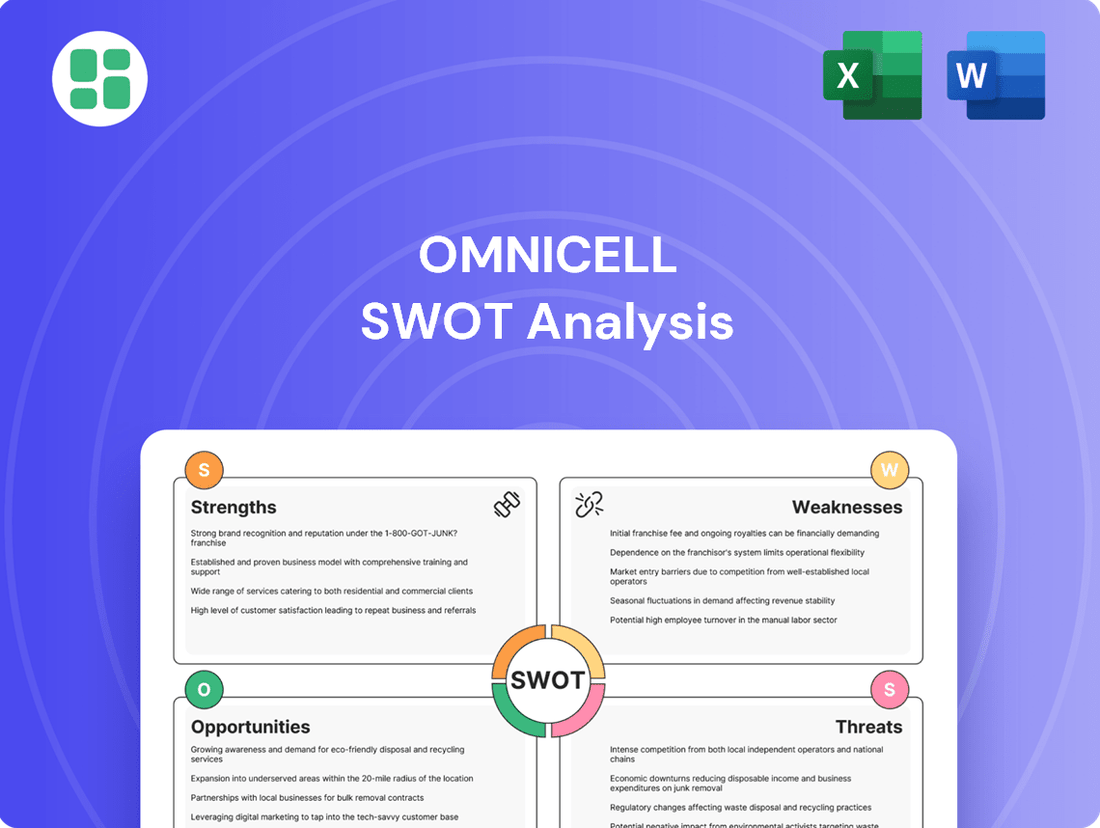

Omnicell SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Omnicell Bundle

Omnicell's innovative automated pharmacy solutions position it strongly in a growing healthcare market, but competitive pressures and evolving regulations present significant challenges. Our comprehensive SWOT analysis dives deep into these dynamics, revealing critical opportunities for expansion and potential threats to its market share.

Want the full story behind Omnicell's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Omnicell holds a strong position as a market leader in medication management, boasting a comprehensive suite of solutions that span automated dispensing, inventory control, and advanced data analytics. This extensive offering allows them to cater to a wide array of needs across hospitals and pharmacies, solidifying their market presence.

Their integrated approach streamlines pharmacy operations, directly contributing to enhanced patient care and improved medication safety. For instance, in 2023, Omnicell reported a 9.1% increase in revenue to $1.13 billion, underscoring the demand for their efficiency-driving technologies.

