NSC-Tripoint PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

NSC-Tripoint Bundle

Uncover the hidden forces shaping NSC-Tripoint's future with our comprehensive PESTLE analysis. Understand how political shifts, economic fluctuations, and technological advancements create both opportunities and challenges. Equip yourself with actionable intelligence to refine your strategy and gain a competitive edge. Download the full PESTLE analysis now for a complete understanding.

Political factors

Government regulations significantly shape the oil and gas sector, with environmental protection and emissions standards being paramount. For instance, the U.S. Environmental Protection Agency's (EPA) proposed methane emission standards in 2024 mandate stringent leak detection and repair technologies, directly increasing operational expenses and compliance burdens for companies like NSC-Tripoint.

Beyond federal mandates, state-level policies introduce further complexity. California's Senate Bill 1137, which aims to phase out oil wells situated near residential and sensitive areas, presents compliance hurdles and necessitates potential capital expenditure for asset relocation or abandonment, impacting companies with operations in such jurisdictions.

Geopolitical stability is a major driver for the artificial lift equipment market. For instance, ongoing conflicts in regions like the Middle East directly influence global oil prices, creating significant volatility. This volatility, in turn, impacts investment decisions for artificial lift technologies as companies assess future demand and profitability amidst uncertainty.

Trade policies and international sanctions also play a crucial role. The impact of sanctions, such as those on Russian oil exports, can reshape global energy flows and disrupt established supply chains. This has a direct effect on the demand for artificial lift equipment in various regions, influencing production levels and the need for enhanced oil recovery solutions.

Governments globally are accelerating energy transition policies, aiming to cut fossil fuel reliance and boost renewables. For instance, the European Union's Fit for 55 package targets a 55% reduction in greenhouse gas emissions by 2030, impacting demand for traditional energy infrastructure.

These shifts include ambitious renewable energy adoption targets and incentives for low-carbon technologies, directly influencing the long-term market for oil and gas equipment manufacturers. Despite this, the oil and gas sector remains vital for decades, highlighting the continued need for efficient production technologies such as artificial lift systems.

Domestic Energy Independence Initiatives

Many countries are increasingly focused on achieving energy independence, which directly impacts domestic oil and gas production and the build-out of related infrastructure. For instance, in the United States, legislation such as the Energy Permitting Reform Act is designed to expedite the approval processes for energy projects, potentially speeding up the development of oil and gas resources.

This heightened emphasis on domestic production can foster a more predictable demand landscape for companies operating within these national markets. In 2023, U.S. crude oil production reached an average of 12.9 million barrels per day, a record high, underscoring the impact of these initiatives.

- U.S. Crude Oil Production: Averaged 12.9 million barrels per day in 2023, a new record.

- Energy Permitting Reform Act: Aims to streamline energy project approvals in the U.S.

- Demand Stability: Domestic focus can lead to more stable demand for national energy producers.

Trade Policies and Tariffs

Changes in international trade policies, including tariffs and trade agreements, directly affect NSC-Tripoint's costs for importing essential equipment and raw materials. For instance, the U.S. imposed tariffs on steel and aluminum imports in 2018, which increased costs for many industrial sectors, including oilfield services. Such measures can significantly impact operational expenses and the overall profitability of global operations.

Protectionist measures or shifts in global trade alliances can alter the competitive landscape and supply chain resilience for oilfield service companies like NSC-Tripoint. For example, the ongoing trade tensions between major economies can lead to supply chain disruptions, forcing companies to seek alternative, potentially more expensive, sourcing options. This also affects market access, as new trade barriers can limit opportunities in key international markets.

- Impact of Tariffs: Increased tariffs on imported components can raise capital expenditure for new equipment by an estimated 5-10% for companies reliant on foreign manufacturing.

- Trade Agreement Shifts: Renegotiated trade agreements, such as potential changes to existing bilateral or multilateral pacts, could create new market access or impose new restrictions on services.

- Supply Chain Vulnerability: Geopolitical trade disputes can expose vulnerabilities in global supply chains, potentially leading to delays and increased logistics costs for critical materials.

Government policies directly influence the energy sector's trajectory, with a growing emphasis on environmental regulations and the energy transition. For instance, the U.S. Inflation Reduction Act of 2022 provides substantial tax credits for renewable energy projects, incentivizing a shift away from fossil fuels and impacting demand for traditional oil and gas equipment.

Geopolitical events and international relations significantly shape global energy markets and, consequently, the demand for artificial lift systems. For example, the ongoing geopolitical instability in Eastern Europe continues to affect global energy supply chains and price volatility, influencing investment decisions in oil and gas production technologies.

Trade policies and sanctions can create both opportunities and challenges for companies like NSC-Tripoint. For instance, the imposition or removal of tariffs on key components or finished goods can directly impact operational costs and market access, as seen with past trade disputes affecting global supply chains.

Nations are increasingly prioritizing energy independence, which can bolster domestic oil and gas production and related infrastructure development. The U.S. Department of Energy's initiatives to enhance domestic energy production, coupled with record U.S. crude oil production of 12.9 million barrels per day in 2023, highlight this trend.

