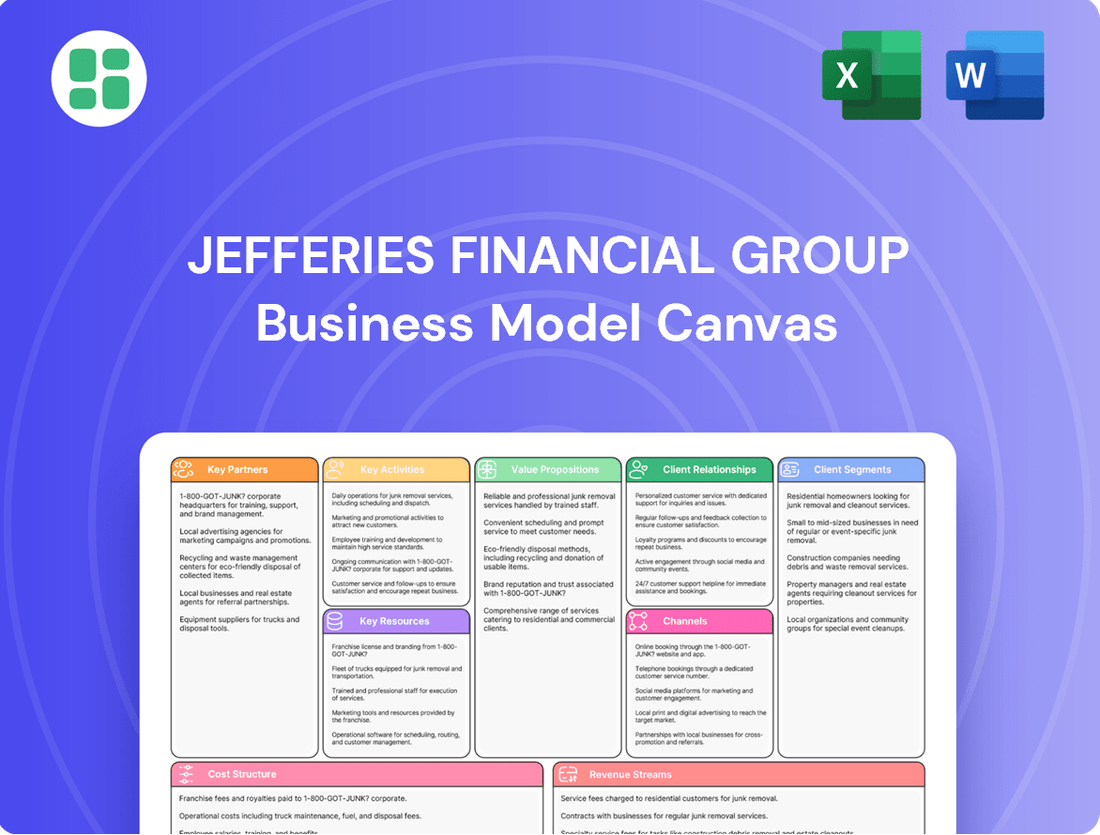

Jefferies Financial Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Jefferies Financial Group Bundle

Discover the core engine of Jefferies Financial Group's success with our comprehensive Business Model Canvas. This detailed breakdown illuminates how they connect with diverse client segments, forge strategic partnerships, and deliver unique value propositions across investment banking, capital markets, and asset management.

Ready to dissect the strategic framework of a financial powerhouse? Our full Business Model Canvas for Jefferies Financial Group provides an in-depth look at their revenue streams, cost structures, and key resources, offering invaluable insights for anyone looking to understand industry dynamics.

Unlock the strategic blueprint of Jefferies Financial Group. This complete Business Model Canvas reveals their approach to customer relationships, channels, and competitive advantages, making it an essential tool for analysts, students, and strategists.

Partnerships

Jefferies' strategic alliance with SMBC Group is a cornerstone of its business model, significantly enhancing its global capabilities. This partnership, which began in 2021, has seen expanded cooperation in corporate and investment banking across North America, Europe, the Middle East, and Africa.

The collaboration specifically targets key areas like leveraged finance, M&A advisory, and capital markets, enabling Jefferies to tap into SMBC's robust balance sheet and extensive international network. This synergy allows Jefferies to offer a more comprehensive suite of services to its clients worldwide.

Further solidifying this relationship, SMBC Group has become a major shareholder in Jefferies, with plans to increase its economic ownership to as much as 15%. This substantial investment underscores the mutual commitment and shared vision for growth between the two financial institutions.

Jefferies actively engages syndication partners and co-advisors, acting as joint bookrunners and co-facilitators on significant M&A, equity, and debt transactions. These collaborations are vital for managing the execution of large-scale deals, broadening the distribution of securities, and effectively sharing risk in complex financial undertakings.

In 2024, Jefferies continued to leverage these partnerships to facilitate a wide range of capital markets activities. For instance, their involvement in numerous syndicated loan facilities and high-yield bond offerings underscores the importance of these relationships in accessing broader investor bases and ensuring successful deal completion.

Jefferies' strategic alliances with technology and data providers are crucial for refining its trading platforms and analytical tools. These partnerships enable the firm to tap into cutting-edge solutions, thereby boosting its electronic execution services and global liquidity provision.

By integrating advanced electronic trading and equity finance platforms, Jefferies ensures efficient and effective market access for its clients. This focus on technological integration is a key driver of its competitive advantage.

