Jefferies Financial Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Jefferies Financial Group Bundle

Navigate the complex external environment impacting Jefferies Financial Group with our comprehensive PESTLE analysis. Understand how political stability, economic fluctuations, and technological advancements are shaping the financial services landscape. Unlock critical insights to inform your investment strategy and gain a competitive edge. Download the full analysis now for actionable intelligence.

Political factors

The stability of government policies directly shapes the financial services landscape. Shifts in fiscal and monetary strategies, alongside sector-specific rules, can significantly alter Jefferies' operating conditions and earnings potential. For instance, the US Federal Reserve's interest rate decisions in 2024 and 2025, aimed at managing inflation, directly impact borrowing costs and investment returns across the financial industry.

Global geopolitical tensions, including ongoing conflicts and shifting trade alliances, continue to inject volatility into financial markets and influence international capital flows. For instance, the protracted conflict in Eastern Europe and rising trade protectionism in various regions have led to increased uncertainty in commodity prices and supply chains, impacting global economic growth forecasts for 2024-2025.

Jefferies, operating as a global investment bank, must actively manage these complexities. Evolving trade agreements, such as potential renegotiations of existing pacts or the emergence of new bilateral deals, directly affect deal flow and client sentiment. This can specifically impact Jefferies' cross-border advisory and underwriting activities, as seen in the fluctuating M&A volumes in regions experiencing heightened geopolitical risk.

Changes in corporate tax rates, capital gains taxes, and other financial levies significantly impact Jefferies' profitability and client investment decisions. For instance, a potential increase in the U.S. federal corporate tax rate from 21% could reduce net income, while adjustments to capital gains taxes influence client portfolio rebalancing strategies.

Anticipating and adapting to these policy shifts is crucial for effective financial planning. For example, in 2024, many countries are reviewing their tax regimes to bolster revenues, which could mean higher compliance costs or altered tax liabilities for Jefferies' international operations.

Furthermore, tax policy can steer capital towards or away from specific markets. If a nation implements favorable tax incentives for certain industries, Jefferies might advise clients to allocate more capital there, enhancing potential returns and aligning with evolving global investment landscapes.

Political Stability and Elections

The outcomes of major elections, such as the upcoming 2024 US Presidential election and various European parliamentary elections in 2024, can introduce significant market volatility and policy uncertainty. For instance, shifts in government can directly impact financial regulations, tax policies, and trade agreements, all of which are critical for Jefferies' diverse client base. Political instability in key markets could deter foreign investment and slow down mergers and acquisitions activity. Jefferies must remain attuned to these developments to guide clients through potential market shifts and identify new opportunities arising from policy changes.

The stability of political regimes in countries where Jefferies operates or has significant client interests is paramount. For example, ongoing geopolitical tensions in Eastern Europe or potential leadership changes in major Asian economies can create ripple effects across global financial markets. These events directly influence investor sentiment, affecting capital raising efforts and the overall risk appetite for financial institutions like Jefferies. Monitoring these factors allows Jefferies to provide timely advice on managing risk and capitalizing on evolving market dynamics.

- 2024 US Presidential Election: Expected to be a significant driver of policy uncertainty, impacting sectors from technology to energy.

- European Parliament Elections (June 2024): Results could influence the direction of EU economic policy and regulatory frameworks.

- Geopolitical Risk: Ongoing conflicts and trade disputes continue to create a complex operating environment for global finance.

- Regulatory Environment: Changes in financial regulation post-election cycles can significantly alter market access and operational costs for financial firms.

Government Spending and Debt Levels

Government spending patterns and national debt levels significantly influence interest rates, inflation, and economic growth, directly impacting financial markets. For Jefferies Financial Group, these macroeconomic conditions are crucial as they affect bond yields, equity valuations, and the demand for new financial instruments. For instance, in the US, the national debt surpassed $34 trillion by early 2024, a figure that continues to grow. Higher debt levels can lead to increased borrowing costs for the government, potentially pushing up interest rates across the economy, which in turn can dampen investment and M&A activity, key areas for Jefferies.

The fiscal policies enacted by governments, including spending priorities and debt management strategies, create a direct link to Jefferies' operational environment. Increased government borrowing to fund deficits can compete with private sector demand for capital, potentially raising borrowing costs for Jefferies and its clients. Conversely, targeted government spending on infrastructure or innovation could stimulate economic activity, creating opportunities for advisory and capital markets services. As of Q1 2024, the US federal deficit was projected to be around $1.5 trillion for the fiscal year, highlighting the ongoing fiscal pressures.

- US National Debt: Exceeded $34 trillion in early 2024.

- US Federal Deficit: Projected around $1.5 trillion for FY 2024.

- Impact on Interest Rates: Rising government debt can exert upward pressure on interest rates.

- Market Sensitivity: Jefferies' capital markets and advisory businesses are directly affected by these macroeconomic shifts.

