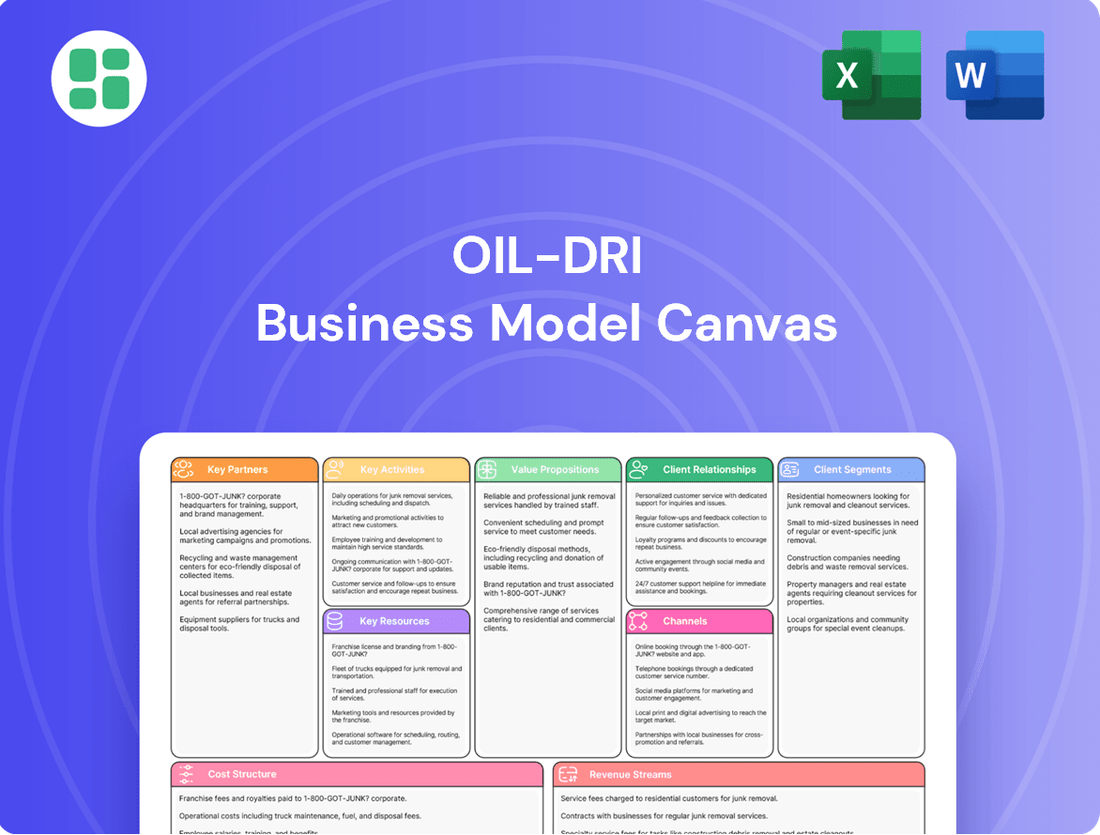

Oil-Dri Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Oil-Dri Bundle

Curious about how Oil-Dri leverages its unique sorbent minerals? Our Business Model Canvas breaks down their customer relationships, revenue streams, and key resources, offering a clear view of their operational genius. This comprehensive analysis is your key to understanding their market dominance.

Unlock the strategic blueprint behind Oil-Dri's success with our full Business Model Canvas. Discover how they create and deliver value through their diverse product lines and robust distribution channels. Download the complete document to gain actionable insights for your own business strategy.

Partnerships

Oil-Dri Corporation of America relies on strategic partnerships with mining operations and landowners to secure its key raw materials, primarily attapulgite and montmorillonite clays. These relationships are vital for ensuring a consistent and high-quality supply of the minerals that form the foundation of their sorbent products.

In 2024, Oil-Dri's ability to maintain strong ties with its raw material suppliers is paramount, as disruptions in supply can directly affect their production capacity and ability to meet customer demand across various sectors, including agriculture, industrial, and consumer products.

Oil-Dri's success hinges on its extensive network of distribution and retail partners. Collaborations with major mass merchandisers, wholesale clubs, and drugstore chains are crucial for widespread consumer access to products like cat litter. In 2023, Oil-Dri's retail segment, which includes these channels, continued to be a significant revenue driver, demonstrating the power of these established relationships.

Furthermore, partnerships with pet specialty retail outlets and dollar stores allow Oil-Dri to target specific market segments and ensure product availability across diverse price points. These collaborations are essential for expanding market penetration for both consumer and industrial absorbent products, as evidenced by their consistent presence in these varied retail environments.

Oil-Dri leverages agricultural and industrial distributors as crucial partners to access its diverse B2B customer base. These specialized distributors provide essential market expertise and existing networks, ensuring Oil-Dri's sorbent products effectively reach clients in agriculture, fluids purification, and various industrial sectors worldwide.

Technology and Research Collaborators

Oil-Dri actively partners with academic institutions and research entities to boost its innovation in sorbent mineral applications. These collaborations are crucial for developing enhanced product performance and uncovering new market avenues, as well as promoting more sustainable production processes. For instance, in 2024, Oil-Dri continued its engagement with universities on projects exploring novel uses for its core mineral assets, aiming to expand beyond traditional applications.

These strategic alliances allow Oil-Dri to leverage external expertise, accelerating the pace of discovery and reinforcing its position as a leader in sorbent technology. Such partnerships can translate into significant advancements, such as improved efficacy in environmental remediation or the creation of specialized materials for emerging industries. Oil-Dri’s commitment to R&D is substantial, with significant investment allocated annually to internal research programs that complement these external collaborations.

- Academic Collaborations: Partnerships with universities focused on materials science and environmental engineering.

- Research Institutes: Joint projects with specialized research centers to explore advanced sorbent functionalities.

- Sustainability Focus: Collaborations aimed at developing eco-friendly extraction and processing methods for sorbent minerals.

- Innovation Pipeline: These partnerships directly feed into Oil-Dri's robust internal R&D efforts, ensuring a continuous flow of new product ideas and technological improvements.