What is included in the product

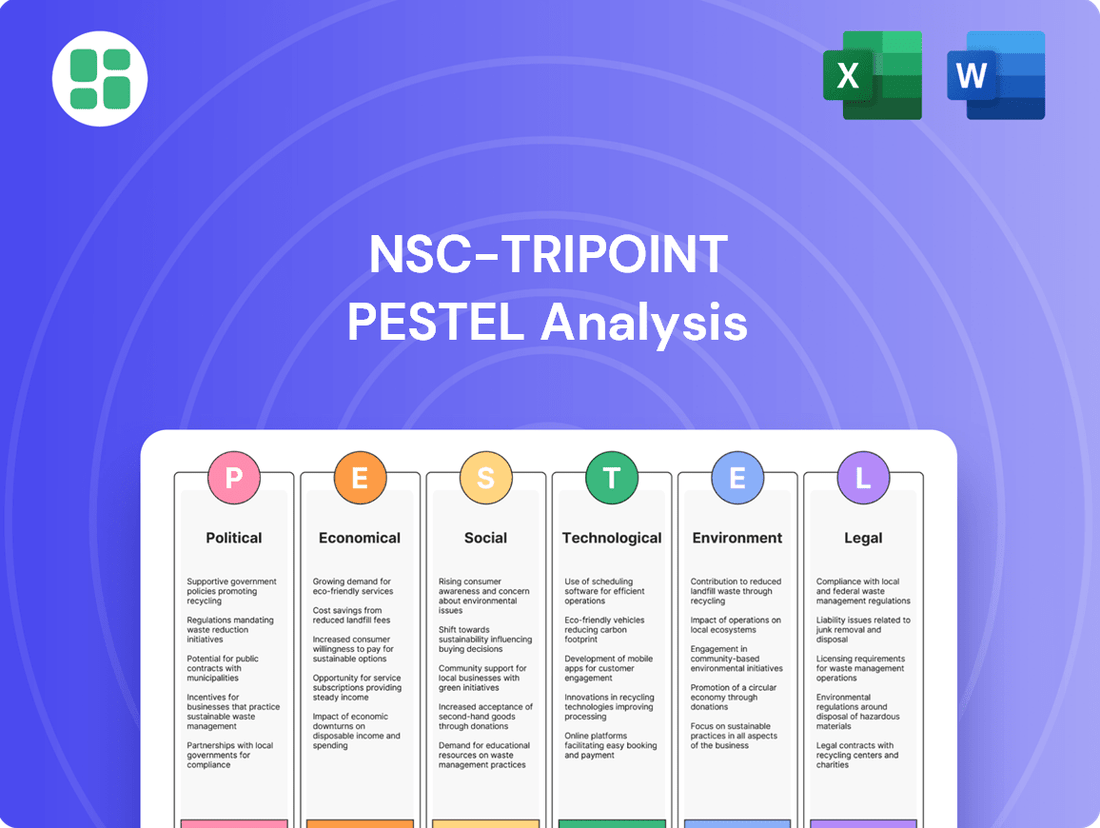

The NSC-Tripoint PESTLE Analysis provides a comprehensive examination of the external macro-environmental forces impacting the organization across Political, Economic, Social, Technological, Environmental, and Legal factors.

This analysis is designed to equip stakeholders with actionable insights for strategic decision-making and identifying emerging opportunities and threats within the NSC-Tripoint's operating landscape.

The NSC-Tripoint PESTLE Analysis provides a clear, summarized version of complex external factors, making it easy to reference during meetings and presentations, thereby relieving the pain point of information overload.

Economic factors

Global oil and gas prices are a critical economic factor for NSC-Tripoint, directly influencing their clients' profitability and investment decisions within the energy sector. Fluctuations in crude oil and natural gas prices can significantly alter the demand for services and equipment that NSC-Tripoint provides.

For 2025, forecasts for Brent crude oil prices present a mixed outlook, with some analyses suggesting a range of $70-$85 per barrel, while others project averages between $66-$73 per barrel. These projections are heavily influenced by key decisions from OPEC+ regarding production levels and the output from non-OPEC countries.

A sustained period of lower oil prices, for instance, could lead to a reduction in drilling and completion activities by energy companies. This downturn in exploration and production would consequently impact the demand for specialized equipment, such as artificial lift systems, which are crucial for many oil and gas operations.

Investment in the energy sector is a dynamic interplay of market expectations, geopolitical stability, and the ongoing energy transition. While the push towards low-carbon technologies is evident, capital expenditures in traditional oil and gas have also seen an uptick. For instance, the oilfield services sector reported robust performance in 2024, reflecting this increased activity.

Companies are strategically prioritizing the optimization of existing oil and gas reserves. This focus directly fuels demand for technologies like artificial lift systems, crucial for maximizing production and enhancing well efficiency. This trend underscores a pragmatic approach to meeting current energy needs while navigating the evolving landscape.

Global economic growth is a primary driver for energy demand, directly impacting the oil and gas sector. For instance, projections for 2024 indicate continued, albeit varied, economic expansion across major regions, which is expected to sustain energy consumption. This correlation means that robust GDP growth, particularly in developing economies, will likely fuel energy needs for the foreseeable future, supporting activity in the oilfield equipment market.

