JCDecaux SA Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

JCDecaux SA Bundle

JCDecaux SA navigates a complex competitive landscape shaped by intense rivalry and significant buyer power from advertisers. The threat of new entrants is moderate, while supplier power is relatively low due to the fragmented nature of media production.

The complete report reveals the real forces shaping JCDecaux SA’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The outdoor advertising sector, including JCDecaux SA, depends on a range of suppliers. These include makers of digital displays and street furniture, tech companies offering programmatic advertising platforms, and importantly, property owners and municipalities that control prime advertising locations. The leverage these suppliers hold can be substantial, especially from municipalities granting exclusive, long-term concessions for public spaces, which are fundamental to JCDecaux's operational model.

Switching costs for JCDecaux are significant, particularly when it involves long-term agreements for prime advertising spaces. For instance, losing a major concession, like the one with Transport for London, would mean substantial lost revenue and the considerable expense of finding and securing new, equally desirable locations. This creates a strong dependency on existing suppliers for these critical assets.

While standard digital display components are easily sourced from various suppliers, the true uniqueness lies in JCDecaux's access to prime, high-footfall locations. These premium sites, such as major airports and central city areas, are scarce resources, granting considerable leverage to whoever controls them.

The scarcity of these coveted locations significantly amplifies the bargaining power of the entities that own or manage them. JCDecaux's strategic advantage is built upon its success in securing and maintaining exclusive contracts for these lucrative advertising spaces.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into JCDecaux's core business of outdoor advertising operations is generally low. This is because the capital requirements for acquiring and managing advertising inventory, along with navigating complex regulatory environments, are substantial barriers for most suppliers.

For instance, manufacturers of advertising panels or technology providers typically lack the operational expertise and market access necessary to compete in the specialized field of out-of-home media sales and deployment. Similarly, municipalities and transport authorities, while holding the underlying assets, usually prefer to delegate the complexities of advertising management to experienced entities like JCDecaux, rather than undertaking these operations themselves.

- Low Threat: Suppliers of panels or technology are unlikely to enter the capital-intensive outdoor advertising operations.

- Lack of Expertise: Municipalities and transport authorities generally lack the specialized skills for advertising sales and infrastructure management.

- Outsourcing Preference: Public entities prefer to outsource these functions to specialists, keeping the threat of forward integration minimal.

Impact of Digital Transformation on Supplier Power

The digital transformation of the Out-of-Home (OOH) advertising industry, particularly the rise of Digital Out-of-Home (DOOH), has reshaped the bargaining power of suppliers for companies like JCDecaux SA. New suppliers have emerged, focusing on programmatic advertising technology and data analytics, which are crucial for the efficient operation and targeting capabilities of DOOH networks.

While JCDecaux has proactively invested in its proprietary supply-side platform, VIOOH, to manage programmatic transactions and data, the broader ecosystem still presents a dynamic supplier landscape. This includes various demand-side platforms (DSPs) and specialized data providers, each potentially holding leverage in the supply chain.

JCDecaux's strategic development of VIOOH is a key factor in mitigating the increased bargaining power of external technology and data suppliers. By controlling a significant portion of its digital supply chain, JCDecaux can negotiate more favorable terms and maintain greater operational independence.

- Digital Transformation Impact: The shift to DOOH has introduced new technology and data suppliers, altering traditional OOH supply dynamics.

- New Supplier Categories: Programmatic advertising technology providers and data analytics firms are now key players in the OOH supply chain.

- JCDecaux's Mitigation Strategy: The development of JCDecaux's own supply-side platform, VIOOH, aims to reduce reliance on and bargaining power of external tech suppliers.

- Ecosystem Interdependence: The reliance on DSPs and data providers means JCDecaux must actively manage these relationships to maintain competitive advantage.

The bargaining power of suppliers for JCDecaux SA is significant, primarily stemming from the control of prime advertising locations. Municipalities and property owners who grant concessions for high-footfall areas hold considerable leverage, as these sites are scarce and essential for JCDecaux's revenue generation.

