Northwest Bancshares SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Northwest Bancshares Bundle

Northwest Bancshares demonstrates a solid market presence with strong community ties and a diversified product offering, but faces challenges from evolving digital banking trends and increased competition.

Want the full story behind Northwest Bancshares' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Northwest Bancshares showcased robust financial health in the first quarter of 2025, achieving record earnings. The company reported a net income of $43 million, marking an impressive 48% increase compared to the same period in the previous year. This strong performance, with earnings per diluted share reaching $0.34, comfortably exceeded market expectations.

Northwest Bancshares has demonstrated a strong ability to enhance its net interest margin, achieving this improvement for four consecutive quarters. This trend continued into Q1 2025, with the NIM expanding by 45 basis points to reach 3.87%.

This positive trajectory is primarily driven by a reduction in the cost of funds and a rise in asset yields, notably bolstered by a significant interest recovery. Such consistent performance highlights effective management of the company's balance sheet and disciplined pricing strategies, even amidst fluctuating interest rates.

Northwest Bancshares has strategically pivoted towards commercial lending, with a notable 20% surge in average Commercial & Industrial (C&I) loan balances in the past year. This move into higher-yielding assets is a key driver for revenue expansion and offers a valuable diversification away from personal banking segments that have experienced some contraction.

Stable Credit Quality and Risk Management

Northwest Bancshares demonstrates robust financial health through its stable credit quality. As of March 31, 2025, nonperforming assets stood at a low 0.52% of total assets, underscoring effective risk oversight. This stability is further supported by an annualized net charge-off rate of just 8 basis points recorded in the first quarter of 2025.

The company proactively managed its risk profile through strategic de-risking initiatives undertaken in late 2024. These actions included the sale of specific loan pools and the reclassification of certain assets, which collectively strengthened the balance sheet and reduced the proportion of classified loans.

These efforts highlight a commitment to maintaining a resilient financial position, crucial for navigating evolving economic landscapes.

Diversified Financial Services and Established Presence

Northwest Bancshares boasts a robust and diversified financial services portfolio, encompassing everything from standard deposit accounts to specialized investment management and trust services. This broad range allows them to serve a wide spectrum of customer needs, from everyday banking to complex wealth management.

The company's established presence is further solidified by its extensive network of 130 full-service financial centers strategically located across Pennsylvania, New York, Ohio, and Indiana. This significant regional footprint, as of early 2024, provides a strong foundation for customer acquisition and retention.

- Diversified Offerings: Deposit accounts, personal and business loans, investment management, trust services.

- Extensive Network: 130 financial centers as of Q1 2024.

- Geographic Reach: Operations spanning Pennsylvania, New York, Ohio, and Indiana.

Northwest Bancshares' strong financial performance in Q1 2025, with a 48% year-over-year net income increase to $43 million and a net interest margin expanding to 3.87%, highlights effective balance sheet management and strategic asset allocation.

The company's pivot to commercial lending, evidenced by a 20% surge in average C&I loan balances, coupled with stable credit quality indicated by nonperforming assets at 0.52% as of March 31, 2025, showcases a disciplined approach to growth and risk mitigation.

Its diversified financial services portfolio and extensive network of 130 financial centers across four states provide a solid foundation for sustained customer engagement and revenue generation.

| Metric | Q1 2025 Value | Previous Year (Q1 2024) | Change |

|---|---|---|---|

| Net Income | $43 million | $29.05 million | +48% |

| Net Interest Margin (NIM) | 3.87% | 3.42% | +45 bps |

| Nonperforming Assets (as % of total assets) | 0.52% | N/A (pre-de-risking) | Stable/Improved |

