Northwest Bancshares Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Northwest Bancshares Bundle

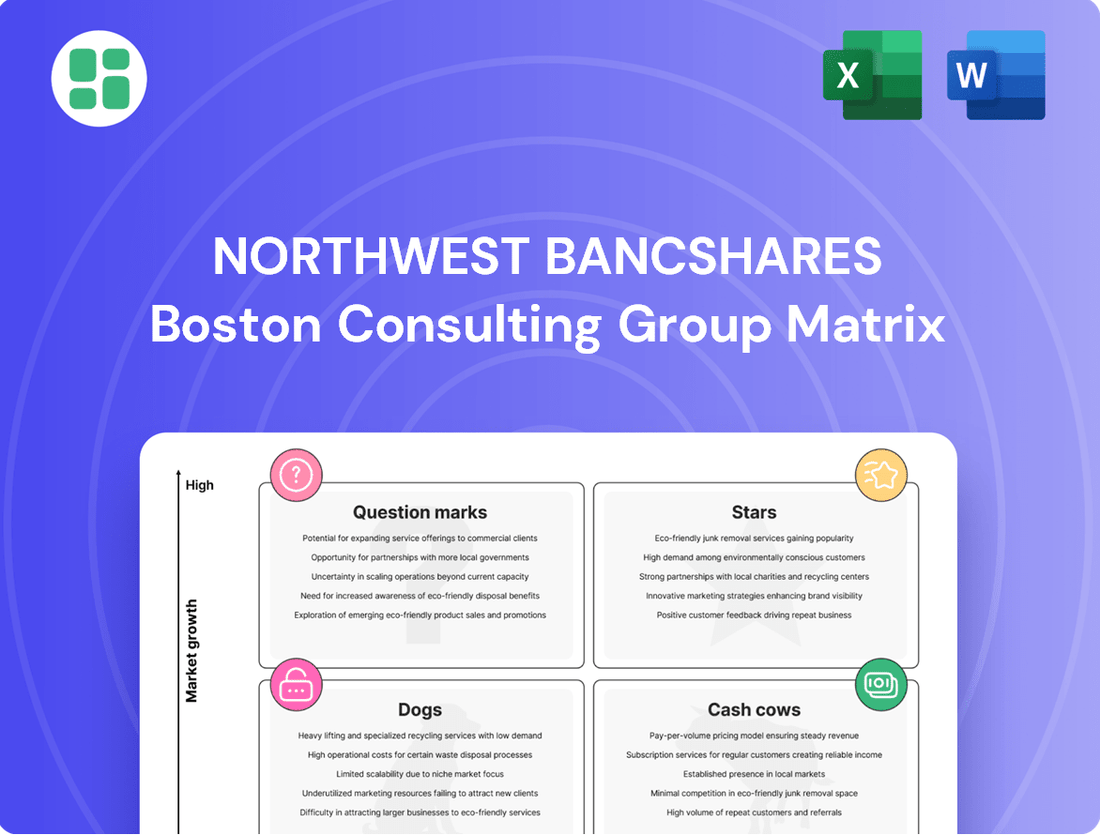

Curious about Northwest Bancshares' product portfolio? Our BCG Matrix analysis reveals which segments are fueling growth and which might be holding them back. Understand their strategic positioning at a glance.

Don't stop at the surface! Purchase the full BCG Matrix report to unlock detailed quadrant placements, actionable insights into market share and growth rates, and a clear roadmap for optimizing Northwest Bancshares' investments.

Gain a competitive edge by understanding precisely where Northwest Bancshares' products fit – are they Stars poised for dominance, Cash Cows generating steady income, Dogs needing divestment, or Question Marks requiring strategic evaluation? Get the full report for the complete picture and make informed decisions.

Stars

Northwest Bancshares is actively pursuing growth in its Commercial & Industrial (C&I) loan portfolio. In the first quarter of 2025, this segment saw a substantial increase of $339 million. This expansion highlights the bank's commitment to this high-growth area.

