Lite-On Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Lite-On Bundle

Curious about Lite-On's product portfolio performance? This glimpse into their BCG Matrix highlights key areas of opportunity and challenge. Understand where their Stars shine and where their Cash Cows are generating consistent revenue.

To truly unlock Lite-On's strategic potential, dive into the full BCG Matrix report. Gain a comprehensive understanding of each product's position, enabling you to make informed decisions about resource allocation and future investments. Purchase the complete analysis for actionable insights.

Stars

Lite-On's AI server power supplies are a significant growth engine, with the company aiming for 20% of its revenue to come from AI products by 2025. These power supplies are essential components within Nvidia's AI server infrastructure, including upcoming GB200 and GB300 models.

The market for AI server power supply units is booming. Projections show it growing from $5 billion in 2025, with an anticipated compound annual growth rate of 15% extending through 2033. This surge is fueled by the ever-increasing need for powerful computing capabilities.

Lite-On's cloud computing solutions, especially their high-end power supplies, are a significant driver within the company's Cloud & AIoT segment. This segment alone accounted for 43% of Lite-On's sales in the first quarter of 2025, demonstrating impressive yearly growth of nearly 50%.

The robust expansion of the data center server power supply market, a critical element for cloud infrastructure, directly fuels this growth. This market is benefiting from the escalating demand for advanced, high-performance computing capabilities.

Lite-On sees its automotive electronics revenue share climbing to 15-20% as demand for sophisticated components grows. This expansion is fueled by the automotive sector's increasing reliance on optoelectronics, LiDAR, infrared sensors, and LED lighting for ADAS and autonomous driving technologies.

The company's strategic focus on these high-value automotive applications leverages its core strengths in optoelectronics and power management. For instance, Lite-On's 2024 product roadmap highlights significant advancements in automotive-grade LED solutions and sensor technologies, positioning them to capture a larger market share.

Advanced Optoelectronic Semiconductors (MiniLED, Infrared)

Lite-On's optoelectronic semiconductor segment, encompassing both visible MiniLED and invisible infrared applications, demonstrates robust growth. This sector is a key contributor to the company's portfolio, leveraging strong market demand.

The broader optoelectronics market is expanding significantly, with an anticipated compound annual growth rate of 17.6% between 2024 and 2025. This surge is fueled by the increasing adoption of energy-efficient technologies and innovations in consumer electronics and automotive lighting solutions.

Lite-On holds a dominant position in the market, recognized as the global number one shipment provider for photocouplers and infrared applications. This leadership highlights the company's established strength and market penetration in these critical areas.

- Market Leadership: Lite-On is the world's leading supplier for photocouplers and infrared applications.

- Market Growth: The optoelectronics market is projected to grow at a 17.6% CAGR from 2024-2025.

- Key Drivers: Growth is propelled by demand for energy-saving solutions and advancements in consumer electronics and automotive lighting.

- Business Segment: MiniLED and infrared technologies are key areas of focus and growth for Lite-On.

5G Private Network Small Cell Applications

Lite-On is actively increasing its involvement in 5G private network small cell applications, partnering with global telecom operators to showcase cutting-edge solutions. This strategic move capitalizes on the expanding 5G infrastructure, a key driver for electronic components and IoT device proliferation.

The global 5G infrastructure market is projected for substantial growth. For instance, the private 5G network market alone was valued at approximately USD 3.1 billion in 2023 and is anticipated to reach USD 11.3 billion by 2028, growing at a CAGR of 29.7%. This expansion directly benefits companies like Lite-On that supply essential components for these networks.

- Market Expansion: Lite-On's focus on 5G private networks aligns with a rapidly growing sector.

- Technological Advancement: Collaboration with telecom operators facilitates the demonstration of innovative 5G small cell solutions.

- Growth Potential: The increasing adoption of 5G infrastructure globally presents a significant opportunity for Lite-On to capture a larger market share.

- IoT Integration: The development of 5G networks is intrinsically linked to the growth of connected devices, a core area for Lite-On's electronic components.

Lite-On's AI server power supplies, integral to Nvidia's upcoming GB200 and GB300 models, represent a significant growth area, with the company targeting 20% of its revenue from AI products by 2025. The AI server power supply market is projected to reach $5 billion in 2025 and grow at a 15% CAGR through 2033, driven by escalating computational demands.

