NSC-Tripoint Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

NSC-Tripoint Bundle

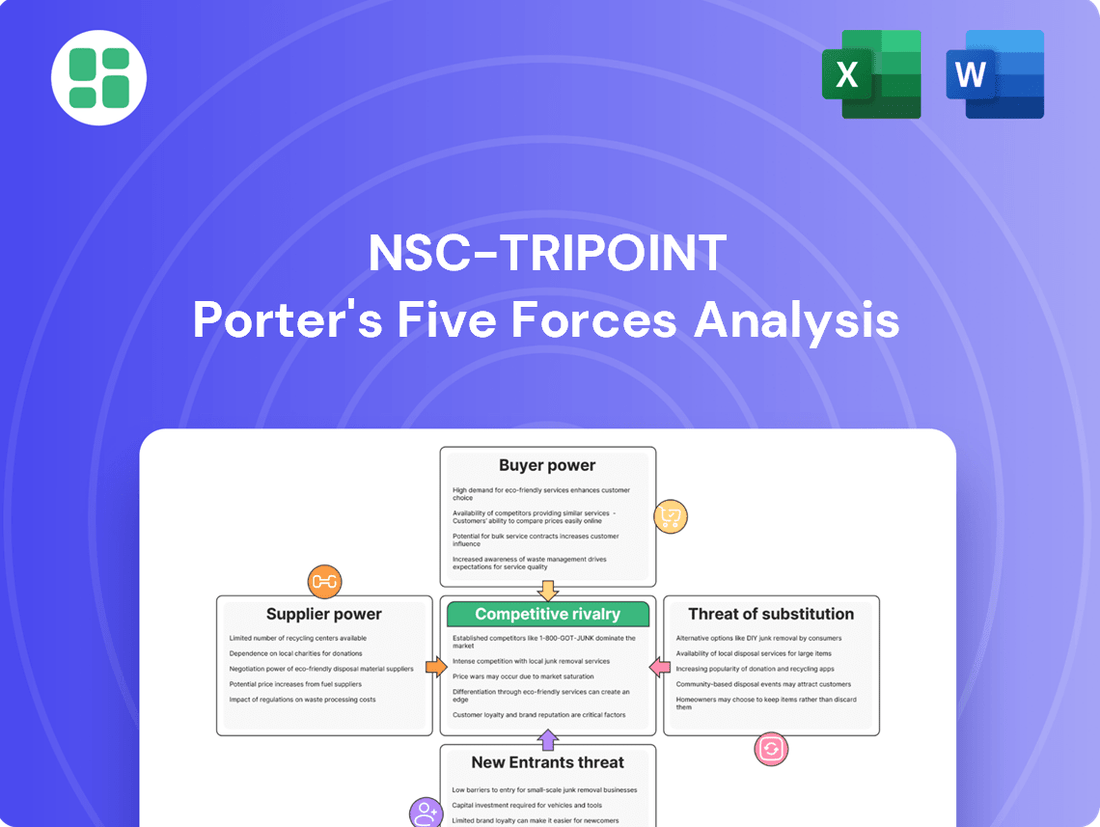

The NSC-Tripoint Porter's Five Forces analysis reveals the intricate web of competitive pressures shaping its market landscape, from the bargaining power of buyers to the threat of new entrants. Understanding these forces is crucial for navigating the industry's dynamics and identifying strategic opportunities.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore NSC-Tripoint’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Suppliers of highly specialized components, like the advanced sensor technologies used in well monitoring systems, can wield considerable bargaining power. This is particularly true when there are few other companies capable of producing these critical parts. For instance, if NSC-Tripoint relies on a specific type of high-strength alloy for its pump components, and only a handful of foundries can produce it to the required specifications, those foundries have a strong hand.

NSC-Tripoint's dependence on unique materials or patented technologies further amplifies supplier leverage. If switching to a different supplier for these specialized items would incur substantial costs or lead to significant production delays, the existing supplier can dictate terms more effectively. This concentration of specialized suppliers limits NSC-Tripoint's options for price negotiation and favorable contract terms, directly influencing their cost of goods sold.

