Omnicell Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Omnicell Bundle

Omnicell operates in a dynamic healthcare technology market, facing pressures from powerful buyers and the constant threat of new entrants. Understanding the intensity of these forces is crucial for strategic planning.

The complete report reveals the real forces shaping Omnicell’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Supplier concentration significantly impacts bargaining power. If a limited number of specialized manufacturers supply critical components for Omnicell's automated medication dispensing systems, these suppliers gain leverage. For instance, if only two or three firms globally produce a unique, high-precision robotic arm essential for Omnicell's advanced solutions, those suppliers can dictate terms and pricing more effectively.

The uniqueness of inputs significantly impacts the bargaining power of Omnicell's suppliers. When suppliers offer proprietary technology, specialized software algorithms, or unique hardware components essential for Omnicell's automated medication management systems, their leverage increases considerably. These specialized inputs make it difficult and costly for Omnicell to switch to alternative suppliers, as finding comparable substitutes would present substantial challenges.

The bargaining power of suppliers for Omnicell is significantly influenced by switching costs. If Omnicell faces substantial expenses or operational disruptions when changing to a new supplier, existing suppliers gain leverage. This leverage is amplified if a supplier's components are deeply integrated into Omnicell's systems, making a transition costly and time-consuming.

For instance, if switching suppliers necessitates redesigning Omnicell's automated pharmacy systems, re-certifying critical components with regulatory bodies, or undertaking complex software integration projects, the current suppliers hold considerable power. These high switching costs make Omnicell less inclined to seek alternative suppliers, thereby strengthening the position of incumbent providers.

Threat of Forward Integration by Suppliers

If suppliers possess the capability or strong incentive to integrate forward into Omnicell's operations and become direct competitors, their bargaining power significantly escalates. This potential for direct competition can compel Omnicell to concede to less favorable terms, such as higher prices or stricter contract conditions, simply to preserve the crucial supply relationship and mitigate the risk of facing its own suppliers as rivals in the market.

For instance, a key component manufacturer for Omnicell's automated dispensing systems might consider developing its own integrated solutions, thereby directly challenging Omnicell's market position. This threat forces Omnicell to carefully manage supplier relationships, potentially through long-term contracts or strategic partnerships, to deter such a move.

- Supplier Integration Threat: Suppliers may enter Omnicell's market by offering their own solutions, increasing supplier leverage.

- Competitive Pressure: This forward integration can force Omnicell to accept less favorable terms to maintain supply and avoid direct competition.

- Strategic Implications: Omnicell must monitor supplier capabilities and incentives for integration to proactively manage this threat.

Importance of Omnicell to Suppliers

The bargaining power of suppliers to Omnicell is influenced by how critical Omnicell's business is to their own revenue streams. If Omnicell constitutes a significant percentage of a supplier's sales, that supplier will likely be more amenable to Omnicell's terms, thereby reducing their bargaining power. For instance, if a key component manufacturer relies heavily on Omnicell for a substantial portion of its income, they have less leverage to dictate unfavorable pricing or terms.

Conversely, if Omnicell is a minor client for a supplier, that supplier holds considerably more power. They can afford to be less flexible, knowing that losing Omnicell's business would have a negligible impact on their overall financial health. This dynamic can lead to higher costs or less favorable contract conditions for Omnicell, as seen in industries where component sourcing is highly specialized and few alternative suppliers exist.

- Supplier Dependence: A supplier's reliance on Omnicell for revenue directly impacts their bargaining power. High dependence weakens supplier power.

- Market Concentration: If few suppliers can provide essential components or services to Omnicell, their collective bargaining power increases.

- Switching Costs: High costs for Omnicell to switch to a different supplier for critical inputs strengthen the existing supplier's position.

- Input Differentiation: Unique or highly specialized inputs provided by a supplier give that supplier greater leverage over Omnicell.

