Medpace Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Medpace Bundle

Medpace operates within a dynamic CRO industry, where understanding the competitive landscape is paramount. Our Porter's Five Forces analysis dissects the critical factors influencing Medpace's profitability and strategic positioning, from the bargaining power of buyers to the intensity of rivalry.

This crucial framework reveals the underlying pressures shaping Medpace's market, highlighting potential threats and opportunities. Don't just guess about Medpace's competitive environment; equip yourself with the full, detailed analysis to uncover actionable insights and drive informed business decisions.

Suppliers Bargaining Power

Medpace's core business hinges on highly specialized medical professionals, including principal investigators and site staff. Their unique expertise in intricate therapeutic areas is indispensable for clinical trial success. For instance, as of late 2023, the demand for oncologists with experience in novel immunotherapy trials continued to outpace supply, a trend expected to persist.

The limited availability of these top-tier specialists, particularly in emerging or niche therapeutic fields, directly amplifies their bargaining power. When their specialized knowledge is crucial for achieving trial milestones and securing regulatory approvals, their leverage increases significantly, potentially impacting Medpace's operational costs and timelines.

Suppliers of clinical trial sites, such as hospitals and specialized research centers, wield significant bargaining power. This is particularly true for sites possessing large, well-defined patient populations or unique, advanced research capabilities. Medpace's operational efficiency and success in executing clinical trials are directly tied to its access to these high-caliber sites. Limited availability or intense competition for specific trial sites can escalate costs and potentially delay critical project timelines, impacting Medpace's overall project delivery.

Vendors offering specialized clinical trial management systems, electronic data capture (EDC) software, and sophisticated analytics platforms hold significant bargaining power. Their proprietary technology is often crucial for Medpace's operations, making these suppliers indispensable.

The high costs and complexities involved in switching from one system to another, including data migration and staff retraining, create substantial switching costs for Medpace. For instance, a major EDC system upgrade can cost hundreds of thousands of dollars and take months to implement, thereby strengthening the leverage of incumbent software providers.

Specialized Laboratory and Diagnostic Services

Medpace's reliance on specialized laboratory and diagnostic service providers presents a significant factor in its bargaining power with suppliers. These external labs are critical for conducting essential tests, analyzing biomarkers, and determining clinical trial endpoints, making their services indispensable for Medpace's operations.

Suppliers possessing unique accreditations, state-of-the-art equipment, or proprietary scientific methodologies can leverage their specialized capabilities to negotiate higher prices. This is directly tied to the critical nature of their services in advancing drug development, where accuracy and specialized expertise are paramount.

- High Switching Costs: For certain specialized tests, switching laboratories can involve significant time and effort to validate new methods and ensure data comparability, increasing dependence on existing suppliers.

- Concentration of Expertise: The market for highly specialized diagnostic services may have a limited number of qualified providers, concentrating bargaining power in the hands of these few suppliers.

- Regulatory Compliance: Suppliers meeting stringent regulatory requirements (e.g., CLIA, CAP) are essential, and finding alternatives that meet these standards can be challenging.

- Impact on Trial Timelines: Delays or errors from diagnostic suppliers can directly impact the timelines of clinical trials, a critical metric for Medpace and its clients, giving suppliers leverage.

Patient Recruitment Agencies and Patient Access

While not traditional suppliers, entities or methods facilitating patient recruitment, such as patient advocacy groups or specialized recruitment agencies, can hold significant influence over Medpace. Difficulties in patient enrollment, a perennial challenge in clinical trials, can empower these facilitators, potentially leading to increased costs or delays for Medpace. For instance, in 2024, the average patient recruitment cost for Phase III trials continued to be a substantial portion of overall trial budgets, sometimes reaching 30% or more, making efficient recruitment critical.

The bargaining power of patient recruitment facilitators is amplified when specific patient populations are required, as these groups often have limited availability. Medpace, like other CROs, faces pressure to secure timely enrollment to meet sponsor timelines and regulatory milestones. In 2023, reports indicated that certain rare disease trials experienced enrollment challenges, with recruitment agencies playing a pivotal role in accessing these niche patient pools, thereby increasing their leverage.