The oil and gas sector, particularly areas like artificial lift, demands a workforce with specialized engineering, technical, and field service skills. A scarcity of these professionals significantly bolsters the bargaining power of the labor pool, potentially driving up wages and benefits, which directly impacts NSC-Tripoint's operating expenses. For instance, in 2024, the U.S. Bureau of Labor Statistics projected a need for thousands of new petroleum engineers and technicians in the coming decade, highlighting the ongoing demand for this expertise.

Suppliers of essential raw materials like steel and various metals for artificial lift equipment manufacturing hold significant bargaining power. Their ability to influence prices directly impacts NSC-Tripoint's production costs.

Global commodity prices are inherently volatile, often swayed by geopolitical tensions and disruptions in supply chains. This volatility translates into unpredictable input costs for NSC-Tripoint, affecting profitability.

While some material shortages seen in prior years have somewhat abated, the oil and gas sector, including manufacturers like NSC-Tripoint, continues to grapple with inflationary pressures. These pressures extend to both the cost of equipment and labor, further challenging the supply chain.

Proprietary Technology and Intellectual Property

Suppliers possessing unique technology or intellectual property for essential components or production methods can command higher prices. If NSC-Tripoint's rod pumps or plunger lift systems depend on patented designs or licensed software from a limited number of suppliers, these suppliers gain significant leverage.

This situation compels NSC-Tripoint to either accept elevated costs or allocate substantial resources towards creating in-house alternatives. For example, a supplier holding a patent for a specialized alloy crucial for pump durability could charge a premium, impacting NSC-Tripoint's cost of goods sold.

- Proprietary Technology: Suppliers with exclusive patents for critical components, like advanced sealing materials for rod pumps, can dictate terms.

- Intellectual Property: Licensed software essential for the manufacturing or operation of plunger lift systems can grant suppliers significant bargaining power.

- High Switching Costs: If NSC-Tripoint has deeply integrated a supplier's proprietary technology, the cost and disruption of finding and implementing an alternative can be prohibitive, increasing supplier leverage.

- Limited Alternatives: The scarcity of suppliers offering comparable patented technology for specialized oilfield equipment inherently strengthens the bargaining position of those who do.

Switching Costs for NSC-Tripoint

The bargaining power of suppliers for NSC-Tripoint is significantly influenced by switching costs. If NSC-Tripoint faces substantial expenses when changing suppliers—such as retooling manufacturing lines, retraining staff, or the lengthy process of requalifying new components—its reliance on current suppliers increases. This dependence directly bolsters the suppliers' leverage in negotiations.

These switching costs can be a major factor. For instance, in the semiconductor industry, which is often relevant to companies like NSC-Tripoint, the qualification process for a new component can take many months and involve rigorous testing. This inertia makes it difficult and costly to move to a different supplier, even if pricing is slightly more favorable elsewhere.

- High Retooling Expenses: Upgrading or altering existing machinery to accommodate new components from a different supplier can incur significant capital expenditure.

- Personnel Training: Employees may require new training to operate with different equipment or handle new materials, adding to operational costs.

- Component Requalification: The time and resources needed to test and approve new parts to ensure they meet quality and performance standards are substantial.

- Integrated Supply Chains: Long-term agreements or deeply integrated supply chain systems can create lock-in effects, further diminishing NSC-Tripoint's ability to negotiate favorable terms.

Suppliers of specialized components for NSC-Tripoint, particularly those with proprietary technology or limited production capacity, hold significant bargaining power. This leverage is amplified when switching costs, such as retooling or requalification, are high, restricting NSC-Tripoint's negotiation flexibility and directly impacting production expenses.

The oil and gas industry's demand for skilled labor, as highlighted by projected shortages of petroleum engineers and technicians in 2024, also strengthens the bargaining position of the workforce. This can drive up labor costs, a critical operating expense for companies like NSC-Tripoint.