The bank's strategic focus on C&I loans is paying off, with average C&I loans growing by 20% over the past year. Furthermore, a 6.2% increase in the most recent quarter demonstrates continued momentum. This suggests Northwest is effectively capturing market share in a dynamic sector.

This deliberate shift in loan mix towards higher-yielding commercial loans positions C&I as a critical engine for future profitability. Northwest Bancshares appears to be strategically cultivating this segment to solidify its market leadership and enhance overall financial performance.

Northwest Bancshares is strategically expanding into specialized commercial lending verticals like healthcare, franchise finance, and sports lending. These niche markets are attractive due to their potential for higher profit margins and reduced default risks when compared to more conventional loan types, signaling a deliberate move towards high-growth segments.

The Penns Woods Bancorp merger integration is a key strategic initiative for Northwest Bancshares, aiming to bolster its position in the banking sector. Successful completion of regulatory and shareholder approvals, with an expected close in late July 2025, will see Northwest Bancshares significantly increase its market share and operational scale.

This merger is poised to elevate Northwest Bancshares into the ranks of the top 100 largest banks nationally, boasting over $17 billion in assets. The combined entity will enjoy a much stronger foothold in North Central and Northeastern Pennsylvania, expanding its reach and customer base.

Financially, the integration is projected to be highly beneficial, with an estimated 23% accretion to Northwest Bancshares' 2026 earnings per share. This strong earnings growth outlook suggests significant potential for future market dominance and value creation.

Net Interest Margin Expansion

Northwest Bancshares has demonstrated impressive net interest margin (NIM) expansion, a key indicator of profitability in the banking sector. This upward trend is a significant positive for the company's financial health.

The bank's NIM reached 3.87% in the first quarter of 2025, continuing a streak of four consecutive quarterly improvements. This consistent growth highlights effective strategic execution.

- Favorable Loan Mix: A shift towards higher-yielding commercial loans has boosted interest income.

- Expense Management: Prudent management of interest expenses has further supported NIM expansion.

- Pricing Power: The ability to command better rates on loans reflects strong market positioning.

- Asset Utilization: Efficient use of assets contributes to the bank's overall profitability.

Strategic Digital Banking Initiatives

Northwest Bancshares is making significant strides in its digital banking offerings, aiming to simplify financial management for its customers. This strategic push is evident in their ongoing investments to enhance online and mobile platforms.

The broader banking sector is experiencing a substantial digital shift, indicating a fertile ground for growth in innovative online financial services. While precise market share figures for Northwest's newest digital products aren't publicly itemized, the overall industry trend points to a strong demand for user-friendly digital solutions. For instance, by the end of 2024, a significant portion of banking transactions are expected to occur digitally, underscoring the importance of these initiatives.

Northwest's dedication to bolstering its digital infrastructure is a key strategy to secure a more prominent position within this rapidly evolving digital banking environment.

- Digital Investment Focus: Northwest Bancshares is prioritizing enhancements to its digital banking platforms for both retail and commercial clients.

- Market Growth Potential: The banking industry's digital transformation presents a high-growth market for advanced online financial services, with digital transactions projected to increase significantly by year-end 2024.

- Strategic Positioning: By improving its digital capabilities, Northwest aims to capture a larger share of the expanding digital banking market.

Northwest Bancshares' digital banking initiatives are positioned as potential Stars within the BCG Matrix, given the high growth of the digital banking sector. The bank's investments in enhancing online and mobile platforms aim to capture a larger share of this expanding market. By the end of 2024, a significant portion of banking transactions are expected to be digital, highlighting the opportunity for Northwest's digital offerings to become market leaders.

| Category | Market Growth | Relative Market Share | BCG Classification |

|---|---|---|---|

| Digital Banking | High | Growing | Star |

| Commercial & Industrial (C&I) Loans | High | Growing | Star |

| Healthcare Lending | High | Developing | Question Mark/Star |

| Franchise Finance | High | Developing | Question Mark/Star |

What is included in the product

This BCG Matrix overview provides tailored analysis for Northwest Bancshares' product portfolio, highlighting which units to invest in, hold, or divest.

