Medpace Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Medpace Bundle

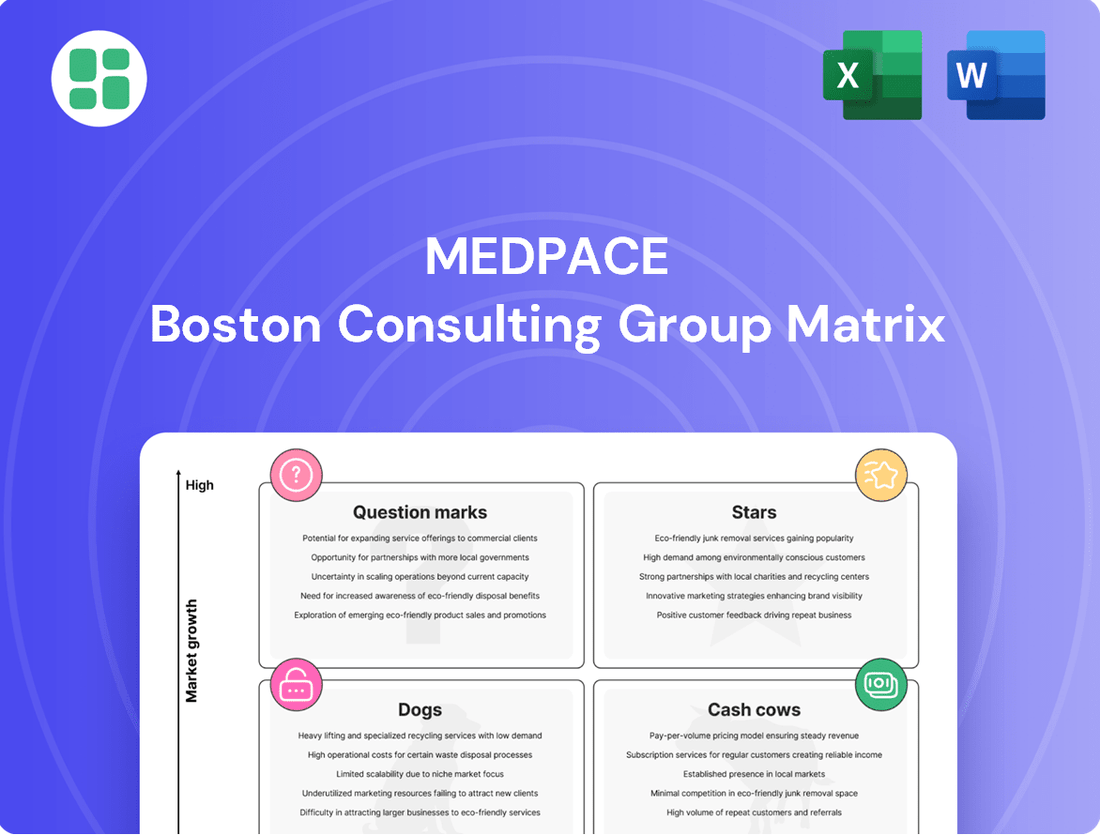

Curious about Medpace's product portfolio performance? Our BCG Matrix preview offers a glimpse into their market position, categorizing products as Stars, Cash Cows, Dogs, or Question Marks. To truly unlock strategic advantage and make informed decisions about resource allocation and future investments, you need the full picture.

Don't settle for a partial view. Purchase the complete Medpace BCG Matrix report for a comprehensive breakdown of each product's quadrant placement, coupled with actionable strategic recommendations. This is your key to navigating the competitive landscape with confidence and driving profitable growth.

Stars

Medpace's significant specialization in oncology, representing 31% of its year-to-date revenue in 2025, firmly establishes it as a leader in this high-growth therapeutic area. This focus is strategically advantageous, as oncology trials constitute a substantial portion of the overall Contract Research Organization (CRO) market.

The dominance of oncology within the CRO landscape is driven by the persistent increase in cancer incidence globally and the continuous, robust demand for innovative treatment options. Medpace's deep expertise and disciplined execution in managing complex oncology trials allow it to capture a significant market share in this rapidly expanding and critically important field.

