NIPPON EXPRESS HOLDINGS SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

NIPPON EXPRESS HOLDINGS Bundle

Nippon Express Holdings leverages its vast global network and strong brand recognition as key strengths, but faces challenges from intense competition and evolving logistics technologies. Understanding these dynamics is crucial for navigating the future of global supply chains.

Want the full story behind Nippon Express Holdings' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Nippon Express Holdings operates an impressive global network, covering 57 countries and regions with more than 300 affiliated companies. This extensive international footprint enables the company to provide seamless, end-to-end supply chain management for clients across the globe.

This widespread presence is a significant strength, particularly in Asia, a critical hub for international trade and cargo movement. In 2023, Asia accounted for approximately 37% of global trade volume, giving Nippon Express a strategic advantage in serving this dynamic market.

The company's ability to support clients entering new markets is amplified by its established infrastructure and local expertise in these diverse regions. This global reach translates into a robust competitive edge in the international logistics landscape.

NIPPON EXPRESS HOLDINGS boasts a remarkably diverse and specialized service portfolio, covering air, ocean, and land freight forwarding, alongside comprehensive warehousing and distribution. This wide array of offerings ensures the company can cater to a broad range of customer needs across the globe.

The company's expertise extends to contract logistics and specialized handling, particularly for high-value and time-sensitive sectors such as automotive, pharmaceuticals, and electronics. For instance, in 2023, NIPPON EXPRESS HOLDINGS reported significant growth in its contract logistics segment, driven by demand from these critical industries.

This strategic diversification is a core strength, significantly reducing the company's vulnerability to downturns in any single transportation mode or industry. This broad operational base provides a stable foundation for sustained growth and resilience in the dynamic global logistics market.

Nippon Express Holdings has strategically bolstered its capabilities through targeted acquisitions. A prime example is the acquisition of cargo-partner in 2024, which significantly expanded its network and service offerings, particularly in Central and Eastern Europe.

Further strengthening its specialized logistics, particularly in the healthcare sector, Nippon Express Holdings acquired Simon Hegele Group in 2025. These moves are designed to enhance its global scale and competitive edge in a dynamic market.

Commitment to Technological Advancement and Digitalization

Nippon Express Holdings is significantly investing in cutting-edge technology to drive efficiency and customer satisfaction. They are deploying warehouse AI and cloud-connected autonomous mobile robots, which are key to optimizing operations. For example, in fiscal year 2023, the company highlighted its progress in automating warehouse operations, aiming to reduce labor costs and improve throughput.

Further strengthening their digital capabilities, Nippon Express is integrating advanced supply chain visibility tools. Investments in IoT and blockchain technology are crucial for enhancing transparency and security across their global network. This commitment to digitalization is directly supporting their growth strategy by making their services more responsive and reliable in a rapidly changing market.

The company's strategic focus on digital transformation is evident in its financial reports, with substantial allocations towards R&D and technology infrastructure. This proactive approach ensures they remain competitive by improving operational efficiency and adapting to evolving customer demands for seamless logistics solutions.

- Leveraging AI and Robotics: Implementation of warehouse AI and autonomous mobile robots to enhance operational efficiency.

- Investing in Visibility: Adoption of IoT and blockchain for improved supply chain transparency and security.

- Digital Transformation Focus: Driving digital initiatives to meet evolving market demands and customer expectations.

- Fiscal Year 2023 Progress: Demonstrated advancements in warehouse automation, contributing to operational improvements.

Strong Financial Performance and Resilience

NIPPON EXPRESS HOLDINGS has demonstrated robust financial performance, with revenues climbing in Fiscal Year 2024 and continuing into the first quarter of Fiscal Year 2025. Projections indicate this upward trend is expected to persist throughout FY2025, underscoring the company's strong market position.

Despite facing headwinds such as rising personnel costs, the company has shown remarkable resilience by not only sustaining revenue growth but also enhancing segment income in key areas. This financial fortitude is a significant strength.

Key contributing factors to this improved profitability include the successful implementation of strategic cost reduction initiatives and ongoing business restructuring efforts. These measures have directly bolstered the company's financial health.

- Revenue Growth: Reported increases in FY2024 and Q1 FY2025, with positive FY2025 forecasts.

