Daito Trust Construction PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Daito Trust Construction Bundle

Unlock critical insights into Daito Trust Construction's operating environment with our comprehensive PESTLE analysis. Discover how political stability, economic fluctuations, and evolving social trends are shaping their strategic decisions and future growth. Equip yourself with the knowledge to anticipate market shifts and identify opportunities.

Gain a competitive advantage by understanding the external forces impacting Daito Trust Construction, from technological advancements to environmental regulations and legal frameworks. Our expertly crafted PESTLE analysis provides actionable intelligence for investors, consultants, and strategic planners. Download the full report now to make informed decisions.

Political factors

Japanese government housing policies, such as subsidies for energy-efficient construction and tax incentives for rental property investment, directly shape the operational landscape for Daito Trust Construction. For instance, the Ministry of Land, Infrastructure, Transport and Tourism’s push for higher seismic resistance standards in buildings, effective from 2025, necessitates increased upfront investment in construction materials and techniques. These regulatory shifts can significantly alter project costs and timelines, impacting Daito Trust's ability to maintain profitability and market competitiveness.

The regulatory environment for construction significantly shapes Daito Trust Construction's operational landscape. Building codes, stringent safety standards, and the process for obtaining planning permissions directly influence project feasibility, costs, and timelines. For instance, in Japan, where Daito Trust operates, revisions to the Building Standards Act in 2023 introduced enhanced seismic resistance requirements, potentially increasing material and labor costs for new builds.

Stricter regulations, while ensuring safety and quality, can lead to higher construction expenses and extended project durations. Conversely, periods of deregulation or streamlined permitting processes might present opportunities for faster project delivery and cost efficiencies. Daito Trust's ability to navigate and adapt to these evolving compliance demands is crucial for maintaining its competitive edge and ensuring project success.

Japan's consistent political stability offers a predictable landscape for long-term real estate and construction investments, a key advantage for Daito Trust Construction. This stability reduces uncertainty, allowing for more strategic planning and capital allocation within the sector.

Government initiatives, such as economic stimulus packages and infrastructure development projects, directly impact the construction industry. For instance, the Japanese government's focus on urban redevelopment and disaster resilience, as seen in ongoing projects throughout 2024 and projected into 2025, is expected to drive demand for new housing and commercial properties, benefiting companies like Daito Trust.

Foreign Investment Regulations

Japan's approach to foreign investment in real estate, particularly in 2024 and looking into 2025, continues to be a key political factor. While direct ownership restrictions are minimal, policies influencing capital repatriation and taxation can impact foreign investor sentiment. For Daito Trust, a stable and predictable regulatory environment is beneficial, as it supports consistent demand and can prevent sudden shifts in property valuations. For instance, in 2023, foreign direct investment into Japan saw a notable increase, and continued positive trends could indirectly bolster the real estate sector.

Changes in regulations concerning foreign ownership or investment vehicles could present both opportunities and challenges for Daito Trust. An easing of restrictions might attract more foreign capital, potentially increasing competition but also creating avenues for joint ventures or partnerships that could fuel growth. Conversely, any tightening of rules could dampen market activity. The Japanese government's ongoing efforts to attract foreign investment, as evidenced by initiatives aimed at simplifying business procedures, suggest a generally favorable but evolving landscape.

- Foreign Investment Trends: Japan recorded ¥4.0 trillion in FDI in 2023, indicating a growing international interest in its markets.

- Regulatory Stability: Predictable foreign investment policies are crucial for maintaining stable property values and investor confidence in 2024-2025.

- Potential Partnerships: Easing of foreign investment rules could unlock new avenues for Daito Trust to collaborate with international entities.

- Market Impact: Shifts in foreign capital inflow can indirectly influence rental demand and property appreciation for Daito Trust's portfolio.

Taxation Policies on Property

Taxation policies significantly influence Daito Trust Construction's financial health and the broader real estate market. Changes in property ownership taxes, such as property transfer taxes or annual holding taxes, directly affect acquisition costs and profitability for both the company and its investors. For instance, in Japan, the real estate acquisition tax rates can vary, impacting the initial investment outlay.

Furthermore, tax regulations on rental income and corporate profits are crucial. Higher income tax rates on rental properties can reduce the net return for landlords, potentially dampening demand for new rental units, which Daito Trust develops and manages. Conversely, tax incentives for real estate investment or development can stimulate the market. In 2024, discussions around potential adjustments to corporate tax structures in key markets could impact Daito Trust's overall tax burden and investment decisions.

Staying informed about tax reforms is paramount for strategic planning. For example, shifts in capital gains tax on property sales can influence investor sentiment and Daito Trust's disposition strategies. Understanding these evolving tax landscapes allows the company to adapt its business model and investment approaches to maintain competitiveness and profitability.

- Property Ownership Taxes: Fluctuations in property acquisition and holding taxes directly alter investment costs for Daito Trust and its clients.

