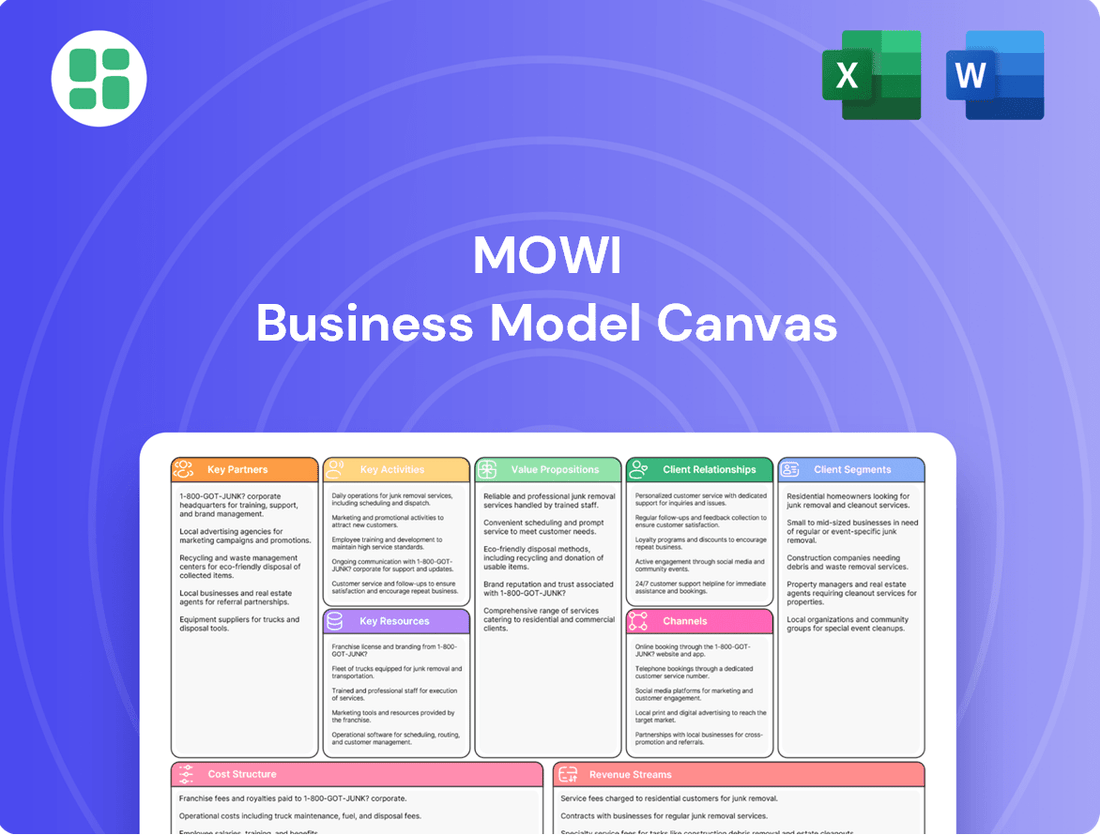

Mowi Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Mowi Bundle

Curious about Mowi's success in the aquaculture industry? Their Business Model Canvas breaks down how they deliver high-quality seafood, manage key resources, and build strong customer relationships. This strategic framework is invaluable for anyone looking to understand competitive advantage.

Unlock the full strategic blueprint behind Mowi's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Mowi actively partners with technology innovators like Innovasea. These collaborations are key to deploying sophisticated environmental monitoring systems and smart farming technologies. For instance, Innovasea's solutions help Mowi gain real-time insights into water quality parameters, directly impacting fish health and growth.

These technological alliances are fundamental to Mowi's pursuit of data-driven precision aquaculture. By integrating advanced sensors and data analytics, Mowi can optimize crucial operational aspects, such as feeding strategies. This leads to improved resource utilization and a more sustainable approach to farming.

In 2024, Mowi continued to invest in digital transformation initiatives. The company reported significant advancements in its smart farming capabilities, aiming to further enhance operational efficiency and fish welfare through technology partnerships. These investments underscore the strategic importance of innovation in maintaining Mowi's competitive edge.

Mowi's business model heavily relies on securing high-quality raw materials for its fish feed production, making partnerships with feed ingredient suppliers crucial. These collaborations ensure a stable and consistent supply of essential components like fish oil, fishmeal, and plant-based proteins, directly impacting the health and growth of farmed salmon.

In 2024, Mowi continued to strengthen these relationships, recognizing that the quality and cost of feed ingredients are significant drivers of both operational efficiency and profitability. For instance, fluctuating global prices for key ingredients like fishmeal, which can trade for over $2,000 per metric ton, underscore the strategic importance of these supplier partnerships in managing cost volatility.

Mowi's commitment to innovation is significantly bolstered by its partnerships with research and development institutions. These collaborations are crucial for advancing aquaculture technology, particularly in areas like superior genetics for faster growth and disease resistance, and developing novel solutions for disease prevention and treatment.

These R&D alliances enable Mowi to explore and implement more sustainable farming practices, including optimizing feed formulations with alternative ingredients to reduce reliance on wild-caught fish. For instance, in 2023, Mowi continued its focus on feed innovation, with research into insect meal and algae as protein sources for salmon feed, aiming to improve the environmental footprint of aquaculture.

Distribution and Retail Partners

Mowi collaborates extensively with major retail chains, wholesalers, and food service providers across the globe. These relationships are fundamental for getting Mowi's diverse salmon products to consumers efficiently. For instance, in 2023, Mowi's sales to retail and food service sectors represented a significant portion of its overall revenue, demonstrating the critical nature of these distribution channels.

These partnerships are not just about logistics; they are key to Mowi's market access and its ability to serve a wide array of customer segments. By working with established players, Mowi ensures its products are readily available, from supermarkets to restaurants. The company's 2023 annual report highlighted strong growth in its consumer products division, largely driven by these retail and food service collaborations.

Key aspects of these partnerships include:

- Market Reach: Enabling access to millions of consumers through established retail and food service networks.

- Brand Visibility: Increasing brand presence and product placement within key markets.

- Supply Chain Integration: Ensuring consistent and reliable supply of Mowi's high-quality salmon products.

