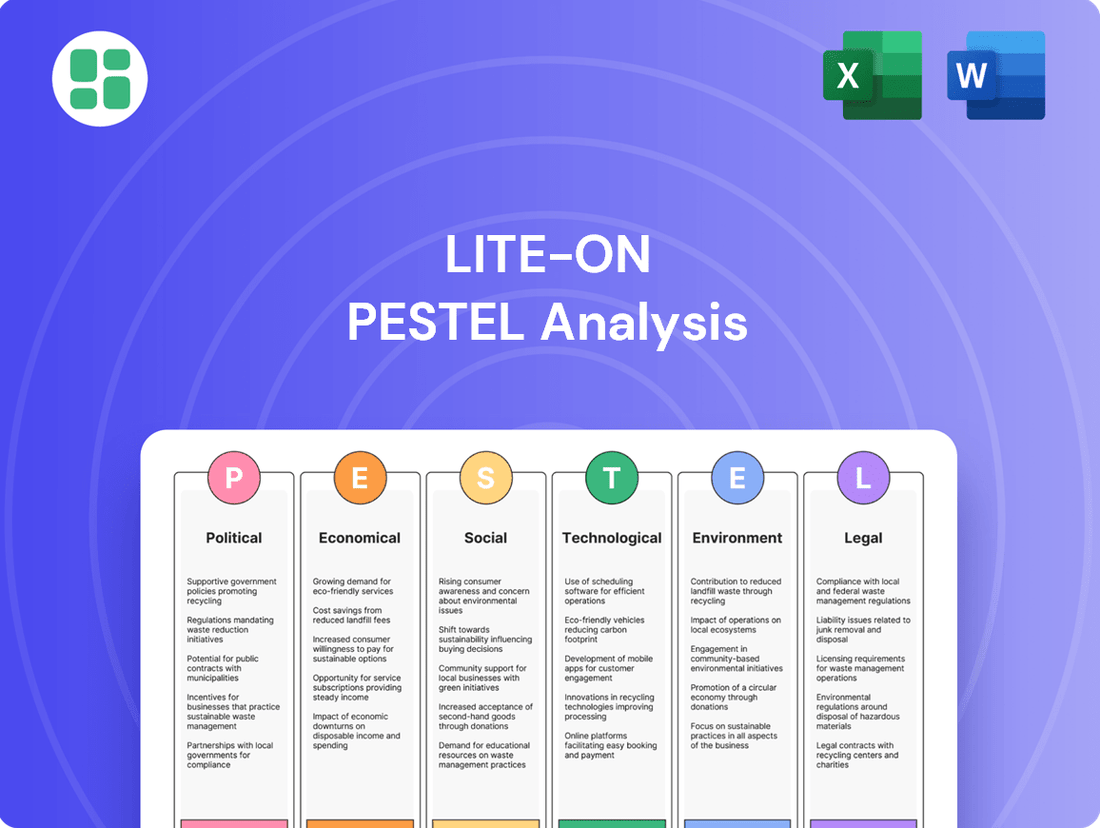

Lite-On PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Lite-On Bundle

Navigate the complex external forces impacting Lite-On with our detailed PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that are crucial for strategic decision-making. Gain a competitive edge by leveraging these insights to anticipate market shifts and identify growth opportunities. Download the full version now for actionable intelligence to inform your Lite-On strategy.

Political factors

Lite-On, a prominent Taiwanese electronics manufacturer, navigates a complex global landscape heavily influenced by geopolitical tensions, especially the ongoing friction between the United States and China. This dynamic directly impacts its operations, as trade restrictions and tariffs on electronic components can escalate costs and narrow the pool of available suppliers.

The persistent US-China trade war, coupled with the potential for further tariff impositions, injects significant uncertainty into the market. For instance, in 2023, the US continued to impose tariffs on various Chinese goods, affecting components that Lite-On might source or utilize. This environment necessitates proactive supply chain diversification to mitigate risks and maintain operational resilience.

The Taiwanese government's proactive industrial policies, including incentives for domestic semiconductor manufacturing, directly impact companies like Lite-On. For instance, the U.S. CHIPS and Science Act, while primarily aimed at the U.S., influences global supply chain dynamics and can indirectly affect Taiwanese firms by encouraging reshoring and nearshoring efforts, potentially leading to stricter controls on technology transfer to China.

Lite-On is strategically responding to these geopolitical shifts by diversifying its manufacturing footprint beyond China, with investments and expansions planned in regions such as the United States and Southeast Asia. This geographical diversification is a direct consequence of evolving government policies and trade tensions, aiming to mitigate risks and ensure supply chain resilience.