Volatile global commodity prices, influenced by geopolitical events, further empower raw material suppliers. For example, fluctuations in steel prices directly affect the cost of manufacturing artificial lift equipment, impacting NSC-Tripoint's cost of goods sold.

| Factor | Impact on NSC-Tripoint | Example Data (2024) |

|---|---|---|

| Supplier Concentration | Limited alternatives increase supplier leverage. | Few suppliers for specialized alloys used in pump components. |

| Proprietary Technology | Suppliers with patents can command higher prices. | Patented designs for rod pump durability. |

| Switching Costs | High costs for NSC-Tripoint to change suppliers. | Months-long component requalification processes in oilfield equipment. |

| Labor Scarcity | Drives up wages for specialized oilfield personnel. | Projected deficit of thousands of petroleum engineers and technicians. |

| Commodity Price Volatility | Unpredictable input costs for raw materials. | Fluctuations in global steel prices impacting manufacturing costs. |

What is included in the product

This analysis meticulously examines the five forces impacting NSC-Tripoint, offering a strategic roadmap to navigate industry competition, supplier/buyer power, new entrants, and substitutes.

Effortlessly visualize competitive intensity across all five forces with an intuitive, interactive dashboard.

Customers Bargaining Power

The bargaining power of customers in the oil and gas sector, particularly for a company like NSC-Tripoint, is significantly influenced by the concentration of its client base. NSC-Tripoint primarily serves oil and gas exploration and production (E&P) companies, a group that ranges from global integrated majors to smaller independent producers.

If NSC-Tripoint's customer roster is dominated by a few large E&P firms, these major players can wield considerable influence. For instance, if the top 5 E&P companies represent over 60% of NSC-Tripoint's revenue, their substantial purchasing volumes grant them significant leverage to negotiate lower prices for services or demand more favorable contract terms. This concentration means these large customers can readily switch suppliers if their demands aren't met, putting pressure on NSC-Tripoint's margins.

Customers' ability to switch suppliers for artificial lift equipment and services significantly impacts their bargaining power. While alternatives exist from competitors or through different artificial lift technologies, the ease and cost of switching are key determinants. For instance, in 2024, the oil and gas industry saw continued investment in optimizing production, meaning customers are always evaluating cost-effectiveness and operational efficiency when considering supplier changes.

The specialized nature of artificial lift systems, requiring precise integration and often involving long-term service agreements, can erect barriers to switching. This complexity can deter customers from easily moving to a new provider, thereby reducing their immediate bargaining leverage. However, advancements in modular designs and standardization efforts, which gained traction in 2023 and continued into 2024, aim to simplify integration and potentially lower switching costs for certain applications.

The profitability of oil and gas companies directly impacts their spending, making them keenly aware of fluctuating crude oil and natural gas prices. When these commodity prices dip, customers in this sector become much more price-sensitive. This heightened sensitivity translates into increased demands for cost reductions from their suppliers, including companies like NSC-Tripoint.

This dynamic creates significant downward pressure on NSC-Tripoint's profit margins. For instance, during periods of low oil prices, such as the average Brent crude oil price of around $77 per barrel in 2023, customers will push harder for lower prices on equipment and services. Consequently, NSC-Tripoint is compelled to offer more competitive pricing to secure business, directly impacting their ability to maintain or increase profitability.

Customers' Ability to In-Source Services

Large oil and gas operators can sometimes bring artificial lift services in-house, which naturally strengthens their negotiating position with companies like NSC-Tripoint. This ability to perform tasks like installation or monitoring internally means they don't have to rely solely on external vendors, giving them leverage during price discussions. For instance, if a major operator has a significant portion of its fleet requiring routine maintenance, investing in its own skilled technicians and basic equipment could be economically viable, directly impacting NSC-Tripoint's revenue potential from that client.

However, the reality of the oilfield often makes complete in-sourcing difficult. The highly specialized nature of artificial lift technology, from advanced downhole tools to sophisticated monitoring software, requires substantial investment in both equipment and ongoing training. Many operators find it more cost-effective and efficient to outsource these specialized functions to dedicated service providers like NSC-Tripoint, rather than bearing the full capital and operational costs of maintaining such expertise in-house.

The bargaining power of customers is directly influenced by their in-sourcing capabilities. For example, a large operator might have the capital to purchase its own specialized pump units, effectively bypassing the need to rent them from NSC-Tripoint. This threat of self-sufficiency, even if not fully realized, can lead to:

- Negotiated price reductions on services.