Acquired Entities and Subsidiaries

Oil-Dri's key partnerships are significantly bolstered by its acquired entities and subsidiaries. For instance, the acquisition of Ultra Pet Company, Inc. in 2023, a move valued at $180 million, immediately expanded Oil-Dri's consumer product offerings and its presence in the pet care market. This integration allows Oil-Dri to leverage Ultra Pet's established customer base and distribution channels, fueling both organic growth through cross-selling opportunities and inorganic growth via market share expansion.

These acquired businesses become vital components of Oil-Dri's operational strategy. By absorbing companies like Ultra Pet, Oil-Dri gains access to new technologies and product lines, enhancing its competitive edge. This strategic integration is a cornerstone for achieving growth targets, as demonstrated by the projected revenue contribution from recent acquisitions to Oil-Dri's overall financial performance in the upcoming fiscal year.

- Ultra Pet Company, Inc. acquisition: Added $180 million in value and expanded Oil-Dri's pet care segment.

- Leveraging existing relationships: Acquired entities bring established customer connections and distribution networks.

- Driving growth: Integration of subsidiaries contributes to both organic expansion and inorganic market share gains.

Oil-Dri's key partnerships are foundational, encompassing raw material suppliers, distribution networks, and research collaborators. These alliances ensure consistent access to critical clay minerals, effective market penetration for its diverse product lines, and ongoing innovation in sorbent technology.

What is included in the product

This Oil-Dri Business Model Canvas provides a detailed breakdown of their strategy, focusing on diverse customer segments like agriculture and industrial applications, and their value propositions centered on absorbent mineral solutions.

It outlines Oil-Dri's key resources, activities, and partnerships, alongside cost structure and revenue streams, offering a clear view of their operational and financial framework.

Oil-Dri's Business Model Canvas offers a clear, concise view of their strategy, simplifying complex operations into an easily digestible format for stakeholders.

This one-page snapshot effectively highlights Oil-Dri's value proposition and key resources, aiding in rapid understanding and strategic alignment.

Activities

Oil-Dri's core operations revolve around identifying and securing significant mineral reserves, primarily attapulgite and montmorillonite clays. This crucial first step underpins their entire business, ensuring a steady supply of raw materials for their diverse product lines.

The company then focuses on the efficient and responsible extraction of these specialty minerals. This process is vital for maintaining production capacity and guaranteeing the consistent quality of their finished goods, which are essential for customer satisfaction.

Oil-Dri's strategic advantage lies in its substantial control over mineral reserves, boasting hundreds of millions of tons. This vast resource base provides a significant competitive edge and long-term supply security, a key factor in their market position.

Sorbent product manufacturing and processing involves transforming raw minerals into finished goods like cat litter and industrial absorbents. This includes crucial steps such as granulation, drying, and packaging, all aimed at creating high-performance products. In 2024, Oil-Dri Corporation of America, a key player in this sector, continued to focus on optimizing these processes to meet diverse market demands.

Manufacturing efficiency and stringent quality control are absolutely vital. These elements ensure that the sorbent products effectively absorb liquids and meet the specific requirements for their intended applications. For instance, the company's commitment to quality directly impacts the performance of their products in demanding industrial settings, where reliability is paramount.

Oil-Dri's commitment to Research and Development (R&D) is a cornerstone of its business model, driving the creation of novel sorbent applications and the enhancement of existing product lines. This continuous investment ensures they stay ahead by improving mineral performance and developing value-added solutions for diverse markets.

In fiscal year 2023, Oil-Dri reported an R&D expenditure of $18.6 million, a testament to their focus on innovation. This investment fuels their dedicated innovation centers, which are tasked with developing proprietary technologies and maintaining Oil-Dri's competitive advantage across sectors like animal health, industrial, and consumer products.

Supply Chain Management and Logistics

Oil-Dri's supply chain management is central to its operations, focusing on the efficient sourcing of its unique clay minerals and delivering finished products globally. This involves meticulous planning for transportation, warehousing, and inventory control to ensure products reach customers reliably and at a competitive cost.

Key activities include:

- Raw Material Sourcing: Securing high-quality clay minerals from owned and leased reserves, ensuring consistent supply and quality control.

- Manufacturing and Processing: Transforming raw clay into specialized products through various processing stages, maintaining strict quality standards.

- Logistics and Distribution: Managing a complex network of transportation, warehousing, and inventory to fulfill diverse customer needs across different industries and geographies.

In 2024, Oil-Dri continued to optimize its logistics, leveraging its strategically located facilities to minimize transit times and costs. The company's commitment to efficient supply chain operations directly impacts its ability to meet the fluctuating demands of its customer base, which spans agriculture, industrial, and consumer markets.

Sales, Marketing, and Brand Management

Oil-Dri’s approach to sales, marketing, and brand management is multifaceted, catering to both direct consumer sales and business-to-business (B2B) markets. This involves distinct strategies for each segment to effectively reach and engage target audiences.

For consumer products, such as their well-known cat litter brands like Cat's Pride, the focus is on building strong brand recognition and loyalty. This is often achieved through advertising, social media engagement, and strategic retail partnerships. In the fiscal year 2023, Oil-Dri reported net sales of $352.7 million, with a significant portion attributed to their consumer products segment.

The B2B side of Oil-Dri’s business, which includes industrial sorbents and agricultural solutions, requires a more targeted sales approach. This often involves direct sales teams working with businesses in sectors like manufacturing, transportation, and agriculture. These efforts emphasize the technical performance and cost-effectiveness of their specialized products.

- Consumer Brand Building: Investing in marketing for brands like Cat's Pride to drive household penetration and repeat purchases.

- B2B Targeted Sales: Employing specialized sales teams to address the specific needs of industrial and agricultural clients.

- Product Diversification Marketing: Highlighting the breadth of Oil-Dri’s solutions, from pet care to environmental remediation.

- Digital Presence: Leveraging online channels for both consumer engagement and B2B lead generation.

