Marathon Oil PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Marathon Oil Bundle

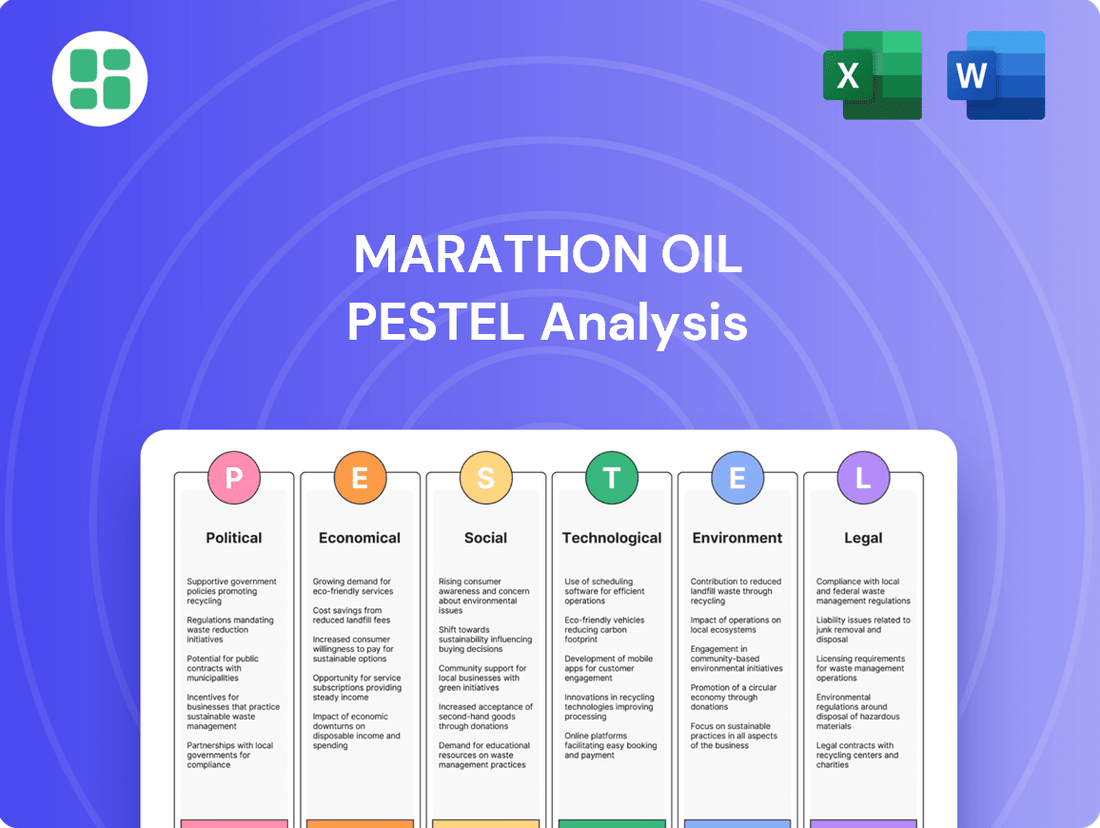

Unlock the critical external factors shaping Marathon Oil's trajectory with our expert PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements are creating both challenges and opportunities for the company. Equip yourself with actionable intelligence to refine your strategy and gain a competitive edge. Download the full PESTLE analysis now for a comprehensive understanding.

Political factors

Future U.S. administrations hold significant sway over the oil and gas sector. A shift favoring domestic production, potentially seen in a Biden-Harris administration's second term or a Republican administration, could mean deregulation and expanded leasing on federal lands, impacting companies like Marathon Oil. For instance, in 2023, the Biden administration approved the Willow Project, a major oil project in Alaska, signaling a complex balancing act.

Conversely, a stronger emphasis on climate change mitigation, a core tenet of current Democratic policies, could lead to more stringent environmental regulations and incentives for renewable energy, potentially slowing fossil fuel development. This could manifest as carbon pricing mechanisms or stricter methane emission rules, affecting operational costs and future investment decisions for Marathon Oil.

While Marathon Oil's core operations are within the United States, global geopolitical stability and international trade relations significantly influence worldwide oil prices, which in turn affect the broader energy market. Events in major oil-producing nations, such as the Middle East or Eastern Europe, can disrupt supply chains, leading to price swings that impact even domestically focused producers. For instance, ongoing tensions in Eastern Europe in 2024 continued to create uncertainty in global energy markets, contributing to price volatility for crude oil and natural gas.

Changes in federal and state taxation policies, including corporate tax rates and industry-specific deductions, directly impact Marathon Oil's profitability and investment strategies. For instance, shifts in severance taxes, a key revenue source for many oil-producing states, can alter the economic viability of certain projects.

Government incentives or disincentives related to energy sources also play a crucial role. Tax credits for renewable energy development or potential carbon taxes and methane emission penalties can influence Marathon Oil's capital allocation decisions, pushing investment towards or away from specific operational areas.

