Omnicell Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Omnicell Bundle

Uncover the strategic positioning of Omnicell's product portfolio with our detailed BCG Matrix analysis. See which offerings are market leaders and which require careful consideration. Purchase the full report for a comprehensive breakdown and actionable insights to optimize your investment strategy.

Stars

Omnicell's XT Amplify innovation program, launched in April 2024, is showing strong momentum and is anticipated to significantly boost 2025 product bookings. This initiative focuses on enhancing their XT Series systems, such as the XTExtend, to optimize medication management and workflow efficiency.

These next-generation automated dispensing systems are engineered to deliver greater capacity and smoother operational processes for healthcare facilities. The program underscores Omnicell's commitment to advancing connected devices and intelligent automation in pharmacy operations.

Omnicell's OmniSphere platform, a cloud-native software workflow engine and data platform, was launched in December 2024. It's designed to integrate robotics and smart devices, paving the way for AI-driven insights in medication management.

This platform is a key component in Omnicell's strategy to leverage advanced AI for optimizing medication management processes. Its cloud-native architecture supports scalability and the seamless integration of new technologies, positioning Omnicell to capitalize on the growing demand for AI solutions in healthcare.

Omnicell's Specialty Pharmacy Services, significantly bolstered by the 2024 acquisition of Vizient's pharmacy business, are a key driver of the company's expanding Software-as-a-Service (SaaS) and Expert Service revenues. This strategic move positions Omnicell to capitalize on the escalating need for sophisticated management of complex and high-cost medications.

This segment represents a high-growth, high-margin opportunity for Omnicell. The increasing prevalence of specialty drugs, which often require specialized handling, administration, and patient support, creates a robust market demand for Omnicell's integrated solutions.

Robotics and Central Pharmacy Automation

Robotics and central pharmacy automation represent a burgeoning segment within the healthcare technology market, and Omnicell is a prominent player. Health systems are increasingly turning to these automated solutions to combat persistent labor shortages and enhance patient care quality.

Omnicell's Central Pharmacy Dispensing Service exemplifies this trend, demonstrating robust market adoption. This adoption underscores a strong demand for efficiency and improved clinical outcomes in pharmacy operations.

- Market Growth: The adoption of robotic pharmacy systems and central fill automation is a key growth driver in the pharmacy sector.

- Omnicell's Position: Omnicell is recognized as a leader in providing these advanced automation solutions.

- Driver for Adoption: Health systems are implementing solutions like Omnicell's Central Pharmacy Dispensing Service to address staffing challenges and boost clinical results.

- Market Validation: This widespread adoption signals strong market demand and validates Omnicell's leadership in this space.

RFID-Enabled Medication Tracking (e.g., MedTrack)

Omnicell's introduction of MedTrack, an RFID-enabled medication tracking system, in May 2025 signifies a strategic move into high-growth healthcare segments. This innovation directly targets the critical need for improved inventory accuracy and workflow efficiency within perioperative and clinic environments. The system aims to provide unparalleled visibility into medication stock, reducing errors and streamlining operations.

The market for healthcare automation solutions, including medication management, is experiencing robust growth. For instance, the global healthcare automation market was projected to reach over $50 billion by 2024, with medication management being a significant contributor. MedTrack's launch positions Omnicell to capture a share of this expanding market by offering a technologically advanced solution to persistent challenges in medication handling.

- Enhanced Accuracy: RFID technology significantly reduces manual counting errors, a common issue in medication inventory.

- Improved Visibility: Real-time tracking provides a clear overview of medication location and status, minimizing stockouts and waste.

- Workflow Efficiency: Automation of tracking processes frees up valuable staff time, allowing for greater focus on patient care.

- High-Growth Segment Focus: Targeting perioperative and clinic settings addresses areas with high patient throughput and complex medication needs.

Omnicell's XT Amplify program, launched in April 2024, is driving innovation in their XT Series systems, like the XTExtend, to enhance medication management. This focus on next-generation automated dispensing systems aims to increase capacity and streamline operations, aligning with the growing demand for intelligent automation in pharmacies.

