Marathon Oil Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Marathon Oil Bundle

Marathon Oil navigates a complex landscape where buyer bargaining power is moderate, influenced by contract terms and the availability of alternative energy sources. The threat of new entrants, while present, is somewhat mitigated by high capital requirements and regulatory hurdles in the oil and gas sector.

The complete report reveals the real forces shaping Marathon Oil’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The oil and gas sector, including companies like Marathon Oil, depends on a limited number of specialized suppliers for critical components such as advanced drilling equipment, essential oilfield services, and proprietary technologies. When these suppliers are few in number or possess unique, patented offerings, their leverage over Marathon Oil grows significantly.

For instance, the oilfield services market demonstrated robust growth in 2023, with revenues for major service providers like Schlumberger and Halliburton showing year-over-year increases, indicating a degree of pricing power within this supplier segment.

Switching between drilling contractors or technology providers presents significant hurdles for Marathon Oil. These transitions involve substantial costs related to re-training personnel, re-tooling equipment, and the potential for operational disruptions, all of which bolster the leverage of existing suppliers.

However, the landscape shifted somewhat in 2024. A notable decrease in U.S. composite day rates for drilling services, especially within key regions like the Permian Basin, indicated a degree of oversupply in the drilling sector. This oversupply could potentially dilute the bargaining power of these suppliers.

Suppliers offering highly specialized inputs, like unique geological data analysis software or proprietary fracking fluids, inherently possess greater bargaining power. Marathon Oil's strategic emphasis on unconventional resource plays, such as those in the Eagle Ford and Bakken shale formations, necessitates reliance on suppliers capable of delivering customized solutions for these intricate and demanding operations.

The ongoing trend of digitalization and automation within the oil and gas drilling services sector further amplifies the significance of unique technological inputs. For instance, advanced drilling optimization software, which can significantly reduce drilling time and costs, represents a critical input where supplier power is substantial due to the specialized knowledge and development required.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward and becoming direct competitors to Marathon Oil is a significant factor in their bargaining power. If suppliers, such as oilfield service companies or equipment manufacturers, were to acquire drilling rights and begin producing oil themselves, they would directly compete with Marathon. This would shift the balance, giving them more leverage in negotiations.

While the substantial capital requirements and operational expertise needed for exploration and production (E&P) generally make large-scale forward integration by suppliers into Marathon's core business less probable, the possibility exists, particularly in more specialized or niche market segments.

- Capital Intensity: The average capital expenditure for a typical oil and gas exploration project can range from tens of millions to billions of dollars, creating a high barrier to entry for potential supplier integrators.

- Niche Market Entry: Some specialized service providers might explore smaller-scale production ventures, especially in unconventional resource plays or specific geographic regions where their existing expertise offers a competitive edge.

- Limited Scope: For major E&P players like Marathon Oil, the threat is more about potential disruption in specific supply chains rather than a wholesale takeover of their production assets by suppliers.

Impact of Commodity Prices on Suppliers

The profitability of oilfield service providers, a key supplier group for Marathon Oil, is directly linked to the fluctuations in commodity prices and the overall level of drilling activity. When oil and gas prices are on an upward trend and drilling campaigns are active, these suppliers gain significant leverage to raise their prices for equipment, labor, and specialized services.

Conversely, the bargaining power of suppliers diminishes considerably during periods of depressed commodity prices or a slowdown in drilling operations. For instance, the rig utilization rate in the US onshore sector saw a notable dip in late 2024, indicating a weaker negotiating position for service providers as they compete for fewer projects.

- Supplier Profitability Drivers: Oilfield service providers' margins are sensitive to oil and gas prices and drilling volumes.

- Increased Supplier Leverage: Rising commodity prices and high drilling activity allow suppliers to command higher prices.

- Weakened Supplier Power: Low commodity prices and reduced drilling activity, exemplified by declining rig utilization in late 2024, reduce supplier leverage.

- Impact on Marathon Oil: This dynamic directly affects Marathon Oil's operational costs and profitability.