Regulatory Environment and Permitting

The ease of obtaining drilling permits and operational approvals from federal and state agencies significantly impacts companies like Marathon Oil. For instance, in 2024, the Bureau of Land Management (BLM) continued to implement new regulations affecting oil and gas leasing and permitting on federal lands, potentially increasing the time and cost associated with new projects.

Legislative efforts aimed at streamlining the permitting process, such as those discussed in Congress throughout 2024 and into 2025, could offer Marathon Oil opportunities to accelerate project timelines and reduce operational costs. However, the specific details and eventual passage of such legislation remain a key variable.

Conversely, stricter permitting requirements, which have been a trend in some states, can lead to project delays and heightened compliance burdens for Marathon Oil. For example, some states have seen an increase in environmental reviews and public comment periods for new drilling applications, adding complexity to the approval process.

- Federal Permitting Challenges: In 2024, the BLM's revised National Environmental Policy Act (NEPA) review process for oil and gas projects introduced new procedural steps, potentially extending approval timelines.

- State-Level Variations: Permitting timelines in key operating states for Marathon Oil, such as North Dakota and Texas, can differ significantly, with Texas generally offering a more streamlined process compared to some other jurisdictions.

- Legislative Impact: Proposed energy infrastructure bills in 2024 and 2025 often include provisions to expedite permitting, but their final form and effectiveness are yet to be fully determined.

International Climate Agreements

While Marathon Oil primarily operates within the United States, international climate agreements such as the Paris Agreement can still shape its operational landscape. Changes in U.S. participation, like the re-entry under the Biden administration in 2021, signal a shift towards climate action, potentially influencing domestic regulations and investor sentiment towards fossil fuels.

These global commitments can indirectly affect U.S. energy policy by creating pressure for stricter environmental standards and encouraging investment in renewable energy sources. This dynamic could impact Marathon Oil's long-term strategic planning and capital allocation decisions as the energy transition accelerates.

- Paris Agreement Re-entry: The U.S. rejoined the Paris Agreement on February 19, 2021, signaling a commitment to global climate goals.

- U.S. NDC: The U.S. has set a target to reduce greenhouse gas emissions by 50-52% below 2005 levels by 2030.

- Market Sentiment: International climate agreements influence global investor sentiment, potentially affecting capital availability for fossil fuel projects versus clean energy investments.

Government policies significantly shape the oil and gas industry, influencing Marathon Oil's operational landscape. Shifts in U.S. administrations, from those favoring domestic production to those prioritizing climate action, directly impact regulations and leasing on federal lands. For instance, the Biden administration's approach, while approving projects like Willow in 2023, also emphasizes climate mitigation, potentially leading to stricter environmental rules and incentives for renewables.

Taxation and incentives are critical political factors. Changes in federal and state corporate tax rates, severance taxes, and energy-specific credits or penalties, such as those for carbon emissions, directly affect Marathon Oil's profitability and investment decisions. Government support for renewables versus fossil fuels can steer capital allocation.

Permitting processes, both federal and state, are vital for project development. In 2024, the BLM's revised NEPA review process presented potential delays for oil and gas projects, while legislative efforts in 2024-2025 aimed to expedite these processes. Variations in state-level permitting, like the generally more streamlined process in Texas compared to other jurisdictions, also play a role.

International climate agreements, like the Paris Agreement, indirectly influence U.S. energy policy and investor sentiment. The U.S. rejoining the agreement in 2021 and setting a target to reduce emissions by 50-52% below 2005 levels by 2030 signals a move towards climate action, potentially impacting long-term capital for fossil fuel projects.

| Policy Area | 2024/2025 Trend/Fact | Impact on Marathon Oil |

|---|---|---|

| Federal Energy Policy | Continued debate on balancing domestic production with climate goals. | Influences leasing, regulations, and operational flexibility. |

| Taxation & Incentives | Potential adjustments to corporate taxes and energy credits. | Directly affects profitability and investment attractiveness. |

| Permitting Processes | Revised NEPA reviews (BLM) potentially extend timelines. Legislative efforts to streamline. | Affects project development speed and costs. State variations exist. |

| Climate Agreements | U.S. commitment to Paris Agreement and emission reduction targets. | Shapes investor sentiment and long-term energy transition strategy. |

What is included in the product

This PESTLE analysis provides a comprehensive overview of the external macro-environmental factors impacting Marathon Oil, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers forward-looking insights to support strategic decision-making and identify potential threats and opportunities within the dynamic energy sector.

Provides a concise version of Marathon Oil's PESTLE analysis that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors for strategic decision-making.

Easily shareable summary format ideal for quick alignment across teams or departments, ensuring everyone understands Marathon Oil's external landscape and potential impacts.

Economic factors

Marathon Oil's financial performance is intrinsically tied to the volatile global commodity markets, particularly crude oil, natural gas, and natural gas liquids (NGLs). These price fluctuations are the primary economic forces shaping the company's revenue, profitability, and overall cash flow. For instance, in early 2024, West Texas Intermediate (WTI) crude oil prices hovered around $75-$80 per barrel, a significant factor influencing Marathon's upstream earnings.