Key factors influencing the bargaining power of patient recruitment agencies include:

- Specialization: Agencies with expertise in specific therapeutic areas or patient demographics can command higher fees.

- Network Reach: The extent of their established relationships with patients and healthcare providers directly impacts their effectiveness.

- Regulatory Landscape: Changes in data privacy regulations or ethical guidelines can affect recruitment processes and agency costs.

- Competition: The number of competing agencies and alternative recruitment methods influences Medpace's negotiating position.

Medpace's bargaining power with suppliers is influenced by the specialized nature of its needs. The company relies on highly skilled professionals, sophisticated technology platforms, and precise laboratory services, all of which can limit supplier options and increase their leverage. This is particularly true in niche therapeutic areas where specialized expertise is scarce, as seen in the persistent demand for oncologists experienced in novel immunotherapy trials through late 2023.

What is included in the product

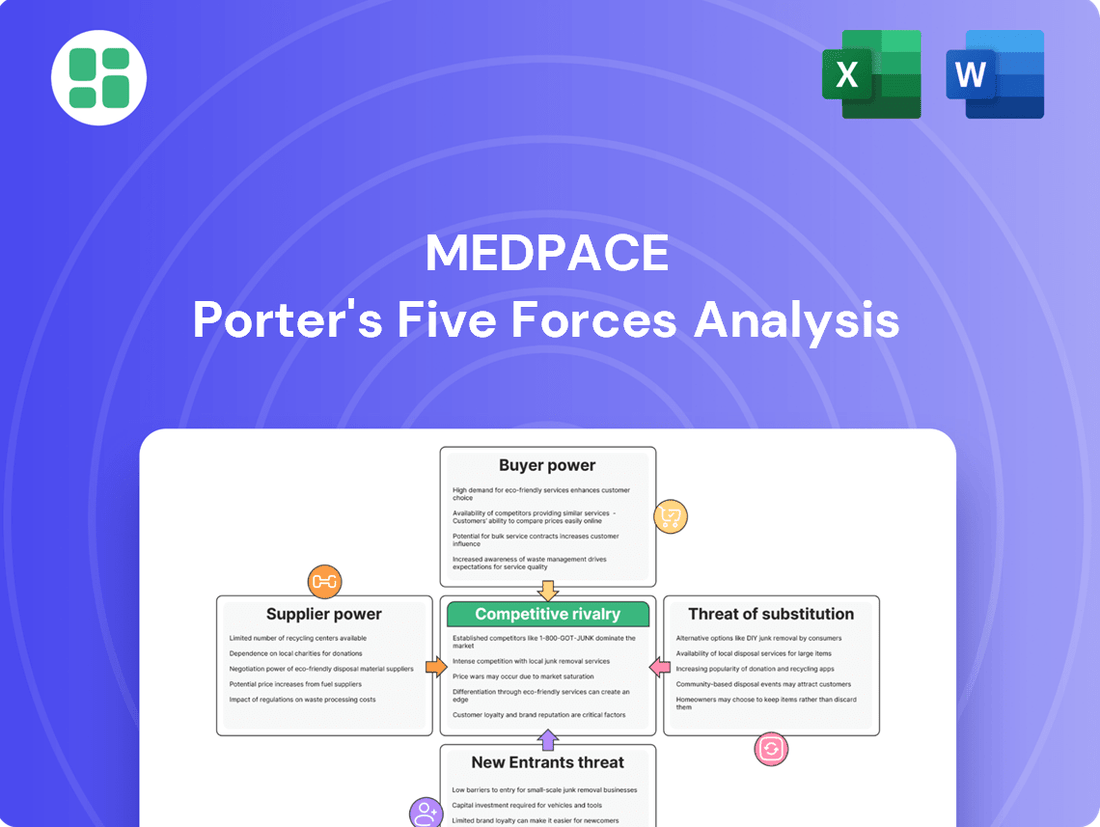

Analyzes Medpace's competitive environment by examining the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within the CRO industry.

Understand competitive pressures instantly with a visual spider chart, simplifying complex market dynamics.

Customers Bargaining Power

Medpace operates within the pharmaceutical, biotechnology, and medical device sectors, which can feature a degree of customer concentration. Large global players within these industries often represent significant revenue streams for contract research organizations (CROs) like Medpace.

