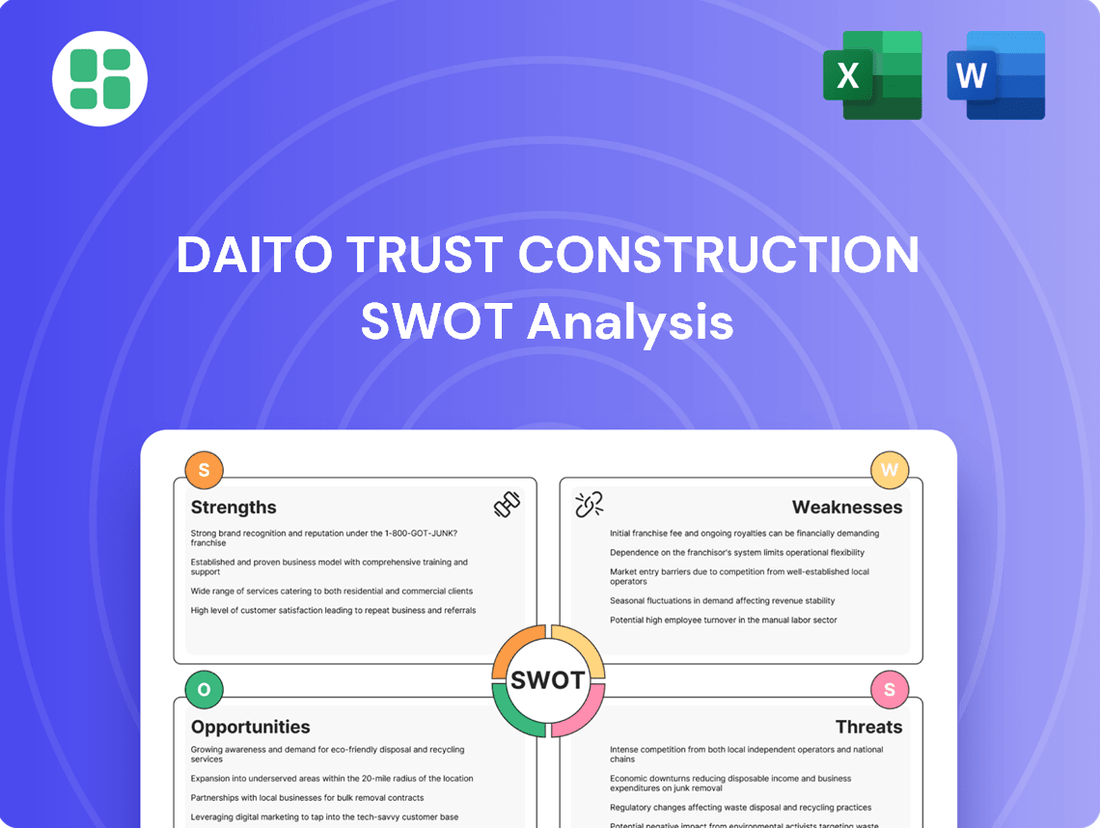

Daito Trust Construction SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Daito Trust Construction Bundle

Daito Trust Construction leverages its strong brand reputation and extensive experience in the Japanese real estate market, but faces challenges from increasing competition and evolving tenant demands. Understanding these dynamics is crucial for navigating its future.

Want the full story behind Daito Trust's market position, potential growth areas, and competitive threats? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Daito Trust Construction's integrated business model, covering planning, design, construction, and property management, especially for rental housing, gives it exceptional control over the entire property lifecycle. This end-to-end capability ensures quality and efficiency from concept to ongoing tenant satisfaction.

The company's market leadership in Japan's rental housing sector is a significant strength. Consistently ranking at the top for new rental housing starts and managing a vast portfolio of over 1.2 million properties, Daito Trust demonstrates substantial market share and operational prowess.

Daito Trust Construction boasts robust financial performance, evidenced by a 6.4% year-on-year increase in net sales for FY2025, reaching ¥544.1 billion. This growth translates to a healthy operating profit of ¥71.4 billion. The company's financial stability is further underscored by its consistent generation of cash flow from operating activities and a strong net cash position, providing a solid foundation for future investments and operations.

Daito Trust Construction consistently achieves impressive occupancy rates, reaching 97.8% in fiscal year 2025. This success stems from their deep understanding of pre-construction feasibility and a proven ability to draw in and retain tenants.