The bargaining power of Omnicell's suppliers is a key factor in its operational costs and profitability. When suppliers provide unique or highly specialized components, like advanced sensors or proprietary software modules for their automated dispensing systems, Omnicell faces higher switching costs. For example, if a critical component is sourced from a single specialized manufacturer, that supplier has significant leverage. In 2024, the healthcare technology sector continued to see supply chain pressures, particularly for specialized electronic components, which could amplify supplier power.

| Factor | Impact on Omnicell | Example Scenario |

|---|---|---|

| Supplier Concentration | High if few suppliers exist for critical components | A single provider for a unique robotic arm mechanism |

| Input Differentiation | Increases supplier leverage if inputs are specialized | Proprietary software for medication tracking |

| Switching Costs | High costs for Omnicell to change suppliers | Deep integration of components into existing systems |

| Forward Integration Threat | Suppliers may become competitors | Component maker offering its own dispensing solutions |

| Supplier Dependence on Omnicell | Low dependence strengthens supplier power | Omnicell represents a small portion of a supplier's revenue |

What is included in the product

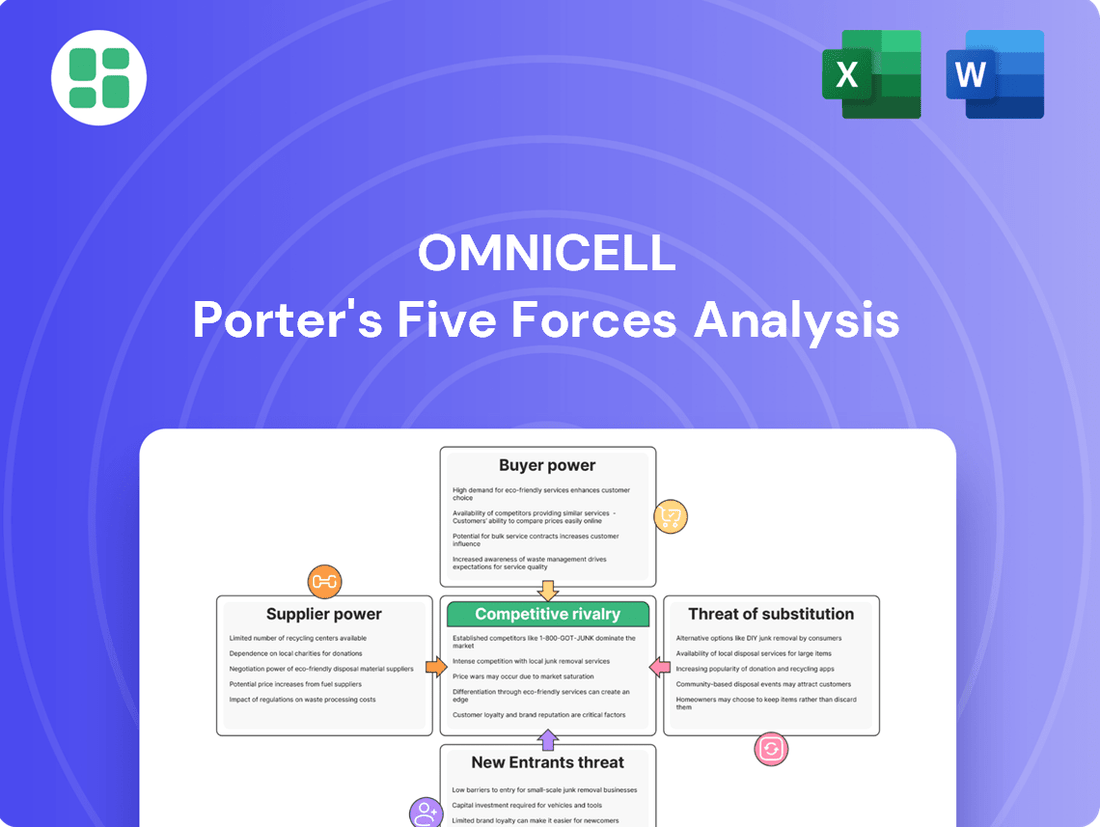

This analysis evaluates the five competitive forces impacting Omnicell's market, detailing the intensity of rivalry, threat of new entrants, bargaining power of buyers and suppliers, and the threat of substitutes.

Easily identify and quantify competitive threats, allowing for proactive strategy adjustments to alleviate market pressure.