- Customer Insights: Gaining valuable feedback and understanding consumer preferences through direct interaction with partners.

Acquired Entities and Joint Ventures

Mowi strategically enhances its market standing and harvest capacity through acquisitions and joint ventures. A notable example is its increased stake in Nova Sea, reinforcing its presence in key aquaculture regions.

These collaborations are crucial for expanding Mowi's operational reach and bolstering its long-term growth trajectory. By integrating new entities and forming strategic alliances, Mowi diversifies its asset base and gains access to new markets and technologies.

- Strategic Acquisitions: Mowi's acquisition strategy focuses on companies that complement its existing operations, such as increasing its ownership in Nova Sea.

- Joint Ventures: These partnerships allow Mowi to share risks and rewards, access specialized expertise, and expand into new geographical areas or product segments.

- Volume Growth: The primary objective of these key partnerships is to increase Mowi's overall harvest volumes, directly impacting its revenue and market share.

- Operational Footprint: Acquisitions and joint ventures enable Mowi to broaden its operational footprint, securing access to prime farming locations and processing facilities.

Mowi's key partnerships extend to technology innovators like Innovasea, crucial for deploying advanced environmental monitoring and smart farming systems. These collaborations enable real-time data on water quality, directly benefiting fish health and optimizing operations such as feeding strategies, as seen in Mowi's 2024 digital transformation investments.

Securing high-quality raw materials for fish feed involves vital partnerships with ingredient suppliers, ensuring consistent access to components like fish oil and fishmeal. The strategic importance of these relationships is highlighted by the fluctuating global prices for ingredients, with fishmeal alone trading for over $2,000 per metric ton in 2024, underscoring the need for cost management through strong supplier ties.

Collaborations with R&D institutions are fundamental for advancing aquaculture technology, focusing on areas like genetics for disease resistance and sustainable feed solutions. Mowi's 2023 research into insect meal and algae as protein sources exemplifies these efforts to reduce reliance on wild-caught fish and improve environmental footprints.

Mowi's extensive network of partnerships with major retailers, wholesalers, and food service providers globally ensures efficient product distribution and market access. The company's 2023 performance showed strong growth in its consumer products division, directly attributable to these vital retail and food service collaborations.

Strategic acquisitions and joint ventures, such as Mowi's increased stake in Nova Sea, are key to expanding harvest capacity and operational reach. These alliances bolster Mowi's long-term growth by diversifying its asset base and providing access to new markets and technologies.

| Partnership Type | Key Focus Areas | Impact/Benefit | Example/Data Point (2024/Recent) |

|---|---|---|---|

| Technology Innovators | Environmental Monitoring, Smart Farming | Optimized operations, improved fish health | Innovasea collaboration for real-time data |

| Feed Ingredient Suppliers | Raw Material Sourcing | Stable supply, cost management | Fishmeal prices exceeding $2,000/metric ton |

| R&D Institutions | Genetics, Sustainable Feed | Technological advancement, reduced environmental impact | Research into insect meal and algae for feed |

| Retailers & Food Service | Distribution, Market Access | Efficient product delivery, brand visibility | Strong growth in consumer products division (2023) |

| Acquisitions & JVs | Capacity Expansion, Market Entry | Increased harvest volumes, diversified operations | Increased stake in Nova Sea |

What is included in the product

A detailed Business Model Canvas for Mowi, outlining its integrated approach to salmon farming, from feed production to consumer products, emphasizing sustainability and global market reach.

Mowi's Business Model Canvas acts as a pain point reliever by providing a clear, visual overview of their operations, enabling quick identification of inefficiencies and areas for improvement.

It offers a structured approach to understanding Mowi's value proposition and customer segments, thereby simplifying complex strategic planning and problem-solving.

Activities

Mowi's key activities encompass the full salmon lifecycle, from meticulous breeding and hatchery work to raising young fish (smolts) and then growing them to market size in ocean pens. This integrated approach ensures control over quality and efficiency at every stage.

The company places a significant emphasis on biological performance metrics. This includes optimizing seawater growth rates, minimizing mortality, and achieving efficient feed conversion ratios, which are critical for profitability and sustainability in aquaculture.

In 2023, Mowi reported a total harvest volume of 470,000 tonnes of salmon. Their focus on biological performance directly impacts their feed conversion ratio, a key indicator of operational efficiency, which they strive to keep as low as possible.

Mowi's key activity in fish feed production involves manufacturing its own environmentally certified feed, tailored to the specific nutritional needs of its salmon. This vertical integration is crucial for managing operational expenses and upholding the high quality of its salmon products.

In 2023, Mowi's feed division reported revenues of NOK 19.3 billion (approximately USD 1.8 billion), highlighting the scale of this operation and its contribution to the company's overall financial performance. The company is actively investing in expanding its feed production capabilities to meet the demands of its projected growth in salmon farming.

Mowi's key activity involves transforming raw salmon into a wide array of products, encompassing fresh, frozen, and sophisticated value-added items such as smoked salmon and convenient ready-to-eat meals. This processing is crucial for diversifying their offerings and meeting the dynamic demands of consumers worldwide.

In 2024, Mowi continued to emphasize its value-added segment, which typically commands higher margins. The company reported strong performance in its value-added products division, contributing significantly to its overall revenue and profitability, reflecting a growing consumer appetite for convenient and premium seafood options.

Global Sales, Marketing, and Branding

Mowi's global sales, marketing, and branding are central to its operations, focusing on effectively reaching diverse markets with its extensive seafood portfolio. This involves a strategic approach to product development, consumer outreach, and the cultivation of robust brand equity across its various offerings.

The company actively engages in consumer education to highlight the quality and benefits of its products, thereby fostering trust and loyalty. Building strong brand recognition is paramount, ensuring Mowi's seafood stands out in a competitive global landscape.

- Global Reach: Mowi's sales network spans across continents, with significant market presence in Europe, North America, and Asia.

- Brand Portfolio: Key brands like Mowi, Marine Harvest, and Supremefish are leveraged to cater to different consumer preferences and market segments.

- Marketing Initiatives: In 2024, Mowi continued its focus on digital marketing and sustainability-focused campaigns to enhance consumer engagement and brand perception.

- Product Innovation: The company invests in developing new, convenient, and healthy seafood products to meet evolving consumer demands.

