid in Rhode Island, requiring substantial transmission upgrades.

Technological advancements in smart grid solutions are vital for managing the intermittent nature of renewables and ensuring grid stability. These technologies enable better forecasting, load balancing, and demand response, crucial for integrating variable energy inputs. Ørsted's strategy inherently depends on the evolution of smart grid capabilities to efficiently manage power flow from its distributed renewable assets.

- Grid Capacity: The ability to connect large-scale renewable projects to existing grids is a primary technological consideration.

- Infrastructure Investment: Development of new transmission infrastructure is critical for accommodating increased renewable energy volumes.

- Smart Grid Advancements: Technologies like AI-driven grid management and advanced energy storage are necessary for reliability.

- Ørsted's Reliance: Ørsted's expansion plans are directly tied to the availability and adaptability of grid infrastructure globally.

Technological advancements in turbine efficiency continue to drive down the cost of offshore wind power. The increasing size and power output of turbines, exemplified by Vestas' 15 MW models, directly translate to more cost-effective energy generation. This innovation is critical for making wind energy increasingly competitive against traditional power sources.

The development of Power-to-X (PtX) technologies, such as green hydrogen production, represents a significant technological frontier for Ørsted. These technologies enable the decarbonization of hard-to-abate sectors and open new market opportunities beyond electricity generation. The global push for green hydrogen, with projected production capacity reaching over 100 million tonnes annually by 2030 according to the IEA, underscores the strategic importance of PtX.

Effective grid integration and energy storage are paramount for managing the variability of renewable energy sources. Smart grid technologies, coupled with advancements in battery storage, are essential for ensuring grid stability and reliable power delivery. Ørsted's investments in projects like the Irish battery storage facility highlight the company's commitment to these critical enabling technologies.

| Technology Area | Key Development | Impact on Ørsted | 2024/2025 Data Point |

|---|---|---|---|

| Wind Turbine Efficiency | Larger rotor diameters, increased MW capacity | Lower cost of energy, higher power output | Vestas V236-15.0 MW turbine operational |

| Power-to-X (PtX) | Advancements in electrolysis, green hydrogen production | Decarbonization of new sectors, market diversification | IEA projects >100M tonnes/year green H2 by 2030 |

| Energy Storage | Large-scale battery deployment, grid integration solutions | Enhanced grid stability, reliable renewable supply | Ørsted's Ireland battery project planned (100 MW) |

| Digitalization & AI | Predictive maintenance, operational optimization | Improved asset performance, reduced downtime | AI adoption for wind farm O&M |

Legal factors

Ørsted operates under stringent environmental regulations, particularly for its offshore wind farms. These laws mandate comprehensive environmental impact assessments to gauge effects on marine life and ecosystems, alongside measures for biodiversity protection and noise mitigation during construction phases. For instance, the company faced scrutiny and had to adapt its construction practices for the Revolution Wind project in the US to minimize impacts on marine mammals, a common challenge in the industry.

Navigating these complex legal frameworks and lengthy permitting processes represents a significant operational hurdle and cost for Ørsted. In 2023, the company continued to emphasize its commitment to sustainable development, investing heavily in ensuring compliance across its global portfolio, which includes projects in various stages of development and operation across Europe and North America.

International agreements like the Paris Agreement, aiming for net-zero emissions by 2050, and national climate legislation, such as the US Inflation Reduction Act (IRA) which allocates significant funding for clean energy, directly shape Ørsted's strategic direction and market expansion opportunities.

Compliance with evolving climate laws, including the EU's Corporate Sustainability Reporting Directive (CSRD) which mandates extensive environmental, social, and governance (ESG) disclosures, influences Ørsted's reporting obligations and operational practices, requiring robust data collection and transparency.

National policies promoting renewable energy, like Denmark's commitment to achieve 100% renewable electricity by 2027, create favorable market conditions and drive demand for offshore wind projects, a core business for Ørsted.

Regulations governing energy markets, including electricity market design and renewable energy tariffs, significantly impact Ørsted's project economics. For instance, the European Union's Renewable Energy Directive (RED III), aiming for at least 42.5% renewable energy by 2030, provides a strong regulatory tailwind for offshore wind development, which is Ørsted's core business.

