Marathon Oil Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Marathon Oil Bundle

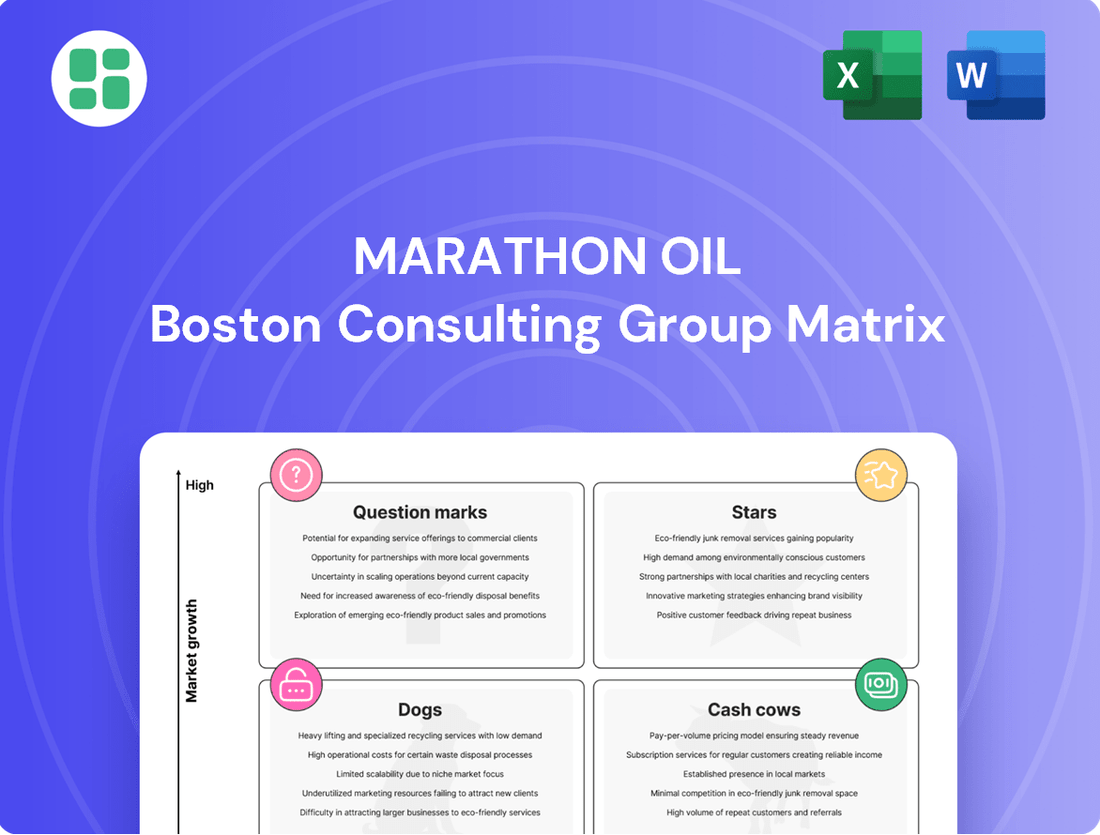

Curious about Marathon Oil's strategic positioning? Our BCG Matrix analysis reveals how their assets stack up as Stars, Cash Cows, Dogs, or Question Marks in the dynamic energy market. Understand which ventures are generating strong returns and which require careful consideration.

Don't miss out on the full picture. Purchase the complete Marathon Oil BCG Matrix for detailed quadrant breakdowns, actionable insights, and a clear roadmap to optimize your investment and resource allocation decisions.

Stars

Marathon Oil significantly boosted its investment in the Permian Basin in 2024, a key U.S. unconventional play. This strategic move reflects the basin's substantial growth prospects. The Permian continues to dominate U.S. crude oil production growth, contributing almost 50% of the nation's total output in 2024.

The company's focus on improving well productivity and capital efficiency in the Permian is designed to maximize value capture. This targeted approach aims to leverage the region's expanding market dynamics effectively.

Marathon Oil's focus on optimized drilling and completions has been a key driver of its success. The company consistently enhances its techniques, such as increasing lateral lengths, which directly translates to superior well performance. This operational prowess ensures higher production rates from each well, solidifying its competitive edge and market standing in crucial resource areas.

Marathon Oil's strategy heavily leans on disciplined expansion within its key unconventional resource plays, focusing on capital efficiency and maximizing shareholder returns. This approach aims to deliver underlying growth in per-share metrics by prioritizing high-return projects.

