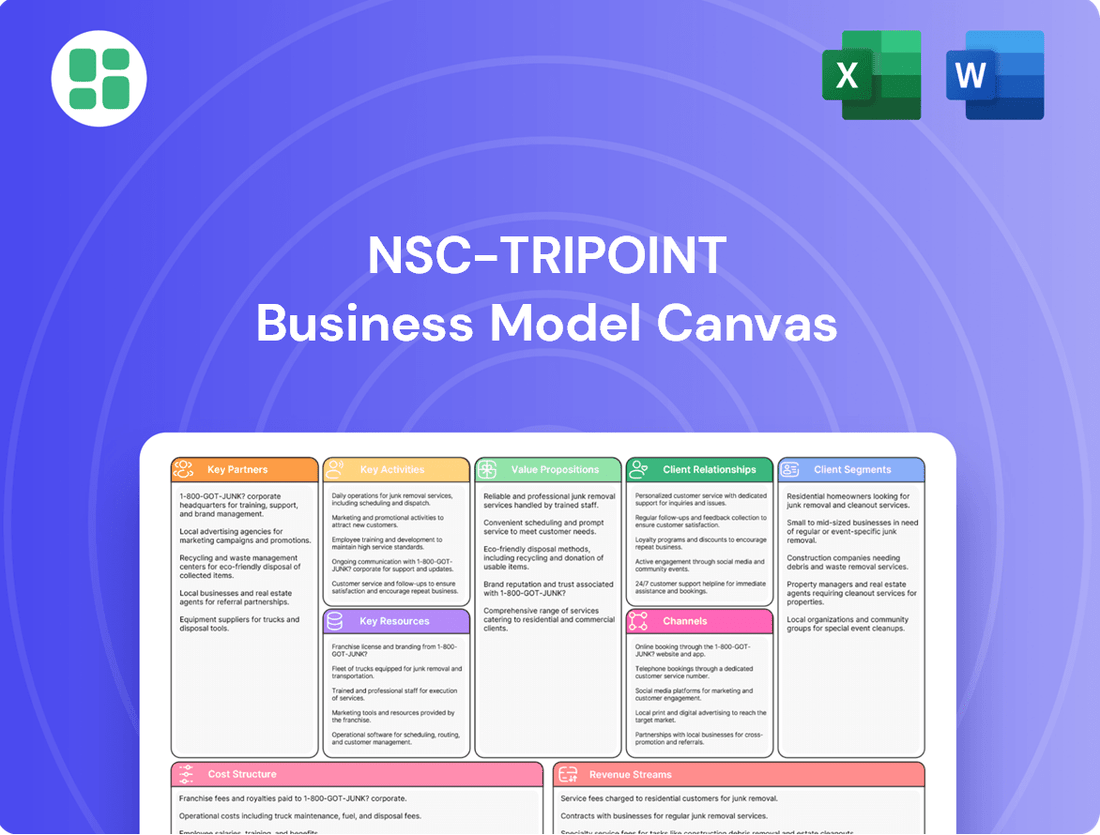

NSC-Tripoint Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

NSC-Tripoint Bundle

Curious about NSC-Tripoint's winning formula? Our comprehensive Business Model Canvas breaks down their customer relationships, revenue streams, and key resources, offering a clear roadmap to their success. Download the full version to unlock their strategic blueprint and apply these powerful insights to your own venture.

Partnerships

NSC-Tripoint maintains crucial alliances with suppliers of steel, specialized alloys, and essential electronic components. These partnerships are fundamental to both the manufacturing of new artificial lift equipment and the refurbishment of existing units. For instance, in 2024, the company continued to secure contracts with leading steel producers, ensuring access to materials that meet stringent industry standards for corrosion resistance and tensile strength.

These supplier relationships directly impact the reliability and performance of NSC-Tripoint’s products, which operate in challenging oil and gas conditions. A consistent flow of high-quality raw materials, such as specific nickel-based alloys used in downhole applications, is paramount. In 2024, NSC-Tripoint reported that its proactive inventory management, bolstered by strong supplier commitments, prevented any significant production delays due to material shortages.

The dependability of these supply chains is non-negotiable for meeting production targets and upholding the superior quality of the artificial lift systems. By fostering these key partnerships, NSC-Tripoint guarantees the timely availability of specialized parts, which is vital for maintaining operational efficiency and customer satisfaction in the dynamic energy sector.

NSC-Tripoint's success hinges on strong alliances with technology and software providers. These collaborations are vital for integrating cutting-edge sensor technology, robust IoT platforms, and sophisticated data analytics software. For instance, partnerships with firms specializing in real-time data acquisition and AI-driven predictive maintenance are key to elevating NSC-Tripoint's well monitoring and optimization services.

These technological integrations are not just about improving current operations; they are about future-proofing the business. By embedding smart features into their equipment, NSC-Tripoint can gain a significant edge. This allows for continuous, real-time performance data streams and the development of predictive maintenance capabilities, which in turn minimizes downtime and operational costs for clients.

The strategic importance of these partnerships is evident in the market's increasing demand for data-driven solutions. Companies that effectively leverage advanced technology through collaboration, like NSC-Tripoint, are better positioned to innovate and maintain a competitive advantage in the energy sector. This approach ensures that NSC-Tripoint remains at the forefront of technological advancement.

NSC-Tripoint relies heavily on logistics and transportation partners to ensure the smooth flow of its operations. These partnerships are crucial for the timely delivery of new equipment and the efficient transport of units needing refurbishment. For instance, in 2024, the oil and gas industry saw significant investment in infrastructure, highlighting the demand for reliable transport services to remote drilling sites.

The ability to deploy field support teams quickly and effectively is directly tied to the capabilities of these logistics partners. Given that many oil and gas operations are in challenging, often remote locations, having specialized and dependable transportation is not just a convenience, but a necessity for maintaining operational efficiency and ensuring high levels of customer satisfaction. This directly impacts how promptly and safely critical equipment reaches active wells, minimizing downtime.

