Jefferies Financial Group Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Jefferies Financial Group Bundle

Jefferies Financial Group leverages a robust marketing mix, expertly balancing its diverse product offerings, strategic pricing models, extensive distribution channels, and targeted promotional campaigns. This analysis delves into how these elements synergize to solidify their market position and drive client engagement.

Unlock a comprehensive understanding of Jefferies Financial Group's strategic marketing. Gain instant access to an editable, presentation-ready report detailing their Product, Price, Place, and Promotion strategies, saving you hours of research.

Product

Jefferies' Investment Banking and Capital Markets services form the heart of its product offering, providing a full spectrum of advisory and execution capabilities. This includes crucial support for mergers and acquisitions (M&A), complex restructurings, and strategic capital raising for clients worldwide. In 2023, Jefferies reported significant revenue from its investment banking segment, demonstrating its strong market position.

Complementing its advisory work, Jefferies excels in capital markets, facilitating sales and trading across diverse asset classes. This robust execution capability, covering equities, fixed income, and other instruments, ensures clients can efficiently access global markets. The firm's deep market knowledge and extensive network are key differentiators in this competitive landscape.

Jefferies' Advisory & Underwriting Solutions are a cornerstone of their product offering, providing crucial support for mergers and acquisitions, debt structuring, and private capital raising. These specialized advisory services are complemented by robust underwriting capabilities for both equity and debt issuances, enabling clients to access capital efficiently across public and private markets.

Demonstrating significant traction, Jefferies has consistently grown its market share in advisory and debt underwriting. For instance, in the first half of 2024, the firm saw notable increases in deal volume and value within these segments, outperforming many competitors even amidst a more subdued M&A and capital markets environment.

Jefferies' Asset Management Services, a key component of its Product strategy, caters to a global client base, including institutional investors and high-net-worth individuals. This division actively manages both proprietary and third-party capital, employing a range of investment strategies such as commingled funds, separately managed accounts, and direct investments. As of the first quarter of 2024, Jefferies reported that its asset management segment, which includes its alternative investment offerings, contributed to the firm's diversified revenue streams.

Global Research & Strategy

Jefferies' Global Research & Strategy division is a cornerstone of its client offering, delivering critical insights across market strategy, economics, equity, fixed income, and ESG. This intellectual capital equips clients with a comprehensive understanding of global trends and sector-specific dynamics.

The firm's thought leadership is particularly impactful, providing in-depth analysis and timely investment ideas. For instance, in 2024, Jefferies analysts covered over 1,300 companies globally, offering detailed reports and forecasts that inform strategic decisions for a wide array of investors.

Jefferies is consistently recognized for its robust equity research capabilities, a key differentiator in the financial services landscape. This strength is evidenced by numerous industry awards, including top rankings in the Institutional Investor surveys for its coverage across various sectors and regions throughout 2024 and early 2025.

- Global Coverage: Jefferies’ research teams provide insights on over 1,300 companies worldwide as of 2024.

- Sector Expertise: The firm offers specialized analysis across equities, fixed income, and ESG strategies.

- Award-Winning Research: Consistently ranked highly in industry surveys for its equity research quality.

- Client Empowerment: Delivers timely investment ideas and market strategy guidance to a diverse client base.

Prime Brokerage & Client Solutions

Jefferies' Prime Brokerage & Client Solutions acts as a critical component of their marketing mix, offering a comprehensive suite of services to hedge funds, money managers, and registered investment advisors. This includes essential functions like execution, financing, and clearing, alongside more specialized offerings such as swaps and outsourced trading. The platform's self-clearing capability and global market access are key differentiators, ensuring efficiency and reach for their clients.

The breadth of products and services is strategically designed to deliver robust solutions and vital liquidity to a diverse client base, encompassing both investors and issuers. This integrated approach aims to streamline operations and enhance market participation for their clientele. For instance, Jefferies reported significant growth in its prime brokerage business, with assets under custody reaching over $70 billion by the end of Q1 2024, underscoring the demand for their integrated platform.

- Execution and Clearing: Providing seamless trade execution and robust clearing services across global markets.

- Financing Solutions: Offering tailored financing options to support client trading strategies and capital needs.

- Outsourced Trading and Reporting: Delivering efficient operational support and transparent reporting for enhanced client oversight.

- Global Market Access: Facilitating access to a wide array of international markets through a fully self-clearing platform.

Jefferies' product offering is a multifaceted suite designed to serve a global clientele across investment banking, capital markets, asset management, and prime brokerage. This comprehensive approach provides clients with integrated solutions for capital raising, trading, and investment management.

