Northwest Bancshares PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Northwest Bancshares Bundle

Gain an edge with our in-depth PESTEL Analysis—crafted specifically for Northwest Bancshares. Discover how political stability, economic fluctuations, and technological advancements are shaping the company’s future, and use these insights to strengthen your own market strategy. Download the full version now and get actionable intelligence at your fingertips.

Political factors

Northwest Bancshares, like other regional banks, operates within a landscape of heightened government regulatory scrutiny. Following the bank failures observed in 2023, regulators have been actively discussing and implementing stricter prudential standards, particularly for mid-sized institutions. This intensified oversight can translate into increased compliance costs and necessitate operational adjustments for Northwest Bancshares, impacting its profitability and strategic flexibility.

A change in the U.S. presidential administration, such as the potential election of Donald J. Trump for a second term, could lead to significant shifts in regulatory priorities for the banking sector. This might translate into a more relaxed approach to financial regulation, potentially easing some consumer protection measures and fostering a more business-friendly environment. For Northwest Bancshares, this could influence capital requirements and the landscape for fintech collaborations.

U.S. federal bank regulators, including the Federal Reserve Board, have intensified their focus on climate-related financial risks throughout 2024. They are actively engaging with financial institutions to develop robust strategies for managing these evolving risks, particularly concerning credit and operational exposures.

In 2024, regulators released principles specifically for large institutions to guide their approach to climate risk management. This signals a proactive stance in ensuring the financial sector's resilience against potential climate-related disruptions.

Consumer Protection Bureau Enforcement Priorities

The Consumer Financial Protection Bureau (CFPB) is intensifying its focus on fees and charges that may be unfair to consumers, alongside efforts to combat discrimination. This regulatory stance directly impacts financial institutions like Northwest Bancshares by increasing scrutiny on pricing models and lending practices.

In a significant shift announced in May 2025, the CFPB has realigned its enforcement priorities. The bureau is now concentrating its resources on larger financial institutions, with a particular emphasis on ensuring consumer remediation. This means that for companies like Northwest Bancshares, adherence to consumer protection laws is paramount, and any identified consumer harm could lead to substantial remediation demands.

- Increased Scrutiny on Fees: The CFPB's focus on unfair fees means Northwest Bancshares must ensure all charges are transparent and justifiable.

- Emphasis on Consumer Remediation: Any past or present instances of consumer harm could result in significant financial penalties and restitution requirements.

- Shift in Enforcement Focus: While deprioritizing some areas, the CFPB's concentrated effort on large banks signals a more rigorous approach to compliance for entities of Northwest Bancshares' size.

Community Reinvestment Act Modernization

The modernization of the Community Reinvestment Act (CRA) is set to significantly reshape how banks, including Northwest Bancshares, are assessed on their lending practices. The final rule, anticipated in 2024, will introduce new evaluation criteria, potentially impacting community development investments and lending strategies.

Banks must also navigate the evolving landscape of small business data collection. Despite ongoing legal challenges to the CFPB's Section 1071 rule, financial institutions are preparing for enhanced reporting requirements. For instance, in 2023, the Small Business Administration reported that small businesses received over $40 billion in loans through SBA programs, highlighting the critical role of lending to this sector.

- CRA Modernization: New evaluation frameworks for bank lending are expected to be finalized in 2024.

- Small Business Lending Data: Banks are preparing for updated data collection and reporting mandates under evolving regulations.

- Regulatory Impact: These changes could influence Northwest Bancshares' approach to community development and small business financing.

Political stability and government policy continue to be significant factors for Northwest Bancshares. The ongoing discussions and potential implementation of stricter prudential standards for mid-sized banks, especially after the 2023 failures, directly influence compliance costs and operational strategies.

The evolving regulatory landscape, including the modernization of the Community Reinvestment Act (CRA) and enhanced data collection for small business lending, will shape how Northwest Bancshares engages with its communities and serves small businesses. For example, in 2023, small businesses received over $40 billion in loans through SBA programs, underscoring the importance of this sector.