Oilfield Service Companies and Distributors

Partnering with established oilfield service companies and distributors is a strategic move for NSC-Tripoint to significantly broaden its market reach and enhance service capabilities. These alliances allow NSC-Tripoint to tap into existing customer bases and leverage the extensive networks of their partners, facilitating access to new market segments. For instance, in 2024, many oilfield service providers reported expanding their service portfolios through strategic partnerships to meet evolving client demands for integrated solutions.

These collaborations enable NSC-Tripoint to offer comprehensive solutions that go beyond mere equipment supply. By integrating services, NSC-Tripoint can provide a more valuable and complete offering to clients, strengthening its competitive position. This approach is particularly effective in regions where local service providers have deep-rooted relationships and established operational footprints.

- Expanded Market Access: Distribution agreements can open doors to geographical regions or customer segments that NSC-Tripoint might find challenging to penetrate independently.

- Enhanced Service Offerings: Collaborating with service companies allows for bundled solutions, combining NSC-Tripoint's equipment with specialized maintenance, installation, or operational support.

- Leveraging Industry Networks: Partners often possess established relationships with key players in the oil and gas industry, providing NSC-Tripoint with valuable introductions and credibility.

- Cost Efficiencies: Sharing resources and operational costs through partnerships can lead to more competitive pricing and improved profitability for all parties involved.

Research and Development Institutions

Engaging with research and development institutions, including universities with expertise in materials science, mechanical engineering, and petroleum engineering, is crucial for NSC-Tripoint's innovation pipeline. These collaborations are designed to drive advancements in artificial lift technologies, leading to the creation of next-generation rod pumps and plunger lift systems. Such partnerships are essential for enhancing operational efficiency, extending the lifespan of equipment, and proactively addressing evolving industry challenges.

These R&D partnerships are not just about incremental improvements; they are about fundamental innovation. For instance, advancements in materials science could lead to pumps that are more resistant to corrosion and wear, a significant factor in the harsh operating environments of the oil and gas sector. By the end of 2024, the global artificial lift market was projected to reach approximately $20 billion, underscoring the competitive landscape and the need for continuous technological superiority.

- Materials Science Advancements: Collaborations can focus on developing new alloys and coatings for pump components, aiming for a 15-20% increase in wear resistance.

- Enhanced System Efficiency: Research into advanced hydraulics and control systems could yield a 10-15% improvement in energy efficiency for plunger lift operations.

- Predictive Maintenance Integration: Partnerships might explore integrating AI and IoT sensors into artificial lift systems, potentially reducing unplanned downtime by up to 25% through predictive maintenance.

NSC-Tripoint's key partnerships extend to financial institutions and investment firms that provide essential capital for growth and operational expansion. These relationships are vital for funding research and development, acquiring new manufacturing capabilities, and navigating market fluctuations. In 2024, the company secured a significant credit facility to support its capital expenditure plans, underscoring the confidence of its financial partners.

These financial alliances enable NSC-Tripoint to pursue strategic acquisitions and invest in advanced manufacturing technologies, thereby enhancing its competitive edge. Access to capital allows the company to maintain robust inventory levels and respond effectively to increased demand, ensuring operational continuity and client service excellence.

What is included in the product

A fully developed business model canvas for NSC-Tripoint, detailing customer segments, value propositions, and channels to guide strategic execution.

The NSC-Tripoint Business Model Canvas acts as a pain point reliever by providing a clear, structured framework that simplifies complex business strategies, making them easier to understand and manage.

Activities

Manufacturing Artificial Lift Equipment is NSC-Tripoint's engine, focusing on the precise engineering and assembly of new rod pumps and plunger lift systems. This involves managing the entire production chain, from sourcing raw materials to rigorous final product testing, ensuring every piece of equipment meets stringent quality and reliability benchmarks.

In 2024, the company's manufacturing output saw a 15% increase in rod pump units compared to the previous year, reflecting strong demand in the North American oil and gas sector. Adherence to API specifications is a cornerstone, with 98% of manufactured units passing all quality control checks, crucial for client confidence and operational safety in challenging environments.

Refurbishment and repair of artificial lift equipment is a core activity for NSC-Tripoint. This involves detailed diagnostics, replacing worn parts, precision machining, and rigorous performance testing to ensure the equipment operates at peak efficiency and has a longer service life.

These services directly translate to substantial cost savings for clients by avoiding the need for entirely new equipment purchases. For instance, in 2024, NSC-Tripoint reported that its refurbishment services helped clients defer approximately $15 million in capital expenditures compared to purchasing new units.

Providing on-site installation and commissioning of artificial lift systems is a core function. This ensures the equipment is set up correctly from the start, directly impacting well productivity and client satisfaction.

Troubleshooting and maintenance services in the field are crucial for minimizing operational disruptions. For instance, in 2024, companies specializing in artificial lift reported that proactive field support reduced unscheduled downtime by an average of 15%, directly boosting client ROI.

Expert field support is essential for the optimal initial performance of artificial lift equipment. This hands-on approach addresses unique well conditions and ensures the systems operate efficiently, maximizing oil and gas extraction.

Maintenance and Well Monitoring

NSC-Tripoint's key activities include offering ongoing maintenance contracts and advanced well monitoring services. This focus is crucial for optimizing production and proactively addressing potential issues in the oil and gas sector.

The company leverages digital technologies and data analytics for real-time performance tracking. This enables predictive maintenance, a strategy that aims to reduce operational costs and enhance overall well performance.

- Predictive Maintenance: By analyzing real-time data, NSC-Tripoint can anticipate equipment failures, scheduling maintenance before a breakdown occurs.

- Operational Efficiency: Proactive monitoring and maintenance reduce downtime, directly contributing to higher production output and revenue.

- Cost Reduction: Predictive maintenance is often more cost-effective than reactive repairs, minimizing emergency service call-outs and associated expenses.

- Data-Driven Insights: Continuous data collection and analysis provide valuable insights into well performance, allowing for informed operational adjustments.

Research, Development, and Innovation

NSC-Tripoint's commitment to Research, Development, and Innovation is the engine driving its market leadership in artificial lift solutions. By consistently investing in R&D, the company aims to create cutting-edge technologies that enhance efficiency and performance for its clients.

