Mowi Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Mowi Bundle

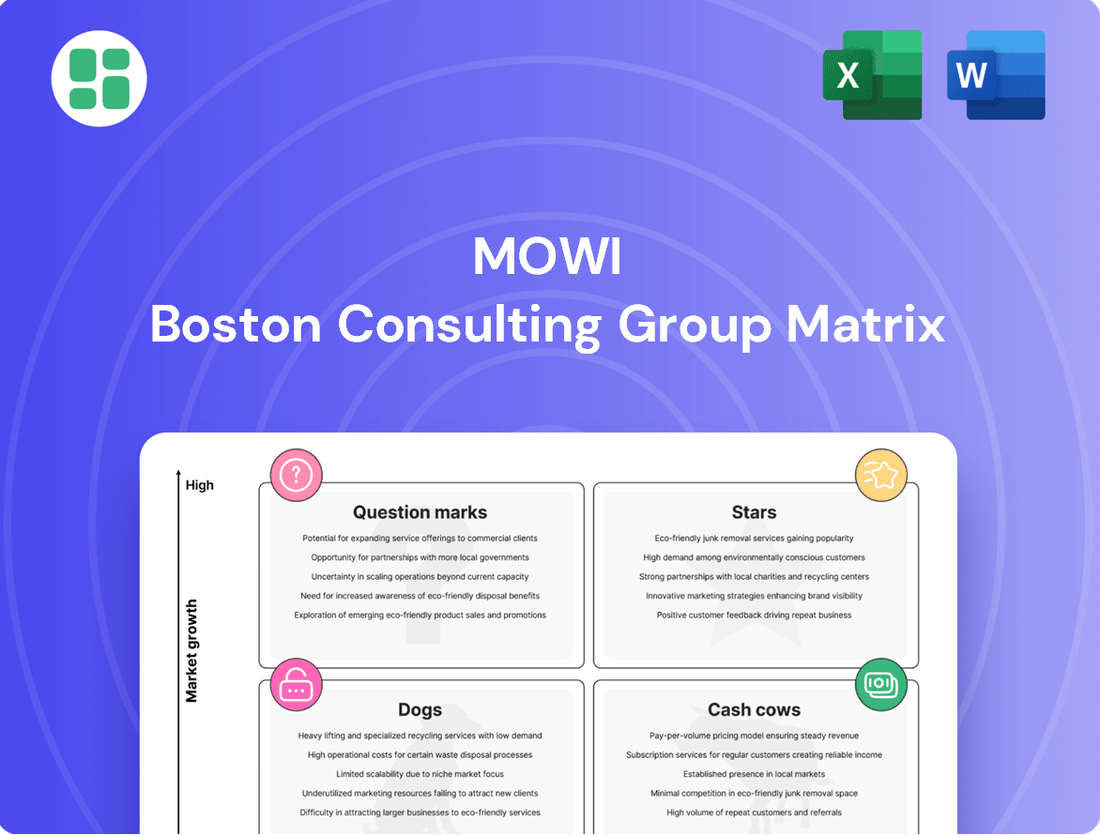

Curious about Mowi's product portfolio? This glimpse into their BCG Matrix reveals the strategic positioning of their key offerings, highlighting areas of growth and stability. Understand which products are fueling Mowi's success and which require careful consideration.

To truly unlock Mowi's strategic potential, dive into the full BCG Matrix. Gain a comprehensive understanding of their Stars, Cash Cows, Dogs, and Question Marks, complete with actionable insights and data-driven recommendations to optimize your investment and product decisions.

Don't miss out on the complete picture. Purchase the full BCG Matrix report for an in-depth analysis that will empower you to make informed strategic moves and stay ahead in the competitive seafood industry.

Stars

Mowi's branded consumer products, especially the MOWI brand, are shining stars in the expanding market for convenient, high-quality seafood. The company is putting significant resources into growing this brand internationally, targeting Europe, the US, and Asia to build strong consumer recognition and preference.

This strategic focus paid off handsomely in 2024, with the branded consumer products segment reporting record profits. This success highlights Mowi's strong market position and the considerable growth opportunities within the premium seafood sector.