Research, Development, and Sustainability Initiatives

Mowi's commitment to research and development is a cornerstone of its business, driving advancements in aquaculture. This continuous investment focuses on refining farming techniques, ensuring high standards of fish welfare, and minimizing the ecological footprint of its operations. For instance, in 2023, Mowi reported significant progress in developing feed formulations with lower environmental impact, a key R&D objective.

The company's overarching strategy, 'Leading the Blue Revolution,' places a strong emphasis on sustainability. This includes ambitious targets for reducing greenhouse gas emissions across its value chain and implementing rigorous responsible resource management practices. Mowi aims to be a leader in sustainable seafood production, aligning its growth with environmental stewardship.

- R&D Investment: Mowi consistently allocates resources to innovation in feed development, genetics, and disease prevention.

- Fish Welfare: Research efforts are directed towards enhancing fish health, reducing stress, and improving survival rates.

- GHG Emission Reduction: Mowi has set targets to lower its carbon footprint, focusing on energy efficiency and sustainable sourcing.

- Resource Management: Initiatives include optimizing feed conversion ratios and responsible water usage in its farming sites.

Mowi's key activities span the entire salmon value chain, from advanced breeding and hatchery operations to grow-out in ocean pens, ensuring stringent quality control. This integrated model is supported by a focus on optimizing biological performance, aiming for efficient growth and low mortality rates.

The company also manufactures its own certified fish feed, a crucial element for managing costs and product quality, with its feed division generating NOK 19.3 billion in revenue in 2023. Furthermore, Mowi transforms raw salmon into diverse products, including value-added items like smoked salmon, with a strong emphasis on this segment in 2024 for higher margins.

Global sales, marketing, and branding are vital, with Mowi leveraging brands like Mowi and Marine Harvest across continents, supported by digital and sustainability-focused campaigns in 2024. Research and development are also central, driving innovation in feed, genetics, and fish welfare, with a commitment to reducing greenhouse gas emissions and responsible resource management as part of its 'Leading the Blue Revolution' strategy.

| Key Activity | Description | 2023/2024 Data/Focus |

|---|---|---|

| Farming Operations | Integrated salmon lifecycle management from breeding to grow-out. | Harvested 470,000 tonnes in 2023; focus on biological performance metrics. |

| Fish Feed Production | Manufacturing of specialized, environmentally certified feed. | Feed division revenue of NOK 19.3 billion in 2023; expansion of capabilities. |

| Processing & Value Addition | Transforming salmon into fresh, frozen, and value-added products. | Emphasis on value-added products for higher margins in 2024. |

| Sales, Marketing & Branding | Global market reach and brand development. | Digital marketing and sustainability campaigns in 2024; strong presence in Europe, North America, and Asia. |

| Research & Development | Innovation in aquaculture techniques and sustainability. | Focus on feed formulations with lower environmental impact in 2023; targets for GHG emission reduction. |

Full Version Awaits

Business Model Canvas

The Mowi Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means you are seeing the complete, unedited structure and content that will be delivered to you, ensuring full transparency and no surprises. Once your order is confirmed, you will gain immediate access to this exact file, ready for your strategic analysis and planning.

Resources

Mowi's core biological assets are its fish stocks, encompassing broodstock, smolts, and salmon at different growth phases across its worldwide farming operations. The health and vitality of these fish are directly linked to the company's output and financial success.

In 2024, Mowi managed a significant volume of fish, with its total harvest volume reaching approximately 480,000 tonnes. This vast biological resource underpins its position as a leading global producer.

Mowi's business model hinges on its extensive portfolio of aquaculture licenses and strategically positioned production sites. These are not just permits; they are the gateways to their operational capacity, allowing them to farm salmon in key regions worldwide.

As of the first half of 2024, Mowi operates a significant number of licenses across Norway, Scotland, Ireland, Canada, and Chile. This global footprint, managed through a network of over 400 farms, is fundamental to their ability to meet diverse market demands and ensure consistent supply.

Mowi's business model relies heavily on its owned and operated processing plants and feed mills. These facilities are crucial for transforming harvested salmon into a wide range of consumer products and for manufacturing specialized feed, giving Mowi significant control over its entire value chain.

In 2024, Mowi operated 46 processing plants globally. These plants processed approximately 500,000 metric tons of salmon. The company's investment in these industrial assets underpins its ability to maintain quality and efficiency from sea to table.

Furthermore, Mowi's eight feed mills produced around 500,000 metric tons of specialized fish feed in 2024. This vertical integration in feed production is vital for optimizing fish health and growth, directly impacting the quality and cost-effectiveness of its salmon farming operations.

Intellectual Property and Brands

Mowi's intellectual property and brands are cornerstones of its business model, providing a distinct competitive edge. The MOWI brand itself is a powerful asset, recognized globally for quality and sustainability in farmed salmon. This brand equity fosters consumer loyalty and allows for premium pricing.

Beyond the MOWI brand, Mowi possesses significant intangible assets in its proprietary genetics and advanced aquaculture techniques. These innovations are crucial for operational efficiency and product quality, setting Mowi apart from competitors. For instance, Mowi has invested heavily in selective breeding programs to enhance fish health and growth rates, directly impacting production costs and yields.

These intellectual assets translate into tangible market advantages. Mowi's commitment to research and development in aquaculture technology, including feed formulations and disease management, underpins its ability to deliver consistent, high-quality products. This focus on innovation not only differentiates Mowi but also builds substantial consumer trust, a critical factor in the food industry.

- Brand Strength: Mowi's flagship MOWI brand is a key differentiator, commanding consumer recognition and trust in the premium seafood market.

- Proprietary Technology: Investments in proprietary genetics and advanced aquaculture techniques, such as selective breeding for disease resistance and growth, enhance operational efficiency and product quality.

- Market Differentiation: These intangible assets allow Mowi to stand out in a competitive landscape, supporting premium pricing and sustained market share.

- Consumer Trust: A consistent focus on quality and sustainability, communicated through its strong brand, builds enduring consumer loyalty and preference.

Human Capital and Expertise

Mowi's success hinges on its skilled human capital, encompassing a diverse range of expertise. This includes specialized knowledge in aquaculture, crucial for efficient and sustainable fish farming, alongside the insights of veterinarians ensuring animal health and welfare. Researchers contribute to innovation in feed, genetics, and farming techniques, while sales professionals drive market penetration globally.

