JCDecaux SA SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

JCDecaux SA Bundle

JCDecaux SA, a global leader in outdoor advertising, boasts significant strengths in its expansive network and innovative digital offerings. However, understanding the nuances of its competitive landscape and potential regulatory shifts is crucial for strategic advantage.

Want the full story behind JCDecaux's market dominance, potential vulnerabilities, and future opportunities? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

JCDecaux holds the undisputed title of the world's largest outdoor advertising company, a position solidified by its expansive and geographically diverse Out-of-Home (OOH) media presence. This global footprint, spanning street furniture, transport hubs, and billboards across numerous countries, offers unparalleled reach and consistent brand visibility for advertisers.

In 2023, JCDecaux reported revenue of €3.1 billion, underscoring its market dominance. The company's extensive network, covering over 1.5 million advertising panels worldwide, provides a significant competitive edge, enabling clients to connect with audiences on a massive scale.

JCDecaux is capitalizing on the booming Digital Out-of-Home (DOOH) sector, which represents the fastest-growing segment in the Out-of-Home advertising market. This strength is clearly demonstrated by their substantial revenue growth in this area.

In the first half of 2024, JCDecaux's DOOH revenue experienced a remarkable 28.3% increase. By the end of full-year 2024, DOOH revenue constituted a significant 39% of the group's total revenue, up from 36.8% in H1 2024, underscoring its strategic importance.

The company's advanced programmatic capabilities are also a key advantage. Their VIOOH SSP saw programmatic advertising revenues jump by an impressive 61.8% in H1 2024 and a solid 45.6% for the full year 2024, showcasing their ability to leverage data and automation in advertising.

JCDecaux's revenue streams are impressively varied, encompassing street furniture, transport advertising, and large format billboards. This broad base is a significant strength, as it means the company isn't overly dependent on any one area of the advertising market.

The company saw robust organic growth across these segments in the first half of 2024 and expects this trend to continue for the full year. Specifically, transport advertising grew by 18.8% in H1 and is projected at 13.1% for the full year, while street furniture saw 10.6% growth in H1 and an expected 8.3% for the full year. Billboards also contributed, with 10.4% growth in H1 and a projected 6.6% for the full year.

This diversification across different advertising mediums and locations provides a strong foundation for stability. It helps to buffer the company against potential downturns in any single market segment, making JCDecaux more resilient to economic fluctuations.

Robust Financial Performance and Profitability

JCDecaux SA has demonstrated a robust financial performance, highlighted by a 14% adjusted revenue growth in the first half of 2024 and a 10.2% increase for the full year 2024. This strong top-line growth has directly contributed to enhanced profitability.

The company's profitability has seen significant improvement, with its adjusted operating margin expanding by 28.7% in H1 2024 and by 15.3% for the entire year. This upward trend in margins indicates effective operational management and pricing strategies.

Further solidifying its financial strength, JCDecaux reported substantial increases in net income and free cash flow. A notable achievement was the 25% reduction in net debt during 2024, underscoring a healthy financial structure and efficient capital allocation.

- Revenue Growth: 14% in H1 2024 and 10.2% for FY 2024.

- Operating Margin Improvement: 28.7% in H1 2024 and 15.3% for FY 2024.

- Net Debt Reduction: Decreased by 25% in 2024.

- Profitability Metrics: Significant increases in net income and free cash flow.

Commitment to Sustainability and ESG Leadership

JCDecaux SA stands out for its unwavering commitment to sustainability and its leadership in Environmental, Social, and Governance (ESG) practices. This dedication is consistently recognized through top-tier ratings and inclusion on prestigious lists, such as the CDP A List. This strong ESG profile resonates with an increasing global demand for responsible corporate behavior.

The company's ambitious climate strategy, targeting Net Zero Carbon by 2050 across all scopes, received validation from the Science Based Targets initiative (SBTi) in June 2024. This strategic alignment with scientific consensus underscores JCDecaux's proactive approach to climate change mitigation.

JCDecaux has made significant strides in reducing its environmental impact. In 2024, the company achieved a nearly 30% reduction in greenhouse gas emissions compared to 2019 levels. Furthermore, 100% of its electricity consumption is now sourced from renewable energy, demonstrating a tangible commitment to a cleaner operational footprint.

- ESG Leadership: Consistently receives best-in-class ESG ratings and inclusion on the CDP A List.

