Orsted Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Orsted Bundle

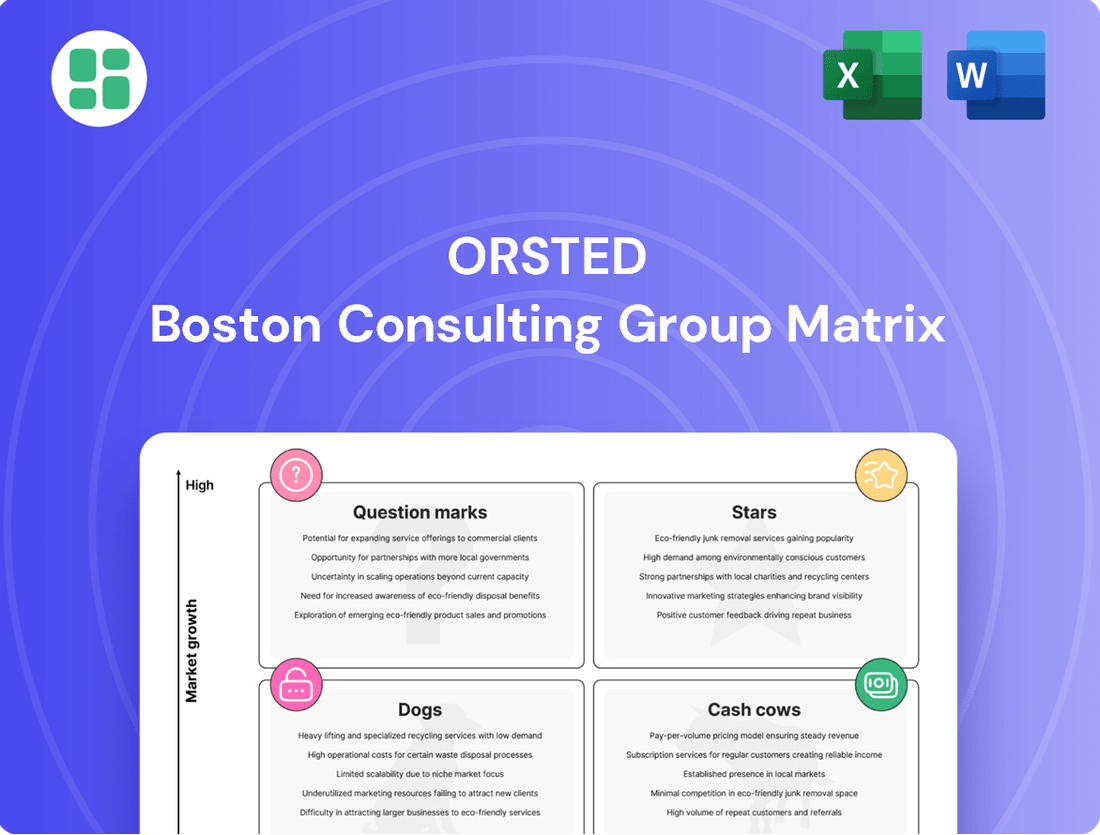

Explore Orsted's strategic positioning with our BCG Matrix preview, highlighting key areas of growth and potential challenges. Understand where their renewable energy ventures fall as Stars, Cash Cows, Dogs, or Question Marks.

Ready to transform this insight into actionable strategy? Purchase the full Orsted BCG Matrix for a comprehensive breakdown, including detailed quadrant analysis and tailored recommendations to optimize your investment and product portfolio.

Stars

Ørsted stands as the undisputed global leader in offshore wind, a sector poised for substantial expansion. The company's extensive operational capacity, coupled with a robust pipeline of projects, especially in Europe and Asia, underscores its dominant market share in this burgeoning industry. As of early 2024, Ørsted had installed over 9 GW of offshore wind capacity, with a further 11 GW under construction or development, highlighting its commitment to maintaining this leadership.

The UK's award of 3.5 GW of offshore wind capacity, notably including Hornsea 3, positions it as a significant growth driver for Ørsted. Hornsea 3 is slated to become the world's largest offshore wind farm, underscoring the company's commitment to leading in this expanding sector.

These developments represent a substantial investment in a high-growth market where Ørsted already holds a dominant market share. The sheer scale of the Hornsea 3 and 4 projects, with a combined capacity of 2.8 GW for Hornsea 3 alone, ensures Ørsted's continued market leadership and a strong pipeline for future cash generation.

The Greater Changhua 1 and 2a offshore wind farms in Taiwan were pivotal for Ørsted's 2024 financial performance, showcasing the company's success in a burgeoning Asian market. These projects, with a combined capacity of 900 MW, represent a substantial investment and a significant step in Taiwan's renewable energy transition.

