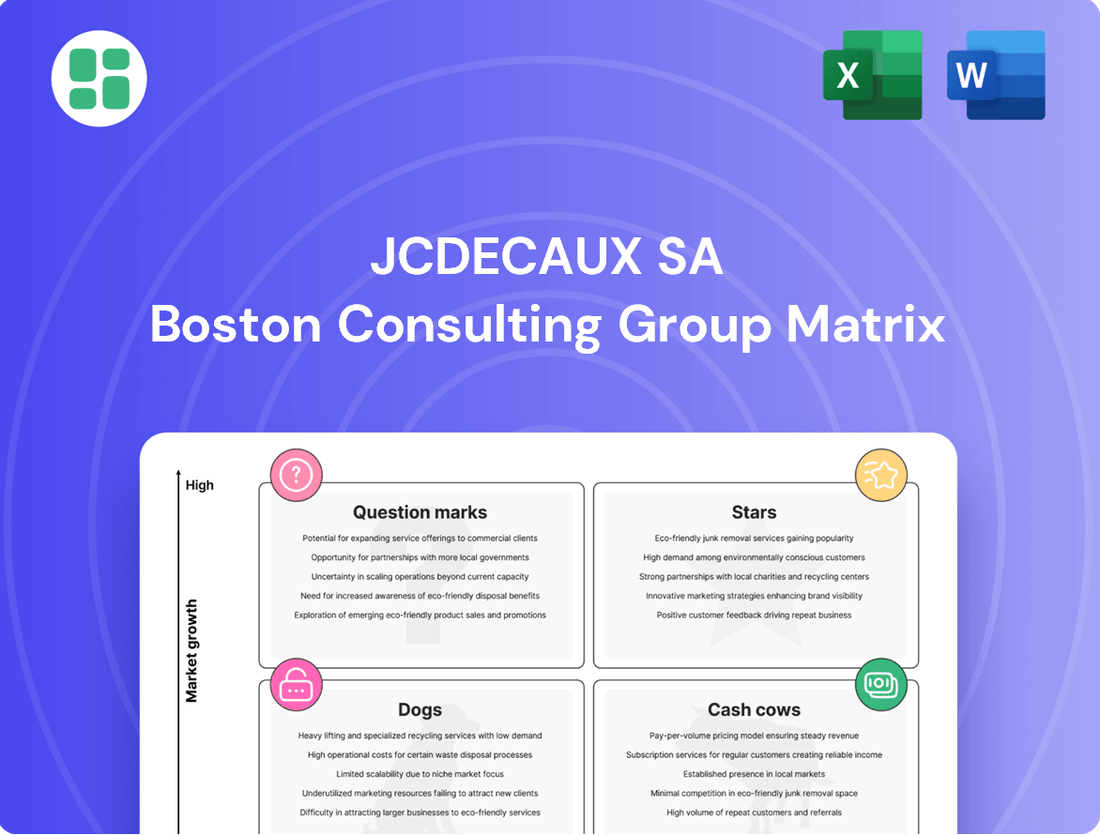

JCDecaux SA Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

JCDecaux SA Bundle

Curious about JCDecaux SA's strategic positioning? Our BCG Matrix analysis reveals which of their offerings are market leaders, which are generating steady profits, and which might be holding them back. Understand their current portfolio health and identify future growth opportunities.

This glimpse into JCDecaux SA's BCG Matrix is just the beginning. Unlock the full report to gain a comprehensive understanding of their Stars, Cash Cows, Dogs, and Question Marks, complete with actionable insights for optimizing their product portfolio and investment strategies.

Don't miss out on the complete strategic picture. Purchase the full JCDecaux SA BCG Matrix to receive a detailed breakdown, expert commentary, and a clear roadmap for making informed decisions about resource allocation and future product development.

Stars

Digital Out-of-Home (DOOH) in prime locations is a clear Star for JCDecaux. The company saw a substantial 21.9% revenue increase in DOOH during 2024, driving its share of total revenue to 39%, and reaching an impressive 42.9% by the fourth quarter.

This segment, particularly in high-traffic urban centers and transit hubs, is a rapidly expanding market where JCDecaux maintains a dominant position. Their ongoing strategic deployment of digital screens in these premium spots solidifies their leadership and future growth prospects.