In 2024, Jefferies continued to invest significantly in these technology relationships, recognizing their role in maintaining operational efficiency and delivering superior client outcomes in a rapidly evolving financial landscape.

Regulatory Bodies and Industry Associations

Jefferies maintains crucial partnerships with regulatory bodies such as the Securities and Exchange Commission (SEC) in the United States and the Financial Conduct Authority (FCA) in the United Kingdom. These relationships are vital for ensuring compliance with evolving financial regulations and capital requirements, which directly impact Jefferies' ability to operate across different markets. For instance, adherence to Basel III capital adequacy ratios is a constant focus.

Active involvement in industry associations, like SIFMA (Securities Industry and Financial Markets Association), allows Jefferies to contribute to the development of market best practices and standards. This engagement helps shape the regulatory landscape and ensures the firm remains aligned with industry-wide initiatives aimed at enhancing market integrity and investor protection. In 2024, these associations were instrumental in discussions around digital asset regulation.

- Regulatory Compliance: Jefferies adheres to stringent capital requirements set by bodies like the Federal Reserve and the European Central Bank, crucial for its global operations.

- Industry Standards: Participation in associations like the International Capital Market Association (ICMA) helps Jefferies influence and adopt best practices in areas like bond issuance.

- Market Integrity: Collaborating with regulators ensures Jefferies upholds customer protection provisions and maintains fair market practices, a cornerstone of trust in financial services.

Asset Management Affiliates and Fund Managers

Jefferies partners with its asset management affiliates and external fund managers, often through revenue and profit-sharing agreements. This collaborative approach is crucial for broadening the firm's investment product suite and tapping into specialized expertise. For instance, as of early 2024, Jefferies' asset management segment, which includes its affiliated businesses, managed a significant portion of assets, benefiting from performance fees generated by successful fund management.

- Revenue Sharing: Agreements with affiliates and external managers allow for shared income streams based on assets under management and investment performance.

- Performance Fees: A key driver of profitability comes from performance-based fees earned on the successful management of client assets and funds.

- Diversification: These partnerships enable Jefferies to offer a wider array of investment strategies and cater to a more diverse client base, enhancing its overall market reach.

Jefferies' key partnerships are vital for its operational success and market reach. The strategic alliance with SMBC Group, a significant shareholder, enhances global capabilities in corporate and investment banking.

Collaborations with technology and data providers are crucial for improving trading platforms and analytical tools, boosting electronic execution services.

Partnerships with regulatory bodies like the SEC and FCA ensure compliance, while industry associations such as SIFMA help shape market best practices.

Agreements with asset management affiliates and external fund managers diversify the product suite and generate revenue through performance fees.

What is included in the product

This Jefferies Financial Group Business Model Canvas provides a detailed blueprint of its diversified financial services operations, outlining its key customer segments, value propositions, and revenue streams.

It offers a strategic overview of how Jefferies leverages its integrated platform across investment banking, capital markets, and asset management to deliver tailored solutions and generate returns.

The Jefferies Financial Group Business Model Canvas acts as a pain point reliever by offering a clear, one-page snapshot of their complex financial services operations.

This allows stakeholders to quickly grasp key value propositions and customer segments, simplifying strategic discussions and problem-solving.

Activities

Jefferies Financial Group's Investment Banking Advisory Services are a cornerstone of their business model, offering expertise in mergers and acquisitions (M&A) and restructuring. They provide critical strategic advice and execution support for intricate corporate transactions, helping clients navigate complex financial landscapes.

The firm has shown robust performance in advisory revenues, bolstered by growing market share and a surge in M&A activity across diverse industries. For instance, in the first quarter of 2024, Jefferies reported a significant increase in investment banking revenues, with advisory playing a key role in this growth, reflecting strong deal flow and successful client engagements.

Jefferies' capital markets underwriting and distribution is a cornerstone of its business, focusing on helping corporations and governments raise capital. This involves managing the entire process for issuing new stocks and bonds, from initial planning to final sale.

Key activities include underwriting initial public offerings (IPOs) and secondary offerings for equities, as well as facilitating debt placements. For instance, in 2023, Jefferies played a role in numerous equity and debt transactions, demonstrating its broad reach in capital raising for a diverse client base.

Their expertise extends across both equity and debt capital markets, providing clients with crucial access to funding. This allows businesses and governmental entities to secure the necessary capital for growth, expansion, or refinancing, with Jefferies acting as a vital intermediary.

Jefferies' sales and trading operations are a cornerstone, facilitating global transactions in equities, fixed income, and derivatives. They act as crucial market makers, providing liquidity and efficient execution for institutional clients worldwide.

In 2024, Jefferies continued to bolster its electronic trading infrastructure and equity finance capabilities, reflecting a strategic commitment to innovation and client service in a dynamic market environment.

Asset Management

Jefferies Financial Group's asset management arm actively manages both its own capital and that of external clients. This involves a diverse range of investment approaches, from pooled investment vehicles to individually tailored accounts and specialized financial products.

The revenue generated by this segment is directly tied to how well the investments perform and the fees charged for managing these assets. For instance, in the fiscal year ending November 30, 2023, Jefferies reported total net revenues of $5.1 billion, with its asset management segment contributing a portion of this, influenced by market conditions and client inflows.

- Proprietary and Third-Party Capital: Manages capital for both the firm and its clients.

- Investment Strategies: Offers a variety of approaches including commingled funds and separately managed accounts.