Customers Bargaining Power

Omnicell's customer base is notably concentrated, with large healthcare systems and group purchasing organizations (GPOs) representing significant buyers. This concentration amplifies the bargaining power of these customers. For instance, a single major hospital network purchasing a substantial volume of Omnicell's automated medication management solutions can leverage its size to negotiate more favorable pricing and terms. In 2023, Omnicell reported that its largest customer accounted for approximately 10% of its total revenue, highlighting the influence that major clients wield.

The costs customers face when moving from Omnicell's automated pharmacy solutions to a competitor's are a key factor in their bargaining power. These switching costs can include the expense and effort of data migration, retraining staff on new systems, and integrating new hardware and software with existing hospital IT infrastructure. For instance, a hospital implementing Omnicell's supply chain management system might have significant investment in specialized hardware and extensive staff training, making a switch to a rival like Cardinal Health's Pyxis or McKesson's solutions a complex and costly undertaking.

Healthcare systems and pharmacies are acutely aware of their budgets, often facing tight financial constraints. This means they're very sensitive to price, a key factor in their purchasing decisions for medication management solutions.

Because of this price sensitivity, these buyers have considerable leverage. They'll scrutinize the return on investment (ROI) for any new technology and actively seek out the most economical options to manage their medication processes effectively.

For instance, a significant portion of hospital budgets is dedicated to pharmaceuticals and related technologies. Reports from 2024 indicate that hospitals continue to grapple with rising operational costs, making any capital expenditure, like that for advanced medication management systems, subject to intense cost-benefit analysis.

Availability of Alternative Solutions

The availability of alternative solutions significantly influences the bargaining power of Omnicell's customers. If clients can readily find similar automated medication management systems from other vendors, or even revert to less sophisticated manual processes, they gain leverage in negotiations. This is because Omnicell would need to remain competitive on price and service to retain these customers.

For instance, the healthcare automation market is seeing increased competition. Companies like McKesson, Cardinal Health, and Cerner offer integrated solutions that can provide some of the same functionalities as Omnicell's offerings. In 2024, many hospitals are evaluating their technology stacks, and the presence of these alternatives means they can more easily switch providers if Omnicell's pricing or terms are unfavorable.

- Customer Leverage: The existence of viable alternatives, whether from direct competitors or internal workarounds, directly enhances customer bargaining power.

- Competitive Landscape: In 2024, the healthcare automation sector features multiple players, including large distributors and EHR providers, offering competing solutions.

- Pricing Pressure: Omnicell faces pressure to maintain competitive pricing and service levels due to the ease with which customers can explore other options.

- Switching Costs: While switching costs exist, the availability of comparable technologies can mitigate these, further empowering customers.

Customers' Information Asymmetry

Customers, particularly large healthcare networks with sophisticated procurement departments, possess significant leverage due to their access to market intelligence. They understand prevailing prices, what competitors offer, and even Omnicell's underlying cost structures. This reduces the information gap, empowering them to negotiate more favorable terms.

This heightened customer knowledge directly diminishes Omnicell's capacity to unilaterally set conditions. For instance, major hospital systems often engage in competitive bidding processes where detailed cost analysis and alternative solution comparisons are standard. In 2024, the increasing complexity of healthcare IT procurement means that buyers are more informed than ever about the total cost of ownership, including integration, maintenance, and ongoing support for automated dispensing cabinets and related software solutions.

- Informed Buyers: Large hospital groups and integrated delivery networks (IDNs) employ dedicated procurement teams with expertise in healthcare technology, market pricing, and vendor capabilities.

- Data-Driven Negotiations: Customers leverage data analytics to compare Omnicell's offerings against competitors, focusing on total cost of ownership and return on investment.

- Reduced Information Asymmetry: The widespread availability of industry reports, peer reviews, and consultant analyses minimizes the information advantage previously held by suppliers like Omnicell.

- Price Sensitivity: Increased focus on cost containment within healthcare systems in 2024 makes customers more sensitive to pricing, further amplifying their bargaining power when armed with comprehensive market data.

Omnicell's customers, particularly large healthcare systems and group purchasing organizations (GPOs), wield considerable bargaining power. This is due to their significant purchasing volume, the presence of viable alternative solutions, and the increasing transparency in pricing and technology offerings within the healthcare automation market.

The cost and complexity of switching from Omnicell's systems to a competitor's are key considerations for customers. While these switching costs can be substantial, the availability of comparable technologies from players like McKesson and Cardinal Health in 2024 means that customers can more readily explore alternatives if Omnicell's pricing or terms are not competitive.