| Avg. C&I Loan Balances | N/A (Growth driver) | N/A | +20% (YoY) |

What is included in the product

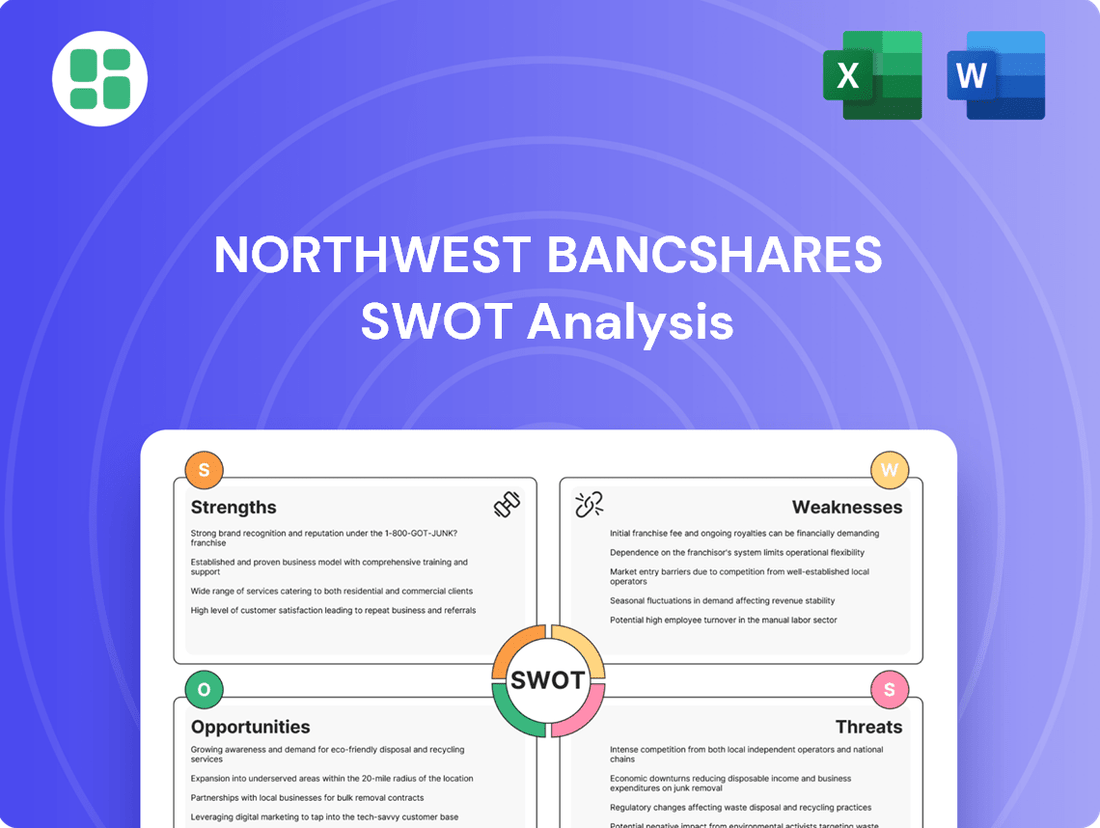

This SWOT analysis provides a comprehensive overview of Northwest Bancshares's competitive landscape, detailing its internal strengths and weaknesses alongside external market opportunities and threats.

Provides a clear, organized view of Northwest Bancshares' competitive landscape, simplifying strategic decision-making.

Weaknesses

Northwest Bancshares has seen a notable contraction in its personal banking loan portfolio. This decline, evidenced by a decrease in average loans receivable, stems from a strategic reallocation of capital towards commercial lending. While this pivot supports a broader company strategy, it raises questions about potential challenges in the personal lending market.

The company's emphasis on profitability and stringent credit standards has contributed to slower growth across its personal banking segment. For instance, as of the first quarter of 2024, while commercial loans showed resilience, the personal loan book experienced a dip, reflecting this focused approach and potentially a moderated demand for consumer credit products.

Northwest Bancshares has observed a concerning uptick in its classified loans, reaching $279 million, or 2.49% of its total loan portfolio, as of March 31, 2025. This represents a notable increase from prior reporting periods, signaling potential headwinds in credit quality.

The primary driver behind this rise appears to be concentrated exposure within the Long Term Healthcare sector, an industry that has encountered significant operational and financial difficulties in the post-COVID-19 environment. While the company's management has initiated de-risking strategies, this segment remains a critical area requiring vigilant oversight and proactive management to mitigate further deterioration.

