Medpace PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Medpace Bundle

Navigate the complex external forces shaping Medpace's trajectory with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors impacting their operations and future growth. Gain a strategic advantage by leveraging these expert-curated insights. Download the full version now for actionable intelligence to inform your investment or business decisions.

Political factors

Government spending on healthcare and related policies significantly shape the demand for Medpace's contract research organization (CRO) services. For instance, in the United States, the Centers for Medicare & Medicaid Services (CMS) projected national health expenditure to grow by 5.4% in 2024, reaching $5.2 trillion. This increased spending often translates to more funding for research and development, directly benefiting CROs like Medpace.

Specific policies impacting drug development and clinical trials are crucial. Favorable government initiatives, such as tax credits for research or streamlined regulatory pathways for innovative therapies, can accelerate drug pipelines and boost demand for Medpace's expertise. The Prescription Drug User Fee Act (PDUFA) reauthorizations, for example, often include provisions aimed at improving the efficiency of FDA reviews, which can positively affect project timelines for Medpace's clients.

Conversely, shifts in government policy, such as austerity measures leading to reduced healthcare budgets or the implementation of more stringent approval criteria for new drugs, can create headwinds. Budget cuts could limit the number of government-funded research projects, while tougher regulations might lengthen the time and increase the cost of bringing a drug to market, potentially impacting Medpace's project pipeline and revenue growth.

Regulatory changes in drug and medical device approval processes directly impact Medpace's operational efficiency and market opportunities. For instance, the UK's new clinical trials regulations, enacted in April 2025, are designed to simplify approvals and lessen administrative hurdles, potentially speeding up trial durations and boosting CRO productivity.

These updates often incorporate a more risk-proportionate approach to regulation, which could expedite the approval of trials deemed lower risk. Such shifts can lead to increased demand for Medpace's services as pharmaceutical companies seek to navigate these evolving frameworks and bring new therapies to market more swiftly.

Medpace's global operations are significantly influenced by international trade policies and geopolitical stability. For instance, the ongoing trade tensions between major economic blocs, such as those involving the United States and China, can introduce tariffs on essential medical supplies or equipment, directly impacting the cost of clinical trial execution. In 2024, the World Trade Organization (WTO) reported a notable increase in trade-restrictive measures, highlighting the dynamic nature of these policies.

Political instability in regions where Medpace conducts trials, such as parts of Eastern Europe or Africa, can disrupt patient recruitment and data collection. For example, conflicts or significant political unrest can lead to temporary cessation of trial activities, as seen in certain regions during 2023. Medpace's strategy of maintaining a diverse geographic footprint, with operations across North America, Europe, and Asia, helps to spread these risks, ensuring that challenges in one area do not cripple its global trial management capabilities.

Clinical Trial Approval Timelines and Bureaucracy

The efficiency of clinical trial approval processes varies significantly across countries, directly impacting Medpace's ability to launch and complete studies promptly. For instance, countries actively seeking to boost their clinical research sectors often implement policies to cut red tape and expedite regulatory reviews, thereby enhancing their appeal for Contract Research Organizations (CROs) like Medpace. This focus on streamlining processes is a recurring theme in recent regulatory modernization efforts globally.

Governments are increasingly recognizing the economic benefits of a robust clinical research infrastructure. Initiatives aimed at reducing bureaucratic hurdles and accelerating review timelines are becoming more common. For example, some European Union member states have made strides in harmonizing submission processes, aiming to shorten the average time from submission to approval. In the US, the FDA continues to explore ways to expedite the review of innovative therapies, which can translate to faster study initiation for CROs.

- Regulatory Harmonization Efforts: Initiatives like the EU's Clinical Trials Regulation (CTR) aim to streamline and harmonize trial approvals across member states, potentially reducing overall timelines for companies operating in the region.

- Government Incentives: Countries like Australia and Canada have introduced specific programs to attract clinical trials, offering faster review pathways and financial incentives, making them attractive hubs for CRO operations.

- Digital Transformation in Regulatory Submissions: Many regulatory bodies are investing in digital platforms to manage submissions and reviews, with a stated goal of improving efficiency and reducing manual processing, which could speed up Medpace's trial initiations.

Public Funding for Biomedical Research

Public funding significantly influences the biomedical research landscape, directly impacting the flow of new drug candidates. For instance, the U.S. National Institutes of Health (NIH) budget for fiscal year 2024 is approximately $47.4 billion, a substantial sum dedicated to advancing health through research. This robust funding supports academic institutions and government-led projects, fostering innovation that can eventually translate into clinical trials.

Increased government investment in early-stage research creates a richer pipeline of potential therapies. As these promising discoveries emerge from academic labs, they often require the expertise of Contract Research Organizations (CROs) like Medpace for preclinical and clinical development. This creates a direct business opportunity for CROs as more research progresses towards the market.

- NIH Funding: The NIH's 2024 budget of around $47.4 billion fuels a vast array of biomedical research projects.

- Grant Allocation: A significant portion of this funding supports grants for universities and research centers, driving foundational scientific discovery.