The digital shift has introduced new suppliers in programmatic technology and data, increasing complexity. However, JCDecaux's investment in its own supply-side platform, VIOOH, aims to curb the power of these external tech providers by enhancing control over its digital inventory and transactions.

In 2023, JCDecaux reported €3.4 billion in revenue, underscoring the importance of securing and retaining access to these premium locations. The threat of suppliers integrating forward remains low due to the high capital and expertise required for outdoor advertising operations, with municipalities preferring to outsource these functions.

What is included in the product

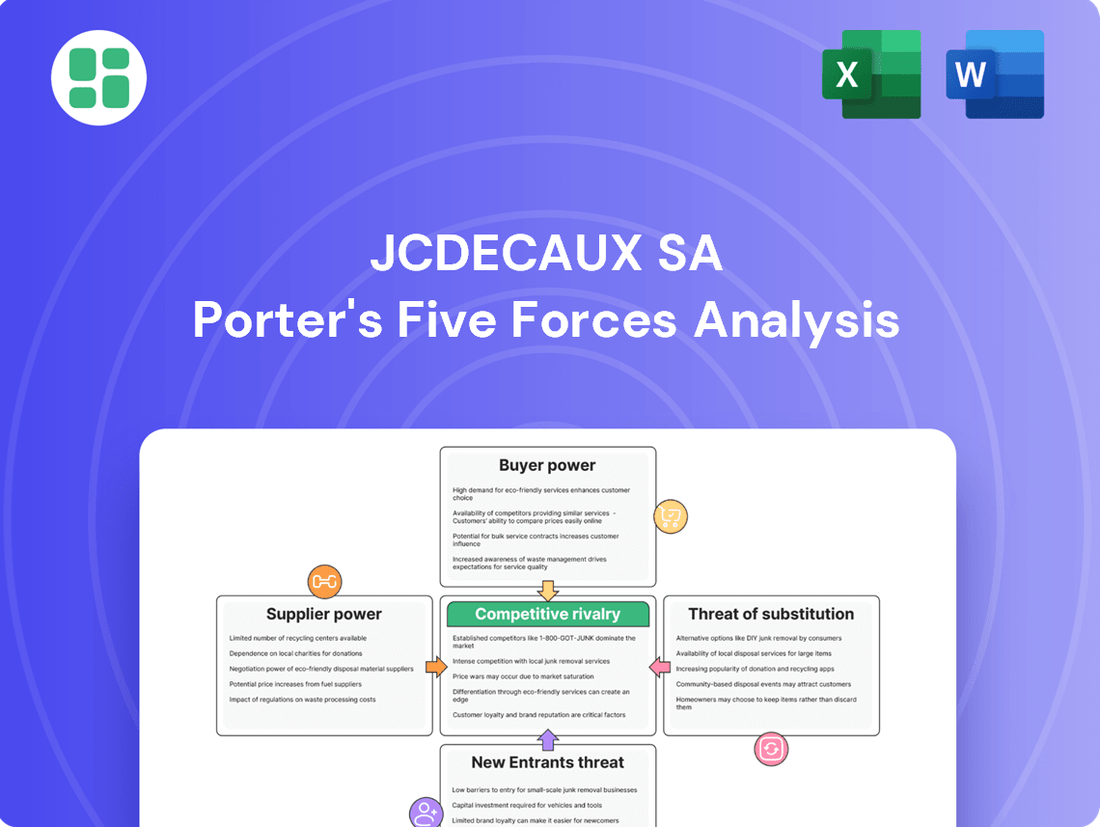

This analysis of JCDecaux SA examines the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, all within the context of the Out-of-Home advertising industry.

Instantly visualize competitive pressures affecting JCDecaux's outdoor advertising dominance, allowing for proactive strategy adjustments.

Customers Bargaining Power

JCDecaux serves a wide array of clients, from global giants and advertising firms to local enterprises. This broad customer base generally dilutes the power of any single buyer.

However, significant advertising agencies and major brands, due to their substantial ad spending, do possess some degree of bargaining leverage. Their volume of business can influence JCDecaux's terms.

In 2024, JCDecaux's top ten clients represented under 14% of its total group revenue. This statistic underscores a well-diversified customer portfolio, which inherently limits the bargaining power of any individual customer.