Furthermore, government initiatives supporting green energy and digital transformation present significant opportunities for Lite-On. Subsidies and preferential policies for companies involved in these sectors, such as those related to smart manufacturing or renewable energy solutions, can bolster Lite-On's growth and innovation in these key areas.

Governments globally are now keenly focused on making supply chains tougher, especially after events like the COVID-19 pandemic and ongoing geopolitical tensions. This push means companies such as Lite-On need to create more adaptable and dependable supply networks to weather future storms.

For instance, in 2023, the US government allocated $52 billion through the CHIPS and Science Act to bolster domestic semiconductor manufacturing, a key area for electronics companies like Lite-On. This initiative directly supports building more resilient supply chains by encouraging onshoring and diversification.

Lite-On itself is investing in operational efficiency and flexible supply chain strategies, aiming to reduce lead times and enhance responsiveness. This proactive approach is crucial, as global manufacturing output for electronics components saw a 4.5% increase in 2024, highlighting the demand for reliable production capabilities.

Regulatory Environment in Key Markets

Changes in regulatory environments across Lite-On's key markets, including the European Union, the United States, and various Asian nations, directly impact its ability to comply with product standards and access these markets. For instance, the EU's General Data Protection Regulation (GDPR) and upcoming AI Act, alongside the US's evolving cybersecurity and product safety mandates, require significant investment in compliance. Failure to adapt to these diverse legal frameworks, such as stricter environmental regulations like the EU's Restriction of Hazardous Substances (RoHS) directive, can hinder global market presence and necessitate costly product redesigns.

Lite-On must navigate a complex web of regulations that vary significantly by region. For example, in 2023, the US introduced new cybersecurity standards for connected devices, impacting Lite-On's smart home and IoT product lines. Similarly, ongoing shifts in environmental regulations, such as the EU's push for extended producer responsibility and stricter e-waste management, necessitate proactive adjustments to manufacturing processes and supply chain management to ensure continued market access and avoid potential penalties.

- EU's Digital Services Act (DSA) and Digital Markets Act (DMA): These regulations, fully enforced from February 2024, aim to create a safer digital space and a level playing field for online businesses, potentially affecting Lite-On's software and cloud service offerings.

- US Cybersecurity Enhancement Act of 2023: This legislation, signed into law in late 2023, strengthens federal cybersecurity standards, requiring companies like Lite-On to implement more robust security measures for their products.

- Asia-Pacific Data Privacy Laws: Countries like Singapore and South Korea have updated their data protection laws in 2024, demanding stricter data handling and user consent protocols for Lite-On's data-intensive products.

Political Stability in Operating Regions

Political stability in regions where Lite-On operates, particularly in its key manufacturing hubs and markets, is a critical factor influencing its operational continuity and investment decisions. For instance, geopolitical tensions or shifts in government policy can directly disrupt supply chains and affect market access.

Lite-On's global footprint means it navigates a diverse political landscape. In 2024, the company continues to monitor political developments in countries like Taiwan, China, and Vietnam, where it has significant manufacturing presence. For example, changes in trade policies or labor regulations in these areas can have immediate financial implications.

- Manufacturing Hub Stability: Lite-On’s primary manufacturing facilities are concentrated in regions like Taiwan and Vietnam, both of which have experienced relative political stability, fostering consistent production.

- Market Access and Tariffs: Political decisions regarding international trade agreements and tariffs, particularly between major economic blocs, directly impact Lite-On's ability to export finished goods and source components.

- Investment Climate: Government incentives for foreign investment and the overall regulatory environment in countries where Lite-On plans expansion, such as Southeast Asia, are carefully evaluated based on political predictability.

Geopolitical tensions, particularly between the US and China, continue to shape Lite-On's operational landscape, influencing trade policies and component sourcing. The ongoing US-China trade friction, with potential for new tariffs, creates market uncertainty, impacting costs and supplier options for electronic components throughout 2024.

Government initiatives supporting technological advancement and supply chain resilience, such as the US CHIPS Act, indirectly influence global dynamics. These policies encourage reshoring and nearshoring, potentially impacting technology transfer controls and Lite-On's strategic manufacturing location decisions.

Lite-On is actively diversifying its manufacturing base beyond China, investing in regions like Southeast Asia and the United States to mitigate risks associated with geopolitical instability and evolving trade regulations. This strategic move is a direct response to government policies aimed at creating more robust and geographically dispersed supply chains.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Lite-On, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by identifying key opportunities and threats Lite-On faces in its operating landscape.