- Resilience: Maintained revenue growth and improved segment income despite increased personnel expenses.

- Profit Improvement: Driven by strategic cost reductions and business restructuring.

Nippon Express Holdings' extensive global network, spanning 57 countries and over 300 affiliates, is a cornerstone strength, particularly vital in Asia, which represented approximately 37% of global trade volume in 2023. This broad reach allows them to offer integrated supply chain solutions worldwide.

The company's diverse service portfolio, encompassing air, ocean, and land freight, along with specialized contract logistics for sectors like automotive and pharmaceuticals, significantly mitigates risks associated with any single market or service mode. Their contract logistics segment saw notable growth in 2023, highlighting this diversification.

Strategic acquisitions, such as cargo-partner in 2024 and Simon Hegele Group in 2025, have further bolstered their capabilities and market presence, especially in specialized logistics and European markets. This proactive expansion enhances their competitive edge.

Nippon Express Holdings is making substantial investments in technology, including AI and autonomous mobile robots for warehouse automation, and IoT and blockchain for supply chain visibility. These digital initiatives, evidenced by significant R&D allocations in FY2023, are crucial for improving efficiency and meeting evolving customer demands.

Financially, Nippon Express Holdings has shown strong performance, with revenue growth in FY2024 and Q1 FY2025, and positive FY2025 forecasts. Despite rising personnel costs, the company maintained revenue growth and improved segment income through effective cost reduction and restructuring efforts.

What is included in the product

Delivers a strategic overview of NIPPON EXPRESS HOLDINGS’s internal and external business factors, highlighting its global network and operational strengths against market competition and evolving logistics demands.

Offers a clear, actionable SWOT analysis of NIPPON EXPRESS HOLDINGS, simplifying complex strategic challenges into manageable insights for confident decision-making.

Weaknesses

NIPPON EXPRESS HOLDINGS experienced a dip in business profit for Fiscal Year 2024, even as revenue climbed. This was largely due to external pressures like sustained high energy costs and increasing labor expenses, which directly impacted their bottom line.

Looking at the first quarter of 2025, the company saw an improvement in its profit margin, reaching 0.2%. However, this figure still indicates a need for careful cost management to bolster overall profitability against these persistent cost pressures.

NIPPON EXPRESS HOLDINGS' significant concentration within Japan, with approximately 59.2% of its net sales originating domestically, presents a notable weakness. This heavy reliance on a single market makes the company vulnerable to any economic slowdowns or sector-specific issues that might arise within Japan. While global operations exist, this domestic focus limits revenue diversification and can amplify the impact of regional challenges.

While Nippon Express Holdings has strategically acquired companies like cargo-partner and Simon Hegele to bolster its global network and service offerings, integrating these new entities presents significant hurdles. The process of post-merger integration (PMI) demands careful attention to aligning disparate corporate cultures, IT infrastructures, and operational workflows.

These integration complexities can lead to temporary dips in efficiency and necessitate substantial management focus and resource allocation. For instance, the successful assimilation of cargo-partner, a move aimed at strengthening European logistics capabilities, requires meticulous planning to harmonize systems and processes, ensuring that the expected synergies are realized without undue disruption.

Impact of Global Economic Slowdown and Trade Frictions

The logistics sector is highly sensitive to the ebb and flow of the global economy. While projections for global GDP growth in 2024 and 2025 remain positive, there are indications of a slowdown in major developed economies. This economic deceleration, coupled with persistent trade frictions, creates an environment of uncertainty for international freight volumes.

These global headwinds are compounded by challenges within Japan's domestic market. Forecasts suggest a sluggish demand for logistics services within Japan itself. This weaker domestic freight transport environment directly impacts the overall strength and growth potential of companies like Nippon Express Holdings.

- Global GDP growth forecasts for 2024 and 2025, while positive, signal a potential slowdown in developed nations.

- Ongoing trade frictions contribute to an uncertain global economic outlook, impacting international logistics demand.

- A projected slowdown in domestic logistics demand within Japan poses a direct challenge to Nippon Express Holdings' operational performance.

