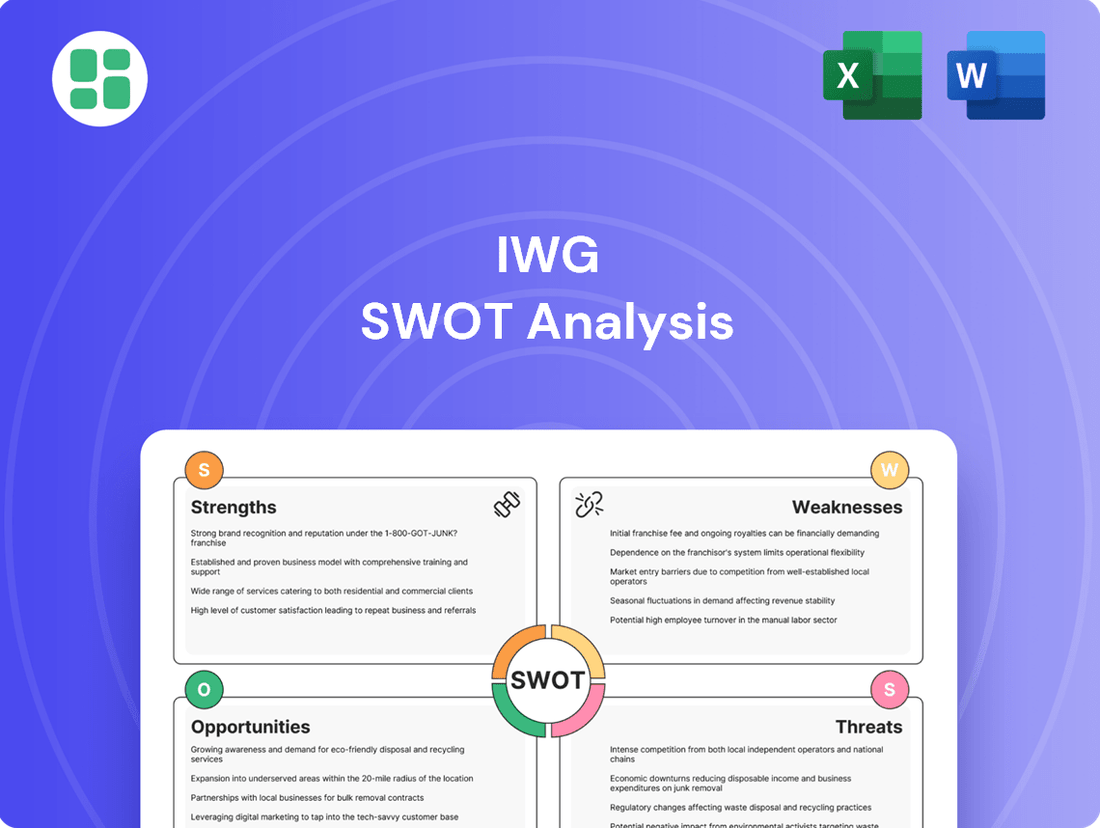

IWG SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IWG Bundle

IWG's market position is shaped by significant strengths in its global network and brand recognition, but also faces challenges from evolving workspace demands and competitive pressures. Understanding these dynamics is crucial for strategic decision-making.

Want the full story behind IWG's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

IWG boasts an extensive global network, operating the world's largest hybrid workspace platform with nearly 4,000 centers in 120 countries. This immense reach, under brands like Regus and Spaces, provides a significant competitive edge, catering to multinational corporations and offering unmatched location flexibility. The strong brand recognition across these markets fosters customer trust and solidifies IWG's market leadership.

IWG is strategically shifting towards a capital-light operational model, heavily leaning on managed and franchised agreements. This pivot substantially cuts down the company's need for capital expenditure, directly boosting free cash flow and reducing its overall net financial debt. For instance, in 2023, IWG reported a significant reduction in net debt, partly attributed to this lighter asset strategy.

By collaborating with property investors, IWG can expedite its global network expansion while simultaneously lowering its financial exposure. This approach not only accelerates growth but also enhances capital efficiency, leading to improved returns for shareholders. This managed partnership model allows IWG to tap into local market expertise and capital, a key driver in its ambitious expansion plans for 2024 and beyond.

The global move towards hybrid work is a significant tailwind for IWG. As companies adapt to distributed teams, they increasingly need flexible, on-demand office solutions. IWG's extensive network of locations and diverse workspace options directly cater to this evolving business need, making it a prime beneficiary of this trend.