The OmniSphere platform, released in December 2024, is a cloud-native workflow and data engine designed to integrate robotics and smart devices, enabling AI-driven insights. This platform is crucial for Omnicell's strategy to leverage AI for optimizing medication management, supporting scalability and new technology integration in the expanding AI healthcare market.

Omnicell's Specialty Pharmacy Services, strengthened by the 2024 acquisition of Vizient's pharmacy business, are a key driver of their SaaS and Expert Service revenue growth. This strategic move addresses the increasing need for managing complex, high-cost medications, representing a high-margin opportunity in a robust market driven by specialized drug handling requirements.

Robotics and central pharmacy automation are significant growth areas, with Omnicell being a key player. Health systems are adopting these solutions, such as Omnicell's Central Pharmacy Dispensing Service, to address labor shortages and improve patient care quality, validating Omnicell's leadership in this space.

The introduction of MedTrack, an RFID-enabled medication tracking system, in May 2025 targets high-growth segments like perioperative and clinic environments. This system enhances inventory accuracy and workflow efficiency, tapping into the expanding healthcare automation market, projected to exceed $50 billion by 2024.

| Product/Service | Launch/Acquisition Date | Key Innovation/Benefit | Market Impact/Growth Driver | Target Segment |

| XT Amplify Program | April 2024 | Enhanced XT Series systems (e.g., XTExtend) for improved capacity and workflow | Boosts 2025 product bookings; drives efficiency in medication management | Pharmacy Operations |

| OmniSphere Platform | December 2024 | Cloud-native workflow engine with AI integration capabilities | Enables AI-driven insights; supports scalability for advanced medication management solutions | Pharmacy Operations, Data Analytics |

| Specialty Pharmacy Services | Acquired Vizient's business in 2024 | Bolstered SaaS and Expert Services for complex medication management | High-growth, high-margin segment; addresses increasing demand for specialized drug handling | Specialty Pharmacy, Healthcare Services |

| Central Pharmacy Dispensing Service | Ongoing adoption | Robotic and central pharmacy automation | Addresses labor shortages; enhances patient care quality and operational efficiency | Central Pharmacy, Healthcare Systems |

| MedTrack (RFID) | May 2025 | RFID-enabled medication tracking for enhanced inventory accuracy | Targets high-growth segments; improves workflow efficiency and reduces errors | Perioperative, Clinic Environments |