Political stability and government policies are critical for Jefferies. Election outcomes, such as the 2024 US Presidential election, can introduce policy uncertainty affecting financial regulations and tax laws. Geopolitical tensions, like those in Eastern Europe, continue to impact global capital flows and market volatility, influencing M&A activity and investor sentiment for Jefferies' operations.

What is included in the product

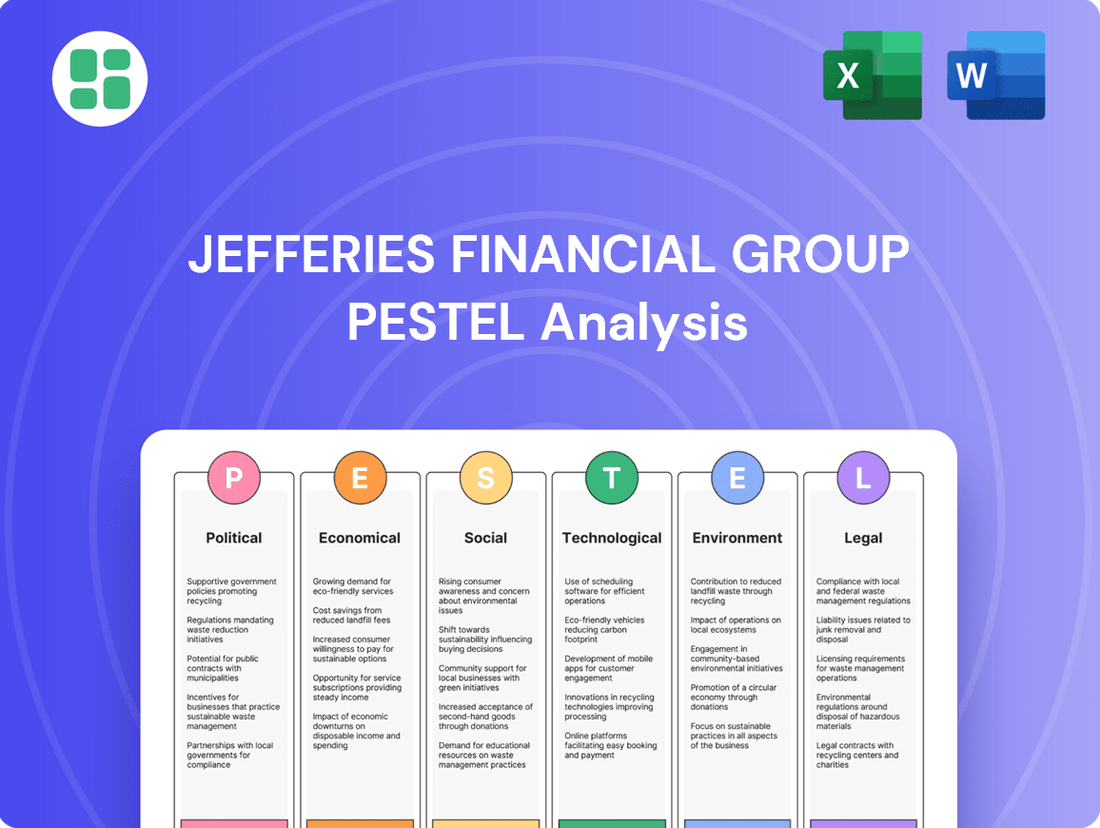

This PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting Jefferies Financial Group, providing a comprehensive overview of its operating landscape.

A clear, actionable PESTLE analysis for Jefferies Financial Group that highlights key external factors, enabling strategic decision-making and proactive risk mitigation.

Economic factors

Interest rate fluctuations significantly influence Jefferies' financial performance. Changes in central bank rates, such as the Federal Reserve's policy rate, directly affect the net interest income Jefferies earns from its balance sheet operations. For instance, if the Fed raises rates, the cost of borrowing for Jefferies and its clients increases, potentially impacting loan demand and M&A activity.

Higher interest rates can lead to a slowdown in capital markets, reducing Jefferies' fees from underwriting and advisory services as deal volumes may decrease. Conversely, lower rates can stimulate borrowing and investment, boosting these revenue streams. As of early 2024, the Federal Reserve maintained a hawkish stance, with rates at multi-decade highs, creating a challenging environment for debt-financed transactions.

Jefferies must also actively manage the interest rate risk embedded within its trading books. This involves strategies to mitigate potential losses arising from adverse movements in interest rates, which can impact the valuation of fixed-income securities and derivatives held by the firm. The firm's ability to navigate these rate shifts is crucial for maintaining profitability and stability.

The global economic outlook for 2024 and early 2025 presents a mixed picture, with varying growth forecasts across major economies. The International Monetary Fund (IMF) projected global growth at 3.1% for 2024, a slight slowdown from 2023, with risks tilted to the downside. This moderate growth environment directly impacts Jefferies' operations, influencing deal volumes and client appetite for financial services.