Oil-Dri's key activities are centered on securing and processing its unique clay minerals, transforming them into a diverse range of products. This involves meticulous raw material sourcing from its extensive reserves, efficient manufacturing processes that ensure product quality, and robust logistics to deliver these specialized sorbents globally. Innovation through research and development is also a critical activity, driving the creation of new applications and enhancing existing product lines to meet evolving market needs.

| Key Activity | Description | 2023/2024 Data/Focus |

| Raw Material Sourcing | Acquiring high-quality clay minerals from owned and leased reserves. | Hundreds of millions of tons of reserves controlled; focus on consistent quality. |

| Manufacturing & Processing | Transforming raw clay into finished products like cat litter and industrial absorbents. | Optimizing processes for granulation, drying, and packaging; emphasis on strict quality control. |

| Research & Development | Creating novel sorbent applications and improving existing products. | $18.6 million R&D expenditure in FY2023; developing proprietary technologies. |

| Logistics & Distribution | Managing global transportation, warehousing, and inventory. | Optimizing transit times and costs through strategically located facilities in 2024. |

| Sales & Marketing | Building consumer brands and engaging in targeted B2B sales. | Net sales of $352.7 million in FY2023; focus on brands like Cat's Pride and industrial solutions. |

Preview Before You Purchase

Business Model Canvas

The Oil-Dri Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means you can be confident that the structure, content, and formatting are exactly what you can expect in the final, complete file. No mockups or samples are used; this is a direct representation of the deliverable, ensuring a transparent and accurate purchasing experience.

Resources

Oil-Dri's most crucial asset is its extensive, owned reserves of specialty sorbent minerals. These include valuable deposits of attapulgite, montmorillonite, and diatomaceous shale, which are fundamental to their product lines.

These vast mineral reserves ensure a consistent and reliable long-term supply of raw materials. This ownership is a cornerstone of Oil-Dri's vertical integration strategy, granting them a significant competitive edge in the market.

For example, in fiscal year 2023, Oil-Dri reported that its mining operations extracted approximately 1.3 million tons of clay. This highlights the scale and importance of their resource base.

Oil-Dri's manufacturing backbone consists of strategically positioned mining and processing facilities across the United States, including Georgia, Mississippi, Illinois, and California. This extensive network, complemented by international processing plants in Canada and England, underpins its ability to produce on a massive scale.

These physical assets are critical for efficiently transforming raw minerals into a diverse range of finished products. For instance, in fiscal year 2023, Oil-Dri reported processing approximately 950,000 tons of raw materials, showcasing the significant operational capacity of its facilities.

Oil-Dri's proprietary technology, backed by numerous patents in mineral processing and product formulation, forms a significant competitive advantage. This intellectual property allows them to create specialized, high-performance sorbent solutions that are difficult for competitors to replicate, driving innovation and market leadership.

Skilled Workforce and Scientific Expertise

Oil-Dri's business model heavily relies on its highly skilled workforce. This team includes geologists, chemists, engineers, and dedicated R&D professionals who possess deep knowledge in mineralogy and material science. Their expertise is crucial for developing new products and ensuring the high quality of existing ones, directly impacting customer satisfaction and market competitiveness.

The scientific expertise within Oil-Dri is a core asset, enabling innovation across various application areas. This human capital is essential for providing robust technical support to customers, helping them optimize the use of Oil-Dri's specialized products. In 2024, the company continued to invest in training and development to maintain this cutting-edge expertise, particularly in areas like sustainable material solutions.

- Geologists and Mineralogists: Identify and assess raw material deposits, ensuring consistent quality and supply.

- Chemists and Material Scientists: Drive product innovation, formulation, and quality control for diverse applications.

- Engineers (Process, Chemical, Mechanical): Optimize production processes, design new equipment, and ensure operational efficiency.

- R&D Professionals: Focus on developing novel applications and improving existing product performance, often collaborating with external research institutions.

Established Brands and Customer Relationships

Oil-Dri's established brands, such as Cat's Pride and Jonny Cat, are cornerstones of their business model. These consumer-facing brands have cultivated significant market recognition and trust over time. This brand equity translates directly into customer loyalty, a crucial intangible asset.

Beyond consumers, Oil-Dri maintains robust, long-standing relationships with its business-to-business (B2B) clients. These partnerships are built on reliability and consistent product performance, fostering repeat business and stable revenue streams. The company's ability to retain these B2B relationships is a testament to its operational excellence and customer focus.

- Brand Recognition: Cat's Pride and Jonny Cat are recognized names in their respective markets, driving consumer preference.

- Customer Loyalty: Strong brand equity fosters repeat purchases and reduces customer acquisition costs.

- B2B Partnerships: Long-term relationships with industrial clients provide a stable revenue base and market insights.

- Market Trust: These established brands and relationships represent significant goodwill, a valuable intangible asset for Oil-Dri.

Oil-Dri's key resources are its vast reserves of specialty sorbent minerals, including attapulgite and montmorillonite, which are essential for its product lines. These owned reserves ensure a consistent supply and provide a competitive advantage through vertical integration. In fiscal year 2023, the company extracted approximately 1.3 million tons of clay, underscoring the scale of this critical resource.

The company's manufacturing infrastructure, comprising strategically located mining and processing facilities across the US and internationally, is another vital asset. These facilities enable efficient transformation of raw minerals into finished goods, processing around 950,000 tons of raw materials in fiscal year 2023.

Proprietary technology, protected by numerous patents, allows Oil-Dri to develop unique, high-performance sorbent solutions, driving innovation and market leadership. Furthermore, a highly skilled workforce, including geologists, chemists, and engineers, possesses deep expertise in mineralogy and material science, crucial for product development and customer support. In 2024, continued investment in employee training reinforced this human capital.