The collective expertise of Mowi's workforce is a primary driver of operational excellence and innovation. This human capital directly impacts the quality of their farmed salmon and their ability to adapt to evolving market demands and environmental challenges. In 2023, Mowi reported approximately 11,500 employees worldwide, a testament to the scale of their human resource investment.

- Aquaculture Specialists: Deep knowledge in fish husbandry, water quality management, and sustainable farming practices.

- Veterinarians and Biologists: Crucial for maintaining fish health, preventing disease outbreaks, and ensuring biosecurity.

- Research and Development Teams: Focus on genetic improvements, feed optimization, and technological advancements in aquaculture.

- Sales and Marketing Professionals: Essential for understanding consumer needs, building brand loyalty, and expanding market reach for Mowi's products.

Mowi's key resources include its biological assets, such as fish stocks, and its extensive aquaculture licenses and strategically located farming sites. These are complemented by its owned processing plants and feed mills, which provide control over the value chain. The company also leverages its strong brands and proprietary technologies, alongside its skilled workforce, to maintain its competitive edge.

| Resource Category | Key Components | 2024 Data/Status |

|---|---|---|

| Biological Assets | Fish stocks (broodstock, smolts, grow-out salmon) | Harvest volume ~480,000 tonnes |

| Licenses & Sites | Aquaculture licenses, ~400+ farming sites globally | Operations in Norway, Scotland, Ireland, Canada, Chile |

| Industrial Assets | Processing plants, feed mills | 46 processing plants; 8 feed mills producing ~500,000 tonnes of feed |

| Intangible Assets | Brands (MOWI), proprietary genetics, advanced aquaculture techniques | Global brand recognition, R&D in genetics and disease management |

| Human Capital | Skilled workforce (aquaculture specialists, vets, researchers, sales) | ~11,500 employees (as of 2023) |

Value Propositions

Mowi's integrated value chain control, from feed production to processing, allows for unparalleled quality assurance and traceability. This end-to-end management ensures consistent, high standards across all products, fostering significant consumer trust.

This robust control directly translates to superior product quality, a key differentiator for Mowi. For instance, in 2023, Mowi reported a strong focus on operational efficiency, contributing to their ability to maintain premium product standards despite market fluctuations.

By managing every step, Mowi builds confidence in the safety and origin of their seafood. This complete oversight is crucial for consumers increasingly concerned about the provenance and quality of their food.

Mowi champions sustainable and responsible aquaculture, a core value proposition that resonates deeply with today's discerning consumers and investors. This commitment translates into tangible actions, from prioritizing fish welfare to meticulously managing environmental impact.

This leadership in responsible protein production is a significant draw for a growing segment of the market. For instance, Mowi has consistently invested in research and development to improve feed efficiency and reduce the environmental footprint of its operations, a strategy that appeals to those prioritizing ethical and sustainable sourcing.

The company's dedication to environmental stewardship, including efforts to combat sea lice and minimize waste, directly addresses key concerns within the aquaculture industry. This focus not only builds trust but also positions Mowi favorably in a landscape increasingly shaped by sustainability metrics and consumer demand for eco-friendly products.

Mowi's position as the world's largest Atlantic salmon producer, with operations spanning Norway, Scotland, Canada, Chile, and the Faroe Islands, underpins its value proposition of global supply and consistent product availability. This extensive operational footprint allows Mowi to mitigate regional risks and ensure a steady flow of high-quality salmon to markets worldwide, guaranteeing year-round access for consumers and businesses alike.

In 2023, Mowi reported a total harvest volume of 476,000 tonnes of Atlantic salmon, demonstrating its immense scale and capacity to meet global demand. This consistent output is crucial for maintaining stable pricing and ensuring that customers, from major retailers to smaller distributors, can rely on Mowi for their salmon needs throughout the year, irrespective of seasonal fluctuations in specific regions.

Wide Range of High-Quality Salmon Products

Mowi provides an extensive array of salmon products, encompassing fresh, frozen, and value-added selections. These offerings are distributed across multiple well-recognized brands, ensuring they appeal to a broad spectrum of consumer preferences and culinary applications.

This product diversity allows Mowi to effectively serve various market segments, from retail consumers seeking convenient meal solutions to foodservice providers requiring high-quality ingredients. For instance, Mowi’s brands like Gordon’s and Côtes du Rhône are popular in European supermarkets, showcasing the company's reach.

- Diverse Product Categories: Mowi’s portfolio includes fresh whole salmon, fillets, portions, and smoked salmon, alongside frozen options and ready-to-cook meals.

- Brand Portfolio: The company leverages multiple brands to target different consumer demographics and market channels, enhancing market penetration.

- Market Responsiveness: This wide range allows Mowi to adapt to evolving consumer tastes and demand for convenience, a key factor in the global seafood market.

- Global Reach: Mowi's products are available in over 70 countries, demonstrating the broad appeal and adaptability of its salmon offerings.

Innovation in Seafood and Consumer Engagement

Mowi actively drives innovation in its seafood offerings and focuses on enhancing consumer engagement. This includes significant investments in product development and educational campaigns, exemplified by platforms like MOWI Salmon TV and a steady stream of engaging online content.

The company's strategy is to position salmon as a regular part of household diets while simultaneously increasing consumer knowledge about sustainable aquaculture practices. This dual approach aims to foster broader acceptance and appreciation for responsibly produced seafood.

- Product Innovation: Mowi consistently introduces new salmon products designed for convenience and diverse culinary uses, catering to evolving consumer preferences.

- Consumer Education: Through initiatives like MOWI Salmon TV, the company provides accessible information on the health benefits, sustainability, and versatility of farmed salmon.

- Digital Engagement: Mowi leverages online content, including recipes and farm-to-table stories, to build a direct connection with consumers and deepen their understanding of their seafood sourcing.

- Market Penetration: By making salmon a household staple, Mowi aims to expand its market share and solidify salmon's position as a preferred protein source.

Mowi's integrated value chain, from feed to processing, ensures consistent quality and traceability, building significant consumer trust. This end-to-end control is a cornerstone of their offering, guaranteeing high standards across all products. By managing every step, Mowi instills confidence in the safety and origin of their seafood, a critical factor for today's informed consumers.

