Orsted Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Orsted Bundle

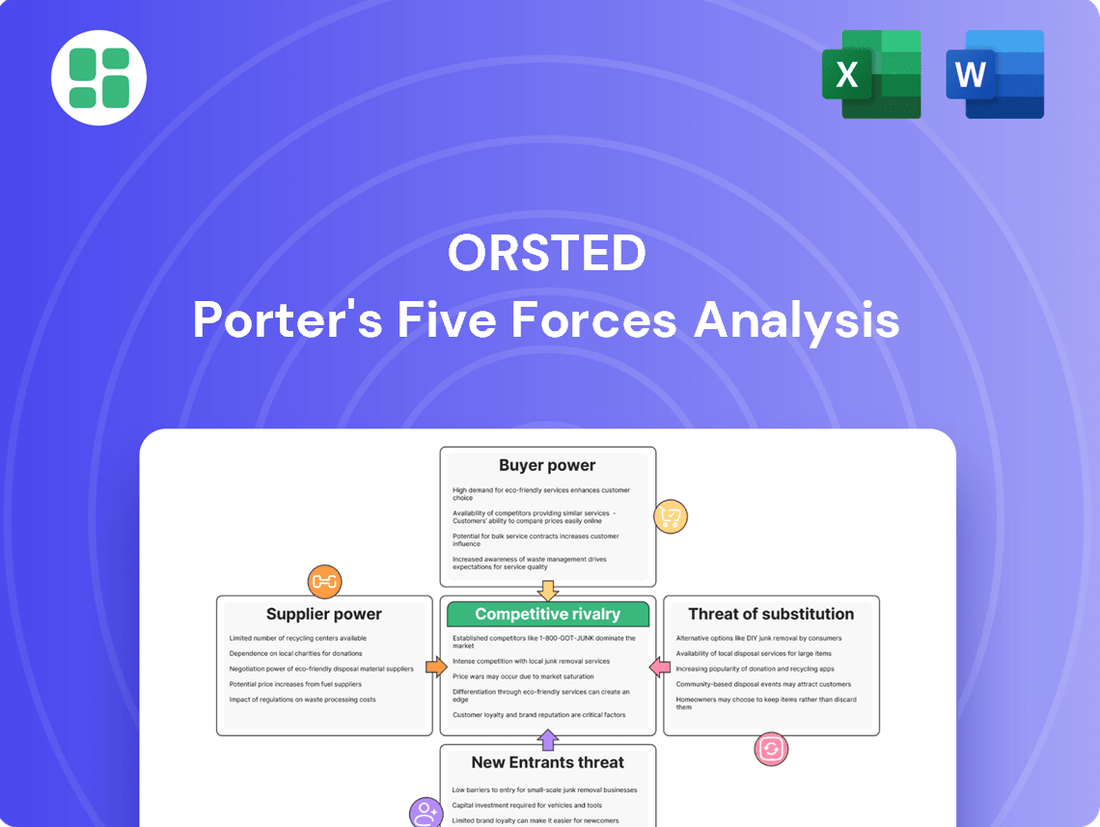

Orsted's position in the renewable energy sector is shaped by intense competition and evolving market dynamics. Understanding the bargaining power of buyers and the threat of new entrants is crucial for navigating this landscape effectively.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Orsted’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The offshore wind sector, including companies like Ørsted, faces a concentrated supply chain for essential components such as massive wind turbines, specialized foundations, and dedicated installation vessels. This limited pool of highly specialized suppliers grants them considerable bargaining power, especially when it comes to cutting-edge or bespoke technological solutions.

Ørsted's experiences in 2023 and early 2024, including project cancellations and significant delays for projects like Ocean Wind 1 and Sunrise Wind, underscore this vulnerability. These setbacks were partly attributed to critical shortages of installation vessels and broader supply chain disruptions, demonstrating the direct impact of supplier leverage on project execution and financial performance.

Suppliers are experiencing significant cost increases across raw materials, energy, and labor. These rising expenses are directly passed on to companies like Ørsted, impacting the overall cost of developing renewable energy projects. For instance, in 2024, global inflation rates, while moderating from previous highs, continued to exert pressure on supply chains, with energy prices remaining volatile.