Northwest Bancshares' revenue streams may experience fluctuations. While the first quarter of 2025 demonstrated robust revenue expansion, projections for the second quarter of 2025 indicate a less consistent performance, with a possibility of falling short of revenue expectations.

This anticipated mixed result in Q2 2025 suggests that Northwest Bancshares' revenue growth could be susceptible to seasonal trends or events that are not recurring, which raises questions about the sustainability of its top-line growth trajectory.

Investors and analysts will be paying close attention to the company's financial reports in the upcoming quarters to assess whether this revenue volatility is a temporary issue or a more persistent challenge.

Integration Challenges from Acquisitions

The pending acquisition of Penns Woods Bancorp, valued at approximately $1.0 billion as of early 2024, introduces significant integration challenges for Northwest Bancshares. These hurdles span the critical areas of cultural alignment between the two organizations, the complex consolidation of disparate technological systems, and the meticulous effort required to maintain seamless regulatory compliance throughout the process.

Successfully navigating these integration complexities is paramount for Northwest Bancshares to unlock the projected cost synergies and to uphold customer confidence. Failure to manage these aspects effectively could lead to operational disruptions, impacting service delivery and potentially eroding market share during a crucial transition period.

- Cultural Integration: Merging distinct corporate cultures requires careful planning and execution to foster a unified workforce and prevent employee attrition.

- Technological Consolidation: Integrating diverse IT infrastructures, including core banking systems, presents technical and financial risks that must be managed proactively.

- Regulatory Compliance: Ensuring all operations adhere to banking regulations during and after the acquisition demands robust oversight and meticulous documentation.

Regional Concentration Risk

Northwest Bancshares' primary operational focus within Pennsylvania, New York, Ohio, and Indiana presents a significant weakness. This regional concentration means the bank is particularly susceptible to economic downturns or increased competition within these specific states. For instance, a slowdown in manufacturing in Ohio could disproportionately impact Northwest Bancshares compared to a bank with a broader national presence.

This limited geographic footprint inherently restricts potential avenues for growth and diversification. While a strong community presence is beneficial, it also means the bank may miss out on opportunities in faster-growing markets outside its current operational areas. By the end of 2024, Northwest Bancshares' asset concentration in these four states remained a key vulnerability.

The bank's reliance on these specific regions exposes it to heightened risks related to localized economic shocks or regulatory changes. A downturn in any one of these key states could have a more pronounced negative effect on earnings and asset quality than if the bank were more geographically dispersed.

Northwest Bancshares faces challenges with its personal banking loan portfolio, which saw a contraction as capital was strategically shifted to commercial lending. This focus, coupled with stringent credit standards, resulted in slower growth in the consumer segment, with personal loans dipping in Q1 2024 while commercial loans remained resilient.

The company's classified loans increased to $279 million, or 2.49% of the total portfolio, by March 31, 2025. This rise is largely attributed to concentrated exposure within the Long Term Healthcare sector, which has experienced difficulties. While de-risking efforts are underway, this sector remains a critical area for management attention.

Revenue growth for Northwest Bancshares may be inconsistent, with Q1 2025 showing strong expansion but Q2 2025 projections indicating a potential shortfall. This suggests susceptibility to non-recurring events or seasonal trends, raising questions about the sustainability of its top-line growth.

The pending $1.0 billion acquisition of Penns Woods Bancorp by early 2024 introduces significant integration challenges, including cultural alignment, technological consolidation, and regulatory compliance. Successfully managing these complexities is crucial for realizing cost synergies and maintaining customer confidence.

What You See Is What You Get

Northwest Bancshares SWOT Analysis

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version. You'll see a comprehensive breakdown of Northwest Bancshares' Strengths, Weaknesses, Opportunities, and Threats, providing valuable strategic insights.

Opportunities

The ongoing acquisition of Penns Woods Bancorp, slated for completion in the third quarter of 2025, represents a prime opportunity for Northwest Bancshares. This strategic move is projected to elevate the company's total assets to over $17 billion.

This asset growth will firmly place Northwest Bancshares within the top 100 largest banks nationwide. Furthermore, the acquisition is expected to substantially bolster its market share and presence across North Central and Northeastern Pennsylvania, creating significant scale and market density.