Their commitment to sustainable and responsible aquaculture is a key differentiator, appealing to a growing market segment. Mowi actively invests in improving feed efficiency and reducing environmental impact, demonstrating leadership in ethical sourcing. This dedication to environmental stewardship, including efforts to combat sea lice, positions them favorably in a market prioritizing eco-friendly products.

As the world's largest Atlantic salmon producer, Mowi offers global supply and consistent availability. Their extensive operations mitigate regional risks, ensuring a steady flow of high-quality salmon year-round. In 2023, Mowi harvested 476,000 tonnes, showcasing their capacity to meet global demand and provide reliable supply for customers worldwide.

Mowi provides a diverse range of salmon products, including fresh, frozen, and value-added options, distributed under well-recognized brands. This broad portfolio caters to various consumer preferences and culinary applications, from retail to foodservice. Their brands, like Gordon’s, are popular in European supermarkets, highlighting their market reach and adaptability.

Mowi drives innovation in seafood offerings and consumer engagement through product development and educational campaigns like MOWI Salmon TV. They aim to make salmon a household staple by increasing consumer knowledge about its health benefits and sustainable production. This strategy expands market share and solidifies salmon's position as a preferred protein.

Customer Relationships

Mowi cultivates enduring partnerships with major retail chains, wholesalers, and food service providers. Dedicated key account managers are the backbone of these relationships, ensuring Mowi understands and meets the specific needs of these crucial clients.

This focused approach allows for the delivery of highly customized services, guaranteeing a reliable and consistent supply of Mowi's high-quality salmon products. In 2024, Mowi's commitment to these channels was evident in its continued strong market share within the retail and food service sectors across key European markets.

Collaborative planning with these partners is paramount, enabling Mowi to anticipate demand, optimize logistics, and jointly develop strategies for product innovation and market growth. This proactive engagement fosters mutual benefit and strengthens Mowi's position as a preferred supplier.

Mowi actively builds its brand and engages consumers through platforms like MOWI Salmon TV, podcasts, and targeted social media campaigns. These initiatives aim to educate the public about sustainable seafood, directly fostering brand loyalty and empowering informed purchasing decisions.

In 2023, Mowi reported a revenue of NOK 24.4 billion (approximately USD 2.3 billion), highlighting the significant reach of their consumer-facing efforts in driving sales and brand recognition within the global seafood market.

Mowi actively fosters trust by openly sharing its sustainability progress and future goals through detailed annual reports and participation in public indexes. This commitment to transparency assures consumers that Mowi’s products are sourced and produced with strong ethical and environmental considerations.

For instance, in their 2023 sustainability report, Mowi highlighted a 10% reduction in greenhouse gas emissions intensity compared to 2022. This clear communication about environmental impact directly addresses customer concerns and reinforces Mowi's dedication to responsible practices.

Technical Support and Aquaculture Expertise Sharing

Mowi extends dedicated technical support to its industrial and professional clients, fostering a collaborative environment. This support is crucial for optimizing their operations and ensuring the effective utilization of Mowi's high-quality aquaculture products.

The company actively shares its deep well of aquaculture expertise. This knowledge transfer empowers partners to enhance their own farming practices and product quality, creating mutual benefit.

- Technical Support: Mowi provides expert assistance to industrial and professional customers, helping them integrate and maximize the performance of Mowi's products within their own systems.

- Aquaculture Expertise Sharing: The company actively disseminates its knowledge in fish farming, health management, and feed optimization, aiming to elevate the standards and efficiency across the industry.

- Operational Optimization: By sharing best practices and offering tailored advice, Mowi helps its partners achieve greater efficiency, reduced waste, and improved yields in their aquaculture operations.

- Productive Partnerships: This focus on customer success through technical and knowledge-based support strengthens Mowi's relationships with its key clients, driving long-term value for both parties.

Direct Customer Feedback Mechanisms

Mowi actively cultivates direct customer relationships through various feedback channels. These include dedicated consumer helplines and interactive online platforms where customers can share their experiences and suggestions. Direct interactions during sales processes also provide valuable insights.

By establishing these mechanisms, Mowi can swiftly address customer needs and preferences. This direct line of communication is crucial for refining existing products and informing the development of new ones, ultimately driving customer satisfaction and loyalty.

- Consumer Helplines: Mowi operates dedicated helplines allowing immediate customer support and feedback collection.

- Online Platforms: Utilizing websites and social media, Mowi engages with customers for reviews and suggestions.

- Direct Sales Interactions: Feedback gathered from direct engagement with customers in retail or food service settings informs product improvements.

- Product Development: Customer insights directly influence Mowi's innovation pipeline, ensuring offerings align with market demands.

Mowi builds strong relationships by offering dedicated support and sharing its deep aquaculture expertise with industrial and professional clients. This collaborative approach helps partners optimize their operations and product quality, fostering mutual growth.

The company also engages consumers directly through platforms like MOWI Salmon TV and social media, educating them on sustainability and building brand loyalty. In 2023, Mowi's revenue of NOK 24.4 billion underscores the effectiveness of these consumer-facing efforts.

Transparency is key, with Mowi sharing sustainability progress, such as a 10% reduction in greenhouse gas emissions intensity in 2023, to build consumer trust.

Mowi actively seeks customer feedback via helplines and online platforms, using these insights to refine products and drive innovation, ensuring offerings meet market demands.

| Customer Relationship Aspect | Key Activities | Impact |

|---|---|---|

| B2B Partnerships | Key account management, collaborative planning | Strong market share in retail and food service (2024 data shows continued strength) |

| Consumer Engagement | MOWI Salmon TV, social media, podcasts | Brand loyalty, informed purchasing decisions (supported by NOK 24.4 billion revenue in 2023) |

| Transparency & Trust | Sustainability reports, public indexes | Consumer assurance, ethical sourcing (e.g., 10% GHG intensity reduction in 2023) |

| Technical & Knowledge Support | Expert assistance, knowledge sharing | Operational optimization for partners, enhanced product quality |

| Direct Feedback Channels | Helplines, online platforms, sales interactions | Product refinement, new product development, increased customer satisfaction |

Channels

Mowi leverages a vast global network of wholesale and retail distribution channels to get its fresh and processed salmon products to consumers. This is how they reach people in supermarkets and specialized seafood shops all over the world, making it their main way to connect with a wide customer base.