Marathon Oil's suppliers, particularly those providing specialized drilling equipment and technology, hold considerable bargaining power due to the limited number of providers and the high switching costs involved. However, the oilfield services market experienced a softening in 2024, with decreased day rates for drilling services in key basins, suggesting a potential shift in leverage towards Marathon Oil.

The bargaining power of suppliers is directly influenced by commodity prices and drilling activity levels. For example, the rig utilization rate in the US onshore sector saw a decline in late 2024, weakening the negotiating position of many service providers.

| Supplier Characteristic | Impact on Bargaining Power | 2024 Context Example |

|---|---|---|

| Number of Suppliers | Fewer suppliers mean higher power. | Limited providers of advanced drilling tech. |

| Switching Costs | High costs empower existing suppliers. | Training, re-tooling, and operational disruption risks. |

| Commodity Prices & Activity | High prices/activity increase supplier leverage. | Decreased US onshore rig utilization in late 2024 weakened power. |

| Specialization of Inputs | Unique or proprietary inputs grant more power. | Specialized geological software or fracking fluids. |

What is included in the product

Marathon Oil's Five Forces Analysis reveals the intense competition in the oil and gas sector, the bargaining power of buyers and suppliers, and the significant barriers to entry that protect established players.

Instantly visualize competitive pressures with a dynamic spider chart, simplifying complex market dynamics for Marathon Oil.

Customers Bargaining Power

Marathon Oil's customers are primarily large refineries, natural gas pipelines, and petrochemical firms. These buyers are often sophisticated, high-volume purchasers, granting them substantial leverage. For instance, Marathon Petroleum, a significant entity in the refining sector, represents a major potential customer for Marathon Oil.

Marathon Oil's significant output from key U.S. shale plays, including the Eagle Ford, Bakken, Permian, and STACK, means it supplies large quantities of crude oil, natural gas, and NGLs. These substantial volumes are essential for refiners and other downstream energy companies. For instance, in the first quarter of 2024, Marathon Oil reported total production of approximately 339,000 barrels of oil equivalent per day (boepd), underscoring the scale of its supply.

Customers who purchase these large volumes often gain considerable bargaining power. Their ability to commit to substantial, consistent orders can translate into leverage during price negotiations with Marathon Oil. This is particularly true when there are multiple suppliers capable of meeting such demand, allowing buyers to seek more favorable terms.

For Marathon Oil's customers, switching suppliers for crude oil or natural gas can involve navigating complex logistics, existing pipeline agreements, and potential adjustments to their refining processes. These factors contribute to switching costs, though they are generally less significant in the highly liquid commodity market compared to specialized industrial products.

Price Sensitivity of Customers

Customers' price sensitivity is a significant factor for Marathon Oil, especially given that crude oil and natural gas are essentially commodities. This means that the profitability of many businesses, including Marathon Oil's customers, is directly tied to the fluctuating prices of these essential inputs.

For example, refineries are particularly sensitive to the cost of crude oil. When crude oil prices rise, their profit margins, often determined by market crack spreads (the difference between the cost of crude oil and the selling price of refined products like gasoline and diesel), can be squeezed. This sensitivity makes them keen negotiators on the price they pay for their feedstock.

- Price Sensitivity Drivers: Crude oil and natural gas are commodities, making their prices highly volatile and directly impacting customer profitability.

- Refinery Margins: Refineries, a key customer segment, experience margin compression when crude oil prices increase, leading to greater price negotiation power.

- Market Crack Spreads: The profitability of refineries is often gauged by crack spreads, which are directly influenced by crude oil input costs.

- Impact on Demand: High energy prices can also reduce demand from end-consumers, further amplifying the price sensitivity of industrial customers.

Threat of Backward Integration by Customers

The threat of customers integrating backward into exploration and production (E&P) is generally low for Marathon Oil. The significant capital requirements and specialized expertise needed for E&P activities create a substantial barrier to entry for most of Marathon Oil's customer base.