Established brands like Cat's Pride and Jonny Cat represent significant brand equity, fostering consumer loyalty and market recognition. Complementing this, strong, long-standing B2B relationships provide a stable revenue base and valuable market insights, built on reliability and consistent product performance.

| Key Resource | Description | Significance | 2023 Data Point |

|---|---|---|---|

| Mineral Reserves | Owned deposits of attapulgite, montmorillonite, diatomaceous shale | Ensures consistent supply, vertical integration, competitive edge | 1.3 million tons clay extracted |

| Manufacturing Facilities | Mining and processing plants (US, Canada, England) | Efficient raw material transformation, large-scale production capacity | 950,000 tons raw materials processed |

| Proprietary Technology | Patented mineral processing and product formulation | Drives innovation, creates difficult-to-replicate solutions | N/A (ongoing development) |

| Human Capital | Skilled geologists, chemists, engineers, R&D professionals | Product innovation, quality control, technical support | Continued investment in training (2024) |

| Brand Equity | Recognized brands (Cat's Pride, Jonny Cat) | Customer loyalty, market recognition, reduced acquisition costs | N/A (intangible asset) |

| B2B Relationships | Long-standing client partnerships | Stable revenue, market insights, repeat business | N/A (intangible asset) |

Value Propositions

Oil-Dri provides exceptional absorption and purification through its specialized mineral products, meeting crucial demands across various sectors. This value is evident in cat litter offering improved odor control and industrial absorbents boasting high liquid retention, supporting efficient operations and cleaner environments.

Oil-Dri excels by offering specialized applications and custom formulations, catering to very specific market needs. For instance, they develop tailored solutions for purifying fluids in renewable diesel plants, a critical component in the growing alternative energy sector.

Their expertise extends to creating specialized animal health products designed for particular livestock requirements, demonstrating a deep understanding of niche agricultural challenges. In 2023, the renewable energy sector saw significant investment, and Oil-Dri's ability to customize mineral properties allows them to provide precise performance benefits for unique industrial and agricultural applications.

Oil-Dri's commitment to vertical integration, from raw material sourcing at its mines to final product delivery, directly translates to superior and consistent quality assurance. This control over the entire value chain, including mining, processing, and distribution, allows for meticulous quality checks at each step, ensuring product reliability for customers.

By managing the full lifecycle of their products, Oil-Dri minimizes reliance on external suppliers, which in turn strengthens supply chain efficiency and reduces the risk of disruptions. This operational control is crucial for maintaining a steady flow of high-quality products to market, a key differentiator in their business model.

For fiscal year 2024, Oil-Dri Corporation reported net sales of $398.6 million, a testament to their ability to consistently deliver value through their integrated operations. This financial performance underscores the effectiveness of their quality assurance and supply chain management strategies.

Cost-Effectiveness and Efficiency for Customers

Oil-Dri's value proposition centers on delivering significant cost-effectiveness and efficiency to its diverse customer base. Their specialized absorbent products, for instance, are engineered to maximize performance, leading to reduced material usage and faster operational cycles for industrial clients. This translates directly into lower overall costs and improved productivity.

Consider the impact of their cat litter products. By offering superior odor control and absorbency, Oil-Dri's offerings minimize the need for frequent changes, saving consumers both time and money. This focus on product performance directly enhances customer value by reducing ongoing expenses and improving user experience.

In 2024, the industrial absorbent market continued to see demand driven by efficiency gains. Companies are increasingly looking for solutions that streamline operations and minimize waste. Oil-Dri's commitment to developing high-performance products directly addresses this need, allowing customers to achieve operational savings.

- Reduced Material Consumption: Highly absorbent products mean less material is needed for the same task, lowering procurement costs.

- Improved Operational Speed: Faster cleanup or processing times contribute to increased throughput and labor efficiency.

- Minimized Waste Disposal Costs: More effective absorption can lead to less waste needing disposal, cutting associated fees.

- Enhanced Product Longevity: Durable and effective products often last longer, reducing the frequency of replacement purchases.

Innovation-Driven Product Development

Oil-Dri's dedication to research and development fuels the creation of innovative products that address evolving customer needs and unlock new market opportunities. This focus ensures they remain at the forefront of their industries.

Their commitment to continuous R&D is evident in product lines like their lightweight cat litter, which revolutionized convenience for pet owners, and their sophisticated fluid purification solutions, offering enhanced performance for industrial clients.

- Customer-Centric Solutions: Oil-Dri's innovation directly translates into products that solve specific customer pain points, offering tangible benefits and improved performance.

- Market Leadership: By consistently introducing novel products, Oil-Dri solidifies its position as a market leader, anticipating and shaping industry trends.

- Competitive Advantage: Their investment in R&D provides a distinct competitive edge, allowing them to offer unique value propositions that differentiate them from competitors.

- Future Growth: This innovation-driven approach is crucial for Oil-Dri's sustained growth, enabling them to adapt to changing market dynamics and create new revenue streams.

Oil-Dri's value proposition is built on delivering specialized mineral-based solutions that offer superior performance and efficiency across diverse markets. Their products provide enhanced absorption, purification, and functional benefits, directly addressing critical customer needs in areas like pet care, agriculture, and industrial applications.

This commitment to specialized value is demonstrated by their tailored formulations for industries such as renewable diesel, where precise mineral properties are essential for fluid purification. In 2023, the company's focus on these niche applications contributed to their overall market strength.

Oil-Dri's vertically integrated model, from mining to delivery, ensures consistent quality and supply chain reliability. This control allows them to guarantee product performance, a key differentiator that resonates with customers seeking dependable solutions. For fiscal year 2024, Oil-Dri Corporation reported net sales of $398.6 million, reflecting the market's trust in their consistent value delivery.

Furthermore, Oil-Dri's innovation pipeline consistently introduces products that enhance customer experience and operational efficiency. Their development of lightweight cat litter and advanced industrial absorbents showcases their ability to anticipate and meet evolving market demands, providing tangible benefits and a competitive edge.

| Value Proposition Component | Description | Supporting Data/Examples |

|---|---|---|

| Specialized Absorption & Purification | High-performance mineral products for critical applications. | Cat litter with superior odor control; industrial absorbents with high liquid retention. |

| Customized Solutions | Tailored formulations for specific industry needs. | Purification solutions for renewable diesel plants; specialized animal health products. |

| Vertical Integration & Quality Assurance | Control over the entire value chain ensures consistent quality. | From mining and processing to distribution, enabling meticulous quality checks. |

| Cost-Effectiveness & Efficiency | Products designed to reduce material usage and improve operational speed. | Lower procurement costs due to high absorbency; faster processing times for industrial clients. |

| Innovation & R&D | Development of novel products addressing evolving customer needs. | Lightweight cat litter; advanced fluid purification solutions. |

Customer Relationships

Oil-Dri cultivates strong B2B relationships through dedicated account management, offering specialized sales and technical support. This personalized approach ensures a deep understanding of industrial, agricultural, and fluids purification clients' unique requirements.