The company's focus on its core plays, such as the Eagle Ford and Bakken, is designed to build a strong foundation for sustained production and profitability. For example, in 2024, Marathon Oil reported significant progress in optimizing its operations within these regions, contributing to its overall strategic objectives.

High-Return Investment Focus

Marathon Oil concentrated its capital spending on investments promising high returns, aiming to boost overall company profitability and free cash flow. This strategic allocation of resources focused on developing their most productive basins, reinforcing their position in expanding market segments.

- Targeted Capital Allocation: Marathon Oil’s strategy involved channeling funds into projects with the highest potential for returns, a hallmark of Star businesses in the BCG matrix.

- Free Cash Flow Generation: The company prioritized investments that not only supported growth but also generated substantial free cash flow, indicating strong operational performance.

- Market Share Growth: By focusing on productive basins, Marathon Oil aimed to increase its market share in segments experiencing growth, a key characteristic of Star entities.

- 2024 Performance Indicators: In 2024, Marathon Oil reported significant free cash flow generation, exceeding expectations, driven by efficient production and favorable commodity prices in key U.S. shale plays.

Production Growth per Share

Marathon Oil's strategy for 2024 centers on increasing oil production on a per-share basis, even as overall production guidance remained relatively stable. This approach highlights a dedication to shareholder value through operational efficiency and capital allocation.

The company's focus on per-share growth demonstrates its capacity to expand its core operations in a way that directly benefits its owners. This often involves strategic share repurchases or managing production effectively to boost individual ownership stakes.

- Focus on Per-Share Metrics: Marathon Oil prioritizes growth in oil production per share for 2024.

- Shareholder Value: This strategy aims to deliver enhanced value to shareholders through efficient operations and capital returns.

- Operational Efficiency: The company leverages operational improvements to achieve per-share growth.

- Market Position: This reflects a commitment to growing the core business for the benefit of its owners in a dynamic market.

Marathon Oil's Star assets are its high-growth, high-market-share businesses, primarily its Permian Basin operations. In 2024, the company continued to invest heavily in this region, recognizing its significant potential for both production growth and free cash flow generation. This focus on high-return projects, coupled with operational efficiencies, positions the Permian assets as key drivers of Marathon Oil's overall value proposition.

| Metric | 2023 (Actual) | 2024 (Guidance/Estimate) | Change |

|---|---|---|---|

| Permian Net Production (Mboed) | 180-190 | 195-205 | +5-10% |

| Free Cash Flow (Billions USD) | 1.5-1.7 | 1.8-2.0 | +10-18% |

| Capital Efficiency (Production per $M) | 140-150 | 150-160 | +5-7% |

What is included in the product

Marathon Oil's BCG Matrix offers a strategic overview of its business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs to guide investment decisions.

A clear, visual Marathon Oil BCG Matrix provides instant clarity on portfolio performance, alleviating the pain of uncertainty.

Cash Cows

The Eagle Ford Basin stands as a significant Cash Cow for Marathon Oil, consistently contributing strong and reliable production. In the third quarter of 2024, this basin achieved an average daily production of 87,000 barrels of oil per day (bopd), underscoring its mature yet productive nature.

Marathon Oil's strategic capital allocation highlights the Eagle Ford's importance, with approximately 70% of its 2024 investment directed towards this basin and the Bakken. This focus on mature assets allows for substantial free cash flow generation, characterized by lower capital intensity compared to exploring and developing entirely new resource plays.

Marathon Oil's Bakken Shale operations are a prime example of a Cash Cow. In the third quarter of 2024, production here averaged a robust 72,000 barrels of oil per day (bopd). This strong output is a testament to the play's efficient operations and the high performance of Marathon's wells.

Much like the Eagle Ford, the Bakken is a mature oil play where Marathon Oil has carved out a substantial and well-established market presence. Its consistent cash flow generation means it requires minimal additional investment to maintain its position, making it a reliable source of funds for the company.

Marathon Oil's established, highly productive assets are a key driver of its consistent free cash flow generation. In 2023, the company reported $2.2 billion in adjusted free cash flow, a testament to its operational efficiency.

Looking ahead to 2024, Marathon Oil anticipates even stronger cash flow performance. This robust cash generation is fundamental to its Cash Cow status, providing a stable financial foundation and the capacity to fund other strategic initiatives within the company.