Market dynamics, including supply and demand imbalances, directly impact these prices. Recent analyses have highlighted periods of oversupply in the oil market, which can exert downward pressure on prices, consequently affecting investment returns for exploration and production companies like Marathon Oil. This sensitivity means that even minor shifts in global production levels or consumption patterns can have substantial economic consequences.

The prevailing interest rate environment significantly impacts Marathon Oil's capital-intensive exploration and production projects. As of mid-2024, the Federal Reserve's benchmark interest rate has remained elevated, influencing the cost of borrowing across the industry. Higher interest rates directly translate to increased financing costs for Marathon Oil, potentially affecting their capacity to fund new developments and manage existing debt obligations.

Access to affordable capital is therefore paramount for Marathon Oil to sustain competitive returns and advance its growth strategies. In 2023, Marathon Oil reported capital expenditures of approximately $1.6 billion, a figure that is sensitive to financing costs. Fluctuations in interest rates can alter the economic viability of projects, making capital availability a critical factor in strategic decision-making.

Inflationary pressures directly impact Marathon Oil's operating expenses, driving up costs for essential inputs like labor, drilling equipment, and raw materials. For example, the Producer Price Index (PPI) for crude petroleum and natural gas saw significant increases throughout 2023 and into early 2024, directly affecting the cost of goods used in oil extraction.

Effectively managing these escalating costs is paramount for Marathon Oil to maintain its capital discipline and deliver competitive returns on investment. The company's ability to control expenditures in a rising cost environment directly influences its profitability and shareholder value.

In such an inflationary climate, achieving cost efficiency and demonstrating operational excellence are no longer just desirable; they are critical necessities for Marathon Oil. This means optimizing every stage of the production process to mitigate the impact of higher input prices.

Economic Growth and Energy Demand

Overall economic growth, especially in key markets like the U.S., directly fuels energy demand. As economies expand, industrial activity, transportation, and consumer spending all increase, leading to higher consumption of crude oil, natural gas, and natural gas liquids (NGLs). This correlation is crucial for Marathon Oil, as robust economic conditions tend to support stable or rising commodity prices for its products.

For instance, the U.S. economy experienced a projected GDP growth of around 2.4% in 2024, according to the Congressional Budget Office (CBO) in February 2024. This growth underpins a healthy demand for energy. Similarly, global economic forecasts for 2024 generally point to continued expansion, which is positive for Marathon Oil's market outlook.

- U.S. GDP Growth (2024 Projection): ~2.4% (CBO, Feb 2024)

- Global Economic Expansion: Forecasts indicate continued growth in major economies, supporting energy consumption.

- Impact of Slowdowns: Economic downturns can significantly suppress energy demand, leading to lower prices and reduced profitability for producers like Marathon Oil.

Investment and Shareholder Returns

Marathon Oil’s strategic focus on generating competitive shareholder returns and robust free cash flow directly influences investor confidence and valuation. The company’s commitment to capital allocation, including dividends and share buybacks, is a primary driver for attracting and maintaining investment.

For instance, Marathon Oil reported returning approximately $1.3 billion to shareholders in 2023 through dividends and share repurchases, a testament to its economic strategy. This consistent capital return policy is vital for its appeal in the investment community.

- Shareholder Returns: Marathon Oil aims to deliver competitive returns by prioritizing free cash flow generation.

- Capital Allocation: The company actively returns capital to shareholders via dividends and share repurchases.

- 2023 Performance: Approximately $1.3 billion was returned to shareholders in 2023, reflecting the company's capital return strategy.

- Investor Attraction: Consistent capital returns are crucial for attracting and retaining investor interest.

Marathon Oil's economic health is fundamentally tied to the fluctuating prices of oil and gas, with West Texas Intermediate (WTI) crude oil prices in early 2024 averaging around $75-$80 per barrel, directly impacting upstream earnings. Market supply and demand dynamics create volatility, meaning even small shifts can significantly affect profitability. Furthermore, elevated interest rates, with the Federal Reserve’s benchmark rate remaining high in mid-2024, increase Marathon Oil's borrowing costs for its capital-intensive projects, potentially impacting investment decisions and debt management.

Inflationary pressures are also a significant concern, driving up operating costs for essential inputs like labor and equipment. For instance, the Producer Price Index (PPI) for crude petroleum saw notable increases through 2023 and into early 2024, directly raising costs for oil extraction. Consequently, cost efficiency and operational excellence are critical for Marathon Oil to maintain profitability and deliver shareholder value in this environment.