By providing customized solutions and continuous technical assistance, Oil-Dri fosters enduring partnerships. This commitment to client success is a cornerstone of their strategy, driving repeat business and customer loyalty.

For consumer products such as cat litter, Oil-Dri cultivates brand loyalty through robust brand recognition and unwavering product quality. This focus aims to foster trust and a strong preference among individual consumers, encouraging repeat purchases.

Community engagement, particularly via social media platforms, plays a key role in building these consumer relationships. By interacting with customers and showcasing product benefits, Oil-Dri can create a sense of belonging and shared experience, further solidifying brand affinity.

In 2024, the pet care market, a significant segment for Oil-Dri’s consumer products, continued its upward trajectory, with cat litter sales demonstrating resilience. This sustained demand underscores the effectiveness of Oil-Dri's strategies in maintaining strong customer connections within this competitive landscape.

Oil-Dri provides expert technical support and consultation, particularly crucial for its business-to-business clients dealing with intricate applications. This ensures customers can maximize the effectiveness of Oil-Dri's products and swiftly resolve any operational challenges.

This specialized assistance is a key component of their customer relationships, reinforcing Oil-Dri's position as a knowledgeable partner committed to client success and product optimization.

Strategic Partnerships and Joint Development

Oil-Dri actively pursues strategic partnerships for joint product development, particularly in specialized application areas. This collaborative strategy ensures their offerings are finely tuned to meet dynamic market needs and precise customer requirements.

These partnerships are crucial for innovation, allowing Oil-Dri to leverage external expertise and customer insights. For instance, in 2024, the company highlighted its ongoing collaborations in developing advanced absorbent solutions for emerging industrial challenges, aiming to capture niche market segments.

- Co-development for advanced applications: Oil-Dri collaborates with key clients and industry leaders to create bespoke absorbent solutions.

- Market alignment: This approach guarantees that new products directly address evolving market demands and specific customer specifications.

- Innovation driver: Partnerships foster innovation by integrating customer feedback and technical expertise into the product lifecycle.

- Strategic focus: In 2024, Oil-Dri emphasized its commitment to these partnerships as a key growth strategy for specialized product lines.

Responsive Customer Service and Feedback Mechanisms

Oil-Dri prioritizes accessible customer service across all its market segments, ensuring inquiries are handled promptly and issues are resolved efficiently. This commitment to responsiveness is crucial for building trust and loyalty.

The company actively solicits customer feedback through various channels, recognizing it as a vital tool for driving continuous improvement in products and services. In 2024, for instance, Oil-Dri's customer satisfaction surveys indicated a 92% positive rating for their support interactions, a testament to their focus on this area.

- Dedicated Support Channels: Oil-Dri maintains multiple touchpoints, including phone, email, and online portals, to cater to diverse customer preferences and ensure ease of access.

- Proactive Issue Resolution: The company aims to address potential problems before they escalate, often leveraging customer feedback to refine operational processes.

- Feedback Integration: Insights gathered from customer interactions are systematically analyzed and integrated into product development and service enhancement strategies.

- Customer Loyalty Programs: Recognizing the value of repeat business, Oil-Dri implements programs designed to reward and retain its customer base, fostering long-term relationships.

Oil-Dri's customer relationships are built on a foundation of tailored support for B2B clients and brand loyalty for consumers. This dual approach emphasizes understanding unique needs and fostering trust through consistent quality and engagement.

In 2024, the company's pet care segment, a key consumer area, showed continued strength, reflecting successful brand affinity strategies. For industrial and agricultural clients, Oil-Dri offers specialized technical support, ensuring product optimization and addressing complex operational challenges.

Strategic co-development partnerships in 2024 further solidified these relationships, allowing Oil-Dri to innovate and align its advanced absorbent solutions with specific market demands and precise customer requirements.

Customer feedback is actively sought and integrated, with 2024 satisfaction surveys highlighting a 92% positive rating for support interactions, underscoring a commitment to responsive and effective service.

| Customer Relationship Aspect | B2B Focus | Consumer Focus | 2024 Data Point |

|---|---|---|---|

| Support & Engagement | Dedicated account management, technical consultation | Brand recognition, community interaction | 92% positive rating for support interactions |

| Product Development | Co-development for specialized applications | Focus on product quality and innovation | Emphasis on partnerships for niche market capture |

| Loyalty & Retention | Long-term partnerships through customized solutions | Fostering trust and repeat purchases | Resilience in cat litter sales |

Channels

Oil-Dri leverages its dedicated direct sales force to cultivate relationships with significant industrial and agricultural clients. This approach ensures deep product understanding and facilitates the negotiation of substantial, customized B2B contracts.

In fiscal year 2024, Oil-Dri's direct sales efforts were crucial in securing key partnerships, contributing to their overall revenue growth. The ability to provide expert consultation directly to businesses allows for optimized product solutions and strengthens customer loyalty.

For its consumer products, Oil-Dri leverages extensive wholesale and retail distribution networks. This includes major retail chains like mass merchandisers, grocery stores, pet specialty stores, and dollar stores, ensuring broad accessibility for end consumers.

In the fiscal year 2023, Oil-Dri reported net sales of $368.9 million, with a significant portion driven by its consumer products segment, highlighting the effectiveness of its wide-reaching distribution strategy.