IWG's business model is inherently designed to support hybrid work, offering businesses the agility to scale their office footprint up or down as required. This adaptability is crucial in the current economic climate, where many organizations are reassessing their long-term real estate strategies. For instance, in 2024, many companies reported a continued preference for hybrid models, with a significant percentage indicating they would maintain or increase their flexible workspace usage.

Diversified Service Offerings

IWG's strength lies in its diverse service portfolio, extending beyond conventional serviced offices to encompass coworking spaces and virtual office solutions. This broad offering effectively addresses the varied requirements of a wide client base, including individual professionals, small to medium-sized enterprises, and large corporations. For instance, by the end of 2023, IWG operated over 3,300 locations globally, showcasing the scale of its diversified reach.

This strategic diversification not only broadens IWG's revenue generation capabilities but also significantly mitigates its dependence on any single category of workspace demand. The company's digital platform, Worka, further enhances its service ecosystem by providing a marketplace for flexible workspace options, adding another dimension to its customer value proposition.

- Broadened Client Appeal: Catering to freelancers, SMEs, and large enterprises with varied workspace needs.

- Enhanced Revenue Streams: Multiple service offerings reduce reliance on traditional serviced offices.

- Scalable Digital Platform: Worka facilitates access to flexible workspaces, expanding market reach.

- Global Network Presence: Over 3,300 locations by end of 2023 underscore the breadth of diversified offerings.

Improved Financial Performance and Outlook

IWG demonstrated robust financial health in 2024, achieving record system-wide revenue of $4.2 billion and an EBITDA of $557 million, signaling a successful return to profitability. This strong performance underpins the company's outlook.

Further solidifying its financial standing, IWG initiated a $50 million share buyback program and adopted a progressive dividend policy. These actions reflect management's confidence in sustained growth and the company's ability to generate shareholder value.

- Record Revenue: $4.2 billion in system-wide revenue for 2024.

- Profitability: Achieved $557 million in EBITDA, marking a return to profit.

- Shareholder Returns: Announced a $50 million share buyback program.

- Dividend Policy: Implemented a progressive dividend policy, signaling financial strength.

IWG's extensive global network, operating as the world's largest hybrid workspace provider with nearly 4,000 centers in 120 countries, offers unparalleled location flexibility and brand recognition. This vast reach, under brands like Regus and Spaces, is a significant competitive advantage, particularly for multinational corporations. The company's strategic shift to a capital-light model, relying on managed and franchised agreements, has substantially reduced its capital expenditure and net financial debt, as evidenced by debt reductions in 2023. This approach enhances capital efficiency and accelerates global expansion by leveraging partnerships with property investors.

| Metric | 2023 Data | 2024 Data |

|---|---|---|

| Global Centers | ~3,300+ | ~4,000 |

| Countries of Operation | 120 | 120 |

| System-Wide Revenue | N/A (reported $4.2 billion in 2024) | $4.2 billion |

| EBITDA | N/A (reported $557 million in 2024) | $557 million |

| Net Debt | Reduced in 2023 | N/A |

What is included in the product

Delivers a strategic overview of IWG’s internal capabilities and external market dynamics.

Simplifies complex SWOT data into actionable insights, reducing the burden of interpretation for busy teams.

Weaknesses

Despite IWG's move towards a capital-light model, a substantial portion of its operations remains tied to company-owned and leased properties. This exposure makes the company susceptible to the inherent volatility of the commercial real estate market. Downturns in property values, declining rental rates, and lower occupancy levels in traditional lease agreements can directly affect IWG's financial performance, necessitating robust risk management strategies.

Maintaining IWG's extensive global network of workspaces incurs significant operational costs, such as rent, utilities, and staffing. These expenses directly influence profit margins, particularly when facing intense market competition.

While IWG employs a capital-light strategy, legacy lease agreements and continuous operational expenditures remain a challenge. Achieving strong occupancy rates, ideally above 80%, is crucial for profitability and offsetting these inherent costs.

The flexible workspace sector is incredibly crowded. Giants like WeWork compete with many smaller, local companies, and even traditional office landlords are now offering flexible options. This means IWG faces constant pressure to stand out and keep its pricing competitive.

This fierce competition can squeeze profit margins, forcing companies to invest heavily in marketing and amenities to attract and keep customers. For instance, in 2024, average occupancy rates across the flexible office market hovered around 75%, a figure that can easily dip when many providers vie for the same clients.