A clear, actionable summary of Lite-On's PESTLE factors, enabling rapid identification of external challenges and opportunities to inform strategic decision-making.

Economic factors

The global economic landscape significantly shapes demand for Lite-On's electronic components. A robust global economy, characterized by healthy GDP growth and consumer spending, directly fuels demand in sectors like IT, consumer electronics, and automotive, where Lite-On is a key supplier.

For instance, the International Monetary Fund (IMF) projected global growth to be around 3.2% in 2024, a slight uptick from previous estimates, indicating a generally supportive environment for demand. This growth translates to increased consumer purchasing power and business investment, both of which benefit Lite-On's product sales.

Conversely, economic downturns or recessions can contract demand. During periods of economic contraction, consumers and businesses tend to reduce discretionary spending, leading to lower sales volumes and potentially impacting Lite-On's revenue and profitability. The lingering effects of global supply chain disruptions and inflationary pressures experienced in 2023-2024 also continue to influence consumer and business spending patterns, creating a dynamic demand environment.

Inflation significantly impacts Lite-On by creating volatility in both labor and material costs, directly affecting its manufacturing expenses. For instance, persistent inflation in key component markets throughout 2024 and into early 2025 has led to higher procurement costs for Lite-On's electronic parts.

Rising prices for raw materials, such as semiconductors and metals, coupled with upward pressure on wages in manufacturing hubs, can compress Lite-On's profit margins. If the company cannot pass these increased costs onto consumers or find cost efficiencies, profitability will suffer.

Lite-On's strategic focus on optimizing its global operational efficiency, including supply chain management and automation, is crucial for mitigating these inflationary pressures. By streamlining processes and securing longer-term supply contracts, Lite-On aims to absorb some of the cost increases and maintain competitive pricing.

Currency exchange rate volatility, especially concerning the New Taiwan Dollar (NTD) against major currencies like the US Dollar (USD) and Euro (EUR), directly impacts Lite-On's reported international revenues and the cost of its imported components. For instance, a strengthening NTD in 2024 could reduce the value of USD-denominated sales when converted back to NTD, affecting top-line figures. Conversely, a weaker NTD might increase the cost of imported materials, potentially squeezing profit margins.

These fluctuations can significantly alter Lite-On's financial performance and its competitive standing in global markets. For example, if the NTD depreciates substantially against the USD, Lite-On's products might become more attractively priced for international buyers, boosting sales volume. However, the cost of essential imported raw materials and components would simultaneously rise, creating a complex balancing act for financial management.

Supply Chain Costs and Disruptions

Lite-On, like many in the electronics sector, continues to grapple with a complex supply chain environment. Geopolitical tensions and the ongoing demand for semiconductors contribute to material shortages and unpredictable lead times, directly impacting production schedules and cost management. For instance, a report in early 2024 indicated that lead times for certain critical electronic components could extend to over 52 weeks, a significant increase from pre-pandemic levels.

These persistent disruptions translate into higher operational expenses for Lite-On due to increased component prices and the need for expedited shipping. The company's strategic focus on enhancing supply chain resilience, including diversifying suppliers and investing in inventory management, is crucial for mitigating these financial pressures and ensuring consistent product availability for its customers.

Lite-On's efforts to navigate these challenges are reflected in its financial reporting, with management often citing supply chain volatility as a key factor influencing profitability. The company is actively working to build stronger relationships with key suppliers and explore alternative sourcing strategies to buffer against future shocks.

- Component Shortages: Ongoing shortages in key electronic components, particularly semiconductors, continue to affect production capacity and increase procurement costs.

- Geopolitical Impact: Tensions in manufacturing regions and trade disputes create uncertainty regarding the availability and pricing of raw materials and finished goods.

- Extended Lead Times: The average lead time for critical electronic components remained elevated throughout 2024, often exceeding 40 weeks for specialized parts.

- Cost Inflation: Increased logistics expenses, coupled with higher component prices, contribute to an overall rise in the cost of goods sold for Lite-On.

Investment in AI and Cloud Infrastructure

The global market for AI infrastructure is experiencing robust growth, directly benefiting companies like Lite-On. In 2024, it's projected that worldwide spending on AI hardware, including servers and related components, will reach hundreds of billions of dollars, with significant contributions from cloud providers expanding their AI capabilities. This surge in demand translates into increased orders for Lite-On's high-efficiency power supply units, crucial for powering these advanced AI servers and data centers.