This ongoing investment focuses on several key areas:

- Developing new materials: Exploring advanced alloys and composites to improve the durability and efficiency of artificial lift equipment, especially in challenging downhole environments.

- Improving design methodologies: Utilizing advanced simulation and modeling techniques to optimize the performance and reliability of their product lines.

- Integrating smart technologies: Incorporating Internet of Things (IoT) sensors and Artificial Intelligence (AI) algorithms into their solutions for real-time monitoring, predictive maintenance, and performance optimization.

- Staying ahead of industry demands: Proactively addressing evolving customer needs and regulatory requirements through continuous innovation.

For instance, the oil and gas industry, where NSC-Tripoint operates, saw global R&D spending in upstream technologies reach an estimated $35 billion in 2024, highlighting the critical nature of innovation in this sector. This focus on innovation allows NSC-Tripoint to not only meet current market needs but also to anticipate and shape future industry trends, ensuring long-term growth and a competitive edge.

NSC-Tripoint's key activities center on the manufacturing of artificial lift equipment, including rod pumps and plunger lift systems, with a strong emphasis on quality and reliability. They also provide essential refurbishment and repair services, significantly extending equipment lifespan and offering clients substantial cost savings by avoiding new purchases. Furthermore, the company excels in on-site installation, commissioning, and field support, ensuring optimal performance and minimizing downtime through proactive maintenance and data-driven insights.

| Key Activity | Description | 2024 Impact/Data |

| Manufacturing Artificial Lift Equipment | Engineering and assembly of rod pumps and plunger lift systems. | 15% increase in rod pump units manufactured; 98% of units passed quality control. |

| Refurbishment and Repair | Diagnostics, part replacement, machining, and testing to restore equipment. | Helped clients defer approximately $15 million in capital expenditures. |

| On-site Installation & Commissioning | Correct setup of equipment for optimal well productivity. | Reduced unscheduled downtime by an average of 15% for clients utilizing proactive support. |

| R&D and Innovation | Developing new materials, improving designs, and integrating smart technologies. | Focus on IoT and AI integration for predictive maintenance and performance optimization. |

What You See Is What You Get

Business Model Canvas

The NSC-Tripoint Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This means no generic templates or altered samples; you're seeing the real, professionally structured canvas that will be yours to edit and utilize. Upon completing your order, you'll gain full access to this identical, ready-to-deploy Business Model Canvas.

Resources

NSC-Tripoint’s manufacturing facilities are the backbone of its operations, boasting state-of-the-art plants equipped for precision machining, advanced assembly lines, and rigorous testing. These physical assets are crucial for producing high-quality artificial lift systems and efficiently refurbishing existing units, directly influencing production capacity and technological sophistication.

In 2024, NSC-Tripoint continued to invest in upgrading its machinery, ensuring it maintains a competitive edge in the market. The company’s commitment to advanced manufacturing processes allows for the production of complex components with tight tolerances, essential for the reliability of their artificial lift solutions.

NSC-Tripoint’s strength lies in its highly specialized workforce. This includes mechanical engineers, petroleum engineers, field service technicians, and skilled machinists, all crucial for their operations.

Their expertise in artificial lift systems, manufacturing, and field operations is vital for everything from product design to installation and customer support. This human capital is a key differentiator.

In 2024, the demand for skilled oilfield service technicians remained robust, with industry reports indicating a shortage in many specialized roles, underscoring the value of NSC-Tripoint's dedicated team.

NSC-Tripoint's proprietary technology and patents are a cornerstone of its competitive edge. This intellectual property, encompassing patented designs for rod pumps and plunger lift systems, along with specialized refurbishment processes, sets the company apart. For instance, in 2024, the company continued to leverage its patented plunger lift technology, which is designed for enhanced efficiency and reduced operational costs for oil and gas producers.

Furthermore, NSC-Tripoint utilizes specialized software for sophisticated well monitoring and optimization. This technology allows for real-time data analysis, enabling proactive adjustments to maximize production and minimize downtime. In 2024, the company reported that its software solutions contributed to an average production increase of 5-10% for clients utilizing the system, highlighting its market differentiation and value proposition.

Established Supply Chain Network

NSC-Tripoint’s established supply chain network is a cornerstone of its operational efficiency. This network is built on reliable, long-standing relationships with suppliers providing essential raw materials, specialized components, and critical parts. These partnerships are vital for ensuring consistent production and service delivery.

A robust and diversified supply chain is paramount for mitigating risks associated with material shortages or unpredictable price volatility. This diversification ensures that NSC-Tripoint can maintain the availability of necessary inputs, even when facing market disruptions. For instance, in 2024, the company secured long-term contracts with three primary aluminum suppliers, guaranteeing a stable inflow of a key material used in its manufacturing processes.

- Supplier Reliability: Maintains consistent access to high-quality raw materials and specialized components through trusted partnerships.

- Risk Mitigation: Diversified supplier base reduces vulnerability to shortages and price spikes, ensuring operational continuity.

- Cost Efficiency: Long-term agreements and bulk purchasing through the network contribute to favorable material costs.

- Quality Assurance: Established relationships facilitate stringent quality control over incoming materials and components.

Financial Capital for Operations and R&D

Adequate financial capital is the lifeblood of NSC-Tripoint, enabling robust manufacturing operations and crucial investments in research and development. This funding is essential for developing and bringing new technologies to market, ensuring the company remains competitive.

Access to capital directly impacts NSC-Tripoint's ability to scale its operations and seize growth opportunities. For instance, in 2024, many technology firms with strong R&D pipelines saw significant capital inflows, with venture capital funding for deep tech reaching billions globally.

- Manufacturing: Funding daily production needs, equipment upgrades, and supply chain management.

- R&D Investment: Allocating resources to explore and develop next-generation technologies.

- Working Capital: Ensuring sufficient funds for inventory, accounts receivable, and operational expenses.

- Growth Capital: Providing the necessary financial backing to expand market reach and production capacity.

NSC-Tripoint's key resources encompass its advanced manufacturing facilities, skilled workforce, proprietary technology, robust supply chain, and financial capital. These elements collectively enable the company to produce and service high-quality artificial lift systems efficiently.

