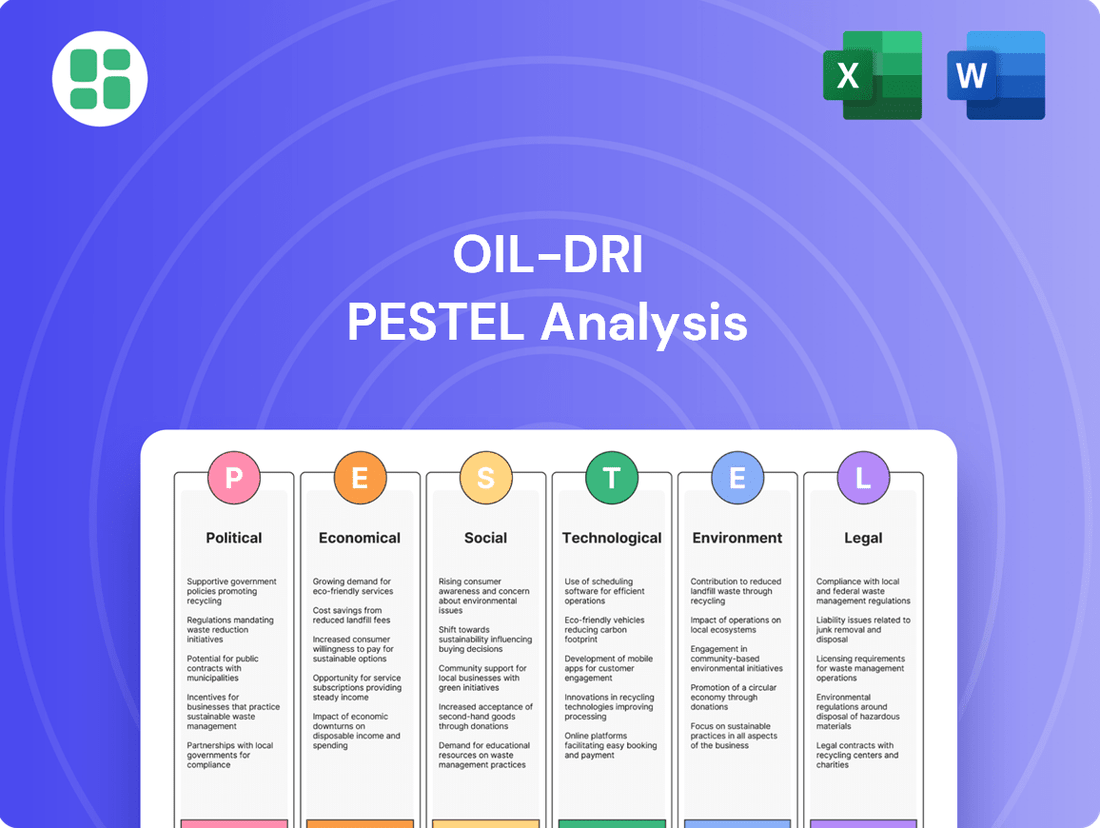

Oil-Dri PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Oil-Dri Bundle

Unlock the external forces shaping Oil-Dri's trajectory with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors driving change in their industry. Equip yourself with the strategic foresight needed to navigate these dynamics and identify opportunities. Download the full PESTLE analysis now for actionable intelligence.

Political factors

Changes in international trade policies, including the potential for new tariffs or shifts in existing trade agreements, could directly affect Oil-Dri's operational costs. For example, if the United States were to impose tariffs on minerals sourced from countries like China or Mexico, where Oil-Dri procures key raw materials, the cost of these inputs would likely increase. This could put pressure on Oil-Dri's margins, especially if these costs cannot be fully passed on to customers.

Furthermore, trade disputes or protectionist measures in key export markets could impact Oil-Dri's competitiveness. If countries where Oil-Dri sells its absorbent clay products, such as Canada or European nations, were to implement retaliatory tariffs or non-tariff barriers, it could reduce demand for Oil-Dri's goods or increase the cost of doing business abroad. This instability in global trade dynamics, a persistent theme in recent years, necessitates careful monitoring and strategic adaptation to maintain supply chain resilience and market access.

Government policies on land use and mineral extraction permits are critical for Oil-Dri, as they directly affect access to essential sorbent minerals like attapulgite and montmorillonite. For instance, in 2024, several states saw increased scrutiny on mining permits, potentially leading to longer approval times and higher compliance costs for companies operating in those regions. Changes in these regulations could significantly impact Oil-Dri's operational expenses and its ability to expand mining activities, influencing the overall cost structure of its raw material sourcing.