Customer switching costs in the outdoor advertising sector are generally quite low. Advertisers can readily move their spending to competing Out-of-Home (OOH) providers or even shift to entirely different media like digital or television. This ease of switching limits JCDecaux's leverage.

However, JCDecaux's significant advantage lies in its exclusive contracts for prime locations and its ability to offer integrated campaigns across multiple markets. For advertisers targeting specific, high-traffic areas or requiring a broad, cohesive presence, JCDecaux’s extensive network and established relationships with municipalities and transport hubs create a degree of customer stickiness, making switching more complex and potentially costly.

The price sensitivity of JCDecaux's customers, primarily advertisers, is a key factor in its bargaining power. During economic downturns, advertisers become more focused on cost-effectiveness and the demonstrable return on investment from their advertising spend. This means they might push harder for lower prices or seek more value for their money.

The evolving landscape of digital out-of-home (DOOH) advertising is also influencing this dynamic. Programmatic DOOH allows for more granular targeting and flexible purchasing, which can increase price transparency. This transparency, coupled with the ability to buy inventory on a more data-driven basis, can empower advertisers to negotiate more effectively with providers like JCDecaux.

For instance, in 2024, as many markets experienced persistent inflation and economic uncertainty, advertisers were observed scrutinizing all media budgets more closely. Reports indicated a growing demand for performance-based metrics in OOH, suggesting a willingness to shift spend towards more measurable channels and to negotiate terms that reflect this demand for accountability.

Customer Information and Transparency

The Out-of-Home (OOH) advertising sector, including companies like JCDecaux SA, is experiencing a significant shift due to increased customer information and transparency. Advances in data analytics, powered by artificial intelligence and programmatic platforms, now provide advertisers with granular insights into audience reach, demographic profiles, and the actual effectiveness of their campaigns. This heightened visibility means clients can more accurately assess the value they receive, potentially leading to stronger negotiation positions.

This enhanced transparency directly impacts the bargaining power of customers. With readily available data on campaign performance and audience engagement, clients can demand more precise targeting and measurable outcomes. For instance, the ability to track impressions and audience segments allows advertisers to scrutinize pricing more effectively, pushing OOH providers to demonstrate clear ROI. This data-driven approach empowers customers to negotiate terms based on quantifiable results rather than relying solely on traditional media metrics.

- Increased Data Availability: AI and programmatic OOH platforms provide detailed audience data, enabling better campaign planning and measurement.

- Performance-Based Negotiation: Advertisers can leverage campaign effectiveness data to negotiate pricing and terms with OOH providers like JCDecaux.

- Demand for Transparency: Clients increasingly expect clear reporting on reach, demographics, and ROI, strengthening their bargaining position.

- Informed Decision-Making: Greater access to information allows customers to make more strategic choices about OOH media investments.

Threat of Backward Integration by Customers

The threat of backward integration by customers for JCDecaux SA is notably low. It would be incredibly impractical and prohibitively expensive for most clients, even large advertising agencies, to replicate JCDecaux's vast and geographically diverse outdoor advertising infrastructure. This includes managing street furniture, billboards, and transit advertising networks.

JCDecaux's deep industry expertise and substantial investment in its asset base create significant barriers to entry for potential customer integration. For instance, the capital expenditure required to build and maintain a comparable network would run into billions, making it unfeasible for the vast majority of JCDecaux's clientele who are focused on advertising, not infrastructure ownership.

- Low Threat: Customers face significant hurdles in attempting to produce advertising media themselves.

- High Capital Intensity: Establishing a comparable outdoor advertising infrastructure requires immense capital investment, far exceeding typical client budgets.

- Specialized Expertise: JCDecaux possesses unique operational and maintenance know-how that clients lack.

- Asset Scale: The sheer scale and geographic spread of JCDecaux's assets are difficult and costly for any single customer to replicate.