These major clients, due to the substantial volume of clinical trial services they procure, wield considerable bargaining power. This leverage allows them to negotiate for more favorable pricing, flexible contract terms, and potentially customized service packages, impacting Medpace's profitability and operational flexibility.

Once a clinical trial is initiated with Medpace, the cost and complexity of switching to another Contract Research Organization (CRO) become exceptionally high. This is due to stringent regulatory requirements, the intricate nature of data transfer, and the potential for significant project delays. These factors create substantial switching costs for pharmaceutical and biotech companies mid-project.

These elevated switching costs effectively reduce the immediate bargaining power of Medpace's customers during an ongoing trial. The inertia and expense involved in changing providers mean clients are less likely to demand concessions, fostering client stickiness and securing Medpace's revenue stream for the duration of the project.

Medpace's large pharmaceutical and biotech clients often boast advanced in-house research and development departments. This internal expertise allows them to thoroughly assess the performance of contract research organizations (CROs) like Medpace.

With a deep understanding of the drug development lifecycle, these clients can negotiate pricing and service terms more effectively. They may even have the capacity to manage certain aspects of clinical trials internally, which directly enhances their bargaining power with CROs.

Project-Based Procurement

Clinical trial contracts are inherently project-based, meaning clients, such as pharmaceutical and biotech companies, frequently re-evaluate their Contract Research Organization (CRO) partners for each new study or phase. This cyclical procurement process empowers customers to consistently assess market competitiveness. In 2024, the global CRO market was valued at approximately $50 billion, with significant competition driving price sensitivity among clients.

This recurring need to solicit bids and compare service providers allows customers to leverage their substantial demand for new clinical trials to negotiate more favorable terms. They can actively shop around, obtaining multiple proposals to benchmark pricing and service levels. This dynamic forces CROs like Medpace to continuously demonstrate their value proposition, not just on scientific merit but also on cost-effectiveness, to retain and win new business.

- Project-Based Nature: Contracts are awarded for specific trials, not long-term retainers, enabling frequent re-evaluation.

- Competitive Bidding: Clients routinely solicit multiple bids, fostering a competitive environment for CRO services.

- Demand Leverage: High demand for clinical trial services allows customers to negotiate better pricing and terms.

- Value Demonstration: CROs must consistently prove their worth to secure ongoing partnerships.

Demand for Specialized Expertise and Quality

Customers increasingly seek Medpace for its specialized, high-science approach, particularly in complex therapeutic areas. This demand for quality and scientific rigor means clients are less sensitive to price for these niche services, but it also raises their expectations for exceptional outcomes and strict adherence to quality benchmarks. For instance, in 2024, Medpace continued to highlight its expertise in oncology and rare diseases, areas where the cost of failure is exceptionally high, thereby empowering clients to demand top-tier performance.

The bargaining power of customers is influenced by their demand for specialized expertise and quality. Medpace's focus on a high-science approach and deep knowledge in complex therapeutic areas allows it to command a premium. However, this also means clients have significant leverage due to their high expectations for successful clinical trial outcomes and stringent quality standards. In 2024, Medpace's success in navigating complex regulatory environments for novel therapies underscored this dynamic, as clients were willing to pay for proven expertise but also demanded flawless execution.

- Specialized Expertise: Clients value Medpace's deep knowledge in niche therapeutic areas, reducing their willingness to substitute.

- Quality Expectations: High client expectations for scientific rigor and successful outcomes grant them leverage.

- Risk Aversion: In complex trials, clients prioritize proven quality over cost, empowering them to demand superior performance.

- Outcome Dependency: The success of a client's drug development is directly tied to the quality of Medpace's services, increasing customer bargaining power.

