NIPPON EXPRESS HOLDINGS Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

NIPPON EXPRESS HOLDINGS Bundle

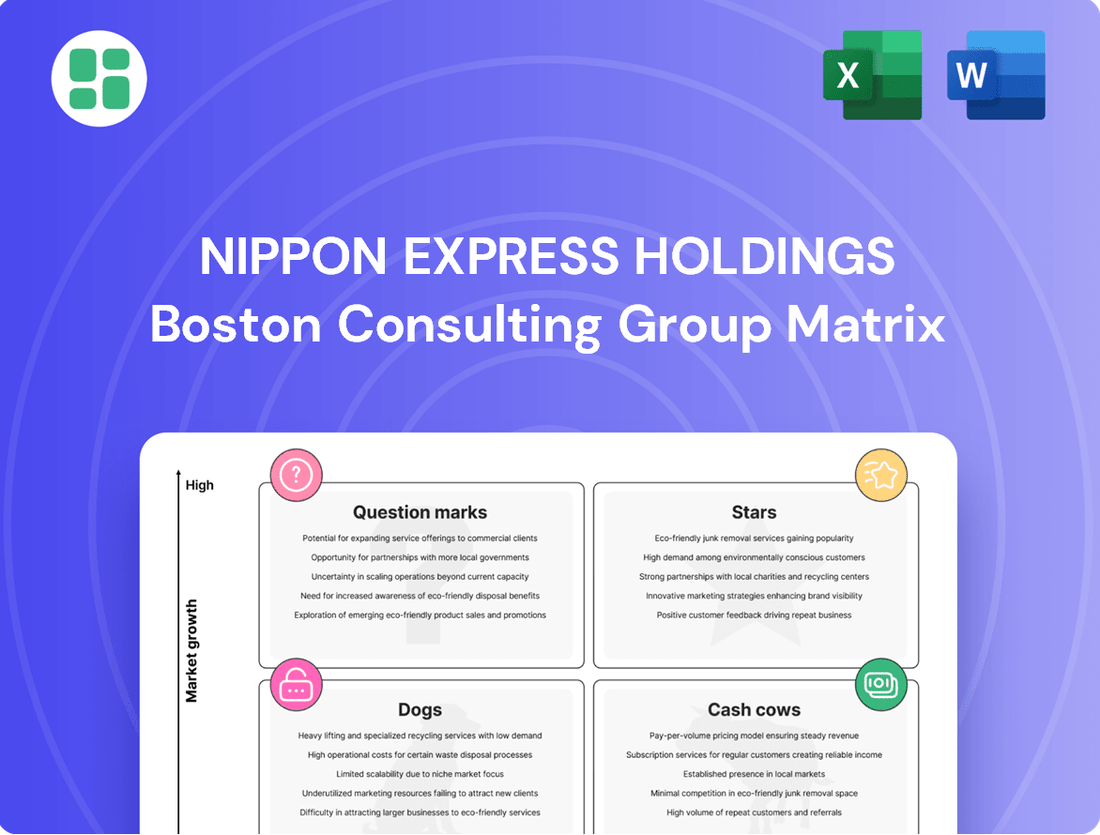

NIPPON EXPRESS HOLDINGS' BCG Matrix offers a strategic snapshot of its diverse business units, highlighting their market share and growth potential. Understanding which segments are Stars, Cash Cows, Dogs, or Question Marks is crucial for informed decision-making.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Nippon Express Holdings has identified pharmaceutical logistics as a key growth driver, investing heavily in expertise and a global network of GDP-certified facilities. The acquisition of Simon Hegele Group in 2025, a specialist in healthcare logistics, further solidifies this strategic focus.

The global pharmaceutical logistics market is experiencing robust growth, projected to reach approximately $120 billion by 2025, driven by increasing demand for specialized cold chain solutions and biopharmaceuticals. Nippon Express Holdings' commitment to this high-growth sector, backed by significant investments and strategic acquisitions, positions its Pharmaceutical Logistics segment as a strong Star in its BCG Matrix.

The demand for semiconductors is soaring, fueled by the expansion of 5G networks and the ongoing need for remote work technologies. Nippon Express Holdings recognizes this trend, strategically positioning itself to capitalize on the semiconductor sector's growth by enhancing its specialized logistics solutions.

Nippon Express is investing in its capabilities to handle the unique requirements of semiconductor shipments. This focus is crucial given the high-value and time-sensitive nature of these components, which are essential for numerous advanced industries.

