Oil-Dri Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Oil-Dri Bundle

Oil-Dri's competitive landscape is shaped by moderate buyer power and a significant threat from substitutes, particularly in the absorbent materials market. The company also faces moderate rivalry among existing competitors, necessitating strategic differentiation.

The complete report reveals the real forces shaping Oil-Dri’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Oil-Dri's reliance on specific sorbent minerals like attapulgite and montmorillonite is a key factor in supplier power. The limited number of companies controlling access to these crucial mineral reserves directly translates into increased bargaining leverage for those suppliers.

The unique absorbent qualities of attapulgite and montmorillonite are fundamental to Oil-Dri's extensive product range. These specialized minerals are not easily substituted, giving their suppliers significant leverage.

The inherent uniqueness of these minerals means that Oil-Dri faces considerable hurdles if it attempts to switch to alternative raw materials or suppliers. These challenges include significant investments in research and development to test new materials, the cost of re-tooling manufacturing processes, and the expense of re-certifying products to meet industry standards. For instance, in 2024, the specialty minerals market saw significant price volatility, with some key raw materials experiencing increases of up to 15% due to supply chain disruptions and increased demand from emerging industries, highlighting the cost implications of switching.

The threat of suppliers integrating forward into processing and manufacturing sorbent products, thereby becoming direct competitors to Oil-Dri, represents a significant bargaining chip. This potential shift could fundamentally alter the competitive landscape, forcing Oil-Dri to adapt its strategy.

This looming possibility grants suppliers considerable leverage in price and terms negotiations. For instance, if a major mineral supplier, possessing significant reserves and processing capabilities, were to enter Oil-Dri's market, it could disrupt existing supply chains and pricing structures. This compels Oil-Dri to cultivate robust supplier relationships and consider securing long-term supply agreements to mitigate this risk.

Importance of Oil-Dri to Suppliers' Revenue

The bargaining power of suppliers in Oil-Dri's industry is significantly influenced by how crucial Oil-Dri is as a customer to those suppliers. If Oil-Dri accounts for a substantial percentage of a mineral supplier's overall sales, that supplier would likely be more inclined to maintain a favorable relationship and potentially offer more competitive pricing. This interdependence can temper the supplier's leverage.

Conversely, if Oil-Dri represents a minor portion of a large, diversified mineral supplier's business, the supplier would possess considerably more bargaining power. In such a scenario, the supplier might be less concerned about losing Oil-Dri as a customer and could therefore dictate terms more assertively. This dynamic is a key consideration in Oil-Dri's procurement strategy.

- Supplier Dependence: If a mineral supplier relies heavily on Oil-Dri for a significant portion of its revenue, its bargaining power is reduced.

- Customer Size: For large, diversified mineral suppliers, Oil-Dri's status as a smaller customer grants the supplier greater leverage.

- Industry Concentration: The number and size of mineral suppliers available to Oil-Dri also play a role; a more concentrated supplier market increases supplier power.

- Input Costs: Fluctuations in the global commodity prices for key minerals, such as bentonite and attapulgite, directly impact supplier costs and their subsequent bargaining position with Oil-Dri.

Availability of Substitutes for Raw Materials

The availability of substitutes for the raw materials Oil-Dri uses, like attapulgite and montmorillonite, significantly influences supplier power. If there are readily available and cost-effective alternatives, suppliers have less leverage to dictate prices or terms.

For instance, the emergence of new synthetic sorbent materials or other mineral deposits that perform similarly to Oil-Dri's current inputs could weaken the bargaining position of existing suppliers. This dynamic is crucial as it directly impacts Oil-Dri's cost structure and operational flexibility.

- Impact of Substitutes: The presence of viable substitutes for attapulgite and montmorillonite reduces the bargaining power of suppliers.

- Cost-Effectiveness: The cost-effectiveness of these substitutes is a key determinant in their ability to displace current materials.

- Market Dynamics: Innovations in material science or the discovery of new mineral sources can shift the balance of power away from current suppliers.