Recession risks remain a pertinent concern, particularly in certain developed economies, due to persistent inflation and tighter monetary policies. Should a significant global slowdown or recession materialize, Jefferies could see reduced M&A advisory fees, lower investment banking activity, and decreased demand for its asset management products. For instance, a contraction in GDP in key markets like the US or Europe would likely translate to lower trading volumes and underwriting opportunities.

Conversely, pockets of resilience and potential growth in emerging markets or specific sectors could offer opportunities. Jefferies' diversified business model is designed to navigate these varied economic conditions, but sustained global economic health is crucial for maximizing performance across its investment banking, capital markets, and asset management segments.

Rising inflation directly impacts Jefferies by diminishing the real value of its capital and increasing operating expenses. For instance, the U.S. Consumer Price Index (CPI) saw an annual increase of 3.4% as of April 2024, a figure that directly translates to higher costs for goods and services Jefferies utilizes.

Such inflationary pressures also affect asset valuations within the financial markets where Jefferies operates, potentially leading to shifts in investment strategies. Furthermore, central banks' responses, such as interest rate hikes to combat inflation, influence borrowing costs and overall market liquidity, a key consideration for financial institutions.

Consequently, Jefferies must focus on strategies to mitigate inflation's effects on client portfolios and offer advice on inflation-hedging instruments. This includes navigating the impact of interest rate policies, like the Federal Reserve's target range for the federal funds rate, which influences the cost of capital and investment returns.

Capital Market Volatility and Liquidity

Capital market volatility and liquidity are crucial for Jefferies' sales and trading. For instance, in early 2024, equity market volatility, as measured by the VIX index, fluctuated, presenting both challenges and opportunities for trading desks. Low liquidity in certain fixed income segments during periods of stress can hinder Jefferies' ability to execute large client orders efficiently, impacting revenue streams from trading commissions and principal transactions.

The ease and profitability of underwriting new securities are directly tied to market conditions. In 2024, the revival of the IPO market saw increased activity, benefiting investment banks like Jefferies. Conversely, periods of high interest rate volatility or credit market tightening can significantly reduce the appetite for new debt and equity issuance, thereby impacting Jefferies' underwriting fees.

- Equity Market Volatility: The CBOE Volatility Index (VIX) averaged around 15-20 in early 2024, indicating moderate but fluctuating market uncertainty.

- Fixed Income Liquidity: Liquidity in the corporate bond market can vary significantly; during periods of economic uncertainty, bid-ask spreads widen, making transactions more costly.

- Commodities Market Dynamics: Energy commodity prices, for example, experienced notable swings in 2024 due to geopolitical factors, creating both trading gains and losses for participants.

- Underwriting Activity: Global equity and debt underwriting volumes in the first half of 2024 showed a rebound compared to the previous year, driven by a more stable macroeconomic outlook.

Currency Exchange Rate Movements

Currency exchange rate movements present a significant economic factor for Jefferies Financial Group. As a global firm, fluctuations in exchange rates directly impact the value of its international assets, liabilities, and revenues when converted back to its primary reporting currency. For instance, a strengthening US dollar could decrease the reported value of overseas earnings, while a weakening dollar might have the opposite effect.

These shifts also influence cross-border investment flows and the attractiveness of international transactions. For example, if the Euro weakens considerably against the US dollar, European companies might find it more expensive to invest in US dollar-denominated assets, potentially affecting deal volumes for Jefferies. Effective foreign exchange risk management is therefore crucial to mitigate these impacts.

Recent data highlights the volatility. For example, the US Dollar Index (DXY), which measures the dollar against a basket of major currencies, experienced fluctuations throughout 2024. By mid-2024, the DXY showed a notable upward trend, indicating a stronger dollar, which would have implications for companies with substantial international operations like Jefferies.

- Impact on International Earnings: A stronger USD can reduce the reported value of foreign earnings for Jefferies, impacting profitability metrics.

- Cross-Border Deal Competitiveness: Exchange rate volatility can make international M&A and capital markets deals more or less attractive for global clients.

- Foreign Exchange Risk Management: Jefferies employs hedging strategies to protect against adverse currency movements, a critical component of its financial operations.

- Economic Indicators: Tracking indices like the DXY provides insight into the broader currency landscape affecting Jefferies' global business.

Jefferies' profitability is closely tied to the overall health of the global economy. The International Monetary Fund (IMF) projected global growth at 3.1% for 2024, a slight deceleration from the previous year, with potential downside risks. This moderate growth environment directly influences deal volumes and client demand for financial services across Jefferies' various segments.

Recessionary concerns, particularly in developed economies, pose a significant threat. A widespread economic downturn could lead to reduced M&A advisory fees, lower investment banking activity, and decreased demand for asset management products. For instance, a contraction in GDP in key markets like the US or Europe would likely impact trading volumes and underwriting opportunities for Jefferies.