Metabolic Disorders Clinical Trials represent a significant growth area for Medpace, contributing 25% of its year-to-date revenue in 2025. This strong performance positions it as a star within Medpace's business portfolio. The increasing prevalence of metabolic diseases and favorable regulatory environments are fueling substantial investment and innovation in this sector.

Medpace's deep expertise and established track record in managing complex metabolic disorder trials are key drivers of its success. This specialized knowledge ensures continuous demand for its services, allowing the company to effectively navigate the intricacies of this therapeutic area and secure a substantial market share.

Medpace excels in rare disease and orphan indications research, a field marked by urgent patient needs and often expedited regulatory processes.

This niche is attractive for substantial investment and swift progress, positioning Medpace for rapid growth and market leadership by utilizing its scientific and regulatory acumen.

The orphan drug market is projected to reach $50 billion by 2025, with rare diseases representing a significant portion of new drug approvals.

Early Phase (Phase I) Clinical Development

Medpace's full-service model is instrumental in Phase I clinical development, offering comprehensive services essential for generating early data and speeding up the drug development pipeline. This critical early phase is experiencing significant growth, highlighting a lucrative market opportunity.

The early phase development services segment is anticipated to see robust expansion. For instance, the global CRO market, which heavily influences early phase development, was valued at approximately $45.6 billion in 2023 and is projected to reach over $70 billion by 2028, demonstrating a compound annual growth rate of around 9.5%.

Medpace's strategic advantage lies in its disciplined approach and integrated laboratory services. These capabilities are key to securing a strong market position in this high-demand, crucial stage of drug development.

- Comprehensive Phase I Services: Medpace provides end-to-end support for early-stage clinical trials, crucial for initial safety and efficacy data.

- High-Growth Market Segment: The early phase development services market is experiencing rapid expansion, driven by increasing R&D investments.

- Competitive Edge: Medpace leverages its integrated laboratory services and disciplined execution to excel in this critical, high-demand phase.

Complex Biologics and Gene Therapy Trials

Medpace leverages its deep scientific and operational foundation to excel in complex biologics and gene therapy trials. This specialized expertise positions them strongly in a high-growth segment of the biopharmaceutical CRO market.

The intricate nature of cell and gene therapies demands unique scientific and operational capabilities, areas where Medpace demonstrates significant strength. This allows them to capture a substantial market share in this cutting-edge, rapidly advancing field.

- High Market Share: Medpace holds a significant position in the complex biologics and gene therapy CRO market due to its specialized capabilities.

- Scientific Acumen: Their foundational expertise in science is critical for managing the complexities of these innovative therapeutic areas.

- Operational Excellence: Medpace's operational strengths are essential for navigating the unique challenges presented by cell and gene therapy trials.

- Growth Segment: This sector represents a high-growth area within the biopharmaceutical CRO landscape, benefiting from Medpace's focused approach.

Stars in the Medpace BCG Matrix represent business segments with high market share in high-growth markets. Medpace's oncology services, accounting for 31% of its 2025 year-to-date revenue, exemplify this category due to the sector's robust growth and Medpace's leading position. Similarly, their metabolic disorder trials, contributing 25% of year-to-date revenue in 2025, are a star, driven by increasing disease prevalence and Medpace's expertise. Rare disease and orphan indications also fall into the star category, benefiting from urgent patient needs and expedited regulatory pathways, with the orphan drug market projected to reach $50 billion by 2025.

| Therapeutic Area | 2025 YTD Revenue Contribution | Market Growth Driver | Medpace's Competitive Advantage |

|---|---|---|---|

| Oncology | 31% | Increasing cancer incidence, demand for new treatments | Deep expertise, disciplined execution |

| Metabolic Disorders | 25% | Rising prevalence of metabolic diseases, favorable regulations | Established track record, specialized knowledge |

| Rare Diseases & Orphan Indications | N/A (High growth potential) | Urgent patient needs, expedited regulatory processes | Scientific and regulatory acumen |

What is included in the product

Medpace's BCG Matrix analyzes its portfolio by market share and growth, guiding investment decisions.