While some integrated oil majors possess upstream capabilities, their core business as customers for Marathon Oil in specific contexts, such as purchasing crude oil or natural gas, remains separate from their own E&P ventures. This means they are unlikely to directly compete by developing their own upstream assets to replace Marathon Oil's supply.

- Low Threat: The high capital intensity and technical complexity of upstream oil and gas operations make backward integration by customers a minimal threat.

- Specialized Expertise: E&P requires specialized geological, engineering, and operational knowledge that most downstream customers lack.

- Capital Requirements: Developing and operating oil and gas fields demands billions of dollars in investment, a barrier few customers can overcome.

- Customer Diversification: Marathon Oil serves a diverse range of customers, from refiners to industrial users, none of whom typically possess the scale or intent to integrate backward into E&P.

Marathon Oil's customers, primarily large refineries and pipeline operators, wield significant bargaining power due to their high-volume purchases and the commodity nature of oil and gas. Their sensitivity to price, driven by refinery margins and volatile market crack spreads, compels them to negotiate aggressively for favorable terms. For instance, in Q1 2024, Marathon Oil's production averaged 339,000 boepd, supplying substantial volumes that reinforce buyer leverage.

| Customer Type | Bargaining Power Drivers | Example |

| Refineries | High volume, Price sensitivity, Commodity nature of crude | Marathon Petroleum (potential major buyer) |

| Pipeline Operators | Essential infrastructure, Contractual relationships | Large midstream companies |

| Petrochemical Firms | Input cost sensitivity, Alternative feedstock options | Chemical manufacturers |