What is included in the product

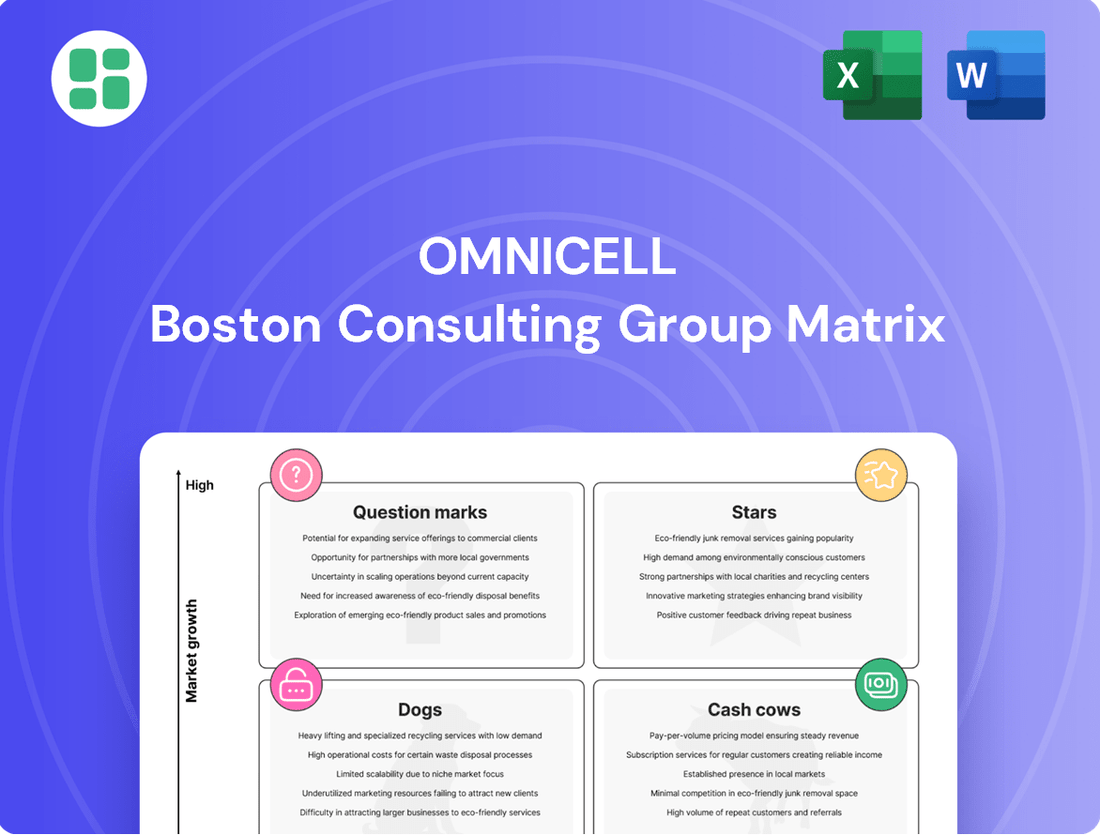

The Omnicell BCG Matrix analyzes its product portfolio, categorizing them as Stars, Cash Cows, Question Marks, and Dogs to guide strategic decisions.

Clear visual representation of pharmacy automation portfolio for strategic decision-making.

Cash Cows

Omnicell's XT Series automated dispensing systems are firmly positioned as cash cows within its product portfolio. Their widespread adoption across numerous healthcare facilities signifies a substantial installed base, translating into predictable and stable revenue streams from both new installations and ongoing upgrades.

These systems are critical to medication management in hospitals, making them a mature yet indispensable product category. For instance, Omnicell reported that in 2023, their automated dispensing cabinets, including the XT series, continued to be a primary driver of their revenue, contributing to a significant portion of their overall sales growth.

Omnicell's core inventory management software has long been a cornerstone of its business, holding a significant share in the healthcare market. This established presence translates into predictable and consistent revenue, characteristic of a cash cow.

These systems are vital for healthcare providers, helping them to minimize drug waste and control operational costs, which solidifies their value proposition. In 2023, Omnicell reported that its automated dispensing cabinets, a key component of its inventory management, were utilized by over 4,000 healthcare facilities globally, underscoring their widespread adoption and market leadership.

Technical services and consumables are a vital component of Omnicell's business, acting as a strong Cash Cow. These offerings, which include maintenance, software updates, and replacement parts for their automated medication management systems, generate a steady stream of recurring revenue. This predictability stems from the essential nature of these services for Omnicell's extensive installed hardware base.

While the growth rate for technical services and consumables might be modest, often in the low single digits, their value as a predictable cash flow generator is immense. For instance, in 2023, Omnicell reported that their Automation and Analytics segment, which heavily features these services, contributed significantly to their overall revenue, highlighting the stability they provide. This consistent income stream allows Omnicell to fund investments in other areas of their business.

Legacy Point-of-Care Automation

Legacy Point-of-Care Automation represents Omnicell's established connected devices. These older systems maintain a significant presence within hospitals, contributing a steady revenue stream despite facing some macroeconomic headwinds.

These products continue to fulfill critical roles in healthcare settings, offering reliable, though not rapidly expanding, income. For instance, in 2024, Omnicell reported that its automation solutions, which include these legacy devices, continued to be a core revenue driver, demonstrating their enduring value in the market.

- Installed Base: A substantial portion of Omnicell's installed base comprises these legacy point-of-care automation systems.

- Revenue Generation: They continue to generate consistent revenue, acting as a stable income source for the company.

- Market Position: While facing competition from newer technologies, their established presence ensures continued demand for essential functions.

- Growth: The growth rate for these legacy products is slower compared to newer innovations, aligning with their Cash Cow classification.

Medication Adherence Packaging Solutions

Omnicell's medication adherence packaging solutions are a prime example of a Cash Cow within the company's portfolio. These offerings are designed to streamline pharmacy operations and enhance patient safety, catering to a market that, while mature, continues to demand these essential services.