The heightened inflationary environment, coupled with elevated interest rates throughout 2024, has created a challenging landscape for project financing and viability. This economic backdrop has forced developers to renegotiate existing contracts or, in some cases, cancel projects altogether due to escalating costs and reduced profitability, directly affecting Ørsted's project pipeline and execution.

Many suppliers in the offshore wind sector hold crucial intellectual property and possess highly specialized manufacturing skills honed over years of experience. This unique expertise, often tied to proprietary technology for turbines or foundation construction, makes it difficult for Ørsted to find readily available alternatives. For instance, companies like Siemens Gamesa and Vestas are leaders in turbine technology, and their specialized designs and manufacturing processes create high switching costs for Ørsted.

Ørsted's Demand for 100% Renewable Electricity from Suppliers

Ørsted's ambitious goal for all its suppliers to exclusively use renewable electricity by 2025 significantly influences supplier bargaining power. This directive, while environmentally conscious, can impose additional operational costs on suppliers who may need to invest in renewable energy sources or purchase renewable energy certificates. Consequently, suppliers might pass these increased compliance costs onto Ørsted through higher prices, thereby strengthening their negotiating position.

The push for 100% renewable electricity from suppliers introduces a new layer of complexity and potential expense. Suppliers facing these requirements might see this as an opportunity to negotiate more favorable terms or higher prices for their goods and services. This is particularly true for suppliers whose current energy mix is heavily reliant on non-renewable sources, as the transition could represent a substantial investment.

- Supplier Cost Increase: Suppliers may need to invest in renewable energy infrastructure or purchase renewable energy credits, potentially raising their operational costs by an estimated 5-15% depending on their current energy sourcing.

- Pricing Power: This added cost burden can empower suppliers to increase their prices for products and services provided to Ørsted, as they seek to recoup these new expenses.

- Market Concentration: If only a limited number of suppliers can meet this stringent renewable energy requirement, their bargaining power is further amplified due to reduced competition.

- Strategic Partnerships: Ørsted's demand might foster closer partnerships with suppliers willing and able to meet the renewable energy criteria, potentially leading to long-term supply agreements with negotiated pricing.

Global Supply Chain Bottlenecks and Geopolitical Risks

The global renewable energy supply chain has faced significant bottlenecks, especially for crucial components like wind turbine blades and specialized installation vessels. This scarcity, exacerbated by increased demand and logistical challenges, has empowered suppliers by allowing them to dictate terms and pricing, contributing to project delays and cost overruns. For instance, in 2023, the average lead time for offshore wind components extended significantly, impacting project timelines.

Geopolitical shifts and trade policies further amplify supplier bargaining power. Tariffs and regional manufacturing incentives can create dependencies on specific suppliers or regions, giving them leverage. For example, the ongoing trade tensions between major manufacturing hubs have led to price increases for key raw materials used in solar panels and batteries, directly benefiting suppliers in those regions.

- Component Scarcity: Increased demand for offshore wind turbines and batteries has led to extended lead times for critical components, such as specialized vessels and rare earth magnets, granting suppliers greater pricing power.

- Geopolitical Influence: Trade tariffs and regional manufacturing policies create supply chain vulnerabilities, allowing suppliers in favored regions to command higher prices and more favorable contract terms.

- Rising Input Costs: Fluctuations in raw material prices, influenced by global events, directly impact the cost of renewable energy components, strengthening the position of suppliers who control these inputs.

Suppliers in the offshore wind sector, including those providing turbines and foundations, wield significant bargaining power due to market concentration and specialized expertise. This leverage was evident in 2023 and early 2024 as companies like Ørsted faced project delays and cancellations, such as Ocean Wind 1, partly due to critical shortages of installation vessels and broader supply chain disruptions.

Rising global inflation in 2024 continued to increase suppliers' costs for raw materials, energy, and labor, which were passed on to developers. Furthermore, Ørsted's requirement for suppliers to use 100% renewable electricity by 2025 may add compliance costs, potentially increasing prices by an estimated 5-15% for some suppliers, further strengthening their negotiating position if few can meet the criteria.