The Medpace BCG Matrix provides a clear, one-page overview of each business unit's strategic position, alleviating the pain of complex portfolio analysis.

Cash Cows

Medpace's core Phase III clinical trial management services are its bedrock, representing a significant cash cow. These large-scale trials in well-established therapeutic areas showcase Medpace's dominance and consistent revenue generation. The company's extensive experience and infrastructure in managing these complex studies allow for highly efficient operations.

While the market growth for these foundational services might not be as explosive as newer biotech areas, their reliability is undeniable. Medpace leverages its established processes and strong client relationships, ensuring high profit margins with relatively low ongoing investment needs. This stability is crucial for funding innovation in other parts of their business.

In 2024, Medpace continued to see robust demand for its Phase III capabilities. The company reported strong revenue growth, partly driven by the successful execution of numerous large-scale oncology and cardiovascular trials. This segment consistently contributes a substantial portion of their overall profitability, underscoring its cash cow status.

Medpace's Central Laboratory Services are a prime example of a cash cow within its BCG Matrix. These services are critical for virtually all clinical trials, offering a stable and consistent revenue stream due to their high demand and widespread use across a diverse client base. In 2024, Medpace reported that its laboratory services continued to be a significant contributor to its overall financial performance, reflecting the mature and essential nature of this market segment.

Data management and biostatistics are the bedrock of clinical trials, ensuring reliable data collection and analysis across all therapeutic areas. This consistent demand makes them a stable revenue generator for Medpace.

Medpace's advanced systems and specialized knowledge in these fields allow for efficient, high-quality results. This translates into predictable, profitable income with minimal further investment, especially given the maturity of this market segment. For instance, in 2024, Medpace reported significant contributions from its clinical services, which heavily rely on these core competencies.

Regulatory Affairs Consulting and Submissions

Regulatory affairs consulting and submissions represent a consistent revenue stream for Medpace, as pharmaceutical and biotech firms perpetually require assistance navigating intricate global regulations. This service holds a significant market share due to its essential role throughout the drug development lifecycle.

Medpace's extensive regulatory expertise, applied across diverse therapeutic areas, ensures a stable and predictable income. For instance, in 2024, the global regulatory affairs outsourcing market was valued at approximately $15 billion and is projected to grow steadily, underscoring the ongoing demand for these critical services.

- Perpetual Demand: Regulatory compliance is a non-negotiable requirement for drug approval and market access worldwide.

- High Market Share: Medpace's established reputation and broad service offering contribute to its strong position in this essential market segment.

- Stable Revenue: The continuous need for regulatory support provides a reliable and predictable income source, characteristic of a cash cow.

- Expertise Leverage: Medpace effectively utilizes its deep regulatory knowledge across all therapeutic areas, maximizing its market penetration.

Post-Marketing (Phase IV) Clinical Support

Medpace's Post-Marketing (Phase IV) Clinical Support acts as a Cash Cow within its Business Growth Curve matrix. This segment focuses on studies conducted after a drug or medical device has received regulatory approval and is already on the market. These services are crucial for ongoing safety surveillance, gathering real-world data on effectiveness, and understanding long-term patient outcomes.

This area typically involves long-term, stable contracts, providing Medpace with a consistent and predictable revenue stream. The demand for post-marketing surveillance and real-world evidence generation is a mature market, driven by regulatory requirements and the need for pharmaceutical companies to demonstrate value beyond initial approval. For instance, in 2024, the global market for clinical trial services, including Phase IV studies, was projected to continue its steady growth, reflecting sustained investment in post-launch drug monitoring.

- Stable Revenue Generation: Phase IV studies often translate into multi-year contracts, offering predictable income.

- Mature Market Demand: Regulatory bodies and payers consistently require real-world evidence, ensuring ongoing need.