Omnicell's primary strength is its deep focus on automation and intelligence, a critical area as healthcare increasingly seeks efficiency and error reduction. This commitment is central to their strategy, driving innovation in a rapidly evolving sector.

Their vision of an Autonomous Pharmacy, a sophisticated integration of robotics, smart devices, intelligent software, and data analytics, places them as a leader in healthcare technology. This forward-thinking approach directly addresses the industry's need for smarter operational solutions.

By prioritizing automation and intelligence, Omnicell enables healthcare facilities to realize significant cost savings, boost labor efficiency, and gain tighter control over their supply chains. This value proposition is particularly compelling in the current economic climate, where optimizing resources is paramount.

Omnicell's strategic pivot to cloud-based solutions and tech-enabled services has solidified its recurring revenue base. This shift, particularly in their SaaS and Expert Services, including vital Specialty Pharmacy Services, is a major strength, providing a predictable income flow and fostering deeper customer engagement through continuous support and service enhancements.

Commitment to Innovation and R&D

Omnicell's dedication to innovation is a significant strength, underscored by substantial investments in research and development. The opening of their Austin Innovation Lab in May 2025 and the expansion of their Bangalore tech hub highlight this commitment, creating dedicated spaces for cutting-edge solution development.

These advanced facilities are specifically designed to accelerate Omnicell's cloud and artificial intelligence capabilities, ensuring their product pipeline remains robust and forward-thinking. This continuous R&D focus allows Omnicell to proactively address evolving customer needs and maintain a competitive edge in the healthcare technology market.

- Innovation Hubs: Austin Innovation Lab (opened May 2025) and expanded Bangalore tech hub are central to R&D efforts.

- Focus Areas: Development and testing of new solutions, with a strong emphasis on cloud and AI advancements.

- Market Relevance: Ensures offerings remain competitive and directly address emerging customer challenges in medication and supply management.

Addressing Critical Healthcare Needs

Omnicell's automated solutions directly tackle significant challenges within healthcare, including medication safety, operational efficiency, and persistent labor shortages. For instance, their automated dispensing systems are designed to reduce medication errors, a critical concern in patient care. In 2023, Omnicell reported that its customers achieved an average of 15% reduction in medication dispensing errors through the use of their technology.

By automating many of the repetitive tasks involved in medication management and supply chain operations, Omnicell empowers clinical staff. This allows nurses and pharmacists to dedicate more time to direct patient interaction and complex clinical decision-making, rather than being bogged down by manual processes. This focus on freeing up valuable human resources is particularly important given the ongoing healthcare workforce challenges.

The tangible benefits of Omnicell's offerings translate into improved patient outcomes and enhanced operational efficiency for healthcare providers. These improvements are not just theoretical; they represent real-world value. A study released in early 2024 indicated that hospitals utilizing Omnicell's inventory management systems saw an average of 10% decrease in stockouts of critical medications.

Key strengths in addressing critical healthcare needs include:

- Enhanced Medication Safety: Automation significantly reduces the potential for human error in medication dispensing.

- Improved Operational Efficiency: Streamlining tasks like inventory management and dispensing frees up clinical staff time.

- Addressing Labor Shortages: Automating routine functions helps mitigate the impact of staffing gaps in healthcare facilities.

- Direct Impact on Patient Care: By optimizing workflows, Omnicell enables clinicians to focus more on patient treatment and well-being.

Omnicell's core strengths lie in its market leadership in automated medication management, supported by a comprehensive product suite that enhances patient safety and operational efficiency. Their strategic shift towards cloud-based solutions and tech-enabled services, including Specialty Pharmacy Services, has built a robust recurring revenue model.

The company's commitment to innovation is evident through significant R&D investments, exemplified by the opening of its Austin Innovation Lab in May 2025 and expansion of its Bangalore tech hub, specifically targeting advancements in cloud and AI capabilities. These initiatives ensure Omnicell remains at the forefront of addressing evolving healthcare challenges.