Oil-Dri's bargaining power with its suppliers is significantly shaped by the uniqueness of its core raw materials, attapulgite and montmorillonite. The limited number of suppliers controlling these specific mineral reserves, coupled with their specialized properties that are difficult to substitute, grants these suppliers considerable leverage. This is further amplified by the substantial costs and operational disruptions Oil-Dri would face if it attempted to switch to alternative materials, including R&D, re-tooling, and re-certification expenses. For example, in 2024, the specialty minerals market experienced price hikes of up to 15% for certain key materials due to supply chain issues, underscoring the financial risks associated with material dependency.

The threat of suppliers integrating forward into processing and manufacturing sorbent products also increases their bargaining power, potentially turning them into direct competitors. This leverage is particularly potent if Oil-Dri represents a small portion of a large supplier's business, as the supplier has less incentive to accommodate Oil-Dri's needs. Conversely, if Oil-Dri is a major customer, its own bargaining power increases. The availability and cost-effectiveness of substitutes for attapulgite and montmorillonite are critical factors in mitigating supplier power; innovations in material science could shift this balance.

| Factor | Impact on Supplier Power | Oil-Dri Specifics |

|---|---|---|

| Uniqueness of Minerals | High | Attapulgite and montmorillonite are difficult to substitute. |

| Supplier Concentration | High | Limited number of companies control key mineral reserves. |

| Switching Costs for Oil-Dri | High | Significant R&D, re-tooling, and re-certification costs. |

| Supplier Forward Integration Threat | High | Potential for suppliers to become direct competitors. |

| Oil-Dri's Customer Importance | Variable | Depends on Oil-Dri's share of supplier revenue. |

| Availability of Substitutes | Lowers Power | Emergence of synthetic or alternative mineral sorbents could reduce leverage. |