Conversely, pockets of economic resilience, especially in emerging markets or specific growth sectors, could present opportunities for the firm. Jefferies' diversified business model is designed to weather varied economic conditions, but sustained global economic stability is paramount for maximizing performance across its operations.

Preview the Actual Deliverable

Jefferies Financial Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Jefferies Financial Group delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations. Gain immediate access to actionable insights for strategic decision-making.

Sociological factors

Demographic shifts are profoundly reshaping financial markets. Developed economies are experiencing aging populations, increasing the demand for retirement planning and wealth transfer services. For instance, in the US, the median age is projected to reach 38.9 by 2030, up from 37.7 in 2020, highlighting the growing need for retirement solutions.

Concurrently, emerging economies are witnessing a burgeoning middle class, creating new opportunities for wealth accumulation and investment products. Asia, particularly, is a key growth engine, with its middle-class consumption expected to reach $35 trillion by 2030, according to some projections. Jefferies must tailor its product suite to capture these diverse and evolving client needs.

Global wealth distribution patterns are also in flux, with a notable concentration of wealth in certain segments and regions. This necessitates strategic adjustments in how financial services are offered, focusing on personalized wealth management and specialized investment vehicles. Understanding these shifts is crucial for Jefferies to maintain its competitive edge and effectively serve a global clientele.

Societal expectations are increasingly prioritizing Environmental, Social, and Governance (ESG) criteria in investment choices. This shift means Jefferies must weave ESG considerations into its advisory, underwriting, and asset management services to satisfy client demand and stay competitive.

For instance, a significant portion of global assets under management, estimated to be over $37 trillion by early 2024, now incorporate ESG factors, highlighting the substantial market shift Jefferies must address.

Failing to adapt to these evolving investor preferences could result in reputational harm and a loss of business to competitors who are more aligned with ESG principles.

Societal trust in financial institutions is a critical, yet often delicate, asset. Historical events, such as the 2008 financial crisis, have left lasting impacts on public perception, making institutions like Jefferies Financial Group subject to heightened scrutiny. Maintaining this trust is not merely about perception; it directly influences client acquisition and retention, the ability to attract top talent, and overall market confidence.

Jefferies' reputation is intrinsically linked to its long-term success and stability. In 2024, for instance, firms demonstrating robust corporate governance and ethical conduct often see better client loyalty and a stronger competitive position. Adherence to stringent ethical standards, coupled with transparent operations and a commitment to responsible business practices, are the cornerstones for building and safeguarding public trust within the financial sector.

Workforce Trends and Talent Acquisition

Societal shifts towards greater work-life balance and robust diversity and inclusion initiatives are significantly shaping how Jefferies attracts and retains talent. The financial sector, in particular, faces intense competition for individuals possessing specialized skills, making a compelling corporate culture and attractive compensation packages crucial. For instance, in 2024, the demand for data scientists and cybersecurity experts within financial services saw a notable surge, with average salaries increasing by 15-20% year-over-year according to industry reports.

Jefferies must actively cultivate an environment that not only offers competitive remuneration but also prioritizes continuous learning and career advancement to secure a high-performing workforce. This includes investing in training programs and mentorship opportunities, especially as new technologies and regulatory landscapes evolve. A 2025 survey of financial professionals indicated that over 60% consider professional development opportunities as a key factor when choosing an employer.

- Work-Life Balance: Growing employee expectations for flexible work arrangements and manageable workloads.

- Diversity & Inclusion: Increased societal and regulatory pressure for diverse representation across all organizational levels.

- Specialized Skills Demand: High demand for expertise in areas like AI, fintech, and sustainable finance, driving up talent acquisition costs.

- Talent Retention: The need for strong corporate culture, competitive pay, and clear career progression paths to combat industry poaching.

Consumer Behavior and Digital Adoption

Societal shifts are profoundly reshaping how consumers engage with financial services. The accelerating adoption of digital tools means clients, from individual investors to large institutions, now expect highly personalized and seamless interactions. Jefferies must prioritize investments in its digital infrastructure and client-facing technology to align with these evolving preferences, thereby boosting accessibility and operational efficiency.

This digital transformation is evident in various consumer behaviors. For instance, by early 2024, global mobile banking active users surpassed 2.5 billion, highlighting a clear preference for digital channels. Furthermore, research indicates that over 70% of consumers expect personalized recommendations from their financial providers. This trend necessitates Jefferies to enhance its digital platforms to cater to these demands.

- Digital Engagement: Over 80% of financial transactions in developed markets are expected to be digital by 2025.

- Personalization Demand: Consumers are increasingly willing to share data for tailored financial advice and product offerings.

- Accessibility Expectations: Clients anticipate 24/7 access to services and support through various digital touchpoints.

- Fintech Influence: The rise of fintech solutions is setting new benchmarks for user experience in financial services.