Northwest Bancshares' strategic shift towards commercial lending presents a significant growth avenue. The bank can leverage this momentum to further penetrate its service markets, capitalizing on the increasing demand for business financing.

The commercial and industrial (C&I) loan sector is showing robust performance, with opportunities for disciplined pricing to enhance yields. For instance, in the first quarter of 2024, Northwest Bancshares reported a notable increase in its commercial loan portfolio, contributing to overall net interest income growth.

This continued expansion in commercial lending allows Northwest Bancshares to directly support and benefit from the economic vitality and business expansion within its operating regions, fostering a mutually beneficial relationship.

Northwest Bancshares can significantly boost customer engagement and operational efficiency by investing more in its online and mobile banking platforms. This digital push aims to attract younger, tech-forward demographics and streamline services, ultimately lowering processing costs. For instance, as of Q1 2024, digital banking transactions represented over 60% of all customer interactions for many regional banks, a trend Northwest can leverage.

Expansion of Wealth Management and Trust Services

Northwest Bancshares' existing investment management and trust services present a significant opportunity for growth, particularly in generating fee-based income. By strategically enhancing these offerings and actively cross-selling them to its established banking clientele, the company can foster deeper customer engagement and expand its share of wallet. This diversification moves revenue generation beyond reliance on traditional lending and deposit activities, strengthening its overall financial resilience.

The expansion of wealth management and trust services can be a key driver for increasing non-interest income. For instance, in 2023, many regional banks saw their wealth management divisions contribute a growing portion of their total revenue. Northwest Bancshares can capitalize on this trend by:

- Developing specialized investment products tailored to evolving client needs.

- Leveraging digital platforms to enhance client accessibility and service delivery.

- Training banking staff to identify and refer potential wealth management clients.

- Acquiring smaller, specialized wealth management firms to gain market share and expertise.

Leveraging Cost Synergies from Mergers

Northwest Bancshares' acquisition of Penns Woods Bancorp in early 2024 is a prime example of leveraging cost synergies. This strategic move is expected to yield substantial savings by consolidating redundant back-office functions and optimizing operational workflows across the combined entity. The company anticipates realizing these efficiencies, which should translate into improved profitability and a stronger competitive position in the market.

The realization of these cost synergies is crucial for Northwest Bancshares' financial performance. By eliminating duplicate roles and streamlining processes, the company aims to enhance its efficiency ratios, a key metric for financial institutions. This operational improvement is projected to boost overall profitability, contributing positively to the company's long-term financial health and market competitiveness.

- Cost Synergies: Expected savings from eliminating duplicate functions post-Penns Woods Bancorp acquisition.

- Operational Streamlining: Focus on optimizing workflows for improved efficiency.

- Efficiency Ratios: Anticipated improvement in key performance indicators due to synergy realization.

- Profitability Enhancement: Direct impact of cost savings on the company's bottom line.

The acquisition of Penns Woods Bancorp, targeted for completion in Q3 2025, will significantly boost Northwest Bancshares' asset base to over $17 billion, positioning it among the top 100 U.S. banks and expanding its market share in Pennsylvania.

A strategic focus on commercial lending presents a substantial growth opportunity, capitalizing on increasing business financing demand and the robust performance of the commercial and industrial loan sector, as evidenced by Northwest's Q1 2024 net interest income growth.

Enhancing digital platforms for online and mobile banking can attract new customer segments and improve efficiency, mirroring the trend where digital transactions exceed 60% of customer interactions for many regional banks as of Q1 2024.

Expanding investment management and trust services offers a pathway to increased fee-based income, diversifying revenue streams beyond traditional lending and deposits, a strategy that proved successful for regional banks in 2023.

Threats

Changes in the interest rate environment present a significant threat to Northwest Bancshares' net interest margin (NIM). While the banking sector experienced modest NIM expansion in late 2024, unforeseen shifts in federal funds rates or competitive pressures on deposit costs and loan yields could compress these margins. This sensitivity means that even small rate movements can impact profitability.