What is included in the product

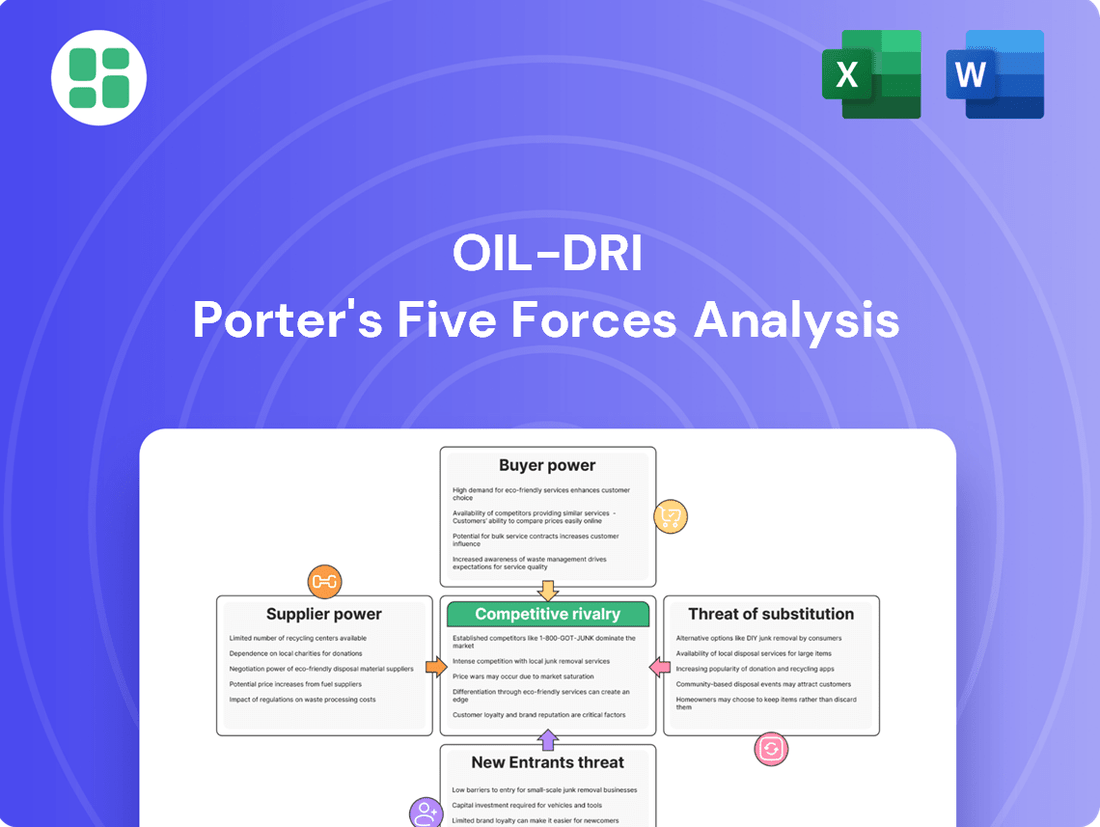

Oil-Dri's Porter's Five Forces analysis dissects the competitive intensity within the absorbent minerals market, examining supplier and buyer power, the threat of new entrants and substitutes, and the rivalry among existing players to understand Oil-Dri's strategic positioning and profitability.

Instantly identify and address competitive threats with a clear, actionable breakdown of each Porter's Five Force for Oil-Dri.

Gain a strategic advantage by easily visualizing and mitigating the impact of supplier power and buyer bargaining on Oil-Dri's profitability.

Customers Bargaining Power

Oil-Dri's diverse customer base, which includes sectors like pet care, animal health, fluid purification, and industrial absorbents, inherently limits the bargaining power of any single customer segment. This broad market reach means that the company isn't overly reliant on any one buyer or industry, providing a buffer against concentrated demands.

For instance, in fiscal year 2023, Oil-Dri reported that its largest customer accounted for only 10% of its net sales, underscoring the fragmented nature of its customer relationships. This diversification across consumer and business-to-business markets dilutes the leverage any individual customer can exert.

In certain business-to-business sectors, like industrial absorbents or fluid purification, Oil-Dri may encounter a limited number of substantial industrial clients who procure significant quantities. These concentrated customers possess considerable leverage due to their large order volumes, enabling them to exert substantial pressure on pricing and potentially switch to alternative suppliers if terms are unfavorable.

Customer switching costs for Oil-Dri's products are not uniform. In consumer segments, such as cat litter, brand recognition and the perceived effectiveness of existing products can lead to moderate switching costs for buyers.

However, for industrial clients, the process of qualifying new sorbent materials involves rigorous testing and regulatory approvals, creating significant switching costs. This complexity in industrial applications effectively lowers the bargaining power of these customers.

Price Sensitivity Across Markets

Consumer markets, especially for everyday items like cat litter, often show significant price sensitivity. For Oil-Dri's conventional clay-based cat litter, this means customers can easily switch brands if prices rise, giving them more bargaining power. This was evident in 2024 as inflation continued to impact household budgets, making consumers more conscious of price points for essential pet supplies.

However, Oil-Dri also serves industrial and specialized markets where the focus shifts from price to performance. In these sectors, such as for animal health applications or industrial absorbents, customers are less likely to be swayed solely by price. They prioritize the efficacy and specific benefits of the product, which can diminish customer bargaining power.

For instance, in the agricultural sector, where Oil-Dri's products might be used for animal bedding or feed additives, the cost savings from a slightly cheaper, lower-performing product could be outweighed by negative impacts on animal health or productivity. This performance-driven demand reduces the leverage customers have in price negotiations.

- Price Sensitivity in Cat Litter: Consumers often compare prices for conventional clay cat litter, making them sensitive to price increases.

- Performance Focus in Industrial Markets: Specialized applications, like animal health or industrial absorbents, prioritize product efficacy over cost, reducing customer price sensitivity.

- Impact of 2024 Economic Conditions: Persistent inflation in 2024 likely heightened price consciousness among consumers for everyday goods, including pet products.

- Reduced Bargaining Power in Niche Markets: For Oil-Dri's specialized offerings, where performance is key, customers have less power to negotiate lower prices.

Availability of Substitutes for End Products

The availability of numerous substitute products significantly amplifies customer bargaining power. For instance, in the consumer market for cat litter, the existence of alternatives like silica gel, pine, or wheat-based litters means customers can easily switch if Oil-Dri's prices or product features are not competitive. This broadens their choices and reduces their dependence on any single supplier.

In industrial sectors, such as spill control or purification, the presence of alternative materials or technologies directly challenges Oil-Dri's market position. If customers can find equally effective or more cost-efficient solutions from other providers, their ability to negotiate better terms with Oil-Dri increases substantially. For example, advancements in biodegradable absorbents or novel filtration systems could present viable alternatives to traditional mineral-based sorbents.