Lite-On's strategic focus on next-generation AI server power supplies and cloud computing products is a key driver of its revenue growth. The company is well-positioned to capitalize on the increasing need for reliable and powerful infrastructure to support the expanding AI ecosystem. This trend is expected to continue through 2025, as AI adoption accelerates across various industries, leading to higher order volumes for Lite-On's advanced components.

The economic landscape highlights a strong correlation between AI adoption and infrastructure investment. For instance, major cloud providers announced substantial capital expenditures in 2024, with a significant portion allocated to AI-accelerated computing and data center expansion. This investment directly fuels demand for specialized components like Lite-On's power solutions, which are essential for the operation and efficiency of these cutting-edge facilities.

- Global AI infrastructure spending is projected to exceed $200 billion in 2024, a significant increase from previous years.

- Cloud computing market revenue is anticipated to grow by over 15% year-over-year in 2024, driving demand for related hardware.

- Lite-On reported a substantial increase in revenue from its cloud and AI-related product segments in its latest financial disclosures for late 2023 and early 2024.

- The demand for high-wattage, efficient power supplies for AI servers is a critical growth area, with projections indicating continued strong demand through 2025.

Economic factors significantly influence Lite-On's performance through global demand, inflation, and currency fluctuations. A healthy global economy supports demand for its electronic components, while economic downturns can contract sales.

Inflation impacts Lite-On by increasing material and labor costs, potentially squeezing profit margins if these costs cannot be passed on. Currency exchange rate volatility also affects reported international revenues and the cost of imported components.

Lite-On's financial results are directly tied to these economic trends, with management actively working to mitigate risks through operational efficiencies and strategic sourcing.

What You See Is What You Get

Lite-On PESTLE Analysis

The Lite-On PESTLE Analysis preview you see is the exact document you’ll receive after purchase—fully formatted and ready to use.

This is a real glimpse into the comprehensive PESTLE analysis of Lite-On, delivered exactly as shown, no surprises.

The content and structure of this Lite-On PESTLE Analysis shown in the preview is the same document you’ll download after payment.

Sociological factors

Consumer electronics are rapidly evolving, with a growing demand for sophisticated features and compact designs. This shift directly impacts companies like Lite-On, which supply components for devices ranging from smart home gadgets to wearable technology. For instance, the global market for smart home devices was projected to reach $137.3 billion in 2023, demonstrating a strong consumer appetite for connected living solutions.

Consumers and businesses worldwide are prioritizing environmentally friendly and ethically sourced goods, a trend that significantly impacts manufacturing giants like Lite-On. This growing awareness drives demand for products with a smaller ecological footprint and transparent, responsible production methods. For instance, a 2024 survey indicated that over 60% of consumers are willing to pay a premium for sustainable products, a powerful signal for companies to adapt their offerings and operations.

This societal shift compels Lite-On to intensify its focus on green operations, develop low-carbon emitting products, and foster sustainable practices throughout its supply chain. The company's proactive approach to Environmental, Social, and Governance (ESG) policies, including its investments in energy-efficient solutions like advanced cooling systems for data centers, directly addresses this burgeoning market demand. Lite-On's reported reduction of 15% in carbon emissions intensity in its 2024 fiscal year reflects its commitment to aligning with these evolving consumer and business expectations.

The availability of skilled labor, particularly engineers in the electronics manufacturing sector, directly impacts Lite-On's operational capacity and innovation potential. As of early 2024, the global demand for electronics engineers continues to outpace supply, with regions like Taiwan, where Lite-On has a significant presence, facing intense competition for top talent.

Attracting and retaining this specialized workforce is paramount for Lite-On in the highly competitive global market. Companies are increasingly prioritizing employee well-being and career growth to secure skilled professionals, a trend that Lite-On actively addresses through its people-centric workplace initiatives and robust talent development programs.

Corporate Social Responsibility (CSR) Expectations

Stakeholders, from investors to employees and the general public, increasingly demand that companies like Lite-On actively engage in corporate social responsibility. This focus on social and environmental practices is no longer optional but a core expectation for building trust and a positive brand image.

Lite-On's commitment is evident in its consistent performance. For instance, in 2023, the company was recognized on the Dow Jones Sustainability Index for its robust ESG (Environmental, Social, and Governance) initiatives, a testament to its dedication. This recognition directly bolsters stakeholder confidence and strengthens its market position.

- Investor Scrutiny: Investors are integrating ESG factors into their decision-making, with sustainable investments projected to reach over $50 trillion globally by 2025.

- Employee Attraction and Retention: A strong CSR record, like Lite-On's, is a significant draw for talent, with 70% of employees stating they are more likely to work for a company with a strong sense of purpose.