Broader economic growth, particularly in the U.S. with a projected GDP growth of around 2.4% for 2024, fuels energy demand, which is positive for Marathon Oil. However, economic downturns can suppress demand and prices, negatively impacting producers. Marathon Oil's strategy to return capital to shareholders, evidenced by approximately $1.3 billion returned in 2023 through dividends and buybacks, is crucial for maintaining investor confidence and company valuation.

| Economic Factor | Key Data Point (2024/2025) | Impact on Marathon Oil |

|---|---|---|

| Commodity Prices | WTI Crude: ~$75-80/bbl (Early 2024) | Directly influences revenue and profitability. |

| Interest Rates | Elevated Federal Reserve Rate (Mid-2024) | Increases borrowing costs for capital projects. |

| Inflation | Rising PPI for Crude Petroleum (2023-2024) | Increases operating expenses. |

| Economic Growth | U.S. GDP Growth: ~2.4% (2024 Projection) | Drives energy demand; economic slowdowns suppress it. |

| Shareholder Returns | $1.3 Billion Returned (2023) | Key to investor confidence and valuation. |

Preview Before You Purchase

Marathon Oil PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Marathon Oil delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions. Understand the external forces shaping Marathon Oil's future.

Sociological factors

Public perception of fossil fuels is increasingly shaped by growing awareness of climate change and environmental sustainability. This sentiment directly affects Marathon Oil's social license to operate, potentially leading to heightened scrutiny and opposition to new projects. For instance, a 2024 survey indicated that over 60% of respondents globally believe fossil fuel companies are not doing enough to address climate change.

The availability of skilled labor and experienced professionals in the oil and gas sector remains a critical sociological factor impacting Marathon Oil. Demographic shifts, with an aging workforce in some regions and changing career preferences among younger generations, can create talent gaps. For instance, the U.S. Bureau of Labor Statistics projected a need for over 500,000 new oil and gas workers between 2020 and 2030, highlighting the ongoing demand.

Competition from other industries for STEM talent further complicates Marathon Oil's ability to attract and retain key personnel. As of early 2024, the energy sector competes with technology and renewable energy fields, both of which often offer appealing career paths. This necessitates robust investment in workforce development, including training and upskilling programs, alongside a strong commitment to safety initiatives to ensure operational continuity and employee well-being.

Marathon Oil's operations in areas like the Eagle Ford Shale and Bakken Formation frequently intersect with local communities, underscoring the critical importance of robust community relations. These operations, particularly in unconventional resource plays, necessitate careful management of public perception and local impact.

Public concerns often revolve around land use, water quality, and potential environmental impacts, which can manifest as local opposition, protests, or regulatory hurdles. For instance, in 2023, community groups in regions where Marathon operates voiced concerns about water usage for hydraulic fracturing, contributing to increased scrutiny from local authorities. Such opposition can significantly delay project timelines and escalate operational costs, as seen in several instances where permits were temporarily held up due to environmental impact assessments initiated by community feedback.

Proactive engagement with communities, including transparent communication and addressing specific concerns like noise pollution or traffic management, is therefore essential for Marathon Oil to maintain social license to operate and ensure the smooth progression of its projects. For example, Marathon reported in its 2024 investor updates that it had invested $5 million in local infrastructure improvements in communities where it has significant operations, a move aimed at fostering goodwill and mitigating potential opposition.

Health and Safety Standards

Societal expectations for rigorous health and safety protocols within the oil and gas industry are increasingly stringent. Marathon Oil's operational integrity hinges on its demonstrated commitment to safeguarding its workforce and the communities where it operates. This includes robust emergency response plans and a proactive approach to incident prevention, which are critical for maintaining public trust and brand reputation. In 2023, Marathon Oil reported a Total Recordable Incident Rate (TRIR) of 0.40, reflecting its ongoing focus on safety performance.

Marathon Oil's adherence to evolving safety regulations and its pursuit of continuous improvement in safety metrics are fundamental to its social license to operate. The company's safety culture aims to minimize risks associated with exploration, production, and transportation of hydrocarbons. For instance, their investment in advanced safety training and technology directly addresses these societal demands. By prioritizing safety, Marathon Oil not only protects its employees but also mitigates potential environmental and community impacts, thereby strengthening stakeholder relationships.

- Employee Safety: Marathon Oil's safety initiatives are designed to reduce workplace injuries and ensure a secure working environment for all personnel.

- Community Impact: The company's focus on safety extends to protecting the well-being of the communities surrounding its operations.

- Regulatory Compliance: Meeting and exceeding industry safety standards and government regulations is a core operational principle.

- Incident Response: Preparedness for and effective management of potential incidents are vital for minimizing harm and ensuring swift recovery.

Energy Transition and Consumer Behavior

Societal preferences are increasingly leaning towards environmental consciousness, directly affecting energy consumption patterns. This shift is evident in the growing market share of electric vehicles (EVs) and renewable energy installations. For instance, global EV sales surged by approximately 35% in 2023 compared to 2022, reaching over 13 million units, indicating a tangible move away from traditional gasoline-powered vehicles.

Marathon Oil's reliance on hydrocarbon products faces potential headwinds as consumers and governments prioritize decarbonization efforts. The International Energy Agency (IEA) projects that by 2030, renewable energy sources could account for over 40% of global electricity generation, a significant increase from around 30% in 2023. This transition could dampen long-term demand for oil and gas.