Moreover, the Consumer Financial Protection Bureau's (CFPB) intensified focus on unfair fees and its May 2025 realignment of enforcement priorities towards larger institutions, emphasizing consumer remediation, means Northwest Bancshares must maintain rigorous compliance with consumer protection laws to avoid potential penalties.

What is included in the product

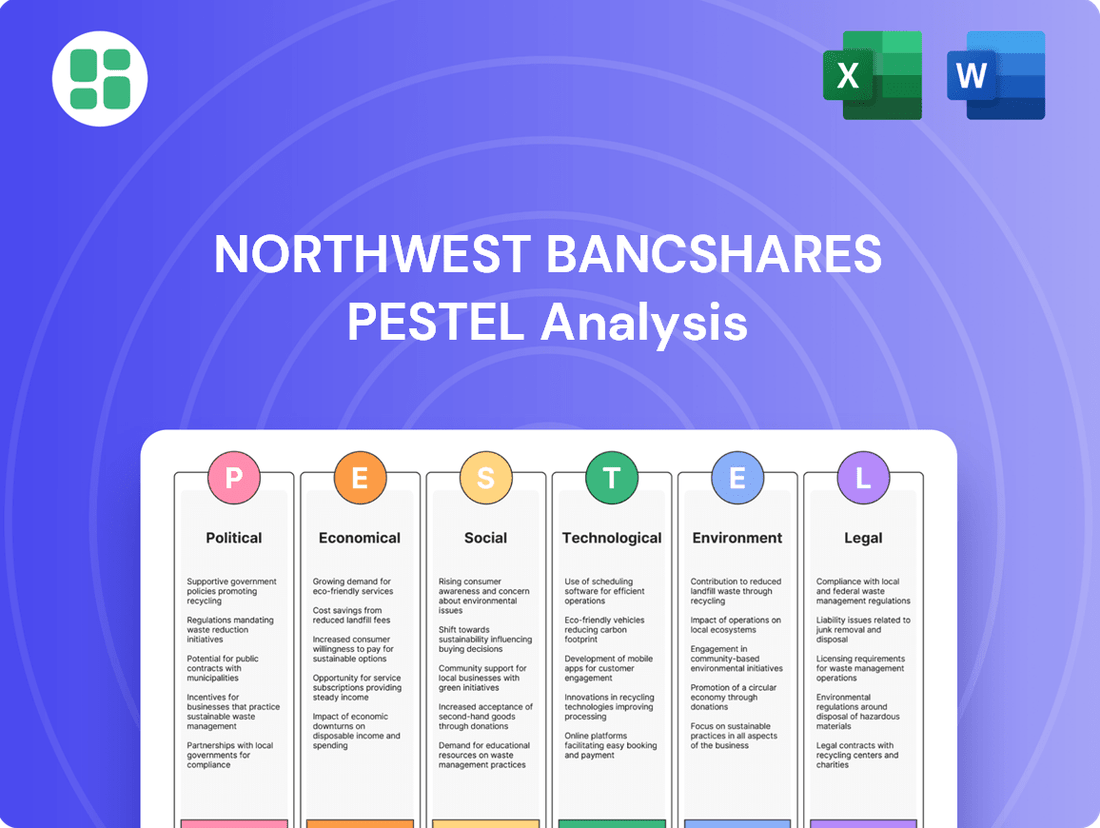

This PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting Northwest Bancshares, providing a comprehensive overview of its external operating environment.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering a clear overview of external factors impacting Northwest Bancshares.

Helps support discussions on external risk and market positioning during planning sessions by highlighting key political, economic, social, technological, environmental, and legal influences.

Economic factors

The interest rate environment is a critical factor for Northwest Bancshares. Their net interest margin (NIM) reached a healthy 3.87% in the first quarter of 2025, reflecting the benefit of higher rates.

While interest rates were high for much of 2024, there's an expectation that they will begin to decrease as economic growth slows down in 2025. This potential easing of rates could put some pressure on future NIM performance.