Northwest Bancshares operates in a fiercely competitive landscape. It contends with a broad spectrum of financial institutions, ranging from large national commercial banks and nimble community banks to credit unions and specialized mortgage companies. The rise of fintech innovators further intensifies this environment, often introducing disruptive technologies and customer-centric models.

Many of these competitors boast superior financial resources and higher lending capacities, which can present a significant challenge. For instance, while Northwest Bancshares reported total assets of approximately $14.7 billion as of September 30, 2023, larger national banks often manage hundreds of billions, allowing them to absorb greater risk and invest more heavily in technology and marketing. This disparity in scale and specialized offerings can impact Northwest's ability to attract and retain customers, potentially capping growth and profitability.

Adverse general economic conditions, such as sustained inflation or a rise in non-performing loans, could significantly hurt Northwest Bancshares' financial health and operational outcomes. The company's ability to manage its loan portfolio effectively is tested by these macroeconomic headwinds.

While Northwest Bancshares has seen stable credit quality, a lingering concern is the inherent risk within its commercial real estate and business loan segments. Even with ongoing de-risking efforts, the broader economic uncertainties present a challenge that could impact loan performance.

Regulatory Changes and Compliance Costs

The banking sector constantly navigates a complex web of evolving legislation. For Northwest Bancshares, this means potential increases in compliance expenditures as new rules are implemented, impacting operational agility and possibly necessitating higher capital reserves. Failure to adapt swiftly to these regulatory shifts could present substantial hurdles.

For instance, the banking industry has seen significant regulatory focus on areas like cybersecurity and data privacy. In 2023, the Federal Reserve, OCC, and FDIC issued a joint notice of proposed rulemaking for enhanced cybersecurity risk management standards for large financial institutions, which will likely translate into increased compliance costs and operational adjustments for banks like Northwest Bancshares. These changes can directly affect profitability and the execution of strategic plans.

- Increased Compliance Burden: New regulations can necessitate significant investment in technology, personnel, and training to ensure adherence.

- Operational Constraints: Regulatory changes might limit certain business activities or require modifications to existing operational processes.

- Capital Requirements: Stricter capital adequacy rules could impact lending capacity and return on equity.

- Reputational Risk: Non-compliance can lead to fines and damage to the institution's public image.

Integration Risks of Acquired Businesses

Integrating newly acquired businesses into Northwest Bancshares' existing operations poses a significant threat. Difficulties in merging disparate company cultures, incompatible IT systems, or unexpected operational challenges can hinder the realization of anticipated cost savings and revenue enhancements.

These integration hurdles can lead to delays in achieving projected synergies, potentially impacting customer satisfaction and diverting crucial management focus from core business activities. For instance, in 2023, the financial services industry saw several mergers where integration challenges led to a temporary dip in operational efficiency, as reported by industry analysts.

- Cultural Clashes: Mismatched corporate values can impede collaboration and employee morale.

- Technological Incompatibilities: Integrating different banking platforms or software can be costly and time-consuming.

- Operational Disruptions: Merging processes and systems may temporarily disrupt customer service and internal workflows.

- Synergy Delays: Unforeseen integration issues can push back the timeline for achieving expected financial benefits.

Northwest Bancshares faces intense competition from larger banks and fintechs, potentially impacting its market share and pricing power. Economic downturns, including inflation or rising loan defaults, pose a significant risk to its financial stability, especially given its exposure to commercial real estate. Evolving regulations, such as enhanced cybersecurity mandates, could increase compliance costs and operational burdens.

| Threat Category | Description | Impact on Northwest Bancshares |

| Competitive Landscape | Intense competition from national banks, community banks, credit unions, and fintechs. | Pressure on market share, pricing, and customer acquisition. |

| Economic Conditions | Inflation, interest rate volatility, and potential increase in non-performing loans. | Compression of net interest margins, reduced loan demand, and increased credit risk. |

| Regulatory Environment | Evolving legislation, including cybersecurity and data privacy standards. | Increased compliance costs, operational adjustments, and potential capital requirement changes. |

SWOT Analysis Data Sources

This SWOT analysis is built upon a robust foundation of data, drawing from Northwest Bancshares' official financial filings, comprehensive market research reports, and expert industry analyses to provide a well-rounded strategic perspective.