- CRO Opportunities: Enhanced public research funding indirectly boosts demand for CRO services as early-stage discoveries move into development phases.

Government spending on healthcare and related policies significantly shape the demand for Medpace's contract research organization (CRO) services, with projected national health expenditure in the US reaching $5.2 trillion in 2024. Favorable government initiatives, such as tax credits for research or streamlined regulatory pathways, can accelerate drug pipelines, directly benefiting CROs. Conversely, austerity measures or stricter approval criteria can create headwinds by reducing healthcare budgets or lengthening time-to-market for new drugs.

Regulatory changes in drug and medical device approval processes directly impact Medpace's operational efficiency and market opportunities. For instance, the UK's new clinical trials regulations, enacted in April 2025, aim to simplify approvals and lessen administrative hurdles, potentially speeding up trial durations. These updates, often incorporating a risk-proportionate approach, can lead to increased demand for Medpace's services as companies seek to navigate evolving frameworks.

Medpace's global operations are influenced by international trade policies and geopolitical stability, with trade tensions potentially introducing tariffs on essential medical supplies. Political instability can disrupt patient recruitment and data collection, though Medpace's diverse geographic footprint helps mitigate these risks. The efficiency of clinical trial approval processes also varies, with countries actively seeking to boost their research sectors by cutting red tape.

| Factor | Impact on Medpace | 2024/2025 Data/Trend |

| Government Healthcare Spending | Drives demand for CRO services | US National Health Expenditure projected at $5.2 trillion in 2024, a 5.4% increase. |

| Regulatory Policies (Drug Approval) | Affects trial timelines and efficiency | UK clinical trials regulations simplified in April 2025; FDA continues efforts to expedite innovative therapy reviews. |

| Trade Policies & Geopolitics | Impacts operational costs and stability | Increased trade-restrictive measures reported by WTO in 2024; geopolitical instability can disrupt trial activities. |

| Public Research Funding | Creates pipeline of potential therapies | US NIH budget around $47.4 billion for FY2024, funding early-stage research that can lead to CRO opportunities. |

What is included in the product

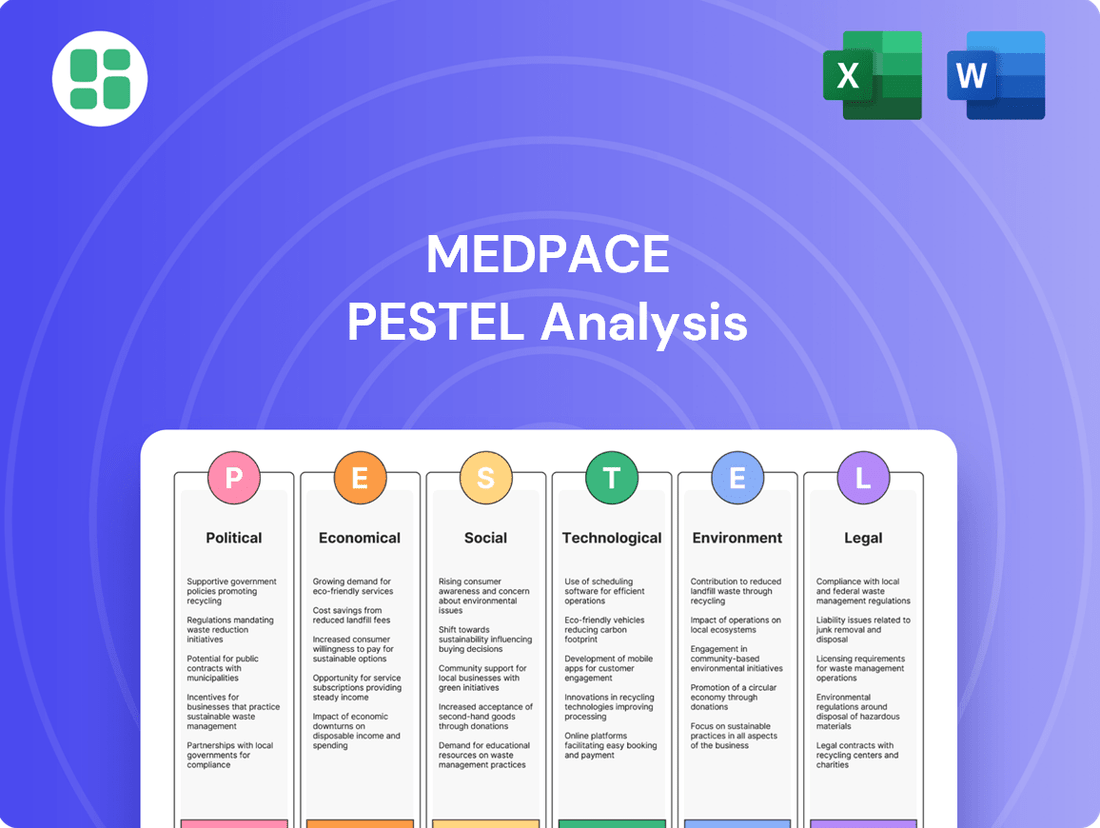

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Medpace across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights to identify strategic opportunities and mitigate potential threats, enabling informed decision-making for Medpace's growth and stability.