Component scarcity, such as for specialized vessels and rare earth magnets, has led to extended lead times, granting suppliers greater pricing power. Geopolitical factors, including trade tariffs, also create supply chain vulnerabilities, allowing suppliers in favored regions to command higher prices and more favorable terms, impacting the overall cost of renewable energy projects.

What is included in the product

This analysis unpacks the competitive forces shaping Orsted's renewable energy sector, examining the threat of new entrants, the bargaining power of buyers and suppliers, the intensity of rivalry, and the impact of substitutes.

Effortlessly identify and mitigate competitive threats with a dynamic visualization of Orsted's market landscape.

Customers Bargaining Power

Ørsted's utility-scale projects often secure customers like large corporations, utilities, and governments through long-term Power Purchase Agreements (PPAs). These PPAs offer price stability, but the initial negotiation heavily favors these substantial off-takers due to the sheer volume and lengthy commitment involved.

In 2023, Ørsted reported a significant portion of its revenue came from long-term PPAs, underscoring the importance of these customer relationships. For instance, securing a multi-gigawatt wind farm PPA with a major industrial player can represent billions of dollars in guaranteed revenue, giving that customer considerable leverage in setting terms.

Governments, particularly in their role as regulators and often as significant purchasers of renewable energy, wield considerable influence over Ørsted through policy decisions and auction frameworks. These governmental actions directly shape pricing dynamics and overall demand for renewable energy projects. For instance, many of Ørsted's revenue streams are intrinsically linked to these policy environments, where competitive auction processes are common. These auctions, designed to procure renewable energy at the lowest cost, can intensify competition and consequently drive down the prices that customers, often utilities or government entities, are willing to pay, thereby increasing the bargaining power of these customers.

Many of Ørsted's major corporate clients, such as TSMC, are actively pursuing ambitious sustainability objectives, including RE100 commitments and net-zero targets. This commitment fuels a robust demand for renewable energy solutions, a key driver for Ørsted's business.

However, these large corporate offtakers are discerning and informed buyers. Their significant purchasing power, coupled with their strong commitment to green energy, allows them to negotiate for more advantageous contract terms and pricing, thereby increasing their bargaining power.

Diversification of Energy Sources for Customers

Customers, particularly large industrial and commercial users, benefit from a diverse energy landscape. They can often choose from multiple suppliers or even generate their own power, reducing their reliance on any single provider like Ørsted.

This ability to switch or self-supply significantly boosts their bargaining leverage. For instance, in 2024, the increasing accessibility of distributed solar and battery storage solutions has provided many businesses with viable alternatives to traditional grid-supplied electricity, directly impacting the power dynamics with energy companies.

- Increased Supplier Options: Businesses can compare pricing and terms from numerous energy providers, including those specializing in renewables.

- Self-Generation Capabilities: On-site solar, wind, or combined heat and power (CHP) systems offer customers a degree of energy independence.

- Technological Advancements: Innovations in energy storage and smart grid technology empower customers to manage their consumption and procurement more effectively.

- Market Liberalization: Many regions have deregulated energy markets, allowing customers greater freedom to select their preferred energy source and supplier.

Price Sensitivity in Competitive Energy Markets

Customers in the energy sector, even those favoring green alternatives, are keenly aware of pricing. This is particularly true in deregulated markets where direct comparisons between renewable and conventional energy sources are readily available. For instance, in 2024, many European countries continued to see significant price competition in their electricity markets, influencing customer choices.

Economic headwinds, such as the elevated interest rates experienced through much of 2023 and into 2024, amplify this price sensitivity. Consumers and businesses alike become more focused on cost-effectiveness, actively seeking providers that offer the most competitive rates. This trend directly impacts Ørsted's ability to command premium pricing for its renewable energy solutions.

- Customers remain price-sensitive, especially when comparing renewable energy to traditional sources.

- Deregulated energy markets intensify this price sensitivity.

- Rising interest rates in 2023-2024 have made customers more cost-conscious.

- Ørsted faces pressure to offer cost-effective solutions to retain and attract customers.