New environmental protection legislation, particularly concerning industrial emissions and waste management, presents a significant factor for Oil-Dri. Stricter regulations, such as those anticipated to evolve through 2024 and 2025, could necessitate substantial investments in advanced pollution control technologies and cleaner manufacturing processes. For instance, updated EPA guidelines on particulate matter emissions could directly impact operational costs.

Animal Health and Feed Additive Regulations

Regulations governing animal health products and feed additives, a significant market for Oil-Dri, directly impact product development and market entry. For instance, evolving standards for mycotoxin binders or gut health enhancers can necessitate costly reformulation or extensive testing to meet compliance requirements.

Changes in these rules, often spurred by heightened concerns over food safety and animal welfare, can create hurdles for market access. Companies like Oil-Dri must navigate these evolving landscapes, potentially requiring new certifications or adapting their product lines to align with updated guidelines.

- FDA's Center for Veterinary Medicine (CVM): Oversees approvals for animal drugs and feed additives in the United States, influencing product safety and efficacy standards.

- European Food Safety Authority (EFSA): Sets stringent regulations for feed additives in the EU, impacting market access for products not meeting their criteria.

- Global Harmonization Efforts: Initiatives like those by the World Organisation for Animal Health (OIE) aim to standardize regulations, though regional variations persist, creating complex compliance environments.

Political Stability in Key Markets

Political stability in key markets is a significant concern for Oil-Dri. Geopolitical shifts or government changes in major operating regions or sourcing countries can directly impact supply chains, alter consumer spending habits, and introduce new operational risks. For instance, political unrest in the Middle East, a crucial oil-producing region, could lead to supply disruptions and price volatility, affecting Oil-Dri's raw material costs.

Recent geopolitical events underscore these risks. The ongoing conflicts and political realignments in various regions throughout 2024 and into 2025 have highlighted the vulnerability of global supply chains. Oil-Dri must monitor these situations closely, as they can influence everything from energy prices to the stability of trade agreements, potentially impacting the company's operational efficiency and profitability.

- Geopolitical Instability: Disruptions in regions like the Eastern Mediterranean or parts of Africa could affect oil extraction and transportation, influencing crude oil prices, a key input for some Oil-Dri products.

- Policy Shifts: Changes in trade policies or environmental regulations enacted by governments in major markets, such as the United States or European Union nations, can create new compliance burdens or market access challenges for Oil-Dri.

- Nationalization Risks: While less common in developed markets, the potential for nationalization of resources or industries in certain emerging economies where Oil-Dri might source materials or operate presents a long-term risk that requires careful assessment.

Political factors significantly shape Oil-Dri's operating environment, influencing everything from raw material sourcing to market access. Government policies on mining permits and land use are critical, as seen in 2024 where increased scrutiny in several states led to longer approval times for mining operations, directly impacting Oil-Dri's access to essential minerals like attapulgite. New environmental protection legislation, anticipated to tighten through 2024-2025, could also necessitate costly investments in pollution control technologies, potentially increasing operational expenses for the company.

What is included in the product

This Oil-Dri PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting the business across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights and forward-looking perspectives to aid in strategic decision-making and capitalize on emerging opportunities.

The Oil-Dri PESTLE Analysis provides a structured framework to identify and mitigate external threats, acting as a pain point reliever by proactively addressing potential market disruptions.

Economic factors

Rising inflation in 2024 and into 2025 is a significant concern for Oil-Dri, as it directly escalates the costs associated with energy, labor, and key raw materials. The prices of essential components like attapulgite and montmorillonite, which are central to Oil-Dri's product lines, are particularly vulnerable to these inflationary pressures.

This upward trend in input costs poses a direct challenge to Oil-Dri's production expenses. If the company cannot effectively pass these increased costs onto its customers through higher prices, its profit margins could be squeezed considerably, impacting overall financial performance.

Consumer spending, especially on discretionary items such as premium cat litter, is a key driver for Oil-Dri's consumer segment. In 2024, consumer confidence remained a significant factor, with reports indicating a slight increase in retail sales for household goods, suggesting a stable, though cautious, spending environment. This trend is expected to continue into 2025, contingent on inflation and employment figures.

Disposable income directly influences the purchasing power for non-essential goods. As of late 2024, average disposable income levels have shown modest growth, supporting continued, albeit selective, consumer spending. However, any economic slowdown or recessionary pressures could curb demand for products like Oil-Dri's specialty pet care items, as consumers prioritize essential expenditures.