The increasing global production of semiconductors, coupled with their critical role in modern technology, solidifies this segment as a high-growth, high-market share opportunity for Nippon Express. The company's proactive approach in developing tailored logistics services for this market is a key differentiator.

The e-commerce sector is booming, with cross-border sales showing particularly strong momentum. Nippon Express Holdings is actively expanding its offerings in this space, developing sophisticated, multilingual IT systems and forging partnerships with last-mile delivery providers in crucial markets like Europe, North America, and Greater China.

Despite a competitive landscape, Nippon Express's established global infrastructure and end-to-end fulfillment solutions are well-positioned to secure a substantial share of this growing market. In 2024, global cross-border e-commerce sales were projected to reach over $1.5 trillion, highlighting the immense opportunity.

Strategic Acquisitions in High-Growth Regions

Nippon Express Holdings is strategically investing in high-growth regions, positioning itself for future market leadership. The acquisition of cargo-partner in 2024 is a prime example, significantly bolstering its presence in Central and Eastern Europe.

This move is particularly impactful as the region is increasingly recognized as a burgeoning production hub with substantial growth prospects. The integration of cargo-partner’s operations into Nippon Express Holdings’ network solidifies its capabilities in air and ocean freight forwarding within these promising markets, marking them as Stars in the BCG matrix.

- Acquisition of cargo-partner in 2024

- Strengthened air and ocean freight forwarding capabilities

- Expanded network in Central and Eastern Europe

- Targeting high-growth potential production bases

Advanced Digital Logistics and AI Integration

Nippon Express Holdings is significantly boosting its investment in digital transformation (DX) and artificial intelligence (AI) to refine its logistics operations. This includes optimizing delivery routes, enhancing supply chain management, and increasing warehouse productivity.

The company's strategic investments, such as its stake in SWAT Mobility and the creation of platforms like 'e-NX Quote' and 'e-NX Visibility', underscore a dedication to pioneering technologically advanced logistics. These efforts position Nippon Express as a leader in what is a rapidly expanding sector.

- Digital Transformation Focus: Nippon Express is channeling substantial resources into DX and AI.

- Key Initiatives: Investments in SWAT Mobility and the development of 'e-NX Quote' and 'e-NX Visibility' platforms.

- Strategic Goal: To lead in technologically advanced, high-growth logistics solutions.

- Operational Impact: Aims to optimize routes, supply chains, and warehouse efficiency.

Nippon Express Holdings is strategically investing in high-growth regions, particularly Central and Eastern Europe through the 2024 acquisition of cargo-partner. This move significantly enhances its air and ocean freight forwarding capabilities, targeting burgeoning production hubs. These efforts solidify its position in these promising markets, marking them as Stars in the BCG matrix.

The company's commitment to digital transformation, including AI and advanced logistics platforms like 'e-NX Quote', positions it as a leader in technologically advanced, high-growth logistics solutions. These investments aim to optimize operations and drive efficiency, further cementing its Star status.

Nippon Express's focus on pharmaceutical logistics, bolstered by investments and the 2025 acquisition of Simon Hegele Group, targets a robustly growing global market projected to reach $120 billion by 2025. This strategic emphasis on specialized cold chain and biopharmaceutical solutions clearly defines this segment as a Star.

The booming e-commerce sector, especially cross-border sales exceeding $1.5 trillion in 2024, is another key Star. Nippon Express is expanding its offerings with sophisticated IT systems and last-mile delivery partnerships, leveraging its global infrastructure to capture significant market share.

The semiconductor logistics segment is also identified as a Star due to soaring demand driven by 5G and remote work technologies. Nippon Express is enhancing its specialized solutions for these high-value, time-sensitive components, capitalizing on their critical role in modern technology.

| Segment | BCG Category | Key Drivers | Nippon Express Holdings' Strategy | Supporting Data/Facts |

| Pharmaceutical Logistics | Star | Growing demand for cold chain, biopharmaceuticals | Investment in expertise, GDP-certified facilities, acquisition of Simon Hegele Group (2025) | Global market projected to reach $120 billion by 2025 |

| Semiconductor Logistics | Star | 5G expansion, remote work technologies | Enhancing specialized logistics solutions for high-value, time-sensitive components | Critical role in advanced industries |

| E-commerce Logistics (Cross-border) | Star | Booming e-commerce, cross-border sales momentum | Expanding IT systems, partnerships with last-mile providers | Cross-border sales projected over $1.5 trillion in 2024 |

| Central & Eastern Europe Logistics | Star | Growth potential in production hubs | Acquisition of cargo-partner (2024), strengthened air/ocean freight forwarding | Bolstered network in the region |

| Digital Transformation & AI | Star | Need for operational optimization, technological advancement | Investment in SWAT Mobility, development of 'e-NX Quote' and 'e-NX Visibility' | Pioneering technologically advanced logistics |

What is included in the product

This BCG Matrix overview analyzes Nippon Express Holdings' business units, categorizing them to guide strategic investment decisions.