Societal expectations for ethical business practices and corporate responsibility are paramount. Consumers and stakeholders increasingly scrutinize companies for their social impact, pushing institutions like Jefferies to integrate Environmental, Social, and Governance (ESG) principles deeply into their operations. By early 2024, over $37 trillion in global assets under management incorporated ESG factors, demonstrating a significant market shift demanding such integration.

Public trust in financial institutions remains a critical factor, influenced by past economic events and ongoing transparency demands. Jefferies must actively cultivate and maintain this trust through robust governance, ethical conduct, and transparent dealings to ensure client loyalty and market confidence. Firms demonstrating strong ethical standards in 2024 often experience enhanced client retention and a stronger competitive standing.

Evolving workforce expectations regarding work-life balance and diversity are reshaping talent acquisition and retention strategies within the financial sector. Jefferies needs to foster inclusive environments and offer competitive development opportunities to attract and retain skilled professionals, especially given the 2024 surge in demand for specialized roles like data scientists, with salaries rising by 15-20%.

Technological factors

Digital transformation is reshaping the financial industry, driving efficiency and cutting costs. Jefferies can harness automation in areas like trade processing and data management to streamline operations. This shift allows for better scalability and frees up employees for higher-value, client-focused activities.

Cybersecurity is a critical operational factor for Jefferies, especially as financial services become more digitized. The firm handles substantial volumes of sensitive client information, making it a prime target for cyberattacks. In 2024, the financial sector experienced a significant increase in sophisticated cyber threats, with the average cost of a data breach reaching an estimated $4.73 million globally, according to IBM's 2024 Cost of a Data Breach Report. This underscores the necessity for Jefferies to maintain and enhance its defenses.

Continuous investment in advanced security technologies and robust data protection protocols is essential for Jefferies to mitigate risks. This includes safeguarding against evolving cyber threats like ransomware and phishing attacks, which can disrupt operations and compromise client data. Failure to do so not only exposes the company to substantial financial penalties and reputational damage but also erodes the trust of its clients, a cornerstone of the financial services industry.

Artificial Intelligence and Machine Learning are transforming financial services, offering Jefferies significant advantages. These technologies can sharpen predictive analytics for market movements and enhance algorithmic trading precision. For instance, by mid-2024, AI adoption in financial services was projected to boost efficiency by up to 25% according to industry reports.

Implementing AI and ML allows Jefferies to gain a competitive edge. This includes optimizing trading strategies, improving risk management by identifying anomalies faster, and delivering highly personalized insights to clients. Such advancements are crucial for rapid decision-making in today's dynamic markets.

FinTech Innovation and Disruption

The financial services landscape is being reshaped by FinTech, with startups and tech behemoths increasingly offering digital solutions. Jefferies must stay ahead by identifying and integrating these innovations. For instance, the global FinTech market was projected to reach $33.5 trillion by 2027, highlighting the immense growth potential and competitive pressure.

To maintain its edge, Jefferies can explore strategic alliances or acquisitions of nimble FinTech companies, or invest in its own digital capabilities. This proactive approach ensures alignment with evolving client expectations for seamless, digital financial experiences. The demand for digital banking services, for example, saw a significant surge in 2024, with many consumers preferring online platforms.

- FinTech Market Growth: Global FinTech market projected to reach $33.5 trillion by 2027, indicating rapid expansion and innovation.

- Digital Service Demand: Increased consumer preference for digital banking and financial management tools in 2024.

- Competitive Landscape: Both startups and established tech firms are entering financial services, intensifying competition.

- Strategic Imperative: Jefferies needs to partner with, acquire, or develop FinTech solutions to remain competitive.

Data Analytics and Big Data

The financial industry's increasing reliance on data analytics is a significant technological factor for Jefferies Financial Group. The ability to collect, process, and analyze vast amounts of financial and market data is now paramount for making sound decisions in investment banking and capital markets. For instance, as of early 2024, the global big data market was projected to reach hundreds of billions of dollars, highlighting the scale of data being generated and analyzed.

Jefferies can harness big data analytics to uncover deeper insights into evolving market trends, understand client behaviors more precisely, and refine risk profiling. This capability directly translates into offering more strategic advisory services and making more profitable trading decisions. Companies that effectively leverage data analytics are demonstrating a competitive edge in identifying new opportunities and mitigating potential threats.

- Enhanced Market Intelligence: Utilizing big data allows for real-time analysis of market sentiment and emerging economic indicators, informing investment strategies.

- Client-Centric Strategies: Analyzing client data helps tailor financial products and advisory services, improving client retention and satisfaction.

- Risk Management Sophistication: Advanced analytics can identify complex correlations and predict potential financial risks with greater accuracy.

- Operational Efficiency: Automating data processing and analysis reduces manual effort, leading to faster decision-making and lower operational costs.

Technological advancements are fundamentally altering financial services, necessitating continuous adaptation by Jefferies. The firm must leverage AI and machine learning for enhanced predictive analytics and algorithmic trading, with AI adoption in finance projected to boost efficiency by up to 25% by mid-2024.