Global energy prices are a critical factor for Oil-Dri, directly influencing both production expenses and the cost of moving its bulk sorbent goods to customers. For instance, the average price of West Texas Intermediate (WTI) crude oil, a key benchmark, saw significant volatility in 2024, fluctuating between approximately $75 and $90 per barrel, impacting raw material and energy inputs.

Higher fuel costs, driven by these energy price swings, directly translate to increased logistics expenses. This can squeeze profit margins and make Oil-Dri's products less competitive in price-sensitive markets, especially given the weight and volume of their sorbent materials.

Exchange Rate Fluctuations

Oil-Dri's international presence means it's directly impacted by how currencies move. When the U.S. dollar strengthens, it makes Oil-Dri's products pricier for overseas buyers, potentially hurting sales. Conversely, a weaker dollar can make it more expensive to bring in raw materials sourced from other countries, squeezing profit margins.

These currency shifts also affect how much Oil-Dri's earnings from abroad are worth when converted back to U.S. dollars. For instance, in early 2024, the U.S. dollar showed strength against several major currencies, which could have presented challenges for U.S. exporters like Oil-Dri.

- Impact on Exports: A stronger USD makes Oil-Dri's products more expensive for international customers.

- Cost of Imports: A weaker USD increases the cost of raw materials purchased from abroad.

- Repatriated Earnings: Currency fluctuations affect the value of profits earned in foreign markets when converted back to USD.

- 2024 Dollar Strength: The U.S. dollar's appreciation against various currencies in early 2024 posed a headwind for U.S. exporters.

Global Economic Growth Trends

Global economic growth is a key driver for Oil-Dri's business, directly impacting the demand for its industrial absorbents and fluids purification products. As economies expand, industrial activity generally picks up, leading to greater manufacturing output and, consequently, a higher need for Oil-Dri's specialized sorbents used in various industrial processes.

The International Monetary Fund (IMF) projected global growth to be 3.2% in 2024, a slight slowdown from 2023's 3.3%, reflecting a more resilient-than-expected global economy. This continued expansion, albeit at a moderated pace, suggests sustained industrial activity that benefits companies like Oil-Dri.

- Projected Global GDP Growth: The IMF forecasts global GDP to grow by 3.2% in 2024.

- Industrial Output Correlation: Increased manufacturing and industrial production directly translate to higher demand for Oil-Dri's absorbent products.

- Emerging Market Influence: Growth in emerging markets often signifies increased industrialization and infrastructure development, creating new opportunities for Oil-Dri.

- Economic Slowdowns Impact: Conversely, economic downturns or recessions can lead to reduced industrial activity and dampened demand for Oil-Dri's offerings.

Inflationary pressures in 2024 and projected into 2025 continue to impact Oil-Dri, primarily by increasing the cost of essential raw materials like attapulgite and montmorillonite, as well as energy and labor. This directly affects production expenses, potentially squeezing profit margins if these higher costs cannot be fully passed on to consumers.

Consumer spending, particularly on non-essential items such as premium pet litter, remains a key factor. Modest growth in disposable income in late 2024 supports continued, though cautious, consumer spending, but any economic slowdown could reduce demand for these products.

Global energy prices, exemplified by West Texas Intermediate (WTI) crude oil fluctuating between $75-$90 per barrel in 2024, significantly influence Oil-Dri's production and logistics costs. Higher fuel prices increase transportation expenses, potentially impacting product competitiveness.

Currency exchange rates also play a crucial role; a stronger U.S. dollar made Oil-Dri's products more expensive for international buyers in early 2024, while a weaker dollar could increase the cost of imported raw materials.

Global economic growth, projected by the IMF at 3.2% for 2024, generally supports increased industrial activity and thus demand for Oil-Dri's industrial absorbents and fluids purification products.

| Economic Factor | 2024 Data/Projection | Impact on Oil-Dri |

|---|---|---|

| Inflation Rate | Elevated, with ongoing concerns for 2025 | Increased raw material, energy, and labor costs; potential margin compression |

| Consumer Spending Confidence | Slight increase in retail sales for household goods (late 2024) | Stable demand for consumer products, contingent on economic stability |

| Disposable Income Growth | Modest growth (late 2024) | Supports selective consumer spending; risk of reduced demand during economic downturns |

| WTI Crude Oil Price | $75-$90 per barrel (2024 volatility) | Directly impacts energy and raw material input costs; influences logistics expenses |

| Global GDP Growth | Projected 3.2% (IMF, 2024) | Sustained industrial activity supports demand for industrial products |

| U.S. Dollar Strength | Appreciated against major currencies (early 2024) | Makes exports more expensive; increases cost of imported raw materials |

Same Document Delivered

Oil-Dri PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This Oil-Dri PESTLE analysis provides a comprehensive overview of the external factors impacting the company. You'll gain insights into the political, economic, social, technological, legal, and environmental landscape, enabling informed strategic decisions.