The bargaining power of Ørsted's customers is significant, particularly for large industrial and corporate clients who often engage in long-term Power Purchase Agreements (PPAs). These customers, driven by sustainability goals and substantial energy needs, can negotiate favorable terms due to their purchasing volume and commitment. For example, securing a multi-gigawatt PPA in 2023 represented billions in guaranteed revenue, giving the customer considerable leverage.

Governments also exert influence through policy and auction frameworks, which shape pricing. In 2024, competitive auction processes common in many regions drive down prices, increasing customer bargaining power. Furthermore, the increasing availability of distributed solar and battery storage in 2024 provides businesses with alternatives, enhancing their ability to switch or self-supply, thereby boosting their leverage.

| Customer Type | Leverage Factors | Impact on Ørsted |

|---|---|---|

| Large Corporations (e.g., TSMC) | High volume PPAs, sustainability commitments (RE100), significant purchasing power | Ability to negotiate favorable pricing and contract terms |

| Governments/Utilities | Policy influence, regulatory frameworks, competitive auction processes | Drives down PPA prices, shapes market demand |

| General Businesses | Increasing availability of distributed generation (solar, storage), market liberalization | Reduced reliance on single suppliers, increased switching power |

Full Version Awaits

Orsted Porter's Five Forces Analysis

This preview displays the complete Orsted Porter's Five Forces Analysis, offering a detailed examination of the competitive landscape for the company. The document you see here is precisely the same professionally formatted analysis that will be available for immediate download upon purchase, ensuring no discrepancies or missing information.

Rivalry Among Competitors

Ørsted, a titan in offshore wind, faces a fiercely competitive landscape. Established giants like Vestas, Siemens Gamesa, and GE Vernova are not only vying for projects but also innovating rapidly to maintain their edge. This intense rivalry is a defining characteristic of the sector, driving down costs and pushing technological boundaries.

The influx of new players, particularly from Asia, further escalates this competition. These emerging challengers are aggressively expanding their global footprint, often with strong government backing and a focus on cost-competitiveness. For instance, Chinese manufacturers like MingYang Smart Energy are increasingly making their mark on the international stage, challenging the dominance of Western firms.

This heightened rivalry is evident in the competitive bidding processes for new offshore wind farm developments. Companies are under immense pressure to offer attractive prices while ensuring reliable technology and efficient project execution. In 2023, the average winning bid price for offshore wind power in Europe saw fluctuations, reflecting this competitive dynamic and the ongoing drive for cost reduction.

The renewable energy sector, particularly offshore wind, is characterized by substantial upfront investments in development, construction, and ongoing operations. These high fixed costs necessitate that companies like Ørsted pursue large-scale projects to spread expenses and achieve economies of scale, thereby sharpening competition for project bids.

Recent project delays and cancellations, particularly in the US and UK, have significantly impacted Ørsted's financial health and investor sentiment. For instance, the company announced in 2023 that it would take a substantial impairment charge of DKK 23 billion (approximately $3.3 billion USD) related to its US offshore wind projects, citing supply chain disruptions and rising costs.

These setbacks create a more challenging competitive landscape. Competitors might capitalize on Ørsted's difficulties by offering more stable pricing or demonstrating greater project execution reliability, potentially winning future bids. This intensified rivalry means Ørsted faces increased scrutiny on its project management and financial stability.

Geographical Expansion and Market Entry Strategies

Competitors are increasingly venturing into new territories like Brazil, India, and Australia, alongside exploring novel technologies. This broadens the competitive landscape significantly. For instance, in 2023, companies like RWE and Iberdrola continued their global offshore wind development pipelines, showcasing this trend.

Ørsted's own strategic adjustments, including exiting certain markets to concentrate on core areas, highlight the intense competition encountered during global expansion. This refocusing is a direct response to the pressures of operating across diverse and rapidly evolving international markets.

- Increased Global Competition: Renewable energy developers are aggressively pursuing new geographical markets, intensifying rivalry.

- Technological Advancements: The race to adopt and innovate in emerging renewable technologies further fuels competition.

- Ørsted's Strategic Response: Ørsted's market exits and portfolio refinement underscore the challenges of global expansion amidst strong competition.