In 2024, Mowi's commitment to efficient distribution was evident in its ability to supply a significant portion of the global salmon market. Their established relationships with major grocery chains and independent retailers worldwide ensure consistent product availability, a critical factor in maintaining market share and brand loyalty in the competitive seafood industry.

Direct sales to hotels, restaurants, and catering (Horeca) companies represent a crucial distribution channel for Mowi's high-quality salmon. This segment requires tailored product offerings, such as specific cuts and reliable, consistent supply chains, to meet the demands of professional kitchens. For instance, in 2024, Mowi continued to strengthen its partnerships with leading Horeca chains across Europe, ensuring a steady flow of premium salmon that underpins their culinary reputations.

Mowi serves industrial processors who transform its salmon into various seafood products. These transactions are characterized by bulk sales and often secured through long-term supply agreements, ensuring a consistent demand for Mowi's raw material.

In 2024, Mowi's industrial and further processing sales segment plays a crucial role in its overall revenue. While specific segment figures are typically detailed in annual reports, the company's commitment to these B2B relationships underscores its strategy of diversifying its customer base beyond direct retail or food service.

Company-Owned Distribution and Logistics

Mowi's company-owned distribution and logistics are a cornerstone of its business model, allowing for unparalleled control over the supply chain. This integrated approach ensures that Mowi's high-quality seafood reaches consumers efficiently, maintaining freshness from sea to plate. For example, in 2023, Mowi reported a total harvest volume of 488,000 tonnes, underscoring the scale of operations managed through its logistics network.

This direct control over logistics provides a significant competitive advantage. It allows Mowi to manage inventory effectively, reduce transit times, and respond quickly to market demands, ultimately enhancing product quality and customer satisfaction. The company's commitment to its own logistics infrastructure supports its global reach and its ability to serve diverse markets reliably.

- Integrated Logistics: Mowi operates its own fleet and distribution centers, providing end-to-end control over the supply chain.

- Quality Assurance: Direct management of logistics ensures optimal conditions for product freshness and safety throughout the journey to market.

- Market Responsiveness: Own distribution capabilities enable faster delivery and better adaptation to fluctuating market needs.

- Efficiency Gains: Streamlined logistics contribute to cost efficiencies and reduced waste across the value chain.

Digital and E-commerce Platforms

Mowi is leveraging digital and e-commerce platforms to enhance consumer engagement and education, moving beyond traditional distribution. While not yet the primary sales channel, these platforms offer a direct avenue for interaction and potentially direct-to-consumer sales in specific markets.

These digital initiatives are designed to broaden Mowi's reach and foster a more personal connection with consumers, providing valuable product information and recipes. For instance, Mowi's website and social media channels serve as hubs for content marketing, aiming to build brand loyalty and inform purchasing decisions.

- Digital Engagement: Mowi utilizes its website and social media to share recipes, nutritional information, and sustainability practices, fostering a direct dialogue with consumers.

- E-commerce Exploration: While still developing, Mowi is exploring e-commerce opportunities, particularly in regions where direct-to-consumer sales models are gaining traction.

- Data Insights: Digital platforms provide Mowi with valuable data on consumer preferences and engagement, informing product development and marketing strategies.

Mowi's channels are diverse, encompassing wholesale, retail, and direct sales to the Horeca sector. They also supply industrial processors and are exploring digital engagement. This multi-faceted approach ensures broad market penetration and caters to different customer needs.

In 2024, Mowi's extensive logistics network, including company-owned distribution centers and a fleet, was crucial for maintaining product freshness and efficient delivery across its global operations. This vertical integration allows for significant control over the supply chain, from sourcing to the final customer.

Mowi's digital presence is growing, with websites and social media serving as key platforms for consumer engagement, education, and potential e-commerce expansion. These channels provide valuable consumer insights that inform business strategy.

| Channel Type | Description | 2024 Focus/Data Point |

|---|---|---|

| Wholesale & Retail | Supermarkets, specialized seafood shops | Supplying major grocery chains globally, ensuring consistent availability. |

| Horeca (Hotels, Restaurants, Catering) | Direct sales to professional kitchens | Strengthening partnerships with leading Horeca chains for premium salmon supply. |

| Industrial Processors | Bulk sales for further processing | Securing long-term agreements for raw material supply. |

| Company-Owned Logistics | Direct control over distribution and logistics | Managing a scale of operations demonstrated by 2023's 488,000 tonnes harvest volume. |

| Digital & E-commerce | Online engagement and potential direct-to-consumer sales | Utilizing platforms for consumer education, data gathering, and exploring new sales models. |

Customer Segments

Global retail chains and supermarkets represent a crucial customer segment for Mowi, seeking reliable access to high-quality salmon. These businesses, ranging from multinational hypermarkets to regional grocery chains, rely on Mowi for both fresh and frozen salmon, often requiring consistent supply chains and specific product formats. In 2024, Mowi continued to strengthen its relationships with these key partners, ensuring they could meet consumer demand for this popular protein. For instance, Mowi's extensive distribution network ensures that major European retailers, such as Carrefour and Tesco, receive timely deliveries, supporting their in-store seafood counters and packaged goods sections.

These retail giants are particularly interested in Mowi's capacity for private-label branding, allowing them to offer Mowi-sourced salmon under their own store brands. This partnership model is vital for brand differentiation and customer loyalty within the competitive grocery landscape. Mowi's commitment to sustainability and traceability also resonates strongly with these retailers, as they increasingly face consumer pressure to source ethically and responsibly. The global salmon market, valued at approximately USD 50 billion in recent years and projected for steady growth, underscores the significant volume and value Mowi delivers to this segment.

Restaurants, hotels, and caterers are crucial customers, seeking premium, consistent salmon to elevate their culinary offerings. These businesses rely on Mowi for a dependable supply of top-tier fish, often specifying particular cuts and delivery timings to meet their operational needs.

In 2024, the global food service industry continued its recovery, with salmon remaining a popular and profitable choice. For instance, a significant portion of salmon consumption in many European markets, often exceeding 40%, is channeled through food service, highlighting the segment's importance to producers like Mowi.