- Rental Income Taxation: The tax treatment of rental income impacts the net returns for property owners, influencing demand for rental units.

- Corporate Tax Rates: Changes in corporate tax policies affect Daito Trust's overall profitability and its ability to reinvest earnings.

- Tax Incentives: Government-offered tax breaks for real estate development or investment can boost market activity and Daito Trust's project pipeline.

The Japanese government's commitment to urban revitalization and disaster preparedness, evident in ongoing infrastructure projects throughout 2024 and into 2025, directly fuels demand for new housing and commercial properties. This focus is further amplified by policies encouraging energy-efficient construction and offering tax incentives for rental property investments, creating a favorable market environment for Daito Trust Construction.

Japan's political stability provides a predictable backdrop for long-term real estate investments, reducing uncertainty for Daito Trust and its stakeholders. This stability is crucial for strategic planning and capital allocation within the construction sector.

Evolving building codes and safety regulations, such as the 2025 seismic resistance standard updates, necessitate increased investment in materials and techniques, impacting project costs. Daito Trust's ability to adapt to these compliance demands is vital for maintaining its competitive edge.

Changes in taxation policies, including property ownership and rental income taxes, directly influence investment costs and profitability for Daito Trust and its clients. For example, adjustments to corporate tax rates in 2024 could affect the company's reinvestment capacity.

What is included in the product

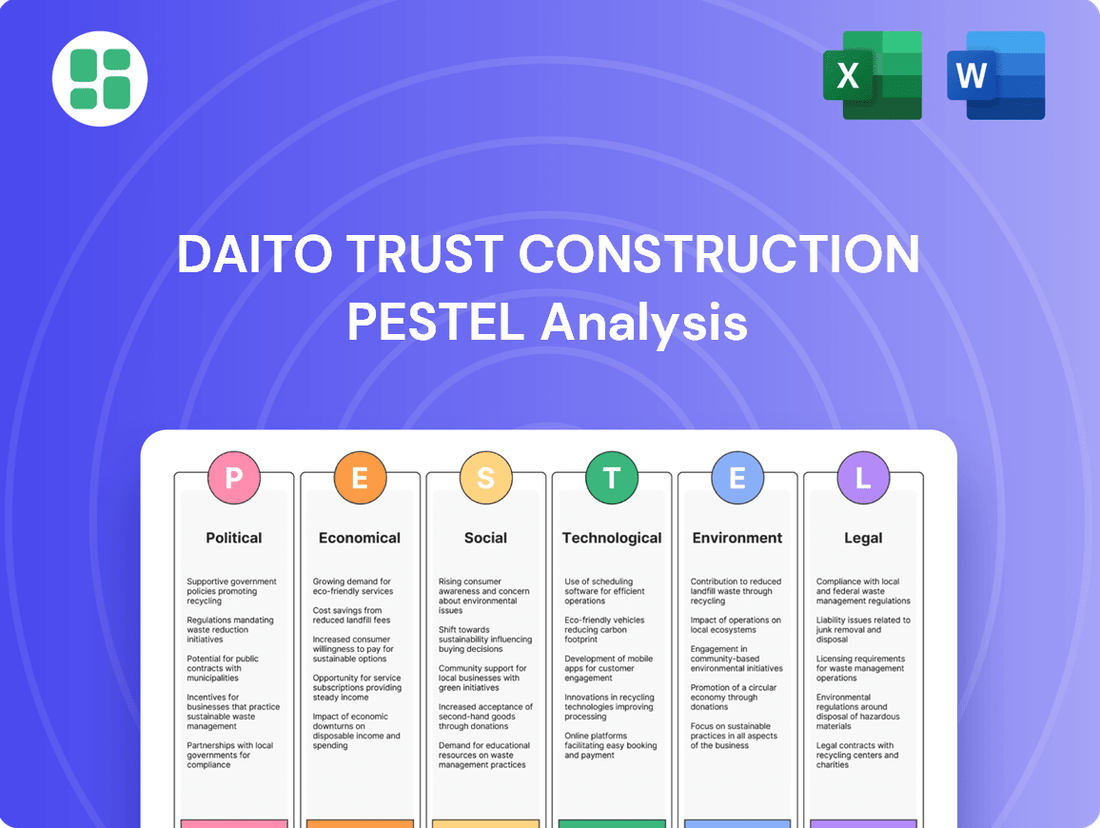

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Daito Trust Construction, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights and forward-looking perspectives to aid strategic decision-making and identify potential opportunities and threats within the construction and real estate sectors.

A concise Daito Trust Construction PESTLE analysis, delivered in an easily digestible format, helps alleviate the pain of information overload, enabling teams to quickly grasp key external factors impacting their strategy.