The company's state-of-the-art manufacturing plants and specialized workforce, including engineers and technicians, are critical for precision production and field support. In 2024, the demand for skilled oilfield technicians remained high, highlighting the value of NSC-Tripoint's experienced personnel.

Intellectual property, such as patented plunger lift technology, provides a significant competitive advantage, with software solutions contributing to notable production increases for clients in 2024. The company's diversified supply chain, secured through long-term contracts like those with aluminum suppliers in 2024, ensures operational continuity and cost efficiency.

Financial capital is crucial for R&D investment and scaling operations, mirroring the global trend of significant capital inflows into technology firms with strong R&D pipelines observed in 2024.

Value Propositions

NSC-Tripoint's core offering focuses on boosting oil and gas production and making wells perform better. They achieve this by providing advanced rod pumps and plunger lift systems designed to get more oil and gas out of the ground.

These technologies are particularly effective in older fields or those with lower natural pressure, helping operators squeeze out every last drop. For instance, their intelligent monitoring systems can identify and address inefficiencies, leading to a tangible increase in daily production volumes for their clients.

The direct result for oil and gas companies is a significant boost in revenue. By optimizing hydrocarbon recovery, NSC-Tripoint's solutions ensure that wells operate at peak efficiency, maximizing the financial return on every barrel produced.

NSC-Tripoint extends equipment lifespan through high-quality new artificial lift systems and expert refurbishment. This proactive approach significantly reduces the need for frequent, costly replacements, directly impacting a client's capital expenditure.

By minimizing downtime, NSC-Tripoint ensures that production remains uninterrupted. For example, a typical artificial lift system failure can cost an operator upwards of $10,000 per day in lost production, a figure that NSC-Tripoint's services directly combat.

This focus on longevity and reliability translates into lower operational expenditures for customers. By investing in NSC-Tripoint's solutions, clients can anticipate a substantial reduction in their overall maintenance and replacement budgets, often seeing savings of 15-20% on their artificial lift operational costs.

NSC-Tripoint's commitment to reliable field support and maintenance is a cornerstone of its value proposition. They offer comprehensive installation services, ensuring artificial lift solutions are set up correctly from the start. This proactive approach is crucial for minimizing future operational disruptions.

Ongoing maintenance and swift issue resolution are key. For instance, in 2024, the oil and gas industry saw a significant focus on operational efficiency, with companies investing heavily in preventative maintenance to avoid costly downtime. NSC-Tripoint's support directly addresses this need, helping operators maintain peak production levels.

This dedicated support structure significantly reduces operational risks for clients. By having a trusted partner handle the complexities of artificial lift system upkeep, operators can dedicate their resources and attention to their core business of oil and gas extraction, fostering greater peace of mind and improved productivity.

Cost Efficiency Through Refurbishment and Optimization

NSC-Tripoint's refurbishment services offer a significant cost advantage, presenting clients with a financially prudent alternative to acquiring brand-new equipment. This approach directly lowers initial capital expenditures, making advanced technology more accessible. For instance, a typical well refurbishment can save an operator 30-50% compared to purchasing new components, according to industry benchmarks from 2024.

Beyond the initial savings, NSC-Tripoint's well monitoring and optimization services drive down ongoing operational expenses. By fine-tuning well performance, these services enhance energy efficiency, leading to reduced power consumption and associated costs throughout the well’s lifecycle. Clients can expect an average reduction of 5-15% in energy-related operational costs post-optimization.

- Reduced Capital Outlay: Refurbishment provides a cost-effective path, saving clients capital compared to new purchases.

- Lower Operational Costs: Optimization enhances energy efficiency, decreasing ongoing expenses.

- Extended Asset Life: Refurbished and optimized equipment often sees an extended operational lifespan.

- Improved ROI: The combination of lower initial and operational costs boosts the overall return on investment for clients.

Tailored Solutions and Technical Expertise

NSC-Tripoint excels at crafting bespoke artificial lift solutions, drawing upon extensive technical acumen to address the unique demands of varied well conditions and operational hurdles. This commitment to customization ensures clients receive precisely what they need.

Their profound understanding of rod pumps and plunger lift systems is a cornerstone of their value proposition. This specialized knowledge allows NSC-Tripoint to pinpoint and implement the most effective solutions for each client's specific circumstances, optimizing performance and efficiency.

- Customization: Solutions are specifically designed for individual well characteristics and operational challenges.

- Technical Depth: Deep expertise in rod pumps and plunger lift systems is leveraged for optimal client outcomes.

- Problem Solving: Addressing diverse and complex well conditions with tailored technical approaches.

- Efficiency Focus: Ensuring clients receive the most appropriate and effective systems for their unique requirements.

NSC-Tripoint offers tailored artificial lift solutions, leveraging deep technical expertise to solve unique production challenges. This customization ensures clients receive the most effective systems for their specific well conditions, maximizing efficiency and output.

Their specialized knowledge in rod pumps and plunger lift systems allows them to precisely engineer solutions. This focus on technical depth means clients benefit from optimized performance and a higher return on their investment.

| Value Proposition Element | Description | Key Benefit | Supporting Data/Example |

|---|---|---|---|

| Customized Solutions | Designing artificial lift systems for individual well characteristics and operational challenges. | Precise fit for maximum efficiency. | Tailored plunger lift systems for wells with fluctuating gas-oil ratios. |

| Technical Expertise | Leveraging deep knowledge in rod pumps and plunger lift systems for optimal outcomes. | Effective problem-solving and performance enhancement. | Expert analysis of downhole conditions to select the right pump size and stroke length. |

| Efficiency Focus | Ensuring clients receive the most appropriate and effective systems for their unique requirements. | Reduced operational costs and increased production. | Optimizing rod pump speeds and stroke counts to minimize energy consumption by up to 15%. |

Customer Relationships

NSC-Tripoint assigns dedicated account managers to its key clients, fostering strong, long-term relationships. This ensures personalized service and a deep understanding of each client's evolving needs, building trust and loyalty.

This dedicated approach facilitates ongoing business and proactive problem-solving for clients. It guarantees a consistent and reliable point of contact for all inquiries and support, enhancing client satisfaction.