- Consumer Preference Shift: Growing public demand for sustainable products and services influences purchasing decisions, potentially reducing demand for fossil fuels.

- EV Adoption Rates: The accelerating adoption of electric vehicles, supported by government incentives and improved battery technology, directly impacts gasoline consumption.

- Renewable Energy Integration: Increased investment and deployment of solar, wind, and other renewable energy sources are reshaping the energy mix, challenging traditional energy providers.

Public sentiment regarding fossil fuels is a significant sociological factor, with growing awareness of climate change influencing perceptions. This can lead to increased scrutiny of companies like Marathon Oil, impacting their social license to operate. A 2024 survey revealed that over 60% of global respondents believe fossil fuel companies are not adequately addressing climate change.

The availability of a skilled workforce is crucial, and demographic shifts, including an aging workforce and changing career preferences among younger generations, present challenges. The U.S. Bureau of Labor Statistics projected a need for over 500,000 new oil and gas workers between 2020 and 2030, underscoring persistent demand.

Community relations are vital, especially in areas with significant operations like the Eagle Ford Shale. Public concerns often focus on land use and water quality, which can lead to opposition and regulatory hurdles. Marathon Oil reported in its 2024 investor updates that it invested $5 million in local infrastructure improvements to foster goodwill.

Societal expectations for stringent health and safety protocols are paramount. Marathon Oil's operational integrity depends on its commitment to protecting its workforce and surrounding communities. In 2023, the company reported a Total Recordable Incident Rate (TRIR) of 0.40, indicating a strong focus on safety performance.

Technological factors

Marathon Oil is heavily reliant on continuous innovation in drilling and completion technologies to maintain its competitive edge. Advancements like enhanced horizontal drilling and multi-layer fracturing are key to unlocking efficiency and boosting productivity in unconventional resource plays.

These technological leaps enable Marathon Oil to tap into more difficult-to-reach reserves, thereby lowering well costs and maximizing the amount of oil and gas that can be extracted. For instance, in 2023, the company reported significant improvements in well productivity in its Eagle Ford operations, partly attributed to these advanced techniques.

Marathon Oil is increasingly leveraging digitalization and automation to streamline its upstream operations. For instance, the company's focus on enhanced oil recovery (EOR) techniques often relies on advanced data analytics and AI to optimize injection strategies and predict reservoir performance. This digital transformation is crucial for improving efficiency and reducing costs in a competitive market.

The integration of AI and the Internet of Things (IoT) is a significant technological factor for Marathon Oil. By implementing AI-powered predictive maintenance on its drilling rigs and production facilities, Marathon Oil aims to minimize unexpected downtime. This proactive approach is projected to reduce maintenance costs by an estimated 10-15% across various asset classes by 2025, directly impacting operational profitability.

The development and deployment of Carbon Capture, Utilization, and Storage (CCUS) technologies are critical for the oil and gas sector's decarbonization efforts. Marathon Oil's investment in CCUS can significantly reduce its environmental impact and potentially create new revenue streams within a transitioning energy landscape.

CCUS is a central pillar of global energy transition strategies, with significant advancements expected. For instance, by 2024, the International Energy Agency (IEA) projected that CCUS capacity could reach over 270 million tonnes per annum (Mtpa) of CO2 captured globally, a substantial increase from previous years, highlighting the growing momentum and technological maturity in this field.

Improved Seismic Imaging and Reservoir Characterization

Marathon Oil leverages advanced seismic imaging and reservoir characterization technologies to gain a more precise understanding of subsurface geology. This enhanced data quality directly translates into more accurate exploration decisions and optimized well placement, significantly reducing geological risk. For instance, in 2024, advancements in full-waveform inversion (FWI) allowed for better delineation of complex fault systems in the Eagle Ford shale, leading to a 15% improvement in predicted hydrocarbon saturation in newly targeted zones.

These technological improvements are crucial for maximizing resource extraction, particularly in unconventional plays where reservoir heterogeneity is high. By enabling more sophisticated reservoir modeling, Marathon Oil can refine enhanced oil recovery (EOR) strategies. In 2025, the company plans to pilot advanced seismic attributes derived from 4D seismic surveys in the Bakken formation, aiming to identify bypassed pay zones and potentially increase recovery factors by an additional 5-7% in mature fields.

- Enhanced Seismic Resolution: Technologies like 5D seismic and full-waveform inversion (FWI) provide unprecedented detail of subsurface structures, crucial for de-risking exploration.

- Improved Reservoir Characterization: Advanced algorithms and machine learning applied to seismic data allow for more accurate prediction of rock properties and fluid content, optimizing well design.

- Optimized Well Placement: Better geological understanding leads to more precise wellbore trajectories, minimizing dry holes and maximizing contact with productive formations, as seen in Marathon Oil's 2024 drilling campaigns.

