Daito Trust Construction Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Daito Trust Construction Bundle

Daito Trust Construction faces moderate bargaining power from buyers due to the standardized nature of rental properties, while suppliers hold some sway given the specialized materials required. The threat of new entrants is significant, as the barrier to entry in the real estate development sector is relatively low, and the threat of substitutes is present through alternative housing options.

The complete report reveals the real forces shaping Daito Trust Construction’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The concentration of suppliers in Japan's construction sector, while featuring large entities like LIXIL and Sekisui House for core materials, generally offers a competitive landscape. This broad supplier base, encompassing both major manufacturers and specialized providers, can temper the bargaining power of any single supplier against a large buyer like Daito Trust Construction.

For common building materials such as concrete, steel, and lumber, Daito Trust Construction benefits from a competitive market with numerous suppliers. This abundance of choices and the interchangeability of these standard inputs generally keeps supplier bargaining power in check. In 2024, the construction materials market in Japan saw continued availability of these core components, with prices fluctuating based on global commodity trends rather than single supplier dominance.

Switching core suppliers for major construction materials or critical services can involve moderate to high costs for Daito Trust Construction. These costs often include contract renegotiation, rigorous testing of new materials for quality and compliance, and the necessary re-calibration of established construction processes. In 2024, for instance, the Japanese construction sector saw material costs rise by an average of 5-8%, making the financial impact of switching suppliers even more significant for companies like Daito Trust.

Importance of Daito Trust Construction to Suppliers

Daito Trust Construction's substantial presence in Japan's construction and real estate sectors makes it a crucial client for numerous suppliers of building materials, equipment, and specialized services. This considerable purchasing power means suppliers are often eager to secure and maintain contracts with Daito, potentially limiting their ability to dictate terms unilaterally.

For instance, Daito Trust Construction's commitment to large-scale residential development projects means consistent demand for a wide array of products. In fiscal year 2023, Daito Trust Construction reported consolidated net sales of approximately ¥540.9 billion. This scale of operation translates into significant order volumes for their supply chain partners, fostering a dynamic where Daito can leverage its market position.

Suppliers who rely heavily on Daito Trust Construction for a substantial portion of their revenue may find their bargaining power diminished. This is particularly true for those supplying standardized components or services where alternative buyers might be less readily available or offer smaller contract values. The company's financial health and project pipeline directly influence the stability and volume of business offered to its suppliers.

- Significant Client Base: Daito Trust Construction's large project volume makes it a key customer for many suppliers.

- Purchasing Leverage: The company's scale allows it to negotiate favorable terms with material and equipment providers.

- Supplier Dependence: Suppliers heavily reliant on Daito's business may have less power to impose their own pricing or conditions.

- Market Position: Daito's established reputation and financial stability (e.g., ¥540.9 billion in net sales for FY2023) reinforce its negotiating strength.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into Daito Trust Construction's business, such as undertaking large-scale construction projects or property management themselves, is generally considered low. This is primarily because the specialized knowledge, significant capital investment, and complex operational management required for Daito's core competencies are substantial barriers.

While some major material providers might dabble in prefabrication or limited assembly, a full forward integration into direct competition with a company like Daito, which operates across development, construction, and management, is unlikely. The business models are fundamentally different, requiring distinct skill sets and market approaches.

- Low Likelihood of Full Forward Integration: Suppliers typically lack the integrated expertise in design, large-scale project management, and property lifecycle management that Daito possesses.

- High Capital and Expertise Barriers: Entering Daito's multifaceted business requires immense capital and a deep understanding of the real estate development and construction sectors, which most material suppliers do not possess.

- Focus on Core Competencies: Suppliers generally concentrate on their manufacturing and distribution strengths rather than diversifying into the highly competitive and complex construction and property management industries.

Daito Trust Construction generally faces moderate bargaining power from its suppliers. The availability of numerous suppliers for common materials like concrete and steel in Japan, coupled with Daito's significant purchasing volume, helps to keep supplier leverage in check. In 2024, the construction materials market remained competitive, with prices influenced more by global trends than individual supplier dominance.