- Net Zero Commitment: SBTi-approved climate strategy aiming for Net Zero Carbon by 2050 across all scopes (approved June 2024).

- Emissions Reduction: Achieved nearly 30% reduction in GHG emissions in 2024 versus 2019.

- Renewable Energy: 100% of electricity consumption is covered by renewable sources.

JCDecaux's market leadership is undeniable, holding the position as the world's largest outdoor advertising company. This extensive global presence, covering street furniture, transport hubs, and billboards across numerous countries, provides advertisers with unmatched reach and consistent brand exposure.

The company's strategic focus on Digital Out-of-Home (DOOH) is a significant strength, with DOOH revenue surging by 28.3% in the first half of 2024 and accounting for 39% of total revenue by year-end 2024. This growth is further amplified by their advanced programmatic capabilities, with VIOOH SSP revenues jumping 61.8% in H1 2024 and 45.6% for the full year 2024.

JCDecaux benefits from diversified revenue streams across street furniture, transport, and billboards, contributing to robust organic growth. Transport advertising saw 18.8% growth in H1 2024, while street furniture grew 10.6%, providing a stable financial foundation and resilience against market fluctuations.

Financially, JCDecaux demonstrated strong performance with 14% adjusted revenue growth in H1 2024 and 10.2% for FY 2024, alongside a 28.7% operating margin expansion in H1 2024. The company also reduced its net debt by 25% in 2024, highlighting sound financial management.