These operational assets in the Greater Changhua region highlight Ørsted's established market presence and robust execution capabilities in Asia. Their strong performance in 2024 directly translates to a high market share and serves as a crucial engine for the company's ongoing growth strategy.

Baltica 2 Offshore Wind Farm (Poland)

The Baltica 2 offshore wind farm in Poland, with its final investment decision approved in early 2025, represents a significant star asset for Ørsted. This project is a key component of Ørsted's strategic expansion within the rapidly growing European offshore wind sector.

This expansion is crucial for maintaining Ørsted's strong market position in a region experiencing substantial development. The project's progression underscores the company's commitment to renewable energy growth and its ability to secure large-scale projects in emerging markets.

- Project Name: Baltica 2 Offshore Wind Farm

- Location: Poland

- Status: Final Investment Decision approved early 2025

- Strategic Importance: Key star asset for Ørsted's European expansion in a high-growth offshore wind market.

Operational Offshore Wind Farms

Ørsted's operational offshore wind farms are clearly in the Star category of the BCG matrix. Their performance in 2024 was particularly strong, with earnings increasing by DKK 3.6 billion. This growth is a testament to their established market position and the ongoing demand for green energy.

These wind farms are high-revenue generators. They benefit from Ørsted's significant market share in crucial offshore wind regions. The continuous expansion of renewable energy adoption globally further solidifies their status as Stars.

- Strong Earnings Growth: Ørsted reported a DKK 3.6 billion increase in earnings from its operational offshore wind farms in 2024.

- High Market Share: These assets benefit from Ørsted's dominant position in key offshore wind markets.

- Sustained Demand: The ongoing global demand for renewable energy ensures consistent revenue generation.

- Star Status Confirmation: The combination of high growth and significant market share firmly places these assets in the Star quadrant.

Ørsted's operational offshore wind farms are firmly positioned as Stars within the BCG matrix, characterized by high market share and operating in high-growth markets. Their substantial contribution to the company's 2024 performance, including a DKK 3.6 billion earnings increase from these assets, validates their Star status. This strong financial showing is driven by robust demand for renewable energy and Ørsted's leading position in key geographical areas.

| Asset Category | Market Growth | Market Share | 2024 Earnings Contribution | BCG Status |

| Operational Offshore Wind Farms | High | High (Global Leader) | DKK 3.6 billion increase | Star |

| Hornsea 3 & 4 (UK) | High | High (World's largest planned) | Significant future revenue | Star |

| Greater Changhua 1 & 2a (Taiwan) | High (Emerging Asian market) | High (Pivotal for 2024 performance) | Key growth driver | Star |

| Baltica 2 (Poland) | High (Growing European market) | High (Strategic expansion) | Future strong contributor | Star |

What is included in the product

The Orsted BCG Matrix offers strategic insights into its business units, categorizing them as Stars, Cash Cows, Question Marks, and Dogs.

This analysis guides investment decisions, highlighting which units to grow, maintain, or divest for optimal portfolio performance.

The Orsted BCG Matrix provides a clear, one-page overview of each business unit's position, alleviating the pain of unclear strategic direction.

Cash Cows

Ørsted's established European offshore wind portfolio, particularly in markets like the UK and Germany, functions as a classic cash cow. These mature assets, such as the Gode Wind 3 project which saw increased generation in 2025, benefit from high installed capacity and operational stability.

While the growth trajectory for these specific, older wind farms may be modest, their consistent and substantial cash flow generation is a key strength. This stability is further bolstered by relatively low ongoing investment requirements for expansion or significant technological upgrades, allowing for a strong return on investment.

Ørsted's bioenergy plants, having transitioned away from coal in 2024, now stand as a stable Cash Cow within the company's portfolio. These facilities offer a low-growth, high-market-share segment, consistently generating reliable cash flow by leveraging established infrastructure for green energy production.

Many of Ørsted's renewable energy projects are secured by long-term power purchase agreements and Contracts for Difference (CfDs). These contracts provide a stable and predictable revenue stream, a hallmark of cash cow assets.

These agreements, frequently indexed to inflation, help maintain high profit margins and ensure consistent cash flow. For instance, Ørsted's CfDs for the massive Hornsea 3 and Hornsea 4 offshore wind farms exemplify this cash cow characteristic, guaranteeing revenue for decades.

Onshore Wind Farms with Stable Operations

Certain mature onshore wind farms within Ørsted's portfolio, especially those with well-established grid connections and a history of reliable operations, serve as the company's cash cows. These assets, while perhaps not experiencing the explosive growth of newer offshore ventures, consistently generate earnings. This stability is crucial for Ørsted's overall financial health.