Changes in these regulations, such as adjustments to feed-in tariffs or the introduction of competitive auctions for capacity, directly influence project revenues and investment decisions. In 2024, many European countries are refining their auction designs to ensure long-term price stability and de-risk investments, a trend Ørsted actively monitors.

Health and Safety Regulations

Operating massive energy projects, particularly offshore wind farms, means Ørsted must meticulously follow health and safety regulations. These rules are designed to safeguard workers and contractors involved in construction, operation, and maintenance. Failure to comply can lead to significant fines and operational disruptions, impacting project timelines and profitability. For instance, in 2023, the offshore wind industry saw a focus on improving safety protocols following incidents, underscoring the critical nature of these legal frameworks.

Adherence to occupational health and safety standards is non-negotiable for Ørsted. This includes everything from ensuring proper training for working at heights and in challenging marine environments to implementing robust emergency response plans. The company's commitment to safety directly influences its ability to maintain operational continuity and avoid legal repercussions. In 2024, Ørsted reported investing heavily in advanced safety training programs for its offshore personnel, aiming to further reduce incident rates.

- Occupational Safety and Health Administration (OSHA) standards are a baseline for many of Ørsted's operations in regions like the United States.

- European Agency for Safety and Health at Work (EU-OSHA) provides guidance and sets standards for safe working practices across the EU, directly impacting Ørsted's European projects.

- International Maritime Organization (IMO) regulations also play a role, particularly concerning the safety of vessels and personnel involved in offshore activities.

- **Ørsted's 2024 sustainability report** highlighted a 15% reduction in lost-time injury frequency rate (LTIFR) compared to 2023, demonstrating ongoing efforts in compliance and safety improvement.

Contractual Obligations and Project Agreements

Ørsted's operations are heavily reliant on intricate contractual frameworks. These include agreements with suppliers for components like wind turbines, power purchase agreements (PPAs) with off-takers for the electricity generated, and various financing contracts. For instance, in 2023, Ørsted finalized a significant PPA for its Revolution Wind project in the US, securing a price for the electricity produced.

Legal challenges or the necessity to renegotiate these contracts can seriously impact Ørsted's financial health and project timelines. Such renegotiations might arise from unexpected cost escalations, supply chain disruptions, or delays in project execution, as seen with some offshore wind projects facing increased material and labor costs in the 2023-2024 period.

- Supply Chain Contracts: Agreements for turbines, foundations, and installation services are critical.

- Power Purchase Agreements (PPAs): These secure revenue streams by defining the price and volume of electricity sold.

- Financing Arrangements: Contracts with banks and investors are essential for funding large-scale projects.

- Contractual Disputes: Potential for litigation or arbitration over contract terms and performance.

Legal factors significantly shape Ørsted's operational landscape, from environmental compliance to contractual agreements. Stringent regulations govern its offshore wind projects, requiring detailed environmental impact assessments and biodiversity protection measures, as seen with the Revolution Wind project's adaptation for marine mammal protection in 2023.

International climate agreements and national legislation, such as the US Inflation Reduction Act and the EU's Renewable Energy Directive, directly influence Ørsted's market opportunities and strategic investments. The company must also adhere to evolving ESG disclosure mandates like the EU's CSRD, ensuring transparency in its operations.

Furthermore, Ørsted's reliance on complex contractual frameworks, including PPAs and supply chain agreements, exposes it to risks from potential disputes or renegotiations, particularly relevant given the cost escalations observed in 2023-2024. Health and safety regulations are paramount, with Ørsted investing in advanced training in 2024 to maintain compliance and reduce incidents, evidenced by a 15% reduction in LTIFR reported for 2024.

Environmental factors

The global push to combat climate change is the primary environmental force shaping Ørsted's operations, driving its strategic focus on decarbonization. The company's core mission is to create a world powered solely by green energy, a vision that directly supports international and national climate objectives.

Ørsted has set ambitious targets, aiming for net-zero emissions by 2040 and substantial emission reductions by 2025, underscoring its fundamental environmental commitment. For instance, in 2023, Ørsted reported a significant reduction in its Scope 1 and 2 emissions, bringing them closer to their 2025 interim goals.

Ørsted's large-scale renewable energy projects, especially offshore wind farms, necessitate a deep understanding of their impact on biodiversity. The company is committed to minimizing its environmental footprint, employing methods like lower-noise pile driving to protect marine life during construction. For instance, in 2023, Ørsted continued its efforts to monitor and mitigate impacts on sensitive marine species, aligning with evolving regulatory requirements and scientific best practices.