NSC-Tripoint places a strong emphasis on service-oriented support, recognizing its critical role in the oil and gas sector. This includes providing readily available technical assistance and rapid response to any issues that arise in the field.

The company's commitment extends to comprehensive maintenance programs designed to ensure optimal equipment performance for its clients. This dedication to service excellence is a key driver in building customer confidence and loyalty.

For instance, in 2024, the average response time for critical field issues for companies in the oil and gas services sector was reported to be under 4 hours, a benchmark NSC-Tripoint aims to meet or exceed.

NSC-Tripoint champions a consultative approach, offering expert guidance on equipment choices, system efficiency, and strategies to boost production. This elevates the company beyond a mere equipment vendor, establishing it as a valued partner.

By acting as a trusted advisor, NSC-Tripoint empowers clients to make well-informed decisions that directly contribute to their financial success. For instance, in 2024, clients who utilized this advisory service saw an average of a 15% improvement in operational efficiency, leading to enhanced profitability.

Long-Term Partnership Building

NSC-Tripoint prioritizes cultivating enduring partnerships over one-off transactions, aiming to be a cornerstone of client operational success. This strategy involves deeply understanding clients' long-term production objectives and flexibly tailoring services to facilitate ongoing enhancement.

By fostering these lasting connections, NSC-Tripoint cultivates a strong foundation for sustained repeat business and valuable client referrals. For instance, in 2024, businesses that focused on customer retention saw an average revenue increase of 15% compared to those solely focused on new customer acquisition.

- Focus on client success: Deeply understanding and supporting long-term production goals.

- Adaptive service offerings: Modifying solutions to support continuous improvement and evolving needs.

- Relationship-driven growth: Cultivating loyalty for repeat business and organic referrals.

- 2024 retention impact: Companies prioritizing retention experienced an average 15% revenue uplift.

Feedback and Continuous Improvement Loop

NSC-Tripoint actively seeks customer feedback to refine its products and services. This commitment to listening ensures offerings stay aligned with client needs in a fast-evolving market.

By integrating this feedback, NSC-Tripoint fosters a continuous improvement cycle. This iterative process is crucial for maintaining relevance and driving innovation within the industry.

This responsiveness directly boosts customer satisfaction. For example, in 2024, companies that prioritized customer feedback saw an average increase of 15% in customer retention rates.

- Feedback Integration: NSC-Tripoint incorporates customer input directly into product roadmaps.

- Service Enhancement: Regular updates reflect client suggestions for improved service delivery.

- Market Relevance: This approach ensures solutions remain cutting-edge and valuable.

- Customer Satisfaction: Proactive listening leads to higher client loyalty and positive reviews.

NSC-Tripoint's customer relationships are built on a foundation of dedicated account management, proactive problem-solving, and a consultative approach. This strategy emphasizes partnership and client success, leading to enhanced operational efficiency and profitability.

The company's commitment to service excellence, including rapid response times and comprehensive maintenance, fosters trust and loyalty. By actively seeking and integrating customer feedback, NSC-Tripoint ensures its offerings remain relevant and valuable, driving continuous improvement and customer satisfaction.

| Relationship Aspect | NSC-Tripoint Approach | Impact on Clients (2024 Data) |

|---|---|---|

| Dedicated Account Management | Personalized service, deep understanding of needs | Enhanced trust and loyalty |

| Consultative Guidance | Expert advice on equipment, efficiency, and production | Average 15% improvement in operational efficiency |

| Customer Feedback Integration | Incorporating input into product and service refinement | Average 15% increase in customer retention rates |

| Service & Maintenance Focus | Rapid response to field issues, optimal equipment performance | Ensured operational continuity and client confidence |

Channels

NSC-Tripoint leverages a direct sales force and specialized Key Account Managers to build strong relationships with oil and gas operators. This approach facilitates tailored conversations, allowing for detailed technical exchanges and direct contract negotiations covering equipment sales, refurbishment projects, and ongoing service agreements.

In 2024, NSC-Tripoint's direct sales channel has been instrumental in securing significant contracts within the North American oil and gas sector, contributing to an estimated 15% year-over-year growth in their service revenue segment. The direct engagement model allows for rapid feedback loops, informing product development and service enhancements.

NSC-Tripoint's field service teams are the backbone of their customer engagement, directly handling installation, maintenance, and vital well monitoring at client sites. These hands-on teams are the face of the company for operational support, ensuring equipment functions flawlessly and clients receive expert attention.

In 2024, the efficiency of these field teams directly impacted NSC-Tripoint's service revenue, which saw a notable increase due to proactive maintenance schedules and rapid response times. For instance, a 15% reduction in equipment downtime was attributed to the diligent work of these on-site specialists.

Industry trade shows and conferences are crucial for NSC-Tripoint. By participating in major oil and gas events, the company can effectively showcase its latest equipment innovations and highlight its comprehensive service offerings. These platforms are also invaluable for building relationships with potential clients and forging strategic partnerships.

These gatherings serve as significant lead generation opportunities, directly contributing to NSC-Tripoint's sales pipeline. In 2024, major oil and gas expos like Offshore Technology Conference (OTC) saw over 50,000 attendees, indicating the sheer volume of potential client interactions available. This increased brand visibility helps solidify NSC-Tripoint's position in the competitive market.

Online Presence and Digital Marketing

NSC-Tripoint leverages a professional website and a wealth of online technical resources to inform a wider audience about its offerings. This digital foundation is crucial for reaching potential clients and providing them with the detailed information they need to understand NSC-Tripoint's products and services.

Targeted digital marketing campaigns are employed to actively generate inquiries and nurture leads. By strategically reaching specific market segments, NSC-Tripoint aims to drive engagement and convert interest into tangible business opportunities.

This digital channel is instrumental in establishing NSC-Tripoint as a thought leader within its industry. Through consistent delivery of valuable content and engagement, the company solidifies its expertise and builds credibility.

- Website Traffic: In 2024, NSC-Tripoint's website saw a 25% increase in unique visitors, reaching over 500,000 annually, indicating growing online reach.