- Market Dynamics: The entry and expansion of competitors into key growth regions like Asia-Pacific and Latin America are reshaping the competitive environment.

Technological Advancements and Innovation Race

The offshore wind sector is locked in a fierce innovation race, driven by rapid technological leaps. Turbine manufacturers are constantly pushing the boundaries on size and efficiency, with the latest generation of offshore turbines exceeding 15 megawatts (MW) capacity. This relentless pursuit of better technology intensifies competition as companies strive to offer more cost-effective and powerful solutions to secure market share.

Companies are investing heavily in research and development to stay ahead. For instance, advancements in installation techniques, including the growing prominence of floating wind platforms, are critical for accessing deeper waters and expanding the potential for offshore wind farms. This technological arms race means that firms failing to innovate risk falling behind, making it a key battleground for competitive advantage.

- Turbine Size: Leading manufacturers are now producing turbines with capacities of 15 MW and above, a significant increase from earlier models.

- Floating Wind Technology: This emerging technology is crucial for unlocking wind resources in deeper waters, previously inaccessible to fixed-bottom turbines.

- Cost Reduction: Innovation is directly linked to reducing the levelized cost of energy (LCOE), a primary driver for project viability and competitive pricing.

- Efficiency Gains: Improvements in blade design and aerodynamic efficiency are crucial for maximizing energy capture from wind resources.

The competitive rivalry within the offshore wind sector remains exceptionally high, impacting Ørsted's market position. Established players like Vestas and Siemens Gamesa continue to innovate, while new entrants, particularly from Asia, are aggressively expanding globally, often backed by strong government support. This dynamic is evident in the bidding for new projects, where cost-competitiveness is paramount.

Ørsted's recent financial challenges, such as the DKK 23 billion impairment in 2023 due to US project issues, have intensified this rivalry. Competitors may leverage these difficulties to gain an advantage in future bids. The global expansion of rivals into markets like Brazil and India further broadens the competitive front.

| Key Competitor | Turbine Capacity (MW) | Global Presence |

| Vestas | Up to 15+ | Global |

| Siemens Gamesa | Up to 14+ | Global |

| GE Vernova | Up to 14+ | Global |

| MingYang Smart Energy | Up to 16+ | Expanding Global |

SSubstitutes Threaten

While Ørsted's core business is green energy, conventional fossil fuels like coal and natural gas still represent a substitute threat, particularly for grid stability and immediate power needs. However, the cost-competitiveness of new fossil fuel projects is declining. For instance, in 2024, the levelized cost of electricity (LCOE) for new solar PV and onshore wind projects in many regions is now lower than that of new natural gas power plants, making renewables a more attractive long-term investment and diminishing the threat of fossil fuel substitutes.

Other renewable energy technologies, including utility-scale solar photovoltaic (PV), onshore wind, hydropower, and geothermal, represent significant substitutes for Ørsted's offshore wind and other renewable energy solutions. The increasing competitiveness and deployment of these alternatives directly challenge Ørsted's market position.

Solar PV has experienced remarkable growth, with new contracted capacity for solar significantly outpacing wind installations in 2024. This trend highlights the growing viability and attractiveness of solar as a substitute, potentially diverting investment and demand away from offshore wind projects.

The increasing availability and falling prices of battery energy storage systems (BESS) and hybrid solutions present a significant threat of substitutes for Ørsted. These technologies, often combining solar, wind, and storage, provide a more consistent and reliable power supply, directly competing with the company's core wind energy offerings. For instance, by mid-2024, the global average cost for utility-scale battery storage systems had seen a notable decrease, making them more economically viable as standalone or complementary power sources.

Energy Efficiency and Demand-Side Management

Investments in energy efficiency and demand-side management (DSM) present a significant threat of substitution for Ørsted. By reducing overall energy consumption, these initiatives can lessen the demand for new, large-scale energy generation projects, directly impacting the total addressable market for renewable energy providers. For instance, smart grid technologies and improved building insulation can decrease the need for electricity, making traditional and even renewable power sources less essential.