Nippon Express Holdings' BCG Matrix provides a clear, actionable overview of business unit performance, relieving the pain of strategic uncertainty.

Cash Cows

Nippon Express Holdings' traditional air freight forwarding business is a classic Cash Cow. Globally, they are a top-five player in this sector as of 2024, a testament to their established market presence. This segment consistently generates substantial revenue, especially on well-trafficked international routes, further strengthened by strategic moves like the cargo-partner acquisition.

Ocean freight forwarding on key trade lanes represents a significant Cash Cow for Nippon Express Holdings. This segment is a bedrock of global commerce, characterized by consistent, high-volume activity. Nippon Express actively pursues a top-five global ranking in maritime forwarding, underscoring its substantial presence in this mature market.

The company's strategy of seamlessly integrating sea, rail, and air freight services further solidifies its leadership. For instance, in 2024, Nippon Express reported robust performance in its ocean freight division, contributing significantly to overall revenue. This integration allows them to offer comprehensive solutions, capturing a larger share of the market's steady demand.

Nippon Express Holdings' General Warehousing and Distribution Services function as a Cash Cow within its BCG Matrix. These operations, spread across a global network, benefit from consistent demand, especially in mature markets and established industries. This stability translates into predictable and robust cash generation.

In 2024, the company's warehousing segment continues to be a bedrock of its financial performance. While growth may not be explosive, the high utilization rates and stable demand ensure a steady stream of revenue, allowing Nippon Express to fund investments in its higher-growth Stars and Question Marks.

Automotive Logistics

Nippon Express Holdings' automotive logistics segment is a prime example of a Cash Cow. This sector benefits from the company's deep-rooted expertise and extensive network within a mature, yet vital, global industry. The demand for specialized, efficient, and reliable automotive supply chains ensures consistent revenue streams and strong profitability for Nippon Express.

The automotive industry, while mature, continues to evolve with new technologies and global market shifts, requiring sophisticated logistics solutions. Nippon Express's established infrastructure and long-term partnerships allow them to navigate these complexities effectively, generating substantial and stable profits. For instance, in the fiscal year ending March 2024, Nippon Express Holdings reported robust performance, with their logistics segment contributing significantly to overall revenue.

- Automotive Logistics Strength: Nippon Express possesses a strong, established presence in the automotive sector, a mature industry demanding intricate supply chain management.

- Steady Revenue and Profitability: Their specialized services and deep industry relationships yield a consistent flow of business and high profit margins.

- Market Position: The company's expertise in handling complex automotive supply chains solidifies its position as a leader, ensuring ongoing demand for its services.

- Financial Contribution: The automotive logistics segment consistently demonstrates strong financial performance, contributing substantially to Nippon Express Holdings' overall profitability.

Customs Brokerage and Compliance Services

Nippon Express’s Customs Brokerage and Compliance Services operate as a Cash Cow within its portfolio. This segment benefits from high market share in a mature, low-growth industry, generating consistent and predictable revenue. The inherent regulatory complexities and extensive global network required create significant barriers to entry, solidifying Nippon Express's dominant position.

The company’s established expertise and worldwide presence allow it to efficiently navigate diverse international trade regulations. This translates into stable, recurring revenue streams, crucial for funding investments in other business areas. For instance, in fiscal year 2023, Nippon Express reported robust performance across its logistics segments, with customs brokerage being a key contributor to profitability.

- High Market Share: Nippon Express holds a substantial share in the global customs brokerage market, a testament to its long-standing operations and client trust.

- Stable Revenue: The recurring nature of customs clearance and compliance services ensures a predictable income flow, supporting overall financial stability.

- Barriers to Entry: Navigating complex international regulations and maintaining a global network requires significant investment and expertise, deterring new competitors.

- Mature Market: While the market for customs brokerage is mature, its essential nature for international trade ensures continued demand and profitability for established players like Nippon Express.