Mowi's strategic focus on advanced land-based hatcheries, particularly for raising larger post-smolts, is a significant factor in its growth. This approach, exemplified by facilities such as the Nordheim hatchery, aims to bolster fish resilience and reduce the biological risks associated with the early stages of growth. This investment is crucial for enhancing overall productivity and sustainability in their operations.

By investing in land-based post-smolt rearing, Mowi is directly addressing environmental concerns and improving fish welfare. This forward-thinking strategy is designed to yield higher harvest volumes and superior biological performance. For instance, Mowi reported significant progress in its land-based operations, contributing to a more stable and predictable supply chain, which is vital in the aquaculture sector.

Mowi's acquisition of a controlling stake in Nova Sea, increasing its ownership from 49% to 95%, is a prime example of a strategic move to bolster its position in the salmon farming industry. This significant consolidation directly enhances Mowi's market share and volume capabilities, especially within Norway, a crucial operational hub.

This move is projected to add considerable harvest volumes to Mowi's operations, directly supporting its ambitious target of reaching 600,000 tonnes by 2026. Such strategic acquisitions are vital for maintaining and expanding leadership in competitive salmon farming regions.

Global Atlantic Salmon Farming Operations (Norway, Scotland, Chile)

Mowi's core Atlantic salmon farming operations in Norway, Scotland, and Chile are undeniably its Stars. These regions are crucial for Mowi's global presence in the expanding seafood market, consistently delivering impressive harvest volumes. For instance, Mowi reported a total harvest volume of 458,000 tonnes in 2023, with a substantial portion coming from these key territories, highlighting their dominant market share.

The company's strategic focus on cost competitiveness and strong biological performance in these locations fuels their Star status. Mowi's commitment to efficient farming practices and innovation allows them to maintain high production levels and profitability. Their ability to scale operations while ensuring quality and sustainability is a testament to their leadership in these vital markets.

- Norway: Mowi's Norwegian operations are a cornerstone, benefiting from favorable environmental conditions and advanced farming technologies.

- Scotland: Scotland represents a significant contributor to Mowi's global harvest, with ongoing investments in capacity and efficiency.

- Chile: Chile is a vital production hub, where Mowi leverages its expertise to navigate market dynamics and maintain strong output.

Sustainable Aquaculture Practices & Technology Integration

Mowi's dedication to sustainability is a cornerstone of its operations, consistently recognized by its top ranking in the Coller FAIRR Protein Producer Index for six consecutive years. This commitment is further solidified by its Mowi 4.0 Smart Farming initiative, which integrates advanced technologies to optimize production.

Through strategic partnerships, such as those with UCO for Remotely Operated Vehicle (ROV) technology and Innovasea for environmental monitoring, Mowi is at the forefront of technologically advanced food production. These collaborations enhance operational efficiency and significantly improve fish welfare, positioning Mowi as a leader in a market that increasingly prioritizes responsible and innovative practices.

- Industry Recognition: Ranked #1 in the Coller FAIRR Protein Producer Index for six consecutive years (as of 2024).

- Technological Integration: Mowi 4.0 Smart Farming initiative leverages AI and IoT for data-driven decision-making.

- Partnerships for Innovation: Collaborations with UCO for ROV inspections and Innovasea for advanced environmental sensors.

- Market Impact: These advancements drive efficiency, improve fish welfare, and bolster market acceptance in a sustainability-focused food sector.

Mowi's core Atlantic salmon farming operations in Norway, Scotland, and Chile are undeniably its Stars. These regions consistently deliver impressive harvest volumes, with Mowi reporting a total harvest of 458,000 tonnes in 2023, a significant portion originating from these key territories, underscoring their dominant market share.

The company's strategic focus on cost competitiveness and strong biological performance in these locations fuels their Star status. Mowi's commitment to efficient farming practices and innovation allows them to maintain high production levels and profitability, demonstrating leadership in these vital markets.

Mowi's branded consumer products, particularly the MOWI brand, are also Stars, capitalizing on the growing demand for convenient, high-quality seafood. This segment reported record profits in 2024, reflecting its strong market position and growth potential in the premium seafood sector.

| Region/Segment | Contribution to Mowi's Star Status | Key Supporting Facts (as of 2024/2023) |

|---|---|---|

| Atlantic Salmon Farming (Norway, Scotland, Chile) | Core revenue and volume driver | Total harvest volume of 458,000 tonnes in 2023; Dominant market share in key territories; Focus on cost competitiveness and biological performance. |

| Branded Consumer Products (MOWI Brand) | High-growth, high-margin segment | Record profits in 2024; Expanding international presence in Europe, US, and Asia; Strong consumer recognition and preference. |

What is included in the product

The Mowi BCG Matrix analyzes its product portfolio by market share and growth rate, guiding investment decisions.