However, switching suppliers can incur costs related to contract renegotiation and process recalibration. For example, the average rise in construction material costs in Japan during 2024, estimated at 5-8%, highlights the financial implications of such changes, reinforcing the importance of stable supplier relationships for Daito.

| Factor | Impact on Daito Trust Construction | Supporting Data (2023/2024) |

|---|---|---|

| Supplier Concentration | Generally Low for common materials | Competitive market for concrete, steel, lumber. |

| Switching Costs | Moderate to High | Potential impact from 5-8% material cost increase in 2024. |

| Purchasing Volume | High; Creates leverage | FY2023 Net Sales: ¥540.9 billion. |

| Supplier Dependence | Can be High for specific suppliers | Suppliers with significant revenue from Daito have less power. |

What is included in the product

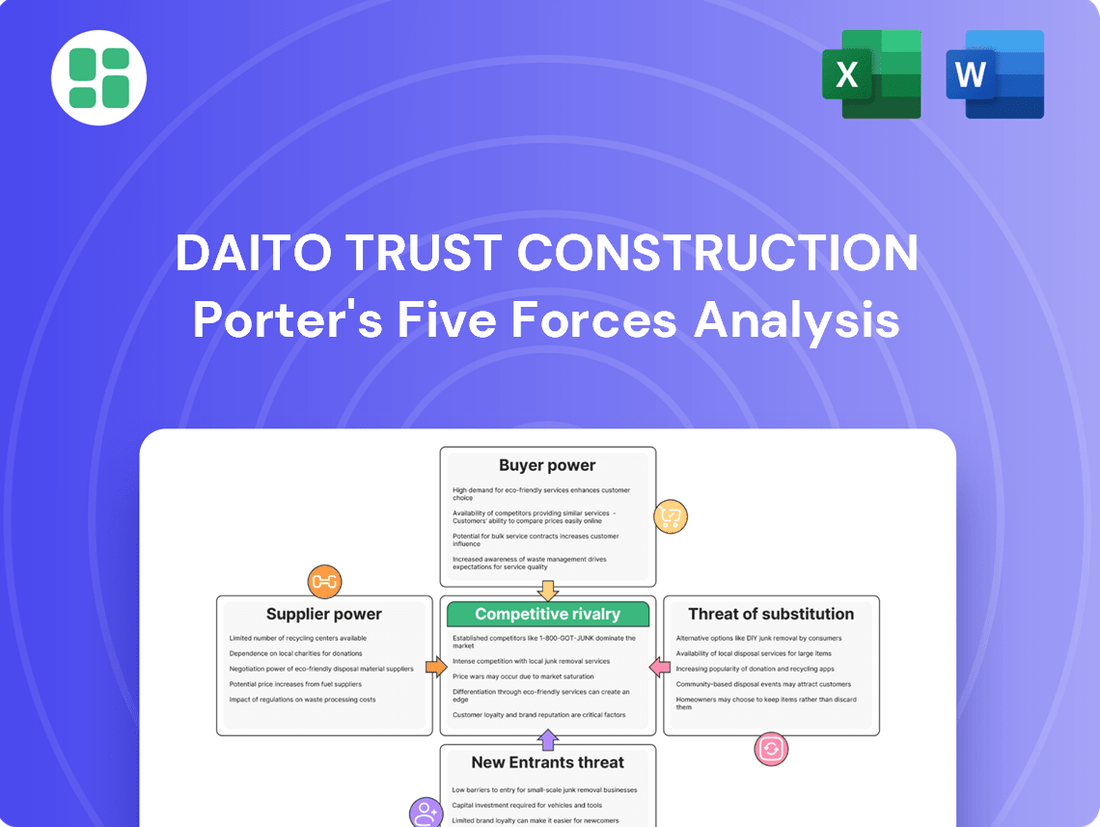

This analysis examines the intensity of competition, the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, specifically within the Japanese real estate and construction sector for Daito Trust Construction.