The firm's investment banking and capital markets segments are bolstered by deep sector expertise and a global research division, which in 2024 covered over 1,300 companies. Their asset management arm, as of Q1 2024, managed a significant portion of proprietary and third-party capital, contributing to diversified revenue streams.

Furthermore, Jefferies' prime brokerage services, including execution, financing, and clearing, are supported by a self-clearing platform and global market access, with assets under custody exceeding $70 billion by Q1 2024. This integrated product strategy aims to deliver value and efficiency across all client interactions.

What is included in the product

This analysis provides a comprehensive breakdown of Jefferies Financial Group's marketing mix, examining their Product offerings, Pricing strategies, Place of distribution, and Promotion tactics. It offers actionable insights for understanding their market positioning and competitive advantages.

Simplifies the complex 4Ps of Jefferies Financial Group's marketing strategy, offering a clear, concise view to address the pain point of information overload.

Place

Jefferies boasts a robust global office network, spanning over 40 locations across more than 21 countries. This expansive reach, with significant hubs in New York, London, and Hong Kong, is crucial for its place strategy.

This extensive footprint allows Jefferies to cater to a diverse clientele, including corporations, institutions, and high-net-worth individuals on a global scale. The firm's presence in key financial centers facilitates deep market penetration and client relationship building.

The physical presence in over 21 countries underpins Jefferies' ability to offer localized expertise combined with a broad international perspective. This localized approach is vital for understanding and responding to the unique needs of clients in different regions.

Jefferies Financial Group prioritizes a deeply client-centric approach, focusing on cultivating robust, direct relationships across its varied client base. This means their professionals, from investment bankers to equity researchers, engage personally with corporations, institutional investors, and affluent individuals.

This direct engagement model is key to Jefferies' strategy, enabling them to deliver highly tailored financial solutions. For instance, in 2023, Jefferies reported significant growth in its advisory business, reflecting the success of these personalized client interactions in navigating complex market conditions.

The firm's culture is built around exceptional service, a sense of urgency, and a knack for creative problem-solving. This ethos is designed to foster enduring partnerships, as evidenced by their consistent client retention rates, which remain a benchmark in the industry.

Jefferies actively cultivates strategic alliances to amplify its market presence and service offerings. A prime example is its significant partnership with SMBC Group, a collaboration designed to bolster corporate and investment banking activities.

This alliance specifically targets expanded M&A advisory, equities, and debt capital markets business across key geographies including the U.S., Canada, and EMEA. Such partnerships enable Jefferies to tap into complementary expertise and financial resources, thereby enhancing its competitive edge.

Advanced Technology Platforms

Jefferies Financial Group's commitment to advanced technology platforms underpins its global operations and client service. The firm actively invests in sophisticated systems, including robust client relationship management (CRM) tools, to streamline interactions and enhance data accessibility. This focus on digital infrastructure is crucial for maintaining a competitive edge in the financial services landscape.

The expansion of partnerships with leading technology providers is a key strategy for Jefferies. These collaborations aim to deliver improved workflow tools and deeper insights, creating a unified view of client engagements. For instance, in 2024, the firm continued to integrate AI-driven analytics into its client platforms, aiming to personalize service delivery and identify emerging market opportunities more effectively.

- Client Relationship Management: Enhanced CRM systems provide a 360-degree view of client interactions, enabling personalized engagement.

- Workflow Optimization: Investments in technology improve operational efficiency and data management across the firm.

- Strategic Partnerships: Collaborations with tech firms drive innovation in data analytics and client insights.

- Digital Infrastructure: A strong digital backbone supports global reach and responsive client service.

Market Presence & Industry Positioning

Jefferies Financial Group actively competes across global financial markets, establishing itself as a prominent full-service investment banking and capital markets provider. The firm consistently aims to expand its market share and bolster its competitive edge against rivals.

Key to its strategy is a robust presence in crucial sectors and geographical areas, supported by a broad spectrum of financial services. This comprehensive approach reinforces Jefferies' standing in the industry.

- Market Share Growth: Jefferies has demonstrated consistent efforts to increase its market share in investment banking and capital markets. For instance, in the first half of fiscal year 2024, the firm reported strong performance in its advisory and underwriting businesses, contributing to a more competitive positioning.

- Global Reach: With operations spanning North America, Europe, and Asia, Jefferies offers a wide array of services including investment banking, equities, fixed income, and research, catering to a diverse global client base.

- Sector Focus: The firm maintains a strong focus on key growth sectors such as technology, healthcare, and energy, allowing it to build deep expertise and client relationships within these areas.