The U.S. economy, which showed resilience in 2024, is expected to slow down in 2025, with forecasts pointing to a Gross Domestic Product (GDP) growth of around 1.5%. This deceleration is largely attributed to anticipated moderation in consumer spending, a potential uptick in the unemployment rate, and subdued business investment.

These economic shifts could directly influence the banking sector, including Northwest Bancshares. A slowdown in growth may lead to reduced loan demand as businesses and consumers become more cautious with borrowing. Furthermore, an increasing unemployment rate could negatively impact credit quality, as more individuals and businesses might struggle to meet their loan obligations.

A potential slowdown in consumer spending, driven by rising unemployment and high consumer debt, poses a challenge for Northwest Bancshares in 2025. For instance, if unemployment ticks up from its current low levels, say to 4.5% by mid-2025, it could directly impact individuals' ability to repay loans.

This economic shift directly influences loan default rates and the overall credit quality of Northwest Bancshares' portfolio. A weaker consumer also means less demand for the bank's core financial services, from mortgages to personal loans, potentially impacting revenue streams.

Housing Market and Loan Portfolio Health

The housing market experienced a dip in new construction starts during 2024, with forecasts suggesting a modest recovery in 2025. This environment directly impacts mortgage lending, a key area for financial institutions.

Northwest Bancshares has proactively managed its loan portfolio, a crucial strategy given market fluctuations. The company has intentionally reduced its exposure to the often-unpredictable commercial real estate (CRE) sector.

Concurrently, Northwest Bancshares has pivoted its lending focus. They are increasingly concentrating on commercial and industrial (C&I) loans, which generally offer more attractive yields. This strategic adjustment aims to bolster profitability while navigating economic shifts.

- Housing Starts: Declined in 2024, projected modest increase in 2025.

- Loan Portfolio Strategy: De-risked by reducing CRE exposure.

- Lending Focus Shift: Increased allocation towards higher-yielding C&I loans.

Competitive Pressure for Deposits

Northwest Bancshares faced heightened competition for deposits in 2024, leading to increased interest expenses. This pressure stemmed from a general market demand for liquidity, forcing banks to offer more attractive rates to retain and attract customer funds. The bank's strategic response involved a concerted effort to expand its base of core deposits, aiming to lessen its dependence on more expensive brokered certificates of deposit (CDs).

This focus on core deposits is a vital strategy for managing funding costs effectively within a highly competitive banking landscape. For instance, during the first quarter of 2024, the average cost of interest-bearing deposits for many regional banks, including those facing similar pressures to Northwest Bancshares, saw a notable uptick. This reflects the direct impact of competitive deposit-gathering strategies on a bank's profitability.

- Increased Interest Expense: Northwest Bancshares reported higher interest expenses in 2024, directly linked to elevated deposit costs.

- Competitive Liquidity Demand: The banking sector experienced significant competition for available liquidity, driving up deposit rates.

- Core Deposit Growth Strategy: The company is prioritizing the expansion of core deposits to reduce reliance on costly brokered CDs.

- Funding Cost Management: Growing core deposits is essential for Northwest Bancshares to manage its overall funding expenses in a competitive environment.

The economic outlook for 2025 suggests a moderation in growth, with GDP expected to reach around 1.5%. This slowdown, influenced by potentially softer consumer spending and a slight rise in unemployment to an estimated 4.5%, could temper loan demand and impact credit quality for Northwest Bancshares.

Interest rates, while high in 2024 with a reported NIM of 3.87% in Q1 2025, are anticipated to decline in 2025. This shift could put pressure on future net interest margins.

The housing market, after a dip in construction starts in 2024, is projected for a modest recovery in 2025, impacting mortgage lending, a key area for the bank.

| Economic Indicator | 2024 (Estimate/Actual) | 2025 (Forecast) |

|---|---|---|

| GDP Growth | ~2.0% | ~1.5% |

| Unemployment Rate | ~3.9% | ~4.5% |

| Interest Rates (Fed Funds Rate) | Avg. ~5.00% - 5.25% | Avg. ~4.50% - 4.75% |

| Housing Starts | Declined | Modest Increase |

Preview the Actual Deliverable

Northwest Bancshares PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. It details a comprehensive PESTLE analysis of Northwest Bancshares, examining Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic outlook.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain immediate access to this in-depth analysis, providing valuable insights into the external forces shaping Northwest Bancshares' business environment.