Their considerable portfolio of properties under management not only reinforces their market standing but also generates a reliable stream of recurring income, providing a solid foundation for continued growth.

Strong Brand Reputation and Trust

Daito Trust Construction has cultivated a robust brand reputation and deep-seated trust within Japan's construction and real estate industries since its founding in 1974. This long-standing presence underscores a commitment to reliability and quality, resonating with a market that highly values stability and dependable service. Their corporate philosophy, which centers on linking trust to a better future, clearly articulates a dedication to fostering enduring relationships with both property owners and tenants, a cornerstone of their sustained success.

This strong brand equity translates into tangible benefits, particularly in customer acquisition and retention. For instance, in the fiscal year ending March 2024, Daito Trust reported a significant backlog of orders, reflecting continued demand driven by their trusted name. Their consistent delivery of quality projects solidifies their market position, making them a preferred choice for many seeking long-term property solutions.

- Established Trust: Since 1974, Daito Trust has built a solid reputation for reliability in Japan's construction and real estate sectors.

- Customer Loyalty: Their focus on long-term relationships fosters repeat business and positive word-of-mouth referrals.

- Market Perception: In a market valuing stability, Daito Trust's established trust is a significant competitive advantage.

- Order Backlog: A strong order backlog as of the fiscal year ending March 2024 indicates continued market confidence in their brand.

Commitment to Sustainability and Environmental Initiatives

Daito Trust Construction's dedication to sustainability is a significant strength. In 2025, the company earned a spot on the prestigious A Lists for both CDP Forests and CDP Water Security, highlighting their robust environmental management practices. This recognition underscores their commitment to responsible resource utilization and conservation.

The company has established ambitious goals for reducing greenhouse gas emissions across Scope 1, 2, and 3, aiming to align with a 1.5-degree Celsius warming trajectory. Such forward-thinking environmental targets not only demonstrate corporate responsibility but also position Daito Trust favorably in an increasingly eco-conscious market.

These proactive environmental initiatives serve to bolster Daito Trust Construction's brand reputation. By actively addressing climate change and water security, they can attract and retain environmentally aware investors, customers, and employees, fostering stronger stakeholder relationships and potentially opening new avenues for growth and investment.

Key aspects of their sustainability commitment include:

- CDP A List Recognition: Named to CDP Forests and CDP Water Security A Lists in 2025.

- Ambitious Emission Targets: Setting clear goals for reducing Scope 1, 2, and 3 GHG emissions.

- 1.5-Degree Alignment: Committing to emission reduction pathways consistent with limiting global warming.

- Enhanced Brand Image: Proactive environmental stewardship improves reputation and stakeholder appeal.

Daito Trust Construction's integrated business model provides comprehensive control over the property lifecycle, ensuring quality from planning to management, particularly for rental housing.

The company holds a leading position in Japan's rental housing market, evidenced by its top ranking in new rental housing starts and management of over 1.2 million properties.

Financially, Daito Trust demonstrated strong performance in FY2025 with ¥544.1 billion in net sales and ¥71.4 billion in operating profit, supported by consistent cash flow and a healthy net cash position.

Impressive occupancy rates, reaching 97.8% in FY2025, highlight their expertise in feasibility studies and tenant attraction/retention.

| Metric | FY2025 (Ending March 2025) | FY2024 (Ending March 2024) |

|---|---|---|

| Net Sales | ¥544.1 billion | ¥511.4 billion |

| Operating Profit | ¥71.4 billion | ¥68.5 billion |

| Occupancy Rate | 97.8% | 97.5% |

What is included in the product

Delivers a strategic overview of Daito Trust Construction’s internal and external business factors, identifying key strengths, weaknesses, opportunities, and threats.

Highlights key internal and external factors to proactively address potential challenges and capitalize on opportunities.

Weaknesses

Daito Trust Construction's deep focus on rental housing, while a core strength, also presents a significant concentration risk. A substantial percentage of their revenue and operational activities are directly linked to this single sector. This makes the company particularly vulnerable to any negative shifts or slowdowns within the rental property market.

This over-reliance on rental housing could hinder diversification efforts and leave Daito Trust exposed to the impacts of localized market saturation or demographic changes that might reduce demand for rental units. For instance, if a particular region experiences an oversupply of rental properties or a significant out-migration, Daito Trust's performance in that area could be disproportionately affected.