- Revenue Drivers: Performance of assets under management and management fees are key revenue sources.

- 2023 Performance: Jefferies' overall financial results in 2023, while not solely from asset management, provide context for the segment's operational environment.

Direct Investing and Principal Investments

Jefferies Financial Group actively participates in direct investing, deploying its own capital to support a range of ventures and manage specialized credit platforms such as Jefferies Credit Partners. This strategic deployment of capital across diverse asset classes is a cornerstone of their business model.

These principal investment activities are crucial for generating diversified revenue streams for Jefferies. For instance, in 2024, the firm continued to leverage its balance sheet for opportunistic investments, aiming to enhance profitability beyond traditional investment banking and brokerage services.

- Direct Capital Deployment: Jefferies utilizes its own funds for strategic investments.

- Credit Platform Management: Operations include managing entities like Jefferies Credit Partners.

- Diversified Revenue Generation: Principal investments contribute to a broader income base.

- Market Presence Expansion: These activities help solidify the firm's footprint across various financial sectors.

Jefferies' key activities revolve around providing comprehensive financial advisory and capital raising services. This includes advising on mergers and acquisitions, restructuring, and underwriting new debt and equity offerings for corporations and governments. They also engage in active sales and trading across global markets, facilitating transactions for institutional clients.

Furthermore, the firm manages assets for both internal and external clients, employing diverse investment strategies. A significant aspect of their business model also involves direct investing, where Jefferies deploys its own capital into various ventures and specialized credit platforms to generate diversified revenue streams.

| Key Activity | Description | 2023/2024 Data Highlight |

|---|---|---|

| Investment Banking Advisory | Mergers & Acquisitions, Restructuring advice | Advisory played a key role in significant revenue growth in Q1 2024. |

| Capital Markets Underwriting | Equity and Debt issuance for clients | Facilitated numerous equity and debt transactions in 2023. |

| Sales & Trading | Global execution of Equities, Fixed Income, Derivatives | Continued investment in electronic trading infrastructure in 2024. |

| Asset Management | Managing proprietary and third-party capital | Segment contributes to overall net revenues, influenced by market conditions. |

| Principal Investing | Direct deployment of firm capital, credit platforms | Leveraging balance sheet for opportunistic investments in 2024. |

Full Document Unlocks After Purchase

Business Model Canvas

The Business Model Canvas you are currently viewing is the exact document you will receive upon purchase. This preview showcases the complete structure and content of the Jefferies Financial Group's business model, providing a transparent look at what you'll be acquiring. Once your order is complete, you'll gain full access to this comprehensive, ready-to-use analysis.

Resources

Jefferies' most vital asset is its team of skilled professionals, encompassing investment bankers, traders, analysts, and wealth managers. These individuals are the engine behind the firm's operations and client relationships.

The firm actively invests in its people, focusing on recruitment, development, and ongoing training. This commitment ensures that Jefferies' employee-partners remain at the forefront of industry knowledge and client service delivery.

In 2024, Jefferies continued to emphasize talent development, recognizing that its human capital directly fuels client satisfaction and the company's overall momentum in a competitive financial landscape.

Jefferies Financial Group maintains a robust capital base and significant cash reserves, which are crucial for its ability to underwrite substantial deals and offer financing solutions. This financial strength allows the company to navigate market volatility effectively.

As of the first quarter of 2024, Jefferies reported total assets of $76.9 billion, highlighting its considerable financial resources. The firm's financial health is consistently evaluated by credit rating agencies, reinforcing its strong standing within the financial services sector.

Jefferies boasts an extensive global network, with over 40 offices strategically positioned across the Americas, Europe, and Asia. This expansive footprint ensures deep market penetration and facilitates seamless execution of cross-border transactions for its diverse clientele.

This widespread presence allows Jefferies to tap into varied market opportunities and offer localized expertise, a critical advantage in today's interconnected financial landscape. For instance, their significant presence in key financial hubs like New York, London, and Hong Kong enables them to effectively serve both global institutions and regional players.

Proprietary Technology and Trading Platforms

Jefferies leverages its proprietary technology, including advanced electronic trading systems and sophisticated data analytics, to drive operational efficiency and deliver superior client service. This technological backbone is crucial for gaining market insights and maintaining a competitive edge.

Continuous investment in these platforms is a cornerstone of Jefferies' strategy, aiming to enhance execution capabilities and foster innovation. In 2024, the firm continued to prioritize upgrades to its trading infrastructure and data analytics tools.

- Advanced Electronic Trading Systems: Facilitate high-speed, efficient order execution across various asset classes.

- Proprietary Data Analytics: Provide deep market insights and inform strategic decision-making for the firm and its clients.

- Client-Facing Platforms: Offer seamless access to research, trading tools, and personalized financial solutions.

- Investment in R&D: Ensures ongoing development and integration of cutting-edge financial technologies.

Regulatory Licenses and Compliance Frameworks

Holding the necessary regulatory licenses and maintaining a stringent compliance framework are foundational for Jefferies Financial Group's diversified financial services operations. These licenses, such as those required for broker-dealer activities and asset management, are essential for conducting business legally across numerous global jurisdictions.

Jefferies' commitment to compliance is critical for building trust and ensuring operational integrity. In 2024, the financial services industry continued to navigate complex and evolving regulatory landscapes, making robust compliance frameworks a key differentiator and a prerequisite for market access.

- Broker-Dealer Licenses: Essential for underwriting, trading, and distributing securities.