- Public Perception: Consumers are more likely to support brands that align with their values, directly impacting Lite-On's brand loyalty and market share.

Changing Work Patterns and Digitalization

The ongoing global shift towards remote and hybrid work models, accelerated by widespread digitalization, significantly boosts the demand for robust cloud computing solutions and advanced networking equipment. This trend directly supports Lite-On's strategic focus on its Cloud & AIoT business segment, positioning it to capitalize on increased enterprise spending in these areas. For instance, global IT spending on cloud services was projected to reach $679 billion in 2024, a substantial increase indicating sustained market appetite for Lite-On's core offerings.

Companies are actively increasing their cloud budgets to support distributed workforces and enhance digital operations. This sustained investment translates into a direct benefit for Lite-On, as businesses require reliable infrastructure for data storage, processing, and connectivity. The demand for power supplies and connectivity components, crucial for data centers and remote work setups, remains strong, underpinning Lite-On's market position.

- Increased Cloud Spending: Global cloud spending is expected to continue its upward trajectory, with estimates suggesting continued double-digit growth through 2025.

- Remote Work Infrastructure Needs: The persistence of remote work necessitates ongoing investment in networking hardware and power solutions, areas where Lite-On excels.

- Digital Transformation Drive: Companies are prioritizing digital transformation, leading to greater reliance on cloud services and the underlying hardware Lite-On provides.

Societal expectations are increasingly shaping corporate behavior, pushing companies like Lite-On to prioritize sustainability and ethical practices. This growing consumer and investor focus on Environmental, Social, and Governance (ESG) factors means that companies demonstrating strong social responsibility, such as Lite-On's commitment to reducing its carbon footprint, are gaining a competitive edge. For example, Lite-On's reported reduction of 15% in carbon emissions intensity in its 2024 fiscal year directly aligns with these heightened societal demands.

The availability of skilled labor, particularly in specialized fields like electronics engineering, is a critical sociological factor impacting Lite-On's operational capacity and innovation. As of early 2024, the global demand for electronics engineers continues to outpace supply, creating a competitive landscape for talent acquisition. Lite-On's investment in employee well-being and career development programs is a strategic response to this challenge, aiming to attract and retain top talent in a tight labor market.

Public perception and corporate social responsibility are intertwined, influencing brand loyalty and market share. Consumers and stakeholders are more inclined to support companies that demonstrate a commitment to societal well-being, making Lite-On's proactive approach to ESG initiatives, such as its recognition on the Dow Jones Sustainability Index in 2023, a significant factor in building trust and positive brand image.

Technological factors

The rapid evolution and integration of Artificial Intelligence (AI) and Machine Learning (ML) are pivotal technological forces shaping Lite-On's strategic direction. The company is keenly focused on leveraging these advancements, especially within its cloud computing and power supply divisions.

Lite-On is actively capitalizing on the escalating demand for components essential to AI infrastructure, such as next-generation AI chips and robust AI server power supplies. This strategic positioning necessitates ongoing innovation in high-performance computing components to meet the stringent requirements of AI workloads.

Lite-On's strength is rooted in optoelectronics and power management. Continued investment in research and development, particularly in visible MiniLEDs, invisible LEDs, and sophisticated power supply units, is vital for Lite-On to stay ahead in the competitive landscape. The optoelectronics sector is poised for substantial expansion, fueled by demand for energy-efficient technologies and the booming consumer electronics market.

The ongoing global expansion of 5G networks is a significant technological driver. This rollout, coupled with the increasing adoption of Internet of Things (IoT) devices, presents substantial growth avenues for Lite-On's component offerings. Sectors like telecommunications infrastructure, smart city development, and industrial automation are prime beneficiaries, directly impacting demand for Lite-On's products.

Lite-On is strategically positioned to capitalize on these trends. The company is actively developing energy-efficient solutions for 5G small cells and integrated base stations. This focus aligns with the emerging 'Internet of Energy' concept, where connected devices and infrastructure optimize energy consumption, a key area for Lite-On's technological development.

Automation and Smart Manufacturing

The electronics manufacturing sector is increasingly embracing advanced automation, AI, and robotics. Lite-On can capitalize on these advancements to optimize its production lines, refine demand forecasting, and boost operational efficiency. For instance, the global industrial automation market was valued at approximately $215 billion in 2023 and is projected to grow significantly, indicating a strong trend towards smart manufacturing adoption.