The rise of FinTech presents both opportunities and challenges, as startups and tech giants innovate digital solutions; the global FinTech market is expected to reach $33.5 trillion by 2027, underscoring the need for Jefferies to integrate these innovations through partnerships or internal development.

Data analytics is now critical for Jefferies, enabling deeper market trend insights and precise client behavior analysis, as the global big data market continues its substantial growth, projected to reach hundreds of billions of dollars by early 2024.

Cybersecurity remains a paramount concern, with sophisticated threats increasing; the average cost of a data breach in the financial sector reached an estimated $4.73 million globally in 2024, highlighting the imperative for robust protection measures.

Legal factors

Jefferies Financial Group navigates a landscape heavily shaped by financial regulations like the Dodd-Frank Act in the United States and MiFID II in Europe. These frameworks dictate everything from capital adequacy to trading practices, demanding constant vigilance.

Adherence to these complex rules is paramount for Jefferies, as non-compliance can result in substantial penalties, including significant fines and operational limitations. For instance, the financial services industry globally saw billions in fines levied in recent years for regulatory breaches, underscoring the cost of oversight failures.

Meeting these stringent requirements necessitates significant investment in legal and compliance teams, as well as robust technological infrastructure. This ongoing commitment ensures Jefferies can operate effectively while mitigating risks associated with the evolving global regulatory environment.

Jefferies Financial Group, like all financial institutions, must navigate a complex web of data privacy and protection laws. Regulations such as the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the United States impose stringent requirements on how the firm collects, stores, and processes sensitive client information.

Compliance is not merely a legal obligation but a cornerstone of maintaining client trust and safeguarding the firm's reputation. Failure to adhere to these evolving data privacy frameworks can result in substantial financial penalties, with GDPR fines potentially reaching up to 4% of annual global turnover or €20 million, whichever is higher. For instance, in 2023, various companies faced significant fines for data breaches and privacy violations, underscoring the critical need for robust data governance.

To effectively manage these risks, Jefferies must implement comprehensive data governance strategies. This involves establishing clear policies for data handling, ensuring data security through advanced technological measures, and providing ongoing training to employees on privacy best practices. A proactive approach to global compliance is essential, given the international nature of financial services and the increasing harmonization of data protection standards worldwide.

Jefferies Financial Group operates under strict anti-money laundering (AML) and sanctions regulations. These laws are in place to combat financial crimes and the funding of terrorism. For instance, in 2023, global AML fines reached billions, underscoring the significant financial penalties for non-compliance.

To adhere to these rules, Jefferies must conduct thorough client due diligence, continuously monitor transactions for suspicious activity, and report any findings to regulatory bodies. This meticulous process is essential for maintaining legal standing and operational integrity.

Failure to comply with AML and sanctions laws can result in substantial financial penalties, legal prosecution, and irreparable damage to the company's reputation. Therefore, maintaining a robust and effective AML program is a critical operational imperative for Jefferies.

Consumer Protection Laws

Jefferies must navigate a complex web of consumer protection laws, especially when dealing with high-net-worth individuals. These regulations mandate fair practices, clear risk disclosures, and transparent dealings to safeguard clients. For instance, in 2024, the financial services industry saw increased scrutiny on advisory fees and product suitability, with regulators emphasizing enhanced client understanding of investment products and associated risks. Failure to comply can lead to significant penalties and reputational damage.

Adherence to these consumer protection frameworks is crucial for building and maintaining client trust. It directly impacts Jefferies' ability to retain its clientele and attract new business, particularly within its wealth management and private banking divisions. For example, in the US, the Securities and Exchange Commission (SEC) continues to enforce Regulation Best Interest, which requires financial professionals to act in the best interest of their retail customers when making a recommendation. This focus on client well-being is a cornerstone of responsible financial intermediation.

The evolving regulatory landscape means Jefferies must remain agile in its compliance strategies. Key areas of focus for 2024 and into 2025 include data privacy, anti-money laundering (AML) measures, and the prevention of financial fraud. These legal factors directly influence operational procedures and client onboarding processes, ensuring that the firm operates ethically and within legal boundaries.

- Fair Dealing: Ensuring all client interactions are equitable and free from bias.

- Transparency: Providing clear and understandable information about products, services, and fees.

- Risk Disclosure: Adequately informing clients about the potential risks associated with investments.

- Regulatory Compliance: Adhering to all applicable consumer protection laws and regulations.

Litigation and Legal Disputes

Jefferies Financial Group, like many institutions in the financial sector, navigates a landscape rife with potential litigation. The complexity of financial instruments and the sheer volume of transactions mean that contractual disputes, allegations of misconduct, or even perceived regulatory missteps are ever-present risks. For instance, in 2023, financial services firms globally saw a significant increase in class-action lawsuits related to alleged market manipulation and misleading disclosures, a trend that continues to influence operational strategies.