Same Document Delivered

Marathon Oil Porter's Five Forces Analysis

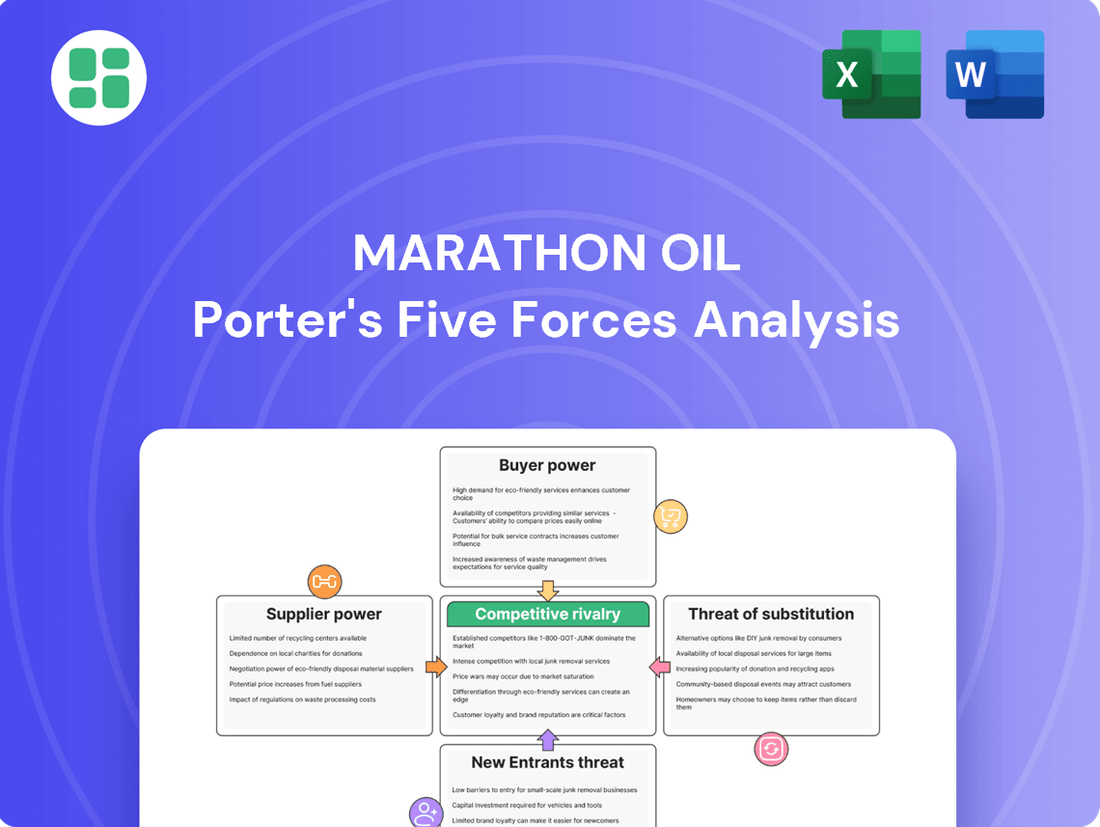

This preview showcases the comprehensive Marathon Oil Porter's Five Forces Analysis, detailing the competitive landscape and strategic positioning of the company within the oil and gas industry. You're looking at the actual document; once your purchase is complete, you’ll get instant access to this exact, professionally formatted file, ready for your immediate use.

Rivalry Among Competitors

Marathon Oil faces intense competition within the U.S. exploration and production (E&P) sector, which is populated by a large number of independent and major oil and gas companies. For instance, in 2024, the U.S. had hundreds of active E&P companies, with many focusing on prolific unconventional plays.

Key competitors include industry giants like ExxonMobil and Chevron, especially in strategically important regions such as the Permian Basin, a major oil-producing area. Beyond these supermajors, numerous other E&P firms actively compete for acreage, talent, and capital, further intensifying the rivalry.

The U.S. oil and gas exploration and production (E&P) sector anticipates moderate production growth through 2025. However, specific onshore markets may experience a steadier, even flat, growth trajectory.

This scenario of subdued overall expansion, coupled with regional flatness, can significantly heighten competitive rivalry. Companies are likely to focus more intensely on capturing market share rather than simply benefiting from a rapidly expanding industry pie.

For instance, while the broader U.S. E&P market might see a few percentage points of growth, certain shale plays could be operating at capacity or facing declining production, forcing intense competition for existing reserves and customers.

Crude oil, natural gas, and natural gas liquids are largely seen as undifferentiated commodities. This means that buyers, like refiners or utilities, often make their purchasing decisions primarily on price and the assurance of a consistent supply. For companies such as Marathon Oil, this lack of product differentiation significantly heightens competition based on cost and operational efficiency.

High Fixed Costs and Storage Capacity

The exploration and production (E&P) sector, where Marathon Oil operates, is inherently capital-intensive. High fixed costs for drilling, pipelines, and processing facilities mean companies must maintain production levels to spread these expenses. This necessity drives intense rivalry, particularly when market conditions weaken.

For instance, in 2024, the significant upfront investment required for new wells and the ongoing maintenance of existing infrastructure create a strong incentive for continuous operation. Companies are compelled to produce even in softer demand environments to avoid leaving expensive assets idle and to cover their substantial fixed cost base.

- High Capital Outlays: E&P companies face substantial upfront costs for exploration, drilling, and developing production infrastructure, often running into hundreds of millions or even billions of dollars.

- Operational Leverage: Once production facilities are in place, marginal costs of producing additional barrels are relatively low, but fixed costs remain high, creating operational leverage that amplifies profit or loss based on production volume and price.

- Storage Capacity Constraints: While not always a direct driver of rivalry, limited storage capacity can exacerbate price volatility during oversupply, forcing producers to sell at lower prices, thus increasing competitive pressure to maintain sales volume.

- Production Maintenance: Companies must continue to operate wells and facilities to maintain their productive capacity and avoid costly workovers or abandonment, even if current market prices are unfavorable.

Exit Barriers

Marathon Oil faces significant competitive rivalry due to high exit barriers. These barriers, like substantial investments in specialized drilling equipment and pipelines, represent sunk costs that are difficult to recover. For instance, the company's extensive midstream infrastructure in the Eagle Ford and Bakken plays necessitates continued operation, even when market conditions are unfavorable, to avoid substantial write-offs.