Provides a clear visual of Mowi's portfolio, helping to identify underperforming units and allocate resources effectively.

Cash Cows

Mowi's mature Atlantic salmon production in established regions, especially Norway, acts as a significant cash cow. These operations benefit from high efficiency and a commanding market share, consistently funneling substantial cash flow into the company.

In 2023, Mowi reported a total harvest volume of 476,000 tons of Atlantic salmon. The company's strong presence in Norway, a key mature region, underpins this consistent performance.

The optimized processes and stable output from these mature farming areas provide a reliable financial foundation. This dependable cash generation supports both reinvestment into other business segments and the distribution of dividends to shareholders.

Mowi Feed, Mowi's integrated fish feed division, functions as a robust cash cow. This segment provides a reliable and cost-controlled supply for Mowi's extensive farming operations.

In 2023, Mowi Feed achieved record-high volumes and earnings, underscoring its significant market share within the company's internal value chain and operational efficiency. This strong performance directly contributes to Mowi's overall profitability by minimizing reliance on external suppliers and effectively managing input costs.

Mowi's bulk salmon sales to major retailers and food service providers are a significant cash cow, generating consistent revenue streams. In 2024, Mowi's total sales volume in this segment remained robust, driven by long-term contracts and strong demand from key global partners.

Despite potentially slower growth compared to niche markets, Mowi's established market share and efficient distribution infrastructure ensure high-volume, predictable sales. This stability, coupled with economies of scale in processing and logistics, translates into strong and reliable cash flow for the company.

Efficient Processing and Distribution Infrastructure

Mowi's highly efficient processing and global distribution networks are central to its status as a cash cow. These well-established infrastructures enable cost-effective handling and timely delivery of vast quantities of salmon, thereby optimizing profit margins on sales. The maturity of these operations means that capital expenditure is primarily directed towards maintaining and enhancing efficiency rather than pursuing aggressive growth.

These operational strengths translate directly into financial performance. For instance, in 2023, Mowi reported a strong operational EBIT of €1,234 million, underscoring the profitability derived from its efficient value chain. The company's ability to manage logistics and processing costs is a significant competitive advantage.

- Global Reach: Mowi's distribution network spans over 70 countries, ensuring broad market access.

- Cost Efficiency: Investments in advanced processing technology in 2023, such as new automation lines, further reduced per-unit processing costs.

- Volume Dominance: Mowi processed approximately 470,000 metric tons of salmon in 2023, highlighting the scale of its operations.

Long-standing Customer Relationships and Supply Contracts

Mowi's long-standing customer relationships and supply contracts are key to its cash cow status. These deep ties with major global customers, cultivated over years, ensure stable demand and predictable revenue. This stability is a hallmark of cash cows, providing a reliable source of income.

The loyalty inherent in these partnerships significantly reduces market volatility for Mowi. Established contracts mean consistent sales volumes, insulating the company from the unpredictable swings often seen in less mature markets. This predictability is crucial for generating consistent cash flow.

- Stable Demand: Long-standing relationships guarantee a consistent customer base.

- Predictable Revenue: Supply contracts provide clear revenue forecasts.

- Reduced Volatility: Customer loyalty mitigates market price fluctuations.

- Consistent Cash Generation: These factors contribute to reliable cash flow for Mowi.

Mowi's established salmon farming operations in mature markets, particularly Norway, are prime examples of cash cows. These operations benefit from high efficiency and significant market share, consistently generating substantial cash flow.

Mowi Feed, the company's integrated fish feed division, also functions as a robust cash cow. It ensures a cost-controlled supply for Mowi's farming operations, contributing to overall profitability by minimizing external supplier reliance.

The company's bulk salmon sales to major retailers and food service providers represent another key cash cow. Despite potentially slower growth, Mowi's market share and efficient distribution ensure high-volume, predictable sales, translating into reliable cash flow.