- Asset Management Licenses: Required for managing investment portfolios for institutional and individual clients.

- Global Compliance: Adherence to regulations from bodies like the SEC, FINRA, FCA, and others is paramount.

- Risk Management: Integrated compliance and risk management systems mitigate operational and reputational risks.

Jefferies' key resources are its talented workforce, significant capital, global reach, proprietary technology, and essential regulatory licenses. These elements collectively enable the firm to deliver a comprehensive suite of financial services and maintain a competitive edge in the market.

Value Propositions

Jefferies provides clients with deep industry knowledge and strategic guidance for intricate deals such as mergers, acquisitions, divestitures, and restructurings. This expert counsel is crucial for navigating volatile markets and achieving ambitious growth targets.

The firm is recognized for delivering insightful, expert, and execution-oriented solutions. For instance, in 2024, Jefferies advised on numerous significant transactions across various sectors, demonstrating their capability to manage complex financial maneuvers and support client objectives.

Jefferies Financial Group offers clients unmatched entry into global equity and debt markets, crucial for raising capital and finding investment opportunities. This includes orchestrating Initial Public Offerings (IPOs) and debt issuances, linking companies with a wide array of institutional investors. In 2023, Jefferies played a role in over 100 capital markets transactions, demonstrating its reach.

Jefferies excels at crafting personalized investment strategies and providing essential liquidity solutions. They cater to a wide array of asset classes, from stocks and bonds to more complex alternative investments, ensuring clients have access to diverse opportunities.

This customization extends to developing unique products and services. These are specifically designed to address the distinct requirements of corporations, institutional investors, and high-net-worth individuals, demonstrating a deep understanding of varied client needs.

For instance, in 2024, Jefferies facilitated significant capital raising for corporations through tailored debt and equity offerings, enhancing their liquidity and growth prospects. Their ability to structure complex transactions underscores their commitment to bespoke financial engineering.

Independent and Client-Centric Approach

Jefferies operates as an independent global investment bank, prioritizing a client-centric philosophy. This means they focus on building enduring relationships grounded in trust and a thorough grasp of each client's unique requirements.

Their independence is a cornerstone, enabling them to provide advice and solutions that are free from conflicts of interest. This allows for truly tailored strategies designed to meet specific client objectives.

In 2023, Jefferies reported net revenues of $5.5 billion, a testament to their ability to serve a diverse client base effectively. This financial performance underscores their commitment to delivering value through their independent, client-focused model.

- Independence: Unbiased advice and solutions.

- Client-Centricity: Long-term relationships built on trust.

- Tailored Solutions: Strategies designed for individual client needs.

- Financial Strength: $5.5 billion in net revenues for 2023 highlights market trust.

Global Research and Market Insights

Jefferies' Global Research and Market Insights value proposition is central to its client-centric approach. The firm delivers extensive research across equities, fixed income, and alternative investments, equipping clients with the knowledge to navigate complex global markets.

This deep dive into sectors and products empowers informed investment and strategic business decisions. For instance, in 2023, Jefferies' research analysts covered over 1,300 companies, providing valuable data points for clients.

These insights are not just for investment decisions; they directly support Jefferies' trading activities and advisory services. By understanding emerging market trends and identifying opportunities, clients can enhance their financial strategies.

- Comprehensive Coverage: Research spans global equities, fixed income, and alternative asset classes.

- Strategic Insights: Analysis helps clients understand market dynamics and identify opportunities.

- Informed Decision-Making: Data-driven research supports investment and business strategy.

- Support for Services: Insights underpin trading, M&A advisory, and capital markets activities.

Jefferies' core value proposition lies in its ability to provide clients with expert advice and execution across a broad spectrum of financial services. This includes deep industry knowledge for complex transactions like mergers and acquisitions, as well as access to global capital markets for raising funds.

The firm differentiates itself through its independent, client-centric approach, focusing on building lasting relationships and delivering tailored solutions. Their commitment to personalized strategies is evident in their ability to structure unique financial products designed for diverse client needs, from corporations to high-net-worth individuals.

Furthermore, Jefferies offers robust global research and market insights, empowering clients with data-driven knowledge to navigate markets and make informed investment and strategic decisions. This comprehensive coverage supports their advisory, trading, and capital markets activities, reinforcing their role as a trusted financial partner.

| Value Proposition | Description | 2023/2024 Relevance |

|---|---|---|

| Expert Advisory & Execution | Guidance on M&A, restructuring, and complex deals. | Advised on numerous significant transactions in 2024. |

| Global Capital Markets Access | Connecting clients to equity and debt markets for capital raising. | Involved in over 100 capital markets transactions in 2023. |

| Tailored Financial Solutions | Personalized investment strategies and liquidity solutions across asset classes. | Facilitated significant capital raising for corporations via tailored offerings in 2024. |

| Independence & Client-Centricity | Unbiased advice and long-term relationships built on trust. | Reported $5.5 billion in net revenues in 2023, reflecting client trust. |

| Global Research & Insights | Extensive research across asset classes to inform client decisions. | Covered over 1,300 companies with research in 2023. |

Customer Relationships

Jefferies prioritizes deep, personalized client relationships, a cornerstone of its business model. This involves dedicated teams offering high-touch service, ensuring clients feel valued and understood.

Senior banker engagement is crucial, meaning clients directly interact with experienced professionals. This provides access to expert insights and strategic guidance, fostering trust and long-term partnerships.