Programmatic DOOH (pDOOH) via VIOOH represents a significant growth engine for JCDecaux. In 2024, programmatic ad revenues through VIOOH experienced a substantial surge of +45.6%, reaching €145.9 million. This impressive figure now accounts for 9.5% of JCDecaux's total digital revenue, underscoring the platform's increasing importance and market penetration.

The robust growth in pDOOH revenue highlights VIOOH's position in a rapidly expanding market. With connections to 46 DSPs across 24 countries, VIOOH enables sophisticated, data-driven advertising campaigns. This capability allows JCDecaux to offer dynamic and targeted advertising solutions, a key factor in attracting new advertisers and driving high performance, solidifying its star status within the BCG matrix.

JCDecaux's Transport division, particularly its airport advertising, is a significant Star in their BCG Matrix. In 2024, this segment experienced impressive organic growth of 13.1%, fueled by the strong recovery in air travel. This robust performance underscores the high demand for advertising space in busy travel hubs.

The introduction of JCDecaux's global airport programmatic DOOH offer in February 2024 is a game-changer. This innovative platform provides advertisers access to over 3,000 screens across major airports worldwide, solidifying the company's leadership in a rapidly expanding market. This strategic move enhances the attractiveness and efficiency of airport advertising.

Continued market dominance is further evidenced by renewed contracts with prestigious airports such as Macau International Airport and Sydney Airport. These agreements not only confirm JCDecaux's strong client relationships but also signal ongoing growth potential within the lucrative airport advertising sector.

Street Furniture in High-Growth European and Asian Markets

Street Furniture is a key performer for JCDecaux, experiencing robust growth. In 2024, this segment saw revenue climb by a healthy +8.3%. This expansion was particularly noticeable in Asia and the Rest of the World, alongside strong high single-digit growth within France and the UK.

JCDecaux's continued dominance in urban advertising is underscored by significant contract renewals. A prime example is the London bus shelter advertising contract with Transport for London, a testament to their entrenched market position in these vital, expanding city advertising landscapes.

The strategic alignment with smart city initiatives further bolsters the Street Furniture segment. These evolving urban environments are actively investing in smart city projects, creating a fertile ground for JCDecaux's innovative offerings and future growth.

- Street Furniture Revenue Growth: +8.3% in 2024.

- Key Growth Regions: Asia, Rest of the World, France, and the UK.

- Contract Wins: Renewal of London bus shelter advertising contract with Transport for London.

- Market Alignment: Strong synergy with smart city investment trends.

Integrated Smart City Advertising Solutions

Integrated Smart City Advertising Solutions, while not a distinct product, represent a significant growth opportunity for JCDecaux SA. Their approach, which blends essential urban services with advertising, such as solar-powered bus shelters, taps into the increasing demand for sustainable urban infrastructure. This synergy allows JCDecaux to secure extended contracts and broaden their market footprint.

By leveraging data-driven insights for urban planning and offering these public amenities, JCDecaux effectively monetizes urban spaces. This strategic positioning is crucial as cities worldwide increasingly adopt smart technologies. For example, in 2024, many cities are investing heavily in smart infrastructure, creating a fertile ground for JCDecaux's integrated model.

- High Growth Potential: Smart city integration is a rapidly expanding sector, driven by urban development and technological advancements.

- Long-Term Contracts: Providing essential public services funded by advertising fosters stable, long-term revenue streams.

- Market Leadership: This innovative approach positions JCDecaux as a key player in the future of urban advertising and infrastructure.

- Data Monetization: Utilizing data for urban planning and advertising optimization unlocks new revenue streams and enhances service value.

Digital Out-of-Home (DOOH) and its programmatic arm, VIOOH, are clear Stars for JCDecaux. DOOH revenue grew 21.9% in 2024, reaching 42.9% of total revenue by Q4. VIOOH's programmatic ad revenue surged 45.6% to €145.9 million in 2024, representing 9.5% of digital revenue.

The Transport division, particularly airport advertising, is also a Star, showing 13.1% organic growth in 2024 due to air travel recovery. JCDecaux launched a global airport programmatic DOOH offer in February 2024, covering over 3,000 screens.