Instantly identify and mitigate competitive threats by visualizing Daito Trust's Porter's Five Forces, providing a clear roadmap for strategic advantage.

Customers Bargaining Power

Daito Trust Construction's customer base is varied, ranging from individuals building rental properties to larger institutional investors and businesses developing commercial spaces. While individual homeowners typically have limited sway, significant property investors or corporate clients can exert more influence due to the sheer scale of their projects or the number of properties they manage.

Customer price sensitivity is a significant factor for Daito Trust Construction. Tenants and smaller property owners often scrutinize rental yields and property values, especially when the broader economic climate in Japan is considered.

In 2024, Japan's residential property market saw a slowdown in price growth, indicating a move toward stabilization. This trend suggests that customers are likely to exhibit increasing price sensitivity, making them more inclined to compare offerings and negotiate terms.

The availability of numerous housing alternatives significantly empowers Daito Trust Construction's customers. For individuals, this includes purchasing pre-owned homes, opting to rent from competing real estate companies, or exploring newer living models like co-living facilities. This wide array of choices means customers aren't solely reliant on Daito Trust, giving them leverage in negotiations.

Similarly, commercial clients possess a robust selection of business premises. They can choose from existing office buildings, lease alternative commercial spaces, or even consider different types of business locations altogether. This broad spectrum of options directly enhances their bargaining power when considering Daito Trust's offerings.

Switching Costs for Customers

For tenants renting properties managed by Daito Trust Construction, the costs associated with switching can be moderate. These typically include expenses like moving fees, the administrative burden of signing new lease agreements, and the potential disruption to their daily lives. For instance, a tenant might face several hundred dollars in moving costs and the time commitment of searching for and securing a new residence.

Property owners who engage Daito Trust for their management services often encounter higher switching costs. This is primarily due to the complexities involved in transferring existing management contracts, which may have specific clauses and notice periods. Furthermore, disentangling established relationships with current tenants and transitioning them to a new management entity adds another layer of difficulty and potential expense.

- Tenant Switching Costs: Moving expenses, new lease agreements, disruption.

- Property Owner Switching Costs: Contract transfer, tenant relationship management.

- Impact on Bargaining Power: Higher switching costs for owners can reduce their leverage.

Customer Information and Differentiation

Customers now have unprecedented access to information. Online real estate portals and rental aggregators allow individuals to easily compare property prices, rental rates, and the amenities offered by various developers, including Daito Trust Construction. This transparency significantly shifts bargaining power towards the customer.

While Daito Trust Construction provides a full spectrum of services from initial design and construction to ongoing property management, the perceived differentiation in the standard rental housing market can be moderate. This means customers can readily find comparable alternatives, making price and overall value key decision drivers.

- Information Access: Real estate platforms provide detailed market data, empowering informed customer decisions.

- Moderate Differentiation: In standard rental segments, Daito's offerings may be comparable to competitors, increasing customer leverage.

- Price Sensitivity: With ample information, customers can more effectively negotiate or choose based on price and value.

Daito Trust Construction's customers, especially individual property owners and institutional investors, possess considerable bargaining power due to the readily available alternatives in Japan's diverse housing market. In 2024, with stabilized property price growth, customers are more price-sensitive and actively compare offerings, leveraging accessible online information to negotiate terms. While tenants face moderate switching costs, property owners encounter higher expenses when changing management, which can slightly temper their leverage.

| Factor | Description | Impact on Daito Trust |

|---|---|---|

| Customer Choice | Abundant housing alternatives (new, used, co-living) empower customers. | Increases customer negotiation leverage. |

| Price Sensitivity | Stabilizing property prices in 2024 make customers more cost-conscious. | Drives demand for competitive pricing and value. |

| Information Availability | Online platforms provide easy comparison of prices and amenities. | Shifts bargaining power significantly towards customers. |

| Switching Costs (Owners) | Complexities in contract transfer and tenant management are high. | Slightly reduces owner bargaining power due to inconvenience. |

Preview the Actual Deliverable

Daito Trust Construction Porter's Five Forces Analysis

This preview showcases the complete Daito Trust Construction Porter's Five Forces Analysis, offering a thorough examination of competitive forces within the industry. You're viewing the exact, professionally formatted document you'll receive immediately after purchase, providing actionable insights for strategic decision-making. This detailed analysis covers all five forces, ensuring you get a comprehensive understanding of Daito Trust Construction's competitive landscape.