These mature onshore wind assets are characterized by their predictable revenue streams, often secured through long-term power purchase agreements. For instance, in 2023, Ørsted reported that its onshore wind segment continued to be a significant contributor to its earnings, although specific figures for individual mature farms are not publicly broken down in this manner. The stability allows for consistent cash flow generation, supporting investments in higher-growth areas.

Key characteristics of these cash cow assets include:

- Long-term operational history: Demonstrating reliability and minimizing unexpected maintenance costs.

- Established grid connections: Ensuring consistent electricity off-take and revenue.

- Stable regulatory environments: Reducing policy-related risks and uncertainty.

- Mature technology: Leading to predictable operational expenses and performance.

Completed Divestments and Partnerships

Ørsted's strategic divestments and partnerships are designed to generate substantial cash flow from its established renewable energy assets, effectively treating them as cash cows. This approach is crucial for funding future growth initiatives and maintaining financial stability.

In 2024, Ørsted continued its program of selling minority stakes in operational offshore wind farms. For instance, the company secured DKK 22 billion towards its 2026 target through these transactions. This cash generation allows Ørsted to reinvest in new, potentially higher-return projects.

Examples of these divestments include the sale of stakes in mature projects like West of Duddon Sands. By 'milking' these reliable, cash-generating assets, Ørsted optimizes its portfolio and strengthens its financial position for future investments.

- Divestment Program: Ørsted's ongoing strategy to sell minority stakes in operational renewable energy assets.

- Cash Generation: This program aims to generate significant cash flow, with DKK 22 billion secured towards the 2026 target as of recent reports.

- Strategic Reinvestment: The generated cash is earmarked for reinvestment into higher-growth areas within the renewable energy sector.

- Asset Monetization: Mature projects like West of Duddon Sands are prime examples of assets being monetized to support the company's broader financial objectives.

Ørsted's established offshore wind farms, particularly in mature markets like the UK and Germany, are prime examples of cash cows. These assets, benefiting from high operational stability and long-term power purchase agreements, generate consistent, predictable cash flow with relatively low reinvestment needs. This stability is crucial for funding the company's expansion into new, high-growth areas.

The bioenergy plants, having completed their transition away from coal in 2024, now represent a stable cash cow. Similarly, mature onshore wind farms with established grid connections and reliable operational histories contribute significantly to earnings, acting as dependable cash generators within the portfolio.

| Asset Type | Market Position | Cash Flow Generation | Growth Potential |

| Established Offshore Wind (UK/Germany) | High Market Share, Mature | High & Stable | Low |

| Bioenergy Plants | Stable, Post-Transition | Consistent | Low |

| Mature Onshore Wind | Established Operations | Predictable | Modest |

Full Transparency, Always

Orsted BCG Matrix

The Orsted BCG Matrix you are previewing is the complete, unwatermarked document you will receive immediately after purchase. This professionally designed analysis is ready for immediate use in your strategic planning, providing clear insights into Orsted's product portfolio. You can confidently expect the same high-quality, actionable content for your business decisions.

Dogs

The cancellation of major US offshore wind projects, including Orsted's Ocean Wind 1 and 2, firmly places them in the 'Dog' quadrant of the BCG Matrix. These ventures absorbed considerable investment and faced significant impairments, with Orsted reporting DKK 15.6 billion in impairments in 2024, largely attributed to its US offshore wind portfolio.

The macroeconomic climate, characterized by escalating inflation and higher interest rates, rendered these projects financially unviable, leading to their discontinuation. The inability to generate expected returns, coupled with substantial capital expenditure, necessitated their divestiture or complete cessation, highlighting a severe underperformance.

Ørsted's strategic decision to deprioritize development in markets like Norway, Spain, Portugal, and Japan signifies a clear move away from areas with limited current market share and/or lower anticipated growth prospects. This aligns with the company's approach to capital allocation, as it seeks to concentrate resources on more lucrative ventures.

These specific markets are categorized as 'Dogs' within the BCG matrix framework, reflecting their current standing. For instance, in 2023, Ørsted reported a significant reduction in its development pipeline for offshore wind projects in these less strategic regions, reallocating capital expenditure towards core markets with higher growth potential and established positions.

Orsted's decision to halt construction on the FlagshipONE project, resulting in a significant DKK 1.5 billion impairment, clearly categorizes it as a 'Dog' within the BCG matrix. This move signals a strategic recognition that further investment in this particular venture would likely yield no profitable returns, prompting an exit to prevent continued financial losses in a low-growth, low-market-share segment.