Sociological factors

Consumer preferences are rapidly shifting towards digital banking, with mobile banking emerging as the dominant channel. In 2024, mobile banking was the primary choice for 55% of U.S. consumers. This trend is particularly pronounced among younger demographics, as 45% of millennials and Gen Zers exclusively use digital channels for their banking needs.

Northwest Bancshares must prioritize continuous enhancement of its digital platforms to align with these evolving customer expectations. Meeting the demand for seamless convenience and round-the-clock access is crucial for retaining and attracting customers in this increasingly digital financial landscape.

A significant societal trend shows that 59% of consumers want digital banking platforms to offer financial literacy resources. This highlights a clear demand for accessible financial education, which Northwest Bancshares can address by integrating such tools into its digital offerings.

Fintech companies are making strides in financial inclusion, particularly for unbanked and underbanked individuals, by utilizing mobile banking. This presents a strategic opportunity for Northwest to expand its reach and provide essential educational content and user-friendly services to these underserved segments of the population.

Customer trust remains a cornerstone for community banks like Northwest Bancshares. Despite the digital shift, a significant portion of customers, particularly in rural or less tech-savvy areas, still prefer the personal interaction and accessibility offered by physical branches. This preference for relationship banking helps insulate Northwest from the volatility often seen in national macroeconomic trends, as community ties foster more stable deposit bases.

Northwest's community-focused approach, emphasizing reliable service and active local engagement, is crucial for building and maintaining this trust. For instance, in 2024, community banks generally saw higher customer retention rates compared to larger national institutions, often attributed to stronger personal relationships. This loyalty translates into a more resilient funding structure, less susceptible to rapid national deposit outflows.

Demographic Shifts and Service Customization

Demographic shifts are fundamentally reshaping how financial institutions operate. For Northwest Bancshares, this means catering to an aging population alongside increasingly digital-native younger generations. Understanding these distinct needs across its key states—Pennsylvania, New York, Ohio, and Indiana—is paramount.

Younger customers, often referred to as digital natives, are driving the adoption of online and mobile banking solutions. For instance, a significant portion of Gen Z and Millennials prefer digital channels for most of their banking needs. Conversely, older demographics may still favor in-person interactions or require more personalized guidance, especially for complex financial products.

Northwest Bancshares must therefore develop a service model that accommodates this spectrum. This involves investing in robust digital platforms while also ensuring accessible and knowledgeable in-branch support. The ability to customize offerings, from simplified mobile payment options for younger users to tailored retirement planning advice for seniors, will be a key differentiator.

- Aging Population Needs: Focus on retirement planning, wealth management, and accessible in-branch services.

- Digital Native Preferences: Enhance mobile banking, online account opening, and digital customer support.

- Intergenerational Needs: Develop products that bridge generational gaps, such as family banking accounts or educational resources.

- Regional Variations: Tailor services to the specific demographic profiles within Pennsylvania, New York, Ohio, and Indiana.

Workforce Dynamics and Talent Acquisition

The financial sector, including institutions like Northwest Bancshares, is grappling with shifting workforce demographics. An aging workforce is becoming more prevalent, with a significant portion of experienced professionals nearing retirement age. This trend, coupled with slower population growth in certain geographic areas, presents a challenge for talent acquisition.

Northwest Bancshares needs a robust strategy to attract and retain skilled employees. This is particularly crucial for individuals with expertise in emerging banking technologies, such as AI-driven customer service, cybersecurity, and data analytics. The ability to onboard and keep these tech-savvy professionals is vital for maintaining operational efficiency and fostering innovation in a competitive landscape.

Consider these points regarding workforce dynamics:

- Aging Workforce: In the US, the median age of workers in the finance and insurance sector was around 43 years old as of 2023, indicating a substantial segment nearing retirement.