Lite-On's Cloud & AIoT segment, powered by high-end power supplies, saw nearly 50% year-over-year growth in Q1 2025, contributing 43% of total sales. This expansion is directly supported by the robust growth in the data center server power supply market, essential for cloud infrastructure and advanced computing needs.

The company's automotive electronics revenue is expected to reach 15-20% as demand for advanced components like optoelectronics, LiDAR, and infrared sensors for ADAS grows. Lite-On's 2024 roadmap emphasizes automotive-grade LEDs and sensors, leveraging its optoelectronics and power management expertise.

Lite-On's optoelectronics segment, including MiniLED and infrared applications, is a key growth driver, benefiting from a market projected to grow at a 17.6% CAGR between 2024 and 2025. This growth is fueled by energy-efficient technologies and advancements in consumer electronics and automotive lighting.

Lite-On is expanding into 5G private network small cell applications, collaborating with telecom operators to showcase advanced solutions. The private 5G network market, valued at approximately USD 3.1 billion in 2023, is forecast to reach USD 11.3 billion by 2028, with a 29.7% CAGR, presenting a substantial opportunity.

| Business Area | Key Products/Focus | Market Opportunity (2025 Est.) | Growth Drivers | Lite-On's Position |

|---|---|---|---|---|

| AI Server Power Supplies | High-end PSUs for Nvidia GB200/GB300 | $5 Billion (AI Server PSU Market) | Increasing AI computational demand | Key supplier, aiming for 20% AI revenue by 2025 |

| Cloud & AIoT | High-end power supplies | N/A (Segment Revenue) | Data center expansion, high-performance computing | 43% of Q1 2025 sales, ~50% YoY growth |

| Automotive Electronics | Optoelectronics, LiDAR, IR sensors, LEDs | N/A (Automotive Component Market) | ADAS, autonomous driving technology adoption | Targeting 15-20% revenue share, strong 2024 roadmap |

| Optoelectronics | MiniLED, Infrared applications, Photocouplers | N/A (Optoelectronics Market) | Energy efficiency, consumer electronics, automotive lighting | Global #1 in photocouplers/infrared, 17.6% CAGR (2024-2025) |

| 5G Infrastructure | Small cell components | USD 11.3 Billion (Private 5G by 2028) | 5G network build-out, IoT proliferation | Partnering with telecom operators, showcasing solutions |