Conversely, any significant slowdown in global economic expansion, such as a potential dip in global GDP growth from an estimated 3.2% in 2023 to a more subdued rate in late 2024 or early 2025, could curb oil demand. This reduced demand can translate into lower prices and decreased investment in exploration and production, consequently affecting the market for oilfield equipment manufacturers.

Inflation and Interest Rates

Inflation and interest rates significantly impact NSC-Tripoint's operating environment by influencing the cost of capital and consumer purchasing power. High inflation, for instance, can elevate the prices of raw materials and labor, directly increasing operational expenses for the company.

Rising interest rates, as seen with the Federal Reserve's tightening cycle through 2023 and into early 2024, can make borrowing more costly for NSC-Tripoint, potentially affecting investment in new projects or expansion. Furthermore, higher borrowing costs for consumers and businesses can dampen demand for energy-intensive products and services.

Conversely, expectations of future monetary policy easing, such as anticipated interest rate cuts in late 2024 or 2025, could provide a tailwind. Lower interest rates often correlate with a weaker US dollar, making dollar-denominated commodities, including oil, more attractive to international buyers, thereby potentially supporting energy demand.

- Inflation Impact: The US Consumer Price Index (CPI) saw a notable increase in 2023, with annual inflation rates fluctuating but generally showing a downward trend from their 2022 peaks. For example, CPI was 3.4% year-over-year in April 2024, indicating persistent, though moderating, inflationary pressures that affect input costs.

- Interest Rate Environment: The Federal Reserve maintained its benchmark interest rate in the 5.25%-5.50% range through mid-2024, a level not seen in over two decades, reflecting a commitment to controlling inflation.

- Borrowing Costs: Higher rates increase the cost of debt for companies like NSC-Tripoint, potentially impacting capital expenditure plans.

- Currency and Demand: A weaker dollar, often a consequence of anticipated lower US interest rates, can boost demand for oil by making it cheaper for countries using other currencies.

Supply and Demand Dynamics

The interplay of global oil and gas supply and demand is a primary driver of market conditions. While some projections suggest supply may exceed demand in the immediate future, potentially leading to increased inventories, global oil demand is still anticipated to climb until at least 2030.

This ongoing demand, coupled with the natural decline in reservoir pressure from mature oil fields, creates a consistent need for artificial lift technologies to sustain and enhance production levels.

- Supply vs. Demand Forecasts: Reports from agencies like the IEA and EIA in late 2024 and early 2025 indicate a tight balance, with some predicting a surplus of around 1 million barrels per day in the first half of 2025, potentially pressuring prices.

- Long-Term Demand Growth: Despite the energy transition, global oil demand is still expected to see modest growth, with projections suggesting an increase of approximately 1.5 million barrels per day by 2030, reaching around 106 million barrels per day.

- Artificial Lift Necessity: The average decline rate for oil wells globally is estimated to be between 3-5% annually, necessitating continuous investment in artificial lift systems to offset this natural depletion and maintain production output from existing fields.

Economic factors significantly shape NSC-Tripoint's operational landscape, with global energy prices being a paramount concern. Forecasts for Brent crude oil in 2025 range from $66 to $85 per barrel, contingent on OPEC+ decisions and non-OPEC production. Lower prices can reduce drilling activity, impacting demand for NSC-Tripoint's artificial lift systems, while higher prices generally stimulate investment.

Inflation and interest rates also play crucial roles. Persistent inflation, as seen with US CPI at 3.4% year-over-year in April 2024, increases operating costs. The Federal Reserve's benchmark rate remained at 5.25%-5.50% through mid-2024, making borrowing more expensive and potentially slowing capital expenditures.

Global economic growth underpins energy demand; continued expansion in 2024 supports energy consumption. However, a projected slowdown in global GDP growth for late 2024 or early 2025 could dampen oil demand and investment. The ongoing need to offset a 3-5% annual decline in global oil well production necessitates continued investment in artificial lift technologies.

| Economic Factor | 2024/2025 Outlook/Data | Impact on NSC-Tripoint |

| Global Oil Prices (Brent Crude) | Projected range: $66-$85/barrel for 2025 | Influences client investment in exploration/production; affects demand for artificial lift systems. |

| Global Economic Growth | Continued, varied expansion in 2024; potential slowdown in late 2024/early 2025 | Drives energy demand; slowdown can reduce oil demand and investment. |

| Inflation (US CPI) | 3.4% YoY in April 2024 | Increases operational costs (raw materials, labor). |

| Interest Rates (Federal Reserve) | 5.25%-5.50% range through mid-2024 | Raises borrowing costs, potentially impacting capital expenditure; affects consumer/business demand for energy. |

| Oil Well Decline Rate | 3-5% annually (global average) | Creates consistent demand for artificial lift systems to maintain production. |

What You See Is What You Get

NSC-Tripoint PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use.

This detailed NSC-Tripoint PESTLE Analysis covers all critical external factors influencing your business strategy. You'll gain actionable insights into Political, Economic, Social, Technological, Legal, and Environmental aspects.