Customers are increasingly informed, leveraging market intelligence and data analytics to negotiate favorable terms. This heightened awareness, coupled with the inherent price sensitivity in healthcare budgets, amplifies their ability to press for better pricing and service from Omnicell.

| Factor | Impact on Omnicell | Customer Leverage Driver | 2024 Context |

|---|---|---|---|

| Customer Concentration | High dependency on large clients | Significant volume purchasing power | Largest customer accounted for ~10% of revenue in 2023 |

| Switching Costs | Moderate to high, depending on integration | Availability of comparable alternatives mitigates costs | Increased competition from McKesson, Cardinal Health |

| Price Sensitivity | Pressure on margins | Tight healthcare budgets and focus on ROI | Hospitals facing rising operational costs in 2024 |

| Information Availability | Reduced pricing power | Informed buyers with access to market data | Sophisticated procurement teams and industry reports |

Same Document Delivered

Omnicell Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details the competitive landscape for Omnicell, thoroughly analyzing the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, the threat of substitute products or services, and the intensity of rivalry among existing competitors. This comprehensive Porter's Five Forces analysis provides actionable insights into Omnicell's strategic positioning and potential challenges.

Rivalry Among Competitors

Omnicell faces significant competitive pressure from numerous well-established players in the automated dispensing and inventory management space. Companies like Cardinal Health, McKesson, and Cerner offer robust solutions that directly challenge Omnicell's market position. This intense rivalry often translates into aggressive pricing strategies as competitors vie for hospital and pharmacy contracts.

The strength of these competitors is evident in their broad product portfolios and extensive customer bases, often built over many years. For instance, McKesson, a major distributor and provider of healthcare services, has a vast reach that can be leveraged to bundle solutions and offer competitive pricing. This forces Omnicell to continually invest in innovation and marketing to differentiate its offerings and maintain market share.

The healthcare technology sector, where Omnicell operates, has experienced robust growth, which tends to temper direct competitive rivalry. For instance, the global healthcare IT market was projected to reach approximately $660 billion by 2025, indicating a strong expansionary environment. This growth allows companies like Omnicell to increase their revenue by capturing new customers and expanding their service offerings rather than solely by taking market share from competitors.

Omnicell's competitive rivalry is significantly shaped by its product and service differentiation. When Omnicell's automated medication management and pharmacy automation solutions offer distinct advantages, such as advanced analytics or seamless integration capabilities, it lessens the pressure from rivals. For instance, their cloud-based platform and focus on data-driven insights help set them apart from more basic dispensing systems.

The degree of differentiation directly influences price competition. If Omnicell's offerings are perceived as unique and superior, customers are less likely to switch based solely on price. This was evident in 2024 as healthcare systems continued to invest in technology that improves efficiency and patient safety, valuing innovation over cost alone. Omnicell’s commitment to continuous software updates and expanding its service portfolio reinforces this differentiation, making its solutions less commoditized.

Switching Costs for Customers Among Competitors

Low switching costs for customers in the healthcare automation market mean that providers like Omnicell face intense pressure from rivals. If a hospital can easily move its pharmacy automation systems from Omnicell to a competitor like BD or McKesson, it forces Omnicell to constantly offer competitive pricing and advanced features to keep its existing customers. This ease of transition directly fuels the competitive rivalry.

The ability for healthcare systems to switch vendors without significant disruption or financial penalty amplifies competition. For instance, if a new entrant offers a slightly better integration or a lower upfront cost, a hospital might be inclined to switch. This dynamic compels Omnicell to invest heavily in customer retention strategies and ongoing product development to maintain its market share.

Consider the impact on pricing. When switching is simple, price becomes a more significant factor in purchasing decisions. This can lead to price wars, squeezing profit margins for all players. For example, if Omnicell's average contract value is $500,000, and a competitor can offer a similar system for $450,000 with minimal hassle, the incentive to switch is substantial.

- Low Customer Switching Costs: Healthcare providers can often switch between pharmacy automation vendors with relative ease, increasing competitive pressure on companies like Omnicell.