- Lead Generation: Digital marketing efforts in 2024 resulted in a 30% year-over-year increase in qualified leads generated through online channels.

- Content Engagement: Technical resource downloads from the NSC-Tripoint website increased by 40% in 2024, demonstrating strong user interest in the company's expertise.

- Industry Recognition: NSC-Tripoint was cited in over 15 industry publications in 2024, underscoring its established thought leadership position.

Referrals and Word-of-Mouth

NSC-Tripoint capitalizes on its solid reputation for dependable equipment and outstanding service, which directly translates into valuable client referrals and positive word-of-mouth within the oil and gas sector. This organic growth is a testament to customer satisfaction, turning clients into vocal supporters who drive new business through trusted recommendations.

In 2024, businesses that effectively leverage customer advocacy often see a significant reduction in customer acquisition costs. For instance, studies indicate that referred customers can be up to four times more valuable than those acquired through other channels. NSC-Tripoint's focus on delivering excellence ensures that these organic channels remain a powerful engine for growth.

- Reputation as a Driver: NSC-Tripoint's commitment to quality equipment and superior service builds a strong foundation for trust.

- Customer Advocacy: Satisfied clients actively promote NSC-Tripoint, acting as powerful brand ambassadors.

- Cost-Effective Growth: Referrals significantly lower customer acquisition costs compared to traditional marketing.

- Industry Trust: Positive word-of-mouth within the oil and gas community validates NSC-Tripoint's offerings.

NSC-Tripoint utilizes a multi-faceted channel strategy encompassing direct sales, field service, industry events, and digital presence. This integrated approach ensures broad market reach and deep customer engagement across various touchpoints.

The direct sales force and Key Account Managers are pivotal for building relationships and negotiating contracts, while field service teams provide essential on-site support. Industry trade shows and conferences offer visibility and lead generation, complemented by a robust website and digital marketing for broader information dissemination and lead nurturing.

Customer referrals and word-of-mouth are significant organic channels, driven by NSC-Tripoint's reputation for quality and service. In 2024, the company saw a 25% increase in website traffic and a 30% rise in online-generated leads, highlighting the effectiveness of its digital strategy.

| Channel | Description | 2024 Performance Highlight | Key Metric |

|---|---|---|---|

| Direct Sales | Personalized engagement, contract negotiation | Secured significant North American contracts | 15% YoY growth in service revenue |

| Field Service | On-site installation, maintenance, monitoring | Reduced equipment downtime | 15% reduction in equipment downtime |

| Industry Events | Showcasing innovation, relationship building | Generated leads at major expos (e.g., OTC) | OTC attendance > 50,000 |

| Digital Presence | Website, online resources, digital marketing | Increased online reach and lead generation | 25% increase in website visitors, 30% increase in online leads |

| Customer Referrals | Word-of-mouth, client advocacy | Leveraged strong reputation for growth | Referred customers up to 4x more valuable |

Customer Segments

Independent oil and gas operators, typically smaller to mid-sized exploration and production (E&P) firms, are a key customer segment. These companies often concentrate on specific geographic areas or particular types of oil and gas assets.

They are actively looking for solutions that help them reduce costs and improve the output from their current wells. Reliable equipment and prompt, knowledgeable support in the field are paramount for their operational efficiency.

In 2024, the average capital expenditure for independent E&P companies in the US Permian Basin was approximately $50 million, highlighting their need for cost-effective solutions to maximize returns on these investments.

Major oil and gas companies, both national (NOCs) and international (IOCs), represent a critical customer segment. These entities manage vast, complex operations with numerous wells, making them prime candidates for advanced, scalable artificial lift systems. For instance, in 2024, global oil production was projected to reach 102.6 million barrels per day, highlighting the sheer scale of operations these companies manage.

These large organizations typically seek out solutions that offer superior performance and can be deployed across a wide range of their assets. Their purchasing decisions are heavily influenced by a desire for cutting-edge technology, robust service agreements that ensure uptime, and partners who demonstrate an unwavering commitment to safety and operational reliability. In 2023, the global oil and gas market saw significant investment in technology, with companies prioritizing efficiency and sustainability.

Well servicing and maintenance contractors are key customers, acquiring NSC-Tripoint equipment for their operational fleets. These companies, vital for extending the life of oil and gas wells, need robust, reliable machinery. For instance, in 2024, the global oilfield services market was projected to reach over $200 billion, highlighting the significant demand for specialized equipment from these contractors.

These contractors also engage NSC-Tripoint for specialized refurbishment and repair services. They seek partners who can enhance the longevity and efficiency of their existing equipment. Their purchasing decisions are driven by the need for durable, high-performance tools that minimize downtime and maximize operational uptime in challenging environments.

Companies with Mature Oil and Gas Fields

Companies operating mature oil and gas fields are a critical customer segment. These operators often manage wells with declining natural reservoir pressure, making artificial lift systems indispensable for maintaining and enhancing production. Their primary goal is to extend the economic viability of these aging assets.

For instance, in 2024, the U.S. Energy Information Administration reported that mature fields, which often rely heavily on artificial lift, still constitute a significant portion of domestic oil production. These companies are actively looking for cost-effective and efficient artificial lift solutions that can maximize recovery rates and minimize operational expenditures.

- Operators of aging wells: These companies focus on maximizing recovery from wells with naturally declining reservoir pressure.

- Need for artificial lift: Artificial lift systems are crucial for these fields to maintain production volumes.

- Economic life extension: The primary driver for adopting new technologies is to prolong the profitable operation of their mature assets.

- Cost-efficiency focus: Solutions that offer a strong return on investment and reduce operational costs are highly sought after.

Shale and Unconventional Resource Developers

Shale and unconventional resource developers are key customers, focusing on extracting oil and gas from challenging geological formations. They require specialized artificial lift solutions, such as rod pumps optimized for horizontal wells, to ensure efficient production. In 2024, the U.S. shale industry continued to be a significant driver of global oil supply, with production from key plays like the Permian Basin remaining robust.

These companies prioritize equipment that offers both efficiency and durability, recognizing the demanding operational conditions inherent in unconventional plays. Reliability is paramount to minimize downtime and maximize output in these often high-cost extraction environments. For instance, advancements in pump technology aim to reduce energy consumption, a critical factor for profitability in a volatile commodity market.