What is included in the product

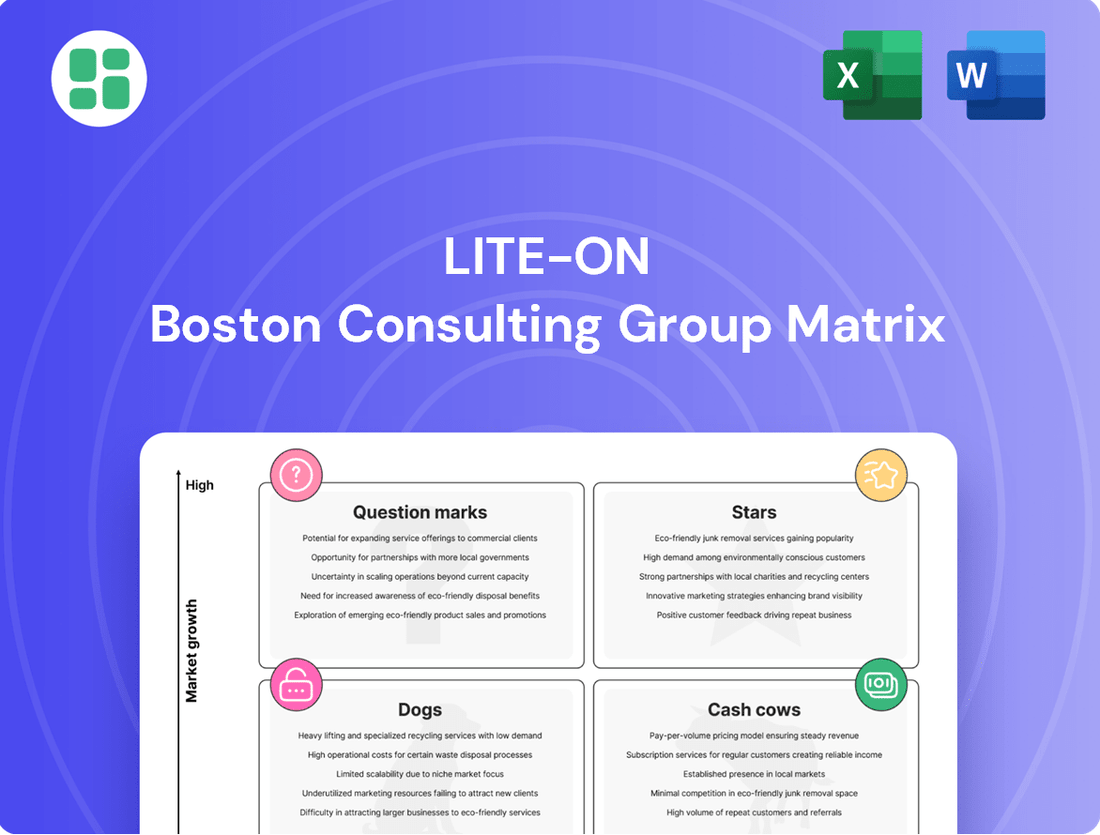

The Lite-On BCG Matrix offers a strategic overview of its product portfolio, categorizing units into Stars, Cash Cows, Question Marks, and Dogs to guide investment decisions.

A clear BCG Matrix visual instantly clarifies Lite-On's portfolio, easing the pain of strategic decision-making.

Cash Cows

Lite-On's traditional power supplies, serving non-AI servers and general IT/consumer electronics, are likely Cash Cows. These products benefit from an established market presence and broad adoption, ensuring consistent cash flow generation.

The company's IT & Consumer Electronics segment, which includes these traditional power supplies, represented a significant 39% of total sales in Q1 2025. This substantial market share in a mature segment points to their role as reliable cash generators.

The Information Technology & Consumer Electronics Components segment is a cornerstone of Lite-On's business, acting as a reliable cash cow. This division, which includes vital items like advanced power supplies and smart keyboards, is a mature but steady contributor to the company's overall financial health.

As of June 2025, this segment is impressive, generating a substantial 40% of Lite-On's total sales. This strong performance is bolstered by the company's strategic focus on optimizing its product mix, ensuring that the most profitable and in-demand items are prioritized.

The consistent demand for these components across a wide range of IT and consumer electronics devices underpins the segment's stability. This broad market appeal translates into predictable revenue streams and sustained profitability for Lite-On.

Lite-On's photocoupler and infrared application segment is a true cash cow, holding the undisputed global No. 1 shipment position. This dominance in a mature market means Lite-On can reliably generate substantial cash flow from these established products.

The widespread adoption of photocouplers and infrared components across diverse industries, from automotive to consumer electronics, ensures a steady and predictable demand. This consistent revenue stream is crucial for funding innovation and growth in other business areas.

Standard LED Components

Lite-On's standard LED components likely represent a cash cow within its product portfolio, operating in a mature but stable market. These fundamental components are essential across a wide array of applications, from general lighting to various display technologies, ensuring consistent revenue streams for the company.

While emerging technologies like MiniLEDs capture growth headlines, the enduring demand for traditional LED packaging underscores the strength of these established products. The broader optoelectronics sector, even as it innovates, continues to depend significantly on these foundational LED solutions.

- Market Maturity: Standard LED components are in a mature phase, characterized by stable demand and established market positions.

- Consistent Sales: These products form the backbone of many lighting and display solutions, generating predictable and reliable sales for Lite-On.

- Market Reliance: Despite advancements in optoelectronics, the industry's continued reliance on fundamental LED technology solidifies the cash cow status of these components.

- Industry Data: The global LED market, excluding specialized segments like automotive and backlighting, is projected to maintain steady growth, with standard lighting and general display applications forming a significant portion. For instance, the general lighting LED market was valued at approximately $25 billion in 2023 and is expected to see a compound annual growth rate (CAGR) of around 5-7% through 2028.

LEO Satellite Power Supplies

Lite-On's LEO satellite power supplies are demonstrating robust growth, positioning them as a potential Cash Cow. The company has experienced consistent year-over-year increases in shipments for these specialized components, reflecting a strong foothold in the burgeoning LEO satellite market.