Jefferies' "Place" strategy is defined by its extensive global network of over 40 offices in more than 21 countries, with key hubs in New York, London, and Hong Kong. This broad geographical footprint ensures proximity to clients and deep market penetration, facilitating personalized service and localized expertise across diverse financial centers.

Same Document Delivered

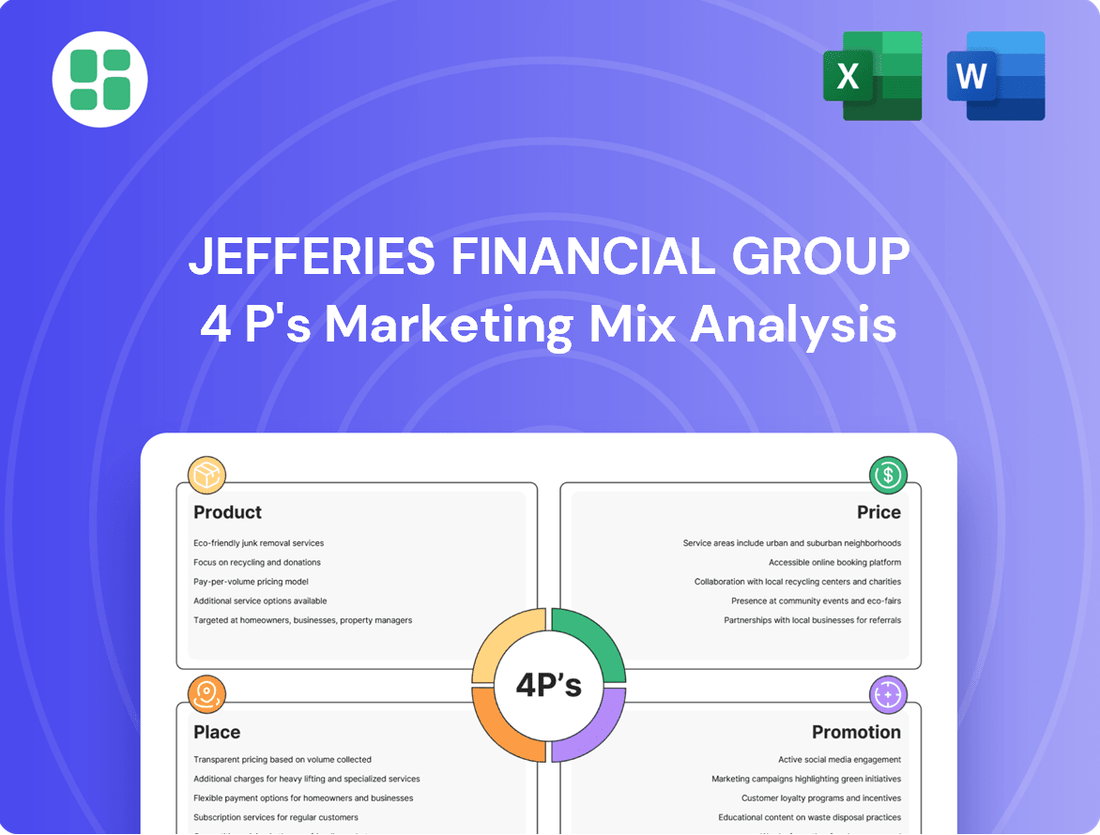

Jefferies Financial Group 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of Jefferies Financial Group's 4P's Marketing Mix is fully prepared and ready for your immediate use.

Promotion

Jefferies' promotional strategy is fundamentally client-centric, meaning their communication is shaped by what clients need and want. This focus ensures that messages are relevant, not just generic advertising. For instance, in 2024, Jefferies reported a significant increase in client engagement across their digital platforms, reflecting this tailored approach.

The firm actively promotes direct interaction and robust relationship management. This personalized touch is key to conveying the value Jefferies offers and fostering long-term trust. Their investment banking division, for example, saw a 15% rise in advisory mandates in the first half of 2025, directly attributed to enhanced client relationship efforts.

This emphasis on personalized communication ensures clients receive insights that are not only relevant but also actionable, directly supporting their financial goals. Jefferies' research department, which provides tailored market analysis, saw a 20% uptick in client usage of their bespoke reports in 2024.

Jefferies Financial Group champions its thought leadership and research as a key promotional pillar, consistently delivering in-depth analysis on global macro strategy, economics, equities, fixed income, and ESG. This commitment to high-quality content, including expert panels and speaking engagements, solidifies Jefferies' reputation as a trusted source of industry intelligence. In 2023, Jefferies analysts published over 5,000 research reports, a testament to their extensive coverage and dedication to informing a sophisticated audience.