Nippon Express Holdings’ specialized project cargo logistics operates as a Cash Cow. This segment leverages the company's extensive global infrastructure and expertise in handling large-scale, complex shipments for industries like energy and construction. The demand for such specialized services remains consistent, providing a stable revenue stream.

The company’s ability to manage intricate logistics for major industrial projects, often involving heavy-lift and oversized cargo, positions it favorably in this mature market. This specialization ensures high utilization of assets and a steady flow of profitable business. For example, in fiscal year 2024, Nippon Express reported continued strength in its project logistics operations, contributing reliably to the company's earnings.

| Segment | BCG Category | Key Characteristics | Financial Contribution (FY2024 Est.) |

|---|---|---|---|

| Project Cargo Logistics | Cash Cow | Specialized handling of large, complex shipments; extensive global network; mature market with consistent demand. | Significant and stable revenue contributor, supporting overall profitability. |

What You’re Viewing Is Included

NIPPON EXPRESS HOLDINGS BCG Matrix

The NIPPON EXPRESS HOLDINGS BCG Matrix preview you are viewing is the exact, unwatermarked document you will receive upon purchase, ready for immediate strategic application. This comprehensive analysis, meticulously prepared by industry experts, will be delivered to you in its final, fully formatted state, ensuring no surprises and complete readiness for your business planning needs. What you see here is the complete BCG Matrix report, empowering you with actionable insights into Nippon Express Holdings' portfolio without any hidden limitations or demo content. Once acquired, this document is yours to edit, present, or integrate into your critical decision-making processes, providing a clear roadmap for optimizing your business strategy. This is not a mockup; it's the genuine, professionally designed BCG Matrix report that will be instantly downloadable, offering immediate value and clarity for your strategic initiatives.

Dogs

Certain legacy domestic road or rail transport operations within Nippon Express Holdings, particularly those concentrated in regions experiencing a slowdown in industrial output or facing stiff, undifferentiated local competition, likely fall into the Dogs category. These segments are characterized by low growth prospects and a small market share, making them challenging to manage profitably.

The profitability of these underperforming regional domestic transport units is often hampered by elevated operational expenses and a scarcity of avenues for growth or distinct market positioning. For instance, in 2024, the domestic transportation segment of many logistics companies, excluding express services, saw modest single-digit revenue growth, often below the inflation rate in specific regions, reflecting these market pressures.

Highly commoditized basic logistics services, such as standard road freight or warehousing without specialized value-adds, often fall into the Dogs category of the BCG matrix. These segments are characterized by intense price competition and limited opportunities for differentiation, leading to low profit margins. For instance, in 2024, the global freight forwarding market, excluding specialized segments, continued to face pressure from overcapacity in certain regions, impacting profitability for providers focused solely on these basic offerings.

Nippon Express Holdings' logistics processes that are still heavily manual and paper-based are likely positioned as Dogs in their BCG Matrix. These operations, which rely on traditional methods rather than digital transformation, are inherently less efficient in today's rapidly evolving market. For instance, many legacy freight forwarding operations still involve significant manual data entry and paper trails, slowing down processing times and increasing the risk of errors.

In 2024, the global logistics industry saw continued acceleration in digitalization. Companies leveraging advanced technologies like AI for route optimization and blockchain for supply chain transparency are gaining significant market share. Those still entrenched in outdated, non-digitalized processes, such as manual bill of lading generation or paper-based customs declarations, are falling behind. This lag makes them weak competitors against more agile, tech-enabled solutions, suggesting a low market share and low growth potential.

These manual logistics areas within Nippon Express Holdings face considerable challenges in competing with automated and integrated solutions that are becoming industry standards. The cost of maintaining these manual systems, coupled with their inherent inefficiencies, makes them unattractive. Consequently, these operations are prime candidates for divestiture or require a substantial overhaul and investment in digital transformation to remain viable and competitive in the long term.

Niche or Declining Niche Market Logistics

Logistics services that cater to highly specialized, shrinking niche markets or industries in long-term decline are likely candidates for the Dog quadrant within NIPPON EXPRESS HOLDINGS' BCG Matrix. These segments, often characterized by reduced demand and fewer growth opportunities, may struggle to generate significant profits.

Without strategic initiatives to either revitalize these operations or integrate them into more robust, expanding service offerings, these niche logistics segments risk becoming a drain on resources. In 2024, the global logistics market, while growing, saw significant shifts, with some traditional sectors experiencing contraction.