While JCDecaux's diversified client base generally limits individual customer power, major advertisers with substantial ad spend, like those in 2024 spending less than 14% of total revenue with the top ten clients, still hold some negotiation leverage. The ease with which advertisers can switch media channels, coupled with increasing data transparency in digital out-of-home advertising, empowers them to demand better pricing and measurable ROI, especially during economically uncertain periods.

| Factor | Impact on JCDecaux | 2024 Context/Data |

|---|---|---|

| Client Diversification | Lowers individual customer power | Top 10 clients < 14% of group revenue |

| Switching Costs | Low for advertisers | Advertisers can shift to digital, TV, or other OOH providers |

| Data Transparency & AI | Increases customer negotiation power | Demand for performance-based metrics and ROI scrutiny |

| Backward Integration Threat | Very Low | Prohibitive capital and expertise required to replicate JCDecaux's infrastructure |

Preview the Actual Deliverable

JCDecaux SA Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis for JCDecaux SA, detailing the competitive landscape and strategic positioning of the outdoor advertising giant. The document you see here is exactly what you’ll be able to download after payment, providing an in-depth look at the industry's forces and their implications for JCDecaux. You're looking at the actual document, ensuring you receive a complete and professionally written analysis upon purchase.

Rivalry Among Competitors

The outdoor advertising market is showing robust expansion, with the global Out-of-Home (OOH) sector anticipated to hit $50.52 billion by 2025, growing at a compound annual rate of 4.84%. Digital Out-of-Home (DOOH) is leading this charge, with an impressive annual growth rate of 15.2%.

JCDecaux itself saw a healthy 9.7% organic revenue increase in 2024, largely fueled by its DOOH segment. This positive market trajectory can help to moderate competitive intensity, as companies have opportunities to expand their revenue streams without necessarily needing to aggressively capture market share from rivals.

The outdoor advertising landscape is characterized by significant concentration, with a handful of global giants dominating the market. JCDecaux SA stands as the world's largest player in this sector.

Key competitors vying for market share include Clear Channel Outdoor Holdings, Lamar Advertising Company, and OUTFRONT Media. These major entities often compete for lucrative, large-scale advertising concessions, creating a concentrated competitive environment at the top tier.

While numerous smaller, regional, and local operators exist, the strategic battle for major contracts and prime advertising real estate is primarily fought among these few dominant global companies. This concentration means that competitive rivalry is intense, particularly for the most valuable advertising placements.

Competitive rivalry in the outdoor advertising sector is intensifying, with product differentiation increasingly centered on digital capabilities, programmatic ad buying, and novel display formats. JCDecaux is strategically investing in the expansion of its digital screen network and bolstering its data and programmatic expertise through its VIOOH platform. By integrating advanced technologies such as AI and augmented reality, the company aims to boost ad interactivity and precision targeting.

Exit Barriers

Exit barriers for JCDecaux SA and its competitors in the outdoor advertising sector are substantial, primarily due to the immense capital outlay required for physical infrastructure like street furniture, digital displays, and billboards. These assets represent long-term investments that are difficult to liquidate without significant loss.

Furthermore, the industry is characterized by lengthy, often exclusive, contracts with local governments and transportation bodies. Breaking these agreements early typically incurs substantial penalties and administrative complexities, effectively trapping companies within the market and discouraging quick exits. This makes strategic divestment a challenging proposition.

- High Capital Investment: JCDecaux's extensive portfolio of street furniture and digital screens represents a significant fixed asset base, estimated to be in the billions of euros globally.

- Long-Term Contracts: Many of JCDecaux's revenue streams are secured through multi-year concessions with municipalities, often spanning 10-15 years or more.

- Contract Termination Costs: Early termination of these municipal contracts can involve substantial financial penalties and reputational damage, acting as a strong deterrent to exiting specific markets or contracts.

Market Share and Historical Rivalry

JCDecaux faces fierce competition in the out-of-home advertising sector, particularly for prime advertising spaces and lucrative government contracts. The company operates in over 80 countries, managing more than one million advertising panels, highlighting its significant global presence and the vast scale of its operations.

The rivalry is most intense for major concessions, such as the Transport for London (TfL) contract, where multiple players vie for these high-value opportunities through competitive bidding. JCDecaux has strategically utilized acquisitions to bolster its market position and expand its reach, a common tactic in this consolidating industry.