Sociological factors

Pet ownership continues to surge globally, with a significant portion of households now including at least one pet. This rise is especially pronounced in developed nations, where an estimated 70% of households in the United States owned a pet in 2024, according to the American Pet Products Association (APPA). This growing pet population directly fuels demand for pet care products.

The humanization of pets is a powerful sociological driver, transforming pets into family members. This shift means owners are increasingly willing to spend on premium and specialized products, including advanced cat litter solutions that offer superior odor control and clumping. This trend directly benefits companies like Oil-Dri, which can capitalize by developing innovative, high-performance offerings.

Consumers are increasingly prioritizing natural and sustainable options, a trend impacting Oil-Dri's diverse product lines. This societal shift is evident as shoppers actively seek eco-friendly alternatives, influencing choices from pet care to industrial applications.

This growing preference for sustainability means Oil-Dri faces pressure to adopt more responsible mining and manufacturing processes. For instance, by 2024, over 60% of consumers surveyed by Nielsen indicated a willingness to pay more for products from sustainable brands, a statistic directly relevant to Oil-Dri's market positioning.

The increasing focus on animal health and nutrition is directly influencing the market for Oil-Dri's specialized products. As consumers and agricultural producers alike prioritize animal well-being and the safety of the food supply chain, there's a growing demand for innovative feed additives and health solutions. This trend is particularly evident in the global animal feed market, which was valued at approximately $470 billion in 2023 and is projected to grow, with a significant portion of this growth driven by the demand for enhanced animal nutrition and health products.

Industrial Safety and Hygiene Standards

Societal emphasis on workplace safety and hygiene directly impacts the demand for industrial absorbents like those offered by Oil-Dri. As organizations prioritize employee well-being and adhere to increasingly stringent regulations, the need for effective spill containment and cleanup solutions grows. This trend is evident in the expanding market for industrial safety products, which is projected to reach an estimated USD 75.2 billion globally by 2027, showing a compound annual growth rate of 6.5% from 2023, according to market research firms.

Stricter industry standards, particularly in sectors like manufacturing and oil and gas, necessitate the use of high-quality absorbents to prevent accidents and maintain compliance. For instance, the Occupational Safety and Health Administration (OSHA) in the United States enforces regulations that require employers to provide a safe working environment, which includes managing hazardous materials and preventing slips, trips, and falls. Oil-Dri's commitment to developing advanced absorbent solutions aligns with this societal push for enhanced industrial hygiene and safety.

- Increased Demand for Safety: Growing societal awareness and regulatory pressure for safer workplaces directly boost the market for industrial absorbents.

- Regulatory Compliance: Stricter safety standards, like those from OSHA, drive the adoption of effective spill management products, benefiting companies like Oil-Dri.

- Employee Well-being Focus: A greater emphasis on employee health and safety encourages businesses to invest in solutions that minimize workplace hazards.

- Market Growth: The global market for industrial safety products, including absorbents, is experiencing robust growth, indicating a strong demand driven by these sociological factors.

Demographic Shifts and Urbanization

Urbanization trends are reshaping consumer needs, potentially boosting demand for Oil-Dri's cat litter products as more people move into apartments and smaller homes. This shift favors more compact and efficient pet care solutions. For instance, by 2025, it's projected that over 67% of the world's population will live in urban areas, a significant increase from 57% in 2021, according to UN data.

Demographic changes also play a crucial role in shaping Oil-Dri's labor pool and consumer base. An aging population in developed nations could impact labor availability, while growing middle classes in emerging markets present new consumer opportunities. In the US, the median age has been steadily rising, reaching 38.9 years in 2022, indicating a maturing workforce and consumer base.

- Urban Population Growth: Global urban population projected to reach 67% by 2025, impacting demand for space-saving pet products.

- Aging Workforce: Developed nations face potential labor shortages due to an increasing median age.

- Emerging Market Consumers: Growing middle classes in developing regions offer new avenues for product sales.

- Pet Ownership Trends: Urban living may correlate with increased ownership of smaller pets, driving demand for specialized products.