Effectively managing these legal challenges is paramount for safeguarding Jefferies' financial stability and its hard-earned reputation. This involves not only robust defense mechanisms but also proactive risk mitigation. A key aspect is the firm's approach to compliance and internal controls, which directly impacts its exposure to potential legal entanglements. For example, heightened regulatory scrutiny in 2024 across areas like ESG disclosures and cybersecurity practices necessitates continuous adaptation of legal and compliance frameworks.

- Litigation Risk: Financial services firms like Jefferies face inherent litigation risks due to the nature of their business, including contractual disputes and allegations of misconduct.

- Reputational Impact: Successful management of legal challenges is crucial for maintaining the firm's financial health and its public reputation.

- Regulatory Scrutiny: Increased regulatory oversight in areas such as ESG and cybersecurity in 2024 poses ongoing legal and compliance challenges for financial institutions.

- Proactive Management: A strong emphasis on risk assessment and defense strategies is vital for mitigating the impact of potential legal disputes.

Jefferies Financial Group operates under a stringent legal and regulatory framework, necessitating robust compliance measures. Key areas include adherence to global financial regulations like Dodd-Frank and MiFID II, which govern capital adequacy and trading practices, with significant penalties for non-compliance, as evidenced by billions in industry-wide fines in recent years.

Data privacy laws such as GDPR and CCPA are critical, requiring careful handling of client information, with GDPR fines potentially reaching 4% of global turnover. Furthermore, anti-money laundering (AML) and sanctions regulations are paramount, with global AML fines in 2023 reaching billions, underscoring the need for thorough due diligence and transaction monitoring.

Consumer protection laws mandate fair practices and transparent disclosures, with regulators in 2024 increasing scrutiny on advisory fees and product suitability. The firm also faces ongoing litigation risks, with class-action lawsuits related to market manipulation and misleading disclosures on the rise, emphasizing the need for proactive risk management and strong internal controls.

| Legal Factor | Key Regulations/Concerns | Impact on Jefferies | Examples/Data (2023-2025) |

| Financial Regulation | Dodd-Frank, MiFID II | Capital adequacy, trading practices, compliance costs | Billions in industry fines for breaches (2023) |

| Data Privacy | GDPR, CCPA | Client data protection, reputational risk, fines | GDPR fines up to 4% of global turnover; significant fines for data breaches in 2023 |

| AML & Sanctions | AML laws, sanctions lists | Transaction monitoring, client due diligence, legal prosecution risk | Global AML fines in billions (2023) |

| Consumer Protection | Fair dealing, transparency, risk disclosure | Client trust, business retention, regulatory scrutiny | Increased scrutiny on fees and suitability (2024); SEC's Regulation Best Interest |

| Litigation & Disputes | Contractual disputes, misconduct allegations | Financial stability, reputational damage, defense costs | Rise in class-action lawsuits (2023); focus on ESG and cybersecurity scrutiny (2024) |

Environmental factors

Climate change poses significant physical risks to Jefferies' clients' assets, such as extreme weather events impacting real estate or supply chains, alongside transition risks stemming from evolving regulations and carbon pricing. For instance, the increasing frequency of severe weather events, like those seen in 2023 and projected for 2024, can directly impact the value of collateral and investment portfolios.

Jefferies can leverage these challenges into opportunities by guiding clients toward green finance solutions and sustainable infrastructure investments. The firm is well-positioned to advise on climate-resilient strategies and facilitate financing for renewable energy projects, capitalizing on the growing demand for ESG-aligned investments, which saw global sustainable fund flows reach record highs in early 2024.

The growing emphasis on Environmental, Social, and Governance (ESG) criteria by major investors, including pension funds and wealthy individuals, is a significant environmental factor shaping Jefferies' business. This trend directly influences the demand for sustainable investment options and advisory services within asset management.

Jefferies needs to adapt by creating investment products that incorporate ESG principles and offering research that highlights sustainability. Advising clients on how to build portfolios aligned with these evolving market expectations is crucial for staying competitive and meeting client demand.

For instance, in 2024, global sustainable investment assets were projected to reach $50 trillion, demonstrating a clear market shift. Firms like Jefferies that proactively integrate ESG into their offerings are better positioned to capture this growth and serve their clients' evolving values.

Financial regulators worldwide are stepping up requirements for climate-related disclosures, with frameworks like the Task Force on Climate-related Financial Disclosures (TCFD) becoming more prevalent. For instance, by the end of 2024, the SEC's proposed climate disclosure rules, though facing legal challenges, signaled a strong direction toward mandatory reporting for many U.S. companies, impacting firms like Jefferies.

This regulatory shift means Jefferies might need to report its own climate-related risks and opportunities, and also assist its clients in navigating their evolving reporting duties. Failure to adapt could lead to non-compliance penalties and reputational damage.