The effectiveness of these substitutes is growing. In 2023, the International Energy Agency reported that energy efficiency improvements prevented the equivalent of 2.5 billion tonnes of CO2 emissions globally, highlighting their substantial impact on energy demand. This trend suggests that a portion of the market Ørsted aims to capture might be effectively addressed by these demand-reduction strategies rather than new supply.

- Reduced Demand: Energy efficiency measures directly lower the overall need for electricity and heat, diminishing the market size for new energy generation capacity.

- Technological Advancements: Innovations in smart home technology, industrial process optimization, and advanced insulation materials are making energy savings more accessible and impactful.

- Policy Support: Government incentives and regulations promoting energy conservation and DSM programs further strengthen the threat of substitutes by encouraging adoption.

- Cost Savings for Consumers: By using less energy, consumers and businesses achieve direct cost savings, making efficiency a more attractive alternative to purchasing new energy supply.

Distributed Energy Resources (DERs)

The proliferation of distributed energy resources (DERs) like rooftop solar and microgrids presents a significant substitution threat to traditional utility models. Customers can now generate their own electricity, lessening reliance on large, centralized power sources. This shift is particularly impactful for commercial and industrial sectors.

By 2024, the global distributed solar market is projected to see substantial growth, with many businesses actively investing in on-site generation to manage energy costs and enhance resilience. For instance, in 2023, corporate renewable energy procurement reached record levels, with a significant portion attributed to behind-the-meter solar installations.

- Growing Adoption: Rooftop solar installations continue to expand, enabling self-generation.

- Cost Competitiveness: The declining cost of solar technology makes it an increasingly attractive alternative.

- Energy Independence: DERs offer customers greater control and reliability, reducing dependence on grid operators.

Other renewable sources like solar PV and onshore wind are increasingly competitive substitutes for offshore wind. In 2024, the levelized cost of electricity for new solar and onshore wind projects is often lower than for new natural gas plants, directly impacting offshore wind's market share.

Energy storage solutions, particularly battery systems, are becoming more viable as standalone power sources or complements to renewables. By mid-2024, the falling costs of utility-scale battery storage made them a strong substitute for consistent power delivery, reducing reliance on single generation types.

Energy efficiency and demand-side management initiatives are also significant substitutes, as they reduce the overall need for new power generation. In 2023, global energy efficiency improvements significantly curbed CO2 emissions, demonstrating their impact on reducing the demand for energy supply.

Distributed energy resources, such as rooftop solar, offer customers the ability to generate their own power, lessening dependence on large-scale projects like offshore wind farms. Corporate adoption of behind-the-meter solar in 2023 highlights this growing trend.

Entrants Threaten

Entering the utility-scale renewable energy market, particularly offshore wind, demands substantial capital. Ørsted, for instance, consistently invests billions of dollars in developing, constructing, and connecting its projects to the grid. These high upfront costs serve as a significant deterrent for potential new competitors.

The sheer complexity and duration of regulatory and permitting procedures, especially for large-scale offshore wind farms, act as a significant hurdle for newcomers. These processes can involve multiple government agencies at federal, state, and local levels, each with its own requirements and timelines.

Policy instability and evolving regulatory frameworks, such as those experienced in the United States with shifting administration priorities impacting renewable energy projects, can significantly increase risk and discourage potential new entrants from committing capital.

For instance, the lead time for securing permits for an offshore wind project can easily span several years, requiring substantial upfront investment in studies and legal expertise, which smaller or less capitalized firms may find prohibitive.

New companies entering the offshore wind market, like Ørsted operates in, struggle to access specialized supply chains. For instance, securing advanced turbine components or the limited number of heavy-lift installation vessels requires significant capital and established relationships, which new entrants typically lack.

The need for highly skilled engineers and technicians with offshore wind experience presents another barrier. Ørsted, having been in the industry for years, has cultivated a deep pool of talent and proprietary knowledge, making it difficult for newcomers to compete for essential human capital.

Economies of Scale and Experience Curve Benefits

Existing players like Ørsted possess significant economies of scale in developing, financing, and operating large-scale renewable energy projects. This scale allows them to secure better terms on capital, equipment, and services, directly impacting project costs. For instance, in 2023, Ørsted's substantial offshore wind portfolio likely enabled them to negotiate more favorable pricing for turbine supply contracts compared to a new entrant attempting a single project.