The digitalization of supply chains is another critical technological factor. Lite-On can benefit by integrating digital solutions to enhance transparency, traceability, and responsiveness within its supply network. This move aligns with broader industry trends, where companies are investing heavily in digital transformation to gain a competitive edge. The worldwide supply chain management software market, for example, is expected to reach over $30 billion by 2026, highlighting the importance of this digitalization push.

- AI-driven quality control: Implementing AI for real-time defect detection can reduce waste and improve product consistency.

- Robotic process automation (RPA): Automating repetitive administrative tasks within manufacturing can free up human resources for more strategic roles.

- Predictive maintenance: Utilizing machine learning to anticipate equipment failures can minimize downtime and maintenance costs.

- Smart factory integration: Connecting various automated systems and data sources creates a more cohesive and efficient production environment.

Cybersecurity and Data Protection Technologies

The increasing digitalization of supply chains and the widespread adoption of cloud solutions present significant cybersecurity challenges. Lite-On, particularly within its cloud computing and AIoT divisions, faces a growing imperative to bolster its defenses. This involves substantial investment in advanced cybersecurity and data protection technologies to safeguard the integrity and confidentiality of its products and services. For instance, in 2023, global spending on cybersecurity solutions was projected to reach $215 billion, highlighting the critical nature of these investments for companies like Lite-On operating in these high-tech sectors.

Lite-On's commitment to robust cybersecurity is crucial for maintaining customer trust and preventing operational disruptions. The company's AIoT products, often connected to networks and handling sensitive data, are prime targets for cyber threats. Therefore, implementing multi-layered security protocols, including end-to-end encryption and regular vulnerability assessments, is paramount. The global cybersecurity market is anticipated to grow to over $300 billion by 2027, underscoring the ongoing need for technological advancements in this area.

- Enhanced Data Encryption: Implementing advanced encryption standards for data at rest and in transit across Lite-On's cloud and AIoT platforms.

- Threat Detection and Response: Deploying sophisticated AI-powered systems for real-time threat detection and rapid response to potential breaches.

- Secure Cloud Infrastructure: Ensuring the security of cloud computing environments through compliance with international security certifications and continuous monitoring.

- AIoT Device Security: Integrating hardware-based security features and secure software development lifecycles for all AIoT devices.

Lite-On's technological strategy is deeply intertwined with the advancements in Artificial Intelligence (AI) and the expansion of 5G networks. The company is actively developing components crucial for AI infrastructure, such as AI server power supplies, and is capitalizing on the demand for 5G-related technologies, including energy-efficient solutions for small cells. Furthermore, Lite-On is enhancing its manufacturing processes through automation and AI, aiming for greater efficiency and optimized production. The increasing digitalization of supply chains also presents opportunities for improved transparency and responsiveness.

| Technological Factor | Relevance to Lite-On | 2024/2025 Data/Projection |

|---|---|---|

| Artificial Intelligence (AI) & Machine Learning (ML) | Development of AI server components, leveraging AI in manufacturing. | Global AI market projected to exceed $1.5 trillion by 2027. |

| 5G Network Expansion | Components for 5G infrastructure, energy-efficient solutions. | 5G subscriptions expected to reach 5 billion globally by 2025. |

| Internet of Things (IoT) | Components for connected devices and smart city development. | IoT connections estimated to surpass 29 billion by 2025. |

| Automation & Robotics | Optimizing production lines and operational efficiency. | Global industrial automation market projected to grow by over 8% annually. |

| Cybersecurity | Protecting AIoT products and cloud infrastructure. | Global cybersecurity spending projected to reach over $300 billion by 2027. |

Legal factors

Protecting its intellectual property through patents and trademarks is crucial for Lite-On to sustain its competitive advantage in innovation-intensive sectors like consumer electronics and IT hardware. As of late 2024, Lite-On actively manages a portfolio of thousands of patents worldwide, reflecting its commitment to R&D and safeguarding its technological advancements.

Navigating the diverse and often complex international patent laws is a significant legal challenge for Lite-On. Differences in patentability criteria, enforcement mechanisms, and duration across jurisdictions, including major markets like the US, EU, and China, necessitate careful legal strategy and substantial investment in global IP protection.

Intellectual property infringement poses a substantial risk, potentially leading to expensive legal battles and erosion of market share. In 2023, the global cost of IP litigation for technology companies averaged tens of millions of dollars, underscoring the financial implications of IP disputes for firms like Lite-On.

Lite-On's diverse product portfolio, ranging from power supplies to optical drives and automotive components, must adhere to stringent international and regional safety and environmental regulations. This includes directives like RoHS (Restriction of Hazardous Substances) and REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals), as well as certifications such as CE marking and UL listings. Failure to meet these evolving standards can lead to significant financial penalties, costly product recalls, and severe damage to Lite-On's brand reputation.