Medpace's PESTLE analysis offers a clear, summarized version of complex external factors, relieving the pain point of information overload during strategic discussions.

Economic factors

Global pharmaceutical and biotechnology companies' investment in research and development (R&D) is a key economic indicator directly impacting Medpace. Despite economic challenges such as inflation and increased operational costs, R&D expenditure saw an upward trend in 2024 and is expected to maintain this growth trajectory. This sustained investment signals a robust demand for contract research organization (CRO) services.

This ongoing commitment to innovation within the pharmaceutical sector translates into increased outsourcing of clinical development activities. For instance, the global pharmaceutical R&D spending was estimated to reach approximately $240 billion in 2024, with projections indicating further growth into 2025. This directly benefits Medpace, as pharmaceutical and biotech firms increasingly rely on CROs to manage and execute complex clinical trials, thereby driving business volume.

Rising inflation in 2024 and projected into 2025 directly impacts Medpace's operational expenses. We're seeing significant increases in costs for essential resources like skilled personnel, vital laboratory consumables, and business travel, all of which are critical for clinical trial execution. For instance, the U.S. Consumer Price Index (CPI) saw a notable uptick in early 2024, indicating broad-based price increases across various sectors that Medpace relies upon.

These escalating costs pose a direct challenge to Medpace's profit margins. To counteract this, the company must implement robust cost management strategies. This includes optimizing operational efficiencies, such as streamlining workflows and leveraging technology, alongside strategic pricing adjustments for their services to ensure profitability is maintained amidst these inflationary headwinds.

A robust global economy and a favorable investment climate within the life sciences sector are crucial drivers for Medpace. In 2024, venture capital and private equity investments in biotech and pharma remained strong, with global funding reaching over $50 billion, according to industry reports. This capital infusion directly fuels the growth of emerging companies, consequently boosting their demand for contract research organization (CRO) services.

This positive investment trend empowers startups to accelerate their drug development pipelines, from early-stage research to late-stage clinical trials. As these companies advance their products, their need for specialized CRO support, like Medpace's clinical trial management and regulatory consulting, escalates significantly, creating a direct benefit for the company.

Currency Exchange Rate Volatility

Currency exchange rate volatility is a key economic factor for Medpace, a global Contract Research Organization (CRO). As Medpace operates in numerous countries, it deals with various currencies, meaning fluctuations can significantly impact its reported financial results when translated back to its primary reporting currency, the U.S. dollar. This can affect both revenue recognition and the cost of operations, potentially influencing overall profitability and investor perception.

For instance, a stronger U.S. dollar relative to currencies where Medpace generates revenue would lead to lower reported revenues. Conversely, a weaker dollar could boost reported revenues. The company's 2023 annual report, filed in early 2024, likely detailed the impact of foreign currency fluctuations on its financial statements. As of the first quarter of 2024, the U.S. dollar has shown some strength against major global currencies, which could present a headwind for companies with substantial international operations like Medpace.

- Global Operations: Medpace's business spans across North America, Europe, and Asia, necessitating transactions in multiple currencies.

- Reporting Impact: Fluctuations in exchange rates directly affect the U.S. dollar value of revenues earned and expenses incurred in foreign currencies.

- Financial Performance: Significant currency movements can lead to gains or losses on translation, impacting Medpace's reported earnings per share and overall financial health.

- 2024 Outlook: Continued U.S. dollar strength in 2024 could pose a challenge to Medpace's reported international revenue growth, though hedging strategies may mitigate some of this impact.

Access to Capital and Funding for Biotech Startups

The lifeblood of biotechnology startups, particularly small and mid-sized ones, is consistent access to capital. Medpace, as a Contract Research Organization (CRO), relies heavily on these companies outsourcing their clinical trials. A thriving funding landscape, marked by successful Initial Public Offerings (IPOs) and subsequent follow-on funding rounds, directly fuels the demand for CRO services.

In 2024, the biotechnology sector saw a notable uptick in venture capital funding compared to the more subdued 2023. For instance, Q1 2024 alone witnessed a significant increase in biotech IPOs, bringing in substantial capital for emerging companies. This renewed investor confidence translates into more clinical development projects, which in turn benefits CROs like Medpace.

The availability of capital directly impacts the pipeline of potential clients for Medpace. When biotech firms can secure funding, they are more likely to advance their drug development programs, necessitating outsourced clinical trial management. Conversely, funding droughts can lead to project delays or cancellations, impacting CRO revenue streams.

- 2024 saw a resurgence in biotech IPOs, with several companies raising over $100 million, directly enabling them to fund clinical trials.

- Follow-on offerings in the biotech space in late 2024 and early 2025 have provided crucial additional capital for companies progressing through clinical development stages.

- A strong capital environment allows smaller biotech firms, often the primary clients for CROs, to undertake more ambitious and longer-term clinical studies.