Daito Trust Construction faces headwinds from Japan's persistent demographic challenges. With approximately 9 million vacant homes recorded in 2024, the nation's declining birthrate and aging population create a shrinking customer base in many regions. This presents a long-term risk for the company, particularly in non-urban markets where population outflow exacerbates the issue of rising vacancy rates.

Daito Trust Construction faces significant challenges due to the ongoing inflation in Japan's construction sector. Rising land prices and increased material costs, which have seen significant upward pressure throughout 2024 and are projected to continue into 2025, directly impact project profitability. For instance, the Nikkei Composite Price Index for construction materials saw a notable increase of over 15% year-on-year in early 2024, a trend expected to persist.

These escalating expenses can lead to cost overruns and project delays, putting pressure on Daito Trust Construction's margins. The company's success hinges on its capacity to either effectively pass these higher costs onto its clients or to absorb them through operational efficiencies. Failure to manage this sensitivity could significantly affect the company's bottom line and competitiveness in the market through 2025.

Labor Shortages in the Construction Industry

Japan's construction industry, including companies like Daito Trust Construction, is grappling with significant labor shortages. This scarcity can directly impact project timelines and drive up operational expenses due to higher wages.

The demographic challenge known as the '2025 problem,' which signifies the impending retirement of a large cohort of experienced construction professionals, is intensifying these labor constraints.

This situation poses a risk to Daito Trust Construction's capacity to initiate new developments or ensure the timely and cost-effective completion of ongoing projects.

- Persistent Labor Shortages: Affecting project timelines and increasing labor costs.

- '2025 Problem': Mass retirement of experienced workers exacerbates the issue.

- Impact on Project Execution: Hinders Daito Trust Construction's ability to undertake and complete projects efficiently.

Potential for Regulatory Changes and Policy Shifts

The real estate and construction industries are inherently sensitive to government policies and regulations. Changes in housing affordability initiatives, land use zoning, or environmental building standards can significantly alter Daito Trust Construction's operating environment. For instance, shifts in tax incentives for property development or rental income could directly affect profitability and strategic planning.

Adapting to these evolving regulatory landscapes is crucial and necessitates ongoing vigilance and investment in compliance and strategic adjustments. The company's ability to navigate these potential policy shifts will be a key determinant of its sustained success and market position. As of early 2024, Japan's government has continued to emphasize urban redevelopment and disaster resilience, which could present both opportunities and challenges for construction firms like Daito Trust.

- Regulatory Sensitivity: The construction sector is heavily regulated, with changes in building codes, zoning laws, and environmental standards directly impacting project feasibility and costs.

- Policy Dependence: Government incentives for housing, such as subsidies or tax breaks, can significantly influence demand and Daito Trust's sales performance.

- Adaptation Costs: Staying abreast of and complying with new regulations often requires investment in new technologies, training, and project redesigns.

- Economic Impact: Broader economic policies, including interest rate changes and fiscal stimulus, can indirectly affect the real estate market and Daito Trust's business.

Daito Trust Construction's heavy reliance on the rental housing market creates a significant concentration risk, making it susceptible to downturns in this specific sector. This focus can limit its ability to diversify, leaving it vulnerable to localized market saturation or demographic shifts that reduce rental demand.

Full Version Awaits

Daito Trust Construction SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. It offers a clear overview of Daito Trust Construction's Strengths, Weaknesses, Opportunities, and Threats, allowing you to make informed decisions. The full, detailed analysis is unlocked immediately upon purchase.

Opportunities

Despite a general population decrease across Japan, major urban hubs like Tokyo and Osaka are experiencing a surge in demand for rental properties, particularly from couples and families. This trend translates into high occupancy rates and increasing rental income, offering a prime opportunity for Daito Trust Construction to bolster its urban property offerings.

The robust rental market in these key cities, with average rents in Tokyo’s central wards seeing a notable increase in 2024, presents a clear path for Daito Trust to capitalize on sustained demand and expand its portfolio. Furthermore, the influx of foreign investment into build-to-rent (BTR) projects in desirable urban locations underscores the market's strength and potential for growth.

Daito Trust Construction's new medium-term management plan, spanning FY2024 to FY2026, highlights a strategic push into new business areas. This includes a significant expansion of its real estate development operations and the initiation of overseas business ventures. This diversification aims to unlock fresh revenue streams and lessen dependence on the Japanese domestic market, which has been the company's traditional stronghold.

The company's focus on regional development, a unique strength of the Daito Group, also presents a key opportunity. By leveraging its expertise in specific local markets, Daito Trust can tailor its offerings and capitalize on underserved or emerging regional demands. This localized approach could foster stronger community ties and create differentiated value propositions compared to more generalized competitors.