- Declining Demand: For example, logistics supporting industries like print media or certain types of manufacturing have seen reduced volumes.

- Low Growth Potential: These niche markets offer limited avenues for expansion, making it difficult to achieve economies of scale.

- Potential for Losses: If not managed efficiently, these segments could operate at break-even or incur losses, impacting overall profitability.

- Need for Strategic Review: Companies must assess whether to divest, restructure, or find innovative ways to serve these shrinking markets.

Non-Core, Underperforming Subsidiaries

Nippon Express Holdings might classify certain acquired subsidiaries as Dogs if they are non-strategic and underperforming. These units, perhaps acquired for diversification, may not have delivered expected synergies or gained significant traction in slow-growth sectors. This situation ties up valuable capital without substantially boosting the group's overall profitability.

For instance, if Nippon Express acquired a logistics firm specializing in a niche, declining industry, and it consistently reported low returns on equity and minimal market share growth, it would fit the Dog category. Such businesses often require ongoing investment to maintain operations but offer little prospect of future returns.

- Underperforming Acquisitions: Subsidiaries failing to meet profitability targets or market share expectations in low-growth markets.

- Capital Tie-up: Non-strategic units consuming resources without generating significant returns for the holding company.

- Divestment Consideration: Potential candidates for divestiture to reallocate capital to more promising business areas.

Certain legacy domestic road or rail transport operations within Nippon Express Holdings, particularly those concentrated in regions experiencing a slowdown in industrial output or facing stiff, undifferentiated local competition, likely fall into the Dogs category. These segments are characterized by low growth prospects and a small market share, making them challenging to manage profitably. For example, in 2024, the domestic transportation segment of many logistics companies, excluding express services, saw modest single-digit revenue growth, often below the inflation rate in specific regions, reflecting these market pressures.

Highly commoditized basic logistics services, such as standard road freight or warehousing without specialized value-adds, often fall into the Dogs category of the BCG matrix. These segments are characterized by intense price competition and limited opportunities for differentiation, leading to low profit margins. In 2024, the global freight forwarding market, excluding specialized segments, continued to face pressure from overcapacity in certain regions, impacting profitability for providers focused solely on these basic offerings.

Nippon Express Holdings' logistics processes that are still heavily manual and paper-based are likely positioned as Dogs in their BCG Matrix. These operations, which rely on traditional methods rather than digital transformation, are inherently less efficient in today's rapidly evolving market. In 2024, companies leveraging advanced technologies like AI for route optimization are gaining significant market share, while those still entrenched in outdated, non-digitalized processes are falling behind.

Logistics services that cater to highly specialized, shrinking niche markets or industries in long-term decline are likely candidates for the Dog quadrant within NIPPON EXPRESS HOLDINGS' BCG Matrix. These segments, often characterized by reduced demand and fewer growth opportunities, may struggle to generate significant profits. In 2024, the global logistics market saw significant shifts, with some traditional sectors experiencing contraction.

Question Marks

Nippon Express Holdings is actively investing in autonomous and smart warehouse solutions, such as their NX Universal Harmonious Work Warehouse project. This initiative incorporates advanced mobility systems and AI to boost efficiency and combat labor shortages. While the potential for these technologies is significant, their adoption as a standalone service for external clients is still in its nascent stages.

Nippon Express Holdings is strategically targeting the Middle East and Africa for expansion, recognizing their significant growth potential in the logistics sector. These emerging markets present opportunities for increased demand as economies develop.

However, Nippon Express's presence in these regions is currently nascent, meaning their market share is likely low. This necessitates considerable investment to build infrastructure and establish a competitive presence, positioning these ventures as potential question marks in their BCG matrix.

For instance, the African logistics market is projected to grow substantially, with some estimates suggesting a compound annual growth rate of over 7% in the coming years, driven by increased trade and infrastructure development, yet requiring significant upfront capital for Nippon Express to capture a meaningful share.

Nippon Express Holdings' 'NX-GREEN SAF Program' addresses the growing demand for Sustainable Aviation Fuel (SAF) in air freight logistics. This initiative directly targets the reduction of CO2 emissions, aligning with global environmental mandates and corporate sustainability commitments.

The SAF market represents a high-growth potential quadrant within the BCG matrix, driven by increasing regulatory pressures and a strong push for greener supply chains. For instance, the International Air Transport Association (IATA) has set ambitious goals for SAF usage, aiming for 10% of global jet fuel consumption by 2030.