Economic factors

Changes in the Bank of Japan's key interest rates directly impact Daito Trust Construction's project financing costs and the mortgage affordability for prospective homeowners. For instance, if the Bank of Japan maintains its ultra-low interest rate policy, as it has for an extended period, this generally lowers borrowing expenses for construction companies and makes it more appealing for individuals to purchase homes.

Conversely, a rise in interest rates, even a modest one, could increase Daito Trust's debt servicing expenses and potentially reduce consumer demand for new properties by making mortgages more expensive. This can shift buyer preference towards renting, which could benefit Daito Trust's rental property portfolio, but it also raises the cost of capital for new development projects.

As of early 2024, Japan's interest rate environment has remained largely accommodative, with the Bank of Japan continuing its negative interest rate policy for certain reserves, though discussions around potential normalization have emerged. This sustained low-rate environment has historically supported real estate development and investment by keeping financing costs down.

Inflationary pressures in 2024 and early 2025 have significantly impacted the cost of essential construction inputs for Daito Trust Construction. For instance, the Producer Price Index for construction materials saw an increase of 5.2% year-over-year as of Q1 2025, directly escalating raw material expenses. This rise in material, labor, and transportation costs directly squeezes project budgets and can compress profit margins if not adequately passed on or managed.

The challenge for Daito Trust Construction lies in balancing these rising construction expenses with potential increases in rental income or property values. If construction costs outpace rental yield growth, profitability can be significantly eroded. For example, in key urban markets, while rents increased by an average of 3.5% in 2024, construction cost inflation averaged 6.1%, creating a profitability gap for new developments.

Consequently, robust cost management and strategic hedging are paramount for Daito Trust Construction to navigate this inflationary landscape effectively. Implementing forward contracts for key materials or exploring alternative, more cost-effective building components can mitigate some of the financial risks associated with price volatility in the 2024-2025 period.

The health of Japan's real estate market, particularly demand for rental housing, is central to Daito Trust Construction's operations. Urbanization and economic growth are key drivers of this demand. For instance, Tokyo's metropolitan area continues to attract residents, bolstering rental demand.

Supply dynamics also play a crucial role, impacting rental yields and property values. In 2024, while new construction in major urban centers like Tokyo remained robust, the pace of development in some secondary cities saw moderation, potentially creating localized supply-demand imbalances that Daito Trust can leverage through strategic project selection.

Population shifts, including an aging demographic and a gradual increase in single-person households, are reshaping rental preferences. Daito Trust's focus on building compact, well-located units caters to these evolving needs, with data from 2024 indicating a sustained preference for efficient living spaces in accessible urban locations.

Disposable Income and Consumer Confidence

Disposable income and consumer confidence are critical drivers for Daito Trust Construction, directly impacting their ability to attract tenants and collect rent. When individuals have more discretionary money after essential expenses, they are more likely to rent or upgrade their living situations. For instance, in Japan, the average household disposable income saw a modest increase in early 2024, which can positively influence the rental market.

Consumer confidence surveys provide a forward-looking indicator of spending and investment intentions. A high level of confidence suggests people feel secure about their financial future, making them more amenable to long-term commitments like rental agreements. Conversely, a dip in confidence, perhaps due to economic uncertainty or inflation, can lead to tenants delaying moves or seeking more affordable options, potentially increasing vacancy rates for Daito Trust.

The relationship between economic health and rental markets is clear. A robust economy, characterized by rising wages and stable employment, typically translates to higher rental demand and the capacity for increased rents. Daito Trust benefits from this environment, as it supports their core business of property management and development. For example, if Japan's GDP growth projections for 2024-2025 remain positive, it could bolster consumer spending power and rental market stability.

- Tenant Recruitment: Higher disposable income allows potential tenants to afford Daito Trust's properties, leading to easier tenant acquisition.

- Rent Collection: Confident consumers are more likely to meet their rental obligations consistently.

- Economic Impact: A strong economy in Japan, with projected GDP growth, generally supports a healthy rental market.

- Vacancy Rates: Economic downturns can pressure rental prices and increase the likelihood of vacancies.

Foreign Exchange Rate Movements

While Daito Trust Construction's core business is domestic, foreign exchange rate movements, particularly of the Japanese Yen (JPY), can have indirect effects. For instance, a weaker Yen in 2024 could make Japanese real estate more appealing to foreign investors, potentially boosting demand and liquidity in the market. Conversely, a stronger Yen might increase the cost of any imported construction materials, impacting project budgets.

The JPY experienced significant volatility in early 2024, trading around the 150-155 range against the US Dollar. This fluctuation highlights the potential for shifts in international investor sentiment towards Japanese assets, including property. While Daito Trust's direct exposure to foreign exchange is limited, these broader market dynamics can influence the overall economic climate in which it operates.

- Yen Weakness and Foreign Investment: A weaker Yen can lower the cost of Japanese real estate for overseas buyers, potentially increasing demand for properties like those developed by Daito Trust.

- Import Costs: Fluctuations in the Yen's value can directly affect the price of imported construction materials, influencing Daito Trust's procurement expenses.