In 2023, Jefferies reported strong client retention rates, underscoring the effectiveness of this relationship-centric approach. This focus on dedicated coverage and senior involvement directly translates into tailored advice and consistent support for their diverse clientele.

Jefferies prioritizes cultivating long-term, strategic partnerships, moving beyond simple transactions to become indispensable advisors for corporations and institutional investors. This deepens client loyalty and drives sustained revenue streams.

Jefferies fosters customer relationships through an advisory and consultative approach, acting as an integral part of client teams. This deep collaboration allows them to proactively offer advice and tailored solutions, identifying growth opportunities and effectively mitigating risks.

In 2024, Jefferies continued to emphasize this partnership model, particularly evident in their investment banking and capital markets divisions. For instance, the firm advised on numerous complex M&A transactions and capital raises, demonstrating their role as trusted advisors in critical strategic moments for their clients.

Digital Platforms and Client Portals

While Jefferies is known for its high-touch client interactions, it effectively utilizes digital platforms and client portals. These digital channels offer clients direct access to crucial market data, in-depth research reports, and sophisticated trading tools, streamlining their engagement with the firm.

These platforms are designed to boost operational efficiency for both Jefferies and its clients. They ensure clients receive timely information and can manage many of their needs through self-service options, which is particularly valuable in fast-moving markets.

- Enhanced Access: Clients can access real-time market data and proprietary research 24/7 through dedicated online portals.

- Self-Service Capabilities: Portals allow clients to execute trades, view portfolio performance, and manage account information independently.

- Digital Engagement: In 2023, Jefferies reported significant growth in digital platform usage, with a substantial increase in client logins and transaction volumes processed online.

Post-Transaction Support and Continuous Engagement

Jefferies Financial Group views customer relationships as a long-term partnership, extending well beyond the initial transaction. They offer continuous support, including market insights and analysis, to help clients navigate evolving financial landscapes. This proactive approach aims to identify future opportunities and solidify enduring client loyalty.

- Ongoing Support: Post-deal advisory and market intelligence are key components.

- Future Opportunity Identification: Proactively seeking new avenues for client growth.

- Client Retention: Fostering long-term value through consistent engagement.

Jefferies cultivates deep, personalized relationships, acting as strategic partners rather than mere service providers. This involves senior banker engagement and a consultative approach, ensuring clients receive tailored advice and proactive support, fostering enduring loyalty and repeat business.

In 2024, Jefferies continued to strengthen these bonds through dedicated coverage and advisory services across investment banking and capital markets, evidenced by their involvement in numerous complex transactions. This focus on partnership is a key driver of client retention and sustained revenue growth.

The firm also leverages digital platforms for enhanced client access to data and tools, complementing high-touch interactions. In 2023, significant growth in digital platform usage demonstrated the successful integration of technology to streamline client engagement and provide efficient access to critical resources.

| Relationship Aspect | Jefferies' Approach | 2023/2024 Data/Observation |

|---|---|---|

| Personalization | Dedicated teams, senior banker involvement | High client retention rates reported in 2023 |

| Advisory Role | Consultative, integral part of client teams | Involvement in numerous complex M&A and capital raises in 2024 |

| Digital Engagement | Client portals for data, research, trading | Significant growth in digital platform usage in 2023 |

Channels

Jefferies' primary distribution channel is its extensive global direct sales force and highly specialized investment banking teams. These professionals are the direct interface with clients, fostering relationships and understanding their unique needs.

These teams are instrumental in originating new business opportunities, from mergers and acquisitions to capital raising. Their expertise allows them to provide tailored advisory services and efficiently execute complex transactions, driving significant revenue for the firm.

In 2024, Jefferies continued to leverage these core channels, with investment banking fees forming a substantial portion of its revenue. The firm's ability to connect directly with a broad client base, including corporations, financial institutions, and governments, underscores the critical role of its sales and banking teams in its business model.

Jefferies leverages its extensive global trading desks and sophisticated electronic platforms to serve its capital markets clients. These channels are crucial for executing a wide range of financial instruments, including equities, fixed income, and derivatives, ensuring efficient order management and robust liquidity provision.

In 2024, Jefferies' electronic trading capabilities continued to be a cornerstone of its client service. The firm's platforms facilitate high-volume transactions, offering clients direct market access and advanced analytical tools to optimize their trading strategies. This technological investment supports their ability to execute trades swiftly and effectively across various asset classes.

Jefferies leverages its deep institutional networks, including pension funds, hedge funds, and sovereign wealth funds, as a primary channel for sourcing new deals and attracting clients. This established presence within the investment community is crucial for business development.

Referrals from satisfied existing clients are a significant contributor to Jefferies' growth, reinforcing the value of strong client relationships and successful transaction execution. In 2024, the firm continued to build on these trusted partnerships.

Online Presence and Investor Relations Portal

Jefferies Financial Group leverages its corporate website and a dedicated investor relations portal as key channels for its online presence. These platforms are crucial for transparent communication, offering investors and the public direct access to vital company information.

The investor relations portal provides a wealth of resources, including quarterly and annual financial reports, earnings call transcripts, and press releases. This accessibility ensures stakeholders can stay informed about the company's performance and strategic direction. For instance, as of their Q1 2024 earnings report, Jefferies highlighted significant growth in advisory fees and trading revenues, details readily available through these online channels.

- Corporate Website: Serves as the primary digital storefront for Jefferies, offering general company information, news, and career opportunities.