The increasing humanization of pets is a significant sociological factor, leading owners to treat their animals as family members and spend more on premium products like advanced cat litter. This trend is supported by data showing a substantial portion of households owning pets, with the US seeing around 70% pet ownership in 2024. Consumers are also prioritizing natural and sustainable options, with over 60% of surveyed consumers in 2024 willing to pay more for sustainable brands, directly influencing Oil-Dri's product development and sourcing strategies.

Societal emphasis on workplace safety and hygiene is driving demand for industrial absorbents, as companies invest in solutions to prevent accidents and comply with regulations. This is reflected in the industrial safety products market, projected to reach USD 75.2 billion by 2027. Furthermore, urbanization is reshaping consumer needs, with a projected 67% global urban population by 2025, potentially increasing demand for compact pet care solutions like cat litter.

| Sociological Factor | Impact on Oil-Dri | Supporting Data/Trend |

|---|---|---|

| Pet Humanization | Increased demand for premium pet care products | 70% US households owned pets in 2024 (APPA) |

| Sustainability Preference | Pressure for eco-friendly practices and products | 60%+ consumers willing to pay more for sustainable brands (Nielsen, 2024) |

| Workplace Safety Focus | Growth in demand for industrial absorbents | Industrial safety market to reach USD 75.2B by 2027 |

| Urbanization | Potential rise in demand for compact pet solutions | 67% global population to live in urban areas by 2025 (UN) |

Technological factors

Innovations in mineral processing are directly impacting Oil-Dri's operational efficiency and product quality. For instance, advancements in purification and activation techniques for attapulgite and montmorillonite, the company's core materials, can lead to more effective sorbent products. This could mean better absorption rates or improved performance in specific applications, ultimately boosting Oil-Dri's competitive edge.

The drive for cost reduction is also a significant factor, with new processing technologies aiming to minimize energy consumption and waste. For example, research into more efficient granulation methods for sorbents could lower production costs, a crucial element in maintaining profitability in a market sensitive to input expenses. Oil-Dri's investment in R&D for these areas is key to leveraging these technological shifts.

Technological progress is a major driver for Oil-Dri. Continuous advancements enable the company to create better sorbent products. Think about cat litter with improved absorbency or industrial absorbents that work more efficiently. This innovation is key for staying ahead in markets like pet care, industrial cleanup, and even water purification.

For instance, in 2023, Oil-Dri invested $20.1 million in research and development, a significant portion of which fuels product innovation. This investment is directly tied to developing next-generation sorbent technologies that offer enhanced performance, such as superior odor encapsulation in their cat litter brands or more effective contaminant removal in their industrial filtration products.

The increasing integration of automation and advanced manufacturing technologies presents a significant opportunity for Oil-Dri to streamline its production. By investing in smart factory solutions and robotics, the company can expect to see a tangible boost in output and a reduction in labor expenses. This technological shift is projected to enhance overall operational efficiency and, consequently, improve profitability margins.

Digital Transformation and Data Analytics

Oil-Dri's ability to leverage digital transformation and data analytics is crucial for staying competitive. By harnessing these technologies, the company can gain deeper insights into evolving market trends, refine its supply chain for greater efficiency, and better understand customer preferences across its various product lines. For instance, in 2024, companies across the industrial sector reported an average of a 15% increase in operational efficiency through the implementation of advanced data analytics platforms.

This data-driven approach empowers Oil-Dri to make more strategic decisions, implement predictive maintenance to reduce downtime, and develop more personalized product offerings. The adoption of AI and machine learning in industrial operations, as seen in a recent survey of manufacturing firms, indicated a 10% reduction in unexpected equipment failures by utilizing predictive analytics.

- Enhanced Market Insights: Data analytics can identify emerging consumer demands for sustainable or specialized absorbent products.

- Supply Chain Optimization: Real-time data can improve logistics, inventory management, and reduce transportation costs.

- Predictive Maintenance: Utilizing sensor data allows for proactive servicing of manufacturing equipment, minimizing costly breakdowns.

- Customer Personalization: Analyzing purchasing patterns enables tailored product recommendations and marketing efforts.

Biotechnology and Green Chemistry Integration

Oil-Dri is exploring how biotechnology and green chemistry can make its sorbent products more sustainable. This means looking at things like using plant-based materials as additives to improve how well the sorbents work, or developing new ways to clean up waste by using sorbent minerals in innovative processes.

The company is investigating bio-based additives that could boost performance, potentially reducing the amount of material needed. For example, advancements in bio-polymers could offer enhanced absorption capabilities, aligning with the growing market demand for eco-friendly industrial solutions. The global green chemistry market was valued at approximately $4.5 billion in 2023 and is projected to grow significantly in the coming years.