Long-term supply contracts and lease agreements also contribute to these exit barriers. Marathon Oil is committed to fulfilling these obligations, which often dictate a minimum production level. Failure to meet these commitments can result in penalties, further incentivizing continued participation in the market. Environmental regulations and site remediation liabilities also add to the cost of exiting a particular region or operation.

These factors collectively ensure that the number of active competitors remains elevated. Even during periods of low oil prices, companies like Marathon Oil are often compelled to maintain production, leading to sustained and intense rivalry as they compete for market share and operational efficiency.

- High Sunk Costs: Marathon Oil's significant capital expenditures in exploration, development, and midstream infrastructure create substantial sunk costs, making it economically challenging to exit operations.

- Long-Term Commitments: The company is bound by long-term contracts for drilling services, transportation, and sales, which often require continued activity regardless of short-term market fluctuations.

- Environmental Liabilities: Managing and remediating environmental impacts from past and current operations incurs ongoing costs and obligations, acting as a deterrent to immediate exit.

- Sustained Rivalry: The presence of these exit barriers keeps the overall number of competitors in the oil and gas sector high, intensifying competitive rivalry as firms strive to maintain market presence and profitability.

Marathon Oil operates in a highly competitive U.S. E&P sector with numerous players, including major integrated companies and smaller independents. This intense rivalry is driven by the commodity nature of oil and gas, where price and supply reliability are paramount. The high capital intensity of the industry, with significant upfront investments in exploration and infrastructure, compels companies to maintain production levels to cover fixed costs, further fueling competition for market share.

Exit barriers, such as substantial sunk costs in specialized equipment and midstream assets, along with long-term contracts and environmental liabilities, keep competitors engaged even in challenging market conditions. This sustained presence of numerous firms ensures that competitive rivalry remains a defining characteristic of Marathon Oil's operating environment.

SSubstitutes Threaten

The primary threat of substitutes for Marathon Oil's core products, crude oil and natural gas, stems from the growing availability and adoption of renewable energy sources. Solar, wind, and hydropower are increasingly cost-competitive, challenging traditional fossil fuels.

Electric vehicles (EVs) represent another significant substitute, directly impacting the demand for gasoline and diesel, which are derived from crude oil. By the end of 2023, global EV sales surpassed 13 million units, a substantial increase from previous years.

These alternatives are bolstered by global energy transition initiatives and supportive government policies aimed at reducing carbon emissions. For instance, many countries have set ambitious targets for renewable energy deployment and EV adoption through 2030 and beyond, creating a long-term headwind for fossil fuel demand.

The increasing cost-effectiveness of renewable energy sources presents a significant threat of substitution for Marathon Oil. New utility-scale solar and onshore wind projects are now demonstrably cheaper than new fossil fuel-fired power plants for electricity generation. For example, in 2024, the levelized cost of energy (LCOE) for new solar PV projects in the US averaged around $30-40 per megawatt-hour, while new natural gas plants could range from $50-70 per megawatt-hour, making renewables a more economically viable alternative for power producers.

The threat of substitutes for Marathon Oil is intensifying due to evolving consumer preferences and a shifting regulatory landscape. Growing environmental concerns and government policies actively promoting decarbonization are accelerating the transition towards cleaner energy sources. This directly influences both consumer behavior and industrial demand, creating a sustained push to reduce reliance on traditional fossil fuels.

Technological Advancements in Substitutes

Technological leaps in battery storage and electric vehicle (EV) efficiency are significantly bolstering the viability of substitutes for traditional oil and gas. For instance, advancements in solid-state batteries, expected to see wider commercialization by 2025-2027, promise greater energy density and faster charging, directly impacting the appeal of EVs over internal combustion engines.

Artificial intelligence is further accelerating the competitiveness of renewable energy sources by optimizing grid integration and energy management. By 2024, AI-powered forecasting for solar and wind output is improving grid stability, making intermittent renewables a more reliable alternative. This trend is projected to continue, with AI contributing to a more resilient and efficient renewable energy infrastructure.

The increasing efficiency and decreasing costs of renewable energy technologies represent a growing threat. Global renewable energy capacity additions reached record levels in 2023, with solar PV alone accounting for a substantial portion. This expansion directly substitutes demand for fossil fuels in power generation.