- The ability of biotech startups to access capital is a direct indicator of future demand for clinical trial outsourcing services.

The economic landscape directly influences Medpace's operational costs and revenue potential. Inflationary pressures in 2024 and anticipated into 2025 continue to drive up expenses for personnel, supplies, and travel, impacting profit margins. Despite these challenges, robust R&D investment by pharmaceutical and biotech firms, projected to exceed $240 billion in 2024, fuels demand for Medpace's contract research services.

A strong investment climate, evidenced by over $50 billion in global biotech funding in 2024, empowers startups to accelerate drug development, creating more opportunities for CROs. However, currency exchange rate volatility, with the U.S. dollar showing strength in early 2024, can affect Medpace's reported international revenues and profitability.

| Economic Factor | 2024 Data/Trend | Impact on Medpace |

| R&D Investment | Projected > $240 billion | Increased demand for CRO services |

| Inflation | Upward trend in 2024 | Higher operational costs, pressure on margins |

| Venture Capital Funding (Biotech) | >$50 billion globally in 2024 | More clients, increased outsourcing needs |

| Currency Exchange Rates | USD strength in early 2024 | Potential reduction in reported international revenue |

What You See Is What You Get

Medpace PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This PESTLE analysis for Medpace provides a comprehensive overview of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It's designed to offer actionable insights for strategic planning.

Sociological factors

Global demographic shifts, particularly the aging population and the rise of chronic diseases, are significantly boosting the demand for innovative therapies and robust clinical research. For instance, by 2050, the World Health Organization projects that over 2 billion people will be aged 60 and over, a trend directly increasing the need for treatments for age-related conditions.

This evolving landscape creates a persistent demand for Medpace's specialized services. The company is well-positioned to support the development of treatments for conditions impacting large or growing patient populations, such as cardiovascular disease and diabetes, which are already major global health concerns.

Patient willingness to participate in clinical trials, coupled with geographic accessibility and the crucial need for diverse trial populations, presents significant hurdles for recruitment and retention efforts. Medpace, like other CROs, faces the ongoing challenge of engaging potential participants who may have concerns about time commitment, travel, or the trial process itself.

To address these sociological factors, Medpace is increasingly adopting decentralized trial models, bringing research closer to patients' homes through remote monitoring and local healthcare providers. This approach, along with community-centric outreach, aims to boost patient engagement and ensure trial populations better reflect real-world demographics, a critical aspect for regulatory approval and drug efficacy. For instance, by mid-2024, the adoption of decentralized clinical trials (DCTs) saw a significant uptick, with many studies reporting improved patient retention rates compared to traditional site-based models.

Public perception of pharmaceutical research significantly impacts patient willingness to participate in clinical trials. In 2024, surveys indicated that while a majority of the public acknowledges the importance of medical advancements, trust in research processes remains a key concern, with data privacy being a prominent worry.

Ethical considerations are paramount; for instance, the increasing scrutiny on data privacy regulations, such as GDPR and similar frameworks expected to be further refined by 2025, directly affects how patient information is handled in clinical research. This necessitates robust consent procedures and secure data management.

Medpace, like other Contract Research Organizations (CROs), must prioritize transparency in its operations and clearly communicate ethical safeguards to build and maintain public trust. A commitment to ethical conduct and open communication is crucial for sustained patient recruitment and regulatory compliance, especially as patient advocacy groups become more vocal in demanding accountability.

Increasing Demand for Personalized Medicine

The shift towards personalized medicine, where treatments are customized based on an individual's genetic makeup and biological characteristics, is significantly reshaping healthcare. This trend necessitates more intricate and precisely designed clinical trials to effectively evaluate these tailored therapies. For instance, the global precision medicine market was valued at approximately $68.4 billion in 2022 and is projected to reach $180.1 billion by 2030, demonstrating robust growth.

Medpace's established proficiency in developing specialized clinical trial designs and advanced data analytics for precision medicine positions it favorably to capitalize on this growing demand. Their ability to manage complex data sets and execute targeted studies aligns perfectly with the evolving needs of pharmaceutical and biotechnology companies focused on this area.

Key implications for Medpace include:

- Increased demand for niche trial expertise: Medpace can leverage its experience in rare diseases and complex patient populations.

- Growth in data analytics services: The need for sophisticated analysis of genomic and biomarker data will rise.

- Strategic partnerships: Opportunities exist to collaborate with companies at the forefront of genetic sequencing and targeted therapy development.

Global Health Awareness and Patient Advocacy

Growing global health awareness directly impacts clinical research. Patients are more informed and vocal about their needs, pushing for research that addresses their specific concerns and preferences. This trend is evident in the increasing demand for patient-centric trial designs, which prioritize participant comfort and accessibility.

Patient advocacy groups play a crucial role in shaping research priorities. By representing patient communities, these organizations influence which diseases and treatments receive attention. For example, advocacy for rare diseases has spurred significant investment in research and development for conditions previously overlooked.