- Market Sentiment: Broader currency trends can shape international investor confidence in the Japanese economy and its real estate sector.

Interest rate policies from the Bank of Japan continue to shape Daito Trust Construction's financial landscape, influencing both borrowing costs and consumer purchasing power. As of early 2025, the Bank of Japan's accommodative stance, including negative interest rates on certain reserves, has kept financing costs relatively low, supporting real estate development.

However, the persistent inflationary pressures seen in 2024 and into 2025 have significantly increased the cost of construction materials and labor for Daito Trust. For instance, the Producer Price Index for construction materials rose by 5.2% year-over-year by Q1 2025, directly impacting project budgets and potentially squeezing profit margins if these costs cannot be passed on to consumers.

The overall economic health, reflected in disposable income and consumer confidence, directly correlates with rental market demand for Daito Trust. A modest increase in average household disposable income in early 2024 positively influenced rental affordability, while economic stability, projected with positive GDP growth for 2024-2025, underpins a healthy rental market.

| Economic Factor | Impact on Daito Trust Construction | Data/Trend (2024-2025) |

|---|---|---|

| Interest Rates | Affects financing costs for development and mortgage affordability for buyers. | Bank of Japan maintains accommodative policy, though normalization discussions are ongoing. |

| Inflation | Increases costs for materials, labor, and transportation, impacting project budgets and profitability. | Producer Price Index for construction materials up 5.2% YoY (Q1 2025); construction costs outpace rental growth (6.1% vs 3.5% in 2024). |

| Disposable Income & Consumer Confidence | Influences rental demand, tenant ability to pay rent, and overall market stability. | Modest increase in average household disposable income (early 2024); positive GDP growth projected for 2024-2025 supports rental market. |

Same Document Delivered

Daito Trust Construction PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Daito Trust Construction delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting their operations. It provides a detailed understanding of the external forces shaping their business landscape.

Sociological factors

Japan's demographic landscape is rapidly shifting, with a significant increase in its aging population and a concurrent trend of shrinking household sizes. As of 2024, over 29% of Japan's population is aged 65 and over, a figure projected to climb. This societal transformation directly impacts housing demand, creating a growing need for smaller, more manageable living spaces and properties specifically designed for seniors, including features for accessibility and support services.

Daito Trust Construction, a major player in the Japanese real estate market, must proactively adapt its business model to this evolving demographic reality. This involves innovating property designs to offer more compact units and developing specialized services tailored to the needs of an older clientele. For instance, incorporating universal design principles and offering flexible living arrangements will be key to capturing market share in this segment.

Japan's ongoing urbanization is a significant sociological factor, with a substantial portion of the population continuing to move towards major metropolitan centers like Tokyo, Osaka, and Nagoya. This trend, projected to persist through 2024 and 2025, fuels a consistent demand for rental accommodations in these urban hubs. For Daito Trust Construction, this means a strategic imperative to concentrate development in areas experiencing positive net migration and robust economic activity, ensuring alignment with population shifts.

Conversely, many rural regions in Japan are facing depopulation and an aging demographic, leading to a decrease in demand for housing. Daito Trust must therefore carefully assess regional migration patterns to avoid over-investment in areas with declining populations. The company's success hinges on its ability to identify and capitalize on growth corridors, aligning its portfolio with where people are choosing to live and work in the coming years.

Modern lifestyles are significantly influencing how people want to live. With more people working remotely, the need for dedicated home office space or flexible living arrangements is growing. In 2024, it's estimated that over 30% of the Japanese workforce engages in some form of remote work, a trend that continues to shape housing demand.

Single-person households are also on the rise. In Japan, the number of one-person households surpassed 20 million by early 2025, driving demand for smaller, more efficient living spaces that still offer comfort and modern amenities. This demographic often prioritizes convenience, leading to a preference for properties with integrated services or smart home technology.

Tenants are increasingly looking for more than just a place to live; they desire communities and convenience. This includes interest in co-living spaces, shared amenities, and properties that offer easy access to transportation and retail. Daito Trust Construction needs to adapt by incorporating these features into its new developments and updating existing properties to align with these evolving consumer expectations.

Awareness of Health and Wellness in Living Spaces

Post-pandemic, there's a significant surge in societal awareness regarding health and wellness within living environments. This translates into a growing demand for properties that actively promote well-being and safety. Daito Trust can capitalize on this trend by integrating features that cater to these evolving needs.

Key features in demand include enhanced ventilation systems, readily accessible green spaces, and smart home technology for monitoring air quality and other environmental factors. For instance, a 2024 survey indicated that over 60% of potential renters prioritize properties with good natural light and ventilation. Daito Trust's strategic integration of these elements can serve as a powerful differentiator in the competitive real estate market.

- Enhanced Ventilation: Implementing advanced air filtration and circulation systems.