The steady demand for these solutions underpins Omnicell's significant market share in medication management. This consistent revenue stream, characteristic of a Cash Cow, provides a stable financial foundation for the company.

- Established Market Presence: Omnicell's adherence packaging has a long-standing reputation for reliability and efficiency in pharmacies.

- Consistent Revenue Generation: The mature market ensures a predictable and ongoing demand for these critical pharmacy tools.

- High Market Share: The company commands a substantial portion of the medication management market due to these established solutions.

- Operational Efficiency and Safety: These products directly contribute to improved pharmacy workflow and patient well-being, reinforcing their value proposition.

Omnicell's XT Series automated dispensing systems are firmly positioned as cash cows within its product portfolio. Their widespread adoption across numerous healthcare facilities signifies a substantial installed base, translating into predictable and stable revenue streams from both new installations and ongoing upgrades.

These systems are critical to medication management in hospitals, making them a mature yet indispensable product category. For instance, Omnicell reported that in 2023, their automated dispensing cabinets, including the XT series, continued to be a primary driver of their revenue, contributing to a significant portion of their overall sales growth.

Omnicell's core inventory management software has long been a cornerstone of its business, holding a significant share in the healthcare market. This established presence translates into predictable and consistent revenue, characteristic of a cash cow.

These systems are vital for healthcare providers, helping them to minimize drug waste and control operational costs, which solidifies their value proposition. In 2023, Omnicell reported that its automated dispensing cabinets, a key component of its inventory management, were utilized by over 4,000 healthcare facilities globally, underscoring their widespread adoption and market leadership.

Technical services and consumables are a vital component of Omnicell's business, acting as a strong Cash Cow. These offerings, which include maintenance, software updates, and replacement parts for their automated medication management systems, generate a steady stream of recurring revenue. This predictability stems from the essential nature of these services for Omnicell's extensive installed hardware base.

While the growth rate for technical services and consumables might be modest, often in the low single digits, their value as a predictable cash flow generator is immense. For instance, in 2023, Omnicell reported that their Automation and Analytics segment, which heavily features these services, contributed significantly to their overall revenue, highlighting the stability they provide. This consistent income stream allows Omnicell to fund investments in other areas of their business.

Legacy Point-of-Care Automation represents Omnicell's established connected devices. These older systems maintain a significant presence within hospitals, contributing a steady revenue stream despite facing some macroeconomic headwinds.

These products continue to fulfill critical roles in healthcare settings, offering reliable, though not rapidly expanding, income. For instance, in 2024, Omnicell reported that its automation solutions, which include these legacy devices, continued to be a core revenue driver, demonstrating their enduring value in the market.

- Installed Base: A substantial portion of Omnicell's installed base comprises these legacy point-of-care automation systems.

- Revenue Generation: They continue to generate consistent revenue, acting as a stable income source for the company.

- Market Position: While facing competition from newer technologies, their established presence ensures continued demand for essential functions.

- Growth: The growth rate for these legacy products is slower compared to newer innovations, aligning with their Cash Cow classification.

Omnicell's medication adherence packaging solutions are a prime example of a Cash Cow within the company's portfolio. These offerings are designed to streamline pharmacy operations and enhance patient safety, catering to a market that, while mature, continues to demand these essential services.

The steady demand for these solutions underpins Omnicell's significant market share in medication management. This consistent revenue stream, characteristic of a Cash Cow, provides a stable financial foundation for the company.

- Established Market Presence: Omnicell's adherence packaging has a long-standing reputation for reliability and efficiency in pharmacies.

- Consistent Revenue Generation: The mature market ensures a predictable and ongoing demand for these critical pharmacy tools.

- High Market Share: The company commands a substantial portion of the medication management market due to these established solutions.