- Consumer Market Example: The cat litter market, a key segment for Oil-Dri, features a wide array of competing products, including silica gel, wood pellets, and recycled paper litters, offering consumers ample choice and leverage.

- Industrial Market Impact: In industrial applications, the development of advanced, eco-friendly absorbents or alternative purification media can diminish customer reliance on Oil-Dri's sorbent minerals, thereby increasing customer bargaining power.

- Price Sensitivity: When substitutes are readily available and perform comparably, customers become more price-sensitive, forcing suppliers like Oil-Dri to maintain competitive pricing to retain market share.

Oil-Dri's diverse customer base, spanning consumer and industrial sectors, generally limits the bargaining power of any single customer. This is reinforced by the fact that in fiscal year 2023, its largest customer represented only 10% of net sales, illustrating a fragmented customer landscape. While some industrial clients might have leverage due to large order volumes, switching costs in these specialized applications, due to rigorous testing and regulatory approvals, effectively reduce their bargaining power.

Consumer markets, however, present a different dynamic. For products like cat litter, high price sensitivity and the availability of numerous substitutes, such as silica gel or pine-based litters, empower consumers. This was particularly relevant in 2024, as ongoing inflation made consumers more attuned to pricing for everyday pet supplies. Conversely, in niche industrial markets where product performance is paramount, such as animal health applications, customers exhibit less price sensitivity, diminishing their negotiation leverage.

| Customer Segment | Key Factors Influencing Bargaining Power | Impact on Oil-Dri |

|---|---|---|

| Consumer (e.g., Cat Litter) | High price sensitivity, numerous substitutes, brand loyalty (moderate) | Increased pressure on pricing, need for competitive product features |

| Industrial (e.g., Absorbents, Purification) | Large order volumes (potential leverage), high switching costs (regulatory, testing), performance focus | Negotiating leverage for large clients, but reduced power for performance-critical applications |

Same Document Delivered

Oil-Dri Porter's Five Forces Analysis

This preview showcases the complete Oil-Dri Porter's Five Forces Analysis, providing a thorough examination of competitive forces within the industry. The document you see here is precisely what you will receive immediately after purchase, ensuring you get the full, professionally formatted report without any alterations or placeholders.

Rivalry Among Competitors

The competitive landscape for Oil-Dri is quite varied, featuring both large global companies and smaller, niche businesses. This diversity is evident across its various product lines.

In the highly competitive cat litter market, Oil-Dri faces significant pressure from giants like Nestlé Purina, whose Tidy Cats brand is a market leader, and Church & Dwight, the maker of Fresh Step. Additionally, numerous private label brands from major retailers further intensify this rivalry, often competing on price and availability.

The cat litter market is expected to see steady growth, but within this, conventional clay-based litter might grow at a slower pace. This slower growth in a key segment means companies will likely compete more fiercely for existing market share.

The industrial absorbents sector is also experiencing growth, partly due to increasing environmental regulations. However, this growth doesn't mean competition is easing; in fact, it remains quite strong as businesses in this area strive to capture opportunities presented by these new regulations.

Oil-Dri's strategy of vertical integration and deep mineral expertise allows it to create distinct products. This is especially true for its business-to-business offerings and higher-end cat litters, such as the popular lightweight and crystal varieties.

While strong brand loyalty, particularly in the consumer cat litter market, helps to soften the blow of competition, products that lack unique features are vulnerable to aggressive price wars among rivals.

Exit Barriers from the Industry

The significant capital investment required for mineral mining and processing facilities acts as a substantial exit barrier for companies in this sector, including Oil-Dri. These high fixed costs mean that exiting the industry can be financially ruinous, forcing companies to continue operating even when market conditions are unfavorable.

This situation intensifies competitive rivalry. When firms cannot easily leave the market, they are more likely to engage in aggressive price competition or market share battles to survive, even if it means lower profitability for everyone. For instance, the specialized nature of absorbent mineral processing means that assets have limited alternative uses, increasing the cost of abandonment.

- High Capital Investment: Specialized mining and processing equipment for absorbent minerals represents a substantial upfront cost, often running into tens or hundreds of millions of dollars for established operations.