- Battery Energy Storage Systems: Continued innovation is reducing costs and increasing capacity, making renewables more dispatchable.

- Electric Vehicle Technology: Improved range, faster charging, and lower upfront costs are making EVs a more practical alternative to gasoline vehicles.

- Renewable Energy Integration: AI and smart grid technologies are enhancing the reliability and efficiency of solar and wind power.

- Cost Competitiveness: The levelized cost of electricity for solar and wind has fallen dramatically, often making them cheaper than new fossil fuel plants.

Long-Term Decarbonization Goals

The global push towards net-zero emissions, with many major economies setting ambitious renewable energy targets, represents a significant long-term threat of substitutes for Marathon Oil. For instance, the European Union aims for climate neutrality by 2050, a goal that will increasingly favor renewable energy sources over traditional oil and gas. While this transition is gradual, the sustained policy support and technological advancements in renewables create a persistent challenge.

This structural shift in the energy landscape means that demand for Marathon Oil's core products could face long-term erosion. By 2024, investments in renewable energy capacity continued to outpace fossil fuel investments in many regions, highlighting the growing momentum of alternative energy solutions. This trend directly impacts the long-term viability and growth prospects of companies heavily reliant on fossil fuel extraction.

- Global Net-Zero Commitments: Over 130 countries have committed to net-zero emissions by mid-century, creating a policy environment that favors decarbonization.

- Renewable Energy Growth: In 2024, global renewable energy capacity additions reached record levels, signaling a tangible shift in energy supply.

- Technological Advancements: Falling costs in solar, wind, and battery storage technologies make them increasingly competitive substitutes for fossil fuels.

- Policy Support: Government incentives and regulations worldwide are actively promoting the adoption of cleaner energy alternatives.

The threat of substitutes for Marathon Oil is substantial, driven by advancements in renewable energy and electric vehicles. The increasing cost-competitiveness of solar and wind power, coupled with supportive government policies for decarbonization, directly challenges fossil fuel demand. By 2024, global renewable energy capacity additions continued to break records, with solar PV leading the charge, directly displacing traditional energy sources.

Electric vehicles (EVs) are a growing substitute for gasoline and diesel, impacting crude oil demand. Global EV sales surpassed 13 million units by the end of 2023, and this trend is expected to accelerate with improvements in battery technology, such as solid-state batteries anticipated for wider commercialization by 2025-2027.

The long-term erosion of demand for Marathon Oil's products is a key concern, as over 130 countries have committed to net-zero emissions by mid-century. This global commitment, alongside significant investments in renewable energy capacity that outpaced fossil fuel investments in many regions by 2024, underscores the persistent challenge posed by substitutes.

| Substitute Category | Key Developments (as of mid-2025) | Impact on Marathon Oil | Supporting Data/Trends |

| Renewable Energy (Solar & Wind) | Continued cost reductions, improved grid integration via AI | Directly substitutes demand for natural gas and oil in power generation | LCOE for new solar PV in US ~ $30-40/MWh (2024); record global capacity additions in 2023 |

| Electric Vehicles (EVs) | Enhanced battery range, faster charging, lower upfront costs | Reduces demand for gasoline and diesel derived from crude oil | Global EV sales exceeded 13 million units by end of 2023 |

| Energy Efficiency & Conservation | Technological advancements in building insulation, industrial processes | Decreases overall energy consumption, indirectly reducing demand for all fossil fuels | Ongoing focus on energy efficiency standards in major economies |

Entrants Threaten

Entering the unconventional oil and gas exploration and production sector demands substantial capital. This includes significant outlays for acquiring promising acreage, the complex process of drilling wells, building essential infrastructure like pipelines and processing facilities, and investing in cutting-edge technologies. Marathon Oil's 2024 capital expenditure forecast, projected to be between $1.1 billion and $1.3 billion, underscores the immense financial commitment required to operate and grow within this industry, acting as a considerable deterrent for potential new competitors.