| Metric | H1 2024 | FY 2024 (Projected/Actual) |

|---|---|---|

| Adjusted Revenue Growth | 14.0% | 10.2% |

| DOOH Revenue Growth | 28.3% | - |

| VIOOH Programmatic Revenue Growth | 61.8% | 45.6% |

| Transport Advertising Growth | 18.8% | 13.1% |

| Street Furniture Growth | 10.6% | 8.3% |

| Adjusted Operating Margin Improvement | 28.7% | 15.3% |

| Net Debt Reduction | - | 25.0% |

What is included in the product

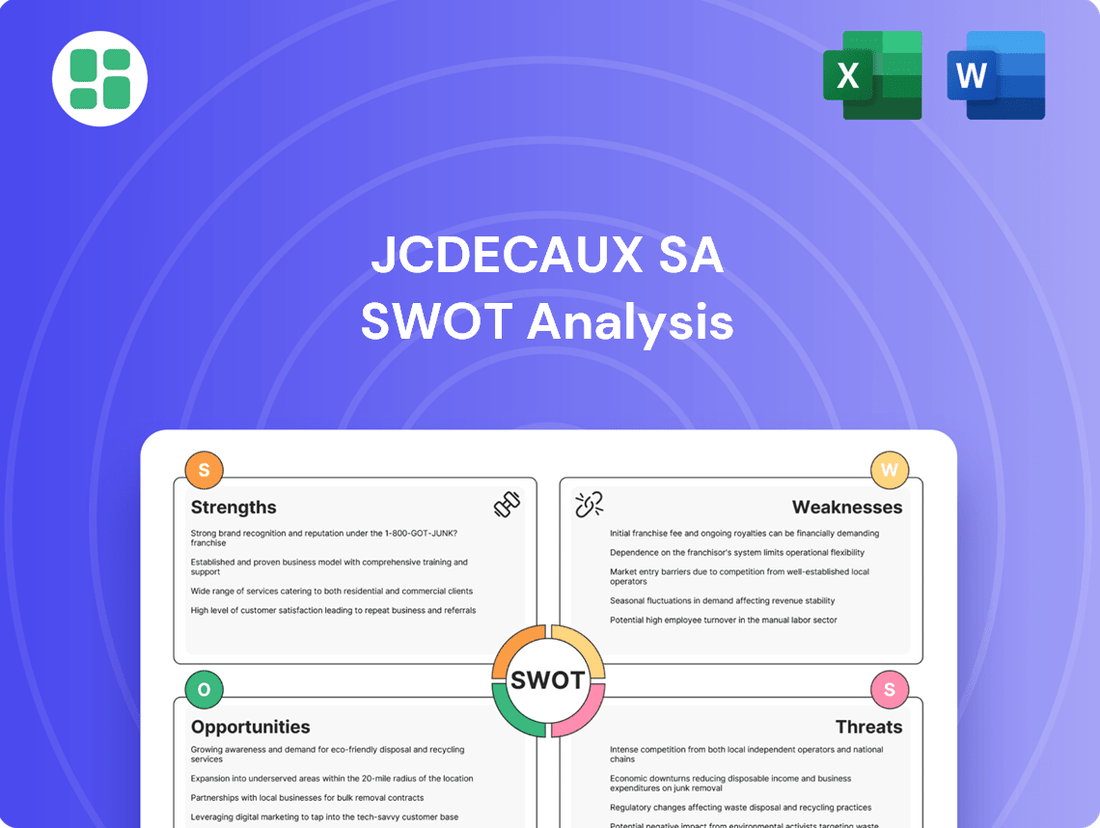

Delivers a strategic overview of JCDecaux SA’s internal and external business factors, identifying key strengths such as its global presence and digital innovation, while acknowledging weaknesses in reliance on traditional advertising and opportunities in programmatic buying and sustainable solutions, alongside threats from evolving media consumption and regulatory changes.

Offers a clear, actionable view of JCDecaux's competitive landscape to proactively address potential market challenges.

Weaknesses

JCDecaux, like others in the outdoor advertising sector, faces significant risks from economic downturns. When economies falter, businesses often cut discretionary spending, and advertising budgets are frequently among the first to be reduced. This directly impacts JCDecaux's top line and overall profitability.

The company's performance is also tied to fluctuations in advertising spend, which can be volatile. Geopolitical tensions and broader economic uncertainty, as seen with certain markets like China remaining below pre-COVID levels in 2024, can cause clients to pull back on campaigns. This sensitivity to external economic factors represents a key weakness.

JCDecaux's reliance on municipal contracts, which form a substantial part of its revenue, presents a key weakness. For instance, in 2023, its outdoor advertising segment, heavily driven by these agreements, generated a significant portion of its total revenue. This dependence makes the company susceptible to shifts in local government policies and budget allocations.

The competitive nature of securing these long-term contracts is another significant challenge. Municipalities often engage in rigorous tender processes, where JCDecaux must compete against rivals, potentially impacting profit margins or leading to the loss of lucrative agreements. This was evident in several key European city tenders in late 2024, where the bidding process intensified.

Furthermore, changes in regulations concerning public advertising or urban aesthetics can directly affect JCDecaux's business model. A growing public sentiment against visual clutter in urban spaces, coupled with potential new regulations, could necessitate costly adaptations or reduce the attractiveness of its core offerings, impacting future contract renewals.

JCDecaux's business, centered on maintaining and expanding its extensive global network of street furniture, transport displays, and billboards, inherently demands significant capital expenditure. This continuous investment in infrastructure, particularly for the strategic deployment of new digital screens, can place pressure on free cash flow, even though the company has demonstrated an upward trend in this metric in recent periods.

Competition from Other Media Channels

JCDecaux faces significant competition from a diverse media landscape beyond traditional out-of-home (OOH) rivals. Digital advertising platforms, such as Meta and Google, offer highly targeted campaigns and robust attribution, posing a challenge to OOH's broader reach. Advertisers increasingly demand measurable ROI, pushing OOH providers like JCDecaux to innovate in demonstrating effectiveness against these digital competitors.

The OOH sector, while growing, competes for advertising budgets against a vast array of media. In 2023, global digital ad spending was projected to reach over $600 billion, highlighting the dominance of online channels. This necessitates JCDecaux to continually prove the unique value proposition of its OOH offerings, especially as digital ad fraud concerns persist, potentially redirecting some spending back to physical media.

- Fragmented Media Landscape: Advertisers can choose from numerous digital, social, search, and traditional media, diluting OOH's share of voice.

- Digital Attribution Demands: OOH effectiveness must be measured against the granular targeting and direct response capabilities of online advertising.

- Evolving Measurement Standards: JCDecaux needs to adapt its metrics to align with the data-driven accountability expected by advertisers from digital channels.

Lingering Impact of Regional Market Challenges

Despite a generally robust performance, JCDecaux SA faces headwinds in specific key regions. For example, China's recovery in transit advertising activity has lagged behind pre-pandemic levels, directly affecting the Transport segment's profitability and revenue generation in the crucial Asia-Pacific market. This uneven geographical recovery, even with double-digit growth in other areas, can act as a drag on JCDecaux's consolidated financial results.