Medpace must adapt by integrating patient perspectives into trial methodologies. This includes embracing technologies that enhance patient experience and accessibility. Remote monitoring and mobile health applications are key examples, allowing participants to engage in trials from their homes, thereby improving data collection and participant retention. In 2024, studies showed a significant increase in patient preference for decentralized clinical trials, with over 60% of participants finding remote data collection methods more convenient.

- Patient-Centricity: Growing awareness drives demand for trials that respect patient time and well-being.

- Advocacy Influence: Patient groups are increasingly powerful in directing research focus and funding.

- Technological Integration: Remote monitoring and mHealth tools are becoming essential for trial accessibility and participant engagement.

- Market Trends: By 2025, it's projected that over 70% of new clinical trials will incorporate elements of decentralization to improve patient participation.

Sociological factors significantly influence Medpace's operational landscape, primarily through evolving patient demographics and increasing health awareness. The global aging population, projected to exceed 2 billion by 2050, directly fuels demand for treatments targeting age-related diseases, a core area for Medpace's services.

Patient engagement in clinical trials remains a critical sociological element, with concerns about time, travel, and data privacy impacting recruitment. By mid-2024, decentralized trial models saw increased adoption, with many studies reporting better patient retention, highlighting a societal shift towards more accessible research participation.

Public trust in pharmaceutical research is paramount, and in 2024, data privacy emerged as a key concern for trial participants. Medpace's commitment to transparency and robust ethical safeguards is essential for maintaining this trust and ensuring successful patient recruitment and regulatory compliance.

The rise of personalized medicine, driven by advancements in genetic understanding, necessitates intricate trial designs. The precision medicine market, valued at $68.4 billion in 2022, is expected to grow substantially, showcasing a societal embrace of tailored healthcare solutions.

Technological factors

The integration of artificial intelligence (AI) and machine learning (ML) is transforming clinical trial operations. These technologies are significantly enhancing data analysis capabilities, enabling more accurate outcome predictions, and optimizing the very design of clinical studies. For instance, AI algorithms can sift through vast datasets to identify patient populations most likely to respond to a treatment, thereby streamlining recruitment.

Medpace can harness these AI and ML advancements to boost operational efficiency and drive down costs throughout the drug development lifecycle. From the initial stages of patient identification and recruitment to the ongoing real-time monitoring of trial progress and data integrity, these tools promise to accelerate the entire process. By leveraging predictive analytics, Medpace can anticipate potential challenges and proactively implement solutions, leading to faster timelines and more successful trial outcomes.

The rise of decentralized clinical trials (DCTs) and hybrid models is reshaping medical research. These approaches leverage technology to conduct trial activities away from traditional sites, often in patients' homes. This shift is driven by digital platforms and remote monitoring tools, making trials more accessible and patient-friendly.

By 2024, it's estimated that over 70% of clinical trials will incorporate decentralized elements, a significant jump from previous years. This technological evolution not only boosts patient convenience and diversity but also improves data collection efficiency, a key factor for companies like Medpace in managing complex research projects.

The rise of digital health technologies, like wearables and mobile apps, is transforming patient data collection. These tools allow for continuous, real-time monitoring, which Medpace can leverage to enhance clinical trial efficiency and patient experience. For instance, by 2024, the global digital health market was projected to reach over $600 billion, highlighting the significant adoption of these innovations.

Enhanced Data Management and Cybersecurity Solutions

The increasing volume of digital data generated in clinical trials necessitates sophisticated data management systems and robust cybersecurity. Medpace’s commitment to these areas is crucial for maintaining data integrity and patient privacy, especially with evolving regulations. For instance, the global cybersecurity market was projected to reach $232 billion in 2024, highlighting the significant investment required.

Medpace needs to continuously upgrade its data management platforms and cybersecurity defenses to ensure compliance with stringent regulations like GDPR and HIPAA. Protecting sensitive clinical trial data from sophisticated cyber threats is paramount. The financial services sector, which handles vast amounts of sensitive data, saw cybercrime costs rise by 15% in 2023, indicating the escalating threat landscape.

- Data Integrity: Implementing advanced data validation and monitoring tools to ensure accuracy and completeness of clinical trial data.

- Patient Privacy: Employing encryption, access controls, and anonymization techniques to safeguard patient information.

- Regulatory Compliance: Adhering to global data protection laws such as GDPR and HIPAA, which impose strict requirements on data handling.

- Cyber Threat Mitigation: Investing in threat detection, prevention systems, and employee training to counter evolving cyber risks.

Innovations in Drug Discovery Platforms

Technological advancements are revolutionizing early-stage drug discovery. Innovations like AI-powered biomarker identification and sophisticated high-throughput screening platforms are significantly improving the quality and quantity of potential therapies moving into clinical trials. For instance, by 2024, AI is projected to accelerate drug discovery timelines by as much as 40%, leading to a more robust pipeline of new compounds. This directly benefits Medpace, as a stronger pipeline translates to a consistent demand for their clinical trial services.