The availability of crucial raw materials like rare earth elements for wind turbines and materials for batteries presents an environmental challenge for renewable energy manufacturers. Ørsted is actively working with its suppliers to implement circular economy principles, aiming to reduce its dependence on newly extracted resources.

This strategic focus on circular solutions includes exploring technologies that minimize the need for virgin materials. For instance, in 2023, Ørsted reported progress in its efforts to increase the recyclability of wind turbine blades, a key component in their offshore wind farms, demonstrating a commitment to a more resource-efficient supply chain.

Waste Management and Decommissioning

The environmental footprint of waste, from construction to the eventual decommissioning of offshore wind farms, is a significant consideration for Ørsted. The company is actively developing and implementing solutions to mitigate this impact. For instance, Ørsted has a target to recycle 100% of its wind turbine blades by 2025, a crucial step given the sheer volume of composite materials involved.

Minimizing disturbance during decommissioning is also paramount. Ørsted is pioneering the use of innovative foundation technologies, such as pile-free suction bucket foundations. These foundations are designed for complete removal, leaving the seabed largely undisturbed, a stark contrast to traditional methods that can have more lasting environmental effects. This approach is key to ensuring the long-term sustainability of offshore wind energy.

- Recycling Target: Ørsted aims to recycle 100% of its wind turbine blades by 2025.

- Foundation Innovation: Utilization of pile-free suction bucket foundations facilitates complete removal, minimizing seabed impact.

- Decommissioning Focus: Efforts are concentrated on reducing environmental disturbance throughout the asset lifecycle.

Extreme Weather Events and Climate Resilience

As climate change intensifies, Ørsted, a global leader in offshore wind, faces growing risks from more frequent and severe extreme weather events. This necessitates a strategic focus on climate resilience in its infrastructure development. For instance, the company's investments in offshore wind farms, such as the Revolution Wind project in the US, must account for increased hurricane intensity and storm surges.

Designing and constructing wind turbines and solar arrays capable of withstanding these harsher conditions is paramount for ensuring operational continuity and safeguarding valuable assets. This involves advanced engineering solutions to enhance structural integrity against extreme wind loads and wave action. Ørsted's commitment to sustainability also means proactively adapting to these climate-related threats.

- Increased Risk: More frequent Category 4 and 5 hurricanes pose a direct threat to Ørsted's offshore wind infrastructure.

- Resilience Investment: Designing for higher wind speeds and wave forces requires significant upfront capital expenditure in turbine foundations and structures.

- Operational Continuity: Ensuring farms can withstand extreme weather prevents costly downtime and revenue loss, as seen in the potential impact of severe storms on energy generation.

- Asset Protection: Protecting multi-billion dollar investments from climate-induced damage is critical for long-term financial viability.

The global imperative to address climate change is the most significant environmental driver for Ørsted, propelling its dedication to a green energy future. The company's objective to power the world with renewables aligns directly with worldwide climate goals, and its 2025 interim targets for emission reductions are a testament to this commitment. In 2023, Ørsted reported notable progress in lowering its Scope 1 and 2 emissions, moving closer to these crucial benchmarks.

Ørsted's large-scale renewable projects, particularly its offshore wind farms, require careful management of their impact on marine ecosystems. The company is actively implementing measures, such as noise reduction techniques during construction, to protect marine life, as demonstrated by its ongoing monitoring and mitigation efforts in 2023. Furthermore, Ørsted is striving to achieve a 100% recycling rate for its wind turbine blades by 2025, a critical step in managing waste from its operations.

The company is also innovating in foundation technology, employing pile-free suction bucket foundations that allow for complete removal, thereby minimizing seabed disturbance. This approach is crucial for the long-term environmental sustainability of offshore wind energy. Despite these efforts, the increasing frequency and intensity of extreme weather events, such as hurricanes, pose a growing risk to Ørsted's infrastructure, necessitating ongoing investment in climate resilience and advanced engineering for its assets.

PESTLE Analysis Data Sources

Our Orsted PESTLE analysis is built on a robust foundation of data from leading international organizations like the IEA and IRENA, alongside national energy agencies and reputable financial news outlets. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the renewable energy sector.