- Operational Efficiency and Safety: These products directly contribute to improved pharmacy workflow and patient well-being, reinforcing their value proposition.

| Product Category | BCG Classification | Key Characteristics | 2023 Revenue Contribution (Est.) | 2024 Outlook |

|---|---|---|---|---|

| XT Series Automated Dispensing Systems | Cash Cow | Large installed base, predictable revenue, critical function | Significant portion of overall sales | Continued stable revenue |

| Technical Services & Consumables | Cash Cow | Recurring revenue, essential for hardware base | Significant contributor to Automation & Analytics segment | Modest but stable growth |

| Legacy Point-of-Care Automation | Cash Cow | Established presence, reliable income | Core revenue driver | Enduring market value |

| Medication Adherence Packaging | Cash Cow | Mature market, high market share, operational efficiency | Stable financial foundation | Consistent demand |

What You’re Viewing Is Included

Omnicell BCG Matrix

The Omnicell BCG Matrix you are previewing is the identical, fully-formatted document you will receive upon purchase. This means no watermarks, no demo content, and no surprises – just a professionally designed and analysis-ready strategic tool ready for immediate implementation in your business planning.

Dogs

Older, non-cloud-native Omnicell software versions, which demand substantial on-premise upkeep and are missing advanced functionalities, can be categorized as 'Dogs' in a BCG Matrix analysis. These products face dim growth prospects as clients increasingly adopt modern, cloud-based alternatives such as OmniSphere.

While these legacy systems still receive support, investment in their further development is minimal, signaling a potential future phase-out. For instance, as of early 2024, Omnicell's strategic focus has heavily shifted towards its cloud offerings, with a significant portion of R&D resources allocated to enhancing OmniSphere's capabilities and market penetration.

Discontinued niche hardware products, those with low market adoption, would be classified as Dogs within Omnicell's BCG Matrix. These items typically contribute very little revenue while demanding significant resources for maintenance and support, especially when their growth prospects are dim.

Omnicell's strategic direction prioritizes investing in and developing new, innovative solutions rather than propping up legacy hardware that isn't gaining traction. For instance, while specific discontinued product revenue figures aren't publicly itemized, the company's consistent investment in R&D for its cloud-based automation solutions signals a clear shift away from such underperforming segments.

Highly specialized, low-volume products, often found in niche markets, can be categorized as Dogs within the Omnicell BCG Matrix. These offerings might include advanced laboratory automation for very specific research applications that haven't gained widespread adoption. Their high development costs coupled with limited market penetration mean low market share and minimal growth potential.

For instance, a hypothetical Omnicell product targeting a highly specialized diagnostic procedure, with only a few hundred potential clients globally, would fit this description. If such a product, despite significant R&D investment, only captured a small fraction of this limited market, it would struggle to generate substantial revenue. By 2024, many companies are re-evaluating such specialized assets, with a focus on either divesting them or maintaining them at the lowest possible cost to free up resources for more promising ventures.

Product Lines Facing Intense Price Competition

Product lines facing intense price competition, potentially categorized as Dogs in Omnicell's BCG Matrix, are those where the company's offerings encounter significant pressure from lower-cost alternatives. This often results in squeezed profit margins and a gradual erosion of market share. For instance, in the healthcare technology sector, while advanced solutions command premiums, certain legacy or less differentiated products, such as basic inventory management software or older dispensing systems, might find themselves competing on price against newer, leaner entrants. The challenge here is that if the market isn't experiencing substantial growth and Omnicell's differentiation is minimal in these specific areas, these products may struggle to generate meaningful profits or expand their market presence.

Omnicell's strategic emphasis on continuous innovation is a direct countermeasure to prevent its product portfolio from falling into the Dog category. By investing in advanced analytics, AI-driven inventory optimization, and enhanced workflow automation, Omnicell aims to create offerings that are not easily replicated or undercut on price. For example, the company's focus on cloud-based solutions and integrated platforms aims to provide a higher value proposition that transcends simple price comparisons. This commitment to innovation is crucial for maintaining competitive advantage and ensuring that its products remain relevant and profitable in a dynamic market.

- Intense Price Pressure: Segments where Omnicell's offerings face significant competition from lower-cost alternatives, leading to shrinking margins.

- Market Dynamics: Products in slow-growing markets with minimal differentiation are particularly vulnerable to becoming Dogs.

- Innovation as a Shield: Omnicell's strategy to avoid commoditization relies heavily on continuous product innovation and value-added services.