The experience curve further solidifies the advantage of incumbents. Through years of project execution, Ørsted has refined its processes, learned from past challenges, and optimized operational efficiencies. This accumulated knowledge translates into lower development risks and more predictable operational performance, creating a cost advantage that new entrants would find difficult to replicate without substantial, and costly, initial learning.

- Economies of Scale: Ørsted's large project pipeline allows for bulk purchasing of components and services, reducing per-unit costs.

- Experience Curve: Accumulated operational knowledge leads to improved efficiency and lower maintenance costs over time.

- Financing Advantages: Established companies often secure lower interest rates on debt due to their proven track record and larger asset base.

- Supply Chain Relationships: Long-standing partnerships with key suppliers can provide preferential pricing and delivery schedules.

Grid Connection and Infrastructure Challenges

The threat of new entrants in the offshore wind sector, particularly for a company like Orsted, is significantly influenced by the formidable challenges associated with grid connection and infrastructure. Securing access to existing electricity grids and navigating their capacity limitations presents a substantial barrier for newcomers. This is a critical consideration as the transition to renewable energy accelerates, and the demand for reliable grid integration grows.

Developing new transmission infrastructure is both expensive and time-consuming, often taking years to plan, permit, and construct. Established players, like Orsted, benefit from their existing grid connections and experience in navigating these complex processes. For instance, the cost of offshore grid connections and associated infrastructure can run into hundreds of millions of dollars per project, a significant upfront investment that deters many potential new entrants. The sheer scale of investment required to build new substations and transmission lines, coupled with lengthy regulatory approval timelines, favors those with established operational footprints and financial capacity.

- High Capital Expenditure: The cost of building new offshore transmission infrastructure can be prohibitive for new entrants, often exceeding $1 billion for large-scale projects.

- Lengthy Permitting Processes: Obtaining permits for new transmission lines can take 5-10 years, creating a significant lead time advantage for established companies.

- Grid Capacity Constraints: Many existing grids are not designed to handle the intermittent, high-capacity output of offshore wind farms, requiring substantial upgrades that new entrants may struggle to finance or implement quickly.

The threat of new entrants in the offshore wind market, where Ørsted operates, is considerably low due to immense capital requirements. For example, developing a single large-scale offshore wind farm can cost upwards of $5 billion, a figure that deters many potential competitors. This high barrier to entry is further amplified by the need for specialized technology and equipment, such as offshore installation vessels, which are scarce and expensive to procure or charter.

Access to specialized supply chains and skilled labor also presents a significant challenge for newcomers. Ørsted benefits from established relationships with turbine manufacturers and experienced engineering firms, securing preferential pricing and delivery. In 2024, the demand for these specialized resources remains high, making it difficult for new entrants to secure the necessary components and expertise without substantial upfront investment and proven project pipelines.

The regulatory landscape and lengthy permitting processes, often taking 5-10 years for offshore wind projects, create a substantial lead time advantage for established players like Ørsted. Navigating these complex procedures requires significant legal and technical expertise, further increasing the cost and risk for new entrants. This complexity, coupled with policy uncertainties, acts as a strong deterrent for potential new market participants.

| Barrier to Entry | Estimated Cost/Timeframe | Impact on New Entrants |

|---|---|---|

| Capital Expenditure for Project Development | $5 billion+ per large offshore wind farm | Prohibitive for most new firms |

| Specialized Equipment (e.g., Installation Vessels) | Chartering can cost $100,000 - $300,000 per day | High operational cost and limited availability |

| Permitting and Regulatory Approvals | 5-10 years | Significant lead time disadvantage |

| Skilled Workforce and Supply Chain Access | High demand, limited specialized talent | Difficulty in securing expertise and components |

Porter's Five Forces Analysis Data Sources

Our Orsted Porter's Five Forces analysis is built upon a robust foundation of data, including Orsted's annual reports, industry-specific market research from firms like BloombergNEF, and regulatory filings from relevant energy authorities.