- Global Operations: JCDecaux boasts a presence in over 80 countries, managing more than 1 million advertising panels worldwide.

- Contract Competition: Intense bidding wars characterize the pursuit of major contracts, especially within public transport and government sectors.

- Strategic Acquisitions: The company actively engages in acquisitions to strengthen its competitive standing and market share.

Competitive rivalry within the out-of-home (OOH) advertising sector remains high, driven by a concentrated market structure and intense competition for premium advertising placements and concessions. JCDecaux, as the largest global player, faces formidable rivals like Clear Channel Outdoor and Lamar Advertising, particularly in securing large-scale contracts. The battleground is increasingly digital, with companies differentiating through technological innovation and data-driven solutions.

The global OOH market is projected to reach $50.52 billion by 2025, with digital OOH (DOOH) experiencing a significant 15.2% annual growth. JCDecaux's own performance in 2024, with a 9.7% organic revenue increase, partly reflects this digital shift. This growth, while positive, also fuels the competitive drive as companies invest heavily in digital infrastructure and programmatic capabilities to capture market share.

| Competitor | Global Presence (Countries) | Key Strengths | 2024 Focus Areas |

|---|---|---|---|

| JCDecaux SA | 80+ | Largest global player, extensive street furniture, strong DOOH investment (VIOOH) | Digital expansion, programmatic, AI/AR integration |

| Clear Channel Outdoor Holdings | 30+ | Significant presence in North America and Europe, large digital inventory | DOOH network expansion, data analytics |

| Lamar Advertising Company | 40+ | Dominant in US, diverse OOH formats including billboards and transit | Digital billboard conversion, programmatic adoption |

SSubstitutes Threaten

The primary substitutes for JCDecaux's out-of-home (OOH) advertising are other media channels. Online advertising, encompassing search, social media, and display ads, is a significant substitute, often providing highly targeted and measurable campaigns at competitive price points.

In 2024, digital advertising continued its strong growth, with global ad spending projected to reach over $600 billion. This digital dominance presents a direct challenge to traditional media like OOH, as advertisers can often achieve precise audience segmentation online.

However, OOH advertising, particularly digital OOH (DOOH), offers unique advantages. Its unavoidable presence in public spaces and its ability to build broad brand awareness and impact remain key differentiators against the often fragmented and user-controlled digital landscape.

Customer propensity to substitute for JCDecaux SA's Out-of-Home (OOH) advertising services is influenced by their marketing goals, available budget, and the specific audience they aim to reach. While digital advertising offers granular targeting and immediate performance data, OOH advertising excels at delivering widespread visibility and significant impact, particularly in bustling urban settings.

The interplay between OOH and digital channels is evolving, with many campaigns now incorporating elements like QR codes to drive social media engagement. This integration effectively blurs the distinction between substitutes and complements, suggesting that customers are increasingly viewing these channels as part of a unified strategy rather than mutually exclusive options.

Switching costs for advertisers moving from Out-of-Home (OOH) advertising to other media, like digital or broadcast, are generally low. Budgets are frequently shifted based on campaign effectiveness and evolving market dynamics, making it easy for advertisers to reallocate funds.

However, certain brands find unique value in OOH's large-scale visual impact and its ability to build significant brand awareness, benefits that are not easily replicated by other advertising channels. This can create a sticky situation for advertisers who rely on these specific OOH advantages.

Perceived Value and Unique Benefits of OOH

The threat of substitutes for JCDecaux SA's Out-of-Home (OOH) advertising is influenced by the evolving perceived value and unique benefits of OOH. Traditional OOH offers unparalleled visibility and broad reach in public spaces, effectively capturing consumer attention. As of 2024, the global OOH advertising market is projected to reach approximately $37.2 billion, demonstrating its continued relevance.

The increasing integration of Digital Out-of-Home (DOOH) significantly enhances OOH's competitive edge. DOOH allows for dynamic content, interactivity, and data-driven targeting, making it a more compelling substitute for traditional media like print or even certain digital channels. This technological advancement is key to maintaining OOH's perceived value.

- Enhanced Engagement: DOOH screens can display real-time updates and interactive elements, boosting consumer engagement beyond static billboards.