- Talent Gap in Tech: Demand for financial professionals skilled in areas like fintech and blockchain is projected to outpace supply, creating a significant talent gap.

- Regional Growth Differences: While some regions experience population stagnation, others see growth, impacting the local talent pool available for recruitment.

- Employee Retention: Companies are increasingly focusing on competitive compensation, professional development, and flexible work arrangements to retain valuable employees, especially those with in-demand digital skills.

Societal expectations are increasingly leaning towards enhanced digital banking experiences, with mobile platforms becoming the preferred channel for a majority of consumers. In 2024, a substantial 55% of U.S. consumers identified mobile banking as their primary method for financial transactions. This digital preference is particularly strong among younger demographics; for instance, 45% of millennials and Gen Zers exclusively utilize digital channels for their banking needs.

Furthermore, there's a growing demand for financial literacy resources integrated within digital banking platforms, with 59% of consumers expressing this desire. This presents Northwest Bancshares with an opportunity to offer valuable educational content, thereby fostering greater financial inclusion, especially for unbanked or underbanked populations who are increasingly leveraging mobile banking solutions. This focus on accessible digital tools and education is key to meeting evolving customer needs and expanding market reach.

Technological factors

The digital banking landscape is accelerating, with more than 83% of U.S. adults actively using digital banking services by 2025. This surge is fueled by sophisticated mobile applications, AI-powered chatbots for customer support, and streamlined digital onboarding processes.

Northwest Bancshares needs to strategically invest in cloud infrastructure and the integration of real-time data to bolster its digital capabilities. Such advancements are crucial for improving customer engagement and delivering a superior digital banking experience in a competitive market.

The accelerating shift to digital banking and the integration of artificial intelligence present significant cybersecurity challenges. Institutions like Northwest Bancshares face escalating cyber risks, necessitating substantial investments in advanced security tools, resilient infrastructure, and sophisticated fraud detection systems. For instance, the global cost of cybercrime is projected to reach $10.5 trillion annually by 2025, highlighting the critical need for proactive defense.

To navigate this evolving threat landscape, financial entities must adhere to stringent regulatory frameworks. Compliance with regulations such as the EU's Digital Operational Resilience Act (DORA) is paramount for financial institutions operating within or serving European markets, requiring them to bolster their digital operational resilience against a wide array of ICT-related threats.

Fintech innovation, particularly embedded finance and AI-driven solutions, is fundamentally altering the financial landscape. For instance, the global embedded finance market is projected to reach $7.17 trillion by 2030, highlighting its significant growth and integration into non-financial platforms.

Northwest Bancshares must actively engage with this trend, as collaborations between established banks and fintech firms are proving lucrative. These partnerships are not only creating new revenue streams but also significantly improving customer experiences, as seen in the rise of digital-first banking services.

Exploring strategic partnerships and API integrations will be crucial for Northwest Bancshares to remain competitive. For example, banks partnering with fintechs for loan origination or payment processing can see improved efficiency and broader market reach, a trend that gained significant traction in 2024.

AI and Automation in Operations

AI is transforming Northwest Bancshares' operations, particularly in enhancing financial security, refining risk assessment, and bolstering fraud detection. By 2025, AI-driven chatbots are projected to manage a substantial volume of customer service interactions, necessitating increased investment in updated data infrastructure to support more proactive decision-making processes.

This technological shift is critical for maintaining a competitive edge and improving operational efficiency. Banks are actively upgrading their systems to leverage AI for better data analysis and customer engagement.

- AI in Financial Security: Enhancing fraud detection and cybersecurity measures.

- Customer Service Automation: AI chatbots handling a significant portion of inquiries by 2025.

- Data Infrastructure Modernization: Banks investing to support AI-driven proactive decision-making.

- Operational Efficiency Gains: Streamlining processes through AI and automation.

Payment System Modernization (ISO 20022)

Community banks like Northwest Bancshares must adapt to the Federal Reserve Banks' shift to the ISO 20022 message format for the Fedwire Funds Service, effective March 10, 2025. This transition necessitates collaboration with technology partners to ensure their software systems are updated to support these new global financial messaging standards.