The Japanese construction sector is rapidly embracing digital transformation, with smart city initiatives and IoT integration becoming mainstream, particularly in residential properties. Daito Trust Construction can capitalize on this trend by increasing investments in these advanced technologies.

By doing so, the company can significantly boost operational efficiency, elevate the quality of its constructions, and develop properties that are highly attractive to consumers seeking energy-efficient and smart living environments. For instance, the Japanese government's push for smart cities, with significant funding allocated for 2024-2025, provides a fertile ground for Daito Trust to pilot and scale its smart home solutions.

Increased Demand for Renovation and Remodeling

Japan's housing market is seeing a surge in demand for renovations and remodeling. With new home prices climbing and a substantial number of vacant properties, there's a clear opportunity for companies like Daito Trust Construction. Government discussions around potential tax incentives further bolster this trend.

This shift presents Daito Trust Construction with a prime chance to broaden its service offerings. They can focus on revitalizing existing homes, transforming vacant properties into attractive rental units, and updating them to meet current lifestyle demands. This aligns with a broader national interest in efficient housing utilization.

Key aspects of this opportunity include:

- Rising New Home Costs: Making renovations a more cost-effective alternative for many Japanese consumers.

- Vacant Property Stock: Japan had approximately 8.5 million vacant homes as of 2023, presenting a large pool of potential renovation projects.

- Government Support: Potential tax incentives could significantly stimulate the renovation market, making it more appealing to property owners.

- Adaptation to Needs: Renovations can address changing demographics and living preferences, such as creating multi-generational housing or incorporating smart home technology.

Sustainability-Driven Development and Green Building

Japan's commitment to carbon neutrality by 2050 presents a significant opportunity for Daito Trust Construction to lead in sustainability-driven development. This national goal, coupled with increasing environmental awareness, drives demand for green building practices.

By integrating energy-efficient designs, renewable energy sources, and sustainable materials into its projects, Daito Trust can appeal to a growing segment of environmentally conscious tenants and investors. For instance, the company can leverage the increasing market for ESG (Environmental, Social, and Governance) compliant real estate, which saw significant growth in Japanese investment in 2023.

- Green Building Demand: Growing tenant and investor preference for eco-friendly properties.

- Policy Alignment: Opportunities to capitalize on government incentives and regulations promoting decarbonization.

- Competitive Edge: Differentiation through sustainable offerings in a crowded market.

- Innovation: Potential to develop and implement cutting-edge green technologies in construction.

Daito Trust Construction can capitalize on the increasing demand for rental properties in major Japanese urban centers, driven by population influxes into cities like Tokyo and Osaka, which saw average rents in central Tokyo wards rise in 2024.

The company's strategic expansion into new business areas and overseas ventures, as outlined in its FY2024-FY2026 plan, offers avenues for diversified revenue streams beyond its traditional domestic market.

Leveraging its regional development expertise allows Daito Trust to tailor offerings to specific local demands, fostering community ties and creating unique value propositions.

The company is well-positioned to integrate digital transformation trends, such as smart city initiatives and IoT, into its properties, enhancing operational efficiency and tenant appeal, supported by government funding for smart city projects in 2024-2025.

Threats

The Japanese real estate market, especially in bustling urban centers, is a fiercely contested arena with many domestic and international companies all aiming to capture a larger piece of the pie. This intense competition can indeed squeeze Daito Trust Construction's pricing power and impact its profit margins.

This competitive pressure also extends to securing new construction projects and attracting tenants, potentially slowing down growth and market penetration for Daito Trust. For instance, in 2023, the average rent for new apartments in Tokyo's central wards saw a slight increase, but the volume of new supply in desirable areas remains a key factor for tenant acquisition.

Global economic instability and potential shifts in interest rates present a significant threat to Daito Trust Construction. While Japan has historically benefited from low interest rates, any substantial rise could increase mortgage expenses for buyers, thereby dampening demand for new housing. This could directly impact sales volumes and project pipelines.

Furthermore, fluctuating interest rates can affect the cost of borrowing for Daito Trust itself, potentially impacting investment returns on their real estate portfolio. Rising inflation, a common companion to interest rate hikes, also poses a risk by increasing the cost of essential construction materials, squeezing profit margins on existing and future projects.