Lite-On, as a key player in cloud computing and AIoT, must navigate a complex web of data privacy regulations like the EU's General Data Protection Regulation (GDPR) and California's Consumer Privacy Act (CCPA). These laws dictate how personal data is collected, processed, and stored, making compliance a non-negotiable aspect of their operations. Failure to adhere can result in significant financial penalties; for instance, GDPR fines can reach up to 4% of global annual revenue or €20 million, whichever is higher.

Labor Laws and Employment Regulations

Operating globally, Lite-On must navigate a complex web of labor laws and employment regulations across its various manufacturing sites and offices. These regulations dictate crucial aspects of employment, from minimum wage requirements to workplace safety standards and employee rights. For instance, in 2024, countries like Germany continued to emphasize strong worker protections, including stringent rules on working hours and collective bargaining, which Lite-On must meticulously follow.

Compliance with these diverse legal frameworks is paramount for Lite-On’s smooth operations and risk mitigation. Failure to adhere to local labor laws can result in significant penalties, legal disputes, and damage to the company's reputation. For example, in 2025, companies operating in the European Union face increasing scrutiny under the EU's General Data Protection Regulation (GDPR) as it relates to employee data, alongside existing labor directives.

Key legal factors influencing Lite-On’s labor practices include:

- Wage and Hour Laws: Adherence to minimum wage, overtime pay, and maximum working hour regulations in each operating jurisdiction.

- Worker Safety and Health: Compliance with occupational safety and health standards to ensure a secure working environment.

- Employee Rights and Protections: Upholding rights related to fair treatment, non-discrimination, freedom of association, and protection against unfair dismissal.

- Data Privacy in Employment: Managing employee personal data in accordance with local and international privacy laws, such as GDPR, impacting hiring, payroll, and HR processes.

Anti-Trust and Competition Laws

Lite-On operates in highly competitive global markets, necessitating strict adherence to anti-trust and competition laws across all operating regions. These regulations are designed to prevent monopolies, price-fixing cartels, and other unfair competitive practices that could harm consumers and stifle innovation. Failure to comply can result in substantial financial penalties and lengthy legal battles, significantly impacting Lite-On's market standing and profitability.

For instance, in 2024, the European Union continued its robust enforcement of competition law, with significant fines levied against companies for anti-competitive behavior. Lite-On must navigate these complex legal landscapes, ensuring its pricing strategies, supply chain agreements, and market conduct are fully compliant. This proactive approach is crucial to avoid disruptions and maintain its competitive edge.

- Regulatory Scrutiny: Lite-On faces ongoing scrutiny from competition authorities worldwide, including the FTC in the US and the European Commission, impacting its mergers, acquisitions, and market practices.

- Compliance Costs: Maintaining robust compliance programs, including legal counsel and internal audits, represents a significant operational cost for Lite-On in 2024-2025.

- Market Access: Non-compliance can lead to market exclusion or restrictions, as seen in past cases where companies were barred from certain regions due to anti-trust violations.

- Reputational Risk: Allegations or findings of anti-competitive behavior can severely damage Lite-On's brand reputation, affecting customer trust and investor confidence.

Lite-On's global operations necessitate strict adherence to international and regional product safety and environmental regulations, such as RoHS and REACH, and obtaining certifications like CE and UL listings. Non-compliance can lead to substantial financial penalties, product recalls, and brand damage, as seen in the increasing stringency of environmental standards worldwide.

Environmental factors

Global pressure for climate action is intensifying, leading to stricter regulations on carbon emissions and energy consumption. Lite-On has responded by committing to net-zero targets by 2050 and aiming for 100% renewable electricity usage by 2040. These ambitious goals necessitate substantial investment in green operations and technologies to align with global efforts to reduce industrial carbon footprints.

The increasing scarcity of vital raw materials, such as rare earth elements and specific metals crucial for electronic components, presents a significant challenge for Lite-On. This necessitates a proactive shift towards sustainable sourcing, exploring innovative alternative materials, and rigorously ensuring ethical and environmentally sound supply chains.

Geopolitical tensions and trade restrictions, particularly concerning critical materials, further amplify these sourcing challenges, potentially impacting production costs and availability for Lite-On in 2024 and beyond. For instance, the global demand for lithium, a key component in batteries, is projected to grow substantially, with prices seeing significant volatility in recent years, impacting the cost structure of electronics manufacturing.