Medpace's customers, primarily large pharmaceutical and biotech firms, possess significant bargaining power due to the substantial volume of services they procure. This power is amplified by their in-house expertise, allowing for rigorous performance assessment and negotiation. The project-based nature of clinical trials, coupled with competitive bidding processes, further enables clients to leverage their demand for services, as seen in the roughly $50 billion global CRO market in 2024, which fosters price sensitivity.

| Factor | Impact on Medpace | Customer Leverage |

|---|---|---|

| Client Size & Volume | High revenue dependence | Negotiate favorable pricing and terms |

| In-house Expertise | Ability to scrutinize CRO performance | Demand tailored services and competitive rates |

| Project-Based Procurement | Need to win bids for each new trial | Shop for best value, driving price competition |

| Specialized Service Demand | Premium pricing potential for niche expertise | High expectations for quality and outcomes |

Preview Before You Purchase

Medpace Porter's Five Forces Analysis

This preview showcases the complete Medpace Porter's Five Forces Analysis, offering a comprehensive examination of the competitive landscape within the contract research organization (CRO) sector. The document you see here is precisely what you will receive instantly after purchase, ensuring full transparency and immediate access to this valuable strategic tool.

Rivalry Among Competitors

The global clinical research organization (CRO) market is a battleground for giants, with Medpace competing against formidable players like IQVIA, Labcorp, Syneos Health, Parexel, and Charles River Laboratories. This intense competition among major global CROs means a constant struggle for significant, worldwide clinical trial contracts and overall market dominance.

In 2024, the CRO industry continues to see consolidation and strategic maneuvering among these large entities. For instance, IQVIA, a leading CRO, reported robust revenue growth in recent years, underscoring its significant market share and competitive strength.

This high concentration of established, well-resourced competitors directly fuels aggressive rivalry. Companies vie intensely for preferred vendor status with pharmaceutical and biotech firms, driving down margins on certain services while pushing innovation and efficiency to gain an edge.

Medpace distinguishes itself through a high-science, disciplined approach, concentrating on complex therapeutic areas like oncology and central nervous system disorders. This specialization allows them to command higher margins and build strong client relationships based on deep scientific understanding.

The competitive landscape is marked by increasing rivalry as other Contract Research Organizations (CROs) also aim to develop or broaden their expertise in these specialized niches. This competition centers on scientific acumen, quality of service delivery, and nuanced regulatory knowledge, rather than solely on cost, as clients seek demonstrable expertise for challenging clinical trials.

Customers, especially major pharmaceutical firms, are under immense pressure to control their research and development expenditures, driving a demand for cost-effectiveness in drug creation. This translates directly into significant pricing pressure on Contract Research Organizations (CROs).

The intense competition among CROs to secure contracts by offering aggressive pricing can erode profit margins across the sector. For instance, in 2024, the CRO market's growth, while robust, is often characterized by tight bidding processes as clients seek the best value.

Talent Acquisition and Retention Challenges

The contract research organization (CRO) sector thrives on a highly skilled workforce, encompassing clinical investigators, project managers, biostatisticians, and medical specialists. This reliance on specialized talent creates significant competitive pressure.

The intense competition for these sought-after professionals directly inflates labor costs. For instance, in 2024, the demand for experienced clinical research associates (CRAs) continued to outstrip supply, leading to average salary increases of 8-12% in many regions, impacting operational budgets.

This talent scarcity intensifies rivalry as companies vie to attract and retain top-tier professionals. Companies like IQVIA and PPD (now part of Thermo Fisher Scientific) are known for their robust training programs and competitive compensation packages, setting a high bar for others in the industry.

- High Demand for Specialized Skills: Clinical investigators, biostatisticians, and project managers are critical and in short supply.

- Rising Labor Costs: Competition for talent in 2024 drove average salary increases for key roles by 8-12%.

- Impact on Operational Capacity: Difficulty in acquiring and retaining staff can limit a CRO's ability to take on new projects.

- Strategic Importance of Talent: Companies investing in talent development and retention gain a competitive edge.

Regulatory Complexity and Global Reach

The competitive rivalry in the CRO sector is intensified by the intricate and ever-changing global regulatory environments. Companies that can effectively navigate these diverse landscapes, coupled with a significant international presence, possess a distinct advantage. This complexity drives continuous investment by Contract Research Organizations (CROs) in expanding their geographical reach and enhancing their regulatory acumen to cater to multinational clients, ultimately aiming to secure a leading position in complex global clinical trials.

The ability to manage varying regulatory requirements across different countries is a key differentiator. For instance, in 2024, the global CRO market was valued at approximately $50 billion, with a significant portion of this driven by the demand for expertise in navigating regulations like the EU's Clinical Trials Regulation (CTR) and the FDA's evolving guidelines.