- Asset Specificity: Facilities and equipment are often designed for specific mineral types and processing techniques, limiting their resale value or adaptability to other industries.

- Operational Commitments: Long-term leases on mineral rights and ongoing operational expenses create further commitments that make exiting costly.

Competitive Strategies and Innovation

Competitive rivalry within the absorbent minerals industry, including for companies like Oil-Dri, is intensified by a constant drive for innovation. Competitors are actively developing new products, such as the growing market for eco-friendly and plant-based cat litters, alongside advancements in industrial absorbents for various applications. This focus on novel product development is a key battleground.

Oil-Dri's own strategic moves, such as its acquisition of UltraPet, demonstrate a clear response to this competitive pressure. These acquisitions, coupled with significant investments in enhancing manufacturing processes and efficiency, are crucial for maintaining market share and profitability. The company aims to compete effectively through an optimized product portfolio, increased sales volume, and operational cost reductions.

- Innovation Focus: Competitors are investing in R&D for differentiated products like sustainable cat litters.

- Strategic Acquisitions: Oil-Dri's acquisition of UltraPet in 2021 for $170 million expanded its consumer product offerings and market reach.

- Manufacturing Investments: Companies are upgrading production facilities to improve efficiency and reduce costs, with Oil-Dri investing in capacity expansions.

- Product Diversification: The rivalry extends to offering a broader range of absorbent solutions for both consumer and industrial markets.

Competitive rivalry is intense for Oil-Dri, particularly in the consumer cat litter market where it faces established brands like Tidy Cats and Fresh Step, alongside aggressive private label offerings. The industrial absorbents sector also sees robust competition driven by evolving environmental regulations. This dynamic environment necessitates continuous innovation and strategic investments, such as Oil-Dri's acquisition of UltraPet for $170 million in 2021, to maintain market position and profitability.

High capital requirements for specialized mining and processing facilities, coupled with asset specificity, create significant exit barriers. This traps companies in the market, fostering aggressive price competition and battles for market share, even when profitability is challenged. Companies are forced to innovate and optimize operations to remain competitive.

| Competitor | Key Product Segments | Market Presence |

|---|---|---|

| Nestlé Purina | Cat Litter (Tidy Cats) | Global Leader |

| Church & Dwight | Cat Litter (Fresh Step) | Major Player |

| Private Label Retailers | Cat Litter | Significant Share, Price-Focused |

| Various Industrial Absorbent Providers | Industrial Absorbents | Diverse, Growing with Regulations |

SSubstitutes Threaten

The threat of substitutes for Oil-Dri's absorbent products is a significant factor, particularly in the cat litter market. While traditional clay-based litters, a core product for Oil-Dri, remain dominant, alternatives like silica gel, recycled paper, corn, wheat, and wood-based litters are carving out market share. These substitutes often appeal to consumers driven by environmental consciousness or specific perceived benefits, potentially impacting Oil-Dri's market position if these trends accelerate.

Technological advancements are continuously introducing new absorbent materials, such as advanced synthetic polymers, that can outperform traditional options. These innovations threaten existing markets by offering enhanced efficiency or specialized capabilities. For instance, the development of superabsorbent polymers (SAPs) has significantly impacted markets for diapers and agricultural water retention, demonstrating how new materials can displace established ones.

A significant threat to Oil-Dri's traditional clay-based cat litter products comes from shifting consumer preferences towards sustainability. There's a noticeable increase in demand for eco-friendly, biodegradable, and plant-based alternatives in the pet care sector. For instance, by 2024, the global market for natural and biodegradable cat litter was projected to reach billions, indicating a substantial shift away from conventional materials.

Alternative Solutions for End-Use Problems

Beyond direct material substitutes, alternative solutions for the end-use problems Oil-Dri addresses also present a threat. For instance, in industrial spill management, advanced containment systems or novel waste disposal methods could lessen the demand for traditional sorbent absorbents. In 2024, the market for industrial absorbents is projected to grow, but innovations in spill response technology could disrupt this trend.

Consider the cat litter market, where Oil-Dri is a significant player. While clay-based litters are dominant, the development and consumer adoption of alternative litter materials, such as silica gel or plant-based options, represent a direct substitute threat. The global cat litter market was valued at approximately $10 billion in 2023, with a growing segment dedicated to eco-friendly alternatives.