This modernization is crucial for seamless interbank communication and data exchange, impacting transaction processing efficiency and compliance. Failing to update could lead to operational disruptions and hinder participation in the evolving financial ecosystem.

- ISO 20022 Adoption Deadline: March 10, 2025, for Fedwire Funds Service.

- Impact on Community Banks: Requires software updates and engagement with technology providers.

- Global Standard: ISO 20022 aims to standardize financial messaging worldwide.

- Operational Efficiency: Modernized systems can improve transaction speed and data accuracy.

The rapid digitization of banking, with over 83% of U.S. adults expected to use digital banking by 2025, demands significant technological investment from Northwest Bancshares. This includes enhancing mobile apps and AI chatbots to improve customer engagement and streamline operations.

Cybersecurity remains a paramount concern, as the global cost of cybercrime is projected to hit $10.5 trillion annually by 2025. Northwest Bancshares must invest in robust security measures and comply with regulations like the EU's DORA to mitigate these escalating risks.

Fintech innovations, particularly embedded finance and AI, are reshaping the financial sector. The embedded finance market alone is anticipated to reach $7.17 trillion by 2030, signaling a need for strategic partnerships and API integrations for Northwest Bancshares to remain competitive and expand its reach.

The adoption of the ISO 20022 message format for the Fedwire Funds Service by March 10, 2025, necessitates that community banks like Northwest Bancshares update their systems. This global standard aims to improve interbank communication and transaction efficiency.

| Technological Factor | 2024/2025 Data/Projection | Impact on Northwest Bancshares |

| Digital Banking Adoption | >83% of U.S. adults by 2025 | Requires enhanced digital platforms and customer service automation |

| Cybercrime Costs | Projected $10.5 trillion annually by 2025 | Demands significant investment in cybersecurity and regulatory compliance |

| Embedded Finance Market | Projected $7.17 trillion by 2030 | Opportunities for strategic fintech partnerships and API integrations |

| ISO 20022 Adoption | Effective March 10, 2025 (Fedwire) | Necessitates system updates for seamless financial messaging |

Legal factors

The U.S. banking sector navigates a dual federal and state chartering system, creating a complex and dynamic regulatory environment. This framework is continually adapting, especially following significant bank failures in 2023, which heightened regulatory attention.

These events have spurred conversations about potentially stricter prudential standards for mid-sized banks, with a particular focus on bolstering capital adequacy and enhancing risk management practices. For instance, the Federal Reserve's stress tests, which inform capital requirements, are under review to better reflect potential systemic risks.

Northwest Bancshares operates within a complex web of consumer protection laws, necessitating strict adherence to regulations enforced by bodies like the Consumer Financial Protection Bureau (CFPB). This includes navigating federal mandates and a patchwork of state-specific consumer financial laws, ensuring all product offerings and customer interactions meet these stringent standards.

The evolving legal landscape presents new compliance challenges, particularly with consumer rights legislation slated for implementation in 2025. Key among these are new rules impacting the reporting of medical debt, which could affect credit reporting practices, and upcoming regulations concerning credit card and debit card interchange fees, potentially altering transaction economics.

Regulators are intensifying their focus on anti-money laundering (AML) and countering the financing of terrorism (CFT) programs. New final rules expected in 2025 will significantly reshape Bank Secrecy Act (BSA) program requirements, introducing a mandatory consideration of AML/CFT Priorities. This necessitates robust, adaptable compliance frameworks to meet evolving standards.

Data Privacy and Security Regulations

Data privacy and security are paramount, especially with the increasing reliance on digital platforms for banking. The Consumer Financial Protection Bureau's (CFPB) finalized 'open banking' proposal, expected to significantly impact financial data sharing, places new data privacy obligations on third parties accessing consumer financial information. This rule aims to enhance consumer control over their financial data.

Furthermore, institutions managing accounts for younger demographics must navigate the Federal Trade Commission's (FTC) updated Children's Online Privacy Protection Act (COPPA) rules. These regulations are designed to protect the privacy of children under 13 online, requiring specific consent mechanisms and data handling practices for any data collected from minors.