Dependency on Economic Stability and Business Spending

IWG's reliance on global economic stability and corporate spending presents a significant weakness. A downturn in the economy directly impacts businesses' ability and willingness to invest in flexible workspace solutions, potentially leading to reduced demand and lower occupancy rates for IWG's centers.

For instance, during periods of economic uncertainty, companies often tighten their budgets, which can translate into a slowdown in office space leasing or a shift towards more economical options, directly affecting IWG's revenue streams. This vulnerability was evident in the broader flexible office market during economic slowdowns prior to 2024, where occupancy and pricing faced pressure.

- Economic Sensitivity: IWG's revenue is directly correlated with the health of the global economy and corporate investment in office infrastructure.

- Impact of Recessions: Economic downturns can lead to decreased demand for flexible office space as businesses cut costs and reduce their physical footprint.

- Competition for Cost-Conscious Clients: During economic slowdowns, IWG may face increased competition from providers offering lower-cost alternatives, impacting its pricing power.

Brand Dilution and Management of Multiple Brands

Operating a diverse portfolio of brands like Regus, Spaces, HQ, Signature, and Worka globally, while beneficial for market reach, poses a significant risk of brand dilution. Maintaining clear differentiation between these offerings is essential to prevent confusion and ensure each brand resonates with its intended customer base.

The challenge lies in managing these distinct identities without cannibalizing market share or diluting the core value proposition of the parent company. For instance, as of late 2024, IWG's extensive global network, encompassing over 3,500 locations, requires meticulous brand management to avoid overlap and ensure each brand's unique selling proposition remains compelling.

- Brand Overlap: Potential for confusion among customers regarding the specific services and target markets of each IWG brand.

- Marketing Inefficiency: Risk of fragmented marketing efforts that fail to build strong, individual brand equity.

- Management Complexity: Increased operational and strategic demands on leadership to effectively steward multiple distinct brands.

- Diluted Value Proposition: If not managed properly, the distinct benefits of each brand may become blurred, reducing overall appeal.

IWG's extensive global network, while a strength, also presents a weakness in terms of brand management. With multiple brands like Regus, Spaces, and HQ, there's a risk of brand dilution and customer confusion if differentiation isn't clearly maintained. This complexity requires significant effort to ensure each brand's unique selling proposition remains strong and appealing to its target audience.

Same Document Delivered

IWG SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version.

This is a real excerpt from the complete document. Once purchased, you’ll receive the full, editable version.

Opportunities

The ongoing shift towards hybrid and remote work is a significant tailwind for IWG. Businesses are actively seeking flexible workspace solutions to adapt to new employee expectations and manage their real estate costs more effectively. This trend, which gained considerable momentum in 2020 and 2021, shows no signs of abating, with many companies solidifying their hybrid policies through 2024 and into 2025.

This structural change in the labor market directly fuels demand for IWG's flexible office spaces. Companies are looking to reduce their long-term lease liabilities and gain agility, making serviced offices an attractive alternative. For instance, a 2024 survey indicated that over 70% of companies plan to maintain some form of hybrid work arrangement, directly benefiting providers like IWG.

The demand for flexible workspaces is no longer confined to major cities. It's increasingly spreading into suburban and smaller, secondary, and tertiary markets as more people want to work closer to home. This shift is driven by a desire for shorter commutes and a better work-life balance, a trend that accelerated significantly in the post-pandemic era.

IWG, with its established global network and flexible operational model, is ideally positioned to tap into this decentralization. The company can leverage its experience to open new centers in these less-served areas, effectively meeting the growing localized demand for flexible office solutions. For instance, IWG reported a 10% increase in inquiries from outside of major metropolitan hubs in early 2024, indicating strong interest in these emerging markets.

IWG's capital-light flexible workspace model is a strong draw for landlords grappling with increasing traditional office vacancies. This approach allows property owners to convert underutilized spaces into revenue-generating flexible offices without significant upfront investment from their side.

By forming more partnerships and management agreements, IWG can rapidly expand its global network. For instance, in 2023, IWG announced plans to open 1,000 new locations in India through a partnership, demonstrating the significant growth potential this strategy unlocks for both IWG and property investors seeking to optimize their real estate portfolios.

Technological Advancements and Digital Platform Enhancement

IWG has a significant opportunity to leverage technological advancements to improve its service offerings and operational efficiency. This includes developing more sophisticated booking systems and integrating smart building technologies to create a more seamless experience for users. For instance, by 2024, the flexible workspace market is projected to grow substantially, with companies increasingly seeking agile solutions.