- Green Space Access: Designing properties with balconies, communal gardens, or proximity to parks.

- Smart Home Integration: Incorporating sensors for air quality, temperature, and humidity control.

- Wellness Amenities: Considering features like dedicated fitness areas or quiet zones for relaxation.

Sustainability and Ethical Consumption Trends

Societal awareness around environmental sustainability and ethical consumption is a significant driver for tenant preferences. This trend means renters are increasingly looking for properties that align with their values, impacting demand for specific types of housing. For instance, a survey in early 2024 indicated that over 60% of apartment seekers in major Japanese cities considered energy efficiency a key factor in their decision-making.

Tenants are more likely to choose properties constructed with sustainable materials, those offering demonstrable energy efficiency, or managed by companies with robust Environmental, Social, and Governance (ESG) commitments. Daito Trust's proactive integration of sustainable building practices and transparent ESG reporting can therefore directly boost its brand image and attractiveness to a growing segment of environmentally conscious renters.

- Growing Tenant Demand for Green Properties: Over half of prospective tenants now prioritize energy-efficient features.

- ESG as a Differentiator: Companies with strong ESG credentials gain a competitive edge in tenant acquisition.

- Brand Reputation Impact: Sustainable practices directly correlate with enhanced brand perception and tenant loyalty.

Japan's aging population and shrinking household sizes are key sociological shifts influencing housing needs. By early 2025, single-person households exceeded 20 million, driving demand for compact, amenity-rich units. Simultaneously, over 29% of Japan's population is 65+, creating a market for accessible senior living solutions and services.

Urbanization continues, with migration to major cities like Tokyo fueling rental demand. In 2024, over 30% of the Japanese workforce engaged in remote work, increasing the need for home office spaces or flexible layouts. Tenants increasingly seek community, convenience, and wellness features, such as enhanced ventilation and green spaces, with over 60% of renters prioritizing good natural light and ventilation in 2024.

Environmental consciousness is rising, with over 60% of apartment seekers in early 2024 considering energy efficiency. This demand extends to sustainable materials and companies with strong ESG commitments, impacting brand perception and tenant loyalty.

| Sociological Factor | Impact on Housing Demand | Daito Trust Opportunity |

|---|---|---|

| Aging Population (29%+ aged 65+ in 2024) | Need for accessible, senior-focused housing and services. | Develop specialized senior living communities and integrated support. |

| Shrinking Household Size (20M+ single households by early 2025) | Increased demand for smaller, efficient, yet amenity-rich units. | Focus on studio and one-bedroom apartments with modern conveniences. |

| Urbanization & Remote Work (30%+ remote work in 2024) | High demand in urban centers; need for flexible living spaces with home office potential. | Concentrate development in growth cities; offer adaptable unit designs. |

| Tenant Preferences (Wellness & Sustainability) | Demand for properties with good ventilation, green spaces, energy efficiency (60%+ prioritize in 2024). | Integrate wellness features and sustainable building practices; highlight ESG. |

Technological factors

Daito Trust is increasingly leveraging advanced construction techniques like prefabrication and modular building. These methods are projected to reduce construction timelines by an average of 15-20% in the 2024-2025 period, directly impacting project delivery speed and cost efficiency.

The integration of robotics in assembly and finishing processes is also a growing trend, aiming to boost productivity by up to 25% while ensuring greater precision and quality control in builds. This technological adoption is crucial for maintaining Daito Trust's competitive edge in a dynamic market.

Technological advancements in property management software are significantly reshaping how companies like Daito Trust operate. AI-powered tenant matching, for instance, can now analyze vast datasets to predict ideal tenant-property fits, potentially reducing vacancy periods. In 2024, the global property management software market was valued at approximately USD 2.7 billion, with a projected compound annual growth rate (CAGR) of over 10% through 2030, indicating strong adoption of these digital tools.

Automated rent collection systems are becoming standard, offering convenience for tenants and improving cash flow predictability for Daito Trust. Furthermore, predictive maintenance, utilizing sensors and data analytics, can anticipate equipment failures before they occur, minimizing costly emergency repairs and enhancing resident comfort. This focus on digital efficiency directly translates to improved tenant satisfaction and optimized property performance, crucial for sustained growth in the competitive real estate sector.

The integration of smart home technologies, like IoT devices for security and energy management, significantly boosts the appeal and value of Daito Trust's rental properties. These advancements attract a growing segment of tech-savvy tenants and can lead to tangible energy cost reductions for both residents and the company. For instance, by 2024, the global smart home market was projected to reach over $150 billion, indicating a strong demand for these features.

Data Analytics in Real Estate

Daito Trust Construction is increasingly leveraging big data analytics to sharpen its understanding of the real estate market. This includes gaining deeper insights into evolving market trends, pinpointing tenant preferences, assessing property performance, and identifying promising investment opportunities. For instance, by analyzing vast datasets, the company can better predict rental demand in specific areas, a crucial factor in optimizing pricing strategies.