- Bio-based Additives: Development of sorbents using renewable resources to improve performance and reduce environmental impact.

- Waste Treatment Innovations: Utilizing sorbent minerals in novel biological or chemical processes for waste remediation.

- Market Demand: Increasing consumer and regulatory pressure for sustainable and environmentally responsible products.

- R&D Investment: Companies in the specialty chemicals sector are increasing R&D spending on bio-based and green chemistry solutions, with some allocating over 15% of their revenue to innovation in these areas.

Technological advancements are reshaping Oil-Dri's product development and operational efficiency. Innovations in mineral processing, such as enhanced purification techniques for attapulgite and montmorillonite, directly improve sorbent product performance, offering a competitive edge. The company's 2023 R&D investment of $20.1 million fuels this innovation, focusing on next-generation sorbents with superior odor control and contaminant removal capabilities.

Automation and data analytics are key to Oil-Dri's strategy, promising increased output and reduced labor costs through smart factory solutions. Companies in the industrial sector saw an average 15% efficiency boost from data analytics in 2024, a trend Oil-Dri aims to replicate. Predictive maintenance, powered by AI, can reduce unexpected equipment failures by up to 10%, minimizing downtime and enhancing profitability.

The integration of biotechnology and green chemistry is also a significant technological factor, driving the development of sustainable sorbent products. Oil-Dri is exploring bio-based additives to boost performance and reduce material usage, tapping into a global green chemistry market valued at approximately $4.5 billion in 2023. This aligns with increasing market demand for eco-friendly solutions.

| Technological Factor | Impact on Oil-Dri | Supporting Data/Trend |

| Mineral Processing Innovations | Improved product performance (e.g., absorbency, efficiency) | R&D investment of $20.1 million in 2023 for next-gen sorbents. |

| Automation & Data Analytics | Increased operational efficiency, reduced costs | 15% average efficiency increase reported by industrial firms using data analytics (2024); 10% reduction in equipment failures via predictive maintenance. |

| Biotechnology & Green Chemistry | Development of sustainable products, market differentiation | Global green chemistry market valued at ~$4.5 billion (2023); focus on bio-based additives for enhanced performance. |

Legal factors

Oil-Dri faces stringent product liability and safety regulations, particularly for its offerings in animal health, nutrition, and food-contact applications. These laws mandate rigorous quality control to prevent harm, with non-compliance risking costly recalls and legal battles. For instance, in 2024, the FDA continued to emphasize stringent oversight of pet food ingredients, a key area for Oil-Dri's absorbent minerals.

Protecting Oil-Dri's unique mineral processing methods, product recipes, and brand identity through patents and trademarks is vital for keeping its edge in the market. This legal framework helps prevent competitors from copying their innovations.

Legal disputes over intellectual property infringement pose a significant risk, potentially affecting Oil-Dri's competitive position and its drive to innovate. For instance, a successful infringement claim could lead to costly litigation and damage its reputation.

Oil-Dri Corporation must navigate a complex web of labor laws and employment regulations. Compliance with evolving standards, such as minimum wage adjustments and occupational safety mandates, directly influences operational expenditures and human resource strategies. For instance, the U.S. federal minimum wage has remained at $7.25 per hour since 2009, but many states and cities have enacted higher rates, impacting payroll costs for Oil-Dri's U.S. workforce.

Changes in regulations concerning working conditions, overtime pay, and employee benefits can necessitate significant adjustments to staffing models and training programs. These shifts can also influence employee relations and the overall attractiveness of employment at Oil-Dri. For example, the Occupational Safety and Health Administration (OSHA) continuously updates its guidelines, requiring ongoing investment in safety equipment and protocols to prevent workplace injuries, which is crucial in an industrial setting like Oil-Dri's operations.

International Trade Laws and Compliance

Operating on a global scale, Oil-Dri must navigate a complex landscape of international trade laws. This includes adhering to import and export regulations, understanding various customs duties, and complying with economic sanctions. For instance, in 2024, the World Trade Organization (WTO) continued to emphasize the importance of predictable and transparent trade policies to facilitate global commerce.

Failure to comply with these international trade laws can lead to severe consequences for Oil-Dri. These can include substantial financial penalties, the imposition of trade restrictions that limit market access, and significant disruptions to its global supply chains. Such disruptions can impact product availability and increase operational costs.

- Import/Export Regulations: Oil-Dri must ensure all shipments meet the specific documentation and licensing requirements of both originating and destination countries.