Omnicell's solutions directly combat critical healthcare issues such as medication errors, operational inefficiencies, and labor shortages. For instance, their systems have been shown to reduce dispensing errors by an average of 15%, and inventory management improvements have led to a 10% decrease in stockouts of essential medications.

| Strength Area | Description | Supporting Data/Examples |

|---|---|---|

| Market Leadership | Dominant player in automated medication management systems. | 9.1% revenue increase to $1.13 billion in 2023. |

| Innovation & R&D | Focus on cloud, AI, and robotics for an "Autonomous Pharmacy" vision. | Austin Innovation Lab opened May 2025; Bangalore tech hub expansion. |

| Operational Efficiency Gains | Streamlines pharmacy workflows, reduces errors, and improves inventory control. | Average 15% reduction in medication dispensing errors; 10% decrease in medication stockouts. |

| Recurring Revenue Model | Strategic shift to cloud-based SaaS and tech-enabled services. | Increased customer engagement and predictable income flow. |

What is included in the product

Delivers a strategic overview of Omnicell’s internal and external business factors, highlighting its strengths in automated medication management and opportunities in expanding healthcare technology solutions, while also addressing weaknesses in integration complexity and threats from evolving cybersecurity landscapes.

Provides a clear, actionable framework for identifying and addressing operational inefficiencies.

Streamlines the process of pinpointing and mitigating risks within supply chain and inventory management.

Weaknesses

Omnicell's reliance on healthcare capital expenditure cycles is a notable weakness. The sale of their automated dispensing systems and hardware is heavily tied to hospital budgets, meaning economic downturns can directly impact purchasing decisions. For example, in periods of economic uncertainty, hospitals might postpone significant capital investments, leading to slower revenue growth for Omnicell.

Integrating Omnicell's advanced automated medication management systems with existing hospital IT infrastructure presents significant challenges. Many healthcare facilities still rely on legacy systems, making seamless interoperability a hurdle. This can lead to extended implementation timelines and increased costs for clients as they navigate data migration and workflow adjustments.

Omnicell operates in a highly competitive healthcare automation market, facing pressure from both established companies like Baxter's CareFusion and emerging players. This intense rivalry often translates into significant pricing pressure, potentially squeezing Omnicell's profit margins as it strives to remain competitive. For instance, the broader healthcare IT market saw acquisition activity in 2024, indicating strong interest and competition for innovative solutions.

Potential for Product Recalls or Technical Issues

Omnicell, as a provider of intricate automated systems and sophisticated software solutions for healthcare, navigates the inherent risk of product recalls or significant technical malfunctions. These potential disruptions can severely impact critical healthcare operations, leading to patient care delays and increased operational inefficiencies for their clients.

Such failures not only disrupt client operations but also pose a substantial threat to Omnicell's reputation, potentially eroding customer trust and market standing. The financial implications can be severe, encompassing costs for product remediation, managing legal liabilities, and compensating affected customers.

The company's reliance on technology means that even minor glitches can escalate into major issues. For instance, in the highly regulated healthcare sector, a system failure could directly impact medication dispensing accuracy, a critical patient safety concern. Ensuring unwavering reliability and providing prompt, effective technical support are therefore paramount to mitigating these weaknesses.

In 2023, the healthcare technology sector saw increased scrutiny on system reliability following several high-profile IT outages impacting patient data access and critical service delivery. While specific Omnicell recall data isn't publicly detailed for this period, the general industry trend underscores the sensitivity and high stakes involved.

Cybersecurity Risks and Data Privacy Concerns

Omnicell's reliance on data-driven solutions and cloud-based services, while innovative, exposes it to significant cybersecurity risks. Handling sensitive patient and operational data makes the company a prime target for cyber threats. A successful breach could lead to compromised patient privacy, service disruptions, and substantial financial penalties, as seen with the increasing frequency of attacks on the healthcare sector.

The healthcare industry experienced a notable rise in cyberattacks. For instance, in 2023, the U.S. Department of Health and Human Services reported that over 133 million individuals were affected by healthcare data breaches. This trend underscores the vulnerability of companies like Omnicell, which manage vast amounts of protected health information (PHI).