- Maximized Recovery: Insights from reservoir characterization inform enhanced oil recovery (EOR) techniques, increasing the ultimate recovery from existing fields, with a projected 5-7% uplift in specific 2025 pilot projects.

Water Management and Recycling Technologies

Marathon Oil's operations, particularly in hydraulic fracturing, necessitate robust water management strategies. Advancements in water recycling technologies are crucial for reducing the substantial water volumes required, directly impacting operational costs and environmental stewardship. For instance, by mid-2024, the industry has seen a notable increase in water recycling rates, with some operators achieving over 90% reuse in certain plays, a trend Marathon Oil is likely to leverage.

Efficient water treatment and disposal methods are paramount to mitigating the environmental footprint of unconventional resource development. These technologies not only ensure compliance with increasingly stringent regulations but also offer cost savings through reduced freshwater sourcing and disposal expenses. The ongoing innovation in this area is driving down the cost per barrel of treated water, making it more economically viable for widespread adoption.

- Water Recycling Rates: Industry-wide efforts are pushing recycling rates higher, with a target of 95% or more in many key shale plays by the end of 2025.

- Cost Reduction: Effective water management can reduce operational costs by an estimated 10-15% through decreased freshwater intake and disposal fees.

- Technological Advancements: New membrane filtration and advanced oxidation processes are improving treatment efficiency, making recycled water suitable for reuse in fracturing operations.

Marathon Oil's technological strategy hinges on digital transformation and automation to boost efficiency. The company is integrating AI and IoT for predictive maintenance, aiming to cut downtime and operational costs by 10-15% by 2025. This digital focus is crucial for maintaining competitiveness in the dynamic energy market.

Advancements in drilling and completion technologies, such as enhanced horizontal drilling and multi-layer fracturing, are key to Marathon Oil's productivity. These innovations allow access to more challenging reserves, lowering costs and maximizing extraction. For example, the company saw significant productivity gains in its Eagle Ford operations in 2023 due to these techniques.

Carbon Capture, Utilization, and Storage (CCUS) represents a critical technological frontier for Marathon Oil's decarbonization efforts. Global CCUS capacity was projected by the IEA to exceed 270 million tonnes per annum by 2024, underscoring the growing importance and maturity of these technologies for environmental impact reduction.

Marathon Oil utilizes sophisticated seismic imaging and reservoir characterization tools to refine exploration and well placement. By 2025, pilot projects in the Bakken formation will test advanced seismic attributes to identify bypassed reserves, potentially increasing recovery by 5-7%.

Legal factors

Marathon Oil navigates a dense regulatory landscape, including the Clean Air Act and Clean Water Act, alongside evolving rules for methane emissions from oil and gas production. For instance, the U.S. Environmental Protection Agency (EPA) has proposed stricter methane regulations, aiming to cut emissions by 75% by 2030 compared to 2019 levels, impacting operations significantly.

Adhering to these demanding environmental standards, which often require implementing sophisticated leak detection and repair (LDAR) technologies, increases operational expenditures. These compliance costs are essential to prevent substantial fines and ensure the continuation of Marathon Oil's operating permits.

Land use and permitting laws are critical for Marathon Oil, as they dictate where and how the company can drill and build necessary infrastructure. These regulations differ significantly from state to state and even within local jurisdictions, directly influencing Marathon's capacity for operational expansion. For instance, in 2023, the Bureau of Land Management (BLM) managed over 245,000 oil and gas leases on federal lands, highlighting the complex web of permits required for operations on these sites.

Changes in federal policies, particularly concerning lease sales and the speed of project approvals, can have a substantial impact on Marathon Oil's access to promising new resource areas. In late 2023, the Biden administration continued to implement reforms aimed at streamlining permitting processes while also emphasizing environmental considerations, a balancing act that directly affects companies like Marathon.

Marathon Oil must rigorously adhere to Occupational Safety and Health Administration (OSHA) regulations to safeguard its employees. This includes strict compliance with standards for drilling safety, hazard communication, and emergency preparedness, crucial for preventing incidents and protecting workers.

Failure to comply can result in significant penalties; for instance, in 2023, OSHA reported over 70,000 citations nationwide, with penalties often reaching tens of thousands of dollars per violation. Marathon Oil's commitment to these safety protocols directly impacts its operational continuity and legal standing, avoiding costly fines and reputational damage.

Contractual and Property Rights

Marathon Oil's operations are heavily influenced by the legal framework governing mineral rights and lease agreements. These contracts define access to resources and dictate terms with landowners. Navigating these property laws is critical for securing and managing unconventional resource plays.

The company's ability to operate hinges on its adherence to these complex legal structures. For instance, in 2024, the oil and gas industry continued to see legal challenges related to environmental regulations and land use, which directly impact lease enforceability and operational permits.

- Mineral Rights: Marathon Oil's ability to extract resources depends on legally defined ownership of subsurface minerals, often acquired through leases.

- Lease Agreements: These contracts outline the terms under which Marathon Oil can explore and produce oil and gas, including royalty payments and lease duration.