The lingering impact of regional market challenges, particularly in China, is a significant weakness for JCDecaux. In the first half of 2024, while the company reported a 6.2% increase in revenue to €1,380.7 million, the Asia-Pacific segment saw a slight decrease of 1.8% to €194.7 million. This disparity highlights how localized economic conditions and slower post-pandemic recovery in certain transit hubs can temper overall global growth and profitability.

- Regional Disparities: Continued underperformance in specific markets, like China, offsets strong growth in other regions.

- Transport Segment Impact: Lower activity in key transit markets directly reduces revenue and margin rates for the Transport division.

- Asia-Pacific Slowdown: A 1.8% revenue decline in Asia-Pacific during H1 2024, contrasted with global growth, illustrates this weakness.

JCDecaux's reliance on municipal contracts, while a core strength, also presents a weakness due to the competitive bidding processes. These tenders can be lengthy and demanding, potentially impacting profit margins if JCDecaux must offer lower rates to secure agreements, as seen in intensified European city tenders in late 2024. Furthermore, changes in urban planning or public sentiment against outdoor advertising could necessitate costly adaptations or reduce the appeal of its offerings, affecting future contract renewals.

The company also faces significant competition from digital advertising platforms. In 2023, global digital ad spending was projected to exceed $600 billion, a vast sum that highlights the challenge JCDecaux faces in proving the ROI of out-of-home advertising against the granular targeting and attribution capabilities of online channels. This necessitates continuous innovation to demonstrate OOH effectiveness.

Regional market performance can be uneven, acting as a drag on consolidated results. For instance, in the first half of 2024, while JCDecaux's global revenue increased by 6.2%, the Asia-Pacific segment experienced a 1.8% revenue decrease to €194.7 million, largely due to slower recovery in transit advertising in markets like China.

Full Version Awaits

JCDecaux SA SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It offers a comprehensive look at JCDecaux SA's Strengths, Weaknesses, Opportunities, and Threats. This preview showcases the depth and structure you can expect in the full, detailed report.

Opportunities

The accelerated shift towards digital platforms and the burgeoning field of programmatic advertising represent a substantial opportunity for JCDecaux. The company's robust performance in Digital Out-of-Home (DOOH) advertising, which saw revenue climb by more than 20% in 2024, underscores its strong position in this evolving market.

Furthermore, JCDecaux's programmatic advertising revenue experienced an impressive surge of over 45% in the same year. This growth trajectory indicates a clear market demand for its digital offerings and positions the company to further expand its market share.

Strategic investments in advanced data analytics, artificial intelligence, and its Supply-Side Platform (SSP), VIOOH, are crucial for enhancing targeting precision and attracting advertisers prioritizing data-driven campaign strategies.

JCDecaux can leverage the growing global smart city movement, with investments in smart city technologies projected to reach $170 billion in 2024, according to IDC. By integrating its digital street furniture with urban infrastructure, JCDecaux can offer more than just advertising space, providing services like real-time public transport updates, environmental monitoring, and public Wi-Fi. This strategic alignment with smart city objectives allows JCDecaux to create new revenue streams beyond traditional advertising, potentially through data monetization or service provision partnerships with municipalities.

JCDecaux has a significant opportunity to grow by tapping into emerging markets and regions experiencing rapid economic development. These areas often have less developed outdoor advertising infrastructure, presenting a chance for JCDecaux to establish a strong presence and secure lucrative contracts.

The company's existing performance in the UK, Rest of Europe, and Rest of the World, where it has secured substantial revenue streams, highlights its capability to operate and expand in diverse geographical landscapes. For example, in 2023, JCDecaux reported a revenue of €3.1 billion, with a notable portion coming from its international operations outside of France, demonstrating its global reach and adaptability.

Strategic acquisitions of local players or winning new public service contracts in these high-growth territories can accelerate JCDecaux's market penetration. This approach not only diversifies its revenue base but also positions the company to capitalize on the increasing advertising spend anticipated in these developing economies over the next few years.

Leveraging Data Analytics and AI for Enhanced Advertising Effectiveness

The explosion of readily available data, encompassing everything from foot traffic patterns to precise geolocation information, when fused with sophisticated Artificial Intelligence (AI) capabilities, presents a significant avenue for JCDecaux to elevate its advertising offerings. This synergy allows for the creation of highly personalized and demonstrably effective advertising campaigns.