These technological leaps in discovery platforms are creating a more fertile ground for new drug development. Companies are leveraging machine learning to analyze vast datasets, identifying novel drug targets and predicting compound efficacy with greater accuracy. This efficiency boost means more promising candidates are ready for the rigorous testing phases that Medpace specializes in. The estimated market for AI in drug discovery was valued at over $700 million in 2023 and is expected to grow substantially in the coming years, indicating a strong future demand for CRO services.

- AI-driven biomarker identification is streamlining the process of pinpointing key indicators for disease progression and treatment response.

- Advanced screening platforms enable the rapid testing of millions of compounds, accelerating the identification of potential drug candidates.

- This technological surge in discovery is expected to increase the number of investigational new drug (IND) applications filed annually, providing Medpace with more opportunities.

- The overall efficiency gains in early-stage research are creating a more predictable and sustainable flow of clinical trial projects for contract research organizations like Medpace.

Technological advancements, particularly in AI and machine learning, are fundamentally reshaping clinical trial operations by enhancing data analysis and optimizing trial design. Medpace can leverage these tools to improve efficiency and reduce costs across the drug development process, from patient recruitment to real-time monitoring. The increasing adoption of decentralized clinical trials (DCTs), with over 70% expected to incorporate these elements by 2024, further underscores the technological shift towards more accessible and efficient research.

The burgeoning digital health market, projected to exceed $600 billion by 2024, fuels the use of wearables and mobile apps for continuous patient data collection, enhancing both trial efficiency and patient experience. Medpace must invest in robust data management and cybersecurity, given the escalating threat landscape where the global cybersecurity market was projected at $232 billion in 2024, to ensure data integrity and patient privacy amidst evolving regulations.

Technological innovations in early-stage drug discovery, such as AI-driven biomarker identification, are accelerating the identification of potential therapies. By 2024, AI is expected to shorten drug discovery timelines by up to 40%, directly benefiting Medpace through increased demand for its clinical trial services. The AI in drug discovery market, valued at over $700 million in 2023, signifies a strong future for CROs.

| Technological Factor | Impact on Medpace | Supporting Data (2024/2025) |

| AI/ML in Clinical Trials | Enhanced data analysis, optimized trial design, improved patient recruitment, accelerated timelines. | AI projected to accelerate drug discovery timelines by up to 40% (2024). |

| Decentralized Clinical Trials (DCTs) | Increased patient accessibility, improved data collection efficiency, broader participant diversity. | Over 70% of trials expected to incorporate decentralized elements (2024). |

| Digital Health Technologies (Wearables, Apps) | Real-time patient monitoring, enhanced data collection, improved patient experience. | Global digital health market projected over $600 billion (2024). |

| Data Management & Cybersecurity | Ensuring data integrity, patient privacy, and regulatory compliance. | Global cybersecurity market projected at $232 billion (2024). |

Legal factors

Global data privacy regulations are becoming increasingly stringent. For instance, the General Data Protection Regulation (GDPR) in Europe and the Health Insurance Portability and Accountability Act (HIPAA) in the United States impose strict rules on how companies like Medpace handle sensitive patient information. These laws dictate everything from data collection methods to storage and processing protocols.

Medpace must maintain rigorous compliance with these evolving legal frameworks to avoid significant penalties and safeguard patient confidentiality. Failure to adhere can result in substantial fines; for example, GDPR violations can lead to penalties of up to 4% of global annual revenue or €20 million, whichever is higher. This necessitates robust data governance and security measures.

The landscape of drug and medical device approvals is continually evolving, directly impacting the requirements for clinical trials. Medpace needs to remain vigilant about these shifts, for instance, the upcoming UK clinical trial regulations set to take effect in April 2026, to guarantee its trial methodologies align with the most current legal mandates.

These legislative updates often mandate more rigorous data collection and patient safety protocols. For example, the US Food and Drug Administration (FDA) has been increasingly emphasizing real-world evidence (RWE) in its decision-making processes, a trend that began gaining significant traction in 2024 and is expected to intensify. This necessitates that Medpace adapt its trial designs to incorporate RWE generation effectively.

Medpace's global reach means navigating a complex web of international clinical trial regulations. Key among these are the International Council for Harmonisation of Technical Requirements for Pharmaceuticals for Human Use (ICH) Good Clinical Practice (GCP) guidelines, with the significant update ICH GCP E6 (R3) anticipated in 2025. This evolving landscape requires constant vigilance and adaptation.

Harmonization initiatives, like those promoted by ICH, aim to streamline multi-country studies by standardizing requirements. While this offers potential efficiencies, Medpace must still maintain deep expertise in the specific nuances of local regulations within each operating region to ensure full compliance and successful trial execution.

Intellectual Property Laws and Patent Enforcement

Intellectual property laws, particularly patent protection for innovative pharmaceuticals and medical devices, are fundamental to the health of the life sciences sector. While Medpace, as a Contract Research Organization (CRO), doesn't directly develop patented products, the strength and enforcement of these IP laws significantly influence the R&D activities of its clients, thereby driving demand for Medpace's clinical trial services.