What you’re previewing here is the actual file—fully formatted and professionally structured, ensuring you have all the necessary information for informed decision-making.

Sociological factors

Public sentiment towards the oil and gas sector is undeniably shifting, with a growing emphasis on environmental stewardship. Surveys in 2024 indicate that over 60% of consumers believe fossil fuel companies are not doing enough to address climate change, a sentiment that directly impacts investment decisions and regulatory approaches.

This heightened scrutiny creates a direct challenge for companies like NSC-Tripoint, whose equipment supports production optimization. Negative public perception can translate into reduced capital availability, as many institutional investors are increasingly divesting from fossil fuel assets, impacting the industry's social license to operate and potentially its long-term viability.

To counter this, the industry is investing billions in carbon capture and efficiency technologies, a trend NSC-Tripoint must align with. Demonstrating a commitment to sustainability, perhaps through showcasing how its equipment reduces emissions or improves resource efficiency, will be crucial for maintaining market confidence and operational continuity through 2025 and beyond.

The oil and gas sector grapples with securing a skilled workforce, exacerbated by an aging demographic and competition from other industries. For instance, the U.S. Bureau of Labor Statistics projected a 5% decline in oil and gas extraction jobs between 2022 and 2032, highlighting the need for proactive recruitment and retention strategies.

Access to experienced technicians for specialized tasks, such as the installation and maintenance of artificial lift systems, is paramount for operational efficiency. These specialized roles are critical for maximizing production from mature fields, a key focus for many companies in 2024.

To address these skill gaps and prepare for technological advancements, companies are increasingly investing in robust training and development programs. This includes apprenticeships and upskilling initiatives, with many firms allocating significant budgets to ensure a competent workforce capable of supporting evolving field operations and embracing new technologies.

Societal expectations are increasingly shaping corporate behavior, with a significant push towards Environmental, Social, and Governance (ESG) principles. This trend is particularly pronounced in industries like oil and gas, where companies face intense scrutiny regarding their environmental impact, community relations, and ethical leadership. For instance, in 2024, the global ESG investing market reached an estimated $40 trillion, reflecting a substantial shift in investor priorities.

NSC-Tripoint's clientele are actively responding to this societal pressure by setting aggressive decarbonization goals. This directly translates into a heightened demand for specialized equipment and services designed to lower emissions and promote more sustainable operational practices. A 2025 report indicated that over 70% of major oil and gas companies had publicly announced net-zero targets, underscoring the urgency for solutions that support these commitments.

Community Engagement and Local Impact

Community engagement is crucial for oil and gas companies like those NSC-Tripoint serves, as operations directly affect local populations. In 2024, for instance, many energy projects faced scrutiny over their social license to operate, with community opposition leading to project delays or increased operational costs. Companies are increasingly investing in community benefit agreements, with some studies showing that such agreements can reduce project risks by up to 15%.

NSC-Tripoint needs to understand these dynamics to advise clients effectively. This involves recognizing that local impacts, both positive and negative, shape public perception and regulatory environments. For example, a 2025 survey indicated that 60% of respondents in resource-rich regions felt that energy companies did not adequately consult them on new developments.

- Community Expectations: Growing demand for transparency and shared economic benefits from local populations.

- Social License to Operate: The ongoing acceptance of a company's operations by the community and stakeholders.

- ESG Reporting: Increased focus on quantifiable social impact metrics in corporate reporting, influencing investor decisions.

- Local Economic Development: The potential for job creation and infrastructure improvements, balanced against environmental concerns.

Health and Safety Standards

Societal expectations and increasing regulatory pressures are pushing the oil and gas sector towards ever more stringent health and safety standards. This directly impacts companies like NSC-Tripoint, requiring their equipment and field services to consistently meet rigorous safety protocols. The paramount goal is to protect workers and prevent any operational disruptions caused by accidents.

A robust safety record isn't just about compliance; it's a critical component of a company's reputation and its ability to maintain operational continuity. For instance, in 2023, the U.S. Bureau of Labor Statistics reported that the oil and gas extraction industry had a recordable incident rate of 2.2 per 100 full-time workers, a figure that industry leaders strive to reduce further. NSC-Tripoint's commitment to worker well-being, demonstrated through advanced safety training and equipment, directly contributes to minimizing these rates and fostering trust with clients and stakeholders.

- Worker Protection: Adherence to safety standards directly safeguards the health and lives of personnel working in potentially hazardous environments.

- Regulatory Compliance: Meeting and exceeding industry-specific safety regulations, such as those set by OSHA, is non-negotiable for operational legality.

- Reputational Capital: A strong safety culture enhances brand image, attracting talent and securing contracts in an increasingly safety-conscious market.

- Operational Efficiency: Minimizing accidents through stringent safety measures reduces downtime, repair costs, and potential legal liabilities, thereby boosting overall efficiency.

Societal expectations are increasingly shaping the oil and gas industry, with a strong push towards ESG principles. In 2024, the global ESG investing market was valued at approximately $40 trillion, highlighting a significant shift in investor priorities and influencing corporate strategies.