The Northwest Bancshares BCG Matrix offers a clear, one-page overview placing each business unit in a quadrant to identify strategic priorities.

Cash Cows

Northwest Bancshares' core deposit accounts, encompassing savings and money market balances, serve as a bedrock for its financial stability. These accounts demonstrate a robust and consistent funding source for the bank.

From the first quarter of 2024 to the first quarter of 2025, average deposits saw an increase of $200 million. This growth highlights Northwest Bank's solid footing and established presence within a mature deposit market, suggesting a stable market share.

These low-cost deposits are crucial, offering a dependable and cost-effective way for the bank to secure funds. This reliability allows Northwest Bank to effectively finance its lending operations and manage its overall cost of funds.

Northwest Bancshares' traditional residential mortgage portfolio functions as a cash cow. These loans are a core part of Northwest Bank's lending operations, making up a substantial segment of its total loan book.

Although the bank is channeling personal banking profits into commercial ventures, the established residential mortgage book consistently delivers significant principal repayments and interest revenue. This mature offering provides a steady and reliable source of cash flow, underpinning the bank's financial stability and acting as a dependable income generator.

For instance, as of the first quarter of 2024, Northwest Bancshares reported total residential mortgage loans of approximately $6.5 billion, contributing significantly to their net interest income.

Established Commercial Real Estate (CRE) Loans are a significant component of Northwest Bancshares' business, representing a mature market where the company has a solid footing. As of December 31, 2024, these loans made up a substantial 26% of Northwest's total gross loan portfolio, underscoring their importance to the company's revenue generation.

While not experiencing the rapid expansion seen in other sectors, CRE loans contribute a consistent and reliable stream of interest income for Northwest. This stability is a key characteristic of a cash cow, providing a dependable financial base for the organization. The company's commitment to rigorous underwriting standards in its CRE lending further bolsters asset quality, ensuring this revenue stream remains robust.

Extensive Branch Network

Northwest Bancshares' extensive branch network, comprising 130 full-service financial centers and eleven drive-up facilities across Pennsylvania, New York, Ohio, and Indiana, positions its retail banking operations as a significant cash cow. This robust physical presence allows for consistent deposit gathering and loan origination within mature regional markets.

- Network Size: 130 full-service financial centers and 11 drive-up facilities.

- Geographic Reach: Operations span Pennsylvania, New York, Ohio, and Indiana.

- Market Position: Facilitates broad customer access and stable revenue generation in established regional markets.

Wealth Management & Trust Services

Northwest Bancshares' Wealth Management & Trust Services function as a classic cash cow within its BCG Matrix. These offerings, designed for an established clientele, consistently generate predictable, fee-based revenue streams. In 2024, the wealth management sector continued to demonstrate resilience, with many institutions reporting steady income from these services despite market fluctuations.

The stability of these services is key. They require minimal new investment to maintain their current revenue generation, freeing up capital for other areas of the bank. This mature business line contributes significantly to overall profitability and plays a crucial role in retaining the bank's most valuable clients.

- Stable Fee Income: Wealth management and trust services provide a consistent, predictable revenue stream, often insulated from the volatility of lending markets.

- Client Retention: These services deepen relationships with existing customers, fostering loyalty and reducing churn.

- Low Investment Needs: As mature offerings, they require limited capital expenditure for continued operation and profitability.

- Profitability Contribution: They represent a reliable source of profit that supports the bank's overall financial health.

Northwest Bancshares' established residential mortgage portfolio and commercial real estate loans are key cash cows. These mature segments provide consistent interest income and principal repayments, acting as reliable revenue generators for the bank. The bank's extensive branch network also functions as a cash cow, enabling stable deposit gathering and loan origination in its established markets.