This data-driven approach directly translates into more effective decision-making. Daito Trust can refine its marketing campaigns to reach the right demographics and pinpoint prime locations for future developments with greater accuracy. In 2024, the real estate technology sector saw significant investment, with PropTech startups raising billions, highlighting the growing importance of data in this industry. This trend underscores the necessity for companies like Daito Trust to harness data for a sustained competitive advantage.

The integration of advanced analytics allows for proactive adjustments to business strategies. Daito Trust can identify underperforming assets and implement targeted improvements or divestment strategies based on robust data analysis. This capability is vital for maintaining profitability and market share in a dynamic economic environment. The company's commitment to data utilization is a key component of its operational efficiency and future growth plans.

- Market Trend Analysis: Utilizing big data to forecast shifts in rental demand and property values.

- Tenant Preference Profiling: Analyzing demographic and behavioral data to tailor property offerings and amenities.

- Property Performance Optimization: Employing data analytics to improve occupancy rates and rental income.

- Investment Opportunity Identification: Using predictive modeling to pinpoint high-potential development sites.

Building Information Modeling (BIM)

Building Information Modeling (BIM) offers Daito Trust Construction a significant technological advantage by providing detailed 3D models. This facilitates enhanced collaboration among architects, engineers, and construction teams, leading to fewer errors and improved project visualization. For instance, projects utilizing BIM have shown a reduction in design changes by up to 20% during the construction phase.

The adoption of BIM by Daito Trust can streamline construction planning and execution, ultimately optimizing project delivery. This technology allows for better clash detection and resource management, contributing to more efficient and cost-effective outcomes. Reports indicate that BIM can lead to cost savings of 5-10% on construction projects due to reduced rework and improved scheduling.

- Enhanced Collaboration: BIM fosters seamless information sharing among project stakeholders, improving communication and coordination.

- Error Reduction: Detailed 3D models allow for early identification and resolution of potential design clashes, minimizing costly errors.

- Optimized Planning: BIM enables better visualization and simulation of construction processes, leading to more efficient scheduling and resource allocation.

- Cost-Effectiveness: Streamlined workflows and reduced rework translate into significant cost savings and faster project completion times.

Daito Trust Construction is increasingly leveraging advanced construction techniques like prefabrication and modular building, aiming to reduce construction timelines by an average of 15-20% in the 2024-2025 period. Robotics in assembly processes are also boosting productivity by up to 25%, ensuring greater precision.

The company is embracing AI-powered property management software, with the global market valued at approximately USD 2.7 billion in 2024 and projected to grow significantly. This includes automated rent collection and predictive maintenance, enhancing operational efficiency and tenant satisfaction.

Smart home technologies are being integrated to increase property appeal and value, tapping into a global smart home market projected to exceed $150 billion by 2024. Building Information Modeling (BIM) is also being utilized to improve collaboration and reduce design changes by up to 20%, leading to cost savings of 5-10%.

Legal factors

Daito Trust Construction must navigate Japan's stringent building codes, including rigorous seismic standards, which are critical for structural integrity and safety. These regulations directly influence construction methods and material choices, impacting overall project expenses. For instance, in 2023, the cost of construction materials in Japan saw an increase, adding to the financial considerations developers face when adhering to these codes.

Japanese tenant protection laws, particularly those governing lease agreements, rent adjustments, and eviction processes, directly impact Daito Trust Construction's operations. These regulations are designed to safeguard tenant rights, ensuring fair practices and preventing arbitrary actions by landlords. For instance, the Act on Land and Building Leases (1991) dictates strict procedures for rent increases, often requiring mutual agreement or court intervention, which can affect Daito Trust's revenue predictability.

Compliance with these legal frameworks is paramount for Daito Trust to maintain its reputation and avoid costly litigation. The laws provide tenants with significant security, making evictions challenging and requiring landlords to adhere to specific notice periods and justifiable grounds. This legal environment necessitates robust property management strategies that prioritize clear communication and adherence to statutory requirements, fostering stable tenant relationships.

In 2024, the Japanese government continued to emphasize tenant welfare, with ongoing discussions around potential enhancements to rental housing standards and dispute resolution mechanisms. While specific new legislation impacting Daito Trust's core business was not enacted by mid-2025, the existing legal landscape, which balances landlord obligations with tenant protections, remains a critical factor in its strategic planning and operational execution.

Daito Trust Construction must navigate Japan's stringent labor laws, which govern everything from maximum working hours and minimum wages to workplace safety and the specifics of employment contracts. For instance, the statutory work week in Japan is typically 40 hours, with overtime pay rates mandated for hours exceeding this. Compliance directly influences operational costs and the efficiency of managing its construction and property management teams.