- Demands for customized service packages.

- Shorter contract terms.

- Increased pressure on service quality and response times.

Importance of Artificial Lift to Customer Operations

While artificial lift is crucial for oil and gas production, the associated equipment and services are a significant, though not overwhelming, part of a company's total operating costs. Customers are keenly aware of this, balancing the need for reliable, high-performing systems with a strong desire for cost efficiency. For instance, in 2024, the global oilfield services market, which includes artificial lift, was projected to reach hundreds of billions of dollars, with a substantial portion allocated to production optimization technologies.

The critical role artificial lift plays in sustaining output from mature fields or challenging unconventional plays grants NSC-Tripoint a degree of bargaining power. Disruptions in artificial lift operations, whether due to equipment failure or suboptimal performance, can lead to substantial revenue losses for customers. This dependency means customers are often willing to invest in dependable solutions, even if they come at a premium, to avoid the far greater cost of lost production.

- Cost Sensitivity: Customers evaluate artificial lift solutions against their overall operational budget, seeking a balance between performance and expense.

- Production Dependency: The critical nature of artificial lift for maintaining output from aging or unconventional wells gives suppliers leverage.

- Reliability Premium: Customers are often willing to pay more for reliable artificial lift systems to avoid costly production downtime.

- Market Dynamics: In 2024, the oilfield services sector saw continued focus on efficiency and cost reduction, influencing customer purchasing decisions for artificial lift.

The bargaining power of customers in the artificial lift sector is shaped by their price sensitivity, driven by commodity prices, and their ability to switch suppliers. When oil prices are low, like the average Brent crude price around $77 in 2023, customers push harder for cost reductions. This makes them more likely to seek lower prices from providers like NSC-Tripoint.

Customers’ ability to switch is influenced by the cost and complexity of integrating new artificial lift systems. While advancements in standardization are reducing switching costs, the specialized nature of the technology still presents a barrier. Furthermore, the potential for customers to bring services in-house, though often limited by the need for specialized expertise, can also increase their leverage in negotiations.

The critical role of reliable artificial lift in maintaining production gives suppliers some leverage, as downtime can be extremely costly for clients. However, customers remain focused on cost efficiency, balancing the need for dependable systems with budget constraints. In 2024, the oilfield services market continued to emphasize efficiency, impacting purchasing decisions for artificial lift technologies.

| Factor | Impact on NSC-Tripoint | 2023/2024 Data/Context |

|---|---|---|

| Customer Concentration | High concentration of large clients increases their bargaining power. | If top 5 clients represent >60% of revenue, their leverage is significant. |

| Switching Costs | High costs reduce customer bargaining power; lower costs increase it. | Advancements in standardization aim to lower switching costs for certain applications. |

| Price Sensitivity | Strongly correlated with oil and gas commodity prices. | Average Brent crude was ~$77/barrel in 2023, increasing customer price sensitivity. |

| In-sourcing Capability | Threat of in-sourcing strengthens customer negotiation position. | Specialized nature of artificial lift often makes full in-sourcing economically challenging. |

| Production Dependency | Criticality of artificial lift for output provides some supplier leverage. | Downtime can lead to substantial revenue losses for customers, making reliability key. |

Same Document Delivered

NSC-Tripoint Porter's Five Forces Analysis

This preview showcases the complete NSC-Tripoint Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the industry. The document you see here is precisely what you will receive immediately after purchase, ensuring full transparency and no hidden surprises. You can confidently expect to download this professionally formatted and ready-to-use analysis the moment your transaction is complete.

Rivalry Among Competitors

The artificial lift market is a crowded arena with major global players such as Schlumberger, Baker Hughes, Halliburton, NOV, and Weatherford. These giants compete alongside numerous smaller, specialized firms, creating a diverse and intensely competitive environment. NSC-Tripoint must navigate this landscape, facing rivals that offer comprehensive oilfield services as well as those concentrating solely on artificial lift solutions.