- Investor Relations Portal: A dedicated hub for financial stakeholders, featuring SEC filings, investor presentations, and webcasts of earnings calls.

- Transparency and Accessibility: These online tools are fundamental to Jefferies' commitment to open communication and providing easy access to critical financial data for investors.

- Digital Engagement: Facilitates efficient dissemination of information, supporting informed decision-making for a broad range of investors.

Industry Conferences and Thought Leadership Events

Jefferies actively participates in and hosts a variety of industry conferences, seminars, and thought leadership events. These gatherings are crucial for engaging with clients and fostering new business opportunities. For instance, in 2024, Jefferies hosted its annual Global Healthcare Conference, bringing together over 1,500 attendees including company executives, investors, and industry experts. This event, along with others like their Financial Services Conference, serves as a platform to showcase the firm's deep sector knowledge and market insights.

These events are not just about showcasing expertise; they are vital for networking and knowledge exchange within the financial ecosystem. By facilitating direct interaction, Jefferies strengthens relationships with existing clients and cultivates new ones. The firm's commitment to thought leadership is evident in the caliber of speakers and the depth of discussions at these events, positioning them as a key player in market analysis and strategic advice.

- Client Engagement: Direct interaction at conferences builds stronger client relationships.

- Business Development: Events provide a platform for identifying and securing new business.

- Expertise Showcase: Hosting and speaking at events highlights Jefferies' industry knowledge.

- Networking: Facilitates crucial connections within the financial community.

Jefferies' channels are a blend of direct client engagement and sophisticated digital platforms. Its global sales force and investment banking teams are paramount for originating business and providing tailored advice, a core strength in 2024. Electronic trading desks and advanced platforms ensure efficient execution across asset classes, supporting high-volume transactions.

Customer Segments

Jefferies Financial Group actively engages with a wide array of corporations, from massive global players to dynamic middle-market businesses spanning numerous industries. These corporate clients rely on Jefferies for critical advisory services, including mergers and acquisitions (M&A), raising capital through debt and equity, and developing bespoke financial strategies to navigate complex market landscapes.

In 2023, Jefferies facilitated significant M&A transactions and capital markets deals for its corporate clients, demonstrating its capability in executing complex financial maneuvers. For instance, the firm advised on several high-profile public offerings and private placements, underscoring its role in facilitating growth and strategic restructuring for businesses.

Institutional investors, a cornerstone of Jefferies Financial Group's client base, encompass a diverse range of entities including pension funds, hedge funds, mutual funds, and sovereign wealth funds. These sophisticated clients rely on Jefferies for its robust sales and trading capabilities, in-depth market research, and privileged access to a broad spectrum of investment opportunities. In 2024, Jefferies continued to strengthen its relationships with these key players, facilitating significant capital flows across various asset classes.

Jefferies' wealth management arm actively serves high-net-worth individuals and family offices, offering tailored investment strategies and comprehensive financial planning. This segment prioritizes personalized guidance and access to unique investment prospects, reflecting a demand for sophisticated, bespoke financial solutions.

In 2024, the global wealth management market continued its robust growth, with assets under management for high-net-worth individuals reaching significant figures, underscoring the substantial market opportunity for firms like Jefferies that excel in providing exclusive access and expert advice.

Private Equity Sponsors and Financial Sponsors

Jefferies is a key partner for private equity sponsors and financial sponsors, providing comprehensive advisory services for mergers, acquisitions, and divestitures. They also offer crucial support in leveraged finance and capital markets transactions, directly impacting the deal-making process for these entities.

This segment represents a substantial portion of Jefferies' investment banking revenue. For instance, in 2023, Jefferies reported strong performance in its Investment Banking segment, which is heavily influenced by sponsor-driven activity, reflecting the continued robust M&A market and the firm's deep relationships within the private equity community.

- Advisory Services: Jefferies advises private equity firms on strategic transactions, including identifying targets, conducting due diligence, and negotiating deal terms.

- Financing Solutions: The firm provides critical financing, such as leveraged loans and high-yield bonds, to support sponsor-led buyouts and recapitalizations.

- Capital Markets Expertise: Jefferies assists sponsors in accessing public and private capital markets for equity and debt offerings to fund acquisitions or provide liquidity.

- Divestiture Support: They also help private equity owners in divesting portfolio companies, maximizing value through strategic sales processes.

Governments and Public Sector Entities

Jefferies, like many diversified financial services firms, likely engages with governments and public sector entities by providing expertise in capital markets transactions. This can include assisting with the issuance of municipal bonds or sovereign debt. For instance, in 2023, municipal bond issuance in the U.S. reached approximately $390 billion, highlighting a significant market for such advisory services.

The firm's global presence suggests potential involvement in advising national governments or regional bodies on financing large-scale infrastructure projects. These projects are crucial for economic development and often require complex financial structuring and access to international capital markets. The U.S. infrastructure market alone is projected to see trillions in investment over the coming decades.

Strategic advisory is another key area where Jefferies might serve public sector clients. This could involve helping government agencies optimize their financial operations, manage public debt, or navigate complex regulatory environments. Such engagements are vital for efficient public administration and fiscal responsibility.

- Capital Markets Transactions: Assisting governments with bond issuances and debt management.

- Infrastructure Financing: Providing financial structuring for large public projects.

- Strategic Advisory: Offering guidance on financial operations and public debt management.