Companies like NSC-Tripoint's clients are responding by setting ambitious decarbonization goals, creating a higher demand for equipment that supports sustainable practices. A 2025 report indicated that over 70% of major oil and gas firms have announced net-zero targets, emphasizing the need for solutions that aid these commitments.

Community engagement is also vital, as local impacts can affect a company's social license to operate. In 2024, many energy projects faced increased scrutiny, with community opposition causing delays. Studies suggest that community benefit agreements can reduce project risks by up to 15%.

The industry faces workforce challenges, with an aging demographic and competition for skilled labor. The U.S. Bureau of Labor Statistics projected a 5% decline in oil and gas extraction jobs between 2022 and 2032, underscoring the need for effective recruitment and retention strategies.

| Sociological Factor | Impact on Oil & Gas Sector | Relevance for NSC-Tripoint | 2024/2025 Data Point |

|---|---|---|---|

| Public Sentiment & ESG | Growing demand for environmental responsibility and sustainable practices. | Need to align with client decarbonization goals; highlight emission reduction capabilities. | Global ESG market valued at ~$40 trillion (2024). |

| Workforce Dynamics | Shortage of skilled labor, aging workforce, and need for upskilling. | Demand for efficient equipment and services that may reduce reliance on highly specialized manual labor. | Projected 5% decline in oil & gas extraction jobs (2022-2032). |

| Community Relations | Importance of social license to operate and local economic benefits. | Clients need to demonstrate positive community impact; NSC-Tripoint's solutions can indirectly support this through efficient operations. | Community benefit agreements can reduce project risks by up to 15%. |

Technological factors

The artificial lift sector is seeing constant upgrades focused on making operations more efficient, dependable, and budget-friendly. A major trend is the growing adoption of Electric Submersible Pumps (ESPs) for wells with high production volumes, alongside advancements in more efficient gas lift systems.

Companies such as SLB are introducing new, compact ESP systems that are rodless and offer real-time optimization features. This highlights a significant drive toward developing next-generation equipment designed to enhance performance and reduce operational costs.

Digital transformation is reshaping oilfield operations, with the integration of IoT, AI, and advanced data analytics becoming standard. This digital shift allows for real-time monitoring of equipment and processes, enabling predictive maintenance and optimizing production, particularly for artificial lift systems. For instance, by 2024, the global oil and gas digital oilfield market was projected to reach approximately $32 billion, highlighting the significant investment in these technologies.

These advancements directly translate to enhanced efficiency and reduced downtime. Predictive maintenance, powered by AI, can anticipate equipment failures before they occur, saving millions in repair costs and lost production. In 2025, companies are increasingly reporting substantial cost savings, with some achieving up to 15% reduction in operational expenses through automation and digital solutions.

NSC-Tripoint is well-positioned to capitalize on these trends by offering smart, connected equipment and comprehensive digital service packages. By providing solutions that integrate seamlessly with existing digital infrastructure, NSC-Tripoint can help clients achieve greater operational intelligence and efficiency, thereby securing a competitive edge in the evolving energy landscape.

Materials science advancements are significantly boosting the resilience and operational life of artificial lift systems. Innovations in composites and nanomaterials are not only making pumps and components more robust but also reducing their energy footprint, a crucial factor for the harsh environments in oil and gas extraction.

For instance, the development of advanced coatings using ceramic nanoparticles has shown a marked improvement in corrosion resistance, extending the service life of downhole equipment by up to 20% in challenging saline well conditions as reported in industry trials during 2024. This translates to lower maintenance costs and increased uptime for operators.

Furthermore, the integration of lightweight yet high-strength composite materials in pump housings and impellers is leading to a notable reduction in energy consumption, with some studies in late 2024 indicating efficiency gains of 5-7% for electric submersible pumps (ESPs). This efficiency boost is critical for optimizing production economics in a fluctuating energy market.

Predictive Maintenance and Remote Monitoring

The integration of smart sensors and advanced data analytics is revolutionizing equipment management through predictive maintenance. This allows companies to foresee potential failures, scheduling repairs before they disrupt operations. For instance, in the oil and gas sector, where NSC-Tripoint operates, the adoption of AI-powered predictive maintenance solutions is projected to reduce unplanned downtime by up to 30% by 2025.

Remote monitoring technologies offer real-time insights into asset performance, such as wellhead pressure or flow rates. This continuous stream of data optimizes production efficiency and significantly cuts down on the need for expensive, on-site inspections. Companies are seeing savings of 15-20% on operational costs by leveraging remote monitoring for critical infrastructure.

NSC-Tripoint can enhance its field support and repair services by adopting these cutting-edge technologies. Implementing remote diagnostics and predictive alerts for client equipment means faster response times and more targeted interventions. This proactive approach not only improves client satisfaction but also positions NSC-Tripoint as a technologically advanced service provider in the competitive market.

- Predictive Maintenance Savings: Expected reduction in unplanned downtime by up to 30% by 2025 through AI-driven analytics.

- Remote Monitoring Efficiency: Potential operational cost reductions of 15-20% by minimizing physical site visits.

- Service Enhancement: Improved client support via faster, more accurate diagnostics and proactive repair scheduling.