Mowi's operational efficiency in processing and its global distribution networks are critical to its cash cow status. These mature infrastructures allow for cost-effective handling and delivery, optimizing profit margins and ensuring consistent cash generation.

| Segment | Role in BCG Matrix | Key Strengths | 2023 Data Point |

| Mature Salmon Farming (Norway) | Cash Cow | High efficiency, strong market share, optimized processes | Harvested 476,000 tons of Atlantic salmon |

| Mowi Feed | Cash Cow | Cost control, reliable supply, market share within value chain | Achieved record-high volumes and earnings |

| Bulk Salmon Sales | Cash Cow | Long-term contracts, strong demand, efficient distribution | Robust sales volume driven by global partners |

Delivered as Shown

Mowi BCG Matrix

The Mowi BCG Matrix preview you are currently viewing is the identical, fully formatted document you will receive upon completing your purchase. This means no watermarks or demo content will be present in the final file, ensuring you get a professional and ready-to-use strategic tool. You can confidently use this preview as an accurate representation of the comprehensive analysis you will download. This ensures immediate applicability for your business planning and decision-making processes.

Dogs

Certain smaller or historically challenging regional farming operations within Mowi's portfolio could be classified as Dogs. These segments might consistently yield lower margins or grapple with persistent biological issues, consuming resources without significantly boosting overall profit or market share. For instance, a specific regional operation in a less favorable climate might have seen its contribution margin fall below 5% in 2024, a stark contrast to more successful regions.

Niche or experimental seafood products outside Mowi's core salmon operations, such as novel algae-based protein alternatives or specialized shellfish ventures, would likely be classified as Dogs. These products, despite potential initial investment, have struggled to achieve significant market penetration or consumer acceptance. For example, a hypothetical Mowi venture into cultivated eel, while innovative, might have seen sales figures below projections, indicating low adoption and poor return on investment.

Older, less efficient production facilities or equipment that don't fit Mowi's current high-tech strategy could be classified as dogs in the BCG matrix. These might lead to higher operating expenses and contribute little to the company's total production, thus consuming valuable resources.

For instance, if Mowi's older salmon processing plants, perhaps those built before 2010, are showing significantly lower throughput compared to newer facilities – say, 20% lower per hour – they might be considered dogs. These older plants could also have higher energy consumption per kilogram of fish processed, potentially 15% more than modern automated lines.

The cost of upgrading these outdated facilities to meet current efficiency standards might be prohibitive. If a significant capital expenditure, like $50 million for a complete overhaul of a single plant, is required with a projected return on investment that is significantly lower than Mowi's hurdle rate of 10%, it reinforces their dog status.

Stagnant Distribution Channels or Markets

Stagnant distribution channels or markets for Mowi could be characterized by areas where the company has a limited footprint and growth has stalled. These might also include markets where competition is so fierce that gaining significant market share is an uphill battle. Investing more in marketing or logistics in these segments might not yield a good return.

For instance, if Mowi's presence in a specific European country's retail seafood sector has seen minimal sales growth for several years, and major competitors dominate shelf space, this could be considered a dog. The cost of expanding distribution or increasing promotional activities might outweigh the potential revenue gains. Mowi's 2023 annual report indicated that while overall sales were strong, certain regional markets experienced slower growth, necessitating a strategic review.

- Limited Market Penetration: Mowi might have underutilized distribution networks in certain developing economies, where logistics infrastructure is a challenge and consumer demand for premium seafood products is still nascent.

- Intense Competitive Landscape: In mature markets like parts of North America or Asia, where established local players and other global seafood giants have strong relationships with retailers and consumers, Mowi may struggle to differentiate and grow its market share in specific product categories.

- Low Return on Investment: Areas where Mowi has invested in distribution or marketing but has seen negligible sales increases or declining profitability, suggesting these channels or markets are not generating sufficient returns to justify continued investment.

Products Facing Declining Consumer Trends or High Competition

Within Mowi's product portfolio, certain offerings might be categorized as Dogs if they are experiencing declining consumer interest or are caught in highly competitive markets with limited differentiation. These products typically hold a small slice of the market and operate within slower-growing segments of the seafood industry.

For instance, if Mowi has a specific processed salmon product, perhaps a pre-marinated fillet that relies on traditional flavor profiles, it could be facing challenges. Consumer tastes are evolving, with a growing demand for more exotic flavors, sustainable sourcing transparency, and convenience formats like ready-to-eat meals. If this particular product has not adapted to these shifts, its market share would likely stagnate or shrink.