Marathon Oil's stronghold in prime locations like the Eagle Ford, Bakken, Permian, and STACK plays presents a formidable barrier. These established, high-quality unconventional resource plays are not easily replicated.

The limited availability of proven, economically viable acreage means new companies face significant challenges securing the necessary land. Incumbent players, including Marathon Oil, often have long-term leases and established infrastructure, making it difficult for newcomers to gain a foothold.

In 2024, the cost of acquiring prime acreage in these basins continued to be a major deterrent. For example, lease acquisition costs in the Permian Basin remained a significant capital outlay, often requiring substantial upfront investment that new entrants may struggle to meet.

The oil and gas sector presents formidable regulatory barriers for potential new entrants. Navigating the intricate web of permitting processes, which can be lengthy and costly, poses a significant challenge. For instance, in 2024, the average time to secure federal permits for oil and gas projects in the U.S. remained substantial, often extending over several months, if not years.

Furthermore, stringent environmental compliance requirements add another layer of complexity and expense. New companies must invest heavily in technologies and practices to meet evolving standards for emissions, water usage, and waste disposal. Failure to comply can result in severe penalties, deterring many from entering the market.

Technological Expertise and Operational Scale

New companies entering the exploration and production (E&P) sector face significant hurdles due to the highly specialized technological expertise required. Mastering techniques like horizontal drilling, hydraulic fracturing, and advanced reservoir management is crucial for success in unconventional resource development.

Marathon Oil, like other established players, benefits from decades of operational experience and significant economies of scale. These advantages translate into lower per-unit costs and greater efficiency, making it difficult for newcomers to compete on price or operational effectiveness without substantial upfront investment.

- High Capital Requirements: The upfront investment for exploration, drilling, and infrastructure is immense, creating a substantial barrier for new entrants.

- Technical Know-How: Expertise in advanced drilling and completion techniques is non-negotiable and takes years to develop.

- Operational Scale Advantages: Established companies leverage existing infrastructure and supply chains, leading to cost efficiencies that are hard for new entrants to match.

Commodity Price Volatility and Market Risk

The inherent volatility of crude oil and natural gas prices presents a substantial threat to new entrants in the energy sector. For instance, crude oil prices experienced significant fluctuations throughout 2024, with West Texas Intermediate (WTI) averaging around $78 per barrel for the year, but seeing intraday swings of several dollars. This price uncertainty can be particularly challenging for new companies that may not possess the financial reserves or diversified revenue streams of established players like Marathon Oil, making it harder to weather downturns and maintain operations.

This market instability can also deter potential investors and complicate the process of securing necessary financing. Potential lenders and equity partners often view highly volatile commodity markets as riskier, demanding higher returns or imposing stricter terms on new ventures. In 2024, the cost of capital for energy projects, especially those in exploration and production, remained a key consideration, with interest rates influencing the feasibility of new developments.

- Price Fluctuations: Crude oil prices averaged approximately $78/barrel in 2024, demonstrating significant volatility that impacts profitability.

- Financing Challenges: Lenders and investors may be hesitant to fund new entrants due to commodity price uncertainty, potentially increasing the cost of capital.

- Operational Risk: New companies with less financial resilience are more vulnerable to the impacts of price shocks, potentially affecting their ability to sustain operations.

The threat of new entrants into the oil and gas exploration and production sector, particularly for companies like Marathon Oil, is generally considered low. This is primarily due to the immense capital requirements, which can run into billions of dollars for exploration, drilling, and infrastructure development. For instance, Marathon Oil's 2024 capital expenditure budget was set between $1.1 billion and $1.3 billion, illustrating the scale of investment needed. Additionally, established players benefit from decades of operational experience, proprietary technology, and economies of scale, creating significant cost advantages that are difficult for newcomers to overcome without substantial resources and time.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Marathon Oil leverages data from company SEC filings, investor presentations, and industry-specific market research reports. We also incorporate insights from financial news outlets and macroeconomic indicators to provide a comprehensive view of the competitive landscape.