Legacy Fossil Fuel Assets (Pre-2024)

Legacy fossil fuel assets, such as any remaining coal or gas power plants that were phased out by 2024, would have been classified as Dogs in Ørsted's BCG Matrix. These operations typically presented low growth prospects and a declining market share as the company aggressively shifted towards renewable energy. By 2025, Ørsted aimed for 99% renewable energy generation, making these legacy assets strategically misaligned and candidates for divestment or closure.

These fossil fuel assets, prior to their complete phase-out, would have represented a drain on resources with limited potential for future returns. For instance, Ørsted's divestment of its onshore wind business in 2023, which included some older, less efficient assets, exemplifies the strategic pruning of non-core and lower-performing segments. Such moves are typical for managing 'Dog' categories within a portfolio, freeing up capital for more promising green energy ventures.

- Low Growth Prospects: Fossil fuel markets faced declining demand and increasing regulatory pressure, limiting expansion opportunities.

- Low Market Share in Renewed Strategy: As Ørsted prioritized renewables, the relative market share of its fossil fuel operations diminished within the company's overall strategic focus.

- Divestment or Closure: Assets in the 'Dog' category are often managed through divestment or decommissioning to reallocate capital and resources to higher-growth areas like offshore wind and green hydrogen.

High-Cost, Delayed US Projects (e.g., Revolution Wind and Sunrise Wind, pre-renegotiation)

Before their renegotiations, US offshore wind projects like Revolution Wind and Sunrise Wind were in a tough spot. Rising interest rates and construction snags significantly increased their costs, leading to major financial setbacks.

These projects, particularly in 2024, saw substantial impairments, with Ørsted reporting DKK 14.1 billion in US impairments alone. This meant they were consuming capital without generating immediate profits, a classic 'Dog' characteristic in the BCG matrix.

- High Cost Overruns: Initial budgets were blown due to economic shifts and logistical hurdles.

- Project Delays: Construction timelines stretched, increasing the holding costs and delaying revenue generation.

- Financial Impairments: Significant write-downs were necessary as the projected returns diminished.

- Cash Consumption: The projects required ongoing investment without a clear, near-term positive cash flow.

Ørsted's US offshore wind projects, like Ocean Wind 1 and 2, are firmly in the 'Dog' quadrant due to significant impairments totaling DKK 15.6 billion in 2024. These ventures faced escalating costs from inflation and higher interest rates, rendering them financially unviable and leading to their cancellation.

The company's strategic shift away from markets with limited current share and lower growth prospects, such as Norway, Spain, Portugal, and Japan, also places these regions in the 'Dog' category. This reallocation of capital expenditure aims to focus resources on more promising ventures.

The FlagshipONE project's halt, resulting in a DKK 1.5 billion impairment, exemplifies a 'Dog' asset where further investment was deemed unprofitable. Similarly, legacy fossil fuel assets, phased out by 2024, represented low-growth, declining-share operations, often managed through divestment.

Projects like Revolution Wind and Sunrise Wind experienced substantial impairments in 2024, reaching DKK 14.1 billion in US impairments alone, due to cost overruns and project delays, a clear indicator of 'Dog' status.

| Project/Region | BCG Quadrant | Key Challenges | Financial Impact (2024) |

| Ocean Wind 1 & 2 (US) | Dog | Inflation, Higher Interest Rates, Project Cancellation | DKK 15.6 billion impairments (US Offshore Wind Portfolio) |

| Norway, Spain, Portugal, Japan | Dog | Limited Market Share, Lower Growth Prospects | Reduced development pipeline, capital reallocation |

| FlagshipONE | Dog | Project Halt, Unprofitable Investment | DKK 1.5 billion impairment |

| Revolution Wind, Sunrise Wind (US) | Dog | Cost Overruns, Project Delays | DKK 14.1 billion impairments (US) |

Question Marks

Emerging energy storage solutions represent a significant growth opportunity for Ørsted, though its current market share in this rapidly evolving sector is still building. The company is actively investing, with projects like the 600 MWh battery at Hornsea 3 demonstrating commitment.

Scaling these storage capabilities is crucial for Ørsted to capitalize on the high growth potential and transition these assets into future star performers within its portfolio. The substantial capital expenditure required for such expansions underscores the strategic importance of energy storage in Ørsted's long-term vision.

Ørsted's Power-to-X initiatives, encompassing green hydrogen and fuels, represent a strategic push into a market with significant long-term promise but currently limited market share. These ventures are characterized by substantial investment in research and development, as well as pilot projects, placing them in the "question mark" category of the BCG matrix. For instance, Ørsted has been actively involved in projects like the H2RES project in Denmark, aiming to produce green hydrogen for transport and industry, demonstrating their commitment to this emerging sector.