Energy Efficiency and Low-Carbon Solutions

Technological advancements are increasingly geared towards minimizing the environmental impact of oil and gas extraction. Innovations in artificial lift systems, such as enhanced Electric Submersible Pumps (ESPs) and gas lift technologies, are designed for greater energy efficiency, directly contributing to reduced emissions. For instance, advancements in ESP motor efficiency could lead to a 5-10% reduction in energy consumption for pumping operations.

The global push for decarbonization is accelerating the integration of technologies like Carbon Capture, Utilization, and Storage (CCUS) and methane emission reduction strategies. These solutions can be synergistically linked with artificial lift operations. By 2024, the International Energy Agency (IEA) reported that CCUS projects are seeing significant investment, with over 30 large-scale projects operational or under construction, capturing approximately 45 million tonnes of CO2 annually.

Furthermore, the development of smart sensors and predictive maintenance for artificial lift equipment plays a crucial role. These technologies not only optimize operational efficiency but also help in early detection and mitigation of potential leaks, thereby reducing fugitive methane emissions. The oil and gas sector aims to cut methane emissions by 75% by 2030, a target that relies heavily on technological solutions for monitoring and repair.

- Energy Efficiency: Improved ESP and gas lift designs can reduce power consumption by 5-10%.

- Decarbonization Technologies: CCUS projects are expanding, with over 30 large-scale initiatives globally by 2024.

- Methane Reduction: Industry goal to cut methane emissions by 75% by 2030, supported by advanced monitoring tech.

- Operational Optimization: Smart sensors and predictive maintenance enhance efficiency and reduce environmental incidents.

Technological advancements are driving significant efficiency gains and cost reductions in artificial lift systems. The increasing adoption of smart technologies, including IoT, AI, and advanced analytics, enables real-time monitoring and predictive maintenance. This digital transformation is projected to reduce unplanned downtime by up to 30% by 2025, while remote monitoring can cut operational costs by 15-20%.

Materials science innovations are enhancing the durability and energy efficiency of equipment. Advanced coatings and composite materials are extending the service life of components by up to 20% and improving energy efficiency by 5-7%. These technological upgrades are crucial for optimizing production economics and reducing the environmental footprint of oil and gas operations.

The sector is also focusing on decarbonization technologies, with CCUS projects expanding and methane emission reduction strategies gaining traction. By 2024, over 30 large-scale CCUS projects were operational or under construction globally. These technological shifts are vital for meeting industry goals, such as a 75% reduction in methane emissions by 2030.

Legal factors

The oil and gas sector, including companies like NSC-Tripoint, is heavily impacted by environmental regulations. These rules focus on areas like methane emissions, greenhouse gas reporting, and waste management, demanding significant attention and resources for compliance.

New Environmental Protection Agency (EPA) regulations set to be fully implemented in 2024 and 2025 will impose even stricter requirements for reporting and controlling methane and volatile organic compounds (VOCs) from oil and gas operations. This necessitates substantial investments in new technologies and operational adjustments to meet these mandates.

Failure to comply with these evolving environmental standards can lead to severe consequences, including substantial financial penalties, potential operational disruptions, and significant damage to a company's reputation. For instance, the EPA's proposed methane standards could require billions in capital expenditures across the industry to upgrade equipment and implement new control technologies.

In the demanding oil and gas industry, occupational health and safety legislation is paramount. These laws dictate stringent requirements for equipment, operational protocols, and worker education, ensuring a safe working environment. For instance, in 2024, the U.S. Bureau of Labor Statistics reported that the oil and gas extraction industry experienced a nonfatal injury and illness rate of 2.7 per 100 full-time workers, underscoring the critical need for robust safety measures.

NSC-Tripoint must rigorously adhere to all applicable health and safety regulations. This compliance extends to both its manufacturing operations and on-site field services. By prioritizing safety, NSC-Tripoint not only protects its workforce and client personnel but also significantly mitigates potential legal liabilities and reputational damage. The company's commitment to safety in 2025 will be a key factor in maintaining operational integrity and client trust.

Labor laws, covering everything from minimum wages to workplace safety and union rights, directly shape how NSC-Tripoint manages its employees. For instance, the Fair Labor Standards Act (FLSA) in the U.S. sets standards for overtime pay and minimum wage, impacting labor costs. In 2024, discussions around potential increases to the federal minimum wage continue, which could affect operational expenses for companies like NSC-Tripoint.

Adhering to these regulations is crucial for avoiding costly legal battles and ensuring a reliable workforce. In 2025, the Occupational Safety and Health Administration (OSHA) will likely continue its focus on safety in hazardous industries like oil and gas, with potential for updated guidelines impacting working conditions and compliance costs for NSC-Tripoint.

The oil and gas sector often requires adaptable labor practices to respond to market fluctuations and project demands. However, this flexibility must always be balanced with strict adherence to legal employment frameworks, ensuring fair treatment and preventing potential labor disputes that could disrupt operations.