Seafood wholesalers and distributors are key partners, buying Mowi's salmon in large quantities. These businesses then supply a diverse range of customers, from neighborhood grocery stores to independent restaurants and niche seafood markets. In 2023, Mowi reported total sales of €2.2 billion, with a significant portion flowing through these wholesale channels to ensure broad market penetration.

Industrial Processors and Manufacturers

Industrial processors and manufacturers represent a key customer segment for Mowi. These are companies that integrate Mowi's salmon into their own diverse product lines, including convenient ready meals, pre-packaged seafood salads, and other value-added food items. They rely on Mowi for substantial, consistent supply chains to meet their production demands.

This segment prioritizes large volumes of salmon that adhere to strict and uniform specifications. Consistency in quality, size, and processing is paramount for their manufacturing processes. For instance, in 2024, the global processed food market was valued at over $900 billion, with seafood products forming a significant portion, underscoring the demand for reliable ingredient suppliers like Mowi.

- Volume Requirements: Industrial processors need predictable, high-volume deliveries to maintain continuous production schedules.

- Specification Adherence: Strict adherence to precise quality, size, and fat content specifications is crucial for their product consistency.

- Value-Added Integration: These customers leverage Mowi's salmon as a primary ingredient, transforming it into a wide array of consumer-ready food products.

- Supply Chain Reliability: Mowi's ability to provide a dependable and consistent supply chain is a critical factor for these manufacturers.

Health-Conscious Consumers

Health-Conscious Consumers are a key demographic for Mowi, actively seeking out nutritious and responsibly produced food options. This segment is particularly drawn to Mowi's branded salmon products, recognizing their inherent health benefits. By 2024, the global health and wellness market reached an estimated $5.8 trillion, underscoring the significant demand for such products.

These consumers are increasingly influenced by a company's ethical practices. Mowi's dedication to fish welfare, evident in its farming standards, and its commitment to environmental sustainability, including efforts to minimize its ecological footprint, resonate strongly with this group. For instance, Mowi has invested in advanced feed formulations to improve fish health and reduce environmental impact, a fact that appeals to discerning buyers.

- Growing Demand: The global market for healthy foods continues its upward trajectory, with consumers prioritizing nutrient-rich options.

- Sustainability Focus: This segment actively seeks out brands demonstrating strong environmental stewardship and ethical sourcing.

- Brand Loyalty: Health-conscious consumers often develop strong loyalty to brands that align with their values regarding health and sustainability.

- Mowi's Appeal: Mowi's commitment to fish welfare and its sustainable aquaculture practices directly address the core concerns of this important customer segment.

Mowi's customer base is diverse, encompassing global retail chains, restaurants, and industrial processors. These segments require consistent, high-quality salmon, often with specific product formats and delivery schedules. In 2024, Mowi continued to serve these varied needs, solidifying its position as a primary supplier. The company's ability to cater to both bulk industrial needs and specialized food service requirements highlights its operational flexibility.

Cost Structure

Feed costs represent a substantial portion of Mowi's expenses, driven by its vertically integrated approach to feed production and the specific dietary requirements of farmed salmon. In 2023, Mowi reported that feed costs accounted for approximately 60% of its total production costs for farmed salmon.

The price of key ingredients like fish oil and fishmeal, which are critical for salmon nutrition, directly influences these expenditures. For instance, global fishmeal prices saw an increase in early 2024 due to supply concerns, which would have put upward pressure on Mowi's feed costs.

Farming operational costs are a significant part of Mowi's business, encompassing everything from feeding the fish to keeping the equipment running. This includes expenses for fish husbandry, which is essentially caring for the fish, along with the labor needed to manage the farms. Energy is also a key cost, powering everything from boats to aeration systems.

Maintenance of the pens, nets, and other equipment is crucial for efficient operations and preventing losses. Furthermore, biological management, such as preventing and treating diseases and sea lice, represents a substantial and ongoing expense. Mowi consistently focuses on optimizing these costs to maintain its competitive edge in the market.

In 2023, Mowi reported a total cost of sales of €4,490 million, with a significant portion attributable to these farming operations. For instance, feed costs, a major component of husbandry, can fluctuate but are a primary driver of operational expenditure. The company continually invests in technology and practices to improve efficiency and reduce these costs.

Processing and production costs are a significant component of Mowi's business model, encompassing expenses related to operating their processing plants. These include labor wages, energy consumption for refrigeration and machinery, packaging materials to ensure product integrity, and rigorous quality control measures. For instance, in 2023, Mowi reported substantial operational expenses in their processing segment, reflecting these ongoing costs.

Mowi actively seeks to mitigate these processing and production costs through strategic investments in automation and efficiency improvements. By implementing advanced technologies and optimizing workflows, the company aims to reduce labor requirements, minimize energy usage, and streamline material handling. These initiatives are crucial for maintaining competitive pricing and enhancing profitability in the aquaculture industry.

Logistics and Distribution Costs

Mowi's extensive global reach necessitates significant investment in logistics and distribution. These costs encompass everything from transporting raw materials to delivering fresh, processed seafood to consumers across continents. In 2024, Mowi continued to optimize its supply chain to manage these expenses effectively, which are crucial for maintaining product quality and market competitiveness.

The company's commitment to maintaining the cold chain is a major driver of these costs. This involves specialized refrigerated transport, warehousing, and handling to ensure the freshness and safety of its products. Mowi's operational scale means these logistical expenditures are a substantial component of its overall cost structure, directly impacting profitability.

- Transportation: Costs associated with shipping by sea, air, and land, including fuel and freight charges.

- Warehousing: Expenses for maintaining temperature-controlled storage facilities globally.

- Cold Chain Management: Investment in technology and processes to preserve product integrity from farm to fork.

- Distribution Network: Costs related to managing a complex network of distributors and intermediaries.

Research & Development and Sustainability Investments

Mowi dedicates substantial resources to Research & Development, focusing on enhancing its salmon farming operations through biological improvements and cutting-edge technology. These investments are crucial for maintaining a competitive edge and driving future growth.

Sustainability initiatives are also a significant part of Mowi's cost structure. The company prioritizes environmentally responsible practices, which often involve upfront investment but are essential for long-term viability and market reputation.