Rivalry Among Competitors

The Japanese construction and real estate sector is intensely competitive, featuring a broad spectrum of companies. Major general contractors such as Kajima Corporation, Obayashi Corporation, and Shimizu Corporation are significant players, alongside a multitude of smaller, regional firms vying for market share.

Daito Trust Construction navigates this concentrated landscape, facing direct competition from these large, established entities. The presence of numerous competitors means that market share gains often come at the expense of rivals, intensifying the pressure on pricing and service delivery.

The Japanese construction market is expected to see a healthy compound annual growth rate of 3.30% between 2024 and 2029. This growth, coupled with a stabilizing and expanding real estate sector, especially in major cities, offers some breathing room. However, this positive outlook doesn't diminish the fierce competition among established players for market share.

Daito Trust Construction provides a full spectrum of services, from initial planning and building to ongoing property management, yet standing out in the construction and real estate sectors is tough. Competitors often vie for attention based on construction quality, project timelines, innovative designs, eco-friendly methods, and how well their services are bundled together.

Exit Barriers

The construction and real estate sector, where Daito Trust operates, is characterized by substantial exit barriers. High capital investments in land acquisition, specialized machinery, and ongoing projects tie up significant resources. For instance, in 2024, the average cost of a new residential construction project in Japan could easily run into tens of millions of dollars, making a quick divestment impractical.

Furthermore, the industry relies on specialized labor and often involves long project cycles, meaning companies cannot easily redeploy assets or personnel if they decide to exit. This immobility of capital and labor discourages companies from leaving the market, even during downturns, leading to intensified competition among existing players as they strive to maintain their market share and recover their investments.

- High Capital Investment: Significant upfront costs for land, equipment, and ongoing projects.

- Specialized Labor: Reliance on skilled workers who are not easily transferable to other industries.

- Long Project Cycles: Extended timelines for project completion, delaying the realization of returns and hindering quick exits.

- Market Persistence: Companies are compelled to compete fiercely to avoid substantial losses from premature project abandonment.

Industry Concentration and Market Share

The Japanese construction sector is notably concentrated, with a handful of major companies holding substantial market sway. Daito Trust Construction operates within this landscape, facing robust competition from other significant entities for lucrative construction contracts and a larger share of the real estate market.

This intense rivalry means that Daito Trust must constantly innovate and maintain competitive pricing to secure its position. The market share dynamics are crucial, as even small shifts can significantly impact revenue and growth prospects for all major players.

- Market Concentration: The Japanese construction market is dominated by a few large firms, indicating a high level of industry concentration.

- Key Competitors: Daito Trust Construction competes directly with other major construction and real estate developers in Japan.

- Competitive Tactics: Firms vie for market share through pricing strategies, project acquisition, and service differentiation.

- Impact on Daito Trust: Intense rivalry necessitates continuous strategic adjustments to maintain and grow market share.

The competitive rivalry within Japan's construction and real estate sector is fierce, with Daito Trust Construction facing established giants like Kajima and Obayashi. This intense competition means companies must constantly innovate and offer competitive pricing to capture market share.

The market's concentration, where a few large firms dominate, forces Daito Trust to employ strategic tactics such as service differentiation and aggressive project acquisition to thrive.

Even with a projected 3.30% CAGR for the Japanese construction market from 2024 to 2029, the battle for dominance remains a significant factor for Daito Trust.