- Low Risk, High Certainty: Compared to early-phase trials, Phase IV studies carry lower scientific risk and higher contractual certainty.

- Foundation for Growth: While not high-growth, these services provide a solid financial base supporting investment in other business areas.

Medpace's core Phase III clinical trial management services are its bedrock, representing a significant cash cow. These large-scale trials in well-established therapeutic areas showcase Medpace's dominance and consistent revenue generation, with the company reporting strong revenue growth in 2024, partly driven by the successful execution of numerous large-scale oncology and cardiovascular trials.

The company's extensive experience and infrastructure in managing complex Phase III studies allow for highly efficient operations, translating into high profit margins with relatively low ongoing investment needs. This stability is crucial for funding innovation in other parts of their business.

Medpace's Central Laboratory Services are a prime example of a cash cow, offering a stable and consistent revenue stream due to their high demand and widespread use. In 2024, laboratory services continued to be a significant contributor to overall financial performance, reflecting the mature and essential nature of this market segment.

Data management and biostatistics are also key cash cows, ensuring reliable data collection and analysis. Medpace's advanced systems and specialized knowledge in these fields allow for efficient, high-quality results, providing predictable, profitable income with minimal further investment.

| Service Area | BCG Category | 2024 Performance Indicator | Revenue Contribution |

| Phase III Trial Management | Cash Cow | Strong revenue growth, driven by oncology & cardiovascular trials | Substantial |

| Central Laboratory Services | Cash Cow | Significant contributor to overall financial performance | High |

| Data Management & Biostatistics | Cash Cow | Predictable, profitable income with minimal investment | Consistent |

Preview = Final Product

Medpace BCG Matrix

The Medpace BCG Matrix preview you are currently viewing is the identical, fully formatted document you will receive immediately after your purchase. This means you can confidently assess the strategic insights and professional presentation of the report, knowing that no watermarks or demo content will obscure the valuable analysis within the final version. The exact file you see here, complete with its comprehensive market data and strategic recommendations, is what will be delivered to you, ready for immediate application in your business planning and decision-making processes.

Dogs

In the bioanalytical services sector, commoditized early-stage testing often falls into the Dogs quadrant of the Medpace BCG Matrix. This means these services likely hold a low market share within a low-growth market segment. For instance, basic bioanalytical assays, widely available from numerous providers, face intense price competition and thin profit margins, with many such services potentially contributing less than 5% to overall revenue in highly competitive sub-segments.

If Medpace were to continue relying on outdated or less flexible data management platforms, especially those that don't integrate with modern decentralized trial technologies or AI, its market share for these specific services would likely be low. Such a scenario places these offerings in the Dogs quadrant of the BCG matrix.

In today's rapidly evolving digital landscape, particularly within clinical research, services that lack adaptability and integration capabilities face significant challenges. For instance, the global clinical trial management system market was valued at approximately $1.7 billion in 2023 and is projected to grow, but solutions not embracing AI or decentralized trial capabilities would lag behind.

These less differentiated data solutions would likely operate in a low-growth market segment, struggling to attract new business as competitors offer more advanced, integrated, and data-driven solutions. This stagnation would further solidify their position as Dogs, requiring careful consideration for divestment or significant reinvestment to modernize.

Generic medical device clinical trials, while a part of Medpace's service offering, might represent a segment where the company faces significant competition. Smaller, specialized Contract Research Organizations (CROs) or even the in-house teams of device manufacturers can often handle these less complex studies efficiently.

In the context of a BCG Matrix, if Medpace doesn't possess a strong competitive advantage or unique selling proposition for these generic device trials, they could be categorized as a 'Dog'. This implies a low market share within a market that may also have limited growth potential compared to more innovative areas like novel drug development.

Standardized Phase II Trials in Saturated Areas

Conducting highly standardized Phase II trials in saturated therapeutic areas, where numerous treatments already exist, presents a challenge for Medpace. These crowded markets often limit opportunities for significant innovation or differentiation, potentially leading to a lower market share for Medpace's services in these specific trials.