Vulnerability to Cybersecurity Risks

Nippon Express Holdings' increasing reliance on digital platforms and integrated IT systems, while driving efficiency, also heightens its vulnerability to cybersecurity threats. The logistics sector's growing data dependency means that safeguarding critical information and maintaining smooth operations against cyberattacks is a paramount and continuous concern.

The potential for data breaches or operational disruptions due to cyber incidents poses a significant risk. For instance, a successful ransomware attack could cripple tracking systems, delay shipments, and compromise sensitive customer data, leading to reputational damage and financial losses. As of early 2024, the global logistics industry continues to see a rise in sophisticated cyberattacks, with companies investing heavily in advanced security measures to mitigate these risks.

- Increased Digitalization: Nippon Express Holdings' adoption of advanced IT systems for supply chain management and customer service expands its digital footprint, creating more potential entry points for cyber threats.

- Data Sensitivity: The company handles vast amounts of sensitive data, including customer information, shipment details, and financial records, making it an attractive target for cybercriminals.

- Operational Interdependence: The interconnected nature of modern logistics means a cyberattack on one system could have cascading effects across the entire network, disrupting global operations.

- Evolving Threat Landscape: The constant evolution of cyber threats requires continuous investment in and adaptation of security protocols to stay ahead of new attack vectors.

Nippon Express Holdings' significant concentration in the Japanese market, representing approximately 59.2% of its net sales, exposes it to the risks of domestic economic downturns and sector-specific challenges, limiting revenue diversification.

The company faces substantial challenges in integrating its recent acquisitions, such as cargo-partner and Simon Hegele, which requires careful alignment of corporate cultures, IT systems, and operational workflows to avoid efficiency dips and resource strain.

A heightened reliance on digital and integrated IT systems, while beneficial for efficiency, increases vulnerability to sophisticated cybersecurity threats, potentially leading to data breaches, operational disruptions, and reputational damage, a growing concern in the logistics sector as of early 2024.