Lite-On's established relationships with key players in satellite manufacturing and its consistent delivery of advanced power supply solutions suggest a significant and growing market share in this niche. This segment is becoming a reliable source of revenue as more satellite constellations are deployed globally.

- Consistent Shipment Growth: Lite-On has observed sustained annual increases in LEO satellite power supply shipments, indicating market acceptance and demand.

- High Market Share Potential: The company's strong supply chain integration and advanced product offerings point to a commanding position in the LEO power supply sector.

- Stable Revenue Stream: As global LEO satellite constellations continue to expand, this segment is expected to provide a predictable and growing income for Lite-On.

Lite-On's traditional power supplies for non-AI servers and general IT/consumer electronics are solid Cash Cows. These products benefit from an established market and broad adoption, ensuring consistent cash flow.

The Information Technology & Consumer Electronics Components segment, including these power supplies, represented 39% of total sales in Q1 2025, highlighting its role as a reliable cash generator.

Lite-On's photocoupler and infrared application segment is a dominant Cash Cow, holding the global No. 1 shipment position. This maturity means reliable cash generation from established products, with widespread adoption across industries like automotive and consumer electronics ensuring steady demand.

Standard LED components are also Cash Cows, operating in a mature, stable market essential for lighting and displays. Despite advancements, the industry's reliance on fundamental LED technology solidifies their predictable revenue streams.

| Product Segment | BCG Category | Key Characteristics | 2025 Data Point |

| Traditional Power Supplies (IT/Consumer) | Cash Cow | Established market, broad adoption, consistent cash flow | 39% of total sales (Q1 2025) |

| Photocouplers & Infrared Applications | Cash Cow | Global No. 1 shipment, mature market, widespread industry use | Undisputed global No. 1 shipment position |

| Standard LED Components | Cash Cow | Mature market, stable demand, essential for lighting/displays | Global general lighting LED market ~$25B (2023), ~5-7% CAGR projected through 2028 |

Full Transparency, Always

Lite-On BCG Matrix

The Lite-On BCG Matrix preview you are currently viewing is the exact, unadulterated document you will receive upon purchase. This means you get the fully formatted, analysis-ready report without any watermarks or demo content, ensuring immediate usability for your strategic planning. The comprehensive insights and professional design you see here are precisely what will be delivered to you, ready for immediate application in your business decision-making processes.

Dogs

Lite-On's legacy optical drives, once a cornerstone of their business, now represent a product line facing significant headwinds. The market for CD, DVD, and Blu-ray drives has been steadily shrinking, a trend that accelerated in 2024. This decline is driven by the widespread adoption of digital downloads and streaming services, coupled with the increasing prevalence of solid-state drives (SSDs) in computing devices, which offer faster performance and greater storage density without the need for optical media.

The market share for optical drives in new PC shipments has become negligible, with many manufacturers ceasing to include them as standard components. This low market share, combined with a projected low annual growth rate of -4% to -6% for the optical drive market through 2027, places this segment firmly in the Dogs category of the BCG Matrix. Consequently, these products are likely generating minimal profits and represent a candidate for divestiture or a strategic pivot to minimize resource allocation.

Lite-On's older, wired PC peripherals like basic mice and webcams likely reside in the Dogs category of the BCG Matrix. These products face declining demand as consumers increasingly favor advanced, wireless, and integrated solutions. For instance, the global market for PC peripherals, while still substantial, is seeing shifts towards higher-end and specialized devices, leaving basic models with a shrinking user base.

General-purpose power adapters for older devices likely represent a declining segment within Lite-On's product portfolio. As the consumer electronics landscape shifts towards more integrated and efficient power solutions, the demand for these standalone, less sophisticated adapters may be shrinking. This is often a characteristic of products in the question mark or cash cow categories, depending on their current market position and growth trajectory.

These adapters typically operate in highly competitive markets with thin profit margins. Lite-On’s strategic focus on advanced, high-efficiency power solutions means resources are likely being directed away from these older product lines. Consequently, these adapters may exhibit low market share and minimal growth prospects, potentially becoming candidates for divestment or phasing out as the company prioritizes innovation and higher-margin opportunities.

Commoditized Basic Electronic Modules

Some of Lite-On's generic electronic modules that face intense price competition and offer little differentiation could be considered Commoditized Basic Electronic Modules. These products operate in highly saturated markets with limited growth potential and low profit margins. The company's strategy is to focus on high-value, high-growth applications, suggesting a potential deemphasis on commoditized items.