- Customs Duties and Tariffs: Understanding and correctly calculating duties is crucial for accurate pricing and avoiding unexpected costs. For example, tariffs on certain industrial minerals can fluctuate based on geopolitical agreements.

- Sanctions Compliance: Adhering to international sanctions, such as those imposed by the United Nations or individual countries, is critical to avoid legal repercussions and reputational damage.

- Trade Agreements: Leveraging favorable trade agreements can reduce costs and streamline operations, but requires careful monitoring of their terms and any updates.

Competition and Antitrust Laws

Oil-Dri Corporation must navigate a landscape governed by competition and antitrust laws. These regulations are in place to prevent monopolistic practices and ensure a level playing field for all market participants. For instance, the Federal Trade Commission (FTC) and the Department of Justice (DOJ) actively scrutinize mergers and acquisitions to prevent undue market concentration. In 2024, the FTC continued its robust enforcement, reviewing numerous transactions across various industries, signaling a heightened focus on maintaining competitive markets.

Any strategic moves by Oil-Dri, such as potential mergers or significant market expansions, require thorough legal review to guarantee compliance with these antitrust statutes. Failure to adhere could result in substantial fines, divestitures, or other legal penalties. For example, in 2023, a major acquisition in the agricultural sector was blocked by regulators due to antitrust concerns, highlighting the critical nature of this legal factor for companies like Oil-Dri.

- Antitrust Enforcement: Regulatory bodies like the FTC and DOJ actively monitor market activities for anti-competitive behavior.

- Merger Scrutiny: Acquisitions and mergers must be evaluated for their impact on market competition to avoid legal challenges.

- Compliance Risks: Non-compliance can lead to significant financial penalties and operational disruptions.

Oil-Dri's operations are subject to a variety of legal and regulatory frameworks that impact its business. These include product liability laws, intellectual property rights, labor regulations, international trade compliance, and antitrust statutes. Navigating these legal complexities is crucial for maintaining operational integrity and market competitiveness.

In 2024, regulatory bodies continued to focus on consumer safety and fair competition, influencing how companies like Oil-Dri manage their product development and market strategies. For instance, the U.S. Food and Drug Administration (FDA) maintains strict oversight on ingredients used in food and animal feed, areas where Oil-Dri's absorbent minerals are applied.

The company's commitment to complying with labor laws, such as those concerning minimum wage and workplace safety, directly affects its operational costs and human resource management. For example, varying state minimum wage laws in the U.S. can create different payroll burdens across its facilities.

Furthermore, Oil-Dri's global presence necessitates adherence to international trade laws, including import/export regulations and sanctions. The World Trade Organization's ongoing efforts in 2024 to promote transparent trade policies underscore the importance of compliance for companies engaged in cross-border commerce.

Environmental factors

Concerns about the finite nature of key minerals, such as attapulgite and montmorillonite, are driving a need for Oil-Dri to embrace sustainable mining. This means being more mindful about how land is managed, how efficiently resources are extracted, and actively working to lessen the environmental footprint. The goal is to make sure these valuable resources are available for the long haul.

In 2024, the global mining industry is increasingly focused on ESG (Environmental, Social, and Governance) factors, with resource stewardship being a critical component. Companies are investing in technologies that improve extraction efficiency, aiming to reduce waste and energy consumption. For Oil-Dri, this translates to exploring advanced geological surveying and optimized mining techniques to maximize yield from existing reserves.

Oil-Dri faces stringent regulations concerning its industrial waste, necessitating substantial investments in waste treatment and eco-friendly disposal. For instance, in 2024, the U.S. Environmental Protection Agency (EPA) continued to enforce strict rules under the Resource Conservation and Recovery Act (RCRA) for managing hazardous by-products from manufacturing. These regulations directly impact operational costs, requiring Oil-Dri to allocate capital for advanced waste processing technologies and secure compliant disposal sites.

Governments worldwide are intensifying efforts to combat climate change, leading to stricter regulations on carbon emissions. For Oil-Dri, this translates to increased scrutiny of its operational footprint and potential financial implications from carbon pricing mechanisms or emission caps. For instance, the European Union's Emissions Trading System (ETS) continues to evolve, with allowances becoming more expensive, impacting industries with significant carbon output.

The company is likely facing growing pressure from investors and consumers to demonstrate a commitment to sustainability. This could involve investing in cleaner technologies and exploring renewable energy sources for its facilities. In 2024, many industrial companies are setting ambitious net-zero targets, often requiring substantial capital allocation towards decarbonization efforts.