- Contractual Obligations: Marathon Oil must fulfill its contractual duties to landowners, mineral owners, and other partners, ensuring compliance with all stipulated terms.

- Property Law: Understanding and adhering to state and federal property laws is essential for securing drilling rights and managing surface use agreements.

Anti-Trust and Competition Laws

Marathon Oil, operating within the significant U.S. energy sector, is subject to stringent anti-trust and competition laws. These regulations are designed to prevent any single entity from dominating the market and to ensure a level playing field for all participants. For instance, the Federal Trade Commission (FTC) and the Department of Justice (DOJ) actively scrutinize mergers and acquisitions to maintain competitive landscapes, a factor Marathon Oil must consider in its strategic planning.

These legal frameworks directly impact Marathon Oil's ability to pursue growth through mergers, acquisitions, and joint ventures. Any proposed consolidation or partnership must undergo regulatory review to ensure it does not unduly stifle competition or lead to monopolistic control of energy resources or markets. The potential for regulatory intervention can significantly shape the feasibility and structure of such strategic moves.

The enforcement of these laws can influence Marathon Oil's market behavior, from pricing strategies to production levels. For example, during 2024, ongoing investigations into potential price manipulation in energy markets by various industry participants underscore the vigilance of regulatory bodies. Marathon Oil, like its peers, must ensure its practices align with these oversight requirements to avoid penalties and maintain operational freedom.

- Regulatory Scrutiny: Marathon Oil faces oversight from agencies like the FTC and DOJ regarding its market activities.

- Merger & Acquisition Impact: Anti-trust laws critically influence the company's strategic growth through M&A.

- Market Behavior Compliance: Adherence to competition laws is essential for Marathon Oil's operational and pricing strategies.

- Enforcement Trends: Regulatory focus on energy market competition in 2024 highlights the importance of compliance.

Marathon Oil's operations are significantly shaped by evolving environmental regulations, particularly concerning methane emissions. Stricter rules, like those proposed by the EPA aiming for substantial reductions by 2030, necessitate investments in advanced leak detection technologies, impacting operational costs and requiring careful compliance to avoid penalties.

Land use and permitting laws present another layer of legal complexity, varying by state and locality, which directly affects Marathon Oil's ability to secure drilling rights and develop infrastructure. The Bureau of Land Management's extensive oversight of oil and gas leases on federal lands in 2023 underscores the intricate permitting landscape Marathon navigates.

The company must also adhere to stringent safety regulations, such as those mandated by OSHA, to protect its workforce. Compliance failures can lead to significant fines, as evidenced by the tens of thousands of dollars per violation OSHA reported in 2023, highlighting the critical importance of safety protocols for Marathon Oil's legal standing and operational continuity.

Furthermore, anti-trust and competition laws, enforced by bodies like the FTC and DOJ, scrutinize market activities, including mergers and acquisitions. Marathon Oil must ensure its strategic growth initiatives do not stifle competition, with regulatory vigilance in energy markets continuing through 2024.

| Legal Factor | Impact on Marathon Oil | Relevant Data/Context (2023-2025) |

|---|---|---|

| Environmental Regulations | Increased operational costs for compliance (e.g., methane emission controls). | EPA proposed 75% methane reduction by 2030 (vs. 2019). |

| Land Use & Permitting | Dictates access to resources and infrastructure development sites. | BLM managed over 245,000 oil/gas leases on federal lands in 2023. |

| Workplace Safety (OSHA) | Requires adherence to safety standards, avoiding penalties. | OSHA reported over 70,000 citations in 2023, with substantial fines per violation. |

| Anti-Trust & Competition | Influences M&A strategies and market behavior. | Ongoing scrutiny of energy market competition in 2024. |

Environmental factors

Marathon Oil, like other energy companies, is navigating a landscape shaped by escalating climate change policies. The U.S. rejoined the Paris Agreement in 2021, signaling a commitment to emissions reductions, and many states, including those where Marathon operates like New Mexico, have set ambitious renewable energy targets and greenhouse gas reduction goals. These policy shifts can translate into tangible impacts such as potential carbon taxes or cap-and-trade systems, directly affecting operational costs and investment decisions for fossil fuel producers.

The pressure to decarbonize is intensifying, pushing Marathon Oil to consider its greenhouse gas (GHG) emissions footprint. While specific 2024 or 2025 emissions reduction targets for Marathon may not be publicly detailed yet, the broader industry trend, underscored by initiatives like the Oil and Gas Methane Partnership 2.0, points towards a necessity for companies to actively manage and reduce methane and CO2 emissions. This focus influences capital allocation, encouraging investments in technologies that lower emissions intensity and potentially shifting long-term strategies towards lower-carbon energy solutions.

Marathon Oil's operations, especially in unconventional resource plays like the Eagle Ford and Bakken shale formations, rely heavily on hydraulic fracturing, a process that demands substantial water volumes. This dependency makes water scarcity and the effective management of these resources a paramount environmental consideration. In 2023, the company reported utilizing approximately 15.5 million barrels of water across its operations, highlighting the scale of this resource requirement.