- Global Regulatory Expertise: CROs must invest heavily in understanding and complying with a patchwork of international regulations, such as ICH-GCP, GDPR, and country-specific health authority requirements.

- Geographic Footprint: A broad operational presence allows CROs to conduct trials in diverse patient populations and regulatory jurisdictions, appealing to large pharmaceutical companies with global development pipelines.

- Investment in Compliance: Competitive pressure forces CROs to continuously update their systems and training to meet stringent quality and data integrity standards mandated by regulatory bodies worldwide.

- Market Share Dynamics: Leading CROs, like IQVIA and Thermo Fisher Scientific (through its PPD acquisition), leverage their scale and global regulatory mastery to capture a larger share of the outsourcing market, particularly for complex, multi-region studies.

Competitive rivalry within the CRO sector is fierce, driven by a limited number of large, established players vying for global clinical trial contracts. This intense competition, evident in 2024, forces companies to differentiate through scientific expertise and operational efficiency, often leading to price pressures despite robust market growth.

SSubstitutes Threaten

A significant substitute for Medpace's clinical research organization (CRO) services is the choice by pharmaceutical, biotech, and medical device companies to manage clinical development entirely in-house. This is particularly true for larger entities with substantial research and development budgets and existing clinical operations infrastructure.

In 2023, the global CRO market was valued at approximately $50 billion, indicating a substantial portion of clinical development is outsourced. However, companies like Pfizer and Johnson & Johnson, with their vast internal resources, possess the capability to handle many trials internally, reducing their reliance on external CROs for specific projects.

Academic research organizations (AROs) and university medical centers can act as substitutes for contract research organizations (CROs), especially for early-phase clinical trials, investigator-initiated studies, or niche disease areas. While they might not match the commercial scale or regulatory speed of major CROs, their strength lies in scientific depth and access to specialized patient cohorts. For instance, many academic institutions have dedicated clinical trial units that excel in complex study designs and recruit patients with rare conditions, offering a distinct value proposition.

The rise of Decentralized Clinical Trial (DCT) technology platforms presents a notable threat of substitution for traditional Contract Research Organization (CRO) services. These platforms enable direct-to-patient engagement, remote data capture, and virtual trial management, potentially lessening the need for site-based infrastructure that many CROs rely on.

By 2024, the DCT market is projected to grow significantly, with some estimates suggesting a compound annual growth rate of over 15%. This expansion means more pharmaceutical companies may opt for these technology-driven solutions, reducing their dependence on the full suite of traditional CRO services, especially for certain trial phases or designs.

While established CROs like Medpace are actively investing in and integrating DCT capabilities, the fundamental shift towards more patient-centric, digitally enabled trials could still erode the market share of purely site-based service models. This necessitates a strategic pivot for CROs to remain competitive in this evolving landscape.

Specialized Consulting Firms and Technology Vendors

The threat of substitutes for Medpace's core contract research organization (CRO) services is growing. Clients increasingly consider unbundling services, engaging specialized consulting firms for niche areas like regulatory affairs or data analytics. This allows them to manage specific trial components internally, bypassing the need for a full-service CRO for every aspect.

Furthermore, the direct licensing of advanced clinical trial software from technology vendors presents another substitute. Companies can leverage these platforms to handle certain trial management tasks independently. For instance, in 2024, the global clinical trial management system (CTMS) market was valued at approximately $1.4 billion, indicating a significant and growing availability of such internal solutions.

- Specialized Consulting: Firms focusing on regulatory strategy or data management offer targeted expertise as an alternative to comprehensive CRO services.

- Technology Licensing: Direct access to clinical trial software allows clients to manage specific trial functions in-house, reducing reliance on external CROs.

- Internal Capabilities: As technology advances, more biopharmaceutical companies are building internal expertise to handle aspects of clinical trial execution.

- Cost-Benefit Analysis: Clients may choose to substitute by performing certain tasks internally if the cost savings and control outweigh the benefits of outsourcing to a full-service CRO.