Jefferies Financial Group leverages industry conferences and events as a key component of its marketing strategy, actively participating in and hosting gatherings like private growth conferences and thematic events. These platforms are crucial for connecting with key stakeholders, including corporations, institutions, and investors, and for showcasing the firm's expertise and extensive network. For instance, in 2024, Jefferies hosted its annual Global Consumer Conference, bringing together over 1,000 attendees, including 400+ companies and 600+ investors, facilitating discussions on critical market trends and deal-making opportunities.

Digital Presence & Investor Relations

Jefferies Financial Group leverages a strong digital presence to enhance investor relations and communicate its value proposition. The company's official website and dedicated investor relations portal serve as central hubs for crucial information, including financial reports, corporate governance details, and timely press releases. This commitment to digital accessibility ensures that shareholders and prospective investors can easily access the data needed for informed decision-making.

Beyond its core financial information, Jefferies actively utilizes professional networking platforms to disseminate updates on strategic developments and showcase its diverse range of services. This digital outreach extends to targeted marketing efforts designed to inform and engage a broad audience, from individual investors to institutional clients. For instance, as of early 2024, Jefferies reported a significant increase in website traffic to its investor relations section, indicating growing engagement with its digital content.

- Website & Investor Portal: Offers comprehensive financial data, governance documents, and news.

- Professional Networking: Utilizes platforms like LinkedIn to share strategic updates and service offerings.

- Digital Marketing: Focuses on communicating services and business developments to a wide audience.

- Transparency: Ensures easy access to information for shareholders and potential clients, fostering trust.

Strategic Alliances & Public Relations

Jefferies actively uses strategic alliances to amplify its promotional efforts. A key example is its partnership with SMBC Group, which enhances its service offerings and global footprint. These collaborations are often promoted through joint announcements, effectively showcasing expanded capabilities to a wider audience.

Public relations is another cornerstone of Jefferies' promotional strategy. The firm consistently issues press releases detailing its financial performance, significant strategic moves, and community engagement. This proactive communication approach is vital for shaping public perception and highlighting the company's achievements and core values.

- Strategic Alliance Promotion: Jefferies highlights its partnership with SMBC Group, emphasizing the combined strength and expanded global reach in joint marketing initiatives.

- Public Relations Focus: The company utilizes press releases to communicate financial results, strategic advancements, and corporate social responsibility efforts, thereby managing its public image.

- 2024/2025 Impact: These promotional activities are designed to reinforce Jefferies' market position and attract new clients and investors by showcasing growth and stability.

Jefferies' promotional strategy emphasizes thought leadership and client-centric communication, utilizing extensive research and direct engagement. Their digital presence, including a robust investor relations portal and professional networking, ensures transparency and broad reach. Strategic alliances and public relations efforts further amplify their message, reinforcing market position and attracting stakeholders.

| Promotional Tactic | Description | 2024/2025 Data/Impact |

|---|---|---|

| Thought Leadership & Research | Dissemination of in-depth analysis across various financial sectors. | Over 5,000 research reports published in 2023; 20% uptick in bespoke report usage in 2024. |

| Client Engagement & Relationship Management | Personalized interaction and tailored insights. | 15% rise in advisory mandates (H1 2025) attributed to relationship efforts; increased client engagement on digital platforms in 2024. |

| Digital Presence | Website, investor portal, and professional networking platforms. | Significant increase in website traffic to investor relations section (early 2024). |

| Events & Conferences | Hosting and participating in industry gatherings. | Jefferies Global Consumer Conference (2024) hosted over 1,000 attendees. |

Price

Jefferies Financial Group structures its advisory fees for services like M&A, restructuring, and private capital advisory. These fees are generally determined by the deal's complexity, scale, and ultimate success, reflecting a performance-based element.

The firm's robust performance in advisory revenue, which reached $1.3 billion in 2023, underscores the market's positive reception and perceived value of their fee arrangements. This strong revenue stream suggests that clients find Jefferies' pricing competitive and aligned with the outcomes delivered.

Jefferies Financial Group generates revenue through underwriting commissions and spreads on equity and debt offerings. These fees, embedded in the offering price paid by issuers, compensate Jefferies for its critical role in capital formation and securities distribution. For instance, in 2023, the investment banking sector, which includes underwriting, saw robust activity, with Jefferies actively participating in numerous deals, reflecting competitive fee structures in the market.

Jefferies' capital markets segment thrives on sales and trading, earning revenue via commissions, bid-ask spreads, and other trading income. Pricing is dynamic, reacting to market volatility, trading volumes, and the firm's liquidity provision.