AI's power can be harnessed for dynamic content adjustments in real-time, in-depth audience segmentation, and the strategic optimization of ad placements across JCDecaux's network. This makes Out-of-Home (OOH) advertising a more compelling proposition for brands actively seeking quantifiable results and a superior return on investment (ROI).

- Enhanced Targeting: AI algorithms can analyze vast datasets to identify specific audience segments present at various locations, enabling hyper-targeted ad delivery.

- Dynamic Content: Real-time data feeds can trigger content changes on digital OOH screens, making ads more relevant to the current audience and time of day. For instance, weather-triggered ads for beverages can be deployed instantly.

- Performance Measurement: AI can provide sophisticated analytics on ad recall, engagement, and even correlate OOH exposure with subsequent online or in-store actions, offering advertisers unprecedented measurability.

- Programmatic OOH: The integration of AI facilitates programmatic buying of OOH inventory, allowing for automated, data-driven ad placements and campaign management, mirroring digital advertising efficiencies.

Strategic Partnerships and M&A

Strategic partnerships offer JCDecaux significant avenues for growth and innovation. Collaborations with technology firms, data analytics providers, and emerging media platforms like Connected TV can unlock new revenue streams and enhance advertising effectiveness. For instance, integrating data insights can lead to more targeted campaigns, a key trend in the 2024-2025 advertising landscape.

JCDecaux is also actively engaged in acquiring smaller companies, known as bolt-on acquisitions, to strengthen its market position. These strategic moves allow the company to expand its geographical footprint, enhance its technological capabilities, and broaden its portfolio of advertising solutions. The acquisition of High Traffic Media in Panama exemplifies this strategy, bolstering JCDecaux's presence in Latin America.

- Synergistic Opportunities: Partnerships with tech and data companies can create integrated advertising solutions, potentially increasing campaign ROI for clients.

- Portfolio Expansion: Bolt-on M&A allows JCDecaux to acquire new technologies or enter new markets, diversifying its revenue base.

- Geographic Reach: Acquisitions like High Traffic Media in Panama directly expand JCDecaux's operational presence in key growth regions.

- Technological Advancement: Acquiring companies with advanced digital advertising or data analytics capabilities can accelerate JCDecaux's digital transformation.

The ongoing digital transformation in advertising presents a significant opportunity for JCDecaux, particularly with the rapid growth of programmatic DOOH. The company's revenue from programmatic advertising saw an impressive increase of over 45% in 2024, highlighting its strong position in this dynamic sector.

JCDecaux's strategic investments in its Supply-Side Platform, VIOOH, and advanced data analytics are crucial for capitalizing on the demand for data-driven campaigns. These investments enable enhanced targeting precision, a key factor for advertisers in 2024 and 2025.

The company can also leverage the global smart city initiative, with projected investments reaching $170 billion in 2024. By integrating its digital street furniture with urban infrastructure, JCDecaux can offer value-added services beyond advertising, creating new revenue streams and aligning with municipal goals.

| Opportunity Area | Key Data Point (2024/2025) | Impact |

|---|---|---|

| Digital Out-of-Home (DOOH) Growth | DOOH revenue up >20% (2024) | Expands market share in a growing digital segment. |

| Programmatic Advertising | Programmatic revenue up >45% (2024) | Attracts advertisers seeking efficient, data-driven campaigns. |

| Smart City Integration | Smart city tech investment $170B (2024) | Creates new revenue streams through urban service integration. |

| Emerging Markets | Revenue of €3.1B (2023) from international ops | Diversifies revenue and captures growth in developing economies. |

Threats

The outdoor advertising landscape is experiencing a surge in competition, with new entrants and a proliferation of diverse media channels. JCDecaux contends not only with established Out-of-Home (OOH) competitors but also, crucially, with digital advertising platforms that excel in precise targeting and campaign measurement. This increasingly fragmented market necessitates ongoing innovation and a strong focus on differentiation to preserve its market standing.

Economic slowdowns and recessionary pressures represent a significant threat to JCDecaux. During times of financial uncertainty, companies often reduce their advertising expenditures, directly impacting demand for JCDecaux's outdoor advertising solutions. This is particularly concerning given the current global economic climate.

Rising inflation and interest rates are further exacerbating these concerns. These factors can lead to decreased consumer spending and lower business confidence, both of which translate into reduced advertising budgets. JCDecaux's own Q2 2025 outlook acknowledges these headwinds, projecting only low single-digit organic revenue growth due to prevailing uncertainties.