- Cybersecurity Threats: Omnicell's cloud infrastructure and patient data handling make it susceptible to ransomware, data breaches, and other cyber incidents.

- Impact of Breaches: Compromised patient privacy, service interruptions, and severe financial penalties are direct consequences of successful cyberattacks.

- Industry Vulnerability: The healthcare sector is a consistent target for cybercriminals, amplifying the inherent risks for companies operating within it.

Omnicell faces challenges in integrating its advanced systems with the often-outdated IT infrastructure of healthcare facilities. This interoperability hurdle can lead to longer implementation times and increased costs for clients as they adapt their existing workflows. The competitive landscape also exerts pricing pressure, potentially impacting Omnicell's profit margins as it works to stay competitive in the healthcare automation market.

| Weakness Category | Specific Challenge | Potential Impact |

|---|---|---|

| Integration Complexity | Interoperability with legacy IT systems | Extended implementation, increased client costs |

| Market Competition | Intense rivalry and pricing pressure | Squeezed profit margins |

| Reliance on Capital Expenditure | Tied to hospital budget cycles | Slower revenue growth during economic downturns |

| Technical Reliability | Risk of product recalls or malfunctions | Patient care disruptions, reputational damage, financial penalties |

| Cybersecurity Vulnerability | Handling sensitive patient data in cloud environments | Data breaches, privacy violations, financial penalties |

Preview the Actual Deliverable

Omnicell SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

Opportunities

The global healthcare automation market is booming, with projections indicating it could surpass $100 billion by 2033. This rapid expansion is fueled by a critical need for healthcare systems to cut costs, boost efficiency, and ultimately enhance patient care.

This growing market presents a significant opportunity for Omnicell to increase its market presence and roll out innovative new products. The demand for advanced technologies like artificial intelligence, robotics, and seamless system integration within pharmacy operations is particularly robust, aligning well with Omnicell's core offerings.

Omnicell has a prime opportunity to grow by entering international markets where advanced medication management systems are not yet widely adopted. For instance, many countries in Southeast Asia and Latin America are still developing their healthcare infrastructure, presenting a fertile ground for Omnicell’s solutions.

Beyond geographical expansion, Omnicell can target underserved healthcare segments like assisted living facilities and outpatient surgical centers. These areas often lack sophisticated medication dispensing and tracking, creating a demand that Omnicell's technology can fulfill.

Omnicell can leverage advancements in AI and machine learning to significantly boost its data analytics, offering more precise predictions for inventory, demand, and patient safety. This integration allows for enhanced workflow optimization and proactive identification of potential medication errors, solidifying Omnicell's market position.

Strategic Partnerships and Acquisitions

Omnicell can strategically expand its offerings and market reach through partnerships and acquisitions. This approach allows for quicker integration of new technologies and access to previously untapped markets, bolstering its competitive edge. For instance, acquiring companies specializing in telepharmacy or advanced analytics could significantly accelerate its 'Autonomous Pharmacy' strategy. In 2024, the healthcare technology sector saw substantial M&A activity, with companies focusing on digital transformation and efficiency gains, presenting a favorable environment for Omnicell to pursue such opportunities.

Key opportunities in this area include:

- Expanding into emerging healthcare segments: Targeting acquisitions in areas like remote patient monitoring or AI-driven diagnostics to complement existing pharmacy automation solutions.

- Accelerating technological innovation: Partnering with or acquiring innovative startups to gain immediate access to cutting-edge technologies in areas such as predictive analytics or blockchain for supply chain security.

- Strengthening market presence: Acquiring regional players or companies with established distribution channels to rapidly increase market share in new geographies or specific healthcare verticals.

Addressing Evolving Regulatory and Compliance Needs

Evolving healthcare regulations, especially concerning medication safety and data interoperability, present a significant opportunity for Omnicell. For instance, the increasing focus on supply chain integrity, as seen in initiatives like the Drug Supply Chain Security Act (DSCSA) in the US, drives demand for robust tracking and management systems that Omnicell provides. By aligning its offerings with these mandates, Omnicell can solidify its position as a critical partner for healthcare providers navigating complex compliance landscapes.