Wealth Management & Trust Services are also strong cash cows, delivering predictable fee-based revenue with minimal reinvestment needs. As of Q1 2025, total deposits grew to $21.2 billion, up from $21 billion in Q1 2024, underscoring the stability of these funding sources.

| Business Segment | BCG Category | Key Characteristics | 2024 Data Point |

|---|---|---|---|

| Residential Mortgages | Cash Cow | Consistent interest income, stable principal repayments | Approx. $6.5 billion in loans (Q1 2024) |

| Commercial Real Estate Loans | Cash Cow | Reliable interest income, mature market | 26% of total gross loan portfolio (Dec 31, 2024) |

| Branch Network | Cash Cow | Stable deposit gathering, loan origination in mature markets | 130 full-service financial centers |

| Wealth Management & Trust Services | Cash Cow | Predictable fee-based revenue, low investment needs | Steady income generation reported across industry in 2024 |

Delivered as Shown

Northwest Bancshares BCG Matrix

The Northwest Bancshares BCG Matrix preview you are viewing is the exact, final document you will receive upon purchase. This comprehensive report is fully formatted and ready for immediate strategic application, containing no watermarks or demo content. You'll gain access to the complete analysis, enabling you to effectively evaluate Northwest Bancshares' business units and make informed decisions.

Dogs

Northwest Bancshares' personal banking loan portfolio, excluding deposits, has experienced a notable contraction. From the first quarter of 2024 to the first quarter of 2025, average loans receivable within this segment decreased by $388 million.

This decline is a deliberate strategic move, as the bank is actively reinvesting cash generated from personal loans into more lucrative commercial opportunities. This signals a strategic shift away from personal banking loans, identifying it as an area with limited growth potential and a shrinking market presence.

Within Northwest Bancshares' consumer lending portfolio, certain segments like legacy automobile loans and specific sales finance products are likely categorized as Dogs. These areas typically demonstrate low market share and sluggish growth, reflecting a strategic shift away from these less dynamic consumer credit avenues.

For instance, in 2024, the automotive loan market, while large, has seen increased competition and evolving consumer preferences, potentially impacting the growth trajectory of older, less differentiated loan portfolios. Northwest's decision to prioritize commercial lending suggests a deliberate move to allocate capital to areas offering higher potential returns and market expansion.

Expanding the physical branch network in areas with shrinking populations, like certain counties in Pennsylvania which saw a 2.1% population decrease between 2020 and 2024, or western New York with a 1.5% decline, often falls into the 'dog' category of the BCG Matrix. This approach involves investing in markets with limited growth potential.

While Northwest Bancshares' established branches in these regions might still generate consistent cash flow, akin to cash cows, new physical expansion here presents a high risk of low returns and minimal market share expansion. Such investments can effectively immobilize capital without promising significant future gains.

Non-Strategic Investment Securities

Northwest Bancshares initiated a significant portfolio adjustment in the second quarter of 2024. They strategically divested certain investment securities, using the generated funds to pay down existing debt. This move indicates a deliberate effort to streamline their holdings, focusing on assets that offer better capital efficiency and higher potential returns.

The securities likely classified as non-strategic are those that have demonstrated sluggish growth and a diminished market position in terms of their return on investment. These types of assets, if retained, would represent a drag on the company's overall financial performance, tying up valuable capital without contributing significantly to profitability.

- Q2 2024 Portfolio Restructure: Northwest Bancshares reduced outstanding borrowings by utilizing proceeds from asset sales.

- Non-Strategic Securities Identified: These are likely underperforming investments that offered low growth and suboptimal returns.

- Capital Efficiency Focus: The divestment aimed to free up capital that was previously tied to these less productive assets.

- Impact on Returns: Shedding these securities is expected to improve the overall return on investment for the company.