- Targeted Reach: Data analytics associated with DOOH enable more precise audience segmentation, rivaling the targeting capabilities of digital advertising.

- Cost-Effectiveness: For certain campaigns, DOOH can offer a more cost-effective way to reach specific demographics compared to broad digital ad spends.

- Measurable Impact: Advancements in measurement allow for better tracking of OOH campaign effectiveness, reducing the perceived risk compared to less measurable alternatives.

Technological Advancements in Substitutes

Technological advancements in digital advertising, like AI-driven personalization and hyper-targeting, present a significant threat by offering highly efficient and measurable alternatives to traditional Out-of-Home (OOH) advertising. For instance, the global digital advertising market was projected to reach over $600 billion in 2024, showcasing the scale of these digital substitutes. These digital platforms can offer more precise audience segmentation and immediate performance tracking, which can be more appealing to advertisers seeking demonstrable ROI.

JCDecaux SA is actively addressing this threat by integrating similar technologies into its OOH offerings. The company is investing in programmatic OOH (pOOH) capabilities, allowing for automated ad buying and real-time campaign adjustments based on data. By Q1 2024, JCDecaux reported continued growth in its digital OOH segment, indicating successful adoption of these advancements. This strategic move aims to enhance the measurability and targeting precision of OOH, making it a more competitive option against purely digital channels.

- Digital advertising's increasing sophistication: AI, hyper-targeting, and advanced attribution models offer measurable alternatives.

- Market size of digital advertising: Projected to exceed $600 billion globally in 2024.

- JCDecaux's counter-strategy: Adoption of programmatic OOH (pOOH) and AI-driven audience analysis.

- Digital OOH growth: JCDecaux's Q1 2024 performance highlights the increasing competitiveness of digital OOH.

The threat of substitutes for JCDecaux's Out-of-Home (OOH) advertising is significant, primarily from digital channels. Online advertising, including search, social media, and display ads, offers highly targeted and measurable campaigns, often at competitive price points. In 2024, global digital ad spending was projected to exceed $600 billion, highlighting its dominance and reach.

While digital offers precision, OOH, especially Digital OOH (DOOH), retains unique strengths like broad brand awareness and unavoidable presence in public spaces. JCDecaux's investment in programmatic OOH (pOOH) and data-driven targeting aims to bridge the gap, making its offerings more competitive against purely digital alternatives. The company's Q1 2024 performance indicated growing adoption of these digital enhancements within its OOH portfolio.

| Substitute Channel | Key Strengths | JCDecaux's Response |

|---|---|---|

| Digital Advertising (Online) | Hyper-targeting, Measurability, Cost-effectiveness | Investing in pOOH, data analytics for DOOH |

| Other Traditional Media (TV, Radio, Print) | Broad reach, established channels | Focus on DOOH's dynamic content and interactivity |

Entrants Threaten

The outdoor advertising sector, particularly for global giants like JCDecaux, demands substantial capital for acquiring and maintaining assets such as street furniture, digital displays, and billboards. Securing prime advertising locations often involves lengthy and costly contracts, further escalating the initial investment required.

This considerable financial barrier makes it difficult for new companies to enter the market and compete effectively. For instance, JCDecaux's extensive network of over 1 million advertising panels globally represents a massive capital commitment that new players would struggle to replicate. In 2023, JCDecaux reported capital expenditures of €300 million, highlighting the ongoing investment needed to maintain and expand its infrastructure.

Securing prime advertising locations through long-term contracts with municipalities and property owners presents a significant hurdle for new entrants. JCDecaux's extensive global presence, boasting over 1 million advertising panels across 80+ countries, including prominent deals with Transport for London and major airports, creates a formidable barrier. These established relationships and prime placements are exceptionally difficult for newcomers to replicate, effectively limiting competition.

Established players like JCDecaux SA leverage significant economies of scale in their operations, from purchasing advertising space to managing vast networks. This scale allows them to offer more competitive pricing and a wider array of services, creating a substantial barrier for newcomers. For instance, JCDecaux's global reach, with operations in over 80 countries as of early 2024, exemplifies this advantage.