- Alternative Spill Management: Innovations in containment booms and absorbent polymers could reduce reliance on traditional sorbents.

- Cat Litter Diversification: The rise of silica gel and plant-based cat litters offers consumers choices beyond clay-based products.

- Waste Disposal Innovations: New methods for industrial waste treatment might bypass the need for absorbent materials altogether.

- Technological Advancements: Ongoing research into material science could yield entirely new solutions to problems currently addressed by Oil-Dri's products.

Price-Performance Trade-off of Substitutes

The threat of substitutes for Oil-Dri's absorbent mineral products hinges significantly on the perceived price-performance trade-off. Customers will readily switch if alternatives offer similar or superior functionality at a more attractive price point. For instance, the growing availability of synthetic absorbents or even repurposed materials could present a challenge if their cost-effectiveness becomes compelling.

Furthermore, evolving environmental consciousness plays a role. If substitute products provide demonstrably better environmental benefits, consumers might tolerate a slightly higher price. This dynamic was evident in 2024 as sustainability initiatives gained further traction across various industries, influencing purchasing decisions beyond just raw cost.

- Price Sensitivity: Customers evaluate if cheaper alternatives meet their core absorption needs.

- Performance Comparison: The effectiveness of substitutes in absorbing liquids and controlling odors is a key factor.

- Environmental Value: Growing demand for eco-friendly options can make pricier green alternatives more appealing.

- Switching Costs: The ease or difficulty for customers to adopt a new product influences their willingness to change.

The threat of substitutes for Oil-Dri's absorbent products is moderate but growing, driven by consumer preferences and technological innovation. While traditional clay-based cat litter remains a staple, alternatives like silica gel, recycled paper, and plant-based litters are gaining traction. These substitutes often appeal to environmentally conscious consumers, potentially impacting Oil-Dri's market share if these trends accelerate.

| Substitute Type | Key Appeal | Market Trend (2024 Projection) |

|---|---|---|

| Silica Gel Litter | Odor control, dust reduction | Steady growth in niche markets |

| Plant-Based Litter (e.g., corn, wheat) | Biodegradability, sustainability | Increasing consumer adoption, significant growth potential |

| Recycled Paper Litter | Eco-friendly, lightweight | Established presence, stable demand |

Entrants Threaten

New entrants in the sorbent mineral industry face formidable capital requirements. Significant investments are necessary for mineral exploration, securing land rights, establishing mining operations, and building specialized processing plants. For instance, in 2024, the average cost to develop a new mine can range from hundreds of millions to billions of dollars, depending on the scale and complexity.

Oil-Dri's significant competitive edge stems from its vertical integration, particularly its vast reserves of attapulgite and montmorillonite. These extensive mineral holdings are crucial for its product lines, giving it a strong foundation.

New companies entering the market would face immense difficulty in acquiring access to comparable, economically feasible, and high-quality mineral deposits. The scarcity and existing control of these resources by established entities create a substantial barrier to entry.

Established players in the absorbent minerals industry, including Oil-Dri, benefit immensely from economies of scale. These savings are realized across mining operations, processing facilities, manufacturing plants, and extensive distribution networks. For instance, in 2023, Oil-Dri reported net sales of $377.7 million, indicating a substantial operational footprint that allows for cost absorption across a broad product range.

New companies entering this market would face a significant hurdle in matching these cost efficiencies. The sheer volume of production and established supply chains for incumbents mean they can often produce and deliver goods at a lower per-unit cost. This makes it particularly difficult for new entrants to compete on price, especially in high-volume, price-sensitive markets such as pet litter, where Oil-Dri holds a strong market position.

Brand Loyalty and Distribution Channels

In consumer-facing segments of the absorbent minerals market, such as cat litter, established brands like Oil-Dri's Cat's Pride and Jonny Cat benefit from significant customer recognition. This brand loyalty, cultivated over years through marketing and product performance, makes it challenging for newcomers to capture market share. For instance, in 2024, the US cat litter market was valued at over $2.5 billion, with established brands holding a dominant position.