Contract Manufacturing Organizations (CMOs) with Integrated Services

While not direct substitutes for Medpace's core clinical trial management, some large Contract Manufacturing Organizations (CMOs) are expanding into adjacent services. These CMOs may offer integrated development and manufacturing services that can sometimes include elements overlapping with early-stage clinical support, presenting a niche, indirect substitution for fragmented services.

For instance, in 2024, the global CMO market continued its robust growth, with reports indicating it reached over $200 billion, demonstrating significant investment and expansion capabilities. This expansion by CMOs into areas like early-phase drug development support, often driven by client demand for streamlined supply chains, poses a potential, albeit limited, threat.

- Expanding Service Portfolios: CMOs are increasingly offering a broader suite of services beyond traditional manufacturing, including formulation development and analytical services that touch upon early clinical needs.

- Integrated Supply Chain Solutions: The drive for efficiency encourages some drug developers to seek single-source providers for development, manufacturing, and early-stage logistical support, potentially bypassing specialized CROs for certain functions.

- Niche Substitution: This threat is most pronounced for specific, less complex early-phase activities where the line between manufacturing support and clinical trial services can blur, rather than for comprehensive Phase I-IV trial management.

The threat of substitutes for Medpace's services is multifaceted, encompassing in-house capabilities, academic research organizations, and technological advancements like Decentralized Clinical Trials (DCTs). Companies can also unbundle services, opting for specialized consultants or licensing trial management software directly. Even some Contract Manufacturing Organizations (CMOs) are expanding into adjacent areas, creating indirect competition.

By 2024, the global CRO market's value, estimated around $50 billion, highlights the significant outsourcing trend, yet large pharma companies with substantial R&D budgets, like Pfizer, can manage many trials internally. The DCT market, projected to grow at over 15% annually, further offers a substitute by enabling patient-centric, digitally managed trials, potentially reducing reliance on traditional site-based CRO models.

The increasing availability of clinical trial management systems (CTMS), with the global market valued at approximately $1.4 billion in 2024, empowers companies to handle specific trial functions independently. This trend, coupled with the expansion of CMOs into early-phase development support—a market exceeding $200 billion in 2024—indicates a growing landscape of alternative solutions for aspects of clinical development.

| Substitute Type | Description | 2024 Market Relevance/Data |

|---|---|---|

| In-house Management | Large pharmaceutical companies managing trials internally. | Companies like Johnson & Johnson have extensive internal clinical operations. |

| Academic Research Organizations (AROs) | University medical centers and AROs for early-phase or niche studies. | Excel in scientific depth and access to specialized patient cohorts. |

| Decentralized Clinical Trials (DCTs) | Technology platforms enabling direct-to-patient and remote trial management. | Projected CAGR of over 15%, offering patient-centric solutions. |

| Specialized Consulting & Software Licensing | Targeted expertise firms and direct licensing of trial management software. | CTMS market valued at ~$1.4 billion in 2024. |

| Contract Manufacturing Organizations (CMOs) | CMOs expanding into early-phase development support. | Global CMO market exceeded $200 billion in 2024. |

Entrants Threaten

Launching a global contract research organization (CRO) like Medpace demands immense upfront capital. Think about the costs involved in setting up clinical trial sites worldwide, equipping advanced laboratories, and building sophisticated technology platforms. These aren't small expenses; they represent a significant financial hurdle.

For instance, establishing a single state-of-the-art laboratory can easily run into millions of dollars. Add to that the need for a global operational network, which includes regulatory compliance, skilled personnel, and logistical capabilities across multiple continents. This high barrier to entry naturally limits the number of new players who can realistically challenge established companies.

The clinical research industry is a minefield of regulations, with bodies like the FDA and EMA setting strict standards. New companies must navigate complex rules like Good Clinical Practice (GCP), demanding significant investment in expertise and robust quality systems.

For instance, in 2024, the FDA continued to emphasize data integrity and patient safety, issuing warning letters to organizations that failed to meet these rigorous requirements, underscoring the high compliance barrier for any potential new entrant.

The need for specialized talent is a significant barrier for new entrants into the Contract Research Organization (CRO) market. Building a competitive CRO requires a deep bench of expertise, including medical doctors, scientists, biostatisticians, clinical operations specialists, and regulatory affairs professionals. For instance, in 2024, the demand for experienced clinical research associates (CRAs) remained exceptionally high, with some reports indicating a shortage of over 15% in qualified personnel globally.