Furthermore, JCDecaux's decades of experience in navigating complex urban planning regulations, securing prime advertising locations, and developing innovative digital out-of-home (OOH) solutions provide invaluable expertise. This accumulated know-how in managing large-scale, intricate advertising infrastructure is difficult and costly for new entrants to replicate quickly, effectively limiting their threat.

Regulatory and Legal Barriers

The outdoor advertising sector faces significant hurdles due to stringent regulatory frameworks. New companies must contend with a complex web of local and national laws governing permits, zoning, advertisement dimensions, and even content, making market entry a costly and time-consuming endeavor.

Securing the necessary licenses and approvals can be a substantial barrier. For instance, in many major cities, obtaining permits for digital billboards or even standard street furniture advertising involves lengthy bureaucratic processes and can require significant investment in legal and compliance expertise, effectively deterring smaller or less capitalized entrants.

- Regulatory Hurdles: Obtaining permits for outdoor advertising installations is often a complex and lengthy process, involving multiple layers of government approval.

- Zoning Restrictions: Local zoning laws can severely limit where advertising structures can be placed, impacting potential site acquisition for new entrants.

- Content Regulations: Rules dictating the type of content allowed on advertisements add another layer of compliance complexity, potentially requiring specialized legal review.

- Capital Investment: The cost associated with navigating these regulations and securing necessary approvals represents a significant upfront investment, acting as a deterrent to new competitors.

Brand Loyalty and Differentiation

While advertisers might not exhibit the same deep-seated brand loyalty as consumers, JCDecaux's long-standing relationships with municipalities and major clients create significant barriers. These established partnerships, built on trust and consistent delivery, are hard for newcomers to replicate. For instance, JCDecaux's extensive network of premium locations, often secured through exclusive contracts, offers a level of visibility and reach that emerging competitors struggle to match.

The company's strength lies in its ability to offer more than just ad space. JCDecaux provides integrated, large-scale advertising solutions, increasingly incorporating data analytics to optimize campaign performance. This comprehensive service offering, from creative execution to performance reporting, differentiates them from smaller, less resourced entrants who can only offer basic media placements. In 2023, JCDecaux reported revenue of €3.02 billion, underscoring its market leadership and the scale of its operations, which new entrants would find challenging to challenge directly.

- Established Relationships: JCDecaux benefits from deep-rooted partnerships with city authorities and large corporations, a crucial advantage in securing prime advertising locations.

- Integrated Services: Beyond media space, JCDecaux offers end-to-end campaign management, including data-driven insights, which sets a high bar for new entrants.

- Scale and Reach: The company's vast network of street furniture, transport advertising, and digital screens provides unparalleled visibility that is difficult for smaller competitors to replicate.

- Reputation for Reliability: A proven track record of successful, large-scale campaigns builds trust and preference among advertisers, acting as a deterrent to new players.

The threat of new entrants for JCDecaux SA is significantly mitigated by high capital requirements for infrastructure and prime location acquisition. Additionally, established relationships with municipalities and extensive operational experience create substantial barriers, making it difficult for newcomers to compete effectively.

JCDecaux's scale, evidenced by its global presence and substantial capital expenditures, along with its integrated service offerings and strong reputation, further solidifies its market position against potential new entrants.

The complexity of regulatory frameworks and the costly process of obtaining necessary licenses and approvals also serve as significant deterrents to new companies entering the outdoor advertising sector.

| Factor | Impact on New Entrants | JCDecaux's Advantage |

|---|---|---|

| Capital Investment | Very High | Extensive existing infrastructure and global network |

| Regulatory Hurdles | High | Decades of experience navigating complex regulations and securing permits |

| Established Relationships | High | Long-standing contracts with municipalities and premium clients |

| Economies of Scale | High | Lower operating costs and competitive pricing due to vast network size |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for JCDecaux SA is built upon a foundation of credible data, including their annual reports, industry-specific market research from firms like Statista and IBISWorld, and public financial filings.

We leverage insights from financial databases such as S&P Capital IQ and Bloomberg, alongside trade publications and competitor announcements, to thoroughly assess the competitive landscape.