What You See Is What You Get

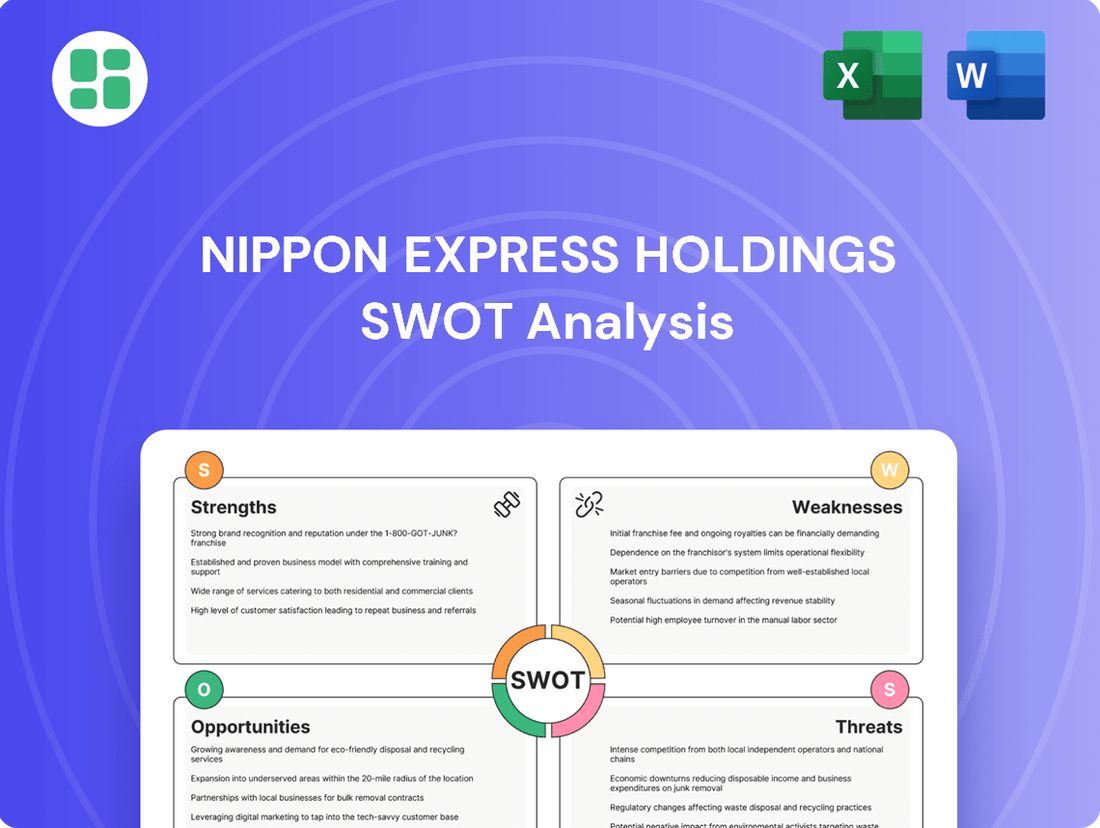

NIPPON EXPRESS HOLDINGS SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're viewing a live preview of the actual SWOT analysis file, detailing Nippon Express Holdings' Strengths, Weaknesses, Opportunities, and Threats. The complete version becomes available after checkout, offering a comprehensive strategic overview.

Opportunities

The global e-commerce market is a powerhouse, with projections showing it hitting $7.4 trillion by 2025. This massive growth directly fuels demand for efficient last-mile delivery, a key area for NIPPON EXPRESS HOLDINGS. The company can capitalize on this by expanding its services in this critical segment.

This trend presents a clear opportunity for NIPPON EXPRESS HOLDINGS to enhance its last-mile delivery capabilities and invest in micro-fulfillment centers. Optimizing supply chains to ensure faster, more dependable deliveries is crucial to capturing market share in this evolving landscape.

Nippon Express Holdings is strategically targeting emerging markets such as India, Africa, and the Middle East for significant expansion. These regions offer substantial growth potential, aligning with the company's long-term vision.

India's economy is projected to grow robustly, with forecasts indicating a GDP growth rate of around 6.5% for 2024-2025. This presents Nippon Express with a prime opportunity to invest in and enhance its domestic logistics infrastructure, thereby capitalizing on the burgeoning demand for efficient supply chain solutions in one of the world's fastest-growing economies.

Expanding into Africa and the Middle East allows Nippon Express to tap into diverse and rapidly developing markets. These regions are increasingly focused on improving trade and connectivity, creating a favorable environment for logistics providers to offer comprehensive services and build a strong presence.

Nippon Express Holdings can significantly boost operational efficiency by deepening its integration of AI, automation, and IoT. These technologies are revolutionizing logistics, enabling advanced route optimization and predictive maintenance, which are crucial for cost reduction. For instance, the global AI in logistics market was valued at approximately $2.1 billion in 2023 and is projected to reach $11.5 billion by 2030, highlighting the immense potential for growth.

By leveraging these digital advancements, Nippon Express can achieve real-time inventory management and tracking, thereby enhancing supply chain visibility and resilience. This proactive approach to technology adoption is key to staying competitive in an increasingly digitalized logistics landscape, as seen with competitors investing heavily in smart warehousing solutions and autonomous delivery systems.

Increased Focus on Sustainability and Green Logistics

The global push for sustainability is creating significant opportunities in green logistics. NIPPON EXPRESS HOLDINGS can capitalize on this by expanding its investments in electric vehicle fleets and energy-efficient warehousing. For instance, by 2024, many regions are seeing increased adoption of electric trucks, with projections indicating substantial growth in this sector through 2025.

By enhancing route optimization and adopting low-carbon transportation methods, NIPPON EXPRESS HOLDINGS can not only reduce its environmental footprint but also appeal to a growing segment of environmentally conscious clients. This strategic alignment with sustainability trends can lead to a competitive advantage and meet evolving customer expectations for responsible supply chain partners.

- Growing demand for eco-friendly shipping solutions.

- Potential for cost savings through energy efficiency and optimized routes.

- Enhanced brand reputation by demonstrating commitment to ESG principles.

- Access to new markets and partnerships focused on green initiatives.

Strategic Partnerships and Collaborations

Nippon Express Holdings can seize opportunities by forging strategic partnerships, particularly with technology innovators. A prime example is their collaboration with Tive, a leader in real-time supply chain visibility solutions. This partnership allows Nippon Express to offer enhanced tracking and monitoring, directly boosting service quality and fostering innovation within their operations.