High exit barriers, due to substantial capital investments and specialized labor, ensure that firms remain in the market, intensifying the rivalry among existing players.

| Key Competitor | Market Focus | Competitive Advantage Example |

|---|---|---|

| Kajima Corporation | Large-scale infrastructure, general construction | Extensive project portfolio, technological innovation |

| Obayashi Corporation | Civil engineering, building construction | Strong financial backing, global presence |

| Shimizu Corporation | Architecture, construction, engineering | Emphasis on sustainability, advanced construction methods |

| Daito Trust Construction | Rental housing development, property management | Specialization in rental properties, comprehensive service offerings |

SSubstitutes Threaten

For Daito Trust Construction, a significant threat comes from alternative housing solutions. In the rental market, these substitutes include purchasing existing homes, a move that becomes more appealing if property prices stabilize. For instance, in 2024, while some markets saw continued price appreciation, others experienced a cooling, making ownership a more viable consideration for some individuals.

Furthermore, alternative rental models like shared housing and short-term vacation rentals, often referred to as minpaku, present another competitive pressure. These options cater to different needs, offering varying degrees of flexibility and cost structures that can draw tenants away from traditional long-term rentals.

Property owners, Daito's clients, increasingly have viable alternatives. They can choose to manage their rental properties themselves, especially with the proliferation of user-friendly online platforms for listings and tenant communication, bypassing the need for a full-service manager. In 2024, the ease of digital tools has lowered the barrier to entry for self-management, potentially impacting Daito's market share.

Smaller, local property management firms also present a significant substitute. These businesses often compete on price and may offer more personalized service for specific property types or locations, drawing clients away from larger, more standardized providers like Daito. The availability of these niche alternatives means property owners aren't locked into one solution.

The rise of modular and prefabricated construction presents a significant threat of substitutes for Daito Trust Construction. This approach streamlines building processes by assembling components off-site, directly challenging traditional on-site construction methods by potentially lowering labor costs and accelerating project timelines. For instance, the Japanese government has been actively promoting off-site construction, aiming to increase its market share in residential building.

Virtual Offices and Remote Work Trends

The increasing adoption of virtual offices and remote work models presents a significant threat of substitutes for Daito Trust Construction, particularly concerning their commercial property segment. As more companies embrace hybrid or fully remote structures, the demand for traditional, centralized office spaces diminishes. This trend forces developers to innovate and adapt their offerings, potentially impacting the profitability of new office building projects.

This shift directly impacts the need for new office construction. For instance, in 2024, many companies continued to re-evaluate their real estate footprints. A significant percentage of businesses indicated plans to maintain or even increase their remote work policies, directly challenging the long-term viability of traditional office tower development.

- Reduced Demand: The rise of remote work directly substitutes the need for physical office space, impacting demand for new construction.

- Vacancy Rates: Older office properties may face higher vacancy rates as companies downsize their physical footprints.

- Developer Adaptation: Daito Trust must consider flexible layouts and mixed-use developments to cater to evolving tenant needs.

- Market Shifts: The sustained trend towards remote work in 2024 signals a fundamental change in commercial real estate demand.

Repurposing Existing Structures

The threat of substitutes for Daito Trust Construction is amplified by the increasing trend of repurposing existing structures. Instead of new construction, there's a growing movement towards renovating and remodeling properties, particularly in Japan where a significant number of vacant homes exist. This approach offers a more cost-effective alternative to new builds.

This repurposing trend is not only budget-friendly but also aligns with crucial sustainability goals. By breathing new life into older buildings, companies can reduce waste and the environmental impact associated with new construction materials and processes. For example, the Japanese government has been actively promoting the use of vacant properties, with initiatives aimed at encouraging renovation and adaptive reuse.

- Cost-Effectiveness: Renovating existing structures often proves cheaper than ground-up construction, saving on land acquisition and initial development costs.

- Sustainability Focus: Repurposing aligns with environmental, social, and governance (ESG) principles by reducing construction waste and carbon footprint.

- Market Dynamics: A large inventory of older, potentially underutilized buildings presents opportunities for renovation rather than new builds.

- Government Incentives: Policies encouraging the use of vacant properties can further boost the appeal of renovation over new construction.