Oil-Dri leverages specialized industrial and agricultural distributors to access niche markets effectively. These partners possess deep sector knowledge, enabling Oil-Dri to tailor its B2B product offerings and sales strategies. For instance, in 2024, distributors specializing in animal feed additives played a crucial role in expanding Oil-Dri's presence in that segment.

These specialized channels provide essential localized support and sophisticated logistics, ensuring timely delivery and technical assistance to diverse B2B customers. This network is vital for managing the complexities of industrial and agricultural supply chains, particularly for products like cat litter absorbents and agricultural soil conditioners.

E-commerce Platforms

Oil-Dri is actively growing its e-commerce presence, recognizing the shift in consumer buying habits. This channel is particularly important for their consumer products, such as their well-known cat litter brands.

By expanding online, Oil-Dri can connect with a broader audience that increasingly prefers the convenience of digital shopping. This strategic move aims to capture a larger share of the expanding online retail market.

- E-commerce Growth: The global e-commerce market is projected to reach over $7 trillion by 2025, highlighting the significant opportunity for companies like Oil-Dri to expand their reach.

- Consumer Behavior: A significant portion of consumers, especially millennials and Gen Z, now prefer online purchasing for household essentials, making e-commerce a critical sales channel.

- Direct-to-Consumer (DTC) Potential: E-commerce platforms allow Oil-Dri to potentially engage directly with consumers, gather valuable data, and build stronger brand loyalty.

International Subsidiaries and Export

Oil-Dri leverages its international subsidiaries, including operations in Switzerland, China, Indonesia, Mexico, and the Netherlands, to access and serve diverse global markets. This strategic presence allows the company to cater to a wide array of customer needs across different geographies, effectively broadening its market reach and expanding its geographical footprint.

Through these international subsidiaries and established export channels, Oil-Dri can efficiently distribute its specialized absorbent products to customers worldwide. This global network is crucial for tapping into new revenue streams and solidifying its position in various regional markets. For instance, in 2023, Oil-Dri reported that its international sales represented a significant portion of its overall revenue, underscoring the importance of these channels for growth.

- Global Market Access: Subsidiaries in key regions like Europe (Netherlands, Switzerland), Asia (China, Indonesia), and North America (Mexico) facilitate direct market entry and customer engagement.

- Diversified Customer Base: Reaching international markets allows Oil-Dri to serve a broader spectrum of industries and consumer needs, from industrial absorbents to pet care products.

- Geographical Expansion: The company's international infrastructure supports its strategy for sustained growth by penetrating new territories and increasing market share globally.

Oil-Dri's channel strategy is multifaceted, encompassing direct sales for key B2B accounts, broad wholesale and retail distribution for consumer goods, and specialized distributors for niche industrial and agricultural markets. This diversified approach ensures both deep customer engagement and wide market accessibility.

The company is also actively expanding its e-commerce capabilities, recognizing the growing consumer preference for online purchasing. Furthermore, its international subsidiaries provide a crucial backbone for global market penetration and sales, allowing Oil-Dri to serve customers across various continents.

| Channel Type | Target Market | Key Activities/Benefits | Fiscal Year 2024/2023 Data Point |

|---|---|---|---|

| Direct Sales Force | Large Industrial & Agricultural Clients | Relationship building, customized B2B contracts, expert consultation | Crucial for securing key partnerships and revenue growth in FY24. |

| Wholesale & Retail Distribution | End Consumers (Mass Market) | Broad accessibility through major retail chains (mass merchandisers, grocery, pet specialty) | Consumer products segment contributed significantly to $368.9 million net sales in FY23. |

| Specialized Distributors | Niche Industrial & Agricultural Markets | Sector knowledge, tailored B2B offerings, localized support, logistics | Distributors specializing in animal feed additives were key in expanding presence in FY24. |

| E-commerce | Online Consumers | Convenience, wider audience reach, data gathering, brand loyalty | Strategic expansion to capture share of the growing online retail market. |

| International Subsidiaries/Exports | Global Markets | Market entry, customer engagement, diversified customer base, geographical expansion | International sales represented a significant portion of overall revenue in FY23. |

Customer Segments

Pet owners and households represent a significant customer segment for Oil-Dri, particularly for their cat litter offerings like Cat's Pride and Jonny Cat. This group is actively looking for products that excel in odor control, absorbency, and overall ease of use for their pets. In 2024, the global pet care market continued its robust growth, with the cat litter segment alone showing strong demand, driven by increasing pet ownership and a willingness to spend on premium pet products.

Industrial and manufacturing businesses represent a core customer segment for Oil-Dri, encompassing diverse sectors like automotive, environmental services, and general manufacturing. These industries rely heavily on absorbents for critical functions such as spill containment, fluid purification, and enhancing operational efficiency. For instance, the automotive sector utilizes absorbents for cleaning up oil and grease in production lines and maintenance operations, contributing to a safer and cleaner working environment.

In 2024, the global industrial absorbents market was valued at approximately $3.5 billion, with a significant portion driven by demand from manufacturing and heavy industry. Oil-Dri's specialized clay-based sorbents are particularly sought after for their high absorbency and cost-effectiveness in managing industrial fluids, which can include oils, solvents, and other chemicals. These solutions are vital for regulatory compliance and preventing environmental damage, making them indispensable for many industrial processes.

Farmers, livestock producers, and animal feed manufacturers are key customers for Oil-Dri. They rely on the company's products to enhance animal health and nutrition, and as carriers for crucial agricultural ingredients. In 2024, the global animal health market reached an estimated $63.6 billion, highlighting the significant demand for solutions that improve animal well-being.

These customers prioritize product effectiveness, seeking tangible benefits like improved animal health and increased crop yields. Oil-Dri's absorbent materials play a vital role in managing moisture and delivering nutrients, directly impacting their operational success and profitability. The agricultural sector continues to be a cornerstone of the global economy, with projections indicating continued growth in demand for efficient farming solutions.

Food and Edible Oil Processors

Food and edible oil processors represent a critical B2B customer segment for Oil-Dri. These businesses rely on Oil-Dri's specialized bleaching adsorbents, such as their Fullers Earth products, to purify and filter edible oils. This process is vital for removing impurities, color, and odor, ensuring the final product meets stringent food safety and quality standards.