Proactively addressing these evolving regulatory landscapes is vital for Jefferies, not only for meeting compliance standards but also for positioning itself as a leader in the growing field of sustainable finance and attracting environmentally conscious investors.

Reputational Risks Related to Environmental Impact

Jefferies' reputation is closely tied to its environmental stewardship. Negative public perception stemming from its own operational footprint or its financing activities in environmentally impactful sectors can significantly damage its brand. For instance, in 2024, a notable portion of investor sentiment surveys highlighted environmental, social, and governance (ESG) factors as critical in their investment decisions, with a growing emphasis on the financing activities of financial institutions.

To counter these reputational risks, Jefferies is actively pursuing a strategy of proactive engagement in sustainable practices. This includes transparent reporting on its environmental performance and a more rigorous selection process for clients and transactions, prioritizing those with a demonstrably positive or minimal environmental impact. This approach aims to bolster its standing as a responsible corporate citizen in an increasingly environmentally conscious market.

- 2024 ESG Fund Flows: Global ESG-focused funds saw continued, albeit moderated, inflows in early 2024, indicating sustained investor interest in sustainable investments.

- Reputational Impact Studies: Research from 2023 and early 2024 suggests that companies with poor environmental track records can experience a 5-10% decrease in market valuation due to reputational damage.

- Sustainable Finance Growth: The sustainable finance market, including green bonds and loans, continued its expansion in 2024, presenting both opportunities and risks for financial intermediaries like Jefferies.

Operational Sustainability and Resource Management

Jefferies Financial Group, like other financial services firms, focuses on operational sustainability by managing its environmental impact. This involves reducing energy consumption in its corporate offices and implementing waste reduction programs. For instance, many companies in the sector are setting targets for renewable energy use in their facilities.

Responsible sourcing of goods and services also plays a role, ensuring that suppliers adhere to environmental standards. This commitment to sustainability can resonate with clients who increasingly prioritize ESG (Environmental, Social, and Governance) factors in their investment decisions. In 2024, many financial institutions reported progress on reducing their Scope 1 and Scope 2 emissions, with Jefferies likely following suit.

- Energy Efficiency: Implementing smart building technologies and energy-efficient equipment in offices to lower electricity usage.

- Waste Management: Enhancing recycling programs and reducing paper consumption through digitalization initiatives.

- Supply Chain Responsibility: Engaging with vendors to promote sustainable practices throughout the procurement process.

- ESG Alignment: Demonstrating commitment to environmental stewardship to attract and retain clients and talent who value sustainability.

The increasing frequency of extreme weather events, such as those observed in 2023 and projected for 2024, directly impacts the physical assets of Jefferies' clients, influencing collateral values and investment portfolios. This also drives a growing demand for ESG-aligned investments, with global sustainable fund flows reaching record highs in early 2024, creating opportunities for Jefferies to advise on green finance and sustainable infrastructure.

Regulatory bodies are enhancing requirements for climate-related disclosures, with frameworks like TCFD gaining prominence. By the close of 2024, the SEC's proposed climate disclosure rules signaled a move towards mandatory reporting for many U.S. companies, necessitating that firms like Jefferies assist clients in navigating these evolving reporting duties and potentially report their own climate risks.

Jefferies' reputation is intrinsically linked to its environmental performance, with investor sentiment surveys in 2024 highlighting ESG factors as crucial. Negative public perception from environmentally impactful financing activities can lead to market valuation decreases, as suggested by studies showing a 5-10% drop for companies with poor environmental track records.

Operational sustainability is a key focus, involving efforts to reduce energy consumption and waste in corporate offices, mirroring sector-wide trends. For instance, many financial institutions reported progress on reducing Scope 1 and 2 emissions in 2024, with Jefferies likely implementing similar measures such as smart building technologies and enhanced recycling programs.

| Environmental Factor | Impact on Jefferies | 2024/2025 Data/Projections |

|---|---|---|

| Climate Change (Physical & Transition Risks) | Asset devaluation, regulatory compliance needs, demand for green finance | Extreme weather events increasing; global sustainable fund flows hit record highs early 2024. |

| ESG Investment Trend | Increased demand for sustainable products and advisory services | Global sustainable investment assets projected to reach $50 trillion in 2024. |

| Climate Disclosure Regulations | Need for internal reporting and client advisory on compliance | SEC's proposed climate rules by end of 2024 signaled mandatory reporting direction. |

| Reputational Risk | Potential market valuation decrease due to poor environmental performance | Studies suggest 5-10% market valuation decrease for companies with poor environmental track records. |

| Operational Sustainability | Cost savings, enhanced brand image, client attraction | Many financial institutions reported progress on reducing Scope 1 & 2 emissions in 2024. |

PESTLE Analysis Data Sources

Our PESTLE analysis for Jefferies Financial Group is built upon a comprehensive review of data from official financial regulatory bodies, global economic institutions, and leading industry research firms. This ensures that insights into political, economic, social, technological, legal, and environmental factors are grounded in credible and current information.