Furthermore, securing widespread distribution is a critical barrier. New entrants must invest heavily to gain shelf space in major retail chains and establish a presence on popular e-commerce platforms. By the end of 2023, traditional retail still accounted for roughly 70% of cat litter sales, underscoring the importance of these established relationships for market access.

- Brand Recognition: High consumer awareness of existing brands reduces the appeal of unfamiliar products.

- Distribution Access: Gaining shelf space in major retailers and visibility on online marketplaces is costly and time-consuming.

- Marketing Investment: Significant marketing spend is required to build brand awareness and compete with incumbents.

- Customer Loyalty: Existing customer bases are often resistant to switching brands without a compelling reason.

Regulatory Hurdles and Intellectual Property

The oil-drying absorbent industry faces significant regulatory complexities, particularly concerning environmental compliance for mining, processing, and waste management. Navigating these stringent rules can present a substantial cost barrier and operational challenge for potential new entrants, potentially requiring extensive capital investment in pollution control and permitting processes. For instance, in 2024, companies operating in this sector often faced increased scrutiny and potential fines for non-compliance with evolving EPA guidelines, making market entry more demanding.

While not as dominant as regulatory factors, intellectual property (IP) can also act as a deterrent. Proprietary formulations for specialized sorbent products or unique processing technologies developed by established players can create a competitive advantage. New entrants might find it difficult and expensive to develop comparable or superior products without infringing on existing patents, thus limiting their ability to quickly gain market share.

- Environmental Regulations: Compliance with mining, processing, and waste disposal laws can be costly and time-consuming for new entrants.

- Permitting Processes: Obtaining necessary permits can be a lengthy and complex procedure, acting as a barrier to entry.

- Intellectual Property: Patented product formulations and processing techniques can protect incumbent firms and discourage new competitors.

The threat of new entrants in the sorbent minerals industry is moderate, primarily due to high capital requirements for mining and processing, significant economies of scale enjoyed by incumbents like Oil-Dri, and established brand loyalty and distribution networks. Potential new players must overcome substantial financial hurdles and brand recognition challenges to gain a foothold.

Newcomers face immense difficulty in securing access to high-quality mineral deposits, as established companies like Oil-Dri possess vast reserves. For instance, Oil-Dri's significant holdings of attapulgite and montmorillonite are crucial competitive advantages. Additionally, the cost of developing a new mine in 2024 can range from hundreds of millions to billions of dollars, presenting a formidable financial barrier.

Economies of scale further deter new entrants. Oil-Dri's 2023 net sales of $377.7 million reflect an operational footprint that allows for cost absorption, making it challenging for newcomers to compete on price, especially in markets like pet litter. The established players' ability to produce at a lower per-unit cost is a significant deterrent.

Brand recognition and distribution access are also critical barriers. Established brands, such as Oil-Dri's Cat's Pride, have cultivated strong customer loyalty, making it difficult for new entrants to capture market share in the over $2.5 billion US cat litter market in 2024. Securing shelf space in major retailers, which accounted for about 70% of cat litter sales by the end of 2023, requires considerable investment and established relationships.

| Barrier | Description | Impact on New Entrants | Example Data Point |

|---|---|---|---|

| Capital Requirements | Cost of exploration, land rights, mining, and processing facilities. | Very High | Mine development costs can reach billions in 2024. |

| Economies of Scale | Cost advantages due to large-scale operations. | High | Oil-Dri's 2023 net sales of $377.7M indicate significant cost absorption. |

| Brand Loyalty & Recognition | Customer preference for established brands. | High | US cat litter market valued at over $2.5B in 2024, dominated by incumbents. |

| Distribution Access | Gaining shelf space and online visibility. | High | ~70% of cat litter sales in late 2023 were through traditional retail. |

| Regulatory Compliance | Adhering to environmental and safety standards. | Moderate to High | Increased scrutiny and potential fines for non-compliance in 2024. |

| Intellectual Property | Proprietary formulations and processing techniques. | Low to Moderate | Patented technologies can create advantages for incumbents. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Oil-Dri leverages data from SEC filings, investor relations reports, and industry-specific market research from sources like IBISWorld. This provides a robust foundation for understanding competitive dynamics, supplier power, and customer influence within the absorbent minerals sector.