New CROs face considerable challenges in attracting, training, and retaining this scarce talent pool. This specialized workforce is not only crucial for the efficient execution of complex clinical trials but also for building the trust and credibility that clients, such as pharmaceutical and biotechnology companies, demand. The high cost of recruiting and onboarding such specialized personnel, coupled with competitive salaries and benefits, further elevates the entry barriers.

Established Client Relationships and Reputation

The Contract Research Organization (CRO) sector thrives on deep-seated client connections and a demonstrated history of successful clinical trial execution. Medpace, as a prominent player, leverages its established reputation for quality and dependability, which translates into significant repeat business and a strong foundation of trust. This makes it exceptionally challenging for new companies to penetrate the market and build the necessary credibility to compete effectively.

New entrants face a substantial hurdle in replicating the extensive network of relationships and the proven success metrics that established CROs like Medpace have cultivated over years of operation. Gaining the confidence of pharmaceutical and biotechnology companies, who entrust critical drug development processes to CROs, requires a long and arduous journey of demonstrating consistent performance and reliability.

- Client Loyalty: Pharmaceutical companies often exhibit high loyalty to CROs that have consistently delivered successful trials, making it difficult for new entrants to secure initial contracts.

- Reputational Capital: A strong reputation for scientific expertise, regulatory compliance, and efficient project management is built over many years and is a significant barrier to entry.

- Track Record: Demonstrating a robust track record of bringing drugs through clinical phases successfully is crucial, and new entrants lack this historical data.

Data Integration and Proprietary Technology

The barrier to entry for new players in the clinical trial management space is significantly elevated by the need for robust data integration and proprietary technology. Modern trials generate immense volumes of complex data, requiring sophisticated management systems and advanced analytics. For instance, in 2024, the global clinical trial management systems (CTMS) market was valued at approximately $2.2 billion, with projections indicating continued growth, underscoring the substantial investment required.

New entrants must either develop these advanced IT infrastructures and data capabilities from scratch or acquire them, both of which represent substantial financial and temporal hurdles. This complex and costly undertaking acts as a significant deterrent, limiting the threat of new competitors entering the market.

- High Capital Investment: Developing or acquiring advanced IT infrastructure and data management capabilities requires significant upfront capital.

- Technological Complexity: Building and integrating sophisticated systems for data analysis and trial management is technically challenging.

- Time to Market: The lengthy development and validation process for new technology platforms creates a substantial time lag, delaying market entry.

- Data Security and Compliance: Ensuring compliance with stringent healthcare regulations like HIPAA and GDPR adds further complexity and cost for new entrants.

The threat of new entrants in the CRO market is generally low due to substantial barriers. These include the immense capital required for global operations, advanced laboratories, and technology platforms, alongside the stringent regulatory landscape demanding significant expertise and compliance investment.

The industry also faces a critical shortage of specialized talent, making it difficult and costly for newcomers to build a competitive team. Furthermore, established players like Medpace benefit from deep-seated client relationships and proven track records, which are hard for new companies to replicate, thus limiting their ability to gain trust and secure initial contracts.

| Barrier Type | Description | Impact on New Entrants |

| Capital Requirements | High costs for global sites, labs, and technology. | Significant financial hurdle, limiting the number of potential competitors. |

| Regulatory Compliance | Complex rules (e.g., FDA, EMA) require substantial expertise and quality systems. | Demands significant investment in compliance and legal teams. |

| Specialized Talent | Shortage of experienced medical, scientific, and operational staff. | Increases recruitment costs and time-to-market for new entrants. |

| Client Relationships & Reputation | Established trust and proven success are key differentiators. | New entrants struggle to gain credibility and secure initial business. |

| Technology & Data Infrastructure | Need for advanced IT systems for data management and analysis. | Requires substantial investment and technical expertise to develop or acquire. |

Porter's Five Forces Analysis Data Sources

Our Medpace Porter's Five Forces analysis is built upon a robust foundation of data, incorporating insights from industry-specific market research reports, Medpace's own SEC filings, and publicly available financial statements. This comprehensive approach ensures a thorough understanding of the competitive landscape.