- CFPB's Open Banking Rule: Mandates data access for consumers and authorized third parties, imposing privacy responsibilities on these entities.

- FTC's COPPA Updates: Strengthens privacy protections for children's data, impacting financial institutions with youth accounts.

- Increased Scrutiny: Regulators are intensifying their focus on how financial institutions safeguard sensitive customer information in the digital age.

Merger and Acquisition Regulatory Approvals

Northwest Bancshares' strategic growth, particularly its planned acquisition of Penns Woods Bancorp, hinges on securing approvals from key regulatory bodies. The Federal Deposit Insurance Corporation (FDIC) and state banking authorities, like the Pennsylvania Department of Banking and Securities, are central to this process. These agencies meticulously review such transactions to ensure they align with banking regulations and consumer protection. For instance, as of early 2024, the banking sector continues to navigate a complex regulatory environment following recent regional bank stresses, making timely approvals crucial.

The approval process involves a thorough examination of the financial stability and operational plans of both entities. Shareholder consent is also a critical legal hurdle. In 2023, the average time for regulatory approval for bank mergers could range from several months to over a year, depending on the complexity and the number of jurisdictions involved. This timeline directly impacts the execution of strategic initiatives.

- FDIC Approval: Essential for federal oversight of deposit insurance and bank safety and soundness.

- State Banking Department Approval: Required for state-chartered banks and branches, ensuring compliance with local financial regulations.

- Shareholder Vote: A mandatory step where stockholders of both Northwest Bancshares and Penns Woods Bancorp must agree to the merger terms.

- Antitrust Review: While often less prominent in smaller regional bank mergers, potential market concentration issues can trigger review by antitrust authorities.

The U.S. banking sector faces evolving legal frameworks, with new consumer protection rules impacting data handling and interchange fees set for 2025. Stricter prudential standards are also being considered for mid-sized banks following 2023 failures, affecting capital adequacy and risk management. Anti-money laundering (AML) and Bank Secrecy Act (BSA) programs are under intensified scrutiny, with new final rules in 2025 mandating consideration of AML/CFT Priorities.

Northwest Bancshares' acquisition of Penns Woods Bancorp requires approval from the FDIC and state regulators, a process that can take months to over a year. Compliance with the CFPB's open banking proposal and updated FTC COPPA rules are critical for data privacy. These legal factors significantly influence operational strategies and growth opportunities.

Environmental factors

Northwest Bancshares is actively integrating Environmental, Social, and Governance (ESG) principles into its operations, focusing on robust corporate governance and efficient resource management. This commitment reflects a broader trend within the financial sector.

Investors and regulatory bodies are increasingly demanding detailed sustainability reports and clear strategies for achieving net-zero emissions. For instance, by the end of 2023, over 90% of S&P 500 companies had published ESG reports, highlighting the growing emphasis on transparency and environmental stewardship.

Climate change poses significant threats to financial stability, with physical risks like extreme weather events and transition risks from policy shifts toward a low-carbon economy impacting global markets. Northwest Bancshares must actively incorporate these climate-related risks into its existing risk management strategies, especially concerning its extensive loan portfolios.

For instance, the increasing frequency and severity of natural disasters, such as the record-breaking hurricane seasons in 2023, directly impact sectors heavily reliant on physical assets, potentially leading to increased loan defaults. Furthermore, evolving regulations aimed at decarbonization could devalue assets in carbon-intensive industries, creating transition risks that financial institutions like Northwest Bancshares need to proactively assess and mitigate within their lending practices.

Northwest Bancshares is committed to reducing its operational environmental footprint. This includes upgrading facilities with energy-efficient LED lighting and HVAC systems, which can lead to significant reductions in energy consumption. For instance, a 2023 report by the U.S. Department of Energy indicated that LEDs can use up to 75% less energy than traditional lighting.