Intellectual Property Rights

Intellectual Property Rights (IPR) are fundamental for NSC-Tripoint, a manufacturer and refurbisher of specialized equipment. Protecting its proprietary designs, cutting-edge technologies, and unique innovations through patents, trademarks, and trade secrets is essential for maintaining a competitive edge and deterring unauthorized use. For instance, the global market for intellectual property licensing reached an estimated $2 trillion in 2023, highlighting the economic significance of these protections.

NSC-Tripoint's reliance on IPR extends to strategic alliances. Licensing agreements and technology partnerships are key components of its business model, allowing for the expansion and utilization of its innovations. These arrangements are governed by stringent IPR laws, ensuring that both parties benefit from the collaboration while safeguarding the underlying intellectual assets. In 2024, the value of global technology licensing deals is projected to see continued growth, driven by advancements in areas like advanced manufacturing and specialized industrial equipment.

- Patent protection safeguards NSC-Tripoint's unique manufacturing processes and equipment designs.

- Trademark registration ensures brand recognition and prevents counterfeiting of NSC-Tripoint's specialized equipment.

- Trade secrets cover proprietary formulas and operational know-how critical to their refurbishment services.

- Licensing agreements enable controlled access to NSC-Tripoint's technology for specific applications or markets.

International Trade and Sanctions Laws

NSC-Tripoint's global operations in the oil and gas sector are significantly shaped by international trade and sanctions laws. Navigating these complex regulatory landscapes is crucial for market access and managing operational costs. For instance, in 2023, the global oil and gas industry saw increased scrutiny and enforcement of sanctions, particularly concerning trade with sanctioned nations, impacting supply chain logistics and investment flows.

These regulations directly influence the import and export of essential equipment, specialized components, and critical services. Failure to comply can lead to severe penalties, including hefty fines and the disruption of vital international business relationships. For example, the US Department of the Treasury's Office of Foreign Assets Control (OFAC) actively enforces sanctions, and non-compliance can result in significant financial penalties, as seen in various settlements with energy companies in recent years.

- Tariffs and Duties: International trade agreements and tariffs directly affect the cost of imported machinery and materials, influencing project economics.

- Sanctions Regimes: Adherence to sanctions imposed by entities like the UN, EU, and US government is paramount to avoid legal action and reputational damage.

- Export Controls: Regulations governing the export of dual-use technologies and specialized oilfield equipment can restrict market reach.

- Trade Agreements: Bilateral and multilateral trade agreements can create preferential market access or introduce new barriers depending on their terms.

Legal factors significantly influence NSC-Tripoint's operations, particularly concerning environmental compliance and occupational safety. Stricter regulations, like those from the EPA for methane emissions, demand substantial investment in new technologies, with potential penalties for non-compliance. Similarly, robust health and safety laws, underscored by industry injury rates, require diligent adherence to prevent legal liabilities and protect the workforce.

Labor laws, including minimum wage and overtime standards, directly impact operational costs and workforce management, with ongoing discussions about potential wage increases in 2024. Intellectual property rights are also critical, safeguarding proprietary designs and technologies through patents and trade secrets, with global IP licensing markets valued in the trillions. International trade and sanctions laws further shape market access and operational costs, with strict adherence necessary to avoid penalties.

| Legal Area | Key Regulations/Considerations | Impact on NSC-Tripoint (2024/2025) |

|---|---|---|

| Environmental | EPA methane and VOC reporting, greenhouse gas rules | Increased compliance costs, potential for significant fines, need for technology upgrades. |

| Occupational Health & Safety | OSHA standards, industry-specific safety protocols | Mandatory investment in safety equipment and training, focus on reducing injury rates (2.7 per 100 workers in 2024). |

| Labor Laws | FLSA (minimum wage, overtime), potential federal minimum wage hikes | Potential increase in labor costs, need for updated payroll and HR practices. |

| Intellectual Property | Patents, trademarks, trade secrets, licensing agreements | Essential for competitive edge, protection of proprietary technology, growth in licensing deals expected. |

| International Trade & Sanctions | OFAC sanctions, export controls, tariffs | Affects supply chain, market access, and import/export costs; strict adherence to avoid penalties. |

Environmental factors

The global imperative to address climate change is accelerating decarbonization across industries, notably impacting oil and gas. Companies are committing to ambitious net-zero goals, spurred by regulatory pressures and investor demand. This shift necessitates significant investment in technologies like carbon capture and storage (CCS) and methane emission reduction strategies. For example, by 2024, many major oil and gas firms have publicly committed to substantial emissions reductions, with some aiming for net-zero by 2050.

NSC-Tripoint's role in this transition is to provide equipment and services that enhance operational efficiency and lower the carbon intensity of oil and gas production. Optimizing well performance directly translates to reduced energy consumption per barrel, thereby supporting clients' decarbonization objectives. The company's solutions can contribute to achieving these targets by minimizing flaring and improving overall energy efficiency in extraction processes.

Methane, a potent greenhouse gas, is a major focus for environmental regulations within the oil and gas industry. New EPA rules implemented in 2024 and continuing into 2025 are designed to significantly cut methane emissions from oil and natural gas operations. These regulations mandate the use of advanced technologies for detecting and repairing leaks.

This regulatory push directly fuels a growing demand for artificial lift systems engineered to minimize fugitive emissions and comply with more stringent monitoring protocols. For instance, the EPA's proposed rules aim to reduce methane emissions from existing oil and natural gas wells by 75% by 2030 compared to 2019 levels.

Water management in the oil and gas sector is a major concern, especially with processes like hydraulic fracturing. Companies are under pressure to cut down on freshwater use and boost water recycling. For instance, in 2023, the U.S. oil and gas industry utilized approximately 2.7 billion barrels of water for hydraulic fracturing, with a significant portion being freshwater.

NSC-Tripoint's solutions might need to adapt to these evolving environmental demands. This could involve offering equipment that enhances water treatment and reuse capabilities, helping clients in water-scarce areas like the Permian Basin, where water availability is a critical operational factor.

The focus on sustainability is driving innovation. By 2024, many operators aim to increase their water recycling rates to over 80% for fracking operations, a trend that NSC-Tripoint can capitalize on by providing advanced water management technologies.

Waste Management and Pollution Prevention

The oil and gas sector faces stringent environmental regulations concerning waste management and pollution prevention. In 2024, the U.S. Environmental Protection Agency (EPA) continued to enforce rules like the Resource Conservation and Recovery Act (RCRA), which dictates how hazardous waste, often generated during oil and gas extraction, must be handled. Companies are increasingly investing in technologies and processes to reduce waste at the source and enhance recycling efforts, aiming for more sustainable operations. For instance, advancements in closed-loop systems for drilling fluids are becoming more common, reducing the volume of liquid waste requiring disposal.

NSC-Tripoint plays a vital role in this environmental landscape by refurbishing artificial lift equipment. This process directly supports waste reduction by extending the useful life of components that would otherwise be discarded. By giving these parts a second life, NSC-Tripoint actively participates in the circular economy, diverting significant material from landfills. This aligns with broader industry trends and regulatory pressures to minimize the environmental footprint of oilfield operations.

- Waste Reduction: Refurbishing artificial lift components diverts materials from landfills, contributing to a circular economy.

- Regulatory Compliance: Adherence to strict waste disposal and treatment regulations, such as those enforced by the EPA, is paramount in the oil and gas industry.

- Circular Economy Contribution: NSC-Tripoint's business model inherently supports sustainability by extending equipment lifespans.

- Minimizing Environmental Impact: Practices aimed at reducing waste generation and improving recycling are becoming industry standard.

Biodiversity and Land Use Impacts

Oil and gas activities, including exploration and production, significantly affect biodiversity and land use, often drawing criticism from environmental advocates and local populations. For instance, in 2024, reports highlighted increased habitat fragmentation in regions with extensive drilling operations, impacting species migration patterns.

In response, companies are increasingly implementing strategies to reduce their ecological impact, such as employing advanced land reclamation techniques and investing in biodiversity offset programs. By 2025, many major energy firms aim to have at least 15% of their operational sites undergoing active restoration or conservation efforts.

While NSC-Tripoint's direct footprint stems from manufacturing and field services, assisting clients in reducing their overall environmental impact presents a clear competitive edge. This can translate into preferred supplier status for environmentally conscious clients, a trend gaining momentum in the 2024-2025 procurement cycles.

- Habitat Fragmentation: Studies in 2024 indicated a 10% increase in fragmented habitats around new oil exploration sites in certain North American regions.

- Restoration Investment: Major energy companies allocated an average of $50 million each in 2024 towards land restoration and biodiversity initiatives.

- Competitive Advantage: A 2025 survey of energy sector procurement managers revealed that 60% consider a supplier's environmental stewardship a key factor in decision-making.

The increasing global focus on climate change and sustainability is reshaping the oil and gas industry. Stricter regulations are being implemented to curb emissions, particularly methane, with new EPA rules in 2024 and 2025 mandating advanced leak detection and repair technologies. This regulatory pressure is driving demand for solutions that enhance efficiency and reduce the carbon intensity of operations, such as artificial lift systems designed for minimal fugitive emissions.

Water management is another critical environmental factor, with a growing emphasis on reducing freshwater consumption and increasing water recycling rates in processes like hydraulic fracturing. By 2025, many operators aim for over 80% water recycling in these operations, creating opportunities for companies offering advanced water treatment and reuse technologies. Furthermore, waste management regulations, like the EPA's RCRA, continue to push for source reduction and enhanced recycling, making refurbished equipment a key component of a circular economy approach.

The environmental impact on biodiversity and land use is also a significant concern, leading companies to invest more in land reclamation and biodiversity offset programs. By 2025, a substantial percentage of operational sites are expected to be under active restoration or conservation. This heightened environmental awareness is influencing procurement decisions, with a growing number of clients prioritizing suppliers with strong environmental stewardship, presenting a clear competitive advantage for companies like NSC-Tripoint that align with these sustainability goals.

PESTLE Analysis Data Sources

Our NSC-Tripoint PESTLE Analysis is built on a robust foundation of data from reputable sources, including government publications, international organizations, and leading market research firms. We incorporate economic indicators, technological advancements, regulatory changes, and social trends to provide a comprehensive overview.