These alliances are crucial for expanding capabilities beyond what can be achieved through internal development alone. By integrating advanced technologies and expertise from external partners, Nippon Express can accelerate the adoption of cutting-edge solutions, thereby strengthening its competitive position in the global logistics market. For instance, by leveraging Tive's IoT tracker technology, Nippon Express can provide clients with unprecedented insights into their shipments, improving efficiency and reducing risks.

- Enhanced Service Quality: Partnerships like the one with Tive enable real-time shipment tracking, improving customer satisfaction and operational efficiency.

- Accelerated Innovation: Collaborations with tech providers allow for the swift integration of advanced logistics solutions, keeping Nippon Express at the forefront of the industry.

- Expanded Capabilities: Strategic alliances offer access to specialized technologies and expertise, complementing organic growth strategies and broadening service offerings.

- Competitive Advantage: By adopting innovative technologies through partnerships, Nippon Express can differentiate itself in a crowded market, attracting new clients and retaining existing ones.

The burgeoning e-commerce sector, projected to reach $7.4 trillion by 2025, presents a significant avenue for Nippon Express Holdings to expand its last-mile delivery services and invest in micro-fulfillment centers. Furthermore, the company's strategic focus on emerging markets like India, with its anticipated 6.5% GDP growth for 2024-2025, offers substantial opportunities for infrastructure development and market penetration. Embracing AI and automation, with the AI in logistics market expected to grow from $2.1 billion in 2023 to $11.5 billion by 2030, can drive operational efficiencies and enhance supply chain visibility.

Nippon Express Holdings is well-positioned to capitalize on the growing demand for green logistics, driven by global sustainability initiatives. Investments in electric vehicle fleets and energy-efficient warehousing, coupled with optimized routing, can reduce environmental impact and appeal to eco-conscious clients. Strategic partnerships, such as the one with Tive for real-time supply chain visibility, are crucial for accelerating innovation and expanding capabilities, thereby securing a competitive edge in the dynamic logistics landscape.

| Opportunity Area | Market Projection/Data | Strategic Implication for Nippon Express |

|---|---|---|

| E-commerce Growth | Global e-commerce market to reach $7.4 trillion by 2025 | Expand last-mile delivery and micro-fulfillment capabilities |

| Emerging Markets (India) | India GDP growth ~6.5% (2024-2025) | Invest in domestic logistics infrastructure, capitalize on demand |

| AI & Automation in Logistics | AI in logistics market: $2.1B (2023) to $11.5B (2030) | Enhance operational efficiency, route optimization, and visibility |

| Green Logistics | Increasing adoption of electric trucks through 2025 | Invest in EV fleets and energy-efficient warehousing, appeal to ESG clients |

| Strategic Partnerships | Collaboration with Tive for real-time visibility | Accelerate innovation, enhance service quality, expand capabilities |

Threats

The global logistics arena is a battlefield, teeming with established giants and nimble newcomers all vying for a piece of the action. NIPPON EXPRESS HOLDINGS, despite its considerable scale, constantly navigates this crowded space, feeling the heat from rivals who can be both global powerhouses and specialized regional operators.

This fierce rivalry often translates into aggressive pricing strategies, a phenomenon that can significantly squeeze profit margins for all involved. For instance, the global freight forwarding market, a key segment for NIPPON EXPRESS, saw average ocean freight rates decrease by over 50% in late 2023 compared to their 2022 peaks, illustrating the downward pressure on pricing.

Nippon Express Holdings faces significant threats from ongoing geopolitical instability. For instance, the Red Sea crisis in early 2024 rerouted shipping, adding an estimated 10-14 days to transit times for some routes and increasing freight costs by up to 150% for certain shipments, directly impacting logistics efficiency and profitability.

Trade frictions and regional conflicts, such as those in Eastern Europe, continue to create unpredictable operational environments. These situations can lead to sudden border closures or increased security measures, causing delays and escalating operational expenses for global logistics providers like Nippon Express.