The threat of substitutes for Daito Trust Construction is multifaceted, encompassing both direct and indirect alternatives to its core business. In the rental market, the option for individuals to purchase existing homes rather than rent presents a significant substitute, a consideration that gained traction in 2024 as some property markets saw price stabilization.

Beyond ownership, alternative rental models like co-living spaces and short-term rentals offer flexibility and cost structures that can divert tenants from traditional long-term leases. Property owners themselves have substitutes, with the rise of user-friendly digital platforms in 2024 making self-management a more accessible alternative to using a property management firm like Daito.

Furthermore, the construction sector faces substitutes in modular and prefabricated building techniques, which can offer faster project completion and potentially lower labor costs. The growing trend of repurposing existing buildings, driven by cost-effectiveness and sustainability goals, also serves as a substitute for new construction projects, a trend actively supported by government initiatives in Japan.

| Substitute Category | Description | Impact on Daito Trust | 2024 Trend/Data Point |

|---|---|---|---|

| Home Ownership | Purchasing existing properties instead of renting. | Reduces demand for rental units. | Stabilizing property prices in some markets made ownership more appealing. |

| Alternative Rentals | Co-living, short-term rentals (minpaku). | Diverts tenants from traditional rentals. | Cater to diverse needs with varying flexibility and cost. |

| Self-Property Management | Property owners managing their own rentals. | Decreases need for management services. | Ease of digital tools lowered barrier to entry for self-management. |

| Modular/Prefab Construction | Off-site assembly of building components. | Challenges traditional on-site building methods. | Japanese government promotion aims to increase market share. |

| Repurposing Existing Structures | Renovating and remodeling older buildings. | Offers cost-effective alternative to new builds. | Aligns with sustainability goals and government initiatives for vacant properties. |

Entrants Threaten

Entering Japan's construction and real estate sector, particularly at the scale Daito Trust Construction operates, demands significant financial resources. This includes substantial outlays for land acquisition, building materials, advanced construction equipment, and the operational costs associated with managing extensive projects. For instance, the average cost of acquiring land for a mid-rise apartment building in a major Japanese city can easily run into millions of dollars, creating a formidable entry barrier.

The Japanese construction sector, including companies like Daito Trust Construction, faces substantial regulatory and legal barriers that deter new entrants. These include rigorous seismic building codes, strict environmental protection laws, and intricate land use regulations, all demanding specialized knowledge and significant upfront investment for compliance.

For instance, Japan's Building Standards Act mandates specific earthquake resistance levels, requiring advanced engineering and materials. In 2023, the Ministry of Land, Infrastructure, Transport and Tourism continued to update these codes, adding complexity and cost for any new player. This high compliance threshold effectively limits the number of new companies that can realistically enter the market.

Established players like Daito Trust Construction leverage significant economies of scale in material procurement and construction, allowing them to achieve lower per-unit costs. For instance, in 2023, Daito Trust's revenue reached ¥458.8 billion, indicating a substantial operational footprint that new entrants would struggle to match immediately.

Furthermore, Daito Trust’s decades of experience in the Japanese real estate market, including navigating complex zoning laws and securing financing, create a formidable barrier. This accumulated expertise translates into more efficient project execution and a stronger ability to win bids for large-scale developments, a crucial advantage over newcomers.

Brand Loyalty and Reputation

Daito Trust Construction benefits from a deeply ingrained brand loyalty and a stellar reputation, especially within the rental housing and property management sectors. This established trust with property owners and tenants presents a significant hurdle for newcomers. Building a comparable level of credibility and market recognition requires substantial capital investment and considerable time, making it difficult for new entrants to quickly gain traction.

For instance, Daito Trust's long history and consistent service have cultivated a strong customer base. In 2024, the company continued to leverage this reputation, with a significant portion of its recurring revenue stemming from its extensive property management portfolio. New companies entering the market would need to overcome this established goodwill, which is not easily replicated through price competition alone.