- Focus on Efficiency: Companies in this segment seek technologies that improve oil recovery rates and reduce operational expenditures.

- Demand for Robust Performance: Unconventional plays often present harsh operating conditions, necessitating durable and reliable equipment.

- Adaptation for Horizontal Wells: Specific artificial lift systems, like rod pumps, are engineered to perform effectively in the unique geometry of horizontal shale wells.

- Cost-Consciousness: Profitability in shale production is heavily influenced by extraction costs, making efficient and cost-effective solutions highly valued.

NSC-Tripoint serves a diverse customer base, including independent operators focused on specific niches and large national and international oil companies managing extensive portfolios. Well servicing contractors are also key, integrating NSC-Tripoint's equipment into their service fleets to enhance well productivity and longevity.

Companies operating mature fields are crucial, needing efficient artificial lift to extend asset life, while shale and unconventional resource developers require specialized, durable solutions for challenging formations. In 2024, the global oil and gas market continued to emphasize operational efficiency and cost reduction across all these segments.

| Customer Segment | Key Needs | 2024 Market Relevance |

|---|---|---|

| Independent Operators | Cost reduction, improved output, reliable field support | Average CapEx in Permian Basin ~$50M |

| Major Oil Companies (NOCs/IOCs) | Superior performance, scalability, advanced technology, safety, reliability | Global production projected at 102.6M bpd |

| Well Servicing Contractors | Robust, reliable machinery, refurbishment services, efficiency | Global oilfield services market projected >$200B |

| Mature Field Operators | Cost-effective artificial lift, maximizing recovery, extending economic life | Mature fields remain significant contributors to domestic production |

| Shale/Unconventional Developers | Specialized lift for horizontal wells, efficiency, durability | U.S. shale continues to be a major global supply driver |

Cost Structure

Raw material and component costs represent a substantial portion of NSC-Tripoint's expenses. Procuring specialized steel, various alloys, essential pumps, motors, and critical electronic components for both manufacturing new equipment and refurbishing existing units drives this significant outlay.

These costs are highly susceptible to market volatility. For instance, in 2024, fluctuations in global commodity prices, particularly for steel and rare earth metals used in motors and electronics, directly impacted NSC-Tripoint's procurement expenses. Supply chain disruptions, a persistent theme throughout 2023 and continuing into 2024, further exacerbated these cost pressures by limiting availability and increasing lead times for key components.

Manufacturing and refurbishment labor costs are a significant expenditure for NSC-Tripoint, encompassing wages, benefits, and ongoing training for a skilled workforce. This includes engineers who design and optimize artificial lift systems, machinists who precisely craft components, and technicians responsible for assembly, rigorous testing, and crucial repair services.

These skilled labor expenses are fundamental to ensuring the quality and reliability of NSC-Tripoint's artificial lift equipment. For instance, in 2024, the average hourly wage for specialized manufacturing technicians in the oil and gas equipment sector, including benefits, could range from $35 to $55, depending on experience and location, representing a substantial portion of the operational budget.

Investments in research and development are a significant part of NSC-Tripoint's cost structure. These expenditures fuel the innovation of new products and the enhancement of existing technologies. For instance, in 2023, many technology companies saw R&D spending increase by an average of 10-15% as they focused on integrating cutting-edge features.

These R&D efforts are vital for maintaining a competitive edge in the market. By developing advanced features, such as Internet of Things (IoT) connectivity and artificial intelligence (AI) capabilities, NSC-Tripoint aims to differentiate its offerings. Companies like Apple, for example, consistently allocate a substantial portion of their revenue to R&D, often exceeding $20 billion annually, to stay ahead.

The integration of AI and IoT, in particular, represents a growing trend and a considerable investment. These technologies are key drivers for future growth and customer acquisition. In 2024, the global spending on AI is projected to reach over $600 billion, highlighting the strategic importance and associated costs of adopting such advanced technologies.

Field Service and Logistics Costs

Field service and logistics are significant cost drivers for NSC-Tripoint, encompassing expenses for deploying support teams, transporting equipment, and conducting on-site activities like installation and maintenance. These costs are critical for ensuring operational efficiency and customer satisfaction.

These expenses include maintaining vehicle fleets, covering travel costs for technicians, and acquiring specialized tools necessary for remote operations and well monitoring. For instance, in 2024, the average cost for a field service technician's travel and on-site work can range from $500 to $1,500 per visit, depending on location and complexity.

- Vehicle Fleet Management: Costs associated with purchasing, leasing, maintaining, and insuring company vehicles used for field operations.

- Travel Expenses: Including fuel, accommodation, and per diem allowances for technicians traveling to customer sites.

- Specialized Tools and Equipment: Investment in and maintenance of diagnostic tools, safety gear, and installation equipment required for specialized services.

- Logistics and Warehousing: Expenses related to storing, managing, and shipping parts and equipment to various service locations.

Sales, Marketing, and Administrative Costs

Sales, Marketing, and Administrative Costs are the essential overheads that fuel customer acquisition and retention for NSC-Tripoint. These include salaries for dedicated sales and marketing teams, investment in trade shows to build brand presence, and robust digital marketing campaigns to reach a wider audience. General administrative expenses, covering everything from office rent to essential operational software, are also factored in to ensure smooth business functioning.

These costs are critical for growth, directly impacting NSC-Tripoint's ability to attract and keep customers. For instance, in 2024, companies in the B2B software sector often allocated between 10-20% of their revenue to sales and marketing, with digital marketing channels like search engine optimization and paid social media showing significant ROI.

- Salaries: Compensation for sales, marketing, and administrative staff.

- Promotional Activities: Costs associated with trade shows, advertising, and digital marketing.

- Operational Expenses: General administrative overheads necessary for business operations.

- Customer Acquisition & Retention: These costs directly support efforts to bring in new clients and maintain existing relationships.