Further investment in its digital marketplace, Worka, is also a key opportunity. This platform can cater to the growing demand for tech-enabled and data-driven workspaces, providing valuable insights for both IWG and its customers. In 2023, digital booking platforms in the flexible workspace sector saw a significant uptick in user engagement, highlighting the market's readiness for such enhancements.

- Enhance Service Offerings: Implement AI-powered tools for personalized workspace recommendations and dynamic pricing models.

- Improve Operational Efficiency: Deploy IoT sensors for real-time space utilization monitoring and automated building management.

- Boost Digital Marketplace: Expand Worka's features to include integrated collaboration tools and data analytics dashboards for clients.

- Seamless User Experience: Develop a unified mobile app for booking, access control, and community engagement across all IWG locations.

Increased Demand from Large Enterprises

Large corporations are actively integrating flexible workspace solutions into their core real estate strategies. This shift is driven by a desire for greater agility, a reduction in capital expenditures, and the operational necessity of supporting a dispersed workforce. For instance, in 2024, a significant percentage of Fortune 500 companies were re-evaluating their office footprints to incorporate more flexible arrangements.

IWG's established global network and its capacity to deliver customized workspace solutions position it as a highly appealing partner for these large enterprises. This segment represents a substantial avenue for growth, as businesses look to optimize their operational efficiency and employee experience through flexible office models.

Key advantages for enterprises partnering with IWG include:

- Cost Efficiency: Reduced upfront investment compared to traditional long-term leases.

- Scalability: Ability to quickly scale workspace up or down based on changing business needs.

- Global Reach: Access to a worldwide network of locations, facilitating employee mobility and client meetings.

- Talent Attraction: Offering flexible work options to attract and retain top talent in a competitive market.

The ongoing global shift towards hybrid and remote work models presents a substantial opportunity for IWG. As businesses increasingly prioritize flexibility and cost-efficiency in their real estate strategies, demand for serviced offices is set to surge. This trend is underscored by data showing a significant portion of companies in 2024 continuing to embrace hybrid work, directly benefiting IWG's flexible workspace solutions.

The decentralization of work, with employees seeking closer-to-home options, opens up new markets beyond major urban centers. IWG's established network and adaptable model are well-suited to capture this localized demand. In early 2024, IWG observed a notable increase in interest from suburban and secondary markets, indicating strong growth potential in these areas.

IWG's capital-light approach is attractive to landlords facing traditional office vacancies, facilitating expansion through partnerships and management agreements. This strategy was exemplified by IWG's 2023 announcement of plans to open 1,000 new locations in India, highlighting the significant scalability and revenue potential of this model.

Technological integration, particularly through platforms like Worka, offers a pathway to enhance user experience and operational efficiency. The projected growth of the flexible workspace market through 2024, coupled with increasing client demand for tech-enabled solutions, positions IWG for further digital advancement.

| Opportunity Area | Key Driver | 2024/2025 Projection/Data |

|---|---|---|

| Hybrid Work Adoption | Employee preference, cost savings | Over 70% of companies maintaining hybrid work (2024 survey) |

| Market Expansion | Demand for suburban/secondary locations | 10% increase in inquiries from outside major hubs (IWG, early 2024) |

| Partnership Growth | Landlord demand for flexible solutions | 1,000 new locations planned in India via partnership (IWG, 2023) |

| Digital Enhancement | Demand for tech-enabled workspaces | Projected substantial growth in flexible workspace market (through 2024) |

Threats

Economic downturns, like the potential for a global recession in late 2024 or 2025, pose a significant threat to IWG. Companies facing economic headwinds often slash discretionary spending, which can include reducing their office footprint or delaying new workspace commitments. This directly impacts demand for IWG's flexible office solutions.

Higher inflation, a persistent concern through 2024, also squeezes corporate budgets. Businesses may opt for more conservative real estate strategies, potentially leading to lower occupancy rates and increased pressure on IWG's pricing power. For instance, if corporate clients cut back on their office needs, IWG could see a dip in new center signings and a decline in revenue per available desk.

The booming flexible workspace sector, a trend IWG has capitalized on, is now drawing significant attention from both new startups and established real estate giants. These traditional players are launching their own flexible offerings, directly challenging IWG's market position. For instance, in 2024, major property developers have been actively converting commercial spaces into flexible office solutions, increasing the overall supply.

This influx of competition, particularly from well-capitalized traditional real estate landlords, risks creating an oversupply of flexible workspace in key urban markets. Such an oversupply could exert downward pressure on pricing, impacting IWG's revenue streams and profitability. Analysts in early 2025 are observing rental rate stabilization in some saturated markets, a direct consequence of increased competition.