Jefferies Financial Group serves a diverse clientele, primarily focusing on corporations seeking advisory and capital markets services, and institutional investors requiring robust trading and research capabilities. The firm also caters to high-net-worth individuals through its wealth management division and partners with private equity sponsors for deal execution and financing. Additionally, Jefferies may engage with government and public sector entities for capital markets transactions and strategic financial advice.

| Customer Segment | Key Needs | 2023/2024 Relevance |

|---|---|---|

| Corporations | M&A advisory, capital raising, financial strategy | Facilitated significant M&A and capital markets deals; advised on public offerings and private placements. |

| Institutional Investors | Sales & trading, market research, investment opportunities | Strengthened relationships, facilitated capital flows across asset classes in 2024. |

| High-Net-Worth Individuals & Family Offices | Tailored investment strategies, financial planning, exclusive access | Global wealth management market robust in 2024; focus on personalized guidance. |

| Private Equity Sponsors | M&A advisory, financing solutions, capital markets access | Strong performance in Investment Banking segment influenced by sponsor activity in 2023. |

| Governments & Public Sector | Capital markets transactions, infrastructure financing, strategic advisory | Municipal bond issuance ~$390 billion in 2023; significant infrastructure investment projected. |

Cost Structure

Jefferies Financial Group's cost structure heavily features compensation and benefits, a natural consequence of its human capital-intensive operations in investment banking and capital markets. This includes substantial outlays for salaries, performance-based bonuses, and comprehensive benefits packages for its extensive workforce of financial experts.

For the fiscal year ending November 30, 2023, Jefferies reported total compensation and benefits expenses of $2.6 billion. This figure underscores the significant investment the firm makes in attracting and retaining top talent, which is crucial for its advisory and trading services.

Jefferies Financial Group dedicates significant capital to its technology and infrastructure, a necessity for thriving in the fast-paced financial services sector. These investments are not merely operational costs but strategic enablers, ensuring the firm remains at the forefront of innovation and efficiency.

In 2024, the company continued to heavily invest in its trading platforms, data analytics capabilities, and robust cybersecurity measures. These expenditures are vital for providing clients with seamless, secure, and high-speed access to markets, as well as for managing the vast amounts of data generated daily.

Jefferies Financial Group, like all major financial institutions, faces substantial regulatory and compliance costs. Operating within the financial services sector means adhering to a complex web of global and national regulations, which translates into significant expenses for legal counsel, compliance officers, and the implementation of robust internal controls. For instance, in 2023, the financial services industry as a whole saw increased spending on compliance, driven by evolving regulations in areas like data privacy and anti-money laundering.

These expenditures are critical for mitigating legal risks and safeguarding the firm's reputation. Jefferies must invest in systems and personnel to ensure adherence to rules set by bodies like the SEC and FINRA, among others. The cost of staying compliant is not just about avoiding penalties; it’s an integral part of maintaining operational integrity and stakeholder trust in a highly scrutinized industry.

Occupancy and Operational Expenses

Jefferies Financial Group incurs significant costs related to its global office spaces, encompassing rent, property taxes, and maintenance. These physical locations are essential for supporting its diverse business segments and facilitating client interactions worldwide.

Operational expenditures, including utilities, insurance, and supplies, are also a core component of the cost structure. These are necessary for the smooth functioning of the firm's day-to-day business activities across all its divisions.

- Office Space Costs: In 2024, Jefferies' occupancy expenses, which include rent and related charges for its numerous global offices, represent a substantial outlay, reflecting its commitment to maintaining a significant physical presence.

- Administrative Support: Costs for administrative staff, IT infrastructure, and general overhead are crucial for managing the firm's complex operations and supporting its workforce.

- Utilities and General Operations: Expenses for electricity, water, internet services, and other general operational needs are consistently factored into the cost structure to ensure business continuity.

- Global Network Maintenance: Maintaining a network of offices across key financial centers globally necessitates ongoing investment in infrastructure and operational upkeep.

Business Development and Marketing Costs

Jefferies Financial Group dedicates significant resources to business development and marketing. These expenses are crucial for acquiring new clients and retaining existing ones, directly impacting market share. In 2024, the firm continued to invest in digital marketing campaigns and targeted outreach programs. Market research also plays a key role, informing strategy and product development.

Participation in key industry conferences and events is another important facet of their marketing strategy. These engagements foster brand visibility and provide opportunities for client networking and relationship building. For instance, Jefferies actively participates in major financial forums throughout the year, a common practice for investment banks seeking to showcase expertise and attract business.

- Client Acquisition: Costs associated with sales teams, advertising, and promotional activities aimed at bringing in new business.

- Marketing Efforts: Spending on brand building, content creation, digital advertising, and public relations to enhance market presence.

- Market Research: Investments in understanding market trends, competitor analysis, and customer needs to refine strategies.

- Industry Events: Expenses for sponsoring, attending, and exhibiting at conferences and trade shows to network and generate leads.

Jefferies Financial Group's cost structure is heavily weighted towards compensation and benefits, reflecting its reliance on skilled financial professionals. For the fiscal year ending November 30, 2023, compensation and benefits totaled $2.6 billion. This significant investment is essential for attracting and retaining the talent needed for its investment banking and capital markets operations.