High-Cost Brokered Deposits and Borrowings

Northwest Bancshares has been strategically reducing its reliance on expensive brokered deposits and borrowings. This effort is reflected in their financial statements, showing a notable decrease in interest expenses related to these funding sources. For instance, their interest expense on deposits saw a reduction, and the average balance of borrowings also declined.

These high-cost funding avenues, while useful for immediate liquidity, are less cost-effective compared to their core deposit base. The bank's proactive management aims to minimize their use, signaling a move towards a more efficient and desirable liability structure. This strategy is crucial for enhancing overall profitability and financial health.

- Reduced Interest Expense: Northwest Bancshares reported a decrease in interest expense on deposits, a direct result of managing down high-cost brokered CDs.

- Lower Borrowing Balances: The average balance of borrowings also experienced a decline, indicating a successful reduction in reliance on these less efficient funding methods.

- Focus on Core Deposits: The bank prioritizes core deposits, which are generally cheaper and more stable, over brokered deposits.

- Improved Efficiency: Minimizing high-cost borrowings contributes to a more efficient funding mix and potentially higher net interest margins.

Certain legacy loan products and physical branch expansions in declining population areas represent Northwest Bancshares' 'Dogs' in the BCG Matrix. These are areas with low market share and low growth potential.

For example, investing in new branches in Pennsylvania counties with a 2.1% population decrease between 2020 and 2024, or western New York with a 1.5% decline, exemplifies this strategy. These initiatives immobilize capital with minimal prospects for significant future gains.

The bank's strategic shift away from personal loans, particularly legacy auto loans and specific sales finance products, further illustrates this. These segments, characterized by increased competition and evolving consumer preferences in 2024, offer limited growth and a shrinking market presence.

Northwest Bancshares' decision to reinvest cash from personal loans into commercial opportunities highlights a deliberate move to allocate capital to areas with higher potential returns and market expansion, moving away from these 'Dog' assets.

Question Marks

Emerging digital lending solutions represent a potential "Question Mark" for Northwest Bancshares. While the bank has a solid digital banking presence, its specific ventures into novel digital lending platforms or fintech partnerships are likely in their early stages. This sector is experiencing rapid growth, with the global digital lending market projected to reach $1.5 trillion by 2027, according to some industry analyses, indicating a high-potential but competitive landscape.

Northwest's market share within these specific emerging digital lending niches may currently be modest. Significant investment in technology, marketing, and talent will be crucial to capture a meaningful share of this expanding market. Success here could transform these initiatives into future Stars within the BCG matrix, but the path requires careful strategic planning and execution to navigate the inherent risks and capitalize on the growth opportunities.

The integration of Penns Woods Bancorp's customer base, especially in newly acquired regions, offers significant potential for Northwest Bancshares to expand its product offerings. This presents a high-growth avenue for cross-selling Northwest's diverse financial products and services.

While the merger itself positions Northwest as a Star in the BCG matrix due to its strong market position and growth prospects, the adoption of Northwest's specialized products, like commercial loans or wealth management, within the acquired customer segment is initially low. This means these specific product lines within the new customer base could be considered Question Marks, requiring strategic investment to increase their market share and future success.

Following the Penns Woods merger, Northwest Bancshares is entering new sub-markets within North Central and Northeastern Pennsylvania. This geographic expansion offers promising growth avenues, though Northwest's initial market share in these newly acquired localized areas is expected to be modest.

To effectively cultivate these emerging markets, substantial investment will be necessary. This includes dedicated resources for targeted marketing campaigns, robust community engagement initiatives, and the development of product offerings tailored to the specific needs of these new customer bases. The goal is to transform these nascent positions into robust market presences.

Enhanced Insurance Services Offerings

Northwest Bancshares, through Northwest Bank, offers insurance services as a component of its broader financial solutions. If the bank is actively broadening its insurance product range or aiming for new customer groups within this market, these initiatives could position its insurance offerings as Stars or Question Marks in the BCG Matrix.