The robust patent system encourages substantial investment in drug discovery and development, as companies seek to recoup their research expenditures. For instance, in 2023, the pharmaceutical industry globally invested an estimated $200 billion in R&D, a figure heavily reliant on the promise of market exclusivity provided by patents. Strong patent enforcement ensures that these investments are protected, creating a stable environment for continued innovation and outsourcing to CROs like Medpace.

- Patent Protection: Crucial for recouping significant R&D costs in drug and device development.

- R&D Investment Driver: Strong IP laws incentivize clients to invest more in research, boosting demand for CRO services.

- Market Exclusivity: Patents grant temporary monopolies, essential for profitability and further innovation.

- Global IP Landscape: Variations in patent laws across regions impact where clinical trials are conducted and how IP is managed.

Compliance with Anti-Bribery and Corruption Laws

Operating globally, Medpace navigates a complex legal landscape, requiring strict adherence to anti-bribery and corruption statutes like the U.S. Foreign Corrupt Practices Act (FCPA) and the UK Bribery Act. Failure to comply can result in significant fines and reputational damage, impacting Medpace's ability to secure international contracts and maintain stakeholder trust.

Robust compliance programs are therefore critical. These programs typically involve comprehensive employee training, due diligence on third-party partners, and clear internal policies and procedures. For instance, in 2023, companies globally faced an increasing number of investigations and enforcement actions related to these laws, underscoring the importance of proactive compliance.

- FCPA and UK Bribery Act: Key legislation governing international business conduct.

- Risk Mitigation: Essential for preventing legal penalties and reputational harm.

- Compliance Programs: Training, due diligence, and policy implementation are vital.

- Enforcement Trends: Global regulatory scrutiny remains high, demanding continuous vigilance.

Medpace must navigate a dynamic legal environment, particularly concerning data privacy. Regulations like GDPR and HIPAA impose stringent requirements on handling sensitive patient data, with GDPR fines reaching up to 4% of global annual revenue. Staying compliant necessitates robust data governance and security measures to avoid substantial penalties and protect patient confidentiality.

The company also faces evolving clinical trial regulations, such as the upcoming UK trial regulations in April 2026, requiring adaptation of methodologies. Furthermore, the increasing emphasis on real-world evidence (RWE) by bodies like the FDA, a trend intensifying since 2024, demands that Medpace's trial designs effectively incorporate RWE generation.

Global operations mean Medpace must also adhere to anti-bribery and corruption laws like the FCPA and UK Bribery Act, with increasing enforcement actions globally in 2023. Implementing comprehensive compliance programs, including training and due diligence, is vital to mitigate legal risks and maintain stakeholder trust.

| Legal Factor | Key Regulations/Considerations | Impact on Medpace | Example Data/Trend |

| Data Privacy | GDPR, HIPAA | Compliance with data handling, storage, and processing; risk of significant fines. | GDPR fines up to 4% of global annual revenue. |

| Clinical Trial Regulations | ICH GCP E6 (R3), FDA RWE emphasis | Adaptation of trial methodologies, increased data collection and safety protocols. | UK trial regulations effective April 2026; FDA RWE trend intensifying since 2024. |

| Anti-Bribery & Corruption | FCPA, UK Bribery Act | Need for robust compliance programs, risk of penalties and reputational damage. | Increased global enforcement actions in 2023. |

Environmental factors

The pharmaceutical sector is under growing pressure to adopt greener practices throughout its supply chain. This includes everything from how clinical trial materials are sourced to how they are shipped and how waste is managed. For companies like Medpace, a Contract Research Organization (CRO), this translates into potential expectations for eco-conscious operations.

By 2024, the global pharmaceutical market's carbon footprint was a significant concern, with logistics and packaging contributing substantially. Medpace, in its role, can contribute to reducing this impact by exploring sustainable options for trial kit components and optimizing shipping routes. For instance, a 2025 report highlighted that a 10% reduction in air freight for pharmaceuticals could yield considerable environmental benefits.

Clinical trials, like those conducted by Medpace, produce diverse waste streams, encompassing biological samples, disposable plastics, and expired pharmaceuticals. Compliance with rigorous waste management and disposal regulations is paramount for ensuring safety and environmental stewardship across Medpace's international operations.

These regulations, often varying by region, dictate everything from segregation and containment to treatment and final disposal methods for clinical waste. For instance, the U.S. Environmental Protection Agency (EPA) sets standards for hazardous waste, which can include certain chemicals or biological materials from trials, and the Resource Conservation and Recovery Act (RCRA) guides much of this framework.

Medpace's commitment to 'green labs' initiatives means actively seeking methods to minimize waste generation and prioritize recycling or environmentally sound disposal options, aligning with global sustainability goals and increasing scrutiny on the environmental impact of the life sciences sector.

The clinical research sector is placing a growing emphasis on reducing its environmental impact, with many companies aiming for net-zero emissions. This trend is driven by both regulatory pressures and increasing stakeholder expectations for corporate responsibility.

Medpace can actively participate in these carbon footprint reduction efforts. Strategies include streamlining site visit travel, consolidating the logistics of study materials, and embracing decentralized clinical trial (DCT) approaches. DCTs minimize the need for extensive physical facilities and patient travel, thereby lowering associated carbon emissions.