Street Furniture is a strong performer, with 8.3% revenue growth in 2024, driven by Asia, the Rest of the World, France, and the UK. Key contract renewals, like London bus shelters, and smart city integration reinforce its Star status.

| Segment | 2024 Revenue Growth (Organic) | Key Data Point | BCG Status |

|---|---|---|---|

| Digital Out-of-Home (DOOH) | 21.9% | 42.9% of total revenue (Q4 2024) | Star |

| Programmatic DOOH (VIOOH) | 45.6% | €145.9 million revenue (2024) | Star |

| Transport (Airports) | 13.1% | Global airport programmatic DOOH launch (Feb 2024) | Star |

| Street Furniture | 8.3% | London bus shelter contract renewal | Star |

What is included in the product

JCDecaux SA's BCG Matrix analysis identifies its outdoor advertising services as potential Stars or Cash Cows, while digital media and street furniture may represent Question Marks or Dogs requiring strategic re-evaluation.

The JCDecaux SA BCG Matrix provides a clear, one-page overview of business units, alleviating the pain point of strategic uncertainty.

This export-ready BCG Matrix design for JCDecaux SA streamlines PowerPoint integration, easing the pain of presentation creation.

Cash Cows

JCDecaux's traditional street furniture, encompassing static bus shelters and city information panels, is a prime example of a cash cow. This segment, especially within mature Western European markets, is characterized by long-term contracts and deep market penetration, ensuring a steady and significant influx of cash.

Despite operating in a low-growth sector, the consistent revenue streams from these established assets are vital for funding other business ventures. The operating margin for Street Furniture saw an increase in 2024, underscoring its robust profitability and its role as a reliable cash generator for JCDecaux.

While JCDecaux's overall billboard revenue saw a healthy +6.6% increase in 2024, the company's traditional, static billboard segment within stable, mature markets is a clear cash cow. These established locations demand little in the way of new capital expenditure for upkeep, consistently delivering reliable revenue.

These assets are crucial for JCDecaux's financial resilience, acting as a bedrock of consistent income. Their maturity means they require minimal ongoing investment, allowing them to efficiently convert revenue into profit and support the company's broader strategic initiatives.

Established transport advertising networks, particularly the non-digital panels in mature city transit systems like metros and buses, are a significant cash cow for JCDecaux SA. These networks tap into high daily commuter volumes and benefit from long-term contracts, ensuring steady revenue streams with minimal marketing expenditure. In 2024, the Transport segment demonstrated a robust operating margin, underscoring its profitability and contribution to the company's overall financial health.

Advertising in Developed Urban Centers (Analog)

JCDecaux's extensive network of traditional, analog advertising in major cities acts as a significant cash cow. These established assets, where the company has long held a strong market position, continue to generate reliable income.

Even with the rise of digital advertising, the analog segment demonstrated resilience in 2024. Revenue from these traditional displays saw mid-single digit growth, highlighting their stability as a mature revenue stream.

Crucially, these analog assets are capital-efficient. They demand considerably less investment for upkeep and operation compared to the ongoing upgrades and maintenance required for digital advertising platforms.

- Dominant Market Share: Historically strong presence in developed urban centers.

- Stable Revenue Growth: Mid-single digit growth observed in 2024 for analog advertising.

- Capital Efficiency: Lower capital expenditure requirements compared to digital alternatives.

- Mature but Profitable: Represents a consistent and reliable income source.

Maintenance and Service Contracts for Public Amenities

JCDecaux's maintenance and service contracts for public amenities, such as self-cleaning toilets and self-service bicycle systems, are significant cash cows. These contracts, often funded by advertising revenue, provide a consistent and predictable income stream. They are characterized by their stability and low growth, acting as a reliable financial bedrock for the company.

These long-standing agreements with municipalities are crucial for JCDecaux's operational stability. They foster strong relationships with local governments, ensuring recurring revenue that supports the company's broader advertising operations. This segment represents a mature, low-risk business that consistently generates cash.

- Stable Revenue: These contracts provide a predictable and recurring revenue stream, insulated from the volatility of advertising cycles.

- Municipal Partnerships: They strengthen JCDecaux's ties with local authorities, creating a foundation of trust and ongoing business opportunities.

- Low Growth, High Return: While not high-growth areas, these services are highly profitable and contribute significantly to the company's cash generation.

JCDecaux's traditional street furniture, including static bus shelters and city information panels, represents a core cash cow. These assets, particularly in established Western European markets, benefit from long-term contracts and deep market penetration, ensuring a consistent cash flow. Despite low sector growth, this segment's stable revenue is crucial for funding other JCDecaux initiatives, with operating margins showing strength in 2024.