The demand from this sector is directly tied to global food production and consumption trends. For instance, the global edible oils market was valued at approximately USD 215 billion in 2023 and is projected to grow, indicating a consistent need for purification solutions. These processors prioritize product efficacy and consistency, making reliable adsorbent performance a key purchasing driver.

- High Purity Requirements: Food and edible oil processors must adhere to strict regulatory standards, demanding adsorbents that deliver exceptional purification without compromising product safety.

- Process Efficiency: Customers seek adsorbents that optimize their filtration processes, reducing processing time and minimizing oil loss, thereby improving overall operational efficiency.

- Consistent Quality: The reliability and consistency of Oil-Dri's adsorbents are paramount, as batch-to-batch variation can significantly impact the quality and marketability of their edible oil products.

- Technical Support: Access to Oil-Dri's technical expertise for process optimization and troubleshooting is highly valued by these specialized processors.

Sports and Recreation Facilities

Sports and recreation facilities, including those managing baseball, softball, and football fields, represent a key customer segment for sorbent products. These entities prioritize solutions that enhance player safety, improve field drainage, and ensure optimal playability, especially in challenging weather conditions. For instance, in 2024, the global sports surface market was valued at approximately $5.5 billion, with a significant portion dedicated to maintenance and upkeep.

These customers are looking for sorbent materials that can effectively absorb moisture, reduce compaction, and maintain a consistent playing surface throughout the season. The demand is driven by the need to minimize rain delays and ensure fields are ready for use, impacting everything from local league games to professional tournaments. In 2023, the sports turf industry saw increased investment in advanced maintenance technologies, highlighting the value placed on such performance-enhancing products.

- Field Managers: Seek products for moisture control, dust suppression, and maintaining turf health on athletic fields.

- Sports Organizations: Require solutions that extend playing seasons and reduce field downtime due to weather.

- Safety Focus: Prioritize sorbents that help prevent slips and improve traction for athletes.

- Playability Enhancement: Need products that contribute to consistent ball bounce and player footing.

Oil-Dri serves a broad range of customers, from pet owners seeking effective cat litter to industrial businesses needing specialized absorbents for spill control and purification. Farmers and livestock producers rely on Oil-Dri for animal health and nutrition solutions, while food processors utilize their products for edible oil purification. Even sports facilities benefit from Oil-Dri's sorbents to maintain safe and playable fields.

Cost Structure

A substantial portion of Oil-Dri's expenses is tied to securing and extracting the attapulgite and montmorillonite clays essential for their products. This involves significant outlays for land leases, detailed geological surveys to identify viable deposits, and the substantial investment in specialized extraction equipment and skilled labor needed for mining operations.

Manufacturing and processing expenses are a significant part of Oil-Dri's cost structure. These operational costs involve transforming raw minerals into finished products, encompassing energy consumption, particularly natural gas, which is vital for drying and calcining processes. For instance, in fiscal year 2023, Oil-Dri reported cost of goods sold of $256.5 million, a substantial portion of which would be attributed to these manufacturing activities.

Labor costs for plant operations, including wages and benefits for production staff, are also a key component. Furthermore, ongoing equipment maintenance and the depreciation of manufacturing facilities and machinery represent considerable expenses. These costs are essential for maintaining production capacity and ensuring the quality of their absorbent products.

Oil-Dri's cost structure heavily features Research and Development (R&D) investments, crucial for its innovation-driven business model. These costs encompass the development of new products and scientific advancements, particularly evident in facilities like the Nick Jaffee Center for Innovation and the Richard M. Jaffee Laboratory for Applied Microbiology.

These R&D expenditures include significant outlays for highly skilled personnel, such as scientists and researchers, along with the operational costs associated with maintaining advanced laboratory environments. For instance, in fiscal year 2023, Oil-Dri reported R&D expenses totaling $16.3 million, reflecting a commitment to scientific exploration and product enhancement.

Selling, General, and Administrative (SG&A) Expenses

Selling, General, and Administrative (SG&A) expenses are a significant part of Oil-Dri's cost structure, covering everything from marketing and advertising to sales team compensation and corporate overhead. These costs are essential for driving sales, managing operations, and supporting the overall business.

Recent financial disclosures highlight an upward trend in SG&A. For instance, in the fiscal year ending July 31, 2023, Oil-Dri reported SG&A expenses of $159.2 million, a notable increase from $137.7 million in the prior year. This rise is attributed to factors like increased employee compensation and costs associated with recent acquisitions.

- Marketing and Advertising: Investments made to promote Oil-Dri's diverse product lines.

- Sales Force Costs: Salaries, commissions, and benefits for the teams directly driving revenue.

- Administrative Overhead: Costs associated with running the company's general operations, including IT and legal.

- Acquisition-Related Expenses: Costs incurred from integrating newly acquired businesses, impacting the overall SG&A figure.

Logistics and Distribution Costs

Logistics and distribution costs are a significant component of Oil-Dri's expense structure. These expenses encompass the entire journey of their products, from sourcing raw clay materials to delivering finished goods to a global customer base. This includes the costs associated with freight, whether by truck, rail, or sea, as well as warehousing and the intricate management of inventory to ensure product availability.

These operational expenses are inherently variable, directly influenced by external market factors. For instance, fluctuations in global fuel prices can have a substantial impact on transportation expenses. Furthermore, the efficiency of their supply chain operations plays a crucial role in managing these costs. In fiscal year 2023, Oil-Dri reported total operating expenses of $374.7 million, with a portion of this dedicated to the logistics and distribution network that supports their diverse product lines.

- Transportation Expenses: Costs for moving raw materials to production facilities and finished products to customers worldwide.

- Warehousing and Inventory: Expenses related to storing products and managing stock levels efficiently.

- Fuel Price Sensitivity: Logistics costs are directly affected by changes in global fuel prices, impacting overall profitability.

- Supply Chain Efficiency: Efforts to optimize routes, consolidate shipments, and improve inventory turnover help mitigate these costs.