For instance, a 2024 report indicated that the life sciences sector’s carbon emissions from business travel alone could be significantly reduced by adopting more virtual interactions and optimizing travel routes. Medpace’s investment in digital platforms and remote monitoring technologies directly supports this objective, potentially cutting travel-related emissions by an estimated 15-20% in the coming years.

Impact of Climate Change on Trial Logistics and Patient Access

Climate change is increasingly impacting clinical trial logistics. Extreme weather events, like the severe heatwaves and flooding experienced globally in 2024, can directly disrupt supply chains for investigational medicinal products and essential trial materials. This can lead to delays in drug delivery to trial sites and affect the integrity of temperature-sensitive shipments, a critical concern for companies like Medpace that manage complex global logistics.

Furthermore, these climate-related events can significantly hinder patient access to trial sites. For instance, hurricanes or heavy snowfall can make travel impossible for participants, leading to missed appointments and potentially compromising trial data. Medpace must proactively build climate resilience into its operational planning, including contingency strategies for transportation and site accessibility, especially considering the geographically diverse nature of many global clinical trials.

- Supply Chain Vulnerability: In 2024, an estimated 30% of global supply chains experienced significant disruptions due to extreme weather events, impacting sectors including pharmaceuticals.

- Patient Access Challenges: Studies indicate that weather-related travel disruptions can lead to a 10-15% increase in patient dropout rates in affected regions.

- Operational Resilience: Investing in climate-resilient infrastructure and diversified logistics networks is becoming crucial for maintaining trial continuity.

- Geographic Diversity: Trials conducted across regions prone to extreme weather (e.g., coastal areas for hurricanes, mountainous regions for blizzards) face heightened risks.

Environmental Impact Assessments for New Drug Development

While Medpace itself is a service provider, its clients in the pharmaceutical sector are facing growing scrutiny regarding the environmental impact of new drug development. Regulatory bodies worldwide are enhancing requirements for environmental impact assessments (EIAs) throughout the drug lifecycle, from research and manufacturing to disposal. For instance, the European Medicines Agency (EMA) has been refining its guidelines on environmental risk assessments for human and veterinary medicines, with updated considerations expected to influence trial design and data collection in 2024 and 2025.

Medpace's role in supporting these clients could evolve to include assisting with data generation and documentation relevant to environmental considerations during clinical trials. This might involve tracking the environmental footprint of trial materials, waste management protocols at study sites, or even the potential environmental fate of investigational products. Such capabilities could become a significant differentiator for Medpace in a competitive landscape where clients increasingly prioritize sustainability.

The pharmaceutical industry's environmental commitment is becoming a key performance indicator. Reports from industry associations in 2024 indicate a rising trend in companies setting ambitious environmental, social, and governance (ESG) targets, which directly impact their choice of contract research organizations (CROs). Medpace's ability to demonstrate how it helps clients meet these evolving environmental responsibilities within the clinical trial phase will be crucial.

- Growing Regulatory Focus: Increased emphasis on environmental impact assessments for pharmaceuticals by agencies like the EMA and FDA in 2024-2025.

- Client ESG Demands: Pharmaceutical companies are prioritizing CROs that align with their own environmental, social, and governance (ESG) goals.

- Differentiating Service: Medpace's support in demonstrating environmental responsibility during clinical trials can set it apart from competitors.

- Sustainability in Trials: Potential for Medpace to assist clients in managing and reporting on the environmental aspects of clinical trial operations.

Environmental regulations are tightening globally, pushing companies like Medpace to adopt sustainable practices in clinical trial operations. This includes managing waste streams, from biological samples to packaging materials, in compliance with stringent regional laws.

The increasing focus on climate change impacts trial logistics, with extreme weather events in 2024 disrupting supply chains and patient access, necessitating robust contingency planning.

Pharmaceutical clients are prioritizing CROs with strong ESG commitments, making Medpace's ability to support environmental data generation and reporting a key competitive advantage.

| Environmental Factor | Impact on Medpace | 2024-2025 Data/Trend |

|---|---|---|

| Regulatory Compliance | Need for adherence to evolving environmental laws for waste management and disposal. | Increased scrutiny on environmental impact assessments by EMA and FDA. |

| Climate Change Impact | Disruption of supply chains and patient access due to extreme weather. | Estimated 30% of global supply chains experienced disruptions in 2024 due to weather. |

| Client ESG Demands | Requirement to align with pharmaceutical clients' sustainability goals. | Growing demand for CROs demonstrating environmental responsibility in trial phases. |

| Operational Efficiency | Opportunities to reduce carbon footprint through optimized logistics and DCTs. | Potential 15-20% reduction in travel emissions via digital platforms and remote monitoring. |

PESTLE Analysis Data Sources

Our Medpace PESTLE Analysis is meticulously constructed using data from leading healthcare industry publications, regulatory body updates from agencies like the FDA and EMA, and economic indicators from reputable financial institutions. This ensures a comprehensive understanding of the external factors influencing Medpace's operations and strategy.