- Market Saturation: The market for basic electronic modules is often characterized by a large number of suppliers, leading to intense price wars.

- Low Differentiation: These modules typically offer standard functionalities, making it difficult for companies like Lite-On to command premium pricing.

- Profit Margin Pressure: Due to price competition and limited innovation, profit margins on commoditized products are generally thin.

- Strategic Shift: Lite-On's focus on specialized, high-growth areas indicates a move away from relying heavily on these lower-margin, basic components.

Segments with High Inventory and Low Turnover

Segments with high inventory and low turnover represent Lite-On's 'Dogs' in the BCG Matrix. These are typically older product lines or components that have seen declining demand and are not expected to experience significant future growth. For instance, certain legacy optical drive components might fall into this category, tying up capital without generating substantial returns.

These 'Dogs' are characterized by low market share and stagnant demand, meaning they consume resources without contributing meaningfully to the company's overall performance. Lite-On's strategic objective is to streamline its product portfolio, which involves divesting or phasing out these underperforming assets to free up capital for more promising ventures.

In 2023, Lite-On reported a gross profit margin of 17.4%, highlighting the importance of optimizing inventory turnover to improve profitability. While specific 'Dog' segment data isn't publicly detailed, the company's focus on shifting towards higher-growth areas like automotive electronics and cloud computing infrastructure suggests a deliberate effort to reduce exposure to slow-moving inventory.

- Legacy components: Older electronic components with diminishing market relevance.

- Declining demand: Products facing reduced customer interest and sales volume.

- Capital inefficiency: Inventory holding costs that outweigh generated revenue.

- Strategic divestment: Lite-On's plan to exit or minimize focus on such segments.

Lite-On's legacy optical drives and older wired PC peripherals are prime examples of its 'Dogs' in the BCG Matrix. These product lines are characterized by declining market share and low growth prospects, a trend that intensified in 2024 with the continued shift towards digital content and wireless technology. For instance, the global market for PC peripherals saw a significant shift in 2024, with basic wired mice and webcams experiencing a noticeable decline in demand as consumers opt for more advanced, integrated, and wireless solutions.

These 'Dogs' consume resources without generating significant returns, often due to intense price competition and limited differentiation. Lite-On's strategic focus on higher-growth areas like automotive electronics and cloud computing infrastructure means a deliberate effort to reduce exposure to these underperforming segments. The company's gross profit margin of 17.4% in 2023 underscores the need to optimize its product portfolio by divesting or phasing out these slow-moving assets.

| Product Segment | BCG Category | Market Trend | Lite-On's Strategy |

| Optical Drives | Dogs | Shrinking market (-4% to -6% annual growth projected through 2027) | Divestiture or strategic pivot |

| Basic Wired Peripherals (Mice, Webcams) | Dogs | Declining demand, shift to wireless/advanced solutions | De-emphasis, resource reallocation |

| Generic Electronic Modules | Dogs | Market saturation, low differentiation, price pressure | Focus on specialized, high-growth applications |

Question Marks

Lite-On is strategically expanding its liquid cooling solutions, mirroring the growth trajectory of its AI server power supply business. This move positions the company to capitalize on the burgeoning demand for efficient thermal management in data centers.

The global liquid cooling market for data centers is projected to reach $15.8 billion by 2028, growing at a CAGR of 22.5%, driven by the increasing power density of AI hardware. While Lite-On's established presence in power supplies provides a strong foundation, its market share in the nascent liquid cooling segment is likely still developing, representing a significant opportunity for expansion.

Lite-On's 'Internet of Energy' (IoE) initiative positions energy storage as a critical component within its long-term strategy, targeting high-growth sectors like green data centers and clean mobility. This market is propelled by global sustainability mandates and the expansion of smart grids, indicating significant future potential.

While the energy storage market is experiencing rapid expansion, with global energy storage capacity projected to reach over 1,000 GW by 2030, Lite-On's current market share in comprehensive energy storage solutions is likely still in its nascent stages. This suggests it may be a developing star or even a question mark in the BCG matrix, requiring substantial investment to gain traction.

The strategic investment in energy storage aligns with Lite-On's vision for an integrated IoE ecosystem. However, the high capital expenditure and the long lead times for market penetration and profitability in this sector mean that initial returns may be low, characteristic of a question mark or a nascent star facing significant development costs.