- Established Brand Recognition: Daito Trust's name is synonymous with quality and reliability in Japanese real estate.

- Customer Trust: Years of successful property development and management have fostered deep trust among its clientele.

- High Barrier to Entry: New competitors face significant challenges in matching Daito Trust's established reputation and customer loyalty.

- Investment in Reputation: Replicating Daito Trust's market standing would require immense investment in marketing and building long-term relationships.

Access to Distribution Channels and Supply Chains

Daito Trust Construction benefits from deeply entrenched distribution channels, particularly its established networks for tenant recruitment and real estate brokerage. These existing relationships are crucial for securing occupancy and maintaining a steady revenue stream.

New entrants would find it incredibly difficult to replicate Daito Trust's extensive network of real estate agents and its proven track record in attracting and retaining tenants. For instance, in fiscal year 2023, Daito Trust reported a robust occupancy rate of 98.7% across its rental properties, highlighting the effectiveness of its tenant acquisition strategies.

Furthermore, Daito Trust has cultivated strong, long-term relationships with a wide array of suppliers and subcontractors. This allows for preferential pricing, reliable material sourcing, and efficient project execution, all of which are vital for cost competitiveness in the construction industry.

- Established Tenant Networks: Daito Trust's extensive experience in managing rental properties has fostered a strong base of repeat tenants and a reputation that attracts new ones.

- Brokerage Relationships: The company maintains strong ties with real estate brokers, facilitating faster property leasing and sales.

- Supplier and Subcontractor Alliances: Long-standing partnerships ensure consistent quality and cost-effective access to construction materials and labor.

- Barriers to Entry: New companies must invest significant time and resources to build comparable distribution and supply chain capabilities, posing a substantial threat to their market entry.

The threat of new entrants for Daito Trust Construction is significantly mitigated by the immense capital required for land acquisition, construction, and operational setup in Japan's real estate market. For instance, acquiring prime land in Tokyo can cost tens of millions of dollars, a substantial hurdle for any new player. This financial barrier, coupled with stringent seismic building codes and environmental regulations, demands extensive expertise and upfront investment, effectively limiting the pool of potential competitors.

Daito Trust's established economies of scale, evident in its 2023 revenue of ¥458.8 billion, allow for cost advantages in procurement and construction that new entrants cannot easily match. Furthermore, decades of market experience and a strong brand reputation built on customer trust create significant barriers. In 2024, the company continued to benefit from this ingrained loyalty, with a substantial portion of its recurring income derived from its well-established property management portfolio.

The company also benefits from deeply entrenched distribution channels, including robust networks for tenant recruitment and strong relationships with real estate brokers. Daito Trust's impressive 98.7% occupancy rate in fiscal year 2023 underscores the effectiveness of these established networks. Replicating this reach and the company's long-standing supplier and subcontractor alliances, which ensure preferential pricing and reliable material sourcing, would require considerable time and investment for any new competitor.

| Barrier Type | Description | Impact on New Entrants | Example (Daito Trust) |

|---|---|---|---|

| Capital Requirements | High costs for land, materials, and equipment. | Formidable financial hurdle. | Land acquisition costs in major Japanese cities can reach millions. |

| Regulatory Hurdles | Strict building codes, environmental laws, land use regulations. | Requires specialized knowledge and compliance investment. | Japan's Building Standards Act mandates advanced earthquake resistance. |

| Economies of Scale | Lower per-unit costs due to large-scale operations. | New entrants struggle to compete on price. | 2023 Revenue: ¥458.8 billion. |

| Brand Reputation & Trust | Established customer loyalty and market recognition. | Difficult to replicate without significant time and investment. | High occupancy rates (98.7% in FY2023) driven by trust. |

| Distribution Channels | Existing networks for tenant acquisition and brokerage. | New entrants need time to build comparable networks. | Strong relationships with real estate agents and repeat tenants. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Daito Trust Construction is built upon a foundation of robust data, including company annual reports, industry-specific market research from firms like Yano Research Institute, and government housing statistics.