Such saturated areas may also translate to slower growth prospects and diminished strategic importance for Medpace if these trials do not offer unique value propositions. For instance, in 2024, the oncology sector, a highly competitive and researched area, saw a significant number of Phase II trials initiated. However, the success rate for new entrants in these established fields can be considerably lower, impacting the overall market penetration for contract research organizations (CROs) like Medpace.

- Saturated Markets: Therapeutic areas with many existing treatments offer limited differentiation opportunities for CROs.

- Lower Market Share: Standardized trials in these areas may result in a reduced share of the market for Medpace.

- Growth Constraints: Limited innovation potential in saturated fields can hinder Medpace's growth trajectory.

- Strategic Importance: These areas might hold less strategic value for Medpace compared to emerging therapeutic fields.

Legacy Paper-Based Trial Management

Legacy paper-based trial management, even in small pockets, is firmly in the 'Dog' category within Medpace's BCG Matrix. This approach is characterized by its inefficiency and lack of competitiveness in the modern clinical research environment.

The market for paper-based systems is negligible, as the industry overwhelmingly favors digital solutions. For instance, a 2024 survey indicated that over 95% of clinical trials globally utilize electronic data capture (EDC) systems, highlighting the steep decline of paper-based methods.

Key characteristics of this 'Dog' quadrant include:

- Low Market Share: Represents a tiny fraction of the overall clinical trial management market.

- Declining Market Segment: The demand for paper-based solutions continues to shrink year over year.

- Inefficiency and High Costs: Manual data entry and storage are time-consuming and prone to errors, increasing operational expenses.

- Lack of Competitiveness: Organizations relying on paper are at a significant disadvantage compared to those using advanced digital platforms.

Services in the 'Dog' quadrant of Medpace's BCG Matrix represent offerings with low market share in low-growth markets. These are typically commoditized services that face intense competition and offer minimal differentiation. For Medpace, this could include highly standardized, early-stage assays or basic data management solutions that have been outpaced by technological advancements.

These 'Dog' services are characterized by their inability to capture significant market share due to a lack of innovation or a highly competitive landscape. For example, basic bioanalytical testing, which is widely available from numerous providers, often operates on thin profit margins, with such services potentially contributing less than 5% to revenue in intensely competitive niches.

Consider the market for legacy, paper-based clinical trial management systems. In 2024, over 95% of global clinical trials utilized electronic data capture (EDC) systems, making paper-based methods a negligible and declining segment. These offerings represent a clear 'Dog' due to their inherent inefficiency, high costs, and lack of competitiveness.

Medpace's 'Dog' segments require strategic evaluation, often leading to divestment or significant reinvestment to modernize. Without such actions, these services will continue to languish, draining resources without contributing substantially to growth or market leadership.

Question Marks

Medpace is actively enhancing its decentralized clinical trial (DCT) offerings, integrating ePRO/eCOA, biosensing, and direct-to-patient logistics to meet the industry's growing demand for these advanced models. This strategic investment positions them to capitalize on the high-growth DCT market.

While the DCT market is expanding rapidly, Medpace's specific market share within this technology-intensive niche, especially when compared to specialized DCT providers, is likely still in its growth phase. For instance, the global DCT market was valued at approximately $1.2 billion in 2023 and is projected to reach over $4.5 billion by 2028, demonstrating substantial growth potential.

The integration of AI and ML in clinical research is rapidly transforming the landscape, with significant potential to optimize trial design, patient recruitment, and data analysis. This trend is a key growth driver, promising increased efficiency and speed in bringing new therapies to market.

Medpace's strategic outlook suggests a measured approach to AI and ML adoption, reflecting its status as an emerging area of investment rather than a fully established market dominance. This cautious experimentation indicates a focus on developing capabilities and exploring applications within their operations.

The demand for Real-World Evidence (RWE) is surging, with regulatory bodies increasingly pushing for its use in both drug development and ongoing safety monitoring. This trend is a significant driver for Medpace's RWE generation services.