Furthermore, restrictions at key transit points, like the Panama Canal experiencing drought-related limitations in late 2023 and early 2024, force carriers to seek longer, more costly alternatives. This directly affects transit times and increases fuel consumption and overall shipping costs, posing a considerable challenge to maintaining competitive service levels.

The logistics sector's reliance on fuel makes it vulnerable to price hikes. For Nippon Express Holdings, sustained elevated energy costs in 2024 and 2025 directly inflate operating expenses, squeezing profit margins. This could force the company to pass on costs, potentially impacting its competitive pricing strategy in a sensitive market.

Labor Shortages and Wage Inflation

Nippon Express Holdings, like others in the logistics industry, faces ongoing labor shortages, especially for critical roles like truck drivers and warehouse staff. This scarcity directly fuels wage inflation, pushing up operational expenses and potentially affecting the company's profitability.

The pressure from rising labor costs is a significant concern. For instance, in 2024, the average wage for truck drivers in many developed economies saw an uptick of 5-10% compared to the previous year, a trend expected to continue into 2025. This directly impacts Nippon Express's cost structure.

- Driver Shortage: The global shortage of qualified truck drivers remains a persistent issue, impacting delivery times and increasing recruitment costs.

- Wage Inflation: Increased competition for available workers drives up wages, directly increasing Nippon Express's operating expenses.

- Impact on Service: Higher labor costs and potential staffing shortfalls could strain Nippon Express's ability to maintain service levels and meet customer demand efficiently.

- Competitive Landscape: Competitors also face these challenges, but companies with stronger employee retention strategies or greater automation may gain an advantage.

Regulatory Changes and Compliance Costs

Evolving environmental regulations, such as the EU's increasingly stringent carbon emission targets, present a significant challenge. Nippon Express Holdings, like other logistics firms, faces rising compliance costs associated with these mandates. For instance, the EU's Fit for 55 package aims for a 55% net greenhouse gas emission reduction by 2030 compared to 1990 levels, impacting transportation sectors directly.

Meeting these evolving standards necessitates substantial investment in cleaner technologies and operational shifts. These investments, while crucial for long-term sustainability and market access, can strain profitability if not strategically implemented and offset by efficiency gains or new revenue streams. The financial burden of adapting fleets and infrastructure to lower-emission alternatives is a key consideration for the company's financial health.

Furthermore, other compliance requirements beyond environmental concerns can add to the operational overhead. These can include evolving labor laws, data privacy regulations, and international trade compliance, all of which require ongoing monitoring and adaptation. Failure to adhere to these diverse regulatory landscapes can result in penalties and reputational damage, underscoring the importance of robust compliance management.

- Stricter Environmental Regulations: The EU's Fit for 55 package, targeting a 55% emission reduction by 2030, directly impacts logistics operations.

- Increased Compliance Costs: Investments in greener fleets and technologies to meet these targets can lead to higher operational expenses.

- Need for Technological Adaptation: Nippon Express Holdings must allocate capital to new technologies and practices to remain compliant and competitive.

- Potential Profitability Impact: Effective management of compliance costs is crucial to prevent negative effects on the company's profitability.

Nippon Express Holdings faces intense competition from both global logistics giants and specialized regional players, leading to aggressive pricing that can compress profit margins. For instance, ocean freight rates saw significant drops in late 2023, illustrating this downward pressure.

Geopolitical instability, such as the Red Sea crisis in early 2024, disrupted shipping routes, adding transit time and increasing costs by up to 150% on certain shipments. Trade frictions and regional conflicts also create operational uncertainties, leading to delays and higher expenses.

The company is vulnerable to fuel price volatility; sustained high energy costs in 2024-2025 directly inflate operating expenses. Furthermore, a persistent global shortage of truck drivers and warehouse staff fuels wage inflation, pushing up operational costs by an estimated 5-10% for driver wages in developed economies in 2024.

Stricter environmental regulations, like the EU's Fit for 55 package aiming for a 55% emission reduction by 2030, necessitate costly investments in cleaner technologies and operational shifts, potentially impacting profitability if not managed effectively.

SWOT Analysis Data Sources

This SWOT analysis is built on a foundation of credible data, drawing from Nippon Express Holdings' official financial reports, comprehensive market intelligence, and expert industry analysis to provide a robust strategic overview.