Solutions with High Customization Requirements

Solutions with High Customization Requirements would be classified as Dogs in the Omnicell BCG Matrix. These offerings, while potentially meeting niche client demands, are characterized by significant upfront investment in tailoring each deployment. This inherent lack of scalability and broad market applicability restricts their growth potential. For instance, a custom-built pharmacy automation system for a single, large hospital network, requiring unique software integrations and hardware modifications, exemplifies this category.

The challenge with these 'Dog' solutions lies in their inefficient resource allocation. The high cost of customization directly impacts profitability, especially in a mature or low-growth market segment. Omnicell's strategic focus on scalable, outcomes-centric solutions means that such highly customized offerings are often divested or phased out to reallocate resources towards more promising areas. In 2024, companies heavily reliant on bespoke solutions often saw their margins squeezed due to the ongoing need for specialized support and development.

- Limited Scalability: Customization hinders replication and broad market penetration.

- High Support Costs: Each unique solution requires dedicated, specialized maintenance.

- Low Market Share: Niche appeal restricts the customer base.

- Resource Drain: Investment in customization detracts from more profitable ventures.

Products in the 'Dog' category for Omnicell are those with low market share and low growth potential. These are typically older technologies or highly specialized solutions that are no longer in high demand or face significant competition. For example, legacy on-premise software versions that require substantial maintenance and lack advanced features fall into this segment. As of early 2024, Omnicell's strategic shift towards cloud-native solutions like OmniSphere has led to a reduced focus on these older, less scalable offerings.

Discontinued hardware or niche products with minimal market adoption also represent 'Dogs'. These items may still require support resources but contribute little to revenue, especially as the market moves towards more integrated and advanced automation. Omnicell's investment in R&D for its cloud-based automation solutions, rather than legacy hardware, underscores this strategic direction. For instance, while specific financial data for discontinued products isn't detailed, the company's overall R&D spend, which was substantial in 2023 and projected to remain so in 2024, is heavily weighted towards future-oriented technologies.

Highly specialized, low-volume products, often catering to very specific market needs that haven't seen widespread adoption, are also classified as 'Dogs'. These may include advanced laboratory automation for niche research applications. The high cost of development and limited market penetration mean these products struggle to achieve significant market share or growth. By 2024, many technology companies, including those in healthcare automation, were reassessing such specialized assets, often opting to divest or minimize support to reallocate capital to more promising ventures.

Products facing intense price competition, where Omnicell's offerings are challenged by lower-cost alternatives, can also be categorized as 'Dogs'. This scenario often leads to squeezed profit margins and declining market share, particularly if the market itself is not experiencing substantial growth. Basic inventory management software or older dispensing systems might fall into this category. Omnicell's strategy to counter this involves continuous innovation, focusing on value-added services and advanced analytics to maintain differentiation and avoid commoditization.

| Product Segment | Market Share | Market Growth | Strategic Implication |

| Legacy On-Premise Software | Low | Low | Minimal investment, potential phase-out |

| Discontinued Niche Hardware | Very Low | Declining | Divestment or minimal support |

| Highly Specialized Low-Volume Products | Low | Low | Resource reallocation |

| Price-Sensitive Basic Systems | Moderate to Low | Low | Focus on innovation and value-added services |

Question Marks

While Omnicell's foundational data analytics are solidifying their position as Stars in the BCG matrix, their more advanced, AI-driven predictive intelligence solutions are still in the nascent stages of market penetration. These cutting-edge offerings, though holding significant future growth potential in healthcare technology, currently represent a smaller market share due to their novelty. For instance, the broader healthcare AI market, projected to reach $188 billion by 2030 according to some estimates, still sees predictive analytics for pharmacy operations as an emerging segment.

Omnicell's introduction of new perioperative and clinic solutions in May 2025, featuring RFID and advanced software, positions them to capture growth in these expanding care areas. These offerings, while innovative, represent new market entries, necessitating significant investment in marketing and sales to build traction and secure market share.

Omnicell's new Bangalore development center, operational since April 2025, is a strategic move to fast-track its cloud-based solutions. This center targets the development of a comprehensive suite of cloud-enabled hardware, software, and services, positioning Omnicell for future growth in a rapidly evolving healthcare technology landscape.