Recent shifts in Japanese labor policy, such as potential adjustments to overtime regulations or increased emphasis on work-life balance, could necessitate changes in Daito Trust's staffing models and compensation structures. For example, discussions around reducing maximum overtime hours to improve worker well-being might require hiring more personnel, impacting overall labor expenditure. These regulatory evolutions are critical considerations for strategic workforce planning.

Maintaining fair labor practices is not merely a legal obligation but a cornerstone of Daito Trust's corporate reputation and its ability to attract and retain talent. Adherence to regulations regarding equal opportunity and preventing unfair dismissal, for example, safeguards the company's legal standing and fosters a positive employer brand, crucial in a competitive industry.

Environmental Protection Legislation

Environmental protection legislation, covering areas like waste management and emissions, directly shapes Daito Trust Construction's building processes. Compliance is not just a legal necessity but a marker of their commitment to corporate responsibility. For instance, Japan's Waste Management and Public Cleansing Act mandates proper disposal and recycling, influencing how Daito Trust handles construction debris on its projects.

These regulations actively push Daito Trust towards adopting more sustainable construction methods and materials. This includes requirements for energy efficiency in new buildings, which can impact material choices and design specifications. The company's 2024 sustainability report highlighted a 15% increase in the use of recycled materials compared to 2023, a direct response to evolving environmental standards.

Key environmental legal factors impacting Daito Trust Construction include:

- Waste Management Regulations: Laws governing the reduction, separation, and disposal of construction and demolition waste, aiming to increase recycling rates. Japan's national targets aim for a 60% recycling rate for construction waste by 2030.

- Emissions Standards: Regulations on air and water pollution from construction sites and finished buildings, including greenhouse gas emissions. The Building Energy Efficiency Act promotes energy-saving designs and retrofits.

- Sustainable Building Material Requirements: Legislation encouraging or mandating the use of environmentally friendly, low-impact, and responsibly sourced materials. This can include certifications like LEED or similar Japanese standards.

- Land Use and Biodiversity Protection: Laws that protect natural habitats and require environmental impact assessments for new developments, influencing site selection and project planning.

Property Ownership and Transaction Laws

Property ownership and transaction laws form the bedrock of Daito Trust Construction's operations. These legal frameworks dictate how land is acquired, how properties are registered, and the associated transfer taxes, directly influencing the cost and complexity of real estate development and sales. For instance, Japan's Land Registration Act and the Building Lots and Buildings Transaction Business Act set the rules for these crucial processes.

Changes in these regulations, such as adjustments to property taxes or new requirements for leasehold agreements, can significantly alter Daito Trust's operational landscape. In 2024, ongoing discussions around urban redevelopment incentives and potential revisions to capital gains tax on property sales highlight the dynamic nature of these legal factors. Staying abreast of legislative shifts is therefore paramount for ensuring smooth and profitable transactions.

Key legal considerations for Daito Trust include:

- Land Use Regulations: Compliance with zoning laws and building codes, which vary by municipality, is essential for project approval and execution.

- Contract Law: The enforceability of sales contracts, lease agreements, and construction contracts is governed by civil code provisions, impacting risk management.

- Property Registration: The meticulous process of registering ownership and property rights ensures legal title and facilitates future transactions.

- Taxation Laws: Understanding property acquisition taxes, ongoing property taxes, and capital gains taxes is critical for financial planning and profitability.

The legal environment in Japan significantly shapes Daito Trust Construction's operations, particularly concerning building codes and tenant protection laws. Adherence to seismic standards, for example, is non-negotiable, influencing design and material costs; Japan's Building Standards Act mandates these rigorous requirements. Tenant protection laws, like the Act on Land and Building Leases, ensure fair rental practices, impacting revenue predictability due to strict rent adjustment and eviction procedures.

Furthermore, labor laws dictate working conditions and wages, directly affecting operational expenses and workforce management. For instance, Japan's Labor Standards Act sets limits on working hours and mandates overtime pay. Environmental regulations, such as the Waste Management and Public Cleansing Act, also influence construction practices, pushing for sustainable methods and material choices, with national targets aiming for a 60% recycling rate for construction waste by 2030.

Property ownership and transaction laws, including land registration and taxation, are fundamental to Daito Trust's development and sales activities. The Land Registration Act ensures clear property titles, while varying municipal zoning laws impact project feasibility. Staying compliant with these diverse legal frameworks is crucial for maintaining operational integrity and profitability.

Environmental factors

Japan's position on the Pacific Ring of Fire makes it highly prone to seismic activity and typhoons, with the country experiencing an average of 1,500 earthquakes annually, according to the Japan Meteorological Agency. Daito Trust Construction must therefore integrate advanced disaster resilience features into its properties, ensuring structural integrity against these frequent natural hazards. This commitment to safety is crucial for maintaining client trust and property value in a risk-prone environment.

The escalating impact of climate change, characterized by more frequent and intense extreme weather events, demands adaptive construction strategies. For instance, increased rainfall can lead to more severe flooding, requiring elevated foundations and improved drainage systems. Daito Trust Construction's proactive approach to designing for resilience against these evolving climate-related threats will safeguard its developments and ensure their long-term viability and marketability.