The insurance industry generally presents opportunities for significant growth. However, Northwest's current market penetration in specialized, enhanced insurance products might be limited. This scenario suggests a need for substantial investment to cultivate market share and brand awareness, characteristic of a Question Mark.

- Market Growth: The U.S. insurance industry experienced robust growth, with direct premiums written reaching an estimated $1.4 trillion in 2023, indicating a potentially high-growth sector for Northwest to tap into.

- Investment Needs: To establish a stronger foothold in enhanced insurance services, Northwest may need to allocate significant capital for product development, marketing, and distribution channel expansion.

- Competitive Landscape: The insurance market is highly competitive, with established players and evolving customer demands, making it challenging for new or expanded offerings to gain immediate traction.

- Strategic Focus: If Northwest Bank is prioritizing the insurance segment for future revenue streams, its current offerings could be viewed as Question Marks requiring strategic investment to become future Stars.

Strategic Expansion of Employee Benefit Services

Employee benefit services represent a distinct area within Northwest Bancshares' portfolio. If the bank is actively pursuing an expansion of its employee benefit offerings, perhaps by introducing innovative solutions or targeting a wider range of businesses, this segment could be categorized as a Question Mark in the BCG Matrix.

This strategic move suggests a belief in the future growth potential of the employee benefits market. However, the current market share for these expanded or new services might be relatively modest. This necessitates significant investment and strategic focus to capture a larger portion of the market, much like a business needs to nurture a promising but unproven product.

For instance, in early 2024, many financial institutions, including regional banks, were observing increased demand for integrated payroll and benefits administration. Northwest Bancshares might be leveraging this trend by enhancing its digital platforms for benefits management, aiming to attract businesses seeking streamlined HR solutions. The success of this expansion hinges on effectively communicating the value proposition of these new or enhanced services to potential clients.

- Market Opportunity: The employee benefits sector is dynamic, with businesses continually seeking comprehensive and cost-effective solutions.

- Investment Required: Significant capital and operational resources are likely needed to develop and market new benefit packages and digital platforms.

- Competitive Landscape: Northwest Bancshares faces competition from established benefits providers and other financial institutions expanding into this space.

- Growth Potential: If executed successfully, this expansion could tap into a growing market and diversify Northwest's revenue streams.

Northwest Bancshares' expansion into new geographic markets following the Penns Woods merger presents a clear "Question Mark" scenario. While the bank is entering promising, high-growth regions in North Central and Northeastern Pennsylvania, its initial market share in these specific localized areas is likely modest.

Significant investment is therefore required to build brand awareness and capture market share. This includes dedicated marketing efforts, community outreach, and potentially tailoring product offerings to the unique needs of these new customer bases. Success in these endeavors could elevate these new markets into future Stars for Northwest.

The bank's foray into emerging digital lending solutions also fits the "Question Mark" profile. Despite a solid digital banking foundation, specific ventures into novel lending platforms or fintech partnerships are likely in their nascent stages within a rapidly expanding and competitive global digital lending market, projected to reach $1.5 trillion by 2027.

Northwest's market share in these specific digital lending niches is probably small, demanding substantial investment in technology, marketing, and talent to gain meaningful traction. Effectively nurturing these initiatives could transform them into future Stars, but this requires careful strategy to manage risks and seize growth opportunities.

| BCG Category | Northwest Bancshares Example | Market Growth | Market Share | Investment Need |

|---|---|---|---|---|

| Question Mark | New Geographic Markets (Post-Merger) | High (Emerging regions) | Low (Initial presence) | High (Marketing, localization) |

| Question Mark | Emerging Digital Lending | High (Industry growth) | Low (Nascent ventures) | High (Technology, talent) |

BCG Matrix Data Sources

Our Northwest Bancshares BCG Matrix is informed by comprehensive financial disclosures, detailed market share data, and expert industry analysis to provide strategic clarity.