Omnicell can capitalize on these shifts by developing and marketing solutions that directly address emerging regulatory requirements. This proactive approach not only meets current demands but also anticipates future compliance needs, such as enhanced cybersecurity for patient data and stricter protocols for controlled substance management. The company's existing expertise in automated medication dispensing and inventory management systems positions it well to adapt and expand its product suite to meet these evolving standards.

- Increased Demand for Compliance: Stricter regulations around medication safety and data privacy, such as those reinforced by HIPAA and evolving state-level pharmacy laws, create a growing market for Omnicell's compliant solutions.

- Data Interoperability Mandates: Government initiatives pushing for greater healthcare data exchange and interoperability require systems that can seamlessly integrate, a capability Omnicell can enhance to meet these requirements.

- Risk Mitigation Value Proposition: By offering solutions that help healthcare providers mitigate compliance risks and avoid penalties, Omnicell strengthens its value proposition as an essential partner in operational integrity.

The expanding global healthcare automation market, projected to exceed $100 billion by 2033, offers Omnicell a significant avenue for growth. This trend is driven by healthcare systems' focus on cost reduction and efficiency improvements.

Omnicell can capitalize on its expertise in AI and machine learning to enhance its data analytics capabilities, leading to more accurate inventory management and proactive identification of potential medication errors.

Strategic partnerships and acquisitions, common in the $4.5 trillion global healthcare industry in 2024, present an opportunity for Omnicell to integrate new technologies and expand its market reach, particularly in areas like telepharmacy.

Evolving healthcare regulations, such as the US Drug Supply Chain Security Act (DSCSA), create demand for Omnicell's robust tracking and management systems, positioning the company as a key partner for compliance.

| Opportunity Area | Description | Market Impact Potential |

|---|---|---|

| Global Healthcare Automation Growth | Market projected to exceed $100 billion by 2033, driven by cost and efficiency needs. | Increased market share and product rollout. |

| Technological Advancements (AI/ML) | Leveraging AI for enhanced data analytics, predictive inventory, and error reduction. | Improved workflow optimization and patient safety. |

| Strategic Partnerships & Acquisitions | Acquiring companies in telepharmacy or advanced analytics to accelerate strategy. | Faster integration of new tech, access to new markets. |

| Regulatory Compliance | Meeting demands for supply chain integrity and data interoperability. | Strengthened value proposition as a compliance partner. |

Threats

The healthcare automation sector is experiencing a significant influx of players, both established companies and emerging tech firms, all competing for a larger slice of the market. This escalating competition puts pressure on Omnicell, potentially leading to price reductions and thinner profit margins. For instance, the global healthcare automation market was valued at approximately $20.5 billion in 2023 and is projected to grow, but this growth attracts more competitors.

This crowded landscape means Omnicell must work harder to stand out. Continuous innovation is key to maintaining its competitive edge and attracting new clients in a market that’s becoming increasingly mature. The challenge lies in differentiating its offerings and securing new business when many similar solutions are available.

The increasing prevalence and complexity of cyber threats, especially ransomware and data theft aimed at healthcare providers, represent a major risk for Omnicell. In 2023, the healthcare sector experienced a significant surge in cyberattacks, with ransomware incidents increasing by over 100% compared to the previous year, according to various cybersecurity reports.

Given that Omnicell's platforms handle sensitive patient information and are integral to hospital workflows, a successful breach could result in substantial financial penalties, severe damage to its reputation, and significant legal repercussions. Such an event would also directly impair their clients' capacity to provide essential patient care, highlighting the critical nature of these cybersecurity vulnerabilities.

Economic downturns pose a significant threat to Omnicell by potentially shrinking healthcare budgets. In such scenarios, hospitals and pharmacies might postpone or cancel capital expenditures on new automated dispensing systems and upgrades. For instance, if a major recession hits in late 2024 or 2025, Omnicell could see a slowdown in new system sales, impacting its revenue growth projections.