While JCDecaux is actively investing in digital out-of-home (DOOH) and programmatic advertising, the speed of technological evolution remains a significant threat. Competitors could leapfrog JCDecaux by introducing more sophisticated interactive displays, AI-powered targeting, or entirely novel advertising mediums that capture market attention.

For instance, advancements in augmented reality (AR) integration or hyper-personalized content delivery could quickly render existing DOOH offerings less appealing. Failure to match or exceed these innovations risks JCDecaux losing its market share and competitive advantage in the rapidly digitizing OOH landscape.

Adverse Regulatory Changes and Public Acceptance Issues

Stricter regulations on outdoor advertising, including limitations on billboard size, digital screen brightness, and content, pose a significant threat to JCDecaux's operations and future expansion. For instance, in 2024, several European cities continued to review or implement tighter controls on digital out-of-home (DOOH) advertising, citing concerns over light pollution and urban aesthetics. This trend could directly impact JCDecaux's revenue streams and its ability to deploy new digital installations.

Public acceptance issues, particularly concerning visual pollution and privacy concerns linked to data-driven advertising, can also trigger adverse policy changes. Growing public awareness and advocacy groups pushing for less intrusive advertising formats could lead to outright bans or severe restrictions in key markets. JCDecaux's reliance on large-format displays and increasingly sophisticated data analytics for targeted advertising makes it vulnerable to shifts in public opinion and subsequent regulatory responses.

- Regulatory Impact: Potential for reduced advertising inventory due to new size or placement restrictions.

- Public Sentiment: Negative public perception could lead to bans on digital screens or data collection practices.

- Market Access: Stricter rules may limit JCDecaux's ability to enter or expand in certain urban areas.

Geopolitical Risks and Regional Instability

Operating across numerous countries means JCDecaux is susceptible to geopolitical shifts. Political instability, trade wars, and regional conflicts can directly hinder operations, dampen local advertising demand, or complicate supply chains. For instance, the slower-than-anticipated economic rebound in China, influenced by geopolitical tensions, has demonstrably affected market performance in that region.

These external pressures can manifest in several ways:

- Disrupted Operations: Political unrest or sanctions can halt or severely limit JCDecaux's ability to deploy and maintain its advertising displays in affected areas.

- Reduced Advertising Spend: Economic uncertainty stemming from geopolitical events often leads businesses to cut marketing budgets, directly impacting JCDecaux's revenue streams.

- Supply Chain Vulnerabilities: Reliance on global manufacturing and logistics means that trade disputes or regional conflicts can create significant delays and cost increases for essential components.

Intensifying competition from digital advertising platforms and new OOH entrants poses a significant challenge, requiring continuous innovation to maintain market share. Economic downturns and rising inflation, as indicated by JCDecaux's projected low single-digit organic revenue growth for 2025, directly threaten advertising spend. Rapid technological advancements, such as AR integration, could render existing digital offerings obsolete if not matched by swift adaptation.

Stricter regulations on outdoor advertising, including limitations on digital screens and content in cities like Paris and London in 2024, could curtail inventory and expansion. Negative public sentiment regarding visual pollution and data privacy may also trigger adverse policy changes, impacting JCDecaux's core business model. Geopolitical instability and trade disputes can disrupt operations, reduce local advertising demand, and create supply chain vulnerabilities, as seen with slower market performance in China due to geopolitical tensions.

| Threat Category | Specific Risk | Impact on JCDecaux | 2024/2025 Relevance |

|---|---|---|---|

| Competition | Digital Ad Platforms | Loss of market share, reduced pricing power | Ongoing, increasing due to programmatic advancements |

| Economic Factors | Recessionary Pressures | Decreased advertising budgets | Projected low single-digit growth in Q2 2025 indicates headwinds |

| Technological Change | Rapid DOOH Evolution | Risk of outdated inventory, competitive disadvantage | AR and AI integration by competitors a key concern |

| Regulatory Environment | Stricter OOH Rules | Reduced inventory, limited expansion | Cities reviewing digital screen regulations in 2024 |

| Geopolitical Factors | Political Instability | Operational disruption, reduced demand | China's economic performance impacted by geopolitical tensions |

SWOT Analysis Data Sources

This analysis draws from a robust foundation of data, including JCDecaux's official financial reports, comprehensive industry market research, and expert analyses of the Out-of-Home advertising sector.