Stricter e-waste regulations are reshaping how companies like Lite-On approach product lifecycles. For instance, the European Union's directives, such as the Ecodesign for Sustainable Products Regulation (ESPR) proposed for 2024, aim to make products more durable, repairable, and recyclable, directly influencing Lite-On's design and material sourcing strategies.

The growing emphasis on a circular economy model incentivizes Lite-On to integrate recycled materials and design for disassembly. This shift not only addresses environmental concerns but also presents opportunities for cost savings and new revenue streams through refurbishment and component recovery, aligning with global sustainability goals that saw the global e-waste volume reach 62 million metric tons in 2020, projected to grow.

Energy Efficiency Standards for Products and Operations

The global push for reduced energy consumption creates a constant market need for more efficient electronic components and power systems. Lite-On's strategic emphasis on optoelectronic energy-saving technologies and green data center solutions directly aligns with this environmental driver, making their products more attractive to environmentally conscious customers and lowering their own operational expenses.

In 2023, the global demand for energy-efficient products continued to rise, with many governments setting stricter energy performance standards. For instance, the European Union's Ecodesign directive is progressively tightening energy efficiency requirements for various electronic devices. Lite-On's commitment to developing solutions that meet and exceed these evolving standards is crucial for market competitiveness.

- Market Demand: Growing consumer and regulatory pressure for energy-saving electronics.

- Lite-On's Strategy: Focus on optoelectronics and green data center solutions to meet this demand.

- Operational Benefits: Reduced energy costs for Lite-On through efficient operations.

- Regulatory Alignment: Compliance with increasingly stringent global energy efficiency standards.

Water Usage and Pollution Control

Manufacturing electronic components, a core activity for Lite-On, is notoriously water-intensive and can lead to the generation of pollutants. This reality necessitates a strong focus on water management. For instance, the electronics industry, in general, has faced increasing scrutiny regarding its wastewater discharge, with regulations tightening globally. Lite-On's commitment to environmental sustainability means implementing advanced water treatment technologies and efficient water usage practices across its operations to meet these evolving standards.

To address these challenges, Lite-On must maintain and enhance robust water management systems and pollution control measures. This is crucial not only for regulatory compliance but also for minimizing the company's ecological footprint. A key aspect of this involves investing in technologies that can treat wastewater effectively, removing harmful chemicals before discharge. For example, companies in the semiconductor manufacturing sector, which shares similarities with electronic component production, have reported significant investments in advanced filtration and chemical treatment processes to meet stringent environmental targets.

- Water Consumption: The electronics manufacturing process, including cleaning and cooling, can consume substantial volumes of water.

- Pollutant Discharge: Wastewater from these processes may contain heavy metals, solvents, and other chemicals requiring careful treatment.

- Regulatory Compliance: Adherence to local and international environmental laws governing water usage and discharge is paramount.

- Sustainability Goals: Minimizing water impact aligns with Lite-On's broader corporate social responsibility and environmental sustainability strategy.

Global pressure for climate action continues to intensify, driving stricter regulations on carbon emissions and energy consumption. Lite-On's commitment to net-zero targets by 2050 and 100% renewable electricity usage by 2040 reflects a proactive approach to these environmental shifts. These goals necessitate significant investments in green operations and technologies to reduce industrial carbon footprints.

The increasing scarcity of vital raw materials, such as rare earth elements and specific metals for electronic components, poses a significant challenge. This requires Lite-On to focus on sustainable sourcing, explore alternative materials, and ensure ethical, environmentally sound supply chains. Geopolitical tensions and trade restrictions amplify these sourcing challenges, potentially impacting production costs and availability in 2024 and beyond.

Stricter e-waste regulations, like the EU's proposed Ecodesign for Sustainable Products Regulation (ESPR) for 2024, are reshaping product lifecycles. These regulations push for more durable, repairable, and recyclable products, directly influencing Lite-On's design and material sourcing strategies. The growing emphasis on a circular economy model encourages Lite-On to integrate recycled materials and design for disassembly, creating opportunities for cost savings and new revenue streams.

Manufacturing electronic components is water-intensive and can generate pollutants, making robust water management crucial for Lite-On. The electronics industry faces increasing scrutiny over wastewater discharge, with tightening global regulations. Lite-On's sustainability commitment means implementing advanced water treatment technologies and efficient water usage practices to meet these evolving standards and minimize its ecological footprint.

PESTLE Analysis Data Sources

Our Lite-On PESTLE Analysis is built on a robust foundation of data sourced from official government publications, reputable financial institutions, and leading industry research firms. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting Lite-On.