The artificial lift system market is expected to see robust growth, with projections indicating a compound annual growth rate (CAGR) of around 5.5% through 2028, fueled by the increasing demand for enhanced oil recovery and the aging global oil and gas infrastructure. This expansion presents opportunities, but it also intensifies rivalry as companies vie for a larger slice of a growing pie.

However, the broader oilfield services sector is navigating a complex landscape. While artificial lift systems are a bright spot, overall sector revenues in 2024 are anticipated to be somewhat uneven, with some segments experiencing potential downturns. This mixed outlook can push companies to compete more fiercely on price and service to secure contracts, especially in regions with established production.

NSC-Tripoint's competitive rivalry is heavily influenced by its specialization in rod pumps and plunger lift systems, aiming to optimize well performance. Differentiation through superior technology, higher efficiency, and enhanced reliability is paramount in this segment.

Competitors are actively investing in digital technologies, AI-powered solutions, and advanced materials to create differentiated offerings. For instance, in 2024, several key competitors in the artificial lift market announced significant R&D investments focused on predictive maintenance and remote monitoring capabilities, aiming to enhance well uptime and reduce operational costs for their clients.

This landscape necessitates continuous innovation for NSC-Tripoint to maintain its competitive edge. The market is seeing a trend where companies that can offer integrated digital solutions alongside hardware are gaining traction, as demonstrated by a projected 15% growth in the digital oilfield services market by the end of 2024.

Exit Barriers and Fixed Costs

The oilfield equipment manufacturing and service sector is characterized by substantial fixed costs. These include significant investments in manufacturing plants, advanced machinery, and a skilled labor force, all of which create high barriers to exiting the industry.

These elevated exit barriers often mean companies continue operating even when market conditions are unfavorable, contributing to persistent overcapacity and intense price competition. NSC-Tripoint's own substantial capital outlay in its manufacturing and refurbishment facilities exemplifies these high fixed costs.

- High Fixed Costs: The oilfield equipment sector demands considerable upfront investment in production facilities and specialized machinery.

- Exit Barriers: These high fixed costs make it difficult and costly for companies to leave the market, even during economic downturns.

- Market Impact: This situation can lead to sustained overcapacity and aggressive pricing strategies as companies strive to cover their fixed operational expenses.

- NSC-Tripoint's Position: NSC-Tripoint's investments in its manufacturing and refurbishment infrastructure contribute to these industry-wide exit barriers.

Pricing Strategies and Market Share Battles

The competitive landscape for NSC-Tripoint is characterized by intense rivalry, particularly concerning pricing. With many players vying for business and customers highly attuned to price, price wars are a common tactic to secure contracts and expand market share. This can significantly squeeze profit margins for all involved.

NSC-Tripoint must therefore maintain a sharp focus on its operational efficiency and the unique value it offers to customers. Balancing competitive pricing with the need to preserve profitability is a critical challenge. For instance, in the broader IT services sector, average profit margins can fluctuate, with some segments seeing margins below 5% during intense competition, as reported by industry analyses in early 2024.

- Aggressive Pricing: Competitors frequently engage in price reductions to capture market share.

- Customer Price Sensitivity: Buyers are highly responsive to lower prices, driving competitive actions.

- Margin Erosion Risk: Price competition can lead to reduced profitability across the industry.

- Strategic Imperative: NSC-Tripoint must optimize costs and differentiate its offerings to thrive.

The artificial lift market is highly competitive, featuring global giants like Schlumberger, Baker Hughes, and Halliburton, alongside numerous specialized firms. NSC-Tripoint must contend with rivals offering broad oilfield services and those focusing exclusively on artificial lift solutions. This intense rivalry, especially on pricing, can compress profit margins, making operational efficiency and clear value proposition crucial for NSC-Tripoint's success.

| Key Competitors | Specialization | 2024 Market Focus |

| Schlumberger | Integrated Oilfield Services | Digital solutions, efficiency gains |

| Baker Hughes | Oilfield Equipment & Services | Technology innovation, ESG solutions |

| Halliburton | Drilling & Completion Services | Cost optimization, production enhancement |

| NOV | Rig Equipment & Services | Infrastructure upgrades, automation |

| Weatherford | Artificial Lift & Production | Remote monitoring, predictive maintenance |

SSubstitutes Threaten

Naturally flowing wells, where reservoir pressure alone drives production, present a fundamental substitute for artificial lift systems. While NSC-Tripoint specializes in wells needing assistance, this natural flow capability, particularly in new or high-pressure fields, offers an alternative method for bringing oil and gas to the surface. This capability, however, is often limited to specific well conditions and stages of a field's life cycle.