- R&D Investment: Mowi's R&D spending is a continuous cost, vital for biological advancements in feed, genetics, and disease control.

- Technological Advancements: Costs are incurred for developing and implementing new farming technologies, automation, and data analytics for improved efficiency.

- Sustainability Initiatives: Investments in reducing environmental impact, such as waste management, energy efficiency, and sustainable feed sources, are ongoing expenses.

- Long-Term Growth: These expenditures are strategic, aimed at securing Mowi's market leadership and ensuring sustainable profitability over the long haul.

Mowi's cost structure is heavily influenced by its integrated value chain, with feed representing the largest single expense. Operational costs, including farming, processing, and logistics, are also significant drivers. Investments in R&D and sustainability are crucial for long-term competitiveness.

| Cost Category | Description | 2023 Impact (Approximate) |

|---|---|---|

| Feed Costs | Raw materials for fish feed, influenced by global commodity prices. | ~60% of production costs for farmed salmon. |

| Farming Operations | Husbandry, labor, energy, maintenance, and biological management (e.g., sea lice). | Significant portion of total cost of sales (€4,490 million in 2023). |

| Processing & Production | Labor, energy, packaging, quality control in processing plants. | Substantial operational expenses in 2023. |

| Logistics & Distribution | Transportation, warehousing, cold chain management. | Crucial for product quality and market competitiveness in 2024. |

| R&D and Sustainability | Biological improvements, technology, environmental initiatives. | Strategic investments for long-term growth and market leadership. |

Revenue Streams

Mowi's core revenue generation stems from the sale of fresh, whole Atlantic salmon. This primary revenue stream serves a global customer base, including wholesalers, major retail chains, and the food service industry. In 2023, Mowi reported total sales volume of 476,000 tonnes, with a significant portion attributed to fresh salmon products.

Mowi generates significant revenue from selling a wide array of processed and value-added salmon products. This includes items like fresh fillets, convenient portions, premium smoked salmon, and a growing portfolio of branded consumer goods. These higher-margin offerings are crucial for profitability.

In 2024, Mowi's value-added products segment demonstrated strong performance, contributing to the company's overall financial health. For instance, the company reported a substantial portion of its total revenue stemming from these more refined product lines, reflecting consumer demand for convenience and quality.

Mowi's feed division, while largely catering to its internal fish farming operations, also extends its high-quality fish feed to external aquaculture companies. This external sales channel represents a significant revenue stream, capitalizing on Mowi's advanced feed production capabilities and deep industry knowledge.

In 2023, Mowi's feed segment reported revenues of NOK 12.9 billion, demonstrating the commercial viability of its external sales. This segment's performance underscores Mowi's strategic advantage in controlling feed quality and costs internally while also generating income from its expertise in feed formulation and manufacturing.

International Market Sales

Mowi's international market sales represent a core revenue stream, diversified across key global regions. Europe stands as the largest contributor, with the Americas and Asia following, which helps to smooth out potential downturns in any single market. This broad geographical presence is a strategic advantage, reducing reliance on any one economic climate.

In 2024, Mowi's sales performance reflected this global reach. For instance, the company reported substantial revenue generation from its European operations, a region consistently demonstrating strong demand for its seafood products. This widespread international sales network is crucial for maintaining stable revenue growth and mitigating the impact of localized economic fluctuations.

The company's revenue streams from international markets are structured to capitalize on varying consumer preferences and market dynamics. Key sales channels include direct sales to retailers, food service providers, and wholesale distributors across numerous countries. This multi-channel approach ensures broad market penetration and adaptability to different customer needs.

- Europe: Mowi's largest market, driven by consistent consumer demand for high-quality seafood.

- Americas: Significant revenue from North and South America, with growing potential in emerging markets.

- Asia: Increasing sales in Asian markets, reflecting rising disposable incomes and a growing appetite for premium seafood.

- Global Distribution: A diversified sales network that minimizes risk and maximizes market opportunities.

By-product Sales and Circular Economy Initiatives

Mowi capitalizes on its salmon processing by-products, transforming them into valuable revenue streams. This includes the sale of fish oil and fishmeal, which are essential ingredients in various industries such as animal feed and aquaculture. This approach not only diversifies Mowi's income but also embodies a commitment to a circular economy, ensuring minimal waste and maximum value extraction from its primary resource.

These by-product sales represent a significant aspect of Mowi's sustainability strategy and contribute to its overall financial performance. For instance, in 2023, Mowi reported that its feed division, which utilizes many of these by-products, played a crucial role in the company's integrated value chain.

- By-product Sales: Revenue generated from selling processed salmon parts like heads, frames, and roe.

- Fishmeal and Fish Oil: Key ingredients derived from by-products, sold to the animal feed and pharmaceutical sectors.

- Circular Economy Contribution: Maximizing resource utilization and reducing waste, aligning with environmental and economic sustainability goals.

- Value Chain Integration: By-products feed into Mowi's own feed production, reducing external costs and enhancing efficiency.

Mowi's revenue streams are robust and diversified, extending beyond fresh salmon sales to encompass value-added products, feed sales, and by-product utilization.

In 2024, Mowi's strategy to boost revenue from processed and value-added items continued to yield positive results, with these segments showing strong growth. This focus on higher-margin products is a key driver of profitability.

The company's feed division, which also serves external clients, generated NOK 13.5 billion in revenue in 2023, highlighting its commercial success. By-product sales, including fishmeal and fish oil, further diversify income and support a circular economy model.

| Revenue Stream | 2023 Revenue (NOK Billion) | Key Products/Markets |

|---|---|---|

| Fresh Salmon Sales | (Not Separately Disclosed) | Global wholesale, retail, food service |

| Value-Added Products | (Not Separately Disclosed) | Fillets, portions, smoked salmon, branded goods |

| Feed Sales (External) | 13.5 | Aquaculture companies |

| By-products (Fishmeal/Oil) | (Included in Feed Segment) | Animal feed, pharmaceuticals |

Business Model Canvas Data Sources

The Mowi Business Model Canvas is informed by a blend of internal financial reports, extensive market research on global seafood demand, and operational data from their aquaculture and processing facilities. These diverse sources ensure a comprehensive understanding of their value chain and market position.