Lite-On is strategically focusing on advanced sensing and autonomous driving system image recognition as a key area for high-value product development within its automotive electronics segment. This market is experiencing robust growth, driven by the accelerating adoption of autonomous vehicles and advanced driver-assistance systems (ADAS). For instance, the global automotive camera market, a core component of image recognition, was valued at approximately USD 6.8 billion in 2023 and is projected to reach USD 13.5 billion by 2028, growing at a CAGR of 14.8% during that period.

While Lite-On's commitment to this sector is strong, its current market share in the highly specialized and competitive field of autonomous driving image recognition may still be developing. This necessitates significant investment in research and development to refine algorithms, improve sensor fusion, and achieve robust performance in diverse driving conditions. Gaining substantial market penetration will require Lite-On to demonstrate superior technological capabilities and secure partnerships with major automotive manufacturers.

Integrated Solutions for Green Data Centers (beyond PSUs)

Lite-On is strategically evolving beyond its established power supply unit (PSU) business to offer comprehensive, system-level solutions for green data centers. This expansion includes integrating AI server PSUs with advanced rack infrastructure and cutting-edge liquid cooling technologies. This move is designed to capitalize on the burgeoning demand for sustainable data center operations.

While Lite-On's individual components, particularly PSUs, demonstrate significant market strength, the company's ambition to be a holistic green data center solution provider represents a newer, albeit promising, frontier. This integrated approach aims to secure a more substantial share of the rapidly expanding green data center market, which is projected to see continued robust growth through 2024 and beyond.

- Market Growth: The global data center market, with a significant emphasis on green initiatives, was valued at approximately $200 billion in 2023 and is anticipated to grow at a compound annual growth rate (CAGR) of over 15% through 2028, driven by AI and cloud computing.

- Investment Needs: Establishing a strong presence as a total solution provider necessitates substantial investment in research and development, manufacturing capabilities for racks and cooling systems, and building robust sales and support networks.

- Competitive Landscape: Lite-On faces competition from established players offering integrated data center solutions, requiring differentiation through innovation, efficiency, and sustainability features in its offerings.

- Strategic Advantage: By bundling AI PSUs with advanced cooling and rack solutions, Lite-On can offer a more cohesive and energy-efficient package, appealing to data center operators focused on reducing their environmental footprint and operational costs.

Smart Life Solutions (e.g., advanced IoT security cameras, access control)

Smart Life Solutions represent Lite-On's commitment to embedding intelligent technology into daily living spaces. This segment includes crucial elements like advanced IoT security cameras and sophisticated access control systems, all underpinned by robust networking infrastructure.

The global smart home and IoT device market is experiencing significant expansion, projected to grow at a compound annual growth rate of 17.0% from 2024 to 2025. This rapid growth presents a considerable opportunity for Lite-On's smart life offerings.

While Lite-On possesses products within this burgeoning sector, its market share in specific consumer-focused smart home applications, such as security cameras and access control, may still be in its formative stages when compared to deeply entrenched consumer brands. This positions these solutions as question marks within the BCG matrix, characterized by high market growth potential but currently uncertain competitive standing.

- Market Growth: The smart home and IoT device market is expanding rapidly, with a projected CAGR of 17.0% between 2024 and 2025.

- Product Scope: Lite-On's Smart Life Solutions encompass networking infrastructure, advanced IoT security cameras, and access control systems.

- Competitive Landscape: Lite-On's market share in specific consumer smart home applications may be developing against established brands.

- BCG Classification: These solutions are considered question marks due to high market growth potential and developing competitive positions.

Question Marks in Lite-On's portfolio represent areas with high growth potential but currently low market share. These segments require significant investment to develop their competitive position and achieve profitability.

Lite-On's energy storage solutions and advanced sensing for autonomous driving are prime examples of such question marks. While the markets for these technologies are expanding rapidly, Lite-On's current market penetration is still nascent, necessitating substantial R&D and market development efforts.

The company's strategy involves channeling resources into these promising but unproven ventures, aiming to transform them into future stars within its diversified business structure.

BCG Matrix Data Sources

Our Lite-On BCG Matrix leverages comprehensive market data, including financial disclosures, industry growth rates, and competitor performance analysis, to provide a clear strategic overview.