The company also encourages paperless statements for its customers, a move that directly contributes to waste reduction and decreased resource usage. This aligns with broader industry trends; by the end of 2024, many financial institutions are expected to have transitioned a substantial portion of their customer communications to digital formats to meet sustainability goals and reduce operational costs.

Green Financing and Sustainable Initiatives

The financial sector is increasingly prioritizing sustainable investments and eco-friendly solutions, with green fintech emerging as a significant trend. Northwest Bancshares can leverage this by developing green financing products or incorporating environmental criteria into its lending, meeting a growing demand for responsible financial services. For instance, by mid-2024, global sustainable debt issuance was projected to reach over $1 trillion, indicating a strong market appetite.

This shift presents a clear opportunity for Northwest Bancshares to differentiate itself and attract environmentally conscious customers and investors. By actively participating in the green finance movement, the company can enhance its brand reputation and potentially access new capital sources dedicated to sustainability. The market for green bonds alone saw significant growth, with issuance expected to continue its upward trajectory through 2025.

- Growing Investor Demand: A 2024 survey revealed that 70% of institutional investors consider environmental, social, and governance (ESG) factors in their investment decisions.

- Market Opportunity: The global green bond market, valued at over $2.5 trillion in early 2024, offers substantial potential for financial institutions to participate in sustainable development.

- Consumer Preference: Studies from 2024 indicate that a majority of consumers prefer to bank with institutions that demonstrate a commitment to environmental responsibility.

Regulatory Disclosure on Climate Risks

Financial authorities are increasingly pushing for greater transparency regarding climate-related risks and opportunities within financial institutions. This regulatory push aims to ensure that companies properly assess and disclose the potential impacts of climate change on their operations and financial stability.

While there have been some shifts in approach by certain US regulators, the Securities and Exchange Commission (SEC) finalized a rule in March 2024 mandating climate-related disclosures in annual reports. This indicates a persistent and growing trend toward requiring more comprehensive reporting on these environmental factors.

- SEC's Final Rule (March 2024): Mandates climate-related disclosures in annual reports, increasing transparency requirements for publicly traded companies.

- Global Trend: Many international financial regulators are also implementing or strengthening requirements for climate risk disclosure, aligning with global efforts to address climate change.

- Impact on Financial Institutions: Northwest Bancshares, like its peers, will need to integrate robust climate risk assessment and reporting into its compliance framework, potentially affecting capital allocation and strategic planning.

Environmental factors significantly influence Northwest Bancshares' operations, driven by increasing investor demand for ESG integration and consumer preference for eco-conscious banking. The company is actively reducing its operational footprint through energy efficiency upgrades and promoting paperless customer interactions.

Climate change presents both risks and opportunities, necessitating proactive management of physical and transition risks within loan portfolios. The growing market for green finance, exemplified by substantial green bond issuance, offers avenues for Northwest Bancshares to innovate and enhance its brand reputation.

Regulatory bodies, such as the SEC with its March 2024 rule on climate disclosures, are mandating greater transparency, requiring financial institutions to integrate climate risk assessment into their frameworks.

| Factor | Impact on Northwest Bancshares | Supporting Data (2024/2025 Projections) |

|---|---|---|

| Climate Change Risks | Increased loan defaults from extreme weather; devaluation of carbon-intensive assets. | Record hurricane seasons in 2023; global sustainable debt issuance projected to exceed $1 trillion by mid-2024. |

| Investor & Consumer Demand | Preference for ESG-integrated institutions; demand for green financial products. | 70% of institutional investors consider ESG factors (2024 survey); majority of consumers prefer eco-responsible banks. |

| Regulatory Environment | Mandatory climate-related disclosures; integration of climate risk into financial strategies. | SEC's final rule on climate disclosures (March 2024); global trend toward stricter disclosure requirements. |

PESTLE Analysis Data Sources

Our PESTLE analysis for Northwest Bancshares is informed by a diverse range of data, including reports from financial regulatory bodies, economic indicators from government agencies, and industry-specific market research. This comprehensive approach ensures that political, economic, social, technological, legal, and environmental factors are assessed with accuracy and relevance.