- Impact on Innovation and Pricing: This ease of switching forces Omnicell and its competitors to continuously innovate and compete aggressively on price to retain and attract clients.

- Market Dynamics: In 2024, the healthcare technology sector saw continued consolidation and innovation, making vendor lock-in less prevalent and increasing the importance of customer satisfaction and value proposition.

High Exit Barriers

Omnicell operates in a market with high exit barriers, meaning it's difficult and costly for companies to leave. These barriers, like the specialized nature of healthcare automation technology and significant investments in proprietary software and hardware, can trap companies in the industry even when financial performance is weak. This situation can lead to prolonged periods of intense competition as firms struggle to recoup their investments, potentially resulting in overcapacity and downward pressure on prices.

For instance, the development and implementation of sophisticated automated medication dispensing systems require substantial upfront capital and specialized engineering expertise. Once these assets are in place, their resale value outside the healthcare sector is often limited, further increasing the cost of exiting. This forces companies like Omnicell to remain competitive, even in challenging economic conditions.

- Specialized Assets: Healthcare automation systems are highly specific, with limited alternative uses, increasing the cost of exit.

- Capital Investments: Significant financial outlays in R&D, manufacturing, and distribution infrastructure create a strong disincentive to leave.

- Long-Term Contracts: Commitments to healthcare providers for service and support can bind companies to the market for extended periods.

- Brand Reputation: Building a trusted brand in the sensitive healthcare sector requires sustained effort, making abandonment costly.

Omnicell faces intense rivalry from established players like Cardinal Health and McKesson, who leverage broad portfolios and extensive customer bases. This competition drives aggressive pricing and necessitates continuous innovation from Omnicell to maintain its market position. The growing healthcare IT market, projected to reach $660 billion by 2025, offers room for expansion but doesn't eliminate the need for differentiation.

Product differentiation, such as Omnicell's cloud-based platform and data analytics, is crucial for mitigating price-based competition. In 2024, healthcare systems prioritized efficiency and safety, valuing innovation over cost alone, which supported Omnicell's strategy. Low customer switching costs, however, mean Omnicell must constantly prove its value to retain clients, as evidenced by competitor offerings that can be adopted with minimal disruption.

High exit barriers, including specialized technology and significant capital investments, keep competitors engaged even during weaker performance periods. This can lead to prolonged competition and price pressures as firms aim to recoup their substantial investments in areas like automated medication dispensing systems.

| Competitor | Key Offerings | Market Presence |

|---|---|---|

| Cardinal Health | Pharmacy automation, supply chain solutions | Global, extensive hospital network |

| McKesson | Healthcare IT, pharmacy services, medical supplies | Major global player, broad service integration |

| Cerner (now Oracle Health) | Electronic Health Records (EHR), healthcare IT solutions | Dominant in EHR, expanding automation integration |

| BD (Becton, Dickinson and Company) | Medication management systems, diagnostics | Strong in hospital point-of-care solutions |

SSubstitutes Threaten

The primary substitute for Omnicell's automated medication management systems remains traditional manual processes. These methods, while requiring more labor and prone to errors, often present a lower initial capital investment, making them attractive to smaller healthcare facilities or those facing significant budget limitations.

For instance, many community pharmacies still rely on manual dispensing and inventory tracking, avoiding the upfront costs associated with Omnicell's technology. This cost sensitivity is a persistent threat, especially in a healthcare landscape where operational budgets are frequently scrutinized.

Customers may choose simpler, less integrated, or generic medication dispensing and inventory systems. These alternatives, while not as feature-rich as Omnicell's offerings, can still meet fundamental requirements. For instance, smaller clinics or pharmacies with less complex needs might find these more basic systems a cost-effective solution.

These lower-cost, less sophisticated systems act as substitutes, particularly for organizations that don't require the extensive advanced functionalities Omnicell provides. The market for these simpler systems is substantial, with many providers catering to budget-conscious healthcare entities.

Healthcare systems increasingly explore outsourcing pharmacy operations to specialized third-party providers. These providers manage the entire medication supply chain and dispensing process, offering a service that directly substitutes for the need for in-house automation solutions like those offered by Omnicell. This trend is driven by a desire to reduce capital expenditure and operational complexity.