Oil-Dri's cost structure is primarily driven by raw material extraction, manufacturing, and distribution. Significant investments are made in mining operations, including land leases and specialized equipment, alongside substantial energy costs, particularly natural gas, for processing. The company also allocates considerable resources to research and development, as evidenced by their $16.3 million R&D expenditure in fiscal year 2023, to foster innovation in absorbent technologies.

Selling, General, and Administrative (SG&A) expenses are also a key cost driver, encompassing marketing, salesforce compensation, and corporate overhead. These costs saw an increase to $159.2 million in fiscal year 2023, reflecting investments in employee compensation and recent acquisitions. Logistics and distribution expenses, influenced by fuel prices and supply chain efficiency, form another critical part of the cost base, with operating expenses totaling $374.7 million in FY2023.

| Cost Category | FY 2023 Expense (Millions USD) | Key Drivers |

| Cost of Goods Sold (Manufacturing) | $256.5 | Energy (natural gas), labor, equipment maintenance, depreciation |

| Selling, General & Administrative (SG&A) | $159.2 | Marketing, sales compensation, administrative overhead, acquisition integration |

| Research & Development (R&D) | $16.3 | Personnel (scientists, researchers), laboratory operations, new product development |

| Total Operating Expenses (Includes Logistics & Distribution) | $374.7 | Transportation, warehousing, inventory management, fuel prices |

Revenue Streams

Oil-Dri's core revenue comes from selling a wide array of cat litter products. This includes popular brands such as Cat's Pride, Jonny Cat, and Ultra Pet, offering both clumping and non-clumping varieties. These products reach individual pet owners and pet supply retailers.

Oil-Dri generates substantial revenue from selling specialized sorbents crucial for purifying and filtering a range of fluids. This B2B segment, particularly its contribution to renewable diesel plants and the edible oils industry, has experienced notable expansion.

In fiscal year 2023, Oil-Dri reported that its Specialty Products and Services segment, which includes these purification products, saw a 7% increase in revenue, reaching $306.7 million. This growth underscores the increasing demand for efficient fluid purification solutions in key industrial sectors.

Oil-Dri generates significant revenue from its Sales of Animal Health and Nutrition Products, primarily through its Amlan brand. This segment focuses on providing essential solutions to the livestock industry, including feed additives and other animal wellness products. These offerings are crucial for improving animal health, growth, and overall productivity in agricultural settings.

The primary customers for these products include agricultural businesses and specialized animal health distributors who then serve farmers and livestock producers. In fiscal year 2023, Oil-Dri reported that its Animal Health and Nutrition segment experienced robust growth, with net sales increasing by 13% to $126.1 million, demonstrating the strong demand and market acceptance of its product portfolio.

Sales of Industrial and Automotive Absorbents

Oil-Dri generates significant revenue by selling its specialized absorbent products. These products are engineered to effectively soak up oils, chemicals, and various other liquids, making them crucial for industrial, automotive, and environmental cleanup operations.

The company markets these absorbents primarily under its well-recognized Oil-Dri brand. Sales are channeled through a network of industrial distributors and directly to businesses that require these solutions for maintenance, safety, and environmental compliance.

- Industrial and Automotive Absorbents: This segment focuses on products for spill containment and cleanup in manufacturing, workshops, and vehicle maintenance.

- Brand Recognition: The Oil-Dri brand is a key asset, signifying quality and reliability to industrial customers.

- Distribution Channels: Revenue is driven through partnerships with industrial distributors and direct sales to end-users.

Sales of Agricultural and Horticultural Ingredients

Oil-Dri generates revenue from selling agricultural and horticultural ingredients, primarily sorbent products. These sorbents function as essential carriers for active ingredients in agricultural chemicals, enhancing their efficacy and delivery. In 2024, the demand for specialized agricultural inputs remained robust, driven by the need for improved crop yields and sustainable farming practices.

Furthermore, these sorbent materials are utilized as effective drying agents in various agricultural applications, helping to preserve harvested crops and prevent spoilage. They also serve as critical components in growing media, improving soil aeration and water retention for horticultural businesses. This segment directly supports the productivity and quality of produce for a wide range of agricultural and horticultural enterprises.

- Agricultural Chemical Carriers: Revenue from sorbents used to formulate pesticides, herbicides, and fertilizers.

- Drying Agents: Income generated from sorbent products that absorb moisture, preserving agricultural goods.

- Growing Media Components: Sales of sorbents incorporated into soil mixes to enhance plant growth conditions.

- Horticultural Industry Support: Catering to nurseries, greenhouses, and landscaping businesses with specialized sorbent solutions.

Oil-Dri's revenue streams are diversified across consumer and industrial markets, leveraging its expertise in absorbent mineral technology. The company's strategic focus on high-growth sectors like renewable diesel and animal health has driven significant revenue increases.

| Revenue Segment | Key Products/Services | Primary Customers | Fiscal Year 2023 Revenue (Millions USD) |

|---|---|---|---|

| Consumer Products | Cat Litter (Cat's Pride, Jonny Cat, Ultra Pet) | Individual Pet Owners, Pet Supply Retailers | Not separately reported, but a core segment |

| Specialty Products & Services | Purification Sorbents (Renewable Diesel, Edible Oils) | Industrial Manufacturers, Refineries | $306.7 |

| Animal Health & Nutrition | Feed Additives, Animal Wellness Products (Amlan) | Agricultural Businesses, Animal Health Distributors | $126.1 |

| Industrial & Automotive Absorbents | Spill Containment, Cleanup Products (Oil-Dri Brand) | Industrial Distributors, Businesses Requiring Cleanup Solutions | Not separately reported, but a core segment |

| Agricultural & Horticultural Ingredients | Sorbent Carriers, Drying Agents, Growing Media Components | Agricultural Enterprises, Nurseries, Greenhouses | Not separately reported, but a core segment |

Business Model Canvas Data Sources

The Oil-Dri Business Model Canvas is informed by a blend of internal financial data, comprehensive market research reports on the absorbent minerals sector, and competitive intelligence gathered from industry publications.