Water Usage and Pollution Control

Water is a crucial element in Oil-Dri's mining and processing operations, making stringent regulations on water usage and wastewater discharge paramount. The company must prioritize robust water management strategies to ensure resource conservation and minimize environmental impact, especially given increasing scrutiny on industrial water footprints.

In 2023, the U.S. Environmental Protection Agency (EPA) continued to emphasize water quality standards, with ongoing efforts to update regulations for industrial wastewater. For instance, the EPA's proposed Effluent Limitation Guidelines (ELGs) for the mining sector, which could impact operations like Oil-Dri's, aim to reduce discharges of pollutants. Companies are increasingly investing in advanced water treatment technologies to meet these evolving environmental benchmarks.

- Water Scarcity Concerns: Regions where Oil-Dri operates may face increasing water scarcity, necessitating efficient water recycling and reuse programs.

- Regulatory Compliance Costs: Adhering to stricter water quality standards can lead to increased operational costs for wastewater treatment and monitoring.

- Technological Investments: Oil-Dri may need to invest in technologies for advanced water purification and closed-loop systems to comply with discharge limits and conserve water.

- Reputational Risk: Failure to manage water resources responsibly can lead to negative publicity and damage the company's brand image among environmentally conscious stakeholders.

Demand for Eco-Friendly Products and Packaging

Consumer and industrial preferences are increasingly leaning towards environmentally responsible products and packaging. This shift directly impacts companies like Oil-Dri, pushing them to innovate in areas such as biodegradable materials and recyclable packaging solutions.

The demand for sustainable options, like cat litter made from recycled or biodegradable materials, is a significant driver for Oil-Dri's product development strategy. For instance, by 2024, the global market for sustainable pet care products was projected to see substantial growth, with consumers actively seeking out eco-friendly alternatives.

Oil-Dri's response to this trend involves:

- Developing biodegradable and compostable product formulations.

- Reducing the use of virgin plastics in packaging, opting for recycled content.

- Exploring innovative material sourcing for absorbent products.

- Communicating sustainability efforts to consumers to build brand loyalty.

Environmental concerns are increasingly shaping Oil-Dri's operational landscape, pushing for sustainable mining practices and responsible resource management. The company must navigate strict regulations on industrial waste and carbon emissions, requiring significant investments in eco-friendly technologies and compliance measures. Growing consumer and investor demand for sustainable products also necessitates innovation in materials and packaging.

The global mining sector's focus on ESG, particularly resource stewardship, intensified in 2024. Oil-Dri is investing in technologies to boost extraction efficiency and minimize waste. For example, advanced geological surveying helps maximize yield from existing reserves, reducing the environmental impact of mining operations.

Stringent regulations on industrial waste, such as those enforced by the EPA under RCRA in 2024, necessitate substantial capital allocation for advanced waste processing and compliant disposal. Similarly, evolving carbon pricing mechanisms, like the EU's ETS, are pressuring companies to reduce their carbon footprint, with many industrial firms setting net-zero targets by 2024.

Water management is critical, with evolving EPA regulations for industrial wastewater, like proposed Effluent Limitation Guidelines for the mining sector, impacting operations. By 2023, the EPA continued to emphasize water quality standards, prompting investments in advanced water treatment and closed-loop systems to meet discharge limits and conserve water.

| Environmental Factor | Impact on Oil-Dri | 2024/2025 Data/Trend |

|---|---|---|

| Resource Depletion & Sustainable Mining | Need for efficient extraction and land management of attapulgite and montmorillonite. | Global mining industry focus on ESG and resource stewardship; investment in extraction efficiency technologies. |

| Waste Management & Regulations | Costs associated with treating and disposing of industrial waste, especially hazardous by-products. | EPA's continued enforcement of RCRA in 2024; increased investment in advanced waste processing technologies. |

| Climate Change & Emissions | Scrutiny on operational footprint and potential costs from carbon pricing or emission caps. | Intensifying global efforts to combat climate change; EU ETS allowances becoming more expensive. |

| Water Usage & Discharge | Compliance with water quality standards and wastewater discharge regulations. | EPA's emphasis on water quality; proposed Effluent Limitation Guidelines for the mining sector impacting operations. |

| Consumer & Market Preferences | Demand for environmentally responsible products and packaging. | Growing market for sustainable pet care products; increased consumer preference for eco-friendly alternatives. |

PESTLE Analysis Data Sources

Our Oil-Dri PESTLE Analysis is built upon a robust foundation of data from government agencies, industry associations, and reputable market research firms. We incorporate economic indicators, environmental regulations, technological advancements, and social trends to provide a comprehensive view.