The company's traditional, static billboard segment in mature markets also functions as a cash cow. These established locations require minimal capital expenditure for upkeep, consistently delivering reliable revenue. This segment's resilience was evident in 2024 with mid-single digit growth in analog advertising revenue, underscoring its stability and efficiency in converting income to profit.

Mature transport advertising networks, specifically non-digital panels in city transit systems, are another key cash cow for JCDecaux. High daily commuter volumes and long-term contracts provide steady revenue with low marketing costs. The Transport segment's robust operating margin in 2024 highlights its profitability and contribution to JCDecaux's financial health.

Maintenance and service contracts for public amenities, such as self-cleaning toilets and bicycle systems, are also significant cash cows. These contracts, often supported by advertising revenue, offer a predictable and stable income stream, acting as a financial bedrock. Their low growth profile is offset by high profitability and strong municipal partnerships.

| Segment | BCG Category | 2024 Performance Highlight | Key Characteristics |

|---|---|---|---|

| Street Furniture (Static) | Cash Cow | Increased operating margin | Long-term contracts, mature markets, capital-efficient |

| Billboards (Traditional/Analog) | Cash Cow | Mid-single digit revenue growth | Established locations, low capex, stable income |

| Transport Advertising (Non-Digital) | Cash Cow | Robust operating margin | High commuter volumes, long contracts, low marketing costs |

| Maintenance & Service Contracts | Cash Cow | Stable, predictable revenue | Municipal partnerships, low growth/high return, operational stability |

What You See Is What You Get

JCDecaux SA BCG Matrix

The JCDecaux SA BCG Matrix you are currently previewing is the identical, fully completed document you will receive immediately after your purchase. This means no watermarks, no incomplete sections, and no demo content—only the comprehensive strategic analysis ready for your immediate use. You're seeing the actual, professionally formatted report, designed to provide clear insights into JCDecaux's business portfolio for your strategic planning and decision-making processes.

Dogs

Outdated static billboards in declining regions are classic examples of Dogs in JCDecaux SA's BCG Matrix. These assets are found in areas with low advertising demand, meaning they have a small market share and generate minimal revenue, often costing more to maintain than they earn.

For instance, JCDecaux's ongoing rationalization of its billboard operations in France, a process that has seen the company strategically divest or redevelop underperforming static assets, directly addresses these Dog categories. This move aims to free up capital and resources from these low-return areas.

Niche or obsolete print advertising formats within JCDecaux SA's portfolio would likely fall into the 'dog' category of the BCG Matrix. These are segments with very low market share and operate in a declining or stagnant market. Think of formats like highly specialized trade publications or local community newsletters that have seen a significant drop in advertiser interest due to the rise of digital alternatives.

These print segments face minimal growth prospects and offer little potential for rejuvenation. In 2024, the overall print advertising market continues its downward trend, with digital channels capturing a larger share of ad spend. For instance, global digital ad spending was projected to reach over $600 billion in 2024, dwarfing traditional print advertising revenues.

Consequently, JCDecaux SA would likely consider divesting or discontinuing these underperforming print advertising formats. This strategic move would allow the company to reallocate valuable resources towards more promising and high-growth areas, such as digital out-of-home advertising, which is experiencing robust expansion.

Contracts in areas experiencing ongoing economic instability or geopolitical risks, such as China's market struggling to surpass 2019 levels, could be classified as dogs. These contracts might consistently generate low revenue and hold a small market share, failing to meet performance expectations.

JCDecaux's efforts to revitalize these markets face challenges. For instance, a €5.9 million impairment charge related to Clear Media highlights investments in regions with persistent underperformance, consuming capital without generating adequate returns.

Legacy Advertising Panels with High Maintenance Costs

Legacy advertising panels with high maintenance costs, often found in older street furniture or transit shelters, can be categorized as Dogs within JCDecaux SA's BCG Matrix. These assets, while potentially still generating some revenue, demand significant investment in upkeep and repair, diverting resources from more promising ventures. For instance, JCDecaux's ongoing modernization efforts aim to replace such older, less efficient formats with digital screens, reflecting a strategic shift away from these low-return, high-cost elements.

These legacy panels represent a drain on operational efficiency and capital. Their continued presence can hinder the company's ability to invest in newer, more profitable digital advertising technologies. By fiscal year-end 2024, JCDecaux has been actively phasing out these older formats, with a stated goal of increasing the proportion of digital advertising revenue, which typically offers higher margins and lower ongoing maintenance per unit of revenue.