Competition in the salmon market is fierce, with numerous producers offering similar products. If Mowi's older, less differentiated processed salmon items are competing against newer, more innovative or aggressively priced offerings from rivals, they would struggle to gain traction. For example, in 2024, the global farmed salmon market, while robust, sees intense price competition, especially in the retail sector. Products lacking a unique selling proposition, such as specific health benefits or premium origin stories, are particularly vulnerable.

- Declining Consumer Trends: Products that fail to align with evolving consumer preferences for healthier, more convenient, or sustainably sourced seafood options.

- Intense Competition: Offerings facing pressure from lower-priced alternatives without a clear competitive advantage or strong brand loyalty.

- Low Market Share & Growth: Such products would typically occupy a small segment of the market within a low-growth category of the seafood industry.

- Diminishing Returns: Continued investment in these "Dog" products would likely result in increasingly poor returns on capital.

Dogs within Mowi's portfolio represent underperforming segments that consume resources without generating substantial returns. These could include older, less efficient processing plants or regional farming operations facing persistent biological challenges. For instance, a plant built before 2010 might process 20% less salmon per hour than newer facilities, and consume 15% more energy per kilogram.

Hypothetical niche products, like a venture into cultivated eel, might also fall into this category if sales figures remain significantly below projections, indicating low market adoption. Similarly, stagnant distribution channels in highly competitive mature markets, where Mowi has a limited footprint and growth has stalled, would be classified as dogs.

These segments are characterized by low market penetration, intense competition, and a low return on investment, making further capital allocation questionable. For example, a specific European retail market showing minimal sales growth for Mowi over several years, despite marketing efforts, exemplifies a dog.

Products lacking differentiation in a crowded market, such as older processed salmon fillets with traditional flavors, also fit the dog classification. These products struggle against innovative or lower-priced competitor offerings, especially in a retail sector where price competition is fierce, as seen in the global farmed salmon market in 2024.

| Category | Example | Potential Issues | Financial Indicator (Illustrative) |

| Operations | Older Processing Plants | Low throughput, high energy consumption | ROI below Mowi's 10% hurdle rate |

| Products | Traditional Marinated Salmon Fillets | Declining consumer interest, intense competition | Market share < 3% in its category |

| Markets | Specific Developing Economies | Nascent demand, logistical challenges | Contribution margin < 5% |

Question Marks

Mowi's ventures into emerging Asian and South American markets are classic question marks within its BCG matrix. These regions, such as Vietnam and Brazil, exhibit robust growth in seafood consumption, with Asia-Pacific projected to account for a significant portion of global seafood demand growth in the coming years. For instance, the demand for farmed salmon in Asia is expected to see substantial increases through 2030.

However, Mowi's current market share in these areas is relatively low, necessitating considerable investment. This includes building out cold chain logistics, establishing local processing facilities, and implementing targeted marketing campaigns to build brand awareness and consumer trust. These investments are crucial for Mowi to gain a competitive edge in these developing markets.

The success of these strategic expansions hinges on Mowi's ability to navigate local regulations, adapt to diverse consumer preferences, and build efficient supply chains. If Mowi can effectively overcome these challenges and capture market share, these question marks have the potential to mature into stars, driving future revenue and profitability for the company.

Investments in novel aquaculture technologies, like fully closed containment systems, are firmly in the question mark category. These are the cutting edge, the potential game-changers for the industry. Think of systems that completely isolate farmed fish from the external environment, offering unparalleled control over water quality, disease, and environmental impact.

The allure is immense: these technologies promise significant growth potential and substantial sustainability advantages, addressing many of the environmental concerns associated with traditional aquaculture. However, their commercial viability and scalability are still very much in the proving stages. Mowi, for instance, has been exploring various advanced containment solutions, but the upfront research and development costs, coupled with high capital expenditures, mean immediate returns are uncertain.

For example, the development and implementation of advanced offshore farming, another question mark area, can involve costs running into tens of millions of dollars per site before any significant revenue is generated. While the long-term outlook for such innovations is positive, the path to profitability is often long and requires substantial financial commitment and patience.