While NSC-Tripoint focuses on rod pumps and plunger lift, the market offers other artificial lift solutions like electric submersible pumps (ESPs), gas lift, and hydraulic pumps. These alternatives can be viable substitutes, especially when well conditions or fluid types favor a different technology. For instance, ESPs are often preferred for higher production rates or wells with significant gas content, potentially drawing customers away from traditional rod pump systems.

The threat of substitutes is amplified if these alternative technologies demonstrate a clear cost advantage or superior operational efficiency. For example, in 2024, the total cost of ownership for ESPs in certain deep-well applications has shown a competitive edge over prolonged periods compared to some rod pump installations, particularly when factoring in maintenance and energy consumption. This can prompt operators to re-evaluate their artificial lift choices.

Advanced Enhanced Oil Recovery (EOR) methods, including waterflooding, gas injection, and chemical injection, are designed to boost oil extraction from existing reservoirs by modifying fluid characteristics or introducing external energy sources. These techniques can, in certain scenarios, diminish the immediate reliance on specific artificial lift systems or shift the type of lift needed, effectively serving as partial substitutes for maximizing production from mature fields.

Well Design and Completion Optimization

Advancements in well design and completion techniques act as a significant threat of substitutes for traditional extraction methods. For instance, sophisticated horizontal drilling and multi-stage hydraulic fracturing, widely adopted and refined through 2024, allow for greater reservoir contact and hydrocarbon recovery from a single wellbore. This directly reduces the long-term need for extensive artificial lift systems, such as rod pumps or electric submersible pumps, which represent a higher operational cost and a different method of production.

More efficient well completions can delay or even eliminate the requirement for artificial lift altogether. In 2024, the industry continued to see innovation in sand control, proppant selection, and stimulation fluid chemistry, all aimed at maximizing the initial flow rate and extending the natural production phase. This translates to a substitute by extracting more oil and gas with less reliance on mechanical assistance, thereby lowering the overall cost per barrel and impacting the economic viability of older, less optimized wells.

The impact of these technological substitutes is quantifiable. For example, optimized completions in the Permian Basin in 2024 have been reported to increase initial production rates by as much as 15-20% compared to previous designs, effectively substituting the need for artificial lift for a longer initial period.

- Improved Reservoir Contact: Horizontal drilling and multi-stage fracturing enhance recovery efficiency.

- Reduced Artificial Lift Dependence: Optimized completions minimize or postpone the need for mechanical lifting systems.

- Lower Operational Costs: Less reliance on artificial lift translates to reduced energy consumption and maintenance expenses.

- Extended Natural Flow: Advanced techniques maximize initial production rates, delaying the onset of lift requirements.

Focus on Renewable Energy and Energy Transition

The global shift towards renewable energy sources presents a significant long-term threat to the oil and gas industry, and by extension, to suppliers of artificial lift equipment. As nations commit to decarbonization, investments in solar, wind, and other green technologies are accelerating. For instance, in 2024, renewable energy capacity additions are projected to reach record levels, with the International Energy Agency (IEA) forecasting that renewables will account for over 90% of global electricity capacity expansion in the coming years.

This macro-level trend could gradually diminish the overall demand for new oil and gas extraction. While hydrocarbons will remain essential for decades, substantial policy changes or a significant redirection of capital away from fossil fuels could act as a powerful substitute for the entire extraction sector. This transition impacts the fundamental need for services and equipment tied to traditional energy production.

- Renewable Energy Growth: Global renewable electricity capacity is expected to grow by almost 50% between 2023 and 2028, reaching over 7,300 GW, according to the IEA's 2023 Renewables Market Report.

- Investment Shifts: In 2024, global investment in clean energy is anticipated to surpass $2 trillion, a significant portion of which is directed towards renewables and electrification, potentially diverting capital from oil and gas projects.