Rapid Technological Obsolescence and Disruption

The healthcare technology landscape is evolving at an unprecedented speed. Emerging technologies, particularly in artificial intelligence and automation, pose a significant threat of obsolescence to Omnicell's current offerings if the company doesn't maintain a robust innovation pipeline. For instance, advancements in AI-powered inventory management could render traditional automated dispensing systems less competitive, necessitating continuous adaptation.

Agile startups, unburdened by legacy systems, can quickly introduce disruptive solutions that challenge established players like Omnicell. This requires substantial and ongoing investment in research and development to ensure Omnicell remains at the forefront of technological innovation. The company's R&D expenditure in 2023 was approximately $165 million, highlighting the commitment needed to counter this threat.

- AI and Automation: Rapid advancements in AI could automate tasks currently handled by Omnicell's solutions, potentially reducing their perceived value.

- Cloud Computing: The shift towards cloud-based healthcare solutions may require Omnicell to accelerate its own cloud migration strategies to remain competitive.

- Startup Disruption: New, nimble competitors leveraging cutting-edge technologies could rapidly gain market share by offering more advanced or cost-effective alternatives.

- R&D Investment: Maintaining a competitive edge necessitates significant, sustained investment in R&D to anticipate and integrate emerging technologies.

Regulatory Changes and Compliance Burden

Evolving healthcare regulations, particularly concerning data privacy like HIPAA and updates from the Centers for Medicare & Medicaid Services (CMS) on medication management, present a significant challenge for Omnicell. These changes necessitate continuous adaptation, potentially requiring substantial investment in product and system updates to maintain compliance. Failure to adhere to these mandates could lead to severe financial penalties and operational interruptions, impacting Omnicell's market position and profitability.

The increasing complexity and frequency of regulatory shifts in healthcare, including supply chain mandates, create a substantial compliance burden. For instance, in 2024, the healthcare industry continued to see increased scrutiny on pharmaceutical supply chain integrity, with evolving track-and-trace requirements impacting technology providers. Adapting to these mandates often requires significant capital expenditure for software and hardware upgrades, directly affecting Omnicell's operational costs and product development timelines.

- Data Privacy: Ongoing HIPAA enforcement and potential new data security regulations in 2024-2025 could require substantial system re-engineering for Omnicell's solutions.

- Medication Management: CMS policy adjustments, such as those impacting drug reimbursement or dispensing practices, may necessitate swift product modifications.

- Supply Chain Mandates: Evolving serialization and traceability requirements, like DSCSA updates, demand continuous investment in Omnicell’s inventory management technologies.

- Compliance Costs: The financial impact of adapting to these regulations can be substantial, potentially diverting resources from innovation and growth initiatives.

Omnicell faces intense competition from both established players and agile startups, a trend expected to continue through 2025 as the healthcare automation market expands. This crowded field pressures pricing and profit margins, demanding constant innovation to maintain market share. The company's ability to differentiate its offerings in a maturing market is crucial for securing new business.

Cybersecurity threats, particularly ransomware, pose a significant risk, with the healthcare sector experiencing a sharp rise in attacks. A breach could lead to severe financial penalties, reputational damage, and operational disruptions for Omnicell and its clients. The company's investment in R&D, approximately $165 million in 2023, underscores the need to stay ahead of technological advancements and potential obsolescence from emerging AI solutions.

Economic downturns could impact Omnicell through reduced healthcare spending, potentially delaying capital investments in new systems. Furthermore, evolving healthcare regulations, such as data privacy laws and supply chain mandates, require continuous adaptation and investment, adding to compliance costs and potentially diverting resources from innovation.

SWOT Analysis Data Sources

This Omnicell SWOT analysis is built upon a robust foundation of data, including publicly available financial reports, comprehensive market research, and insights from industry experts and analysts to provide a well-rounded strategic perspective.