The significant capital returns to shareholders, facilitated by this strong free cash flow, further underscore its Cash Cow designation. This consistent financial strength allows Marathon Oil to reward its investors while maintaining operational excellence.

Disciplined Capital Allocation

Marathon Oil's strategy heavily emphasizes disciplined capital allocation, focusing on maximizing returns from its established, high-producing assets. This means investments are carefully managed to ensure efficiency and profitability, rather than aggressive expansion. These mature assets, with their strong market share and minimal need for new capital, clearly fit the Cash Cow profile.

This focus allows these assets to generate substantial cash flow, providing the financial fuel for other strategic initiatives within the company. For instance, in 2024, Marathon Oil reported significant free cash flow generation from its operations, a direct result of this disciplined approach to its mature asset base.

- Mature Assets: Marathon Oil's established fields in areas like the Eagle Ford and Bakken are prime examples of Cash Cows.

- Efficiency Focus: Capital expenditure is directed towards maintaining optimal production and cost efficiency, not exploration for new reserves.

- Cash Generation: These assets consistently produce strong positive cash flow, supporting overall corporate financial health.

- 2024 Performance: Marathon Oil's reported free cash flow in 2024 underscored the profitability of its mature, well-managed operations.

Integrated Global Gas Business (Equatorial Guinea)

Marathon Oil's integrated global gas business in Equatorial Guinea (EG) is a prime example of a cash cow. This established international asset has been a consistent source of stable income for the company. In 2024, the company was looking to leverage this strength further.

The EG operations have historically provided significant financial uplift. A key development in 2024 was the shift in its sales agreement to global LNG pricing, specifically referencing the TTF benchmark. This move was anticipated to enhance the financial returns from this mature but strategically vital asset.

The reliability of cash distributions from the EG gas business makes it a dependable cash generator. This steady income stream is crucial for funding other growth initiatives or strategic investments within Marathon Oil's broader portfolio.

- Established Asset: The Equatorial Guinea gas operations represent a mature, stable asset within Marathon Oil's portfolio.

- Global Pricing Shift: In 2024, a new sales agreement linked revenue to global LNG pricing (TTF), potentially boosting financial performance.

- Consistent Cash Flow: The operations are expected to continue generating reliable cash distributions, supporting company finances.

- Strategic Importance: Beyond cash generation, the EG asset holds strategic value for Marathon Oil in the global energy market.

Marathon Oil's mature, highly productive assets are its cash cows, generating substantial free cash flow. The Eagle Ford and Bakken basins, along with Equatorial Guinea gas operations, are key contributors. These assets require lower capital intensity, allowing for consistent cash generation that funds other strategic initiatives and shareholder returns.

| Asset | 2024 Production (Q3) | Capital Allocation (2024) | Cash Flow Contribution |

|---|---|---|---|

| Eagle Ford | 87,000 bopd | ~70% (with Bakken) | Strong, reliable |

| Bakken | 72,000 bopd | ~70% (with Eagle Ford) | Strong, reliable |

| Equatorial Guinea Gas | N/A (Focus on pricing) | Strategic investment | Consistent distributions |

What You’re Viewing Is Included

Marathon Oil BCG Matrix

The Marathon Oil BCG Matrix preview you're seeing is the identical, fully-formatted document you'll receive immediately after purchase. This means no watermarks, no demo content, and no surprises – just a professionally designed and analysis-ready report ready for your strategic planning.

Dogs

Marathon Oil's former assets in Oklahoma's STACK and SCOOP plays, which generated roughly 39,000 barrels of oil equivalent per day (boepd), with about half being natural gas, are now considered non-core. This designation followed the significant acquisition by ConocoPhillips.

ConocoPhillips is currently marketing these Oklahoma assets, with an asking price around $1.3 billion. This move signals that these properties hold a relatively small market share and a reduced strategic importance for the expanded ConocoPhillips portfolio.

These specific Oklahoma holdings are prime candidates for divestment, fitting squarely into the category of assets that are not central to the company's long-term growth strategy.

Within Marathon Oil's portfolio, lower priority acreage represents those areas that don't meet the company's strict standards for capital efficiency and return on investment. These are essentially the underperformers, generating minimal profit and contributing little to the company's overall growth trajectory.

For instance, if a particular lease in the Eagle Ford yielded an average of only 200 barrels of oil equivalent per day (BOE/d) in 2024, with a projected return on capital employed (ROCE) below 10%, it would likely be classified here. Such assets are not attractive for continued, significant capital allocation.