The Bangalore initiative represents a Question Mark within Omnicell's BCG matrix. While the commitment to cloud strategy signifies high growth potential, the specific cloud-based offerings emerging from this center are likely in their nascent stages of market adoption. This means they require significant investment to gain market share and achieve profitability, mirroring the characteristics of a Question Mark.

Blockchain-Enabled Supply Chain Traceability Solutions

Blockchain-enabled supply chain traceability solutions are emerging as a critical innovation in healthcare, addressing concerns around counterfeit drugs and inefficient inventory management. This nascent market is poised for substantial growth as more organizations recognize the benefits of secure, transparent, and immutable record-keeping.

Omnicell, a leader in pharmacy automation and supply chain control, is strategically positioned to leverage these advancements. While the current market share for blockchain solutions in healthcare supply chains is still relatively small, its future potential is immense, driven by increasing regulatory demands and the pursuit of operational excellence.

- Market Growth: The global blockchain in supply chain market was valued at approximately $1.2 billion in 2023 and is projected to reach over $13.5 billion by 2028, demonstrating a compound annual growth rate (CAGR) of over 60%.

- Healthcare Adoption: Within healthcare, early adoption is seen in pharmaceutical track-and-trace initiatives, aiming to comply with regulations like the Drug Supply Chain Security Act (DSCSA).

- Omnicell's Position: Omnicell's existing infrastructure for managing medications and supplies provides a strong foundation for integrating blockchain technology, potentially offering enhanced security and real-time visibility.

- Future Potential: As the technology matures and interoperability increases, blockchain will likely become a standard for ensuring the integrity and provenance of healthcare products from manufacturer to patient.

Advanced Tele-pharmacy and Remote Dispensing Solutions

Omnicell's advanced tele-pharmacy and remote dispensing solutions fall into the question mark category of the BCG matrix. This is due to the rapidly expanding telehealth market, which presents a high-growth opportunity. Omnicell's innovative offerings are designed to capture significant market share in this emerging sector.

These solutions are crucial as healthcare increasingly shifts towards remote patient monitoring and decentralized care models. The market for pharmacy automation, including tele-pharmacy, is projected to grow substantially. For instance, the global pharmacy automation market was valued at approximately $4.2 billion in 2023 and is expected to reach over $7.5 billion by 2028, indicating a strong compound annual growth rate.

- High Growth Market: The expansion of telehealth services is a significant driver for tele-pharmacy and remote dispensing.

- Emerging Sector: Omnicell is positioned to capture substantial share in this developing market.

- Strategic Investment: These solutions represent a strategic investment for Omnicell in a future-oriented healthcare segment.

- Competitive Landscape: While emerging, the competitive landscape is evolving, requiring continuous innovation from Omnicell.

Omnicell's investments in emerging technologies like blockchain for supply chain traceability represent Question Marks. While the market for blockchain in supply chains is experiencing rapid growth, with projections showing a significant increase from $1.2 billion in 2023 to over $13.5 billion by 2028, its adoption within healthcare, particularly for track-and-trace, is still in its early stages. Omnicell's existing infrastructure provides a solid base for integrating this technology, but substantial investment is needed to gain market traction and realize its full potential.

Similarly, Omnicell's advanced tele-pharmacy and remote dispensing solutions are classified as Question Marks. The telehealth market is expanding quickly, creating a high-growth opportunity for these services. The global pharmacy automation market, including tele-pharmacy, was valued at approximately $4.2 billion in 2023 and is expected to exceed $7.5 billion by 2028, highlighting the strategic importance of these investments for Omnicell to capture share in this developing sector.

| Category | Market Growth Potential | Current Market Share | Investment Required | Strategic Importance |

|---|---|---|---|---|

| Blockchain for Supply Chain | Very High (60%+ CAGR projected) | Low (Emerging in healthcare) | High | High (Security, Traceability) |

| Tele-pharmacy/Remote Dispensing | High (Driven by telehealth expansion) | Moderate (Growing adoption) | Moderate to High | High (Decentralized care) |

BCG Matrix Data Sources

Our Omnicell BCG Matrix leverages a robust blend of internal sales data, market share analysis, and industry growth projections to accurately position product portfolios.