- Low Revenue Generation: These panels often contribute minimally to overall revenue compared to their operational expenditure.

- High Maintenance Expenses: Significant costs are incurred for repairs, upkeep, and potential regulatory compliance.

- Strategic Obsolescence: They are often superseded by newer digital technologies offering greater flexibility and higher ad engagement.

- Capital Reallocation: Divesting or converting these assets frees up capital for investment in growth areas like digital street furniture.

Advertising in Very Low-Traffic or Niche Public Spaces

Advertising placements in public spaces with consistently very low foot traffic or highly niche audiences that do not attract a broad range of advertisers would be considered Dogs in the JCDecaux SA BCG Matrix.

These locations would struggle to achieve significant market share or deliver strong returns, making them inefficient uses of company resources. For instance, a small digital screen in a rarely visited historical landmark, while potentially offering a unique context, might yield minimal impressions and advertiser interest. JCDecaux's strategic focus on prime locations, such as major transit hubs and high-traffic urban areas, suggests a deliberate shift away from such less productive sites.

The company's emphasis on high-visibility placements aims to maximize advertiser ROI and consolidate its market leadership in premium outdoor advertising. In 2024, JCDecaux continued to prioritize its portfolio of high-impact digital and premium traditional advertising formats, which represent the bulk of its revenue. The company's investment strategy is clearly geared towards assets with proven audience engagement and advertiser demand, leaving less desirable, low-traffic locations as potential divestments or underutilized assets.

Dogs in JCDecaux SA's BCG Matrix represent assets with low market share in slow-growing or declining markets, demanding significant resources for minimal returns. These are typically legacy formats or placements in less desirable locations. For instance, static billboards in areas with diminishing advertising appeal or older, high-maintenance panels exemplify these 'dog' assets. JCDecaux's strategy involves divesting or phasing out these underperforming elements to reallocate capital to more lucrative digital advertising ventures. By fiscal year-end 2024, the company's focus on digital growth, which saw digital advertising revenue increasing significantly, underscores this strategic pivot away from low-yield, legacy assets.

| Asset Type | Market Share | Market Growth | Revenue Contribution | Strategic Action |

|---|---|---|---|---|

| Static Billboards (Declining Regions) | Low | Declining | Minimal | Divestment/Rationalization |

| Obsolete Print Formats | Very Low | Stagnant/Declining | Negligible | Discontinuation |

| Legacy Panels (High Maintenance) | Low | Low/Stagnant | Low | Phasing Out/Modernization |

| Low Foot-Traffic Placements | Low | Low | Minimal | Strategic De-prioritization |

Question Marks

JCDecaux's expansion into emerging markets, such as specific cities in Africa and South America, positions them as potential Stars. These regions, characterized by rapid urbanization and ongoing infrastructure development, present significant growth opportunities. For instance, cities like Lagos, Nigeria, and São Paulo, Brazil, are experiencing substantial population increases and economic expansion, creating fertile ground for out-of-home advertising.

However, JCDecaux's presence in these nascent markets is typically characterized by a low market share, necessitating considerable upfront investment in infrastructure and contract acquisition. The company's success in these areas is contingent on its ability to secure dominant contracts and effectively navigate diverse local market conditions and regulatory landscapes.

Developing and integrating advanced AI-driven data analytics for hyper-targeted advertising is a key Question Mark for JCDecaux SA. This area offers significant growth potential within the digital advertising landscape, but JCDecaux's current market share in this sophisticated niche may require substantial investment in research and development to secure a leading position and prove its return on investment.

JCDecaux's investment in new digital formats and experiential Out-of-Home (OOH) aligns with the characteristics of a question mark in the BCG matrix. These are emerging, high-potential areas where JCDecaux is exploring innovative advertising solutions like augmented reality and interactive installations. The company is actively investing in these nascent technologies, aiming to capture future market share.

This segment represents a significant opportunity for growth, but also carries inherent risks due to its early stage and the need for market adoption. In 2024, the global digital OOH market was projected to reach over $30 billion, indicating substantial growth potential for innovative players. JCDecaux's strategic focus here is to build a strong position in these evolving advertising landscapes.