Mowi's ventures into novel value-added seafood categories, such as ready-to-eat meals featuring diverse species or products incorporating alternative proteins, represent potential question marks on the BCG matrix. These initiatives tap into evolving consumer preferences for convenience and novel protein sources, aiming for high-growth markets.

Currently, these new product lines likely exhibit low market share and brand recognition within these nascent categories. Significant investment in marketing and consumer education will be crucial to build demand and establish a foothold, a common characteristic of question mark strategic initiatives.

Direct-to-Consumer (D2C) E-commerce Expansion

Mowi's strategic move into direct-to-consumer (D2C) e-commerce represents a significant question mark within its business portfolio. This expansion aims to tap into the burgeoning online food market, a sector that saw substantial growth, with global online grocery sales projected to reach over $1.5 trillion by 2025.

Despite the high growth potential, Mowi's current market share in the D2C fresh seafood segment is relatively small, indicating a nascent stage for this initiative. The company faces considerable investment needs in critical areas such as specialized cold-chain logistics, sophisticated digital marketing campaigns, and robust customer service infrastructure to effectively compete and scale.

- Market Share: Mowi's D2C market share in fresh seafood is currently low, reflecting an emerging opportunity.

- Growth Potential: The global online food sales market is expanding rapidly, offering significant upside.

- Investment Requirements: Success necessitates substantial investment in logistics, digital marketing, and customer support.

- Competitive Landscape: The D2C fresh seafood space is still developing, presenting both opportunities and challenges for early entrants.

Investment in Alternative Feed Ingredients beyond traditional sources

Mowi's strategic focus on alternative feed ingredients, like algae oil and plant-based proteins, positions this area as a potential question mark within its Business Growth Matrix. While the market for these sustainable inputs is experiencing rapid expansion, driven by ecological concerns and technological advancements, Mowi's precise market penetration and efficacy in employing these novel feed components are still under development.

This investment reflects a high-growth potential, as the aquaculture industry increasingly seeks to mitigate its environmental footprint and diversify away from finite resources like wild-caught fishmeal. For instance, the global alternative protein market, which includes plant-based ingredients for animal feed, was valued at approximately USD 4.3 billion in 2023 and is projected to grow significantly in the coming years. Mowi's commitment to research and development in this space is crucial for solidifying its position.

- Growth Potential: The global market for alternative proteins in animal feed is expanding rapidly due to sustainability demands.

- Innovation Focus: Mowi is investing in R&D for ingredients like algae oil and plant-based proteins to reduce reliance on traditional fishmeal.

- Market Share Uncertainty: Mowi's specific market share and success in utilizing these newer feed sources are still evolving.

- Sustainability Driver: Environmental pressures are a key factor pushing the aquaculture industry towards these alternative feed solutions.

Mowi's strategic investments in expanding its presence in emerging markets, such as Southeast Asia and South America, represent classic question marks. These regions show strong potential for increased seafood consumption, with Asia alone expected to drive a substantial portion of global demand growth. However, Mowi's current market share in these areas is low, requiring significant capital for infrastructure development and brand building to compete effectively.

The company's exploration of advanced aquaculture technologies, including fully closed containment systems and offshore farming, also falls into the question mark category. While these innovations promise enhanced sustainability and growth potential, their commercial viability and scalability are still being proven. For example, developing offshore farming sites can incur tens of millions of dollars in upfront costs before generating revenue, highlighting the substantial financial commitment and long-term perspective required.

Mowi's push into novel value-added seafood products and direct-to-consumer (D2C) e-commerce are also question marks. These initiatives target evolving consumer preferences for convenience and online purchasing, with global online grocery sales projected to exceed $1.5 trillion by 2025. Despite high growth potential, Mowi faces challenges in building market share and requires substantial investment in logistics, marketing, and customer support to succeed.

Furthermore, Mowi's focus on alternative feed ingredients like algae oil and plant-based proteins is a question mark. The market for these sustainable inputs is growing, driven by environmental concerns, with the global alternative protein market valued at approximately USD 4.3 billion in 2023. Mowi's investment in R&D for these feeds is crucial, but its market penetration and the efficacy of these new sources are still developing.

BCG Matrix Data Sources

Our Mowi BCG Matrix is constructed using a blend of internal sales data, market share analysis, and industry growth forecasts to accurately position each product line.