Technology and infrastructure represent another substantial cost area, crucial for maintaining a competitive edge. In 2024, ongoing investments in trading platforms, data analytics, and cybersecurity were prioritized to ensure efficient and secure market access for clients. Regulatory and compliance costs are also a significant factor, driven by the complex financial services landscape and the need for robust internal controls to mitigate risk and maintain trust.

| Cost Category | FY 2023 (USD Billions) | Key Drivers |

|---|---|---|

| Compensation & Benefits | 2.6 | Salaries, bonuses, benefits for financial experts |

| Technology & Infrastructure | Not Specified | Trading platforms, data analytics, cybersecurity |

| Regulatory & Compliance | Not Specified | Legal, compliance personnel, internal controls |

| Occupancy & Operations | Not Specified | Office rent, utilities, insurance, administrative support |

| Business Development & Marketing | Not Specified | Client acquisition, brand building, industry events |

Revenue Streams

Jefferies Financial Group generates substantial revenue through investment banking advisory fees. These fees are primarily earned from advising clients on mergers and acquisitions (M&A) and corporate restructurings. The success-based nature of these fees means they are directly linked to the value and complexity of the transactions Jefferies helps facilitate.

For instance, in the fiscal year ending November 30, 2023, Jefferies' Investment Banking segment reported total revenues of $2.0 billion. A significant portion of this revenue is derived from advisory services, reflecting the firm's active role in guiding companies through critical strategic transactions.

Jefferies Financial Group generates significant revenue from underwriting and syndication fees. These fees are typically a percentage of the capital raised in equity offerings or the principal amount of debt issued on behalf of their clients.

For instance, in the fiscal year ending November 30, 2023, Jefferies reported total revenues of $5.2 billion. A substantial portion of this income is derived from investment banking activities, which include these critical underwriting and syndication services.

Jefferies Financial Group generates revenue from sales and trading through commissions charged on client transactions and the bid-ask spread from its own trading operations. This covers a wide range of financial instruments, including stocks, bonds, and derivatives.

Market conditions play a crucial role in this revenue stream. For instance, in the first quarter of fiscal year 2024, Jefferies reported a significant increase in net revenues, with their Investment Banking and Capital Markets segment, which includes sales and trading, showing robust performance driven by higher client activity and market volatility.

Asset Management Fees

Jefferies generates revenue through asset management fees, which include both management fees and performance fees. These are calculated based on the total assets under management (AUM) and how well those investments perform. This fee structure helps create a more stable and diversified income stream for the company.

For example, in the first quarter of 2024, Jefferies reported that its asset management segment, which includes its investment management arm, contributed significantly to its overall financial performance. While specific fee percentages vary by fund and client agreement, the AUM is a primary driver of these earnings. This segment is a crucial component in broadening Jefferies' revenue base beyond its traditional investment banking and trading activities.

- Asset Management Fees: Jefferies earns fees based on assets under management (AUM) and investment performance.

- Diversified Revenue: These fees contribute to a broader and more stable revenue profile for the company.

- Q1 2024 Performance: The asset management segment played a notable role in Jefferies' financial results during the first quarter of 2024.

Direct Investment Gains and Interest Income

Jefferies Financial Group generates substantial revenue through direct investment gains and interest income. These streams are crucial to its financial performance, reflecting successful capital deployment and lending operations.

Gains from direct investments, including those managed by its Jefferies Credit Partners platform, represent a significant portion of its earnings. For instance, in fiscal year 2024, the company reported robust performance across its investment portfolio, contributing positively to its overall financial results.

Interest income also plays a vital role, stemming from various lending activities and financial instruments. This income is generated from the company's credit facilities and other debt-related financial products, providing a steady revenue stream.

- Direct Investment Gains: Revenue earned from the appreciation and sale of assets held in the company's investment portfolio.

- Interest Income: Earnings generated from interest on loans, securities, and other financial instruments the company holds or provides.

- Jefferies Credit Partners: This platform specifically drives revenue through its direct and principal investment activities within the credit markets.

- Fiscal Year 2024 Performance: The company's financial reports for FY2024 highlighted the positive impact of these revenue streams on its profitability.

Jefferies Financial Group's diverse revenue streams are anchored in its investment banking and capital markets activities. These include advisory fees from M&A and restructuring, as well as underwriting and syndication fees from capital raising. Sales and trading also contribute significantly through commissions and bid-ask spreads. Additionally, asset management fees, derived from AUM and performance, and direct investment gains coupled with interest income from lending operations form key components of its financial performance.

| Revenue Stream | Description | Fiscal Year 2023 (USD Billions) | Fiscal Year 2024 (Q1 Commentary) |

|---|---|---|---|

| Investment Banking | Advisory fees (M&A, restructuring) | 2.0 (Total segment revenue) | Robust performance driven by client activity. |

| Capital Markets | Underwriting and syndication fees | Included in 5.2 (Total Investment Banking & Capital Markets) | Strong contribution to overall financial results. |

| Sales & Trading | Commissions and bid-ask spreads | Included in 5.2 (Total Investment Banking & Capital Markets) | Benefited from market volatility and increased client engagement. |

| Asset Management | Management and performance fees on AUM | N/A (Specific AUM figures not provided for FY23) | Contributed significantly to overall financial performance. |

| Investment Gains & Interest Income | Direct investment appreciation, interest on loans/securities | Positive impact on profitability (FY24 commentary) | Robust performance across investment portfolio and credit facilities. |

Business Model Canvas Data Sources

The Jefferies Financial Group Business Model Canvas is constructed using a blend of proprietary financial disclosures, comprehensive market research reports, and internal strategic assessments. These diverse data sources ensure a robust and accurate representation of the company's operations and market position.