For instance, in 2024, the global healthcare outsourcing market was projected to reach hundreds of billions of dollars, indicating a strong preference among providers for delegating non-core functions. This growing market for outsourced pharmacy services presents a significant threat to Omnicell’s product-based revenue streams, as it offers an alternative pathway for hospitals to achieve efficiency and cost savings in their pharmacy departments.

Evolving Healthcare Delivery Models

The healthcare landscape is rapidly shifting, with new delivery models emerging that could lessen the demand for Omnicell's traditional automation solutions. For instance, the rise of telehealth and at-home care means fewer patients might require in-hospital medication management systems. By 2024, the global telehealth market was projected to reach over $200 billion, indicating a significant move away from traditional brick-and-mortar healthcare settings.

These evolving models may necessitate different approaches to medication management, potentially acting as substitutes for Omnicell's current offerings. Community-based pharmacies and specialized clinics are increasingly handling medication dispensing and patient support, reducing the need for hospital-based automation. This trend is supported by data showing a steady increase in outpatient care services, which often bypass traditional hospital infrastructure.

- Telehealth Adoption: Increased use of virtual consultations and remote patient monitoring reduces the need for in-person hospital visits and associated automation.

- Home-Based Care Growth: A shift towards managing chronic conditions and post-operative care at home can decrease reliance on centralized hospital pharmacy automation.

- Community Pharmacy Expansion: Enhanced services offered by community pharmacies, such as medication synchronization and adherence programs, provide alternatives to hospital-based medication management.

Pharmacist-Led Manual Interventions

While automation like Omnicell's solutions offers significant advantages, the threat of substitutes in pharmacy operations remains a consideration. Highly skilled pharmacists and pharmacy technicians performing manual verification and dispensing can serve as a substitute, particularly in settings where the upfront cost or complexity of automation is prohibitive. This is especially true for smaller pharmacies or those with lower prescription volumes where manual processes might still be deemed more cost-effective.

The reliance on human expertise in manual processes presents a viable, albeit less efficient, alternative to automated dispensing systems. This human element is critical for tasks requiring nuanced clinical judgment that automation may not fully replicate. For instance, in 2024, community pharmacies still handle a substantial number of prescriptions manually, highlighting the continued relevance of skilled personnel as a substitute for technology.

- Manual processes offer a lower initial investment compared to automated systems.

- Skilled pharmacists and technicians provide a level of clinical judgment that automation may not fully replicate.

- Lower-volume or specialized pharmacy settings may find manual operations more practical.

The threat of substitutes for Omnicell's automated medication management systems is multifaceted, encompassing both traditional manual methods and evolving healthcare delivery models. While Omnicell offers advanced features, lower-cost, less integrated systems and manual processes remain viable alternatives, particularly for smaller or budget-constrained healthcare facilities. The growing trend of outsourcing pharmacy operations and the rise of telehealth and home-based care also present significant substitute threats, as these models can reduce the need for in-hospital automation.

| Substitute Type | Key Characteristics | Impact on Omnicell | Example/Data Point (2024) |

|---|---|---|---|

| Manual Processes | Lower initial cost, reliance on human labor and judgment | Persistent threat for smaller facilities, cost-sensitive markets | Many community pharmacies still rely on manual dispensing, handling a substantial number of prescriptions manually. |

| Simpler/Generic Systems | Basic functionality, lower price point | Appeals to organizations with less complex needs | Market exists for basic systems catering to budget-conscious healthcare entities. |

| Outsourced Pharmacy Operations | Service-based, reduces capital expenditure and operational complexity | Directly substitutes for in-house automation needs | Global healthcare outsourcing market projected to reach hundreds of billions of dollars. |

| Telehealth & Home Care | Shift in care delivery models, reduced need for in-hospital automation | Potentially decreases demand for traditional automation solutions | Global telehealth market projected to exceed $200 billion. |

Entrants Threaten

Developing and deploying advanced pharmacy automation and software solutions demands significant capital. Companies like Omnicell invest heavily in R&D, manufacturing capabilities, and building robust sales and support infrastructures. For instance, in 2023, Omnicell reported R&D expenses of $160.6 million, showcasing the financial commitment needed to stay competitive in this sector.