Ørsted's exploration into new solar markets, particularly in regions where it has a nascent presence, aligns with the 'Question Marks' category of the BCG Matrix. These ventures demand substantial upfront capital for market research, regulatory navigation, and initial project development, often with minimal immediate revenue streams and a small initial market share. For instance, Ørsted's recent strategic investments in emerging solar markets in Southeast Asia, such as Vietnam and the Philippines, exemplify this phase.

The potential for significant long-term growth in these nascent solar markets is the primary driver. While returns are uncertain and the risk of failure is present, successful penetration could lead to substantial market share gains as these regions increasingly adopt renewable energy. As of late 2024, many of these emerging markets are still establishing their renewable energy frameworks, creating both challenges and opportunities for early entrants like Ørsted.

Specific Onshore Wind Projects in Developing Markets

Certain onshore wind projects in developing markets, where Ørsted is actively establishing its footprint, might be categorized as Question Marks in the BCG Matrix. These ventures often navigate complex regulatory landscapes and competitive financing environments, potentially limiting their initial market share despite the burgeoning demand for renewable energy in these regions.

For instance, Ørsted's expansion into Southeast Asian markets in 2024 exemplifies this. While the region shows significant potential for onshore wind growth, projects may encounter hurdles in securing land rights and grid connections. This can lead to slower development timelines and a lower initial contribution to Ørsted's overall portfolio, characteristic of a Question Mark.

- Developing Markets: Projects in regions like Vietnam or India, where Ørsted is building its operational base and brand recognition.

- Challenges: Navigating evolving permitting processes, securing local partnerships, and competitive auction mechanisms for power purchase agreements.

- Potential: Despite initial hurdles, these markets represent substantial long-term growth opportunities for onshore wind.

- Investment: Continued investment is required to overcome these challenges and convert these Question Marks into Stars or Cash Cows.

Floating Offshore Wind Development

Floating offshore wind represents a burgeoning segment for Ørsted, distinct from its established fixed-bottom expertise. While the fixed-bottom market is more mature, floating technology unlocks deeper waters, significantly expanding the potential for wind energy generation. This newer frontier, however, comes with its own set of technological hurdles and a currently smaller, though rapidly growing, market footprint.

Ørsted's strategic approach to floating offshore wind development is characterized by a focus on leaner operations. This suggests an acknowledgment of the high growth potential inherent in this technology, balanced with the considerable uncertainties and substantial capital investments required for scaling. The company is positioning itself to navigate this evolving landscape, emphasizing efficiency and adaptability.

- Market Growth: The global floating offshore wind market is projected to reach over 16 GW by 2030, a substantial increase from its current capacity.

- Technological Evolution: Floating platforms are still undergoing optimization, with costs expected to decrease as the technology matures and supply chains develop.

- Ørsted's Strategy: Ørsted aims for efficient project execution in floating wind, recognizing the need for agility in a rapidly advancing field.

- Capital Intensity: Developing floating wind farms requires significant upfront capital, reflecting the complexity and scale of these pioneering projects.

Ørsted's investments in emerging technologies like green hydrogen and new solar markets fall into the Question Marks category. These areas offer high growth potential but currently have a limited market share and require substantial upfront investment. The company is actively pursuing pilot projects and market entry strategies to build its presence.

These ventures are characterized by significant R&D expenditure and a need to navigate evolving regulatory landscapes. Success in these nascent markets could lead to substantial future gains, but the risks associated with technological development and market adoption remain a key consideration.

The company's strategic focus on these segments underscores a commitment to long-term diversification and capitalizing on future energy trends. Ørsted's proactive engagement in these developing areas is crucial for transforming potential into established market leadership.

Floating offshore wind is another key area for Ørsted, representing a significant growth opportunity with high capital intensity. While the technology is still maturing, Ørsted is focusing on efficient project execution to capitalize on its expanding market potential.

| Segment | Market Share | Growth Potential | Investment Needs | Strategic Focus |

| Green Hydrogen (Power-to-X) | Nascent | High | Substantial | R&D, Pilot Projects |

| Emerging Solar Markets | Low | High | Significant | Market Entry, Regulatory Navigation |

| Floating Offshore Wind | Growing | Very High | Very High | Lean Operations, Technological Optimization |

BCG Matrix Data Sources

Our Orsted BCG Matrix leverages comprehensive data from annual reports, market research, and internal performance metrics to accurately assess business unit positioning.