While Medpace possesses strong data management capabilities that are foundational for RWE, this market is evolving rapidly. Dedicated RWE firms and larger Contract Research Organizations (CROs) may currently hold more established positions, indicating a high-growth potential for Medpace in this developing segment.

The global RWE market was valued at approximately $1.5 billion in 2023 and is projected to reach over $4.5 billion by 2028, growing at a CAGR of around 25%. This robust growth underscores the opportunity for Medpace to expand its market share.

Expansion into New Geographic Markets (e.g., specific APAC regions)

The Asia Pacific (APAC) region is poised to be a significant growth engine for the Contract Research Organization (CRO) market. This expansion is fueled by a surge in clinical trial activities and the region's vast and diverse patient demographics, making it an attractive area for pharmaceutical and biotech companies. For Medpace, a strategic focus on specific, high-growth emerging markets within APAC could represent a Question Mark in the BCG Matrix.

This means that while the potential for market share is substantial, it will likely demand considerable investment. Medpace would need to allocate resources to establish a strong presence and compete effectively against existing local CROs and larger, more entrenched global players. For instance, the APAC CRO market was projected to grow at a compound annual growth rate (CAGR) of over 10% leading up to 2024, with countries like China and India showing particularly robust activity.

- APAC CRO Market Growth: Expected to be the fastest-growing region, driven by increasing clinical trial outsourcing and a large patient pool.

- Medpace's Opportunity: Targeted expansion into specific emerging APAC markets presents a Question Mark, offering high growth potential but requiring significant investment.

- Competitive Landscape: Medpace will face established local and global competitors, necessitating strategic resource allocation to build market share.

- Investment Rationale: The potential reward of capturing market share in a rapidly expanding region justifies the investment, even with the inherent risks.

Specialized Companion Diagnostics Development

The personalized medicine revolution is fueling a surge in demand for companion diagnostics (CDx) developed in tandem with new drugs, creating a lucrative, fast-growing market segment.

Medpace's established scientific expertise and robust laboratory infrastructure offer a strong foundation for entering this specialized CDx development space. However, it's a relatively nascent area for Medpace, necessitating strategic investment to compete effectively with established diagnostic firms and secure substantial market share.

- Market Growth: The global companion diagnostics market was valued at approximately $4.1 billion in 2023 and is projected to reach over $11.5 billion by 2030, growing at a compound annual growth rate (CAGR) of around 16%.

- Integration Advantage: Developing CDx alongside drug candidates streamlines the regulatory pathway and enhances drug efficacy, a key driver for pharmaceutical companies.

- Medpace's Potential: Leveraging Medpace's existing clinical trial management and laboratory services could offer a competitive edge by providing an integrated solution for biopharmaceutical clients.

- Investment Needs: Capturing significant market share will require dedicated investment in specialized diagnostic technologies, regulatory expertise specific to diagnostics, and marketing to highlight this new service offering.

Medpace's expansion into the Asia Pacific (APAC) region, particularly in emerging markets, represents a classic Question Mark. While the region offers substantial growth potential, with the APAC CRO market projected to grow at a CAGR exceeding 10% leading up to 2024, Medpace faces intense competition from established local and global players.

This strategic move requires significant investment to build brand recognition and operational infrastructure, mirroring the characteristics of a Question Mark where potential rewards are high but so are the risks and required capital outlay.

Similarly, Medpace's foray into companion diagnostics (CDx) development positions it as a Question Mark. The CDx market is booming, with a projected valuation of over $11.5 billion by 2030, but Medpace needs to invest heavily in specialized technologies and regulatory expertise to gain traction against incumbent diagnostic firms.

The company's cautious approach to Artificial Intelligence (AI) and Machine Learning (ML) integration in clinical research also places it in the Question Mark category. While these technologies are transforming the industry, Medpace is still in the exploration phase, needing further investment to translate potential into market leadership.

BCG Matrix Data Sources

Our BCG Matrix leverages a blend of financial disclosures, market analytics, and expert commentary to provide a comprehensive view of product performance and market dynamics.