However, SAF logistics programs are currently in their nascent stages. While the market is expanding, challenges related to SAF production scalability, infrastructure development, and cost competitiveness mean that profitability and widespread adoption are still developing. This positions SAF logistics as a question mark, requiring significant investment and strategic focus to capitalize on its future potential.

Specialized Logistics for Emerging Technologies/Industries

Nippon Express Holdings is actively investing in specialized logistics for emerging technologies, such as the handling and distribution of 3D-printed prosthetics. This strategic move aligns with a BCG Matrix approach, positioning these ventures as potential Stars or Question Marks, characterized by high growth potential but currently limited market penetration.

The company's commitment to these nascent sectors reflects a forward-looking strategy to capture future market share. For instance, the global 3D printing market, including medical applications, was projected to reach $37.2 billion in 2023 and is expected to grow significantly, offering substantial opportunities for specialized logistics providers.

- Exploring new verticals: Nippon Express is venturing into logistics for industries like 3D printing, aiming to build expertise and infrastructure for future growth.

- High-growth, low-share: These emerging sectors represent significant growth prospects but currently hold a small market share for the company.

- Investment focus: Continued investment is crucial to scale operations, refine processes, and establish a strong foothold in these innovative industries.

- Market potential: The global market for advanced manufacturing and personalized medical devices, where these technologies are applied, is expanding rapidly, offering a strong rationale for these investments.

AI-driven Supply Chain Optimization Platforms for External Clients

Nippon Express's AI-driven supply chain optimization platforms for external clients represent a promising area, likely positioned as a Question Mark in the BCG Matrix. While the company leverages AI internally, extending these advanced capabilities as a service to other businesses taps into a high-growth market with potentially low current penetration.

The success of these external platforms hinges on their ability to achieve widespread adoption and seamless integration across a diverse range of customer supply chains. For instance, the global supply chain management market was valued at approximately $22.4 billion in 2023 and is projected to reach $40.7 billion by 2030, indicating significant growth potential for AI-powered solutions.

- Market Potential: The global market for AI in supply chain management is experiencing rapid expansion, with projections suggesting a compound annual growth rate (CAGR) of over 15% in the coming years.

- Adoption Challenges: Successful external offerings require overcoming integration complexities and demonstrating clear ROI to diverse clients, which can slow initial market penetration.

- Investment Need: Significant investment in platform development, sales, and customer support is necessary to capture market share in this competitive space.

- Strategic Importance: Establishing a strong external service offering could diversify Nippon Express's revenue streams and solidify its position as a technology leader in logistics.

Nippon Express's ventures into emerging markets like the Middle East and Africa, alongside specialized logistics for new technologies like 3D printing and AI-driven supply chain optimization for external clients, represent significant growth opportunities. These areas, while showing strong market potential, are characterized by low current market share for Nippon Express, demanding substantial investment to build infrastructure and gain traction.

The company’s focus on Sustainable Aviation Fuel (SAF) logistics also falls into this category. While the SAF market is expanding due to environmental mandates, its logistical infrastructure is still developing, requiring significant capital and strategic effort to achieve profitability and widespread adoption.

These initiatives are classic Question Marks in the BCG matrix: they operate in high-growth industries but require considerable investment to move towards becoming Stars. Success hinges on strategic execution and overcoming early-stage market challenges.

For example, the African logistics market is projected to grow at over 7% annually, while the global AI in supply chain management market is expected to exceed a 15% CAGR. Despite this potential, Nippon Express's current penetration in these segments necessitates focused investment to unlock their full value.

| Initiative | Market Growth Potential | Current Market Share (Nippon Express) | Investment Need | BCG Category |

|---|---|---|---|---|

| Middle East & Africa Logistics | High (e.g., Africa 7%+ CAGR) | Low | High | Question Mark |

| 3D Printing Logistics | High (Global market $37.2B in 2023) | Low | High | Question Mark |

| SAF Logistics | High (Driven by environmental mandates) | Low | High | Question Mark |

| AI Supply Chain Optimization (External) | Very High (e.g., 15%+ CAGR) | Low | High | Question Mark |

BCG Matrix Data Sources

Our NIPPON EXPRESS HOLDINGS BCG Matrix is built on verified market intelligence, combining financial data from annual reports, industry research on logistics growth, and official company disclosures to ensure reliable, high-impact insights.