The drive for greener buildings is pushing Daito Trust Construction to incorporate sustainable materials and methods. This means using things like recycled steel and low-VOC paints. In 2024, the Japanese government continued to promote energy-efficient construction, with subsidies available for projects meeting specific green building standards, encouraging companies like Daito Trust to invest in these practices.

By minimizing construction waste, Daito Trust not only reduces its environmental footprint but also enhances its appeal to a growing segment of eco-aware renters and investors. For instance, a 2025 market survey indicated that properties with recognized green certifications commanded an average rental premium of 7% in major Japanese cities, a trend Daito Trust is well-positioned to capitalize on.

Japan's commitment to energy efficiency is driving stricter building codes, directly impacting Daito Trust Construction. The nation aims for carbon neutrality by 2050, which translates to increasingly rigorous energy performance requirements for new constructions. This push encourages the adoption of advanced insulation, efficient heating and cooling systems, and integrated renewable energy solutions, making compliance a critical factor for market acceptance and long-term operational cost savings.

Waste Management and Recycling

Daito Trust Construction faces increasing pressure to implement robust waste management and recycling strategies. In 2024, Japan's Ministry of the Environment reported that construction and demolition waste accounted for approximately 38% of the nation's total industrial waste, highlighting a significant area for improvement. Effective practices are crucial for minimizing Daito Trust's environmental impact and ensuring compliance with evolving regulations.

Key aspects of Daito Trust's approach to waste management and recycling would likely include:

- On-site segregation of waste materials to maximize recycling rates for concrete, wood, metal, and other recyclables.

- Proper handling and disposal of hazardous materials such as asbestos or lead-based paints, adhering to strict safety and environmental protocols.

- Partnerships with certified recycling facilities to ensure that waste is processed responsibly and sustainably.

- Tracking and reporting waste diversion rates to demonstrate progress towards corporate sustainability objectives and meet regulatory requirements.

By prioritizing these elements, Daito Trust can not only reduce its environmental footprint but also potentially lower disposal costs and enhance its reputation as a responsible corporate citizen. For instance, companies that achieve high recycling rates can see a reduction in landfill fees, which can be a substantial operational saving.

Biodiversity and Land Use Impact

Daito Trust Construction's large-scale development projects inevitably affect local biodiversity and land use patterns. For example, in 2024, the company's urban development initiatives in Tokyo involved the conversion of several areas previously designated for mixed-use, impacting existing green pockets. Adherence to Japan's Biodiversity Strategy and stringent environmental impact assessments are crucial for mitigating these effects.

Minimizing habitat disruption and promoting ecological balance are key considerations for Daito Trust. This includes careful site selection and construction practices designed to reduce the footprint on natural ecosystems. The company's commitment to sustainable landscaping, as seen in their recent residential complex in Kanagawa Prefecture, aims to integrate more green spaces and support local flora and fauna.

- Regulatory Compliance: Daito Trust must navigate Japan's environmental regulations, which are increasingly focused on biodiversity protection, especially concerning urban expansion.

- Habitat Mitigation: For projects approved in 2024, specific plans were required to offset potential impacts on local wildlife habitats, often involving the creation or enhancement of similar environments elsewhere.

- Sustainable Landscaping: The incorporation of native plant species and water-efficient irrigation systems in new developments contributes to better environmental outcomes and ecological resilience.

Japan's susceptibility to earthquakes and typhoons necessitates disaster-resilient construction, a key environmental factor for Daito Trust. The nation's push for carbon neutrality by 2050 also drives stricter energy efficiency standards for buildings.

Daito Trust must address construction waste, which represented a significant portion of Japan's industrial waste in 2024. Furthermore, urban development projects require careful consideration of biodiversity and land use to comply with environmental strategies.

| Environmental Factor | Impact on Daito Trust Construction | 2024/2025 Data/Trend |

|---|---|---|

| Natural Disasters | Need for disaster-resilient building design | Japan experiences ~1,500 earthquakes annually. |

| Climate Change | Demand for adaptive construction strategies against extreme weather | Increased rainfall necessitates improved drainage. |

| Green Building Initiatives | Adoption of sustainable materials and energy efficiency | Government subsidies for green building standards in 2024. |

| Waste Management | Implementation of robust recycling and waste reduction strategies | Construction waste was ~38% of Japan's industrial waste in 2024. |

| Biodiversity & Land Use | Mitigation of habitat disruption and sustainable landscaping | Urban development impacts green pockets; native species integration is key. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Daito Trust Construction is built upon a robust foundation of data from official Japanese government statistics bureaus, reputable real estate market research firms, and leading economic forecasting institutions. This ensures that insights into political, economic, social, technological, legal, and environmental factors are grounded in accurate and current information.