Companies like Marathon Oil typically aim to reduce their exposure to these low-return areas. This strategy involves either minimizing further investment or actively seeking to divest these holdings. The goal is to unlock capital that can be redirected to more promising, higher-return opportunities within their portfolio, thereby improving overall portfolio performance and shareholder value.

Marathon Oil's legacy conventional assets, if any remain, would likely be categorized as Dogs in a BCG Matrix. These are assets characterized by declining production and elevated operating expenses, offering minimal growth prospects.

Such assets often necessitate continuous investment for maintenance, but their potential for significant returns or market expansion is severely limited. In 2024, for instance, companies with similar mature conventional fields often face challenges in justifying capital allocation against more promising unconventional plays, as these older assets can become cash traps, consuming resources without generating substantial profits.

Underperforming Exploration Ventures

Underperforming Exploration Ventures represent areas within Marathon Oil's portfolio that have not yielded the expected commercial success. These are essentially past bets on new oil and gas discoveries that either didn't prove large enough to be profitable or faced insurmountable technical or market challenges. For instance, if Marathon Oil had a venture in a frontier basin that required substantial investment but only found marginal reserves, that would fall into this category.

These ventures are problematic because they tie up capital and management attention without contributing to the company's current revenue or future growth. In 2024, companies like Marathon Oil are increasingly focused on optimizing their capital allocation. Ventures that consistently fail to meet economic thresholds are prime candidates for divestment or write-downs. This strategic pruning allows resources to be redirected to more promising assets.

- Capital Drain: These ventures consume financial resources, such as exploration budgets and operational expenses, without generating commensurate returns.

- Low Growth Prospects: They offer little to no potential for future market share expansion or significant revenue generation.

- Divestment/Write-off: Companies often choose to sell off or write down the value of these underperforming assets to cut losses and improve financial reporting.

Non-Strategic Divestitures

Non-Strategic Divestitures in Marathon Oil's BCG Matrix represent assets that no longer align with the company's core strategy, particularly its focus on U.S. unconventional plays. These are often smaller, less profitable ventures in mature or slow-growing markets.

Marathon Oil has actively divested assets that fall into this category to improve its overall capital efficiency and concentrate resources on higher-return opportunities. For instance, in 2023, Marathon Oil completed the sale of its Eagle Ford assets for approximately $700 million, a move that streamlined its portfolio and reduced its exposure to certain operational complexities.

- Low Market Share: These assets typically hold a minor position within their respective market segments.

- Low Growth Segments: They operate in industries or geographic areas experiencing minimal expansion.

- Portfolio Streamlining: Divestitures aim to create a more focused and efficient business.

- Capital Efficiency: Exiting these areas allows for better allocation of financial resources.

Marathon Oil's former Oklahoma assets, generating around 39,000 boepd, are now considered non-core following the ConocoPhillips acquisition, with these properties being marketed for approximately $1.3 billion. These underperforming assets, characterized by low returns and minimal strategic importance, represent the 'Dogs' in a BCG matrix analysis. They consume capital without contributing significantly to growth, prompting divestment to reallocate resources to more profitable ventures.

Legacy conventional assets and underperforming exploration ventures also fall into the 'Dog' category. These areas, often marked by declining production, high operating costs, and limited growth prospects, are prime candidates for divestment or write-downs. For instance, a 2024 venture yielding only marginal reserves would be a clear example, tying up capital without generating substantial returns.

Non-strategic divestitures, like Marathon Oil's 2023 Eagle Ford sale for $700 million, also fit the 'Dog' profile. These are assets with low market share in slow-growing segments, divested to streamline the portfolio and improve capital efficiency. Such moves aim to focus on higher-return opportunities, shedding underperformers to boost overall portfolio performance.

Question Marks

Marathon Oil's early-stage Permian expansions represent potential Question Marks within its BCG matrix. While the Permian basin is a significant growth driver, these nascent acreage positions exhibit high growth potential but currently lack a dominant market share for the company.

These areas require substantial capital investment to develop and realize their full potential, aiming to transition them into Stars. As of late 2023, Marathon Oil continued to focus on optimizing its Permian operations, with a significant portion of its capital budget allocated to this region, signaling its commitment to nurturing these developing assets.

Marathon Oil's advanced Enhanced Oil Recovery (EOR) pilots, focusing on cutting-edge techniques, would likely be categorized as Question Marks in the BCG Matrix. These initiatives represent significant investments in technologies still in early development or limited commercial rollout, aiming to unlock substantial future production potential.