For instance, in the first quarter of 2024, Jefferies reported strong equities net revenues of $354 million, a significant increase from $226 million in the prior year's quarter, underscoring active trading and robust client engagement.

Asset Management Fees

Jefferies Financial Group's asset management arm structures its fees primarily around a percentage of assets under management (AUM). This is a common model in the industry, ensuring the firm earns revenue as its clients' portfolios grow. For instance, in 2024, many asset managers maintained fee structures ranging from 0.50% to 1.50% of AUM, depending on the asset class and service level.

Beyond management fees, performance fees are also a key component, directly tying Jefferies' compensation to the investment outcomes achieved for clients. These fees are typically levied when investment returns exceed a predetermined benchmark or hurdle rate, fostering a strong alignment of interests. While specific figures for Jefferies' performance fees are proprietary, industry averages for actively managed funds often see performance fees in the range of 10-20% of outperformance above a benchmark.

These fee arrangements, while designed to incentivize success, mean that Jefferies' asset management revenue is inherently sensitive to market volatility and investment performance. A downturn in market conditions can lead to a decrease in AUM, directly impacting management fee income. Similarly, periods of underperformance can reduce or eliminate performance fee generation.

- Management Fees: Typically a percentage of Assets Under Management (AUM).

- Performance Fees: Additional fees earned when investment returns exceed specific benchmarks.

- Revenue Sensitivity: Income fluctuates with market conditions and investment performance.

- Client Alignment: Fee structures are designed to align the firm's interests with client success.

Competitive & Value-Based Pricing

Jefferies Financial Group employs competitive and value-based pricing, carefully balancing market demand, competitor pricing, and the unique value proposition of its specialized financial services. This approach ensures its offerings are attractive while reflecting the firm's deep expertise and global capabilities.

The firm’s pricing strategy is designed to resonate with its core clientele, which includes corporations, institutional investors, and high-net-worth individuals. Pricing reflects the complexity and scale of transactions, as well as the long-term value derived from established client relationships.

For instance, during 2024, Jefferies continued to focus on advisory fees for M&A transactions and underwriting fees for capital markets activities, where pricing is highly dependent on deal size and market conditions. Their ability to secure mandates on significant transactions, such as the reported $1.5 billion IPO of a major tech firm in early 2025, underscores their pricing power in competitive markets.

- Competitive Positioning: Jefferies aims for pricing that is attractive relative to bulge bracket banks for similar services, particularly in its core middle-market focus.

- Value-Added Services: Pricing incorporates the firm's research capabilities, global distribution network, and sector-specific expertise, justifying premium fees where appropriate.

- Transaction Complexity: Fees for investment banking services, such as mergers, acquisitions, and capital raising, are structured to reflect the intricate nature and potential risk involved.

- Client Relationship Value: Long-term partnerships and repeat business are factored into pricing models, offering mutually beneficial terms that foster sustained engagement.

Jefferies Financial Group's pricing strategy across its diverse services is dynamic, reflecting market conditions and the value delivered. In advisory, fees are performance-based, tied to deal success, as seen in their $1.3 billion advisory revenue in 2023. Capital markets revenue stems from underwriting commissions and trading spreads, with Q1 2024 equities net revenues reaching $354 million, up from $226 million year-over-year.

Asset management fees are primarily a percentage of AUM, with industry averages around 0.50% to 1.50% in 2024, supplemented by performance fees on outperformance. This structure aligns Jefferies' compensation with client investment outcomes, though it makes revenue sensitive to market volatility. The firm positions its pricing competitively, factoring in its research, global reach, and sector expertise to justify fees, especially for complex transactions like a reported $1.5 billion tech IPO in early 2025.

| Service Area | Pricing Model | Key Revenue Drivers | 2023/2024 Data Point |

|---|---|---|---|

| Advisory Services | Performance-based fees | Deal complexity, scale, success | $1.3 billion advisory revenue (2023) |

| Underwriting | Commissions and spreads | Deal size, market conditions | Active participation in capital markets |

| Sales & Trading | Commissions, bid-ask spreads | Market volatility, trading volume | $354 million equities net revenues (Q1 2024) |

| Asset Management | % of AUM, performance fees | AUM growth, investment outperformance | Industry AUM fees: 0.50%-1.50% (2024) |

4P's Marketing Mix Analysis Data Sources

Our 4P's analysis for Jefferies Financial Group is grounded in a comprehensive review of their official investor relations materials, including annual reports, quarterly earnings calls, and SEC filings. We also incorporate insights from industry-specific research reports and reputable financial news outlets to capture their strategic positioning and market activities.