This high financial barrier effectively deters many potential new entrants. The sheer cost of developing sophisticated technology, establishing production facilities, and creating a widespread service network makes it challenging for smaller or less capitalized companies to enter the market and compete effectively against established players.

The sophisticated nature of automated dispensing systems, intelligent software, and data analytics demands significant technological expertise and continuous research and development. New entrants would need to invest heavily to match Omnicell's established technological capabilities and intellectual property, creating a substantial barrier.

For instance, in 2024, the global healthcare automation market, which includes dispensing systems, was projected to reach hundreds of billions of dollars, underscoring the massive investment required to compete. Developing and maintaining the cutting-edge software and hardware that Omnicell offers necessitates ongoing R&D spending, a significant hurdle for any newcomer.

The healthcare sector, where Omnicell operates, presents substantial regulatory hurdles for new entrants. Navigating complex compliance standards, certifications like FDA approvals for medical devices, and stringent data privacy regulations such as HIPAA, significantly elevates the cost and time required to bring a new product to market. For instance, the average time to gain FDA clearance for a new medical device can stretch to several years, a substantial barrier for smaller or less capitalized competitors.

Established Brand Reputation and Customer Relationships

Omnicell benefits from deeply entrenched relationships with healthcare systems, built over years of providing reliable medication management solutions. This established brand reputation for innovation and dependability makes it difficult for new entrants to gain traction.

New competitors face a significant hurdle in replicating Omnicell's established trust and customer loyalty. The critical nature of medication safety within healthcare settings means that providers are hesitant to switch from proven vendors, creating a strong barrier to entry.

- Brand Loyalty: Omnicell's long-standing presence fosters significant customer loyalty, a difficult asset for newcomers to replicate.

- Switching Costs: Healthcare systems incur substantial costs and operational disruptions when changing critical technology vendors, deterring new entrants.

- Regulatory Hurdles: Navigating the stringent regulatory landscape for medical devices and software adds another layer of complexity for potential new competitors.

- Market Penetration: Omnicell's widespread adoption across numerous hospitals means new entrants must displace an incumbent with a significant market share.

Access to Distribution Channels and Supply Chains

New entrants face significant hurdles in securing access to established distribution channels within the complex healthcare ecosystem. Building and maintaining reliable supply chains for specialized medical equipment, like those Omnicell offers, demands substantial investment and expertise.

Existing companies, such as Omnicell, have cultivated deep relationships and robust logistical networks over years, creating a formidable barrier. For instance, Omnicell's established partnerships with major hospital systems across the US and Europe provide immediate reach that newcomers struggle to match.

The threat of new entrants is therefore moderated by the difficulty and cost associated with replicating these established channels and supply chain efficiencies.

- Distribution Channel Access: Newcomers must overcome established relationships between existing players and healthcare providers.

- Supply Chain Complexity: Building a reliable supply chain for specialized medical devices requires significant capital and operational expertise.

- Existing Player Advantage: Companies like Omnicell benefit from years of network development and logistical infrastructure.

- Replication Difficulty: The time and investment needed to replicate these established advantages are substantial deterrents.

The threat of new entrants for Omnicell is generally low due to significant barriers. These include the substantial capital required for research, development, and manufacturing of advanced pharmacy automation, as evidenced by Omnicell's 2023 R&D expenses of $160.6 million. Furthermore, navigating complex healthcare regulations and achieving necessary certifications adds considerable time and cost, deterring potential competitors. The established brand loyalty and high switching costs for healthcare systems also create a formidable challenge for newcomers seeking to gain market share.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High investment in R&D, manufacturing, and infrastructure. | Deters less capitalized firms. |

| Technological Expertise | Need for sophisticated automation and software development. | Requires significant innovation and IP. |

| Regulatory Hurdles | Compliance with healthcare standards and certifications. | Increases cost and time to market. |

| Brand Loyalty & Switching Costs | Established trust and operational integration with healthcare systems. | Makes displacing incumbents difficult. |

| Distribution Channels | Access to established healthcare networks and supply chains. | Requires extensive relationship building. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Omnicell is built upon a robust foundation of data, including Omnicell's own annual reports and SEC filings, alongside industry-specific market research reports from firms like IBISWorld and Gartner. This blend of internal and external data provides a comprehensive view of the competitive landscape.