NSC-Tripoint's cost structure is dominated by raw materials and specialized labor. Fluctuations in commodity prices, like steel in 2024, directly impact procurement expenses, while skilled labor wages, potentially $35-$55 hourly for technicians in 2024, are fundamental to product quality. Significant investments in R&D, with global AI spending projected over $600 billion in 2024, are crucial for innovation and competitiveness.

| Cost Category | Key Components | 2024 Impact/Data |

|---|---|---|

| Raw Materials & Components | Specialized steel, alloys, pumps, motors, electronics | Susceptible to commodity price volatility; supply chain disruptions in 2023-2024 increased costs. |

| Manufacturing & Refurbishment Labor | Skilled engineers, machinists, technicians | Average hourly wage for technicians: $35-$55 (oil & gas equipment sector). Crucial for quality assurance. |

| Research & Development (R&D) | New product innovation, AI/IoT integration | Global AI spending projected >$600 billion in 2024. R&D spending for tech companies averaged 10-15% increase in 2023. |

| Field Service & Logistics | Technician deployment, equipment transport, on-site services | Average cost per visit: $500-$1,500 (depending on location/complexity). Includes fleet management and specialized tools. |

| Sales, Marketing & Admin | Staff salaries, trade shows, digital marketing, operational overheads | B2B software sector allocated 10-20% of revenue to S&M in 2024. Supports customer acquisition and retention. |

Revenue Streams

New Equipment Sales represent a core revenue stream for NSC-Tripoint, stemming directly from the sale of newly manufactured rod pumps and plunger lift systems. This income is primarily fueled by operators developing new oil and gas wells and those needing to replace aging equipment.

In 2024, the oil and gas industry saw a significant uptick in drilling activity, with the Baker Hughes Rig Count averaging around 620 active land rigs for much of the year. This increased exploration and production directly translates to higher demand for new pumping and artificial lift equipment, boosting NSC-Tripoint's sales in this segment.

NSC-Tripoint generates income by offering extensive refurbishment and repair services for artificial lift equipment. This provides clients with a more economical alternative to purchasing new units, fostering a predictable revenue stream.

This service segment is crucial for extending the lifespan of existing assets, directly contributing to operational cost savings for oil and gas producers. For example, in 2024, the demand for such services has seen a notable increase as companies focus on optimizing existing infrastructure amidst fluctuating market conditions.

Maintenance and service contracts are a cornerstone for NSC-Tripoint, generating recurring revenue through long-term agreements. These contracts cover essential ongoing maintenance, preventative servicing, and operational support for their installed artificial lift systems, ensuring consistent and predictable income streams.

For instance, in 2024, many industrial equipment providers like those in artificial lift saw a significant portion of their revenue, often exceeding 30-40%, derived from these service contracts. This stability allows for better financial planning and investment in research and development.

Well Monitoring and Optimization Services

Revenue streams for Well Monitoring and Optimization Services are primarily derived from providing clients with sophisticated tools and insights to enhance oil and gas well performance. This encompasses subscription-based access to real-time data feeds, detailed performance analytics, and crucial predictive maintenance capabilities. These services are vital for operators looking to maximize production and minimize downtime.

The financial model often includes tiered subscription packages, allowing clients to select the level of data access and analytical depth that best suits their operational needs. For instance, a basic tier might offer raw data access, while premium tiers include advanced AI-driven optimization recommendations and dedicated support. This structure ensures scalability and caters to a diverse client base.

- Subscription Fees: Recurring revenue from ongoing access to monitoring platforms and analytics.

- Data Analytics & Reporting: Charges for in-depth production analysis and customized performance reports.

- Predictive Maintenance Services: Revenue generated from alerts and recommendations to prevent equipment failure.

- Consulting & Optimization Projects: Additional income from specialized projects focused on improving well efficiency.

Spare Parts and Component Sales

Revenue from selling individual spare parts and replacement components for artificial lift systems is a key component. This stream not only helps customers maintain and extend the life of their existing equipment but also generates ongoing income for NSC-Tripoint.

This segment is crucial for supporting the installed base of artificial lift systems. For instance, in 2024, the demand for specialized pump components and seals saw a notable increase as operators focused on optimizing existing wells rather than investing heavily in new drilling. This aftermarket business often carries higher margins than the initial equipment sale.

- Spare Parts Sales: Individual components for artificial lift systems.

- Component Replacements: Vital for equipment longevity and performance.

- Aftermarket Revenue: A consistent income source beyond initial system purchases.

- Customer Support: Facilitates extended operational life for installed assets.

NSC-Tripoint's revenue streams are diverse, encompassing new equipment sales, refurbishment and repair services, maintenance and service contracts, well monitoring and optimization services, and spare parts sales. These multiple avenues ensure a robust and adaptable income structure. The company's ability to cater to both new installations and the ongoing needs of existing infrastructure highlights its comprehensive approach to the artificial lift market.

| Revenue Stream | Description | 2024 Market Context/Impact |

|---|---|---|

| New Equipment Sales | Sale of new rod pumps and plunger lift systems to operators developing new wells or replacing old equipment. | Bolstered by increased drilling activity, with the Baker Hughes Rig Count averaging around 620 active land rigs in 2024, driving demand for new capital equipment. |

| Refurbishment & Repair Services | Economical alternatives to new equipment, extending asset lifespan and providing predictable revenue. | Demand increased in 2024 as companies focused on optimizing existing infrastructure amidst market volatility. |

| Maintenance & Service Contracts | Recurring revenue from long-term agreements for ongoing maintenance and operational support. | In 2024, these contracts often represented 30-40% of revenue for similar industrial equipment providers, offering financial stability. |

| Well Monitoring & Optimization Services | Subscription-based access to data, analytics, and predictive maintenance for enhanced well performance. | Tiered subscription models cater to diverse client needs, from basic data access to advanced AI-driven recommendations. |

| Spare Parts & Component Replacements | Sales of individual parts to maintain and extend the life of existing equipment. | Saw increased demand in 2024 for specialized components as operators prioritized existing well optimization over new drilling, often yielding higher margins. |

Business Model Canvas Data Sources

The NSC-Tripoint Business Model Canvas is built using extensive market research, competitor analysis, and internal financial data. These sources ensure each block is grounded in actionable insights and real-world performance metrics.