Strategic Acquisitions in Adjacent Technologies (e.g., IoT for Smart Cities)

JCDecaux's involvement in initiatives like Software République highlights its strategic interest in adjacent smart city technologies, such as IoT for data collection. These represent potential "Question Marks" in the BCG matrix, characterized by high growth potential but currently low market share within the broader smart city ecosystem. For instance, in 2024, the global IoT market was projected to reach over $1.5 trillion, indicating substantial growth avenues.

Investing in IoT sensors for urban data collection could allow JCDecaux to integrate new functionalities with its existing street furniture and advertising platforms. This strategy positions the company to capitalize on the increasing demand for smart city solutions, even if current market penetration is minimal. The company's participation in open-innovation platforms suggests a proactive approach to exploring these nascent markets.

- High Growth Potential: The smart city market, including IoT integration, is experiencing rapid expansion, with significant future revenue opportunities.

- Low Market Share: JCDecaux's current presence in these specific adjacent technologies is likely limited, placing them in the Question Mark quadrant.

- Strategic Bets: These investments are considered strategic plays to secure future market positions in evolving urban landscapes.

- Integration Synergy: The aim is to leverage existing infrastructure to enhance advertising capabilities with smart city data and services.

Programmatic DOOH in Untapped or Nascent Geographies

Programmatic DOOH in nascent geographies presents a classic Question Mark scenario for JCDecaux SA. While the overall programmatic DOOH market is a Star, these emerging markets, where programmatic adoption for DOOH is still in its early stages, require substantial upfront investment.

These markets, while offering significant long-term growth potential, demand considerable resources for:

- Education and Awareness: Building understanding among local advertisers and agencies about the benefits and mechanics of programmatic DOOH.

- Infrastructure Development: Supporting the build-out of necessary technological frameworks and data capabilities within these regions.

- Partnership Cultivation: Establishing strong relationships with local media owners, demand-side platforms (DSPs), and data providers.

For instance, while specific figures for JCDecaux's nascent programmatic DOOH markets are proprietary, the global programmatic DOOH market was projected to reach approximately $10.6 billion in 2024, indicating the scale of opportunity. Successfully navigating these nascent markets will be crucial for JCDecaux to maintain its Star position in programmatic DOOH.

Developing and integrating advanced AI-driven data analytics for hyper-targeted advertising is a key Question Mark for JCDecaux SA. This area offers significant growth potential within the digital advertising landscape, but JCDecaux's current market share in this sophisticated niche may require substantial investment in research and development to secure a leading position and prove its return on investment.

The company's investment in new digital formats and experiential Out-of-Home advertising, such as augmented reality and interactive installations, also falls into the Question Mark category. These are emerging, high-potential areas where JCDecaux is actively exploring innovative solutions, aiming to capture future market share despite inherent risks due to their early stage and the need for market adoption.

JCDecaux's involvement in smart city technologies, including IoT for data collection, represents potential Question Marks. While the global IoT market was projected to exceed $1.5 trillion in 2024, JCDecaux's current penetration in these specific adjacent technologies is likely limited, necessitating strategic bets for future market positions.

Programmatic DOOH in nascent geographies also presents a classic Question Mark scenario. While the overall programmatic DOOH market is a Star, these emerging markets require substantial upfront investment for education, infrastructure development, and partnership cultivation, despite the global programmatic DOOH market reaching approximately $10.6 billion in 2024.

| Area | BCG Quadrant | Rationale | 2024 Market Insight | JCDecaux's Position |

| AI-driven Data Analytics | Question Mark | High growth potential, low current market share, requires significant R&D investment. | Digital advertising growth driven by AI. | Needs to build leadership position. |

| New Digital/Experiential OOH | Question Mark | Emerging technologies with high potential but market adoption risks. | Global digital OOH market projected over $30 billion. | Investing to capture future share. |

| Smart City Technologies (IoT) | Question Mark | High growth potential in a vast market, but limited current presence. | Global IoT market projected over $1.5 trillion. | Strategic bets for future urban integration. |

| Programmatic DOOH in Nascent Geographies | Question Mark | Requires significant investment to establish market presence despite overall Star status of programmatic DOOH. | Global programmatic DOOH market ~$10.6 billion. | Investment needed to translate potential into dominance. |

BCG Matrix Data Sources

Our JCDecaux SA BCG Matrix is constructed using a blend of financial disclosures, market share data from industry reports, and internal sales performance metrics to accurately reflect business unit standing.