Converting traditional office spaces into flexible, modern work environments presents significant regulatory and planning obstacles for IWG. These can include securing a variety of building permits, zoning approvals, and ensuring compliance with evolving local building codes, which can vary dramatically across different regions. For instance, in major urban centers, the process for obtaining permits for a change of use or significant renovation can extend for many months, impacting IWG’s agility.

These regulatory complexities directly translate into increased costs and extended timelines for IWG’s expansion and adaptation strategies, particularly for its substantial portfolio of owned or long-leased properties. The asset-heavy nature of some of IWG's locations means that navigating these planning hurdles can add a considerable percentage to project budgets and delay revenue generation from newly converted spaces. For example, a single conversion project might see its timeline extended by 20-30% due to unforeseen planning issues.

Technological Disruption and Cybersecurity Risks

The rapid evolution of technology presents a significant threat, as new collaboration tools could reduce demand for physical workspace, even flexible options. For instance, advancements in immersive virtual reality (VR) and augmented reality (AR) could offer compelling alternatives for remote team interactions, potentially impacting IWG's core business model. This disruption necessitates constant adaptation to remain competitive in a shifting market landscape.

As a company relying heavily on technology, IWG is inherently exposed to cybersecurity risks. The increasing sophistication of cyber threats means continuous investment in robust security measures is crucial to protect client data and maintain operational integrity. A significant data breach could severely damage IWG's reputation and client trust, impacting future revenue streams.

- Technological Obsolescence: Emerging virtual collaboration platforms could reduce the perceived value of physical office spaces.

- Cybersecurity Breaches: Threats to data security and operational continuity require substantial ongoing investment in IT infrastructure and protection.

- Data Privacy Regulations: Evolving global data privacy laws, such as GDPR and similar frameworks, necessitate stringent compliance measures, adding operational complexity and cost.

Geopolitical Instability and Global Supply Chain Disruptions

IWG's extensive global presence, operating in over 120 countries, inherently exposes it to significant geopolitical risks. Regional conflicts, such as those in Eastern Europe and the Middle East, can directly impact demand in affected markets and disrupt local operations. For instance, the ongoing conflict in Ukraine has led to economic uncertainty and a slowdown in business activity across several European nations, potentially affecting IWG's occupancy rates in those regions.

Furthermore, currency fluctuations tied to geopolitical instability can erode profitability. A weakening of local currencies against the British Pound, IWG's reporting currency, can reduce the value of its international earnings. In 2024, several emerging markets experienced significant currency volatility, directly impacting the repatriated profits for multinational corporations like IWG.

Global events also pose a threat to IWG's supply chains, impacting the availability and cost of materials for fitting out new centers or maintaining existing ones. Disruptions at major shipping ports or manufacturing hubs, often triggered by geopolitical tensions or trade disputes, can lead to project delays and increased capital expenditure. For example, the Red Sea shipping crisis in late 2023 and early 2024 caused significant delays and cost increases for goods transported globally, a challenge IWG would have faced for its fit-out projects.

- Geopolitical Exposure: Operating in 120+ countries means IWG is susceptible to regional conflicts and political instability, affecting demand and operations in specific markets.

- Currency Volatility: Fluctuations in exchange rates, often exacerbated by geopolitical events, can negatively impact IWG's reported earnings from its international operations.

- Supply Chain Risks: Global events can disrupt the flow of goods and materials needed for center fit-outs and maintenance, leading to delays and increased costs.

The increasing competition from both new entrants and established real estate players, who are converting traditional spaces into flexible offerings, poses a significant threat. This heightened competition, observed throughout 2024, could lead to an oversupply in key markets, potentially driving down rental rates and impacting IWG's revenue. For instance, major property developers actively expanding into the flexible workspace sector in 2024 are increasing market saturation.

Economic downturns, characterized by potential global recessionary pressures anticipated for late 2024 and 2025, threaten IWG's business by reducing corporate demand for office space. Companies facing financial constraints tend to cut discretionary spending, including their office footprint, directly impacting IWG's client acquisition and retention.

Regulatory hurdles and the complexities of converting traditional office spaces into flexible environments can significantly increase costs and extend project timelines for IWG. Navigating diverse building permits, zoning laws, and local codes across its global operations, as seen in 2024, adds considerable overhead and delays revenue generation from new or renovated centers.

SWOT Analysis Data Sources

This IWG SWOT analysis is built upon a robust foundation of data, drawing from internal financial reports, comprehensive market research, and expert industry analysis to provide a clear and actionable strategic overview.