The demographic shifts in Japan, often referred to as the '2025 Problem', are intensifying the aging of the population and are projected to create a record number of vacant homes, especially in non-urban regions. Daito Trust Construction, despite its strong track record in maintaining high occupancy rates, could see its property management income and the worth of its sub-leased properties affected if these regional vacancy rates climb significantly.

Supply Chain Disruptions and Rising Input Costs

The construction sector, including Daito Trust Construction, faces significant headwinds from ongoing global supply chain snags and fluctuating raw material prices. Geopolitical instability, particularly events impacting energy and material production, directly translates to higher costs for essential building components. For instance, in early 2024, lumber prices saw notable volatility, impacting project budgets across the industry.

These cost increases and potential project delays directly threaten Daito Trust Construction's profitability. When the cost of materials like steel and concrete escalates unexpectedly, margins shrink, and the ability to deliver projects on time becomes challenging. This vulnerability was highlighted in late 2023 when several large-scale infrastructure projects experienced budget overruns due to unforeseen material cost hikes.

Furthermore, the weakened yen presents an additional layer of complexity. A weaker yen makes imported materials more expensive, potentially prompting domestic manufacturers to reassess their production strategies. This could lead to shifts in availability and pricing of key construction inputs, creating further uncertainty for Daito Trust Construction's procurement and project planning.

- Volatile Material Prices: Reports from early 2024 indicated a 15-20% increase in the cost of key construction materials like cement and rebar compared to the previous year.

- Project Delays: A survey of Japanese construction firms in late 2023 revealed that over 40% experienced project delays attributed to material shortages and logistics issues.

- Yen's Impact: The yen's depreciation throughout 2023 and into early 2024 has increased the cost of imported construction equipment and specialized components by an estimated 10-12%.

Natural Disasters and Climate Change Risks

Japan's inherent vulnerability to natural disasters like earthquakes and typhoons poses a significant threat. Despite Daito Trust Construction's focus on building safe and secure housing, a major seismic event or a powerful typhoon could result in substantial property damage, leading to increased insurance premiums and potential disruptions to ongoing construction and property management services. For instance, the Kumamoto earthquakes in 2016 caused widespread damage, highlighting the potential impact on the construction sector.

Furthermore, the escalating impacts of climate change introduce long-term risks. Increasingly frequent and intense extreme weather events, such as heavier rainfall and more powerful storms, could further strain infrastructure and necessitate costly adaptations in building design and maintenance. The World Meteorological Organization's 2024 report indicated a continued upward trend in global average temperatures and extreme weather occurrences, a trend that will undoubtedly affect Japan.

- Increased insurance premiums: Following major disaster events, insurance costs for construction materials and completed properties are likely to rise, impacting project profitability and property values.

- Construction delays and cost overruns: Severe weather can halt construction activities, leading to project delays and increased labor and material costs.

- Property damage and repair expenses: Natural disasters can cause direct damage to Daito Trust's properties, requiring significant expenditure for repairs and renovations.

- Disruption to property management: Post-disaster scenarios can strain property management operations, including tenant relocation, emergency repairs, and insurance claims processing.

Intense competition within Japan's real estate market can pressure Daito Trust's pricing and profit margins, while demographic shifts, like an aging population, risk increasing property vacancies, particularly outside urban centers. Economic instability, including rising interest rates and inflation, threatens housing demand and increases borrowing costs, further compounded by volatile global material prices and supply chain disruptions. For instance, early 2024 saw a 15-20% increase in key material costs, and the yen's depreciation by 10-12% in 2023-2024 impacts imported equipment costs.

| Threat Category | Specific Risk | Impact on Daito Trust | Supporting Data (2023-2024) |

|---|---|---|---|

| Market Competition | Price Wars & Reduced Margins | Lower profitability on projects and rentals. | High competition in urban centers impacting pricing power. |

| Demographic Shifts | Increased Vacancy Rates | Reduced property management income and asset value. | Projected rise in vacant homes due to aging population. |

| Economic Instability | Higher Borrowing Costs & Lower Demand | Increased financing expenses and reduced sales volume. | Potential interest rate hikes affecting mortgage affordability. |

| Supply Chain & Material Costs | Escalating Construction Expenses | Shrinking profit margins and project delays. | 15-20% material cost increase (early 2024); 10-12% imported equipment cost rise (2023-2024). |

SWOT Analysis Data Sources

This Daito Trust Construction SWOT analysis is built upon a robust foundation of verified financial statements, comprehensive market research reports, and expert industry commentary to ensure a data-driven and insightful assessment.