- Policy Impact: Stringent climate policies and carbon pricing mechanisms enacted by governments worldwide in 2024 and beyond are increasing the operational costs and long-term viability concerns for new oil and gas infrastructure.

- Demand Reduction: Projections suggest that the peak demand for oil could occur before 2030, driven by the accelerating adoption of electric vehicles and energy efficiency measures, thereby reducing the need for enhanced oil recovery techniques that often utilize artificial lift.

The threat of substitutes for NSC-Tripoint's services comes from alternative technologies and methods that can achieve similar oil and gas production goals. These range from natural reservoir flow and other artificial lift systems to advancements in well completion and the broader energy transition.

Alternative artificial lift systems like ESPs and gas lift can be more cost-effective or efficient in specific well conditions, posing a direct substitute. For instance, ESPs in 2024 have shown a competitive total cost of ownership in certain deep-well applications compared to rod pumps, factoring in maintenance and energy usage.

Innovations in well design, such as horizontal drilling and hydraulic fracturing, significantly enhance reservoir contact and recovery, often delaying or eliminating the need for artificial lift. In 2024, optimized completions in areas like the Permian Basin have boosted initial production rates by 15-20%, directly substituting the immediate requirement for artificial lift systems.

The long-term shift towards renewable energy also acts as a substitute by potentially reducing overall demand for oil and gas extraction. With renewable capacity additions reaching record levels in 2024 and global investment in clean energy projected to exceed $2 trillion, the fundamental need for traditional extraction services could diminish.

| Substitute Category | Example | 2024 Relevance/Impact | Potential Impact on NSC-Tripoint |

|---|---|---|---|

| Alternative Artificial Lift | Electric Submersible Pumps (ESPs) | Competitive total cost of ownership in specific applications | May divert customers seeking higher production rates or specific well conditions |

| Advanced Well Completions | Horizontal Drilling & Multi-Stage Fracturing | 15-20% initial production rate increase reported (e.g., Permian Basin) | Delays or eliminates the need for artificial lift, reducing long-term demand |

| Energy Transition | Renewable Energy Sources (Solar, Wind) | Record renewable capacity additions; >$2 trillion clean energy investment | Gradual reduction in overall oil & gas demand, impacting the entire extraction sector |

Entrants Threaten

The artificial lift equipment sector demands substantial upfront capital. Setting up manufacturing facilities, acquiring specialized machinery, and stocking necessary inventory can easily run into tens of millions of dollars. For instance, a new entrant might need upwards of $50 million just to establish a basic operational capacity.

Ongoing research and development is not optional; it's critical for survival. Companies must invest heavily in R&D to innovate and stay ahead of technological curves. In 2024, the average R&D spending for established players in this niche market ranged from 5% to 8% of their annual revenue, a significant ongoing commitment that deters many potential newcomers.

The intricate design, manufacturing, and servicing of artificial lift equipment for the oil and gas sector necessitate a deep well of specialized knowledge. This includes advanced engineering, materials science, and hands-on operational experience, skills that are not easily replicated. Newcomers must invest heavily in acquiring or cultivating this often scarce talent pool.

Furthermore, the industry operates under rigorous quality and safety standards, requiring new entrants to navigate a complex web of certifications. For example, obtaining API (American Petroleum Institute) certifications, crucial for product credibility and market access, can be a time-consuming and expensive undertaking. This regulatory hurdle acts as a significant barrier, deterring less prepared companies from entering the market.

Established players like NSC-Tripoint leverage deep-seated relationships with major oil and gas operators, built over years of reliable service and proven performance. This existing trust is a significant barrier for newcomers. In 2024, the oil and gas services sector continues to emphasize long-term partnerships, making it challenging for new entrants to displace incumbents without a substantial track record.

Economies of Scale and Experience Curve

Existing players in the NSC-Tripoint industry often enjoy significant economies of scale. For example, major manufacturers might procure raw materials in bulk, leading to lower per-unit costs compared to a new entrant buying smaller quantities. This cost advantage makes it challenging for newcomers to compete on price from the outset.