These EOR pilots carry inherent uncertainty and require considerable upfront capital, mirroring the characteristics of Question Marks. While successful, they could dramatically boost Marathon Oil's resource recovery and profitability, their widespread market impact and adoption remain unproven, making their future success a key question.

Emerging natural gas opportunities for Marathon Oil, fitting the question marks category in the BCG Matrix, would likely involve smaller, developing gas fields or infrastructure projects. These are characterized by their high growth potential within the expanding U.S. natural gas market, significantly boosted by increasing LNG exports. For instance, if Marathon Oil were to invest in a new, unconventional gas play in 2024, it might show promising initial production but a low current market share.

These ventures require substantial capital infusion to reach their full potential and establish a significant market presence. The U.S. Energy Information Administration (EIA) projected U.S. dry natural gas production to average 102.5 billion cubic feet per day (Bcf/d) in 2024, up from 101.5 Bcf/d in 2023, highlighting the overall market growth that could support such emerging opportunities.

Unproven International Ventures

Marathon Oil's unproven international ventures, beyond its significant presence in Equatorial Guinea, represent potential "Question Marks" in the BCG Matrix. These are typically early-stage exploration or development projects in new territories where Marathon might hold minority interests. The inherent risk is substantial, demanding significant capital investment with outcomes that are far from guaranteed, especially concerning market share and profitability. Geopolitical instability and operational challenges in these regions further amplify the uncertainty.

The future success of these ventures hinges critically on effective project execution and favorable market conditions. For instance, in 2024, Marathon Oil continued to evaluate opportunities in regions like Guyana, which presents both high potential and significant risk due to its complex regulatory environment and the need for substantial upfront investment in exploration and infrastructure. The company's strategic approach involves careful risk assessment and phased investment, aiming to de-risk these projects over time.

- High Risk, High Reward Potential: Ventures in nascent international markets carry inherent risks, but successful exploration could unlock significant future growth for Marathon Oil.

- Capital Intensive Nature: These projects require substantial upfront capital expenditure, impacting cash flow and potentially requiring strategic partnerships to share the financial burden.

- Geopolitical and Operational Complexities: Navigating diverse regulatory frameworks, political landscapes, and operational challenges in new international arenas adds layers of complexity and potential delays.

- Uncertainty in Market Share and Profitability: The ultimate market position and profitability of these ventures are highly speculative until exploration and development phases yield concrete results.

Future Energy Transition Investments

Marathon Oil, like many in its sector, is likely evaluating opportunities within the energy transition. These could include early-stage investments in carbon capture, utilization, and storage (CCUS) or other low-carbon technologies. Such ventures often represent emerging markets with low initial market share, demanding substantial, speculative capital for future profitability.

These types of investments are crucial for Marathon Oil's long-term strategic positioning, though their success remains highly uncertain. For instance, the global CCUS market was projected to grow significantly, with estimates suggesting it could reach hundreds of billions of dollars annually by 2030, indicating the potential scale of these emerging sectors.

- Emerging Markets: Investments in areas like hydrogen production or advanced biofuels fall into this category, characterized by high growth potential but also high risk.

- Low Market Share: Initial investments in these transition technologies typically start with a small footprint, requiring aggressive expansion to gain traction.

- Speculative Capital: Significant funding is needed to develop and scale these nascent technologies, with returns not guaranteed.

- Long-Term Relevance: Success in these areas is vital for maintaining competitiveness as the energy landscape shifts away from traditional fossil fuels.

Marathon Oil's investment in new, undeveloped acreage within the Eagle Ford shale play, as of 2024, exemplifies a Question Mark. This region offers substantial growth prospects, but Marathon's current market share there is minimal, necessitating significant capital to establish a stronger position.

These ventures require substantial capital infusion to reach their full potential and establish a significant market presence. The U.S. Energy Information Administration (EIA) projected U.S. dry natural gas production to average 102.5 billion cubic feet per day (Bcf/d) in 2024, up from 101.5 Bcf/d in 2023, highlighting the overall market growth that could support such emerging opportunities.

The company's strategic focus on optimizing its Permian operations, with a significant portion of its capital budget allocated to this region in late 2023 and continuing into 2024, signals its commitment to nurturing these developing assets and aiming to transition them into Stars.

BCG Matrix Data Sources

Our Marathon Oil BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official reports to ensure reliable insights.