Navigating evolving regulations and increasing public attention concerning water withdrawal, treatment, and disposal is crucial for Marathon Oil's long-term sustainability. The company's commitment to responsible water stewardship, including recycling and reuse initiatives, directly impacts its social license to operate and its ability to minimize ecological footprints in water-stressed regions.

Marathon Oil's operations, which involve drilling and building infrastructure, can affect the variety of plant and animal life and their homes in the areas where it works. For instance, in 2023, the company reported engaging in habitat restoration projects across its U.S. onshore assets, though specific biodiversity metrics were not publicly detailed.

To address these impacts, Marathon Oil is expected to actively protect different species and their natural environments. This includes conducting thorough environmental impact assessments before new projects begin and developing strategies to lessen any negative effects on local ecosystems. For example, in its Eagle Ford operations, the company has stated its commitment to minimizing land disturbance and managing water resources responsibly to support biodiversity.

Waste Management and Pollution Control

Marathon Oil faces significant environmental considerations concerning waste management and pollution control, particularly in its upstream operations. Effectively managing drilling waste, produced water, and atmospheric emissions is paramount. Failure to do so can lead to substantial environmental damage and significant financial penalties.

Regulatory compliance is a critical aspect of Marathon Oil's environmental strategy. Adhering to stringent rules on spill prevention, emission controls, and waste disposal is essential to mitigate risks. For instance, in 2023, the U.S. Environmental Protection Agency (EPA) continued to enforce regulations like the Clean Air Act and Clean Water Act, impacting oil and gas operations nationwide.

- Regulatory Scrutiny: Increased focus on methane emissions and water management in oil and gas production.

- Operational Costs: Investments in advanced waste treatment and emission reduction technologies are necessary.

- Reputational Risk: Environmental incidents can severely damage public perception and stakeholder trust.

- Compliance Data: Marathon Oil reported its environmental performance, including waste generation and disposal methods, in its sustainability reports, aiming for transparency.

Land Disturbance and Reclamation

Marathon Oil's operations, particularly in areas like the Eagle Ford and Bakken shale plays, inherently involve land disturbance for exploration, drilling pads, and infrastructure. The company is obligated to undertake comprehensive land reclamation and remediation projects once these sites are no longer active, aiming to return them to a state that meets or exceeds regulatory standards and environmental expectations.

These reclamation efforts are guided by stringent federal and state regulations, such as those from the Bureau of Land Management (BLM) and state environmental agencies. For instance, in 2023, Marathon Oil reported ongoing reclamation activities across its operating regions, with specific budget allocations for environmental stewardship and site closure, reflecting the significant costs associated with restoring disturbed land. This commitment is crucial for maintaining social license to operate and minimizing long-term environmental impact.

- Regulatory Compliance: Adherence to federal and state land use and reclamation laws is paramount.

- Site Restoration: Efforts focus on returning disturbed land to its pre-operational or an agreed-upon post-operational condition.

- Environmental Best Practices: Implementing advanced techniques to minimize erosion, manage water runoff, and promote revegetation.

- Financial Provisions: Setting aside funds for reclamation and closure as part of operational planning and accounting.

The energy sector's environmental footprint is under increasing scrutiny, with climate change policies driving significant shifts. Marathon Oil, like its peers, faces pressure to reduce greenhouse gas emissions, particularly methane. The company's 2023 sustainability report indicated efforts to manage emissions intensity, aligning with industry trends and regulatory expectations for lower-carbon operations.

Water management remains a critical operational and environmental challenge. Marathon Oil reported using approximately 15.5 million barrels of water in 2023 for its operations, primarily in hydraulic fracturing. This highlights the need for robust water recycling and conservation strategies to mitigate impacts in water-scarce regions and comply with evolving regulations.

Land use and biodiversity are also key environmental factors. Marathon Oil engages in habitat restoration projects across its U.S. onshore assets, aiming to minimize the impact of its infrastructure on local ecosystems. Compliance with land reclamation regulations, such as those from the Bureau of Land Management, is essential for responsible operations and maintaining its social license.

| Environmental Factor | Marathon Oil's 2023 Data/Context | Key Considerations |

| Greenhouse Gas Emissions | Focus on reducing emissions intensity; industry trend towards methane reduction. | Climate policy, regulatory compliance (e.g., EPA methane rules). |

| Water Management | Used ~15.5 million barrels of water in 2023. | Water scarcity, recycling initiatives, regulatory compliance (e.g., Clean Water Act). |

| Land Use & Reclamation | Ongoing habitat restoration projects. | Land disturbance, reclamation regulations (e.g., BLM), site remediation. |

PESTLE Analysis Data Sources

Our Marathon Oil PESTLE analysis is built upon a robust foundation of data, drawing from official government reports, industry-specific publications, and reputable financial news outlets. We meticulously gather information on political stability, economic indicators, technological advancements, environmental regulations, and social trends to provide a comprehensive view.