The experience curve also plays a crucial role. Companies that have been operating for years have had the opportunity to refine their production processes, optimize supply chains, and reduce waste. This accumulated operational efficiency translates into lower costs and higher quality, creating a formidable barrier for new businesses trying to establish themselves.

Consider the automotive sector, a related industry where economies of scale are paramount. In 2024, major automakers continued to leverage their vast production volumes to achieve cost efficiencies. For instance, a leading manufacturer producing millions of vehicles annually can spread its fixed costs over a much larger output, significantly reducing the per-unit cost of production.

- Economies of Scale: Established firms benefit from lower per-unit costs due to high-volume production, bulk purchasing, and optimized distribution networks.

- Experience Curve: Incumbents have honed their operational processes over time, leading to greater efficiency and cost reduction.

- Cost Disadvantage for New Entrants: New companies struggle to match the cost structures of established players, hindering their ability to compete on price.

- Industry Example: In 2024, automotive giants continued to demonstrate how massive production scales translate into significant cost advantages in manufacturing and procurement.

Regulatory Hurdles and Environmental Standards

The oil and gas sector faces significant regulatory hurdles, particularly concerning environmental and safety standards. New companies must navigate a labyrinth of complex frameworks, requiring numerous permits and adherence to evolving environmental mandates. For instance, in 2024, the U.S. Environmental Protection Agency (EPA) continued to enforce stringent methane emission regulations, impacting operational costs for all players.

Meeting these stringent requirements presents a substantial barrier to entry. The capital investment and ongoing compliance costs associated with environmental protection, such as carbon capture technologies or advanced spill prevention measures, can be prohibitive, especially for smaller, less capitalized entrants. This complexity deters many potential new competitors from entering the market.

- Regulatory Complexity: Navigating permits and compliance with agencies like the EPA and state-level environmental bodies is time-consuming and costly.

- Environmental Standards: Adherence to evolving standards for emissions, water usage, and waste disposal requires significant technological and financial investment.

- Capital Intensive Compliance: The cost of implementing and maintaining compliance, estimated to add billions to operational expenses annually across the industry, acts as a major deterrent.

- Permitting Delays: Obtaining necessary operational permits can take years, delaying market entry and increasing upfront financial risk.

The threat of new entrants in the artificial lift equipment sector is significantly mitigated by substantial capital requirements for manufacturing and R&D, often exceeding $50 million for basic operations. Established players' deep-rooted relationships with major oil and gas operators, built on trust and proven performance in 2024, also present a formidable barrier.

The industry's reliance on specialized knowledge, encompassing advanced engineering and materials science, coupled with rigorous API certifications, demands significant investment in talent and compliance. Furthermore, economies of scale and the experience curve enjoyed by incumbents create a cost disadvantage for newcomers, making it challenging to compete on price.

Stringent environmental and safety regulations, such as EPA methane emission standards in 2024, add another layer of complexity and cost, requiring substantial investment in compliance technologies and potentially lengthy permitting processes, further deterring new market participants.

| Barrier Type | Description | Estimated Impact |

|---|---|---|

| Capital Requirements | Establishing manufacturing, machinery, and inventory. | $50M+ for basic operational capacity. |

| R&D Investment | Staying ahead of technological curves. | 5-8% of annual revenue for established players in 2024. |

| Specialized Knowledge | Engineering, materials science, operational experience. | High cost of acquiring or cultivating scarce talent. |

| Regulatory Compliance | API certifications, environmental and safety standards. | Time-consuming and expensive undertaking. |

| Customer Relationships | Long-term partnerships in the oil and gas sector. | Difficult for new entrants to displace incumbents. |

| Economies of Scale | Bulk purchasing, optimized production. | Lower per-unit costs for established firms. |

| Experience Curve | Refined processes, supply chain optimization. | Greater operational efficiency and cost reduction. |

Porter's Five Forces Analysis Data Sources

Our NSC-Tripoint Porter's Five Forces analysis leverages a comprehensive suite of data, including company financial statements, industry-specific market research reports